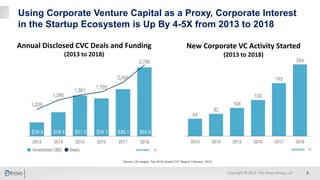

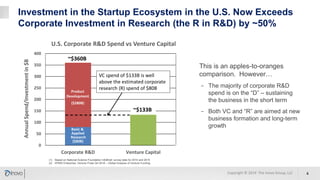

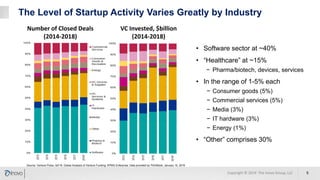

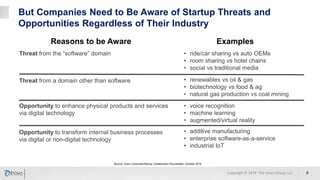

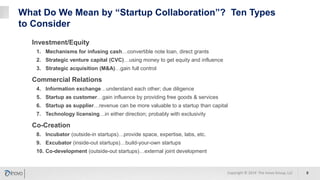

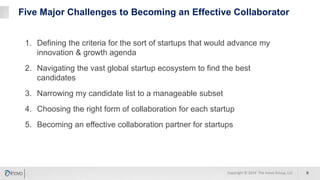

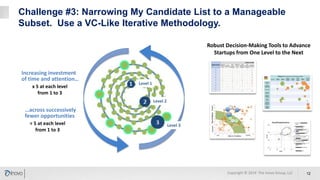

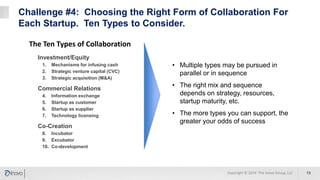

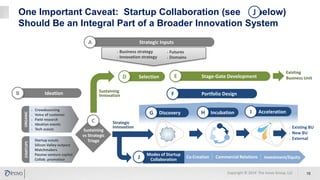

The Inovo Group document outlines key trends driving corporate interest in startup collaboration, including a growing startup ecosystem, increased cash reserves, and evolving collaboration modes. It highlights that corporate venture capital investment has surged, surpassing corporate R&D spending, and discusses opportunities and challenges companies face in engaging with startups. Various collaboration types and a structured approach to navigating the startup ecosystem are emphasized as critical for achieving strategic innovation success.