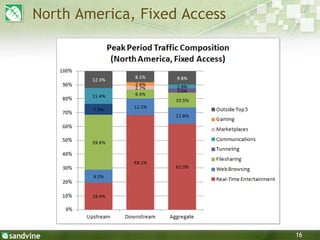

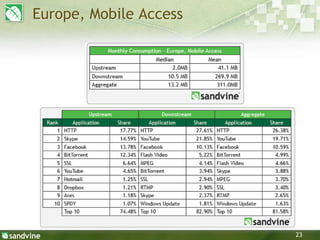

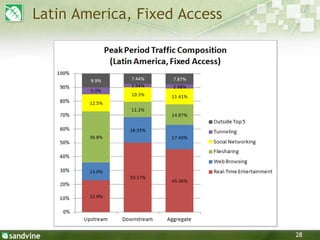

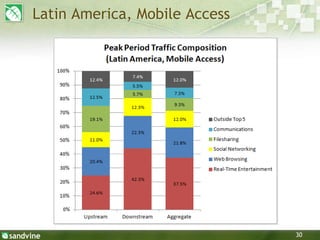

The 2013 Global Internet Phenomena Report analyzes internet usage trends globally, highlighting a 25% increase in European mobile monthly usage. Key findings indicate that Skype and other communication apps dominate traffic in Latin America, while Apple devices account for significant audio and video streaming in North America. The report also details SMS revenue leakage, with significant use of messaging apps like WhatsApp across multiple regions.