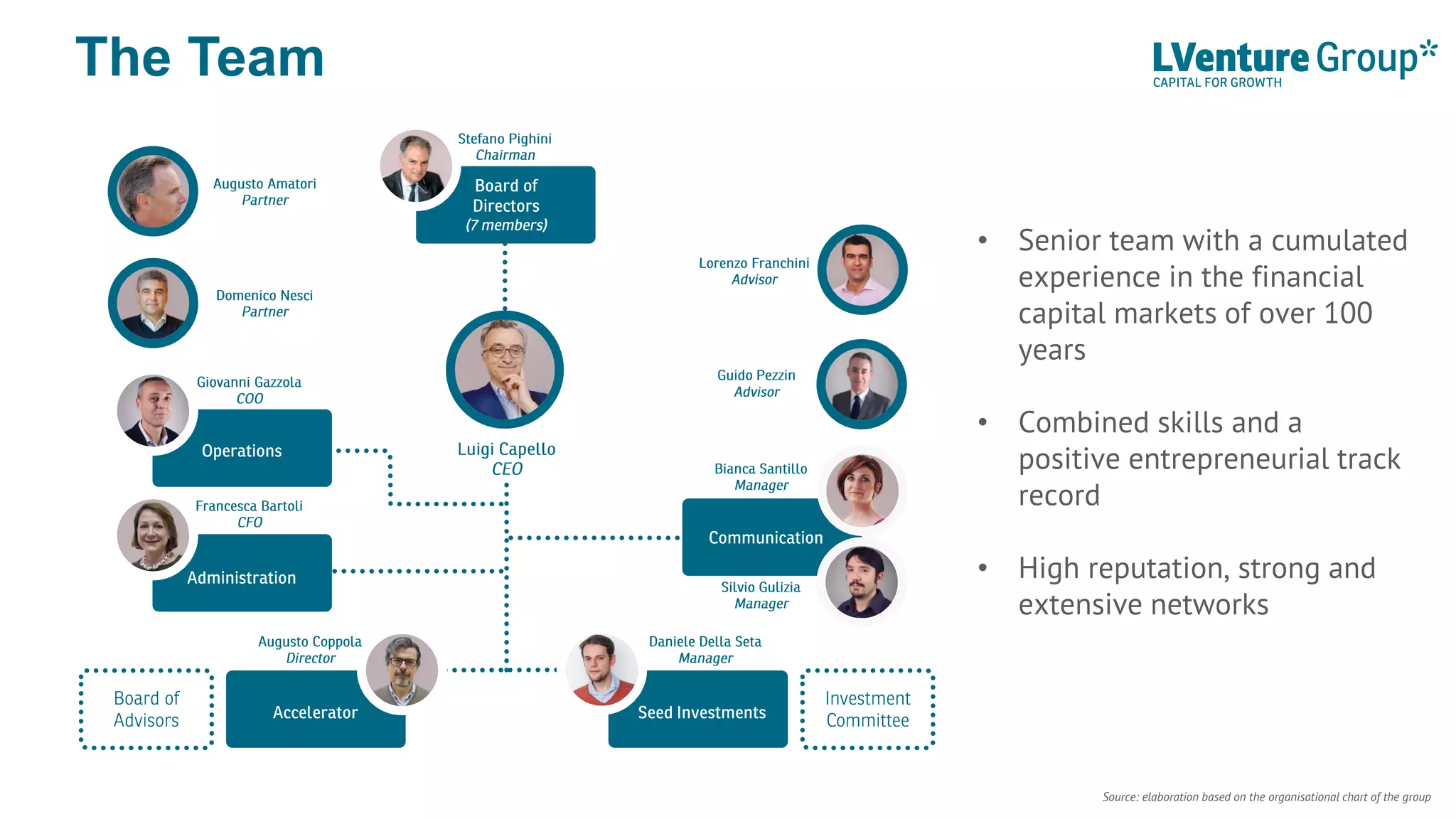

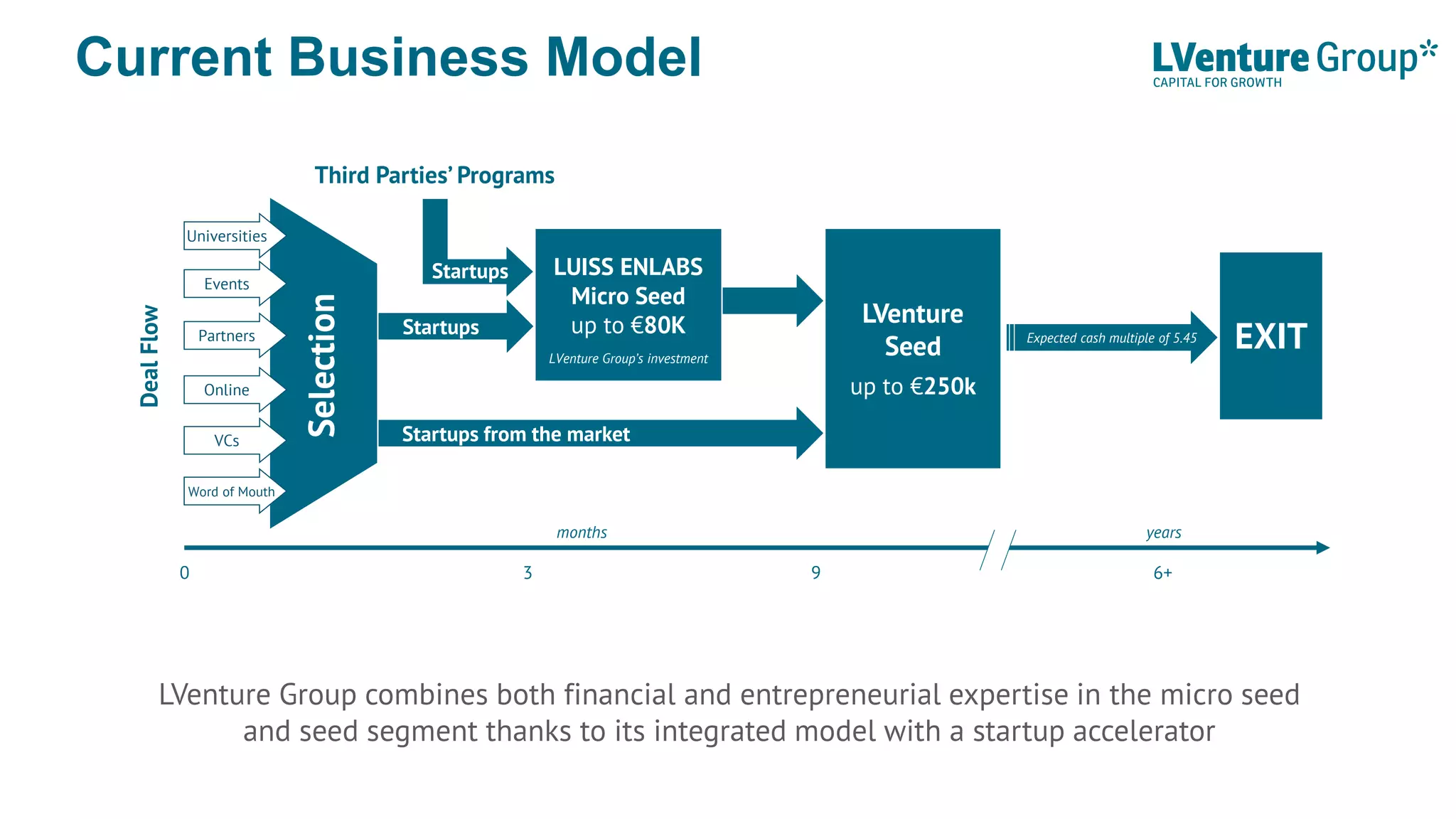

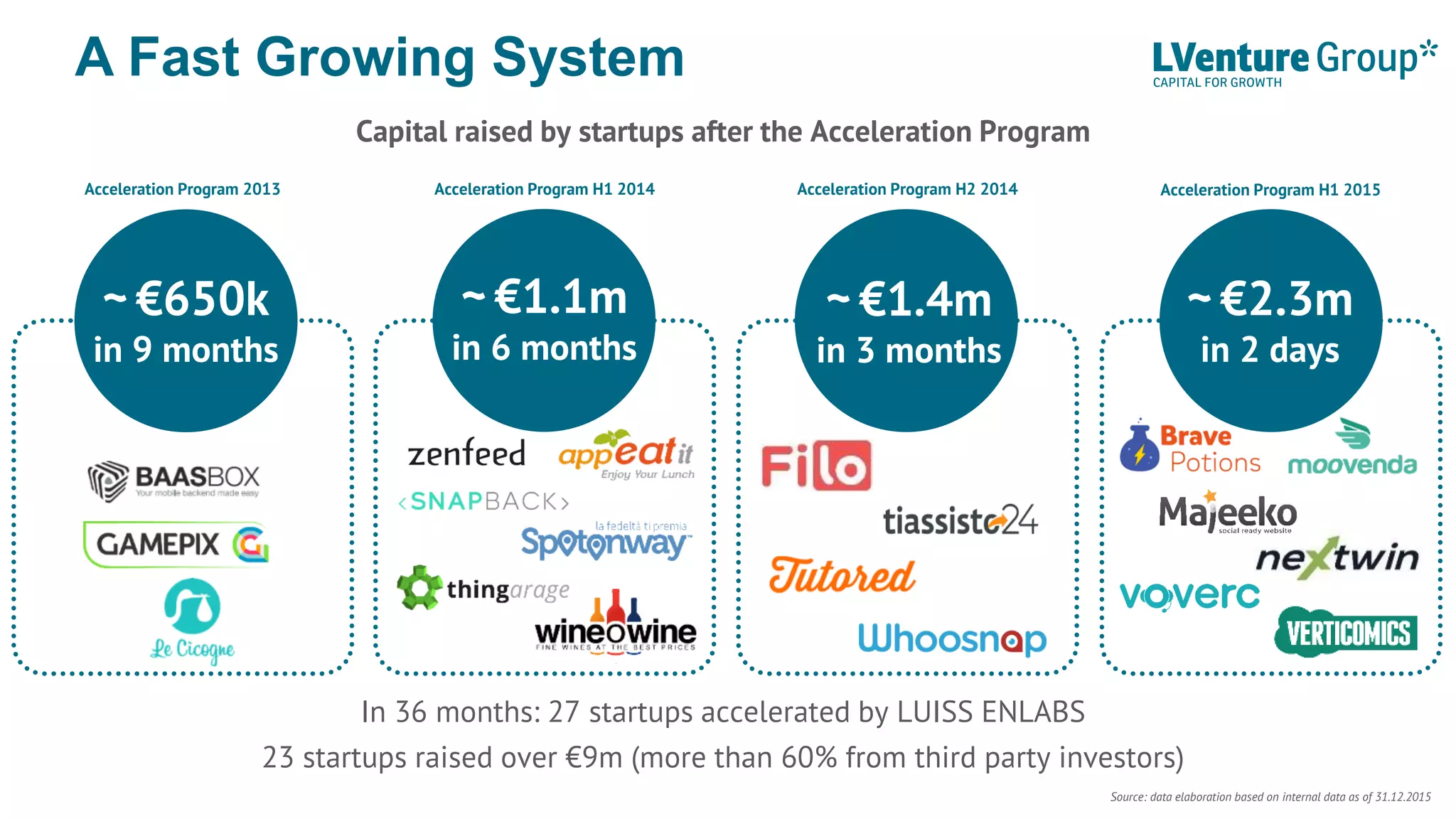

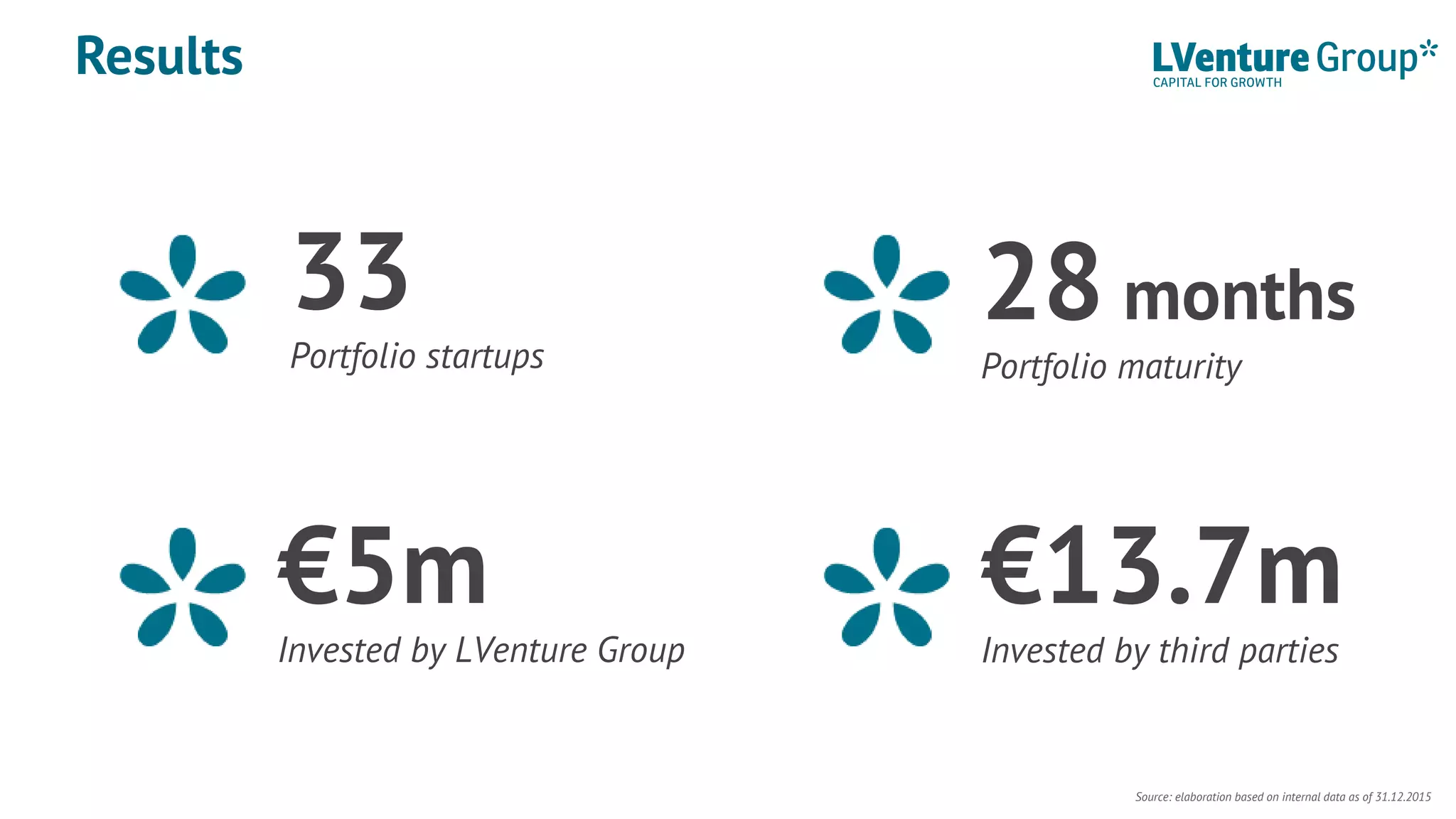

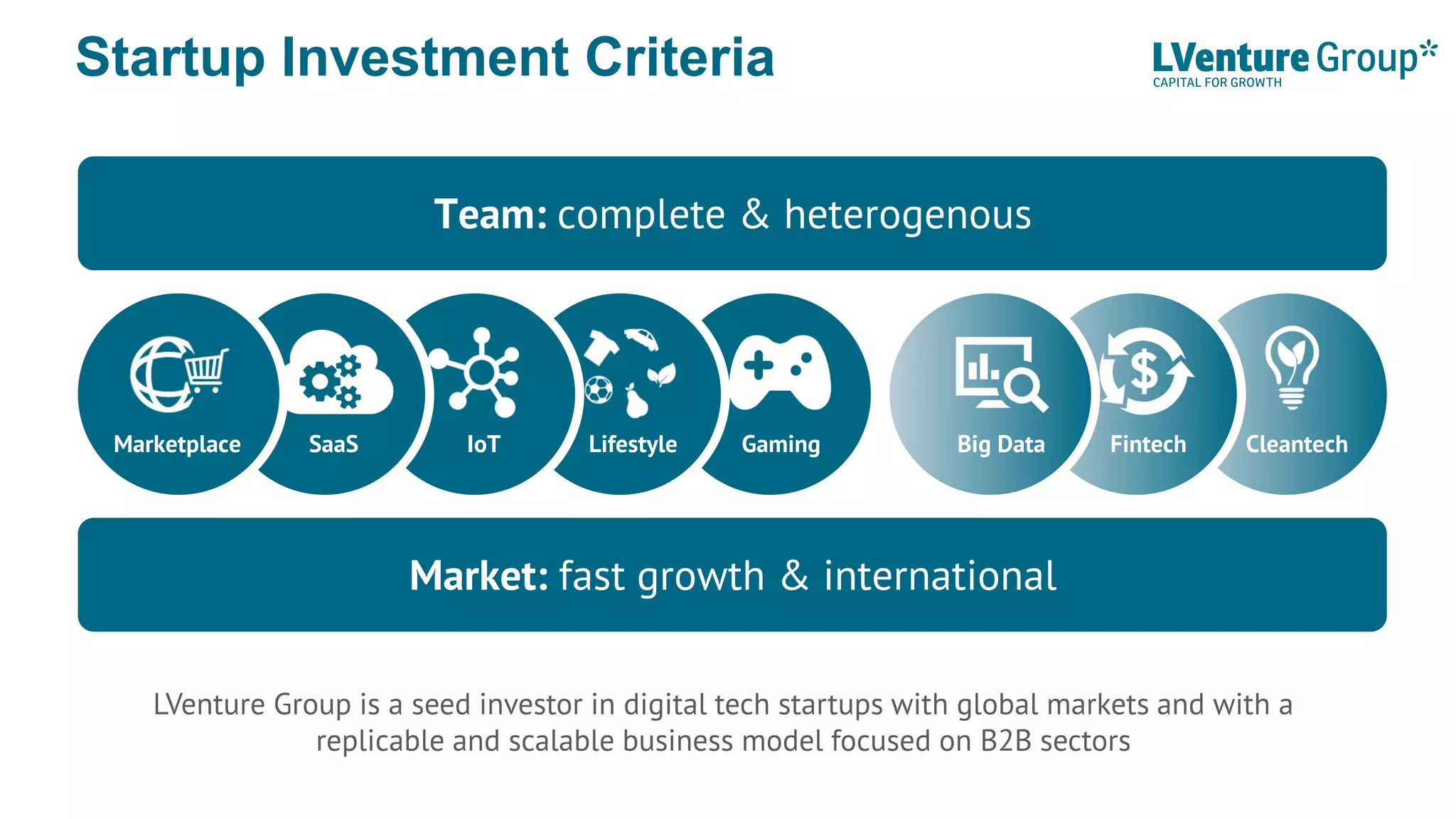

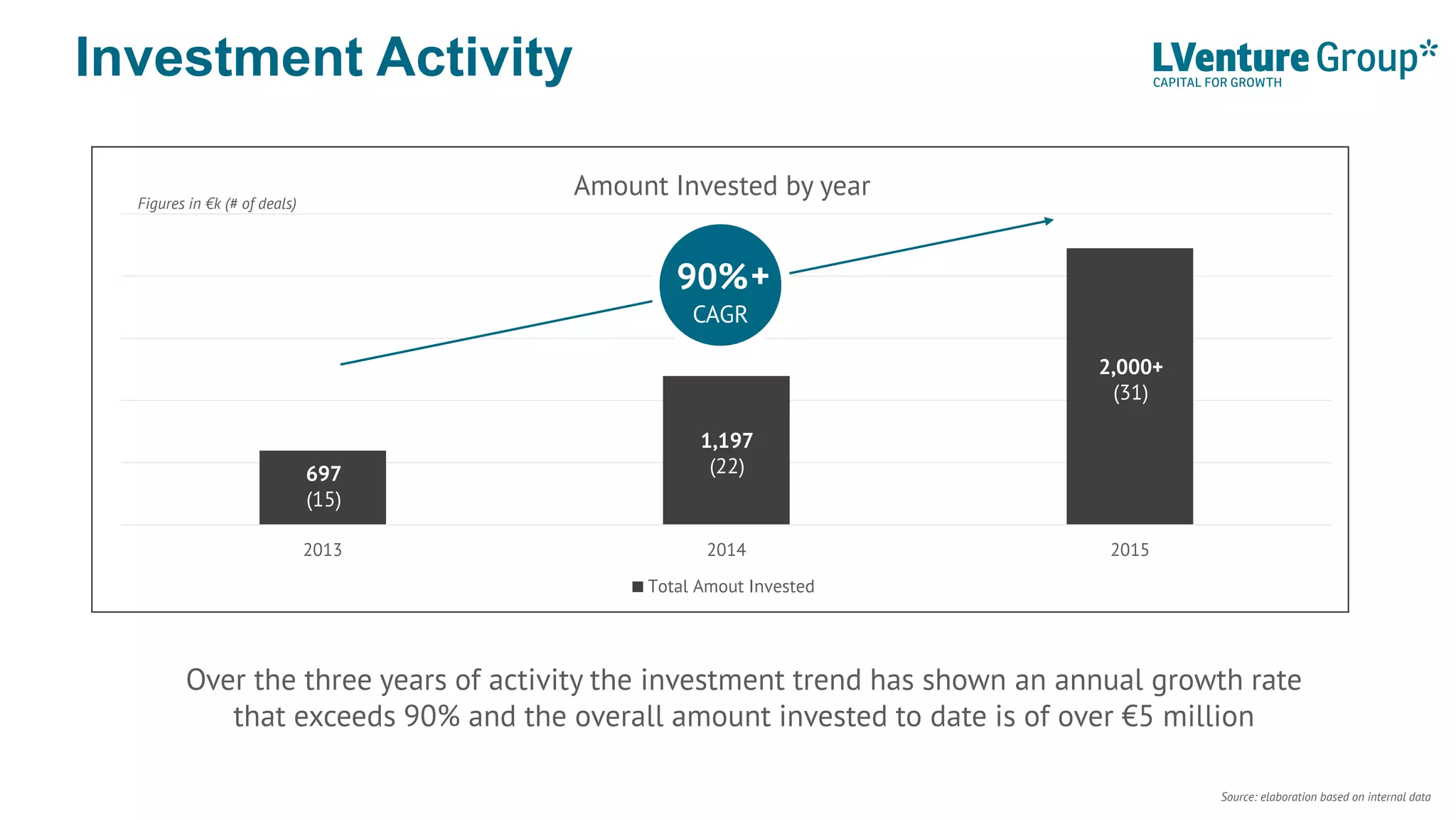

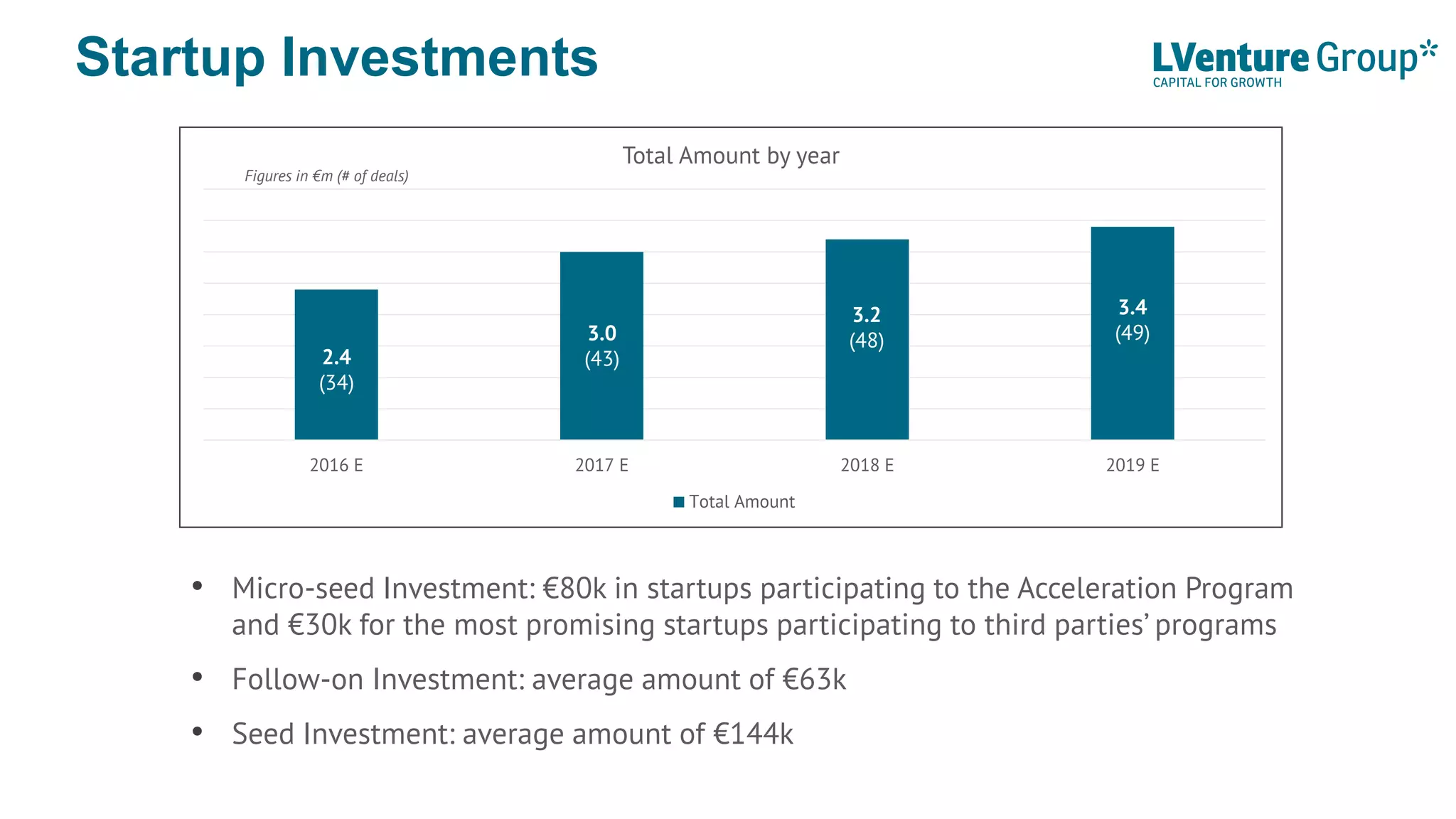

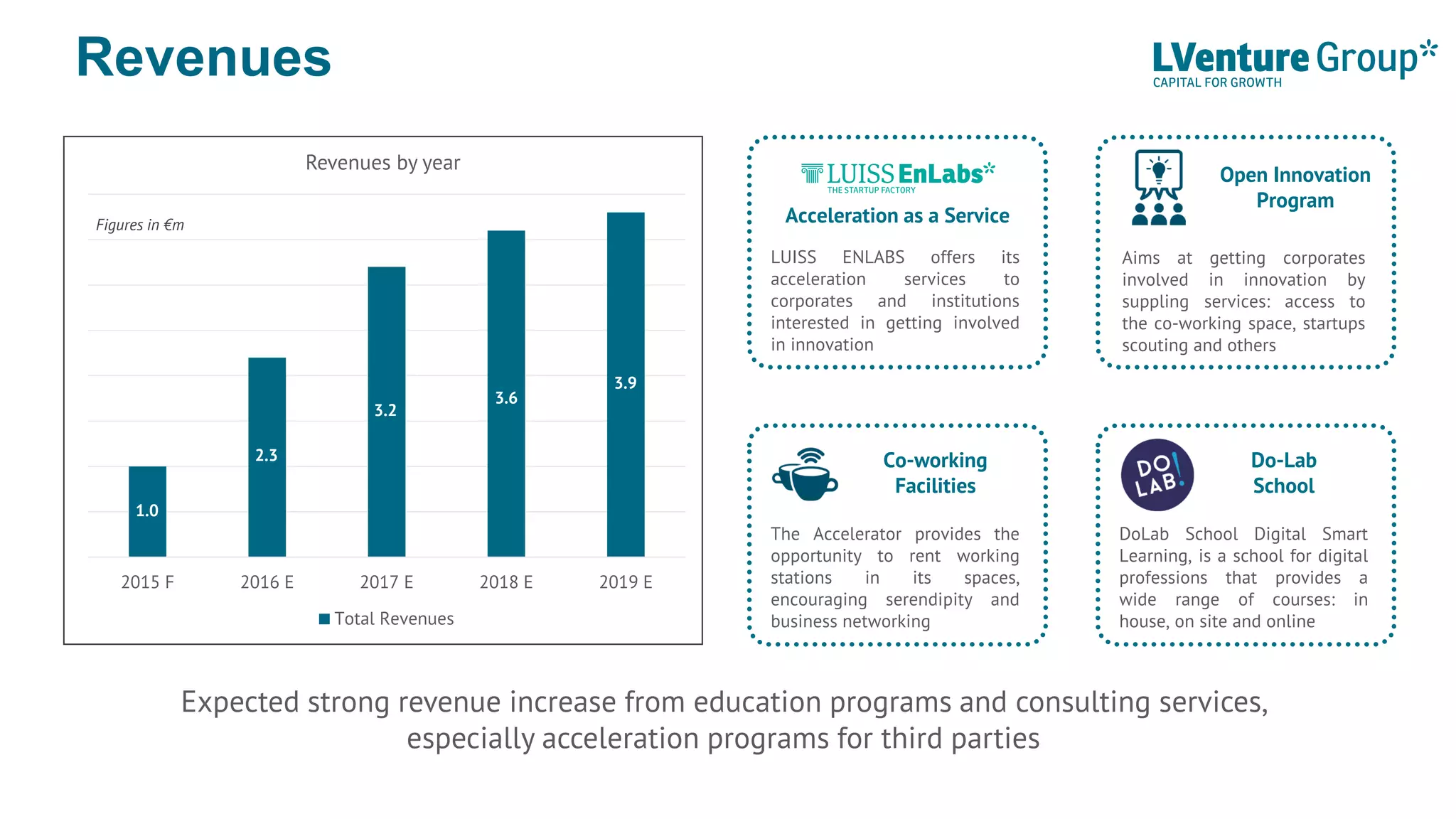

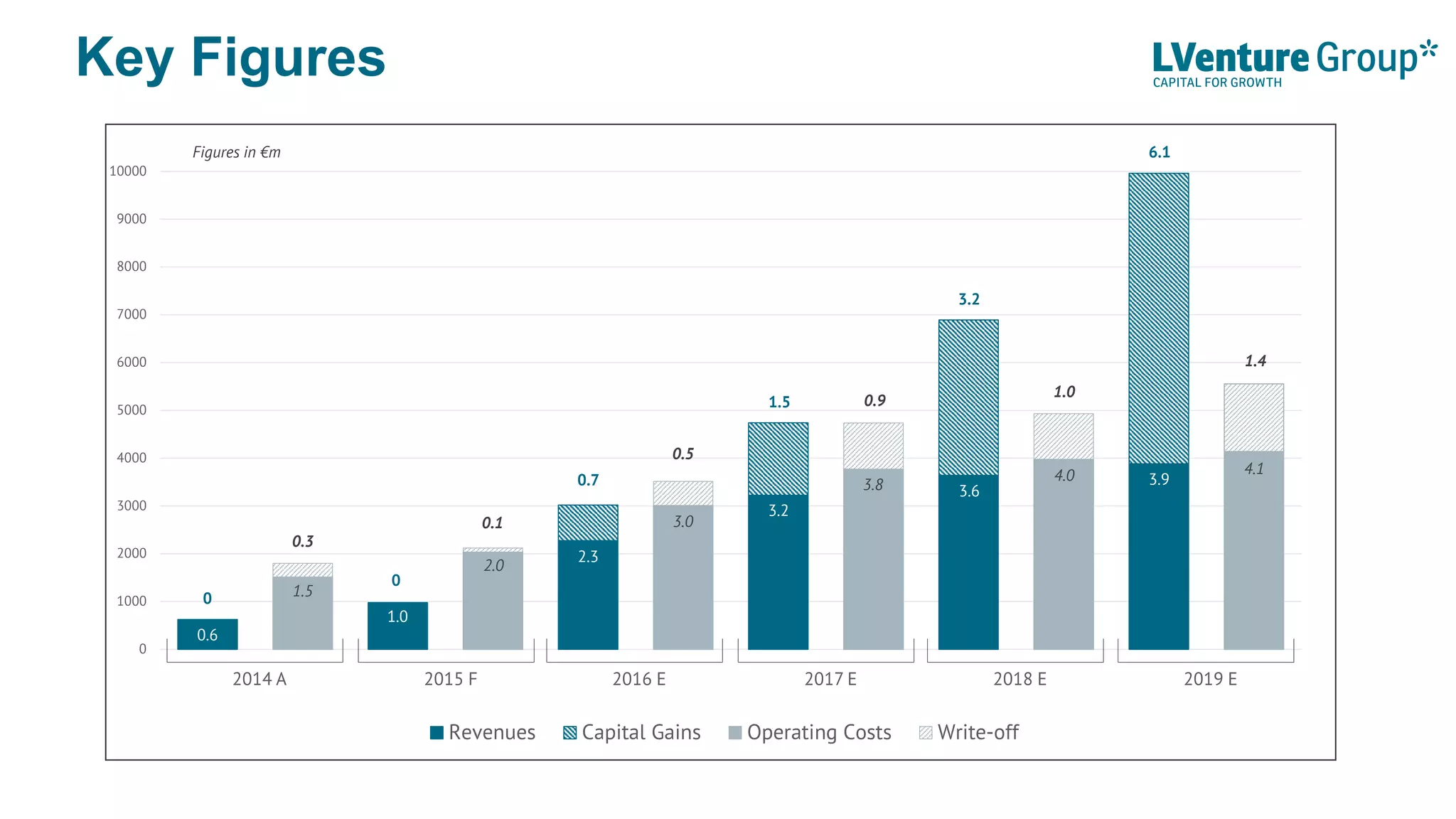

This document provides an overview and disclaimer for LVenture Group, an Italian venture capital firm. It summarizes LVenture Group's business model, which includes micro-seed and seed stage investments in startups through an acceleration program. It also discusses LVenture Group's competitive advantages, ecosystem of partners, investment portfolio and results to date. The document outlines LVenture Group's strategic goals of exits from portfolio companies, increasing revenues, and expanding internationally. It promotes investing in LVenture Group for exposure to high-growth startups through a publicly traded security.