This document discusses the growing need for global infrastructure investment totaling over $40 trillion by 2030. Rapid economic growth and urbanization in developing nations is straining existing infrastructure networks and necessitating massive upgrades. Developed nations also need to upgrade deteriorating infrastructure assets. The document outlines the attractive characteristics of listed infrastructure securities as an investment class to help meet this growing need, including stable cash flows, high barriers to entry, and low correlation to other asset classes.

![EDUC ATIONAL SERIES

3GLOBAL LISTED INFRASTRUCTURE

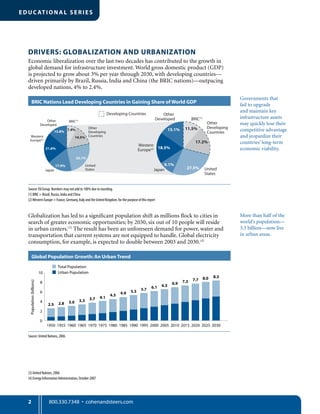

The $40 Trillion Infrastructure Challenge: 2005–2030

Projected Infrastructure Spending (in trillions)

Sources: Booz Allen Hamilton, Global Infrastructure Partners,World Energy Outlook, Organisation for Economic Co-operation and Development (OECD), Boeing,

Drewry Shipping Consultants, U.S. Department ofTransportation

Water $0.23

Power $0.18

Road Rail $0.31

Air/Seaport $0.14

MIDDLE

EAST

Total: $0.86

Water $0.23

Power $0.54

Road Rail $0.31

Air/Seaport $0.02

AFRICA

Total: $1.10

Water $3.62

Power $1.53

Road Rail $0.94

Air/Seaport $0.43

NORTH

AMERICA

Total: $6.52

Water $4.97

Power $1.44

Road Rail $1.01

Air/Seaport $0.06

LATIN/

SOUTH

AMERICA

Total: $7.48

Water $4.52

Power $1.08

Road Rail $3.12

Air/Seaport $0.43

EUROPE

Total: $9.15 Water $9.04

Power $4.23

Road Rail $2.11

Air/Seaport $0.51

ASIA/

OCEANIA

Total: $15.89

Water 55%

Power 22%

Road Rail 19%

Air/Seaport 4%

Percentage of

Infrastructure

Spending by Sector,

Through 2030:

In most developing nations, the lion’s share of infrastructure spending will target new

construction as governments strive to expand inadequate networks. In developed

countries, the immediate need is to upgrade and maintain existing infrastructure.(1)

Global demand

for infrastructure

demand is diversified

by geography and

by industry.

Global Leaders Weigh in on Infrastructure

Presidents and prime ministers around the world have made infrastructure

creation and upkeep a priority.

Brazil—“As a government priority we have taken on the construction of major

infrastructure projects in our region. More than just a large group of paths of

integration, it will be a channel for development, bringing economic progress to

areas that have been left out of the benefits of modern society.”

–President Luiz Inácio Lula da Silva, 2004

Canada—“In collaboration with the private sector and other levels of government,

our government is embarking on the largest infrastructure development program

in half a century (C$33 billion). Not since the great national transportation mega

projects of the post-war era has the federal government launched such a massive

undertaking.”

–Prime Minister Stephen Harper, 2007

Australia—“Many urban water pipe systems have been laid down a century ago,

leak like hell, resulting in certain cities [having] up to 30% loss in leakage. That’s

why we’ve established a quarter of a billion dollar fund to partner with local

authorities and state governments, where appropriate, to deal with that.”

–Prime Minister Kevin Rudd, 2008

(1)“Policy Brief: Infrastructure to 2030,”Organisation for Economic Co-operation and Development (OECD), January 2008](https://image.slidesharecdn.com/3fd6f80a-4685-464a-9e34-7193e340177a-151126004225-lva1-app6892/85/GlobInfrastructure-5-320.jpg)