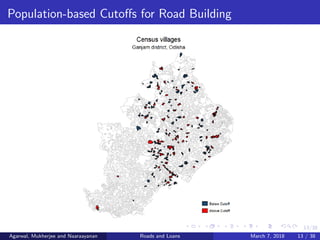

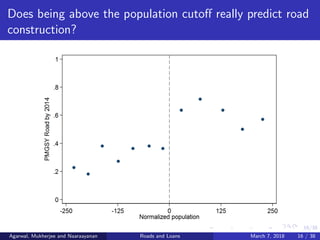

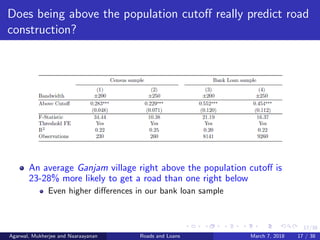

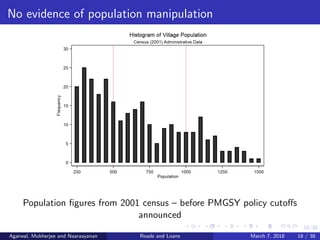

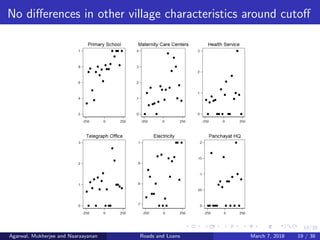

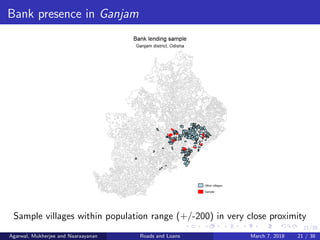

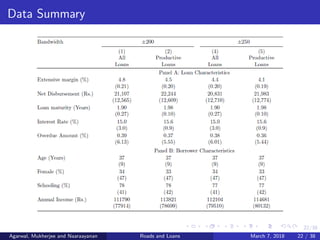

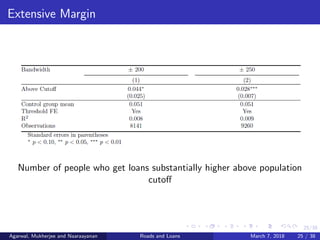

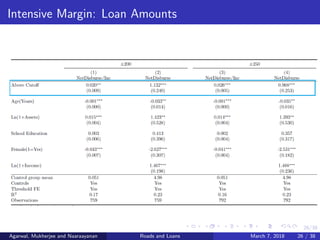

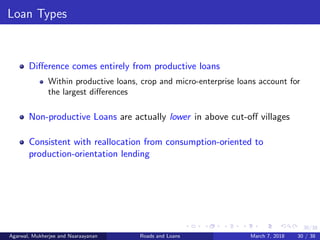

The document discusses the relationship between road infrastructure and financing in rural India, emphasizing that improved roads are expected to boost productivity by enabling access to markets and opportunities. It questions whether private financing will respond effectively to these productivity changes, noting that many rural areas lack formal financial services. The study highlights the implications of financing availability for rural households and the potential impact on inequality in access to opportunities created by new roads.