September 2014 Market Commentary by David Offer

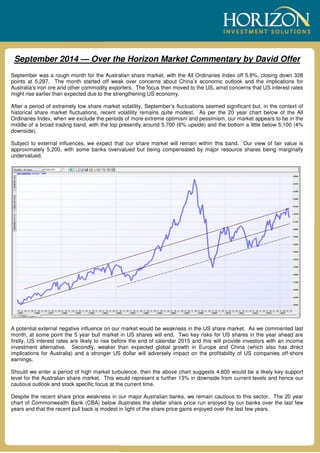

- 1. September 2014 — Over the Horizon Market Commentary by David Offer September was a rough month for the Australian share market, with the All Ordinaries Index off 5.8%, closing down 328 points at 5,297. The month started off weak over concerns about China’s economic outlook and the implications for Australia’s iron ore and other commodity exporters. The focus then moved to the US, amid concerns that US interest rates might rise earlier than expected due to the strengthening US economy. After a period of extremely low share market volatility, September’s fluctuations seemed significant but, in the context of historical share market fluctuations, recent volatility remains quite modest. As per the 20 year chart below of the All Ordinaries Index, when we exclude the periods of more extreme optimism and pessimism, our market appears to be in the middle of a broad trading band, with the top presently around 5,700 (6% upside) and the bottom a little below 5,100 (4% downside). Subject to external influences, we expect that our share market will remain within this band. Our view of fair value is approximately 5,200, with some banks overvalued but being compensated by major resource shares being marginally undervalued. A potential external negative influence on our market would be weakness in the US share market. As we commented last month, at some point the 5 year bull market in US shares will end. Two key risks for US shares in the year ahead are firstly, US interest rates are likely to rise before the end of calendar 2015 and this will provide investors with an income investment alternative. Secondly, weaker than expected global growth in Europe and China (which also has direct implications for Australia) and a stronger US dollar will adversely impact on the profitability of US companies off-shore earnings. Should we enter a period of high market turbulence, then the above chart suggests 4,600 would be a likely key support level for the Australian share market. This would represent a further 13% in downside from current levels and hence our cautious outlook and stock specific focus at the current time. Despite the recent share price weakness in our major Australian banks, we remain cautious to this sector. The 20 year chart of Commonwealth Bank (CBA) below illustrates the stellar share price run enjoyed by our banks over the last few years and that the recent pull back is modest in light of the share price gains enjoyed over the last few years.

- 2. Key reasons for our defensive stance towards the banks include a likely regulatory increase in capital adequacy requirements which will reduce the current high returns enjoyed on shareholder equity, increased government regulation such as potentially imposing loan to value ratios for property investment, a general cooling of East Coast residential markets, an inability to further boast profits by reducing bad and doubtful debts now they are at historically low levels and a likely increase in the bank sectors’ cost of off-shore funding. These headwinds are in their infancy but are likely to grow over the next few years. Should Australia’s economy remain soft or weaken, we would not be surprised if Australia’s banks have a year or two of no profit growth. Should this eventuate, investors will require bank yields to increase substantially (we guess to somewhere between 6.5% and 7.0% fully franked) and this can only occur by bank shares falling in value. After allowing for dividend growth in the 2014/15 year, CBA would need to trade at $64.50 to provide a 6.5% yield (9.3% when including franking credits) and at $60.00 to provide a yield of 7.0% (10% including franking credits). Such an outcome would suggest a significant share price fall from current levels but, as the above CBA share price chart shows, CBA shares would simply be back to the mid-point of a 20 year trading range. Of Australia’s big 4 banks, our preference is ANZ. Allowing for the November dividend, ANZ is on a prospective yield of 6.2% (8.85% including franking credits) for the 2015 calendar year. This would suggest a modest 10% downside from the current share price should our bear case scenario materialise. We view the current weakness in resource shares more optimistically. While much has been made of the iron ore price falling to a 5 year low of $80 a tonne, there has been far less talk on the cost reductions being made by Australia’s major iron ore producers. As per the chart below, Australia’s majors in BHP, RIO and Fortescue dominate the world in terms of low cost iron ore production.

- 3. With the majors still increasing production, we don’t expect the iron ore price to increase materially for a number of years. As a result, just as cheap Chinese manufacturing has had dire implications for Australia’s manufacturing sector, we expect Australia’s massive investment in iron ore mines and infrastructure to become the world’s low cost iron ore producer will drive many of China’s smaller high cost producers out of business, as well as most of Australia’s smaller iron ore players. Longer term, this fall in production from high cost iron ore producers will be a positive for Australia’s major iron ore producers. On a 4% fully franked yield and undemanding PE ratio of 14 times, BHP is back in buy territory. We still view capital management initiatives as likely and, for more conservative investors, we like BHP’s diversified earnings base with iron ore representing a third of BHP’s asset base. We view the BHP share price as entering a broad area of share price support. Since expressing our views in July that the hybrid interest securities market was expensive, this sector has weakened considerably over the last 2 months, as evidenced by the CBA PERLS VI chart below.

- 4. We view this sector as once again providing value with our key recommendations being the above CBA PERLS VI, which offer a running yield of 6.5% until maturity in 4 years and the Suncorp Convertible Preference shares, which offer a running yield of 7.25% until maturity in 3 years. Finally, the opportunity to register for a Medibank prospectus is presently open until 15 October 2014. We are presently registering all clients care of our Horizon Bunbury office and also Sydney IPS office. To maximise the likelihood of any potential allocation, we also suggest that you pre-register care of your home address and this can be done care of the following link ‘https://www.medibankprivateshareoffer.com.au/cba’ or by calling 1800 998 778. Should you wish to discuss any of the above and how it may relate to your portfolio, please do not hesitate to contact our office. Sincerely David Offer AUTHORISED REPRESENTATIVE 259188 Director HORIZON INVESTMENT SOLUTIONS PTY LTD SUITE 1, POST OFFICE PLAZA, 153 VICTORIA STREET, BUNBURY WA 6230 T. 08 9791 9188 F. 08 9791 9187 E.david.offer@horizonis.com.au www.horizoninvestmentsolutions.com.au Horizon Investment Solutions Pty Ltd, ACN 083 142 438, ABN 79 668 035 212, AFSL 405897 GENERAL ADVICE WARNING: Please note that any advice provided in this newsletter is GENERAL advice only, as the information or advice given does not take into account your particular objectives, financial situation or needs. Opinions, conclusions and other information expressed in this email are not given or endorsed by Horizon, unless otherwise indicated. Therefore, before you act on any of the information provided in this newsletter, you must consider the appropriateness of the information having regard to your particular objectives, financial situation and needs and if necessary, seek appropriate professional advice. This newsletter is confidential. If you are not the intended recipient, you must not view, disseminate, distribute or copy this document without our consent. Horizon does not accept any liability in connection with any computer virus, data corruption, incompleteness, or unauthorised amendment of this newsletter.