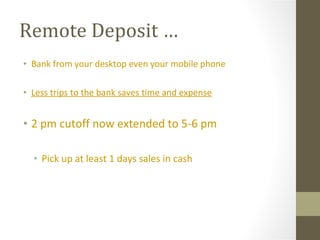

The document provides advice for financial advisors on helping clients dealing with cash flow issues. It discusses using treasury management products like remote deposit, ACH payments, and zero balance accounts to improve cash flow. It also recommends advisors check if their client's bank is financially stable and still lending before putting the client's financial destiny in its hands. Advisors should find clients a profitable bank that is adequately capitalized and actively lending if their current bank has regulatory issues.