Organizational behaviour

- 1. BIG FIVE PERSONALITY TRAITS MODEL University ofColombo InstituteofHumanRecourseAdvancement Individual Assignment 1

- 2. ABSTRACT A digital era of consumerism and the diversity of customer’s background have brought a new perspective in customer service field. As marketplace environment become broader, the expectations of customer continue to rise. This is very important and challenging task to be done by most banks and financial institutions. Hence, this discussion aims to propose a conceptual framework on what are personality traits need in banking sector and its relationship towards their job performance in financial and banking industry. The five-factors in Big-five Model are used as critical dimensions that possibly provide empirical evidence in relation to banking job performance. Those dimensions or traits are namely as openness to experience, conscientiousness, extraversion, agreeableness and emotional stability. Advances in technology are allowing for delivery of banking products and services more conveniently and effectively than ever before thus creating new bases of competition. Rapid access to critical information and the ability to act quickly and effectively will distinguish the successful banks of the future. The bank gains a vital competitive advantage by having a direct marketing and accountable customer service environment and new, streamlined business processes. Consistent management and decision support systems provide the bank that competitive edge to forge ahead in the banking marketplace. In reality there are possibilities that bankers’ personality traits would be required differently based on nature of the industry. Other than that, in some cases, each Big-five dimensions were not tested independently. In this scenario, this discussion would be a cushion to identify how the Big Five Personality Traits Model compares with bank industry. 2

- 3. INTRODUCTION Commercial Bank of Ceylon PLC is one of the leading commercial banks in Sri Lanka with more than 255 branches and 625 ATMs. Commercial Bank has the largest single ATM network in Sri Lanka. The bank expanded the baking operations to international market by establishing banking operations in Bangladesh & Maldives. It has been rated as the Best Bank in Sri Lanka by "Global Finance" for the 14th consecutive year and also as the Bank of the Year by "The Banker" Magazine on seven occasions. Having set a benchmark in banking in Sri Lanka Commercial Bank have set standards, created an identity, and forged an unsurpassable trend. Recognized as a trend setter, Commercial Bank has maintained their cultural identity while providing a range of products and services. Powered by state-of-the-art technology and driven by a team of highly motivated, dynamic individuals Commercial Bank have become the leader in private banking in Sri Lanka. Organizational Profile Organization Name - Commercial Bank of Ceylon PLC Address - Commercial House, No 21, Sir Razik Fareed Mawatha, P.O. Box 856 Colombo 1, Sri Lanka. Type of organization - Licensed Commercial Bank Nature of business - Providing of financing facilities and services for individuals & business entities in accordance to the rules & guidelines issued by the Central Bank of Sri Lanka Vision of the Bank - To be the most technologically advanced, innovative and customer friendly financial services organization in Sri Lanka, poised for further expansion in South Asia. Mission of the Bank - Providing reliable, innovative, customer friendly financial services, utilizing cutting edge technology and focusing continuously on 3

- 4. productivity improvement whilst developing our staff and acquiring necessary expertise to expand locally and regionally. Number of employees- More than 4,000 employees Corporate Management Pride combined with a passion for excellence has forged in Commercial Bank a unique brand of banking. They have served their loyal customers, shareholders, partners and employees with a level of commitment that has set us apart and made them a byword in the industry. They are at all times committed to the highest standards of Corporate Governance. They have complied fully with the practices as recommended by the august regulatory bodies such as the Central Bank of Sri Lanka, the Colombo Stock Exchange, the Securities and Exchange Commission of Sri Lanka and the institute of Chartered Accountants of Sri Lanka. In furthering such standards, the Board of Directors has ensured the Bank conducted its business to the highest ethical standards and in the best interests of all its stakeholders. The Bank has several layers and delegation authorities regarding the approval of credit facilities and decision making activities. Mainly, the top management is Corporate Management including Board of Directors and after that there are Regional Managers, Senior Manager, Managers & Assistant Managers as middle management. Simple definition of banking is buying and selling money. We buy money from excess places by giving an interest and sell (lend) the same for the people who are in short of funds by charging of interest. The income of bank is margin between the buying & selling. In addition that the banking industry is the key factor of functioning of all transactions related to physical & trade activities funds activities such as exports, imports and treasury activities. At present, banking industry is developing by utilizing new technology rapidly and most of the banking operations are automated. This will be a key factor to enhance the quality of the customer service and speedy delivery. 4Managing Director / Chief Executive Officer Chairman & Board of Directors

- 5. S. Renganathan Sanath Manatunge Managing Director / Chief Executive Officer Chief Operating Officer / Executive Director 5 Chief Operating Officer / Executive Director Chief Financial Officer DGM HR Management DGM Marketing DGM Personal Banking Head of Global Markets DGM Corporate Banking AGM Information Technology AGM Finance AGM Services AGM Compliance Head of Global Treasury AGM - Credit Supervision & Recoveries AGM Operations AGM Corporate & Trade Services AGM Management Audit Chief Risk Officer AGM Personal Banking I/SME AGM Personal Banking II AGM Personal Banking III AGM Planning AGM Corporate Banking

- 6. Nandika Buddhipala Isuru Tillakawardana Hasrath Munasinghe Chief Financial Officer DGM - HR Management DGM - Marketing Sandra Walgama Prins Perera Naveen Sooriyarachchi DGM - Personal Banking Head of Global Markets DGM – Corporate Banking Krishan Gamage Prasanna Indrajith Chinthaka Dharmasena AGM - Information Technology AGM – Finance AGM – Services Selva Rajasooriyar S Prabagar Asela Wijesiriwardena AGM – Compliance AGM - Operations Head of Global Treasury Priyantha De Silva B A H S Preena Delakshan Hettiarachchi 6

- 7. AGM -Credit Supervision & Recoveries AGM -Corporate & Trade Services AGM - Personal Banking I/SME Kapila Hettihamu John Premanath Mithila Shamini Chief Risk Officer AGM – Management Audit AGM - Personal Banking II M P Dharamasiri Dharshanie Perera Tamara Bernard AGM - Planning AGM - Personal Banking III AGM - Corporate Banking History of Big Five personality theory Several independent sets of researchers discovered and defined the five broad traits based on empirical, data-driven research. Ernest Tupes and Raymond Christal advanced the initial model, based on work done at the U.S. Air Force Personnel Laboratory in the late 1950s. J.M. Digman proposed his five factor model of personality in 1990 and Goldberg extended it to the highest level of organizations in 1993. In a personality test, the Five Factor Model or FFM and the Global Factors of personality may also be used to reference the Big Five traits. Personality Characteristics of Immediate Supervisor Author is employed attached to Commercial Bank- Old Moor Street branch in the capacity of a Junior Executive Assistant. Old Moor street Branch is situated at Colombo 12 near to Armour Street. It is unique due to following reason, 7

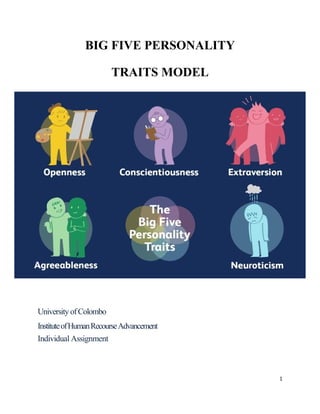

- 8. • Old Moor Street is the place where most of the goods relating to construction activities such as iron based equipments & goods, ceramic goods are being sold. More than 60% of total consumption of the country has been manufactured or imported through the sellers of Old Moor street. • Most of the facilities are import line facilities with large exposure ( more than Rs.100.00 Mn) and High demanding clientele. Job Profile of Immediate Supervisor Name - Mr. J C D Wijesinghe ( Charles Wijesinghe) Post - Assistant Manager Credit department Age - 37 years old Employment History - Joined with Commercial Bank in 2002 as a banking trainee. - Promoted to JEO level in 2008. - Promoted to Assistant Manager Grade in 2014. - Worked attached to Dehiwala branch, HR Department,Mathara branch. Big Five personality traits Human resources professionals often use the Big Five personality dimensions to help place employees. That is because these dimensions are considered to be the underlying traits that make up an individual’s overall personality. The Big Five personality traits are as follows, • Openness to experience • Conscientiousness • Extraversion • Agreeableness • Emotional Stability Big Five Personality Characteristics of Immediate Supervisor 1) Openness to experience 8

- 9. Openness is one of the five personality traits of the Big Five personality theory. It indicates how open-minded a person is. A person with a high level of openness to experience in a personality test enjoys trying new things. Mr.Wijesinghe is an imaginative, curious, and open-minded person. Most of the time, he intends to complete his works by adding new ideas and new theories which will help to enhance the quality of the works. In addition to that he delegates his works with his team members where his subordinates get a chance to learn new things and grab the leadership qualities. He always motivates and encourages fresh ideas. The sub traits of the openness of Mr.Wijesinghe are, • Imagination • Artistic interests • Emotionality • Adventurousness • Intellect • Liberalism 2) Conscientiousness A person scoring high in conscientiousness usually has a high level of self-discipline. Mr.Wijesinghe prefers to follow a plan, rather than act spontaneously. His methodic planning and perseverance usually makes the highly successful in chosen works and targets. Conscientiousness is about how a person controls, regulates, and directs their impulses. Mr.Wijesinghe is good at formulating long-range goals, organizing and planning routes to these goals, and working consistently to achieve them. Despite short-term obstacles he may encounter and also he is a responsible and reliable person. The sub traits of conscientiousness of Mr.Wijesinghe are, • Self-efficacy • Orderliness 9

- 10. • Dutifulness • Achievement-striving • Self-discipline • Cautiousness 3) Extraversion Extraversion indicates how outgoing and social a person is. A person who scores high in extraversion on a personality test is the life of the party. He enjoys being with people, participating in social gatherings, and are full of energy. Mr.Wijesinghe enjoys engaging with the external world and thrives on excitement, and is enthusiastic, action-oriented people. 4) Agreeableness A person with a high level of agreeableness in a personality test is usually warm, friendly, and tactful. Such qualities has delighted the personality of Mr.Wijesinghe. He generally has an optimistic view of human nature and gets along well with others. Social harmony is an important goal for individuals that score high on agreeableness in a career test. He is willing to put aside his interests for other people and is helpful, friendly, considerate, and generous. His basic belief is that people are usually decent, honest, and trustworthy. The sub traits of the agreeableness of Mr.Wijesinghe are, • Trust • Morality • Altruism • Cooperation • Modesty • Sympathy 5) Emotional Stability 10

- 11. Emotional stability refers to a person's ability to remain stable and balanced. At the other end of it, a person who is high in neuroticism has a tendency to easily experience negative emotions. He reacts less emotionally and is less easily upset towards the decision making activities & difficult situations. He tends to be emotionally stable, calm, and do not constantly experience negative feelings. How helps the Big Five Personality Characteristics of Mr.Wijesinghe to achieve the targets at his work place Openness to experience is positively related to job performance of banking industry and lead to job satisfaction where the banker with open minded tend to be creative, smart, eager to try new things, imaginative, thoughtful, intellectual, and being independent. By using unique and innovative method, productivity and creativity in a workplace will be increase. It will be cushion to complete the target with open-mind and easy going on activities. In banking activities, customer service is the core element. So as an Assistant Manger, he needs to grab new ideas and theories to meet the present market demand and targets. Banking is depends on money so we need to act financial discipline and our works need to be done in time scheduled to meet the monthly targets. As an assistant Manager, Mr.Wijesinghe needs to organize the monthly works and plans the strategic methods to meet the whole year activities. Customer service work requires service provider become dependably and follow procedure and rules, it suit well the trait of conscientiousness. Extraversion is a trait when an individual tend to be sociable, outgoing, gregarious, expressive, warm hearted and talkative. In banking industry, we need all of those qualities & personalities to win the heart of the customer and maintains the good customer relationship. 11

- 12. Agreeableness is a vital component of social attitude in terms of interaction among group members, interpersonal relationship, blending with others and positively correlates with teamwork and negatively affected leadership abilities. In the bank environment, the team work is very important activity and the attributes such as kindness, likeability and thoughtfulness would lead successful relationships and increase performance and motivation among co-workers. Agreeableness was positively related to customer service orientation where frontline employee predisposed to perform well and enjoyed the work related to serving customers. Bankers with high emotional stability feel easy to adapt with new environment, remain calm in difficult situation, peacefulness, confidence and receptive would excel in customer service field since they are emotionally stable in stressful situation. Individual with ability to control stress, anxiety and depression strongly related to job performance that involved teamwork. Dealing with challenging customers with multiple request, complaint and demand require high emotional tolerate. According to above discussion, in banking industry, the customer relationship is the main factor of successful. So maintain the same, we need to act as a smart, intelligent, openness to experience, conscientiousness, extraversion, agreeableness and emotional stability. So, Mr.Wijesinghe is role model for other young banking employees regarding the above personality traits. Motivation influence on performance of bank employees Staff motivation is one of the key drivers of success in today's competitive environment and also it is an essential item of banking industry. Every person needs motivation to gear up their life and official work activities. In banking industry, motivation facts are vary from employee to employee since their life and professional targets in the banking industry is different. The discussion seeks to determine the factors that influence bank staff motivation. Analyzing the variance explained by variables in staff motivation as well as determining whether there are 12

- 13. statistically significant differences in the levels of the factors that affect staff motivation. There were statistically significant differences between the levels of the factors that affect staff motivation except between staff supervision and staff perceived competence and staff recognition and job satisfaction. This is an age-old management questions, how to motivate employees for higher productivity and how to get them to produce over and beyond established goals without busting the budget. Fortunately, there are several solutions. We must remember that while employees need money to survive, they often are motivated by other elements in the workplace. As humans, we all have different motivators. When management can determine and then best satisfy its employees' needs, it will create a process that promotes productivity without going over budget. Following are the eight needs with some tips on how to best use them to motivate. Personal growth and development. To satisfy this need, management must match employees' interests, strengths and skills with the job to be done. If there is no match, or if it's minimal, interest in the job may wane, and so will productivity. Management should perform 360 º assessments of needed job core competencies, duties and responsibilities and compare the results with incumbent capabilities. This test will examine whether employees in specific areas are fulfilled, motivated and productive. They look on it as only a part of the total life experience, and like life itself, it should provide for their personal growth and development. If these needs aren't met in the work environment, these employees may be less than fully motivated and productive, and often will move on, to develop themselves elsewhere. Challenging work. Those with this need want to exercise their talents to attain success. They are self-motivated, so management must provide challenging assignments in order for them to consistently produce and they must be allowed to learn from failure. Recognition. When employees have done a good job, particularly when they've succeeded in a challenging assignment, nearly all want to be recognized for doing so. When this doesn't occur, the result often is de-motivating .But, when honestly and genuinely offered by supervisors and 13

- 14. other management, praise and recognition can be one of the greatest motivators. Authority. Those with this need like to lead, direct, influence and control others. They should be given decision-making opportunities on projects that may motivate them to produce with maximum effort. Interaction and affiliation. People with these needs should be with others, and must find the social aspects of the workplace to be a valuable and rewarding experience. To motivate these employees, provide opportunities to work on teams, as well as to participate in group projects and meetings. Independence. Some employees need freedom to set their own schedules, to make their own decisions and to work without interference from others. These are the people who want to work rather strange hours. Often, those in creative functions and the arts are highly motivated and produce great things when this need is fulfilled. Predictability. Many people are best motivated when they have job security. A predictable environment, steady income and health benefits, as well as a pleasant, safe, harassment-free, non-confrontational workplace are adequate to satisfy, motivate and create productivity in those with this need. Fairness. To satisfy this need, there must be equality of work, pay, hours and treatment. For employees with this need, favoritism becomes a de-motivator, and it may lower productivity substantially. Money is an important motivator too. But, be careful. Sometimes, individual cash awards for excellence can cause a reduction in teamwork since some employees may concentrate on their own personal cash gains. Unless cash bonuses and incentives are awarded for the right reasons and in a fair and equitable way, de-motivation and lower productivity of individuals and teams may occur. It's wise to balance individual awards with those for team success. 14

- 15. Top management can help their bottom lines by coaching supervisors on the benefits of assessing employee needs, and then satisfying them. The result can be a motivated workforce that creates higher productivity and greater profits. CONCLUSION Determining employees’ performance is a vital as it is believed to have a direct impact factor towards the overall organization performance. However, with resources constrained faces by today’s banking industry, organizations can implement a strategy for improving customer experience by hiring talented customer service representatives. A good strategy implementation will yield tangible benefits for both company and its customers. A part from that, workplace such as in banking environment and the job design that suits to employee’s personality traits contribute to employee behaviors which produce results for customers. This is in-line with the tagline of ‘happy employee, happy customers’. The above discussion brings the organization to sit down and think what kind of personality traits that are actually influenced job performance thus enable company to create a happy customer who in turn will do a repeat purchase and become a lifetime loyal customer to the organization. Due to that, industry players are encouraged to determine the influence of its employee’s personal traits towards their job performance. More importantly, talented employees that correctly-hired by the organization may result in long-term increase in customer’s loyalty, this in turn leads to cost savings by reducing employees turnover. Indirectly, these effects improved bank’s profitability and market share. REFERENCE • Stephen P. Robbins, Organizational Behavior (15th edition), Pearson Education, Inc. • Bank information - https://www.combank.net/ 15

- 16. • Annual report of 2017. 16