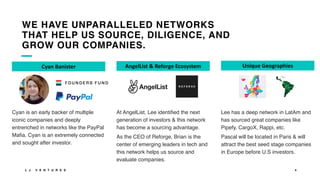

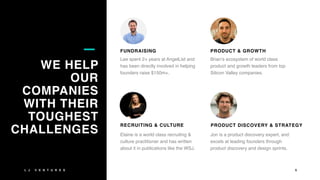

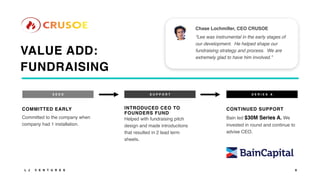

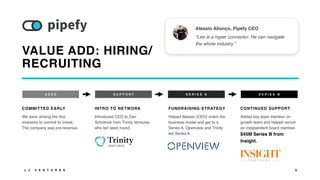

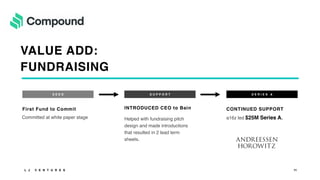

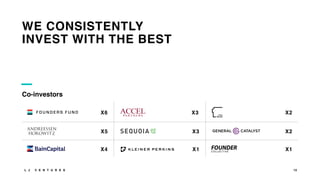

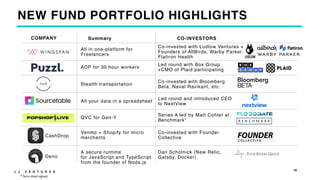

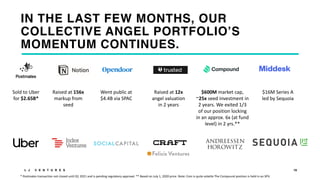

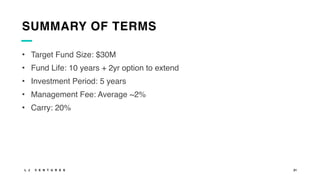

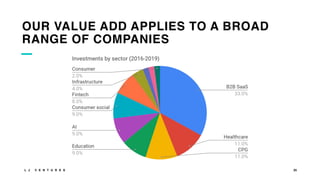

LJ Ventures is an early-stage venture fund focused on sourcing, diligence, and growing companies, leveraging a strong network of founders and investors. The document outlines investment strategies, notable investments, and the team's expertise in aiding companies with fundraising, product development, and culture. Additionally, it provides performance data and investment criteria, emphasizing a focus on entrepreneurs with resilience and customer empathy.