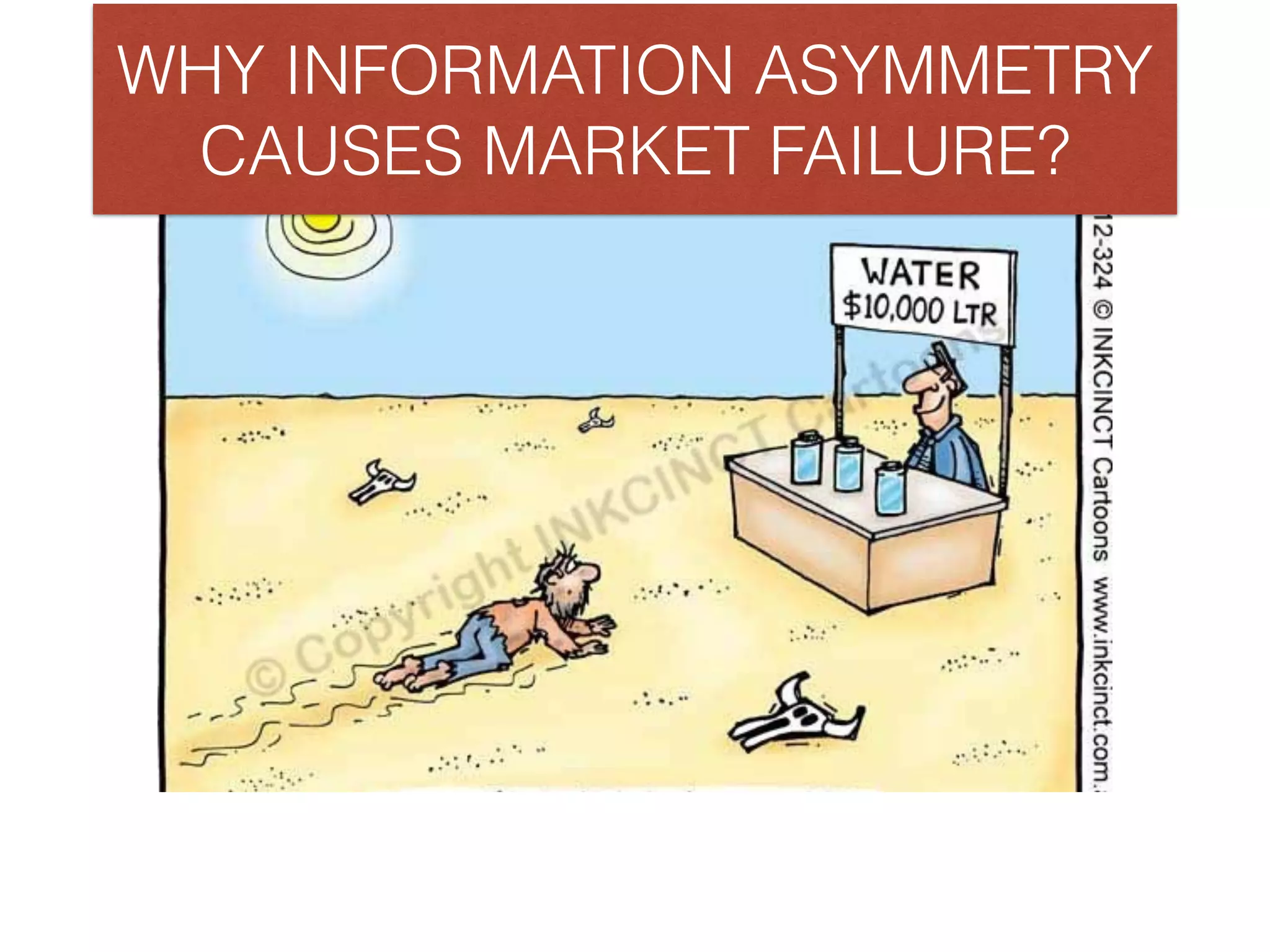

- Markets with asymmetric information involve situations where buyers and sellers have unequal access to information, such as with used cars or insurance.

- In the market for used cars, sellers know more about quality than buyers. With more low-quality cars for sale, high-quality cars are driven from the market, creating a "lemons problem."

- Similar problems occur in insurance and employment markets due to information asymmetries. Principals and agents also have misaligned incentives in these contexts due to unequal access to information.