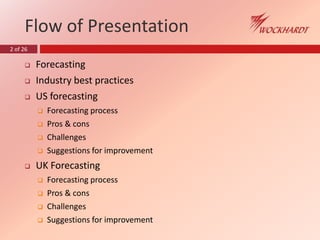

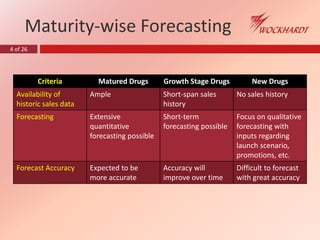

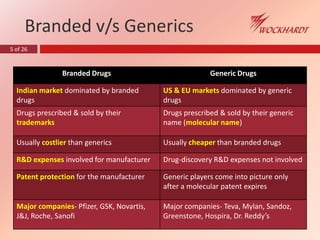

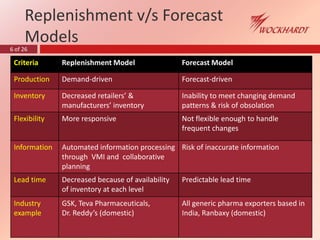

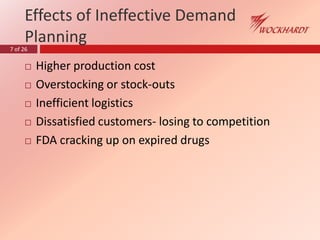

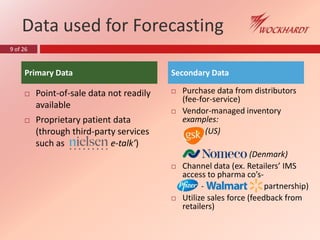

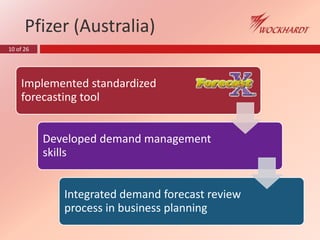

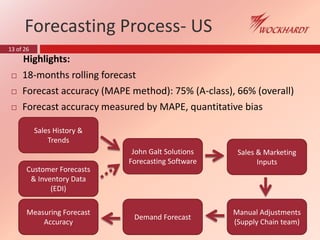

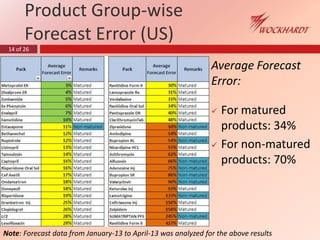

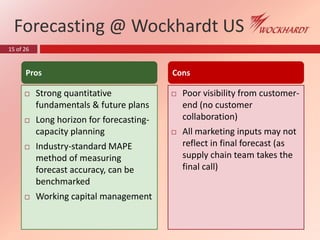

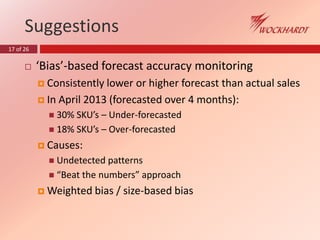

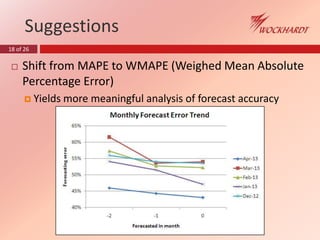

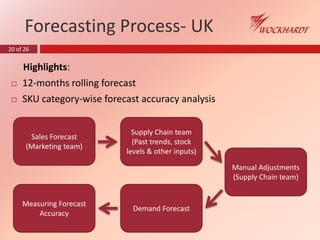

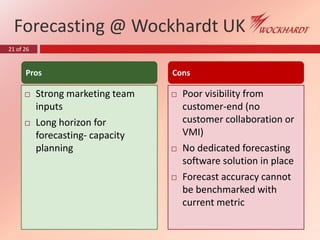

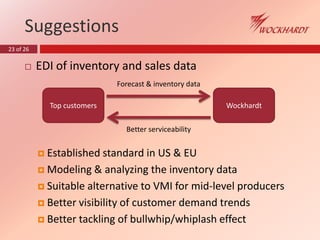

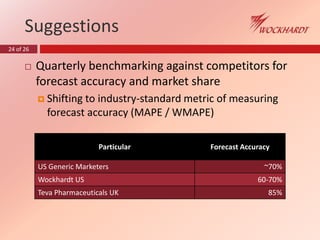

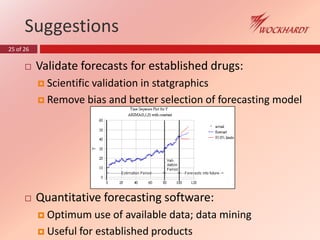

The document discusses forecasting in regulated markets, focusing on the US and UK pharmaceutical industries. It covers forecasting models, best practices, challenges, and suggestions for improving accuracy and collaboration between supply chain and marketing teams. The analysis also highlights the differences between branded and generic drugs and the implications of ineffective demand planning.