Q2 2105 North American Industrial Highligts

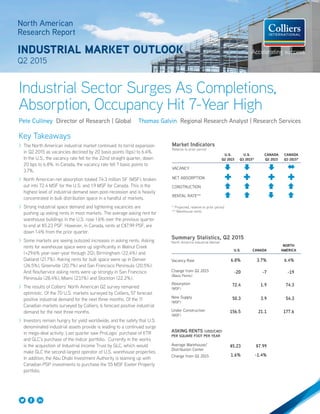

- 1. North American Research Report INDUSTRIAL MARKET OUTLOOK Q2 2015 Key Takeaways >> The North American industrial market continued its torrid expansion in Q2 2015 as vacancies declined by 20 basis points (bps) to 6.4%. In the U.S., the vacancy rate fell for the 22nd straight quarter, down 20 bps to 6.8%. In Canada, the vacancy rate fell 7 basis points to 3.7%. >> North American net absorption totaled 74.3 million SF (MSF), broken out into 72.4 MSF for the U.S. and 1.9 MSF for Canada. This is the highest level of industrial demand seen post-recession and is heavily concentrated in bulk distribution space in a handful of markets. >> Strong industrial space demand and tightening vacancies are pushing up asking rents in most markets. The average asking rent for warehouse buildings in the U.S. rose 1.6% over the previous quarter to end at $5.23 PSF. However, in Canada, rents at C$7.99 PSF, are down 1.4% from the prior quarter. >> Some markets are seeing outsized increases in asking rents. Asking rents for warehouse space were up significantly in Walnut Creek (+29.6% year-over-year through 2Q), Birmingham (22.4%) and Oakland (21.7%). Asking rents for bulk space were up in Denver (26.5%), Greenville (20.7%) and San Francisco Peninsula (20.5%). And flex/service asking rents were up strongly in San Francisco Peninsula (28.4%), Miami (23.1%) and Stockton (22.2%). >> The results of Colliers’ North American Q2 survey remained optimistic. Of the 70 U.S. markets surveyed by Colliers, 57 forecast positive industrial demand for the next three months. Of the 11 Canadian markets surveyed by Colliers, 6 forecast positive industrial demand for the next three months. >> Investors remain hungry for yield worldwide, and the safety that U.S. denominated industrial assets provide is leading to a continued surge in mega-deal activity. Last quarter saw ProLogis’ purchase of KTR and GLC’s purchase of the Indcor portfolio. Currently in the works is the acquisition of Industrial Income Trust by GLC, which would make GLC the second-largest operator of U.S. warehouse properties. In addition, the Abu Dhabi Investment Authority is teaming up with Canadian PSP investments to purchase the 55 MSF Exeter Property portfolio. Industrial Sector Surges As Completions, Absorption, Occupancy Hit 7-Year High Pete Culliney Director of Research | Global Thomas Galvin Regional Research Analyst | Research Services Summary Statistics, Q2 2015 North America Industrial Market U.S. CANADA NORTH AMERICA Vacancy Rate 6.8% 3.7% 6.4% Change from Q1 2015 (Basis Points) -20 -7 -19 Absorption (MSF) 72.4 1.9 74.3 New Supply (MSF) 50.3 3.9 54.3 Under Construction (MSF) 156.5 21.1 177.6 ASKING RENTS (USD/CAD) PER SQUARE FOOT PER YEAR Average Warehouse/ Distribution Center $5.23 $7.99 Change from Q1 2015 1.6% -1.4% Market Indicators Relative to prior period U.S. Q2 2015 U.S. Q3 2015* CANADA Q2 2015 CANADA Q3 2015* VACANCY NET ABSORPTION CONSTRUCTION RENTAL RATE** * Projected, relative to prior period ** Warehouse rents

- 2. C A N A D A N O R T H E A S T M I D W E S T S O U T H W E S T Absorption Per Market (SF) Q1 2015 to Q2 2015 8,000,000 4,050,000 810,000 -810,000 -4,050,000 -8,100,000 4.5 billion 2.25 billion 450 million Occupied SF Vacant SF SF By Region U.S. Industrial Economic Indicators GDP Q2 2015 3.7% (second estimate) Q1 2015 0.6%, down from 2.1% in Q4 2014 ISM Jul-15 PMI® 52.7, down 0.8 pctg. pts. from June-15 RAIL TIME INDICATORS: AAR.ORG Total Railcar Traffic - 1.8% YOY since July-14 Intermodal Traffic + 3.5% YOY since July 14 N O R T H E A S T M I D W E S T S O U T H W E S T Absorption Per Market (SF) Q1 2015 to Q2 2015 8,000,000 4,050,000 810,000 -810,000 -4,050,000 -8,100,000 4.5 billion 2.25 billion 450 million Occupied SF Vacant SF SF By Region S O U T H -4,050,000 -8,100,000 4.5 billion 2.25 billion 450 million Occupied SF Vacant SF SF By Region 2 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International The North American industrial market is at a post-recession high, recording the lowest levels of vacancy coupled with record completions and record net absorption. In the U.S., this is leading to upward pressure on asking warehouse rental rates, which have increased 1.6% from the previous quarter and 5.2% year over year. Still, some caution is warranted as this market strength is highly concentrated. Moreover, 40% of the net absorption seen in 2015 and nearly half of the construction activity are taking place in only a handful of markets: Southern California, Houston, Dallas-Ft. Worth, Chicago and Atlanta. The economic drivers of these markets - international trade and supply chain modernization - will have an outsized effect on the North American aggregate numbers. Caution is also warranted as recent financial market volatility point to rising global economic risks that could weigh on future economic growth in North America and ultimately slow industrial space demand. Nonetheless, recent performance in the industrial sector has been among the strongest this century and explains growing investor interest in good industrial product. Industrial Economic Indicators For the United States, second quarter GDP numbers increased at an annual rate of 3.7%. Gains were made in personal consumption, housing construction and exports. For the United States the manufacturing sector continues to expand, with the Purchasing Managers Index (PMI) recording 52.7 in July, the 31st consecutive month of growth. For Canada, the latest results indicate a decline in GDP and the Bank of Canada has lowered interest rates in an effort to bolster lending. The RBC Canadian Manufacturing PMI registered 50.8 in July, a marginal upturn in the manufacturing sector. Job growth has been positive in the manufacturing sector, which has added 522,000 jobs (1.4%) since the second quarter of 2014. U.S. manufacturing has become increasingly attractive due to cheaper domestic energy and rising labor costs overseas. For many companies the decision to outsource has added complexity, when the shrinking margin on foreign labor, product quality, intellectual property rights and a long distance supply chain are factored in. Overall, however, manufacturing employment is still down from before the recession, but the recent job growth has been a welcome turnaround for the economy – and a driver for U.S. industrial demand. One negative indicator is the 1.0% year-over-year decrease in total railcar traffic according to the American Association of Railroads, although intermodal traffic has increased by 2.5% year-over-year. A major reason for the decline in railroad traffic has been decreased demand for petroleum, metallic ores and coal. Several complex issues are at play that impact the industrial landscape in the near and longer term. In the short term, the Chinese currency was devalued by more than 4% in late August, partly in response to lagging exports. This was the sharpest drop in the Yuan since 1994 and will likely boost imports from China in the short term while also limiting exports to China. Industries likely to suffer as a result include agricultural products, electronic equipment, machines and aircraft – which can ultimately hit warehouse demand, particularly near port cities. The slowdown in China and elsewhere in emerging markets is another growing risk to U.S. expansion and continued strength in the industrial property sector. For the longer term, the prolonged collapse in the commodity market is likely to persist for some time and almost certainly into 2016, meaning pain for those areas whose economies depend on natural resources such as oil, coal or iron. This is an increased chance of recession for Canada and Australia among others, whose economies Sources: BEA, ISM, AAR North American Industrial Vacancy, Inventory & Absorption Q2 2015 | NA

- 3. How would you characterize current industrial rents in your market? % of reporting markets Source: Colliers International Up SamUpSameDown N/A 7.7 7.5 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q2 2013 Q3 Q4 Q1 2014 Q2 Q3 Q4 Q1 2015 Q2 Vacancy% Absorption MSF Completions MSF Vacancy % 8.7 8.3 8.1 7.9 7.7 7.5 7.2 U.S. INDUSTRIAL MARKET Q2 2013 - Q2 2015 8.1 7.07.0 6.86.8 -2.0 0.0 2.0 4.0 6.0 8.0 10.0 Millions Currently U/C Q2-15 Absorption Calgary, AB Winnipeg, MB Regina, SK Ottawa, ON Victoria, BC Montréal, QC Saskatoon, SK Edmonton, AB Waterloo Region, ON Vancouver, BC Toronto, ON ABSORPTION, UNDER CONSTRUCTION (SF) | SELECT MARKETS | Q2 2015 0. New Jersey - Northern Savannah, GA New Jersey - Central Indianapolis, IN Houston, TX Los Angeles, CA Atlanta, GA Dallas-Ft. Worth, TX Los Angeles - Inland Empire, CA Chicago, IL -100% 0% 100% 200% 300% $- $20 $40 $60 Billions 2007 2008 2009 2010 20122011 2013 2014 2015 Rolling 4-Qtr Deal Volume Year-over-Year %Change $- $20 $40 $60 Billions 2007 2008 200 12-Month Traili 3 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International depend heavily on resource extraction. Those areas in the United States that depend heavily on oil production will also be impacted negatively. Vacancy Driven by robust absorption in the top U.S. markets, the North American vacancy rate fell by 20 bps to 6.4% in Q2. The decline was broad-based, as the U.S. vacancy rate dropped 20 bps to 6.8%, while the vacancy rate in Canada dropped 7 bps to 3.7%. Vacancy rates declined in each U.S. region, led by the South, which dropped 24 bps to 7.6%. There is a wide disparity in rates among the regions as of the first quarter. The West remained the lowest at 5.0%, trailed by the Midwest (6.6%) and the South (7.6%) while vacancies remained relatively high in the Northeast (8.6%). Western markets ranked among the lowest vacancy rates include Los Angeles (1.8%), Honolulu (2.0%), San Francisco Peninsula (2.7%) and Orange County (3.1%). Savannah was the best performer in the second quarter with the vacancy rate dropping by 150 bps to 3.7%. Other markets with sharp drops in vacancy rates were Dayton (-130 bps to 9.1%) and Austin (-120 bps to 7.1%). On the other end of the spectrum, markets with the largest increases were Calgary (+150 bps to 5.8%), Bakersfield (+140 bps to 4.8%) and Stockton (+110 bps to 8.4%). Calgary is the epicenter of Canadian oil and gas extraction, while Bakersfield and Stockton are heavily reliant on agricultural products hurt by a prolonged drought in California. Manufacturing at a Glance - July 2015 INDEX SERIES INDEX (JULY 2015) SERIES INDEX (JUNE 2015) PERCENTAGE- POINT CHANGE DIRECTION RATE OF CHANGE TREND* (MONTHS) PMI® 52.7 53.5 -0.8 Growing Same 31 New Orders 56.5 56.0 0.5 Growing Faster 32 Production 56.0 54.0 2.0 Growing Faster 35 Employment 52.7 55.5 -2.8 Growing Slower 3 Supplier Deliveries 48.9 48.8 0.1 Faster Slower 2 Inventories 49.5 53.0 -3.5 Contracting From Growing 1 Customer Inventories 44.0 48.5 -4.5 Too Low Faster 8 Prices 44.0 49.5 -5.5 Decreasing Faster 9 Backlog of Orders 42.5 47.0 -4.5 Contracting Faster 2 Exports 48.0 49.5 -1.5 Contracting Faster 2 Imports .... 53.5 -1.5 Growing Slower 30 OVERALL ECONOMY Growing Slower 74 Manufacturing Sector Growing Slower 31 U.S. Industrial Market Q2 2013 to Q2 2015 Note: Latest data as of Q2 2015 Source: Colliers International *Number of months moving in current direction Source: ISM 0% 20% 40% 60% 80% 100% Midwest Northeast South West Canada U.S. N.A. Excluding renewals, of the leases signed this quarter, did most tenants Expand, Hold Steady or Contract? Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% How would you characterize current industrial rents in your market? N/A Declining Bottoming No Clear Direction Increasing Peaking 8.6% 8.3% 8.5% 25.0% 3.7% 1.4% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 0% 20% 40% 60% 80% 100% U.S. Canada N.A. 8.6% 8.3% 8.5% 25.0% 1.2% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 8.6% 8.3% 8.5% 25.0% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 0% 20% 40% 60% 80% 100% ortheast South Midwest West U.S. Canada N.A. Provide a three month forecast for vacancy levels (relative to current quarter): 0% 20% 40% 60% 80% 100% Provide a three month forecast for rents (relative to current quarter): ortheast South Midwest West U.S. Canada N.A. 66.7% 38.5% 82.6% 67.1% 16.7% 59.8% 30.0% 30.5% 25.0% 12.5% 7.7% 4.3% 7.1% 6.1% 70.0% 66.7% 38.5% 82.6% 67.1% 16.7% 59.8% 30.0% 20.8% 53.8% 13.0% 25.7% 58.3% 30.5% 25.0% 20.8% 53.8% 13.0% 25.7% 58.3% 3.7%12.5% 3.7% 7.7% 4.3% 7.1% 6.1% 70.0% 80.0% 62.5% 38.5% 56.5% 58.6% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.2% 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.4% 1.2%1.4% 25.0% Up SUpSameDown N/A 7.7 7.5 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q2 2013 Q3 Q4 Q1 2014 Q2 Q3 Q4 Q1 2015 Q2 Vacancy% Absorption MSF Completions MSF Vacancy % 8.6 8.3 8.1 7.9 7.7 7.5 7.2 U.S. INDUSTRIAL MARKET Q2 2013 - Q2 2015 8.1 7.07.0 6.86.8 -2.0 0.0 2.0 4.0 6.0 8.0 10.0 Millions Currently U/C Q2-15 Absorption Calgary, AB Winnipeg, MB Regina, SK Ottawa, ON Victoria, BC Montréal, QC Saskatoon, SK Edmonton, AB Waterloo Region, ON Vancouver, BC Toronto, ON ABSORPTION, UNDER CONSTRUCTION (SF) | SELECT MARKETS | Q2 2015 New Jersey - Norther Savannah, GA New Jersey - Centra Indianapolis, IN Houston, TX Los Angeles, C Atlanta, GA Dallas-Ft. Worth, TX Los Angeles - Inland Empire, CA Chicago, I

- 4. Absorption, Under Construction (SF) Select U.S. Markets | Q2 2015 Absorption, Under Construction (SF) Select Canada Markets | Q2 2015 0% 20% 40% 60% Northeast South Midwest West U.S. Canada N.A. 0% 20% 40% 60% Up Same Down N/AUpSameDown N/A Northeast South Midwest West U.S. Canada N.A. 66.7% 38.5% 82.6% 67.1% 16.7% 59.70.0% 66.7% 38.5% 82.6% 67.1% 16.7% 59. 58.3%58.3% 70.0% 80.0% 62.5% 38.5% 56.5% 58.6% 53.7% 50.0% 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53.7% 50.0% 25.0% 7.7 7.5 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q2 2013 Q3 Q4 Q1 2014 Q2 Q3 Q4 Q1 2015 Q2 Vacancy% Absorption MSF Completions MSF Vacancy % 8.6 8.3 8.1 7.9 7.7 7.5 7.2 U.S. INDUSTRIAL MARKET Q2 2013 - Q2 2015 8.1 7.07.0 6.86.8 -2.0 0.0 2.0 4.0 6.0 8.0 10.0 Millions Currently U/C Q2-15 Absorption Calgary, AB Winnipeg, MB Regina, SK Ottawa, ON Victoria, BC Montréal, QC Saskatoon, SK Edmonton, AB Waterloo Region, ON Vancouver, BC Toronto, ON Currently U/C Q2-15 Absorptio ABSORPTION, UNDER CONSTRUCTION (SF) | SELECT MARKETS | Q2 2015 0.0 5.0 10.0 15.0 20.0 25 New Jersey - Northern Savannah, GA New Jersey - Central Indianapolis, IN Houston, TX Los Angeles, CA Atlanta, GA Dallas-Ft. Worth, TX Los Angeles - Inland Empire, CA Chicago, IL Millio 4 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International Absorption Net absorption was strong in Q2 at 74.3 MSF, broken out into 72.4 MSF in the U.S. but only 1.9 MSF in Canada. We expect positive absorption to continue this year in the vast majority of markets. In fact, of the 82 markets in North America, we forecast negative absorption in only two: Calgary and Boston. U.S. Q2 absorption was concentrated in a handful of markets such as the Los Angeles – Inland Empire market, which saw absorption of 5.3 MSF, followed by Houston (3.8 MSF), Atlanta (3.7 MSF), Northern New Jersey (3.5 MSF) Los Angeles (3.5 MSF) and Dallas-Ft. Worth (3.0 MSF). Top Canadian markets for absorption were Vancouver (1.8 MSF) and Toronto (1.7 MSF). 0% 20% 40% 60% 80% 100% Midwest Northeast South West Canada U.S. N.A. Excluding renewals, of the leases signed this quarter, did most tenants Expand, Hold Steady or Contract? Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 0% 20% 40% 60% 80% 100% Northeast South Midwest West U.S. Canada N.A Provide a three month forecast for vacancy levels (relative to current quarter): UpSameDown N/A 80.0% 62.5% 38.5% 56.5% 58.6% 53 25.0% 53.8% 43.5% 32.9% 50.0% 35 20.0% 8.3% 7.7% 7.1% 25.0% 9.8 4.2% 1.2 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53 25.0% 53.8% 43.5% 32.9% 50.0% 35 20.0% 8.3% 7.7% 7.1% 25.0% 9.8 4.2% 1.4% 1.21.4% 25.0% 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q2 2013 Q3 Q4 Absorption MS 8.6 8.3 8. U.S. INDUSTR 8. 0% 20% 40% 60% 80% 100% Midwest Northeast South West Canada U.S. N.A. Excluding renewals, of the leases signed this quarter, did most tenants Expand, Hold Steady or Contract? Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 0% 20% 40% 60% 80% 100% Northeast South Midwest West U.S. Canada N.A Provide a three month forecast for vacancy levels (relative to current quarter): UpSameDown N/A 80.0% 62.5% 38.5% 56.5% 58.6% 53 25.0% 53.8% 43.5% 32.9% 50.0% 35 20.0% 8.3% 7.7% 7.1% 25.0% 9.8 4.2% 1.2 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53 25.0% 53.8% 43.5% 32.9% 50.0% 35 20.0% 8.3% 7.7% 7.1% 25.0% 9.8 4.2% 1.4% 1.21.4% 25.0% 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 2 2013 Q3 Q 8.6 8.3 8. U.S. INDUSTR 8. 0% 20% 40% 60% 80% 100% Midwest Northeast South West Canada U.S. N.A. Excluding renewals, of the leases signed this quarter, did most tenants Expand, Hold Steady or Contract? Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% How would you characterize current industrial rents in your market? N/A Declining Bottoming No Clear Direction Increasing Peaking 8.6% 8.3% 8.5% 25.0% 3.7% 1.4% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 0% 20% 40% 60% 80% 100% U.S. Canada N.A. 8.6% 8.3% 8.5% 25.0% 1.2% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 8.6% 8.3% 8.5% 25.0% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 0% 20% 40% 60% 80% 100% Northeast South Midwest West U.S. Canada N.A. Provide a three month forecast for vacancy levels (relative to current quarter): 0% 20% 40% 60% 80% 100% Provide a three month forecast for rents (relative to current quarter): Up Same Down N/AUpSameDown N/A Northeast South Midwest West U.S. Canada N.A. 66.7% 38.5% 82.6% 67.1% 16.7% 59.8% 30.0% 30.5% 25.0% 12.5% 7.7% 4.3% 7.1% 6.1% 70.0% 66.7% 38.5% 82.6% 67.1% 16.7% 59.8% 30.0% 20.8% 53.8% 13.0% 25.7% 58.3% 30.5% 25.0% 20.8% 53.8% 13.0% 25.7% 58.3% 3.7%12.5% 3.7% 7.7% 4.3% 7.1% 6.1% 70.0% 80.0% 62.5% 38.5% 56.5% 58.6% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.2% 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.4% 1.2%1.4% 25.0% 7.7 7.5 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q2 2013 Q3 Q4 Q1 2014 Q2 Q3 Q4 Q1 2015 Q2 Vacancy% Absorption MSF Completions MSF Vacancy % 8.6 8.3 8.1 7.9 7.7 7.5 7.2 U.S. INDUSTRIAL MARKET Q2 2013 - Q2 2015 8.1 7.07.0 6.86.8 0% 0% 0% 0% 0% 0% Midwest Northeast South West Canada U.S. N.A. Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% N/A Declining Bottoming No Clear Direction Increasing Peaking 8.6% 8.3% 8.5% 25.0% 3.7% 1.4% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 0% 20% 40% 60% 80% 100% U.S. Canada N.A. 8.6% 8.3% 8.5% 25.0% 1.2% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 8.6% 8.3% 8.5% 25.0% 17.1% 33.3% 19.5% 67.1% 25.0% 61.0% 5.7% 8.3% 6.1% 0% 20% 40% 60% 80% 100% Northeast South Midwest West U.S. Canada N.A. Provide a three month forecast for vacancy levels (relative to current quarter): 0% 20% 40% 60% 80% 100% Provide a three month forecast for rents (relative to current quarter): Up Same Down N/AUpSameDown N/A Northeast South Midwest West U.S. Canada N.A. 66.7% 38.5% 82.6% 67.1% 16.7% 59.8% 30.0% 30.5% 25.0% 12.5% 7.7% 4.3% 7.1% 6.1% 70.0% 66.7% 38.5% 82.6% 67.1% 16.7% 59.8% 30.0% 20.8% 53.8% 13.0% 25.7% 58.3% 30.5% 25.0% 20.8% 53.8% 13.0% 25.7% 58.3% 3.7%12.5% 3.7% 7.7% 4.3% 7.1% 6.1% 70.0% 80.0% 62.5% 38.5% 56.5% 58.6% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.2% 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.4% 1.2%1.4% 25.0% 7.7 7.5 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 0.0 10.0 20.0 30.0 40.0 50.0 60.0 70.0 80.0 Q2 2013 Q3 Q4 Q1 2014 Q2 Q3 Q4 Q1 2015 Q2 Vacancy% Absorption MSF Completions MSF Vacancy % 8.6 8.3 8.1 7.9 7.7 7.5 7.2 U.S. INDUSTRIAL MARKET Q2 2013 - Q2 2015 8.1 7.07.0 6.86.8 0% 20% 40% 60% 80% 100% Midwest Northeast South West Canada U.S. N.A. Excluding renewals, of the leases signed this quarter, did most tenants Expand, Hold Steady or Contract? Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 0% 20% 40% 60% 80% 100% Northeast South Midwest West U.S. Canada N.A. Provide a three month forecast for vacancy levels (relative to current quarter): UpSameDown N/A 80.0% 62.5% 38.5% 56.5% 58.6% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.2% 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.4% 1.2%1.4% 25.0% 0% 20% 40% 60% 80% 100% Midwest Northeast South West Canada U.S. N.A. Excluding renewals, of the leases signed this quarter, did most tenants Expand, Hold Steady or Contract? Contract Holding Steady Expand N/A 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 20.0% 25.0% 2.9% 6.1% 46.2% 40.0% 45.8% 43.5% 58.3% 44.3% 46.3% 46.2% 40.0% 41.7% 52.2% 16.7% 45.7% 41.5% 7.7% 12.5% 4.3% 7.1% 6.1% 0% 20% 40% 60% 80% 100% Northeast South Midwest West U.S. Canada N.A. Provide a three month forecast for vacancy levels (relative to current quarter): UpSameDown N/A 80.0% 62.5% 38.5% 56.5% 58.6% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.2% 80.0% 62.5% 38.5% 56.5% 58.6% 25.0% 53.7% 25.0% 53.8% 43.5% 32.9% 50.0% 35.4% 20.0% 8.3% 7.7% 7.1% 25.0% 9.8% 4.2% 1.4% 1.2%1.4% 25.0% U.S. INDUSTRIAL MARK 7 7.5 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 2 Q3 Q4 Q1 2015 Q2 Vacancy% letions MSF Vacancy % 7 7.5 7.2 7.07.0 6.86.8 Currently U/C Q2-15 Absorption DER CONSTRUCTION (SF) TS | Q2 2015 0.0 5.0 10.0 15.0 20.0 25.0 New Jersey - Northern Savannah, GA New Jersey - Central Indianapolis, IN Houston, TX Los Angeles, CA Atlanta, GA Dallas-Ft. Worth, TX Los Angeles - Inland Empire, CA Chicago, IL Millions 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 Q4 Q1 2015 Q2 Vacancy% SF Vacancy % 7.2 7.07.0 6.86.8 Currently U/C Q2-15 Absorption STRUCTION (SF) 2015 0.0 5.0 10.0 15.0 20.0 25.0 New Jersey - Northern Savannah, GA New Jersey - Central Indianapolis, IN Houston, TX Los Angeles, CA Atlanta, GA Dallas-Ft. Worth, TX Los Angeles - Inland Empire, CA Chicago, IL Millions 0% 20% 40% Up Same Down N/A Northeast South Midwest West U.S. Canada N.A. 66.7% 38.5% 67.1% 16.7% 59.8%70.0% 66.7% 38.5% 67.1% 16.7% 59.8%70.0% 7.2 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 Q4 Q1 2015 Q2 Vacancy% MSF Vacancy % 7.2 2013 - Q2 2015 7.07.0 6.86.8 Currently U/C Q2-15 Absorption ONSTRUCTION (SF) 2 2015 0.0 5.0 10.0 15.0 20.0 25.0 New Jersey - Northern Savannah, GA New Jersey - Central Indianapolis, IN Houston, TX Los Angeles, CA Atlanta, GA Dallas-Ft. Worth, TX Los Angeles - Inland Empire, CA Chicago, IL Millions Excluding renewals, of the leases signed this quarter, did most tenants expand, hold steady or contract? Provide a three month forecast for rents (relative to current quarter): Source: Colliers International Provide a three month forecast for vacancy levels (relative to current quarter): % of reporting markets Source: Colliers International

- 5. 5 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International Construction Activity Rising industrial demand is pushing new supply to pre-recession totals. Some 54 MSF of space came online in North America in Q2, including 50.3 MSF in the U.S. and 3.9 MSF in Canada. The quarterly volume of construction activity is at the highest level since Q4 2007, with no letup in sight. 177.6 MSF is under construction in North America, including 156.5 MSF in the U.S. and 21.1 MSF in Canada. Markets with the most new supply in the second quarter were Los Angeles – Inland Empire (6.5 MSF), Chicago (5.6 MSF) and Atlanta (3.6 MSF). In each of those markets virtually all of the new supply was in modern distribution centers which have the higher ceilings, larger truck courts, ESFR sprinklers and other improvements that are needed by logistics and e-retailer tenants. A large and growing portion of the new supply is speculative – 56% in the United States and over 70% in Canada – as developers and lenders become more comfortable with taking on leasing risk for new product. So far that confidence has been justified as supply and demand have been in balance with enough tenant demand to fill the projected development pipeline. Transaction Activity Investor demand for U.S. industrial real estate remains high and will likely increase. For the first half of 2015, investment volume is up 70% from the previous year on investment volumes of $37 billion. Of this, roughly 14.3 billion (38%) have been from foreign direct investment inflows, primarily focused in Chicago ($1.1 billion), New Jersey ($1 billion) and Los Angeles ($1 billion). Investors are drawn to the industrial sector’s relatively low volatility compared to office or retail investments. Institutions looking in this sector are willing to pay a premium for portfolios in order to allocate large chunks of capital. In today’s low yield environment, the industrial sector continues to post the highest average cap rates for any commercial property type, averaging nationwide at 6.9%. This is down 10 bps from the 7.0% reported in the previous quarter and down 140 bps since 2010. Investors will look keenly to what the Federal Reserve Bank will or will not do in the fall and the resulting impact on cap rates. Investors are likely to pull money out of emerging markets in anticipation of higher returns on U.S. backed assets; paradoxically we may see investment rise if rates increase. Industrial Transaction Volume Q2 2015 - NA Note: Latest data as of Q2 2015; all data are 12-month trailing Sources: Real Capital Analytics, Colliers International Currently U/C Q2-15 Absorption Calgary, AB Winnipeg, MB Regina, SK Ottawa, ON -100% 0% 100% 200% 300% $- $20 $40 $60 Billions 2007 2008 2009 2010 20122011 2013 2014 2015 Rolling 4-Qtr Deal Volume Year-over-Year %Change Sources: Real Capital Analytics, Colliers International Top 5 MSAs in Transaction Volume Q2 2015 1. Los Angeles, CA $3.0 bil. 2. Chicago, IL $1.9 bil. 3. Dallas, TX $1.6 bil.. 4. Northern New Jersey $1.5 bil.. 5. Los Angeles - Inland Empire, CA $1.4 bil. Winnipeg, MB Saskatoon, SK Halifax, NS** Victoria, BC Toronto, ON Regina, SK Ottawa, ON*** Edmonton, AB Waterloo Region, ON Vancouver, BC Montréal, QC Calgary, AB Currently U/C Q4-14 Absorp Currently U/C Q4 Savannah, GA Dallas-Ft. Worth, TX Houston, TX Los Angeles, CA Indianapolis, IN Los Angeles Inland Empire, CA Chicago, IL Atlanta, GA -100% -50% 0% 50% 100% 150% 200% $0 $10 $20 $30 $40 $50 $60 $70 $80 2007 2008 2009 2010 2011 2012 2013 2014 Bil. 12-Month Trailing Volume (left-axis) Year-Over-Year % Change (right-axis) Source: Colliers InternationalSource: Colliers International Industrial Real Estate Indicators U.S. GDP: 3.7% in Q2 Inventory 15.0 BSF Vacancy 6.8% Nationwide (down 20 bps) Net Absorption 72.4 MSF in Q2 New Supply 50.3 MSF in Q2, up 1.2% over Q1 New Supply to Inventory 1.3% annualized Note: Up to 2% is considered healthy Net Absorption to New Supply Ratio 1.4:1 Q2 2015 vs. 1.2:1 Q1 2015 • Top 10 Markets account for 57.2% of 72.4 MSF net absorption in Q2. Top 5 MSAs Q2 Net Absorption 1. Chicago, IL 8.1 MSF 2. Los Angeles - Inland Empire, CA 6.9 MSF 3. Dallas-Ft. Worth, TX 6.1 MSF 4. Atlanta, GA 4.6 MSF 5. Los Angeles, CA 3.1 MSF

- 6. 6 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International Conclusion and Outlook The industrial sector is posting record absorption and rental rate increases with mixed macro-economic signals. Domestically, the U.S. is in fine shape, though risks from abroad are rising, particularly in China. The rising U.S. dollar is making exports less competitive and the prolonged commodity bust for oil, gas and other minerals is ongoing. This means that markets reliant on oil and gas extraction or agricultural products are likely to remain subdued. By contrast, markets along the path of goods movement and growing population centers with robust housing demand are seeing record development and industrial demand. North American Industrial Overview | Q2 2015 NORTH AMERICA CANADA UNITED STATES WEST MIDWEST SOUTH NORTHEAST Number of Markets 82 12 70 23 13 24 10 Inventory (Millions SF) 16,838.2 1,800.1 15,038.1 3,890.3 4,275.2 4,601.5 2,271.1 % of N.A. Inventory 100.0% 10.7% 89.3% 23.1% 25.4% 27.3% 13.5% New Supply (Millions SF) 54.3 3.9 50.3 16.2 13.7 15.3 5.2 % of N.A. New Supply 100.0% 7.2% 92.8% 29.8% 25.3% 28.2% 9.5% Vacancy (%) 6.4% 3.7% 6.8% 5.0% 6.6% 7.6% 8.6% Absorption (Millions SF) 74.3 1.9 72.4 21.6 19.1 24.5 7.3 % of N.A. Absorption 100.0% 2.5% 97.5% 29.0% 25.8% 32.9% 9.8%

- 7. 7 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International United States | Industrial Survey | Inventory, New Supply, Under Construction MARKET EXISTING INVENTORY (SF) JUNE 30, 2015 SPECULATIVE NEW SUPPLY Q2 2015 (SF) TOTAL NEW SUPPLY Q2 2015 (SF) YTD NEW SUPPLY SPECULATIVE CURRENTLY UNDER CONSTRUCTION (SF) TOTAL CURRENTLY UNDER CONSTRUCTION (SF) NORTHEAST Baltimore, MD 229,576,428 N/A 587,295 1,811,985 0 0 Boston, MA 171,329,699 0 386,000 386,000 0 1,061,855 Hartford, CT 95,613,351 0 0 0 0 0 Long Island, NY 155,999,372 52,000 52,000 122,000 0 0 New Hampshire 61,542,042 0 0 0 0 0 New Jersey - Central 316,665,638 418,276 608,276 608,276 2,473,486 2,539,061 New Jersey - Northern 369,591,579 0 0 144,000 1,070,846 1,725,846 Philadelphia, PA 421,370,971 1,435,920 2,518,735 4,726,751 2,083,753 3,924,025 Pittsburgh, PA 176,186,457 0 0 691,522 85,000 154,824 Washington, DC 273,228,819 231,207 1,011,561 1,253,778 1,116,770 2,075,185 Northeast Total 2,271,104,356 2,137,403 5,163,867 9,744,312 6,829,855 11,480,796 SOUTH Atlanta, GA 628,540,091 1,698,790 3,598,790 4,808,862 11,746,195 19,267,560 Austin, TX 66,285,819 207,008 207,008 207,008 552,205 572,705 Birmingham, AL 107,102,000 0 0 70,000 0 120,000 Charleston, SC 33,362,960 0 0 273,000 500,720 500,720 Charlotte, NC 337,400,613 N/A 587,822 818,122 0 3,004,827 Columbia, SC 76,991,680 0 0 122,100 252,500 327,500 Dallas-Ft. Worth, TX 755,061,065 1,066,614 3,052,067 9,695,248 11,529,361 13,533,800 Ft. Lauderdale-Broward, FL 110,175,651 189,620 189,620 306,287 729,555 729,555 Greenville/Spartanburg, SC 185,218,011 484,000 484,000 1,210,000 1,145,000 1,835,032 Houston, TX 505,979,005 1,975,018 2,062,898 6,353,999 5,658,276 10,608,276 Huntsville, AL 54,828,183 0 0 0 62,366 62,366 Jacksonville, FL 123,131,683 0 297,579 302,579 0 637,381 Little Rock, AR* 45,275,910 0 0 0 0 0 Louisville, KY 183,769,510 N/A 557,450 1,826,036 0 1,639,395 Memphis, TN 230,219,325 554,040 2,290,121 2,632,265 1,147,916 1,635,740 Miami, FL 211,828,390 189,140 189,140 798,334 807,512 807,512 Nashville, TN 188,085,761 0 278,541 370,541 595,000 2,400,000 Norfolk, VA 101,114,247 23,400 380,400 545,900 0 303,209 Orlando, FL 134,720,243 714,389 714,389 839,474 334,190 334,190 Raleigh, NC 111,854,700 N/A 96,360 110,360 0 384,405 Richmond, VA 113,326,913 23,000 23,000 402,550 0 241,000 Savannah, GA 45,579,700 0 0 267,400 645,185 1,670,585 Tampa Bay, FL 201,309,656 302,000 302,000 340,000 450,120 450,120 West Palm Beach, FL 50,311,978 0 0 754,634 0 0 South Total 4,601,473,094 7,427,019 15,311,185 33,054,699 36,156,101 61,065,878 * Q1-15 data displayed

- 8. 8 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International8 United States | Industrial Survey | Inventory, New Supply, Under Construction MARKET EXISTING INVENTORY (SF) JUNE 30, 2015 SPECULATIVE NEW SUPPLY Q2 2015 (SF) TOTAL NEW SUPPLY Q2 2015 (SF) YTD NEW SUPPLY SPECULATIVE CURRENTLY UNDER CONSTRUCTION (SF) TOTAL CURRENTLY UNDER CONSTRUCTION (SF) MIDWEST Chicago, IL 1,329,353,086 2,724,560 5,650,311 7,492,137 6,124,687 12,982,171 Cincinnati, OH 247,891,995 0 134,000 1,337,450 2,334,861 3,236,710 Cleveland, OH 393,910,588 0 0 0 448,148 1,542,036 Columbus, OH 222,567,395 0 312,000 2,680,688 276,800 1,961,800 Dayton, OH 105,005,425 0 70,000 1,900,000 0 311,500 Detroit, MI 524,540,140 0 596,889 1,570,247 0 605,527 Grand Rapids, MI 114,039,955 244,890 284,857 340,721 198,020 574,993 Indianapolis, IN 288,771,868 1,677,510 1,858,679 5,040,981 889,819 2,341,057 Kansas City, MO-KS 239,154,380 2,046,569 2,046,569 2,491,627 4,184,265 5,157,685 Milwaukee, WI 224,125,094 164,000 164,000 942,263 409,423 1,349,131 Minneapolis/St. Paul, MN 245,828,357 817,066 1,452,130 2,273,630 534,800 1,677,800 Omaha, NE 68,222,531 0 0 0 133,919 274,970 St. Louis, MO 271,801,572 N/A 1,139,137 1,139,137 0 841,577 Midwest Total 4,275,212,386 7,674,595 13,708,572 27,208,881 15,534,742 32,856,957 WEST Albuquerque, NM 37,203,914 0 0 0 0 0 Bakersfield, CA 37,157,189 60,000 1,845,600 3,095,600 237,300 609,880 Boise, ID 46,373,012 0 0 157,305 0 0 Denver, CO 220,227,659 296,745 489,449 977,796 607,377 928,377 Fairfield, CA 47,967,726 150,925 327,685 464,035 872,044 1,534,210 Fresno, CA 67,774,220 0 0 0 62,680 62,680 Honolulu, HI 39,651,225 0 0 0 0 0 Las Vegas, NV 119,043,569 515,705 788,703 788,703 1,197,000 1,731,785 Los Angeles - Inland Empire, CA 452,910,200 2,557,000 6,556,200 13,076,900 13,162,200 16,912,200 Los Angeles, CA 892,482,600 1,599,300 1,599,300 2,367,600 2,737,500 2,737,500 Oakland, CA 143,233,909 670,089 670,089 670,089 440,024 440,024 Orange County, CA 184,482,940 313,040 313,040 313,040 611,345 611,345 Phoenix, AZ 286,593,245 900,051 1,137,491 3,200,824 1,031,323 1,632,573 Pleasanton/Tri-Valley, CA 17,391,991 0 0 0 1,298,207 1,298,207 Portland, OR 193,992,268 N/A 1,232,000 1,708,980 0 3,699,720 Reno, NV 85,989,807 N/A 566,660 1,793,660 0 7,420,960 Sacramento, CA 162,662,416 0 271,147 271,147 884,041 1,104,041 San Diego, CA 187,511,421 0 80,000 111,058 718,406 1,412,043 San Francisco Peninsula, CA 39,504,239 0 0 0 0 0 San Jose - Silicon Valley, CA 250,919,908 0 0 691,218 402,457 1,478,153 Seattle/Puget Sound, WA 261,813,207 277,972 277,972 1,109,099 3,886,674 3,886,674 Stockton/San Joaquin County, CA 97,772,885 0 0 257,000 1,747,018 3,553,011 Walnut Creek, CA 17,649,288 0 0 0 54,430 54,430 West Total 3,890,308,838 7,340,827 16,155,336 31,054,054 29,950,026 51,107,813 U.S. TOTALS 15,038,098,674 24,579,844 50,338,960 101,061,946 88,470,724 156,511,444 (continued)

- 9. 9 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International United States | Industrial Survey | Absorption, Vacancy MARKET ABSORPTION Q2 2015 (SF) YTD ABSORPTION VACANCY RATE MARCH 31, 2015 VACANCY RATE JUNE 30, 2015 QUARTERLY CHANGE IN VACANCY NORTHEAST Baltimore, MD -329,546 846,908 9.1% 9.5% 0.4% Boston, MA -1,331,254 -1,227,839 17.8% 18.6% 0.8% Hartford, CT 1,143,200 591,194 8.9% 7.7% -1.2% Long Island, NY 180,810 249,949 4.7% 4.6% -0.1% New Hampshire 511,652 248,220 8.8% 8.0% -0.8% New Jersey - Central 1,820,470 3,258,838 7.3% 6.9% -0.4% New Jersey - Northern 64,662 3,021,684 7.2% 7.2% 0.0% Philadelphia, PA 2,571,984 4,058,141 8.7% 8.7% -0.1% Pittsburgh, PA -22,503 732,680 6.9% 6.9% 0.0% Washington, DC 2,647,166 2,951,567 9.7% 8.9% -0.7% Northeast Total 7,256,641 14,731,342 8.7% 8.6% -0.1% SOUTH Atlanta, GA 4,617,769 7,575,169 8.6% 8.4% -0.2% Austin, TX 1,063,561 1,091,157 8.3% 7.1% -1.2% Birmingham, AL 148,149 423,572 10.0% 9.8% -0.2% Charleston, SC 200,179 700,306 7.7% 7.1% -0.6% Charlotte, NC 798,775 2,313,467 9.6% 9.5% -0.1% Columbia, SC 614,872 871,269 9.6% 8.9% -0.7% Dallas-Ft. Worth, TX 6,141,892 11,738,738 7.8% 7.4% -0.4% Ft. Lauderdale-Broward, FL -27,578 459,217 7.3% 7.3% 0.0% Greenville/Spartanburg, SC 557,774 62,130 8.2% 8.2% -0.1% Houston, TX 2,627,370 6,965,095 4.7% 4.6% -0.1% Huntsville, AL 165,432 -92,818 8.5% 8.2% -0.3% Jacksonville, FL 613,376 331,825 8.1% 7.8% -0.3% Little Rock, AR* 393,161 393,161 11.8% 10.8% -0.9% Louisville, KY 597,458 950,524 6.5% 6.4% 0.0% Memphis, TN 1,313,068 2,648,244 11.7% 11.8% 0.1% Miami, FL 992,423 2,131,117 5.4% 5.0% -0.4% Nashville, TN 572,549 1,698,822 6.7% 6.5% -0.2% Norfolk, VA 739,109 1,396,965 7.6% 7.2% -0.4% Orlando, FL 564,958 1,451,738 7.9% 8.0% 0.1% Raleigh, NC 595,249 944,552 8.1% 7.7% -0.5% Richmond, VA -14,082 491,693 8.1% 8.1% 0.0% Savannah, GA 685,197 1,040,959 5.2% 3.7% -1.5% Tampa Bay, FL 385,239 1,449,937 8.1% 8.0% -0.1% West Palm Beach, FL 106,391 552,299 5.9% 5.7% -0.2% South Total 24,452,291 47,589,138 7.8% 7.6% -0.2% * Q1-15 data displayed

- 10. 10 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International10 United States | Industrial Survey | Absorption, Vacancy MARKET ABSORPTION Q2 2015 (SF) YTD ABSORPTION VACANCY RATE MARCH 31, 2015 VACANCY RATE JUNE 30, 2015 QUARTERLY CHANGE IN VACANCY MIDWEST Chicago, IL 8,050,705 9,319,580 7.6% 7.2% -0.4% Cincinnati, OH 744,450 2,324,880 4.8% 4.6% -0.2% Cleveland, OH -622,940 158,247 5.5% 5.7% 0.2% Columbus, OH 183,174 1,774,102 5.8% 5.8% 0.0% Dayton, OH 1,429,337 3,058,179 10.4% 9.1% -1.3% Detroit, MI 2,391,249 3,324,100 7.0% 6.6% -0.3% Grand Rapids, MI 286,975 324,789 6.1% 6.0% -0.2% Indianapolis, IN 2,257,860 3,135,196 7.2% 7.0% -0.2% Kansas City, MO-KS 949,252 1,405,165 6.3% 6.7% 0.4% Milwaukee, WI 1,089,216 2,121,285 5.5% 5.0% -0.5% Minneapolis/St. Paul, MN 1,386,554 2,069,479 7.0% 7.0% 0.0% Omaha, NE -69,779 14,003 2.8% 2.9% 0.1% St. Louis, MO 1,051,519 942,769 7.2% 7.2% 0.0% Midwest Total 19,127,572 29,971,774 6.8% 6.6% -0.2% WEST Albuquerque, NM 25,628 -78,455 7.1% 7.1% -0.1% Bakersfield, CA 1,124,980 1,925,007 3.4% 4.8% 1.4% Boise, ID -58,283 217,784 4.4% 4.6% 0.1% Denver, CO 964,292 1,879,324 4.0% 3.8% -0.2% Fairfield, CA 255,607 215,358 6.1% 6.3% 0.1% Fresno, CA 267,156 294,975 5.6% 5.2% -0.4% Honolulu, HI 88,955 30,281 2.3% 2.0% -0.2% Las Vegas, NV 1,751,409 2,632,741 7.8% 7.0% -0.9% Los Angeles - Inland Empire, CA 6,929,200 12,185,400 4.5% 4.3% -0.2% Los Angeles, CA 3,136,100 6,593,500 1.9% 1.8% -0.2% Oakland, CA 1,074,645 1,116,733 3.9% 3.6% -0.3% Orange County, CA 1,007,500 735,000 3.3% 3.1% -0.2% Phoenix, AZ 523,646 2,021,257 12.0% 12.1% 0.2% Pleasanton/Tri-Valley, CA 113,289 -9,105 6.4% 5.8% -0.7% Portland, OR 876,504 1,937,572 5.4% 5.5% 0.1% Reno, NV -390,983 501,444 8.2% 9.3% 1.1% Sacramento, CA 310,139 1,265,771 10.7% 10.6% 0.0% San Diego, CA 1,517,634 2,834,748 6.1% 5.3% -0.8% San Francisco Peninsula, CA -96,375 83,649 2.5% 2.6% 0.1% San Jose - Silicon Valley, CA 2,069,078 3,440,111 6.8% 5.8% -1.0% Seattle/Puget Sound, WA 1,288,253 2,920,679 4.4% 3.9% -0.5% Stockton/San Joaquin County, CA -1,076,681 81,618 7.3% 8.4% 1.1% Walnut Creek, CA -147,600 -235,084 7.4% 8.2% 0.8% West Total 21,554,093 42,590,308 5.2% 5.0% -0.2% U.S. TOTALS 72,390,597 134,882,562 7.0% 6.8% -0.2% (continued)

- 11. 11 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International United States | Industrial Survey | 3-Month Forecasts, Sales Price, Cap Rates MARKET VACANCY FORECAST (3 MONTHS)** RENT FORECAST (3 MONTHS)** ABSORPTION FORECAST (3 MONTHS)** SALES PRICE (USD/SF) CAP RATE NORTHEAST Baltimore, MD Down Up Close to zero $54.50 8.5% Boston, MA Up Same Negative $77.00 7.3% Hartford, CT Down Same Positive $38.00 8.5% Long Island, NY Up Up Positive $95.00 8.3% New Hampshire Down Same Positive N/A N/A New Jersey - Central Down Up Positive $81.67 N/A New Jersey - Northern Down Up Positive N/A N/A Philadelphia, PA Down Up Positive $75.52 6.6% Pittsburgh, PA Down Up Positive $55.00 8.0% Washington, DC Down Up Positive $125.00 7.1% Northeast Average*** $75.21 7.8% SOUTH Atlanta, GA Same Up Positive $50.57 7.2% Austin, TX Up Up Positive $98.00 N/A Birmingham, AL Same Same Close to zero N/A N/A Charleston, SC Down Up Positive N/A N/A Charlotte, NC N/A N/A N/A N/A N/A Columbia, SC Down Up Positive N/A N/A Dallas-Ft. Worth, TX Same Same Positive $35.00 7.3% Ft. Lauderdale-Broward, FL Down Up Positive $95.73 6.0% Greenville/Spartanburg, SC Down Up Positive N/A N/A Houston, TX Same Up Positive $84.00 N/A Huntsville, AL Down Same Positive N/A N/A Jacksonville, FL Down Same Positive $47.00 8.1% Little Rock, AR* Same Same Close to zero $65.45 9.0% Louisville, KY Up N/A Positive N/A N/A Memphis, TN Down Up Positive $38.00 7.8% Miami, FL Down Up Positive $78.60 5.8% Nashville, TN Down Up Positive $59.00 8.6% Norfolk, VA Down Up Positive $110.00 7.0% Orlando, FL Down Up Positive $65.00 7.3% Raleigh, NC Down N/A Positive N/A N/A Richmond, VA Same Up Positive N/A N/A Savannah, GA Down Up Positive $38.00 8.0% Tampa Bay, FL Down Up Positive $44.00 4.0% West Palm Beach, FL Down Up Positive $86.37 N/A South Average*** $66.31 7.2% * Q1-15 data displayed ** Forecasts for Warehouse space *** Straight averages used

- 12. 12 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International12 ** Forecasts for Warehouse space *** Straight averages used United States | Industrial Survey | 3-Month Forecasts, Sales Price, Cap Rates MARKET VACANCY FORECAST (3 MONTHS)** RENT FORECAST (3 MONTHS)** ABSORPTION FORECAST (3 MONTHS)** SALES PRICE (USD/SF) CAP RATE MIDWEST Chicago, IL Down Same Positive $62.00 5.3% Cincinnati, OH Same Up Positive $38.00 8.5% Cleveland, OH Down Same Positive $37.00 N/A Columbus, OH Up Up Positive $40.00 N/A Dayton, OH Same Same Close to zero $30.00 N/A Detroit, MI Down Up Positive $82.00 7.8% Grand Rapids, MI Same Up Positive N/A N/A Indianapolis, IN Down Same Positive $49.00 7.0% Kansas City, MO-KS Same Same Positive N/A N/A Milwaukee, WI Same Same Positive $55.00 8.0% Minneapolis/St. Paul, MN Same Same Positive $30.00 N/A Omaha, NE Same Up Close to zero N/A N/A St. Louis, MO Down N/A Positive N/A N/A Midwest Average*** $47.00 7.3% WEST Albuquerque, NM Same Same Close to zero $83.50 7.7% Bakersfield, CA Same Same Positive $42.00 10.0% Boise, ID Same Up Positive N/A N/A Denver, CO Down Up Positive $72.48 6.9% Fairfield, CA Same Up Positive $60.00 6.7% Fresno, CA Down Up Close to zero $70.00 7.3% Honolulu, HI Down Up Positive N/A N/A Las Vegas, NV Down Up Positive $83.17 6.8% Los Angeles - Inland Empire, CA Same Up Positive $80.00 6.0% Los Angeles, CA Same Up Close to zero $97.95 5.5% Oakland, CA Same Up Positive $136.60 5.0% Orange County, CA Same Same Close to zero $117.50 5.5% Phoenix, AZ Down Up Positive $70.00 7.5% Pleasanton/Tri-Valley, CA Down Up Close to zero $140.00 5.8% Portland, OR Down Up Positive $82.26 6.2% Reno, NV Down N/A Positive N/A N/A Sacramento, CA Down Up Positive $46.39 6.5% San Diego, CA Down Up Positive $84.46 6.5% San Francisco Peninsula, CA Down Up Positive $180.00 5.0% San Jose - Silicon Valley, CA Down Up Positive $229.00 N/A Seattle/Puget Sound, WA Down Up Positive $96.00 5.8% Stockton/San Joaquin County, CA Same Up Positive N/A N/A Walnut Creek, CA Same Up Close to zero N/A N/A West Average*** $98.41 6.5% U.S. AVERAGES*** $75.81 7.0% (continued)

- 13. 13 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International United States | Industrial Survey | Average Asking NNN Rents as of June 2015 MARKET WAREHOUSE / DISTRIBUTION SPACE (USD/SF/YR) BULK SPACE (USD/SF/YR) FLEX / SERVICE SPACE (USD/SF/YR) TECH / R&D SPACE (USD/SF/YR) NORTHEAST Baltimore, MD $4.66 $4.66 $10.08 N/A Boston, MA $6.39 $5.96 $7.34 $16.36 Hartford, CT $3.89 $5.39 $8.03 $6.50 Long Island, NY $9.54 $9.54 $15.73 N/A New Hampshire $6.22 N/A $8.66 $11.26 New Jersey - Central $4.93 $4.47 $11.84 N/A New Jersey - Northern $6.19 $5.75 $9.68 N/A Philadelphia, PA $4.50 $4.35 $7.50 $11.25 Pittsburgh, PA $4.76 $4.76 $12.45 $12.45 Washington, DC $7.40 $6.54 $12.03 $13.05 Northeast Average** $5.85 $5.71 $10.33 $11.81 SOUTH Atlanta, GA $3.54 $3.29 $8.08 $10.78 Austin, TX $5.99 $5.17 $11.10 $10.07 Birmingham, AL $4.16 $3.54 $7.39 N/A Charleston, SC $4.55 $4.76 $9.77 N/A Charlotte, NC $3.69 $3.67 $8.09 N/A Columbia, SC $3.22 $3.35 $7.81 N/A Dallas-Ft. Worth, TX $3.45 $2.90 $7.50 $8.95 Ft. Lauderdale-Broward, FL $7.03 $6.60 $11.38 $9.52 Greenville/Spartanburg, SC $3.37 $3.68 $7.75 N/A Houston, TX $6.22 $4.39 $12.38 $13.64 Huntsville, AL $5.31 $5.36 $6.51 N/A Jacksonville, FL $3.84 $3.66 $9.00 N/A Little Rock, AR* $3.71 $3.12 $6.41 N/A Louisville, KY $3.65 $3.69 $6.81 N/A Memphis, TN $2.60 $2.75 $5.44 $9.75 Miami, FL $7.72 $7.27 $13.38 $8.60 Nashville, TN $4.60 $3.23 $8.69 $8.07 Norfolk, VA $4.69 $4.27 $8.29 $10.35 Orlando, FL $4.89 $4.45 $9.59 $9.19 Raleigh, NC $4.18 $4.80 $11.12 N/A Richmond, VA $3.98 $4.06 $8.25 N/A Savannah, GA $3.95 $3.75 $7.00 $10.00 Tampa Bay, FL $4.40 $4.42 $7.73 $6.20 West Palm Beach, FL $7.50 $6.87 $12.40 N/A South Average** $4.59 $4.29 $8.83 $9.59 * Q1-15 data displayed ** Straight averages used

- 14. 14 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International14 United States | Industrial Survey | Average Asking NNN Rents as of June 2015 MARKET WAREHOUSE / DISTRIBUTION SPACE (USD/SF/YR) BULK SPACE (USD/SF/YR) FLEX / SERVICE SPACE (USD/SF/YR) TECH / R&D SPACE (USD/SF/YR) MIDWEST Chicago, IL $4.50 $3.58 $9.50 N/A Cincinnati, OH $3.39 $3.15 $6.32 $6.32 Cleveland, OH $3.08 $3.08 $6.65 $6.65 Columbus, OH $2.89 $2.89 $5.56 $5.56 Dayton, OH $2.45 $2.57 $4.52 $4.52 Detroit, MI $4.39 $3.75 $7.83 $7.99 Grand Rapids, MI $2.88 $3.07 $4.68 $4.51 Indianapolis, IN $3.00 $3.25 $4.00 $9.00 Kansas City, MO-KS $4.43 $3.98 $8.17 $7.45 Milwaukee, WI $3.89 $3.44 $4.83 N/A Minneapolis/St. Paul, MN $5.10 $5.11 $7.24 $7.60 Omaha, NE $4.06 $3.85 $6.73 $5.10 St. Louis, MO $3.93 $3.89 $8.43 N/A Midwest Average** $3.69 $3.51 $6.50 $6.47 WEST Albuquerque, NM $5.27 $4.29 $9.49 $9.49 Bakersfield, CA $4.00 $3.42 $8.00 N/A Boise, ID $5.04 $5.28 $6.69 N/A Denver, CO $6.63 $5.20 $10.10 $11.00 Fairfield, CA $5.48 $5.84 $7.03 $8.41 Fresno, CA $4.40 $3.18 $4.75 $4.80 Honolulu, HI $14.04 N/A N/A N/A Las Vegas, NV $5.88 $5.40 $6.48 $9.60 Los Angeles - Inland Empire, CA $5.41 $4.93 $7.18 $7.80 Los Angeles, CA $7.15 $5.76 $9.30 $12.75 Oakland, CA $6.72 $6.48 $6.72 $10.32 Orange County, CA $8.15 $7.50 $14.75 $11.30 Phoenix, AZ $5.91 $4.53 $11.93 $11.81 Pleasanton/Tri-Valley, CA $5.88 $6.24 N/A N/A Portland, OR $5.45 $4.65 $11.40 $9.88 Reno, NV $4.09 $3.80 $7.54 N/A Sacramento, CA $4.92 $3.48 $8.40 $8.52 San Diego, CA $8.52 $7.80 $12.60 $19.08 San Francisco Peninsula, CA $11.52 $12.00 $32.04 $32.04 San Jose - Silicon Valley, CA $8.40 $5.86 $10.32 $20.28 Seattle/Puget Sound, WA $6.36 $5.53 $14.63 $15.18 Stockton/San Joaquin County, CA $4.08 $4.32 $7.92 $7.92 Walnut Creek, CA $4.20 N/A N/A $12.48 West Average** $6.41 $5.50 $10.36 $12.37 U.S. AVERAGES** $5.20 $4.71 $9.06 $10.29 (continued) ** Straight averages used

- 15. 15 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International Canada | Industrial Survey | Inventory, New Supply, Under Construction MARKET EXISTING INVENTORY (SF) JUNE 30, 2015 SPECULATIVE NEW SUPPLY Q2 2015 (SF) TOTAL NEW SUPPLY Q2 2015 (SF) YTD NEW SUPPLY SPECULATIVE CURRENTLY UNDER CONSTRUCTION (SF) TOTAL CURRENTLY UNDER CONSTRUCTION (SF) Calgary, AB 133,903,440 982,222 992,700 1,364,525 2,420,566 3,947,379 Edmonton, AB 137,712,997 415,557 475,279 475,279 2,556,496 3,245,776 Montréal, QC 324,708,553 0 0 250,000 677,637 892,637 Ottawa, ON 46,560,666 0 0 191,600 0 0 Regina, SK 18,223,953 20,000 70,000 109,095 20,000 251,000 Saskatoon, SK 22,010,354 40,000 83,438 253,339 230,000 559,560 Toronto, ON 766,246,067 1,458,755 1,458,755 5,847,215 6,729,398 8,895,929 Vancouver, BC 193,721,350 457,982 587,814 1,695,768 2,230,718 2,932,685 Victoria, BC 9,159,327 0 0 0 0 0 Waterloo Region, ON 60,007,544 0 198,571 461,620 85,659 191,175 Winnipeg, MB 80,206,782 30,000 49,700 49,700 0 189,000 CANADA TOTALS 1,800,108,227 3,404,516 3,916,257 10,698,141 14,950,474 21,105,141 Canada | Industrial Survey | Absorption, Vacancy Rate MARKET ABSORPTION Q2 2015 (SF) YTD ABSORPTION VACANCY RATE MARCH 31, 2015 VACANCY RATE JUNE 30, 2015 QUARTER CHANGE IN VACANCY Calgary, AB -982,546 -889,321 4.2% 5.7% 1.5% Edmonton, AB 98,964 -293,386 2.5% 2.7% 0.3% Montréal, QC 19,392 1,020,875 3.7% 3.6% -0.1% Ottawa, ON 0 0 4.6% 3.3% -1.4% Regina, SK -82,086 -47,744 2.0% 2.9% 0.8% Saskatoon, SK 36,268 34,804 5.9% 6.1% 0.2% Toronto, ON 1,487,500 3,152,252 3.6% 3.3% -0.3% Vancouver, BC 1,022,822 2,796,910 3.6% 3.3% -0.2% Victoria, BC 0 0 4.6% 4.6% 0.0% Waterloo Region, ON 451,253 371,970 7.2% 6.4% -0.8% Winnipeg, MB -184,928 -426,555 4.1% 4.4% 0.3% CANADA TOTALS 1,866,639 5,719,805 3.8% 3.7% -0.1% Canada | Industrial Survey | 3-Month Forecasts, Sales Price, Cap Rates MARKET VACANCY FORECAST (3 MONTHS)** RENT FORECAST (3 MONTHS)** ABSORPTION FORECAST (3 MONTHS)** AVERAGE SALES PRICE (CAD/SF) CAP RATE Calgary, AB Up Down Negative $175.00 6.5% Edmonton, AB Up Down Positive $126.38 6.1% Montréal, QC Same Same Close to zero $65.00 7.3% Ottawa, ON Same Same Close to zero $125.00 7.0% Regina, SK Same Same Close to zero $168.00 7.0% Saskatoon, SK Up Down Positive $177.00 7.1% Toronto, ON Same Up Positive $85.92 6.9% Vancouver, BC Down Up Positive $185.00 4.9% Victoria, BC Same Same Positive $195.00 7.5% Waterloo Region, ON Down Same Positive $94.00 7.0% Winnipeg, MB Same Same Close to zero N/A N/A CANADA AVERAGES* $139.63 6.7% * Straight averages used ** Forecasts are for Warehouse space Note: Halifax included in averages, but detail not shown Note: Halifax included in totals, but detail not shown Note: Halifax included in totals, but detail not shown

- 16. 16 North American Research Report | Q2 2015 | Industrial Market Outlook | Colliers International Canada | Industrial Survey | Average Asking Rents as of June 2015 MARKET WAREHOUSE/ DISTRIBUTION SPACE (CAD/SF/YR) BULK SPACE (CAD/SF/YR) FLEX / SERVICE SPACE (CAD/SF/YR) TECH / R&D SPACE (CAD/SF/YR) Calgary, AB $9.25 $8.00 $12.25 $12.25 Edmonton, AB $8.30 $7.75 $10.17 $17.00 Montréal, QC $4.75 $4.25 $5.75 $8.00 Ottawa, ON $8.00 $8.00 $10.00 $12.00 Regina, SK $11.00 $10.00 $12.00 $13.75 Saskatoon, SK $10.00 $10.00 $9.50 $14.00 Toronto, ON $5.42 $5.46 N/A N/A Vancouver, BC $8.16 $7.44 $8.49 $14.00 Victoria, BC $11.50 $10.00 $13.50 $13.50 Waterloo Region, ON $4.75 $4.14 $7.93 $7.93 Winnipeg, MB $6.60 $5.91 $10.21 $12.75 CANADA AVERAGES* $7.99 $7.41 $9.89 $12.74 Canada | Vacancy Rankings MARKET VACANCY RATE JUNE 30, 2015 Edmonton, AB 2.7% Regina, SK 2.9% Ottawa, ON 3.3% Toronto, ON 3.3% Vancouver, BC 3.3% Montréal, QC 3.6% CANADA AVERAGE 3.7% Winnipeg, MB 4.4% Victoria, BC 4.6% Calgary, AB 5.7% Saskatoon, SK 6.1% Waterloo Region, ON 6.4% MARKET VACANCY RATE JUNE 30, 2015 Los Angeles, CA 1.8% Honolulu, HI 2.0% San Francisco Peninsula, CA 2.6% Omaha, NE 2.9% Orange County, CA 3.1% Oakland, CA 3.6% Savannah, GA 3.7% Denver, CO 3.8% Seattle/Puget Sound, WA 3.9% Los Angeles - Inland Empire, CA 4.3% Boise, ID 4.6% Cincinnati, OH 4.6% Houston, TX 4.6% Long Island, NY 4.6% Bakersfield, CA 4.8% Milwaukee, WI 5.0% Miami, FL 5.0% Fresno, CA 5.2% San Diego, CA 5.3% Portland, OR 5.5% Cleveland, OH 5.7% West Palm Beach, FL 5.7% San Jose - Silicon Valley, CA 5.8% Pleasanton/Tri-Valley, CA 5.8% MARKET VACANCY RATE JUNE 30, 2015 Columbus, OH 5.8% Grand Rapids, MI 6.0% Fairfield, CA 6.3% Louisville, KY 6.4% Nashville, TN 6.5% Detroit, MI 6.6% Kansas City, MO-KS 6.7% U.S. AVERAGE 6.8% New Jersey - Central 6.9% Pittsburgh, PA 6.9% Las Vegas, NV 7.0% Indianapolis, IN 7.0% Minneapolis/St. Paul, MN 7.0% Albuquerque, NM 7.1% Charleston, SC 7.1% Austin, TX 7.1% Norfolk, VA 7.2% New Jersey - Northern 7.2% Chicago, IL 7.2% St. Louis, MO 7.2% Ft. Lauderdale-Broward, FL 7.3% Dallas-Ft. Worth, TX 7.4% Raleigh, NC 7.7% Hartford, CT 7.7% MARKET VACANCY RATE JUNE 30, 2015 Jacksonville, FL 7.8% New Hampshire 8.0% Orlando, FL 8.0% Tampa Bay, FL 8.0% Richmond, VA 8.1% Greenville/Spartanburg, SC 8.2% Huntsville, AL 8.2% Walnut Creek, CA 8.2% Stockton/San Joaquin County, CA 8.4% Atlanta, GA 8.4% Philadelphia, PA 8.7% Columbia, SC 8.9% Washington, DC 8.9% Dayton, OH 9.1% Reno, NV 9.3% Baltimore, MD 9.5% Charlotte, NC 9.5% Birmingham, AL 9.8% Sacramento, CA 10.6% Little Rock, AR* 10.8% Memphis, TN 11.8% Phoenix, AZ 12.1% Boston, MA 18.6% U.S. | Vacancy Rankings * Straight averages used Note: Halifax included in averages, but detail not shown * Q1-15 data displayed

- 17. Copyright © 2015 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. Colliers International 666 Fifth Avenue New York, NY 10103 +1 212 716 3500 colliers.com INDUSTRIAL SERVICES | contact Dwight Hotchkiss President, Brokerage Services | USA National Director, Industrial | USA +1 213 532 3229 dwight.hotchkiss@colliers.com FOR MORE INFORMATION Pete Culliney Director of Research | Global +1 212 716 3689 pete.culliney@colliers.com CONTRIBUTORS Jeff Simonson U.S. Senior Research Analyst | USA AJ Paniagua U.S. Research Analyst | USA Andrew Nelson Chief Economist | USA Glossary Bulk Space – Warehouse space 100,000 square feet or more with minimum ceiling heights of 24 feet. All loading is dock-height. Flex Space – Single-story build- ings having 10 to 18-foot ceilings with both floor-height and dock-height loading. Includes wide variation in office space utilization, ranging from retail and personal service, to distribution, light industrial and occasional heavy industrial use. Service Space – Single-story (or mezzanine) with 10 to 16-foot ceilings with frontage treatment on one side and dock-height loading or grade-level roll-up doors on the other. Less than 15 percent office space. Tech/R&D – One and two-story, 10 to 15-foot ceiling heights with up to 50% office/dry lab space (remainder in wet lab, workshop, storage and other support), with dock-height and floor-height loading. Warehouse – 50,000 square feet or more with up to 15 percent office space, the balance being general warehouse space with 18 to 30-foot ceiling heights. All loading is dock-height.