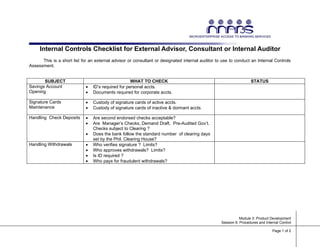

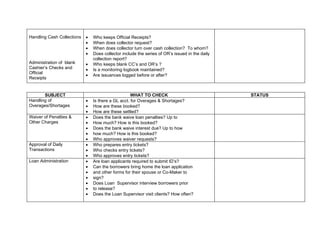

This internal controls checklist is to be used by an external advisor to assess the controls in place for various bank operations. It includes controls to check for savings and checking account openings, signature cards, handling deposits, withdrawals and cash collections. It also includes controls for blank check and receipt administration, overages/shortages, waivers, daily transaction approvals and loan administration. The advisor is to check the status of the controls listed for each subject area.