AMCC Stock Pitch Deck

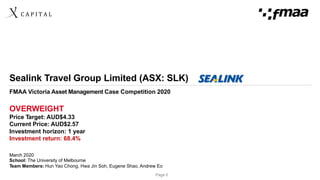

- 1. C A P I T A L Page 0 Sealink Travel Group Limited (ASX: SLK) FMAA Victoria Asset Management Case Competition 2020 OVERWEIGHT Price Target: AUD$4.33 Current Price: AUD$2.57 Investment horizon: 1 year Investment return: 68.4% March 2020 School: The University of Melbourne Team Members: Hun Yao Chong, Hwa Jin Soh, Eugene Shao, Andrew Eo

- 2. C A P I T A L Disclaimer: Please read this disclaimer before viewing the contents of this deck The contents of this pitch deck are provided to you for information only and should not be used as a basis for making any specific investment, business or commercial decision. Investments in financial products are subject to market risk. Some financial products, such as currency exchange and/or stocks, are highly speculative and any investment should only be done with risk capital. Past performance figures as well as any projection or forecast used in this pitch deck, are not necessarily indicative of future or likely performance of any investment products. Trading on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work for you as well as against you. Before investing in market, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading or stock, and seek advice from an independent financial adviser if you have any doubts. This pitch deck serves as an informative piece only. Accordingly, the authors makes no warranties or guarantees in respect of the content. The publications herein do not take into account the investment objectives, financial situation or particular needs of any particular person. You should obtain individual financial advice based on your own particular circumstances before making an investment decision on the basis of information on this website. In addition, you are advised that past performance is no guarantee of future price appreciation. The information contained in these pages is not intended to provide professional advice and should not be relied upon in that regard. It also does not have any regard to your specific investment objective, financial situation and any of your particular needs. The authors accepts no responsibility for any use made of the information provided. The authors will not be held responsible for the reliability or accuracy of the information available on this pitch deck. The content herein is provided in good faith and believed to be accurate; however, there are no explicit or implicit warranties of accuracy or timeliness made by the authors. You agree not to hold the authors or any of its affiliates liable for decisions that are based on information from this website. Any views, opinions, references or other statements or facts provided in this pitch are personal views of the authors and are not supported, sanctioned or endorsed by any group or corporation. Page 1

- 3. C A P I T A L Page 2 Background 1. Global urban bus service market is projected to grow at 10% CAGR for the next three years on the back of government incentives to privatise public transportation 2. Australian tourism is expected to spike when market rebounds 3. SeaLink is one of the major players in tourism and urban bus markets Industry Overview Investment Theses Valuation Key Catalysts Key Risks Executive Summary SeaLink Travel Group (or “SeaLink”) is an Australian company that offers national tourism transportation services. 16 January 2020 marked a pivotal inflection point with the acquisition of Transit Systems Group, transforming the company into a premier multi-modal transport provider. The combined company has operations in Australia, Singapore and London. 1. Merger between SeaLink and Transit Systems Group, Australia’s leading bus operator, brings significant revenue growth in their domestic segment. Furthermore, SeaLink’s strong balance sheet allows them to persevere throughout the downturn in tourism industry, and grow alongside the steady rise in demand for public transportation services. 2. The timely acquisition of Transit Systems places SeaLink in good defensive posture against Covid-19. Having long-term fixed revenue contracts with the government, Transit Systems’s revenue will not be severely affected by the worsening situation and the travel ban. 3. Our camp holds the view that SeaLink has high prospects of securing future government contracts. In totality, there is A$3.56b in the tender pipeline up for competition. SeaLink’s (a) expert leadership, (b) impeccable track record for contract wins and (c) longstanding ability to meet KPIs cement our confidence in SeaLink’s deal origination capabilities X Capital issues a BUY recommendation on SeaLink Travel Management Group Limited with a target price of A$ 4.33, representing a 68.4% investment return from the closing price of A$ 2.57 per share on 23 Mar 2020. Our target price was derived using a Discounted Cash Flow (DCF) model as our primary valuation method. 1. Successful expansion in US and NZ market: Submitting tenders for bus contracts in the United States and New Zealand being a near term target 2. Continued efforts of strategic acquisitions: Increased market exposure and ability to become a multi-modal transportation provider 1. Cancellation of contract by government due to coronavirus 2. SeaLink Group’s lost of key personnel 3. Competitive industry landscape

- 4. C A P I T A L Industry Analysis – Tourism and Public Transport Industry Australia’s public transportation market is projected to grow at 10% for the next 3 years on the back of rising incentives of government to privatise public transportation services. Tourism is expected to experience a spike in revenue when market rebounds. SeaLink’s diversification of revenue is expected to turbo boost its resilience to macro downturns and outperform the market. Australia’s public transportation market growth outlook remains positive Opportunity for growth in tourism market Major Competitors in the Bus Transportation MarketGovernment incentives drive privatisation opportunity 0 1 2 3 4 5 6 7 8 2022E2019A 2021E2020E2017A 2018A +2% +10% Urban Bus and Tramway Transport Market Growth (USD’bn, %) Tailwinds ✓ Government continues to outsource bus contracts to private sector ✓ Diversified operations makes SeaLink resilient to exogenous shocks ✓ V-shaped recovery in tourism segment revenue expected when market rebounds ✓ Potential to expand into multi-modal transport provider 7 7 13 12 Other failuresMechanical Failures Publically operatedContracted out Failures per 100,000 miles (2011) 40% 60% PrivateGovernment 70% 30% Estimated growth potential in the private transportation -8 -6 -4 -2 0 2 4 6 8 10 12 14 2011 2012 2013 2014 2015 2016 2017 2018 2019 Public TransportAutomotive Public Transport vs Non-Public Transport Revenue Growth (%) Public transport growth is leading Australia London Singapore The distribution of market share of competitors below are similar, averaged at 10.75%. This highlights Transit System Group’s stable market share in Australia. Competitors below takes up 93% of market share, with it being fairly well-distributed. This presents strong opportunity for Tower Transit (Transit System Group’s subsidiary) to grow. Competitors below takes up 92% of market share, with 60% concentrated in SBS Transit. Regulation on monopoly presents opportunity to Tower Transit to grow. 2019 2022 -4 -2 0 2 4 6 8 2021E2020E2019A2018A2017A2016A Post-COVID 19 Tourism Growth Pre-COVID 19 Tourism Growth International passenger International Passengers and Tourism Growth (% change) 128,638 131,470 138,251 141,251 135,601 136,442 -10 -5 0 5 10 0 50,000 100,000 150,000 2021E2020E2019A2018A2017A2016A Australia Tourism Market Size ($M) and growth rate (%) Market size ($AUD) Covid-19 adjust growth rate Page 3 Note: 2020E is adjusted for COVID- 19 impact on tourism market Sources: Source: IBISWorld, Capital IQ, sell-side reports, World Tourism Organization (UNWTO) report, Macquarie Research, the World Bank, SeaLink, X Capital Estimates Note: Major competitor focused in the bus transportation market as tourism market plays a less significant role revenue-wise.

- 5. C A P I T A L 0 2mm 4mm 6mm 8mm -42% -22% -2% 18% 38% Mar-24-2019 Sep-24-2019 Mar-24-2020 SLK share price SLK volume ASX200 Acquisition news Company Analysis SeaLink Travel Group was founded in 1989 in Adelaide and has since expanded into a dominant leader in the national tourism transport scene. Despite commendable success in the tourism and freight industries, 16 January 2020 marked a pivotal inflection point with the acquisition of Transit Systems Group, transforming the company into a premier multi-modal transport provider. Key Financials Diversified Revenue Streams Key product offeringsResilient Balance Sheet Key Management and Shareholders Trading Statistics(1)Share Price Performance Page 4 201 209 251 659 1,234 1,265 FY19AFY17A FY21EFY18A FY22EFY20E +44% 42 41 38 25 22 19 11 10 11 0% 50% 40% 10% 30% 20% FY17A FY18A FY19A FY20E FY21E FY22E Gross Margin EBITDA Margin FY17 177 FY19FY18FY16FY15 111 201 251 209 SA & Tasmania Queensland & NT CCC, NSW & WA Corporate Fraser Island Eliminations Revenue was already growing… Pre-acquisition FY20A Post-acquisition FY21ETop line expansion exceed margins contraction post acquisition of Transit Systems Group 18% Low debtors' exposure Name Position Clint Feuerherdt Group Chief Executive Officer Andrew D. Muir Chief Financial Officer & Company Secretary Donna Gauci Chief Operating Officer Chris Benson Chief Information Officer Joanne H. McDonald General Counsel & Company Secretary Richard Doyle Head of International Sales Brooke Martlew Chief People Officer Share Price $2.57 Enterprise Value (m) $512.60 Market Capitalisation (m) $561.30 LTM Net Debt $(48.7) LTM EV/EBITDA 10.4x LTM EV/EBIT 16.5x LTM P/E 16.5x LTM P/B 2.42x Sources: Macquarie Research, Capital IQ, CFRA Research, SeaLink Travel Group Notes: (1) As of 23 March 2020 51%49% Major Shareholder (Public) % Neil Smith 15.31 Leishman Family Trust 8.55 Bennelong Australian Equity Partners Ltd. 4.47 Cleveland Transport Trust 4.22 Perennial Value Management Ltd. 3.54 Public Private ASX.SLK 4% 95% 1% Corp. TravelSeaLink 80% 20% 0% 47% 37% 16% Flight Travel Public Transportation Government Contracts 0 2 4 6 8 10 20121996 2004 2020 RemainingTerm(years) WA LN VIC SA NSW NT SG Long Term Debt Cash & Equivalent Short Term Debt Revenue 27% 21%30% 22% 82% Transit Systems Group SeaLink 18% Each bubble represents size of contract Total: A$895m (24) Tourism & Ferry ServicesPublic Transportation Australia Singapore & United Kingdom Credit Ratios Total Debt/EBITDA 0.4x S.T. Debt/EBITDA 0.3x L.T. Debt/EBITDA 0.3x 0.0 50.0 100.0 150.0 200.0 250.0 300.0 FY15A FY16A FY17A FY18A FY19A Receipts from customers (A$m) Sales Revenue(A$m) Uniform timing between revenue recognized and cash received SeaLink

- 6. C A P I T A L Investment Thesis 1 – Untapped value from strategic merger Merger between SeaLink and Transit Systems Group - number 1 bus operator brings significant growth potential in both domestic and international market. This allows SeaLink to persevere with strong balance sheet throughout downturn in tourism industry and grow through further steady rise in demand of public transportation services Cross-pollination of management expertise Opening doors to new possibilities Jeff Ellison CEO and MD (retiring) ✓ Experience: 28+ years ✓ Appointed in 1997 ✓ At the helm of the ferries and tourism group for 21 years ✓ Stepping down as SeaLink CEO ✓ Agreed to remain in the board to provide advice to Clint ✓ Promising recurrence of contract wins offshore and retention rate history throughout his tenure in Transit Systems ✓ Instrumental to building Transit Systems Marine (later acquired by SeaLink) Clint Feuerherdt CEO of Transit Group & Incoming CEO of SeaLink Group Neil Smith Founding shareholder & current chairman of Transit Systems ✓ Over 30 years of commuter transport operations experience in domestic and international markets ✓ Own approximately 15.3% of SeaLink shares on issue upon completion of the Acquisition ✓ Clint has extensive experience in marine transportations, introducing new angles to the ferry tourism market ✓ Clint is eminent in securing contracts and will help realise the vision of a multi-modal transport provider ✓ Neil’s shareholding position reflects his optimism in SeaLink’s future prospects ✓ Merger brings in international capabilities with experienced personnel handling the Singapore and UK region ✓ Potential for SeaLink to expand its tourism business to Singapore and UK ✓ SeaLink utilising Transit System’s buses to advertise its Australian destinations on buses in London and Singapore, thereby creating awareness offshore of SeaLink’s offering ✓ This was also flagged as a major opportunity for emerging tourist destinations in SeaLink’s portfolio such as Tiwi Islands ✓ Integration of bus and marine transportations allows SeaLink to diversify and expand into a multi-modal transportation solutions to local government ✓ The potential to operate trams has also been flagged by management, with this now being realised with the announcement of the North South region in Adelaide in March 2020 ✓ In the medium to long term, the combined group has sufficient influence and scale to look into expansion at New Zealand, US, Asia and Europe SeaLink to benefit from diversified revenue stream 30 50 7 5 8 Europe Americas TotalAsia Other continents Predicted global employment loss in the travel and tourism industry due to the COVID-19 in 2020, by region (in millions) 82% 18% Tourism market Public Transportation market SeaLink’s Revenue Stream Domestic ✓ Travel and tourism market is in dire trouble due to COVID outbreak ✓ SeaLink is in better position compared to its competitors in tourism market with only 18% of its revenue exposed ✓ Public transport remains an essential service for commuting COVID-19 factor overstated on SeaLink’s share price 0.0E+00 2.0E+06 4.0E+06 6.0E+06 8.0E+06 -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% 30.00% 40.00% Mar-22-2019 Jun-22-2019 Sep-22-2019 Dec-22-2019 SeaLink Travel Group vs. ASX 200 Share Price Volume SeaLink Travel Group ASX 200 Index CBOE Volatility Index (annual % change) ✓ A spike in uncertainty over the recent 3 months due to COVID-19 has resulted in under-pricing of SeaLink ✓ Management guidance reports estimated $9.5 million EBITDA impact in 2H20 on their tourism and marine business due to coronavirus and bushfire, but no impact on Transit System Group business ✓ This does not justify the ~20% drop in share price in 1H20 Page 5 Sources: Company Merger Report, sell-side reports, Yahoo Finance, Statista, Macquarie Research

- 7. C A P I T A L Post-SARS tourism spike Investment Thesis 1 – Untapped value from strategic merger (cont’d) SeaLink and Transit System Group’s to take advantage of steady revenue stream from its public transportation segment in addition to its revamped management team to penetrate the market and provide a streamlined integrated service to the growing tourism market Good prospects for tourism industry post COVID-19 Demonstrated ability of capturing offshore market share Chinese residents visiting Australia Australian residents visiting China Increasing number of China tourist Sources: Company Report, Austrade, IBISWorld, Macquarie Research Awareness of locations by Chinese residents 78 6 20 96 106 230 125 42 0 100 200 300 400 0 500 1,000 1,500 Hong Kong IndiaSingaporeUK South Korea USA MalaysiaChina NZ Japan 000’s (2018-19)% change (2008-09 to 2018-19) 303 28 Short term visitor arrivals in Australia 19% 19% 19% 14% 14% 9% 7% Canberra AdelaideGold Coast Kangaroo Island Barossa ValleyMelbourne Sydney ✓ Sydney and Kangaroo Island are famous amongst growing number of Chinese tourists ✓ SeaLink in a good position to capture further market share through Captain Cook Cruises (Sydney) and their operations at Kangaroo Island ✓ Clint demonstrated his capabilities through promising recurrence of contract wins offshore, and high retention rate of domestic contracts ✓ Demonstrated history of entering offshore market through strategic acquisitions, such as FirstGroup Plc (London penetration) in FY13 and Sita Group (Melbourne penetration) in FY19 Date Settled Target Rationale Performance 16-Jan-20 Transit Systems Group 26-Mar-18 Kingfisher Bay Resort Group 2-May-16 Captain Cook Cruises WA 6-Nov-15 Transit Systems Marine Strong top line growth achieved via new contract wins, re-tendering success, and targeted acquisitions ✓ TBC ✓ FY18 performance in line with expectations ✓ FY19 performance is unclear - management speaks positively of progress and contribution ✓ FY16 performance in line with expectations ✓ FY17 performance slightly under-performed ✓ FY16 and FY17’s performance in line with expectations ✓ Greater exposure to contracted revenue streams ✓ Cross-selling to existing customer base, exposure to prime tourism locations with strong barriers to entry, add to existing tourism hospitality and marine transport capabilities ✓ Gain exposure to Western Australia market ✓ Gain exposure to marine opportunity SeaLink’s acquisitions have achieved expectations thus far ✓ SeaLink’s strong track record of successful mergers is evident through their consistency of meeting expectations from mergers ✓ Clint was instrumental to to building Transit Systems Group’s marine operations before it got acquired by SeaLink ✓ This well positions Clint to takeover operations in SeaLink which was previously managed by Jeff Ellison ✓ Clint has successfully lifted the revenue drag of Captain Cook Cruises Page 6 FY00 Adelaide East West, SA FY05 Adelaide North South & Outer North East, SA FY10 Clint Graeme join Transit System Group FY13 Sydney Region 3, NSW London acquisition from FirstGroup Plc FY15 Sold the marine business to SeaLink FY16 Singapore entry FY18 Sydney Region 6, NSW FY19 Sita Group acquisition 0 100 200 300 400 500 600 700 800 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 WA SA London NSW (R3) NT Singapore NSW (R6) Vic FY01-FY15 Investment in marine business, subsequently sold to SeaLink FY01-FY19A CAGR (excluding marine): 17% 7 -3 0 -2 11 4 6 6 3 -6 6 5 5 6 4 5 -10 -5 0 5 10 15 12/11 11/10 10/09 09/08 07/06 02/01 04/03 08/07 05/04 03/02 06/05 01/00 15/14 00/99 17/16 16/15 14/13 13/12 International tourism receipts, change (real terms, %) ✓ A spike in the tourism industry post-SARS may be a helpful benchmark to predict the post COVID-19 situation ✓ This increase in tourism is significant to SeaLink cash flow stream

- 8. C A P I T A L -4% -2% 0% 2% 4% 6% 8% 10% 12% 0 20 40 60 80 100 120 140 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 TS revenue in WA tourism growth QLD Floods 2019 Bushfire H1N1 Outbreak Investment Thesis 2 – SeaLink is a top defensive player against COVID-19 Steady Revenue: long term government contracts minimise SeaLink exposure to tourism downturn “Bus contracts are typically structured with Transit Systems only exposed to operating performance.” – Macquarie Research “The combined impact of bushfires and coronavirus… with no impact on Transit System’s business.” – SeaLink Major government clients On-Time running performance ü Public transport is considered an “essential service” as per announcement by the government ü Pubic transportation operations as per usual Defensive Low Risk Reliable TS revenue in WA ($M) and change in international tourist arrival in Australia Indexed long-term contracts Australia London Singapore ✓ Typically 6-10 years ✓ Government has option to extend contract depending on performance ✓ Typically 5 years ✓ Government has option to extend contract for 2 years depending on performance ✓ Typically 5 years ✓ Government has option to extend contract for 2 years depending on performance ✓ TS has a good track record of meeting KPIs. This mitigates risk of failure to contract renewal with government as per evident from their 91% contract renewal rate to date. Good performance increases contract renewal rate Most revenue derived from contracts in commuter sector ü Risks associated with uncontrollable revenue items (e.g. fare box risk) are retained by government. Natural disasters and pandemics had limited impact on Transit Systems’ revenue in history SARS Outbreak Cyclones & Droughts GFC Major Client Country WA government Australia SA government Australia VIC government Australia NSW government Australia NT government Australia Singapore government Singapore London government United Kingdom ✓ Transit System has a strong track record of contract renewals – with only 2 renewal failures over a span of 24 years ✓ Government retaining external risks contributes largely to Transit Systems resilience to economic and tourism downturns in history. ✓ Contracts with CPI and wage indexing only exposed to operating performance make Transit Systems defensive to Covid-19 ✓ Unlikely for the Government to breach long-term contracts with Transit Systems because of short term negative impact of Covid-19 ✓ This is solidified by offshore competitor, ComfortDelGro, who never experienced a transportation authority counterparty terminating without cause ✓ There is demand for bus operation even in a severe economic downturn ✓ Transit Systems has 91% renewal rate across 24 years in the business ✓ Passing assets and liabilities onto new bus service providers is a complex process which generates heavy inertia and high costs to the Government when it comes to switching operators ✓ This increases tendency of market share retention by Transit System in Australia 82% 18% TourismCommuter 83% 17% Uncontracted Revenue Contracted Revenue The acquisition of Transit Systems has placed SeaLink in a good defensive posture against Covid-19. Having long-term fixed revenue contracts with the government, Transit Systems’s revenue will not be severely affected by the worsening situation and the travel ban On-time running performance Page 7 Sources: Macquarie Research, the World Bank, SeaLink, X Capital Estimates

- 9. C A P I T A L Domestic Operations Investment Thesis 2 – SeaLink is a top defensive player against COVID-19 (cont’d) Ferry business less affected by Covid-19 SeaLink Group’s marine business which comprises 17% of total revenue is more likely to be affected by Covid-19 pandemic. Negative impacts of Covid-19 can be minimised through (a) cost-reduction strategies and (b) government support. SeaLink estimated a reduction of $9.5million on EBITDA of its ferry business, 13.11% of its estimated total EBITDA prior to the pandemic, compared to the 40% drop in share price, indicating undervaluation Government supportCost reduction strategies ü Yet long-distance water freight is severely impacted by restrictions on export and import, there is a spike in demand from within-country logistics and freight service due to the increasing demand from online orders. Short-distance water freight industry has a positive outlook Suspend Tourism Operation Defer expenditure ✓ Suspending tourism dining and sightseeing operations on Sydney Harbour and cruises in South Australia Scale back discretionary business ✓ Targeted scaling back of some discretionary touring and marine services in Australia ✓ Deferring all non-essential projects and capital expenditure Work with government ✓ Working closely with government to keep cities moving in a safe and reliable manner In response to Covid-19 pandemic Cost cut – Key Operating Expenses QLD NT SA NSW WA TAS Waiver of utility or other fees Concessional loan Payroll tax refund Direct financial support ü ü ü ü SeaLink is eligible to various kinds of supports from governments Summary ü ü ü ü ü ü ü ü SeaLink owns many brands across regions in Australia ü ü ü ü ü Covid-19 impact on water freight is expected to be smaller than on tourism ü The water freight industry is capital intensive with high barriers to entry ü 16 vehicles and freight ferries ü 50 passenger ferries ü 12 accommodation and dining vessels ü SeaLink owns freight ferries in key ports in Australia, enabling the company to expand capacity in response to the increasing demand. ü In-country water freight is considered an essential service and will continue operation during the pandemic. 52% 25% 16% 5% 2% SeaLink Revenue by Geographic Region WA NSW SA TASQLD&NT 19% 17% 16% 19% 16% 19% 16% 1% SeaLink Ferry Business Cost Structure Meals & Beverage Depreciation Others Repairs & Maintenance Commission Tour Cost AccommodationFuel ü 25% estimated cost reduction ü Suspension of tourism operation saves 100% of tour, meals & beverage, accommodation costs ü Because of the seasonal nature of tourism, some contracts with employees are short-termed. It is easy to cut wage expense -20% -10% 0% 10% 20% 30% 0 500 1000 1500 2000 2500 3000 3500 2008A 2009A 2010A 2011A 2012A 2013A 2014A 2015A 2016A 2017A 2018A 2019A 2020E Freight Market Size Freight Growth Tourism Growth Page 8 Ability to increase business capacity in freight service Government support varies by region Sources: Macquarie Research, The World Back, Company Report, X Capital Analysis

- 10. C A P I T A L Opportunity for additional 30% market share New & Renewed Contracts Timeline Investment Thesis 3 – Huge potential growth pipeline in domestic and offshore markets Our camp holds the view that SeaLink has high prospects of securing future government contracts. In totality, there is A$3.56b in the tender pipeline up for competition. SeaLink’s (a) expert leadership, (b) impeccable track record for contract wins and (c) longstanding ability to meet KPIs cement our confidence in SeaLink’s deal origination capabilities Page 9 New South Wales – expanding market 2014 2015 2016 2017 2018 2019 100 150 125 Sydney (NSW) Transperth Melbourne Adelaide SEQ Sources: Grand Thornton Corporate Finance, Macquarie Research, SeaLink and Affiliates, Australian Bureau of Statistics Notes: (1) Sydney Morning Herald, (2) Motor Vehicle Census & Demographic Data from ABS, (3) The Age Bus Patronage Index 8% 4% 10% 6% 7% 8% 10% 47% NSW VIC Las Vegas Denver Singapore West Covina Phoenix London Potential Future Contracts Sydney Region 6 Contract Win – stamp of approval A$1.15b Quality services ran by forward looking management 92 93 90 93 97 88 92 92 90 70 75 80 85 90 95 100 Other ContractsClaremont Marmion 92 FY16 FY17 FY18 OverallSatisfaction(%) Customer Satisfaction Ratings Victoria – potential for further market ingress ✓ Bus patronage continues to grow in NSW, as the region’s undulating terrain indicates a secular tailwind for bus services over tram services ✓ SeaLink strategically positioned to take advantage of growing TAM, with almost half of tender pipeline dedicated to New South Wales ✓ SeaLink has submitted 4 contracts for tender in NSW, totalling A$1.15b. Winning 2/4 of the contracts in tender will garner ~A$600m of revenue Sydney Region 6 Bus Route Transit Systems Group ü In 2018, Transit Systems signed the largest metropolitan bus contract in Australia, introducing 600 buses and 1,200 new staff ü Region 6 comprises 4 of the busiest bus routes in Sydney ü 2nd contract win after Sydney Region 3 in 2013, and after their 2nd successive year as the leading on-time operator in the region ü Strong vote of confidence from the Government given the complexity of Region 6 and relative youth in the region ü Strong track record for closing new deals and securing renewals – 20 successful tenders in 24 years, with only 2 non-renewals Jan-2000 25k Jan-1980 Jan-1990 Jan-2010 Jan-2020 0 50k WA VIC NSW Change in population per quarter 1995 1996 1997 1998 1999 2000 2001 2002 2003 Midland Canning East West Claremont Marmion DoE Special Schools 25/N25 23/N23 328 28/N28 W15 SMBSC Region 3 Darwin Busselton BunburySouthern River WA SA VIC London NSW NT SG Bulim Westbourne College 13/N13 Albany NS & Outer NE SMBSC Region 6 PTV 89 Demand Responsive Services utilizes proprietary predictive technology to enhance resource allocation Customer-oriented work culture means Transit Systems consistently scores higher when it comes to customer satisfaction National Avg. Routing and customer allocation algorithms optimize bus service for passengers More direct routes, higher service frequency, shorter journey times Reduces operational cost while improving customer service Experienced and progressive leadership ensures good customer relationships ü Urbanisation trends suggest Melbourne to become the largest Australian city by 2026 (1) ü Population growth exceeds passenger vehicle growth(2) ü Need for public transportation continues to grow Joondalup 30% 16% 49% Transit Systems 5% ComfortDelgro Transdev Others ü Low market share base indicates legroom for growth ü Transdev’s contract to run 30% of bus routes set to expire in 2021 ü Government plans to increase competition in industry ü Transit Systems well postured for contract win ü Transdev tenure in Melbourne can be characterized as unsuccessful, plagued with defective fleets(3) ü Failed to meet contractual punctuality obligations(3) ü ComfortDelgro have monopoly market share if contract won ü Unlikely as they are international firm and already has 16% 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

- 11. C A P I T A L Investment Thesis 3 – Huge potential growth pipeline in both domestic and offshore markets (cont’d) Our camp holds the view that SeaLink has high prospects of securing future government contracts. In totality, there is A$3.56b in the tender pipeline up for competition. SeaLink’s (a) expert leadership, (b) impeccable track record for contract wins and (c) longstanding ability to meet KPIs cement our confidence in SeaLink’s deal origination capabilities Page 10 Singapore – unique opportunity Sources: Macquarie Research, Transit Systems, US Bureau of Transportation, SMRT Corporation, SBS Transit, Our World in Data, Pew Research Center, Statistica Notes: (1) Survey conducted May 10 – June 6, 2016 (Pew Research Centre). (2) Bus Industry Confederation, Australia History seldom repeats, but it often rhymes 25 80~ 9% 31 +200Number of Bus Routes ü May 2015 marked Transit System’s entry into the Singaporean market as the 1st non-Singaporean transport operator ü Successfully won a competitive tender for “Bulim” contract ahead of 10 other bidders including incumbent operators ü Won despite being the 3rd cheapest bidder. Alludes to the outstanding service quality of Transit Systems ü SG Government shift to contracts model in 2014 indicates commitment to incite competition in transportation sector Market penetration imminent Privatisation transformed Singapore’s taxi industry ü Took over operations of Tower Transit from Andrew Bujtor in 2019 who had successfully erected the business in 2015 ü Former Brigadier General in the Singapore Armed Forces, BG Winston Toh was Commander of 9th Infantry Division and Chief Infantry Officer ü The appointment is likely to be Government influenced, and is a sign that Tower Transit is here to stay Army Generals as Head of Transport Divisions is a recurring pattern in Singapore 2012 – Desmond Kuek (CEO) Former Chief of Defense Lieutenant General 2018 – Neo Kian Hong (CEO) Former Chief of Defense Lieutenant General 2008 – Gan Juay Kiat (CEO) Former Senior Commander Lieutenant-colonel 2020 – Cheng Siak Kian(CEO) Former Air Force Commander Brigadier General 2015 – Andrew Butjor (MD) Inception of Tower Transit First contract win in SG 2019 – Winston Toh (MD) Former Chief Infantry Officer Brigadier General 2 contracts in the pipeline up for tender in Singapore Strong signal of support towards Tower Transit from Government We believe Tower Transit will win at least one if not both contracts United States – going green Government transit revenues and expenditures on the rise 1970-1995 2003-2007 2013-2020 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 $40bn $70bn $60bn 15m 0 5m 10m 20m 2014 20152013 2016 20182017 2019 2020 2021 2022 2023 Expanding US Government Budget for Transit Government Revenue (Transit) Government Expenditure (Transit) US yearly passenger vehicle purchases 75% 20% 25% 63% 13% 4% Particularly Concerned Not Particularly Concerned % of U.S. adults concerned about helping the environment(1) % of U.S. adults who say they are environmentally friendly(1) Always Sometimes Not at allSeldom US populace understands the pressing need to reduce carbon emissions… United States 5 contracts (~27%) in tender pipeline US bus transportation underdeveloped and growing Almost all of West Coast transit operators are public agencies Cost savings incentivise State Governments to go private ü Climate change in the spotlight ü Survey shows that US individuals are willing to take action ü Cars account for more than 50% of CO2 emissions ü Buses account for less than 10% of CO2 emissions “A full bus takes 40 cars off the road” – BIC(2) ü Higher proportion of the US Budget dedicated to public transportation ü Government Expenditure on transit has increased 5% year on year from 2007-2016 ü Expenditure exceeds revenue, and privatisation can reduce expenditure ü Decelerating passenger vehicle sales despite period of economic boom ü Implies possible shift to alternatives such as bus transportation ü Opportunity for Transit Systems to participate in growing TAM 0 50 100 1990 1995 2000 2005 2010 2015 2020 CO2 emissions for road transport (‘000s Gg) Buses Passenger Cars

- 12. C A P I T A L 2.00 3.00 4.00 5.00 6.00 Valuation – BUY recommendation by X Capital X Capital issues a BUY recommendation on SeaLink Travel Management Group Limited with a target price of A$ 4.33, representing a 68.4% investment return from the closing price of A$ 2.57 per share on 23 Mar 2020. Our target price was derived using a Discounted Cash Flow (DCF) model as our primary valuation method. Discounted cash flow model input assumptions Weighted average cost of capital assumptions Impact of Bushfire/Covid-19 to last until 2H20 ✓ Management suspended its guidance of $5m for 2H20 EBITDA as a potential impact from both bushfire and COVID-19 ✓ EBITDA impact from estimates for COVID-19 and bush fires adjusted from an earlier $7m to $9.5m for 2H20E Football field analysis Football Field – Fair Value of Equity Details Valuation Methodology 52 W High / Low SOTP Valuation Dividend Discount Model DCF Exit Multiple DCF Gordon Growth Residual Income Model Current Price A$ 2.57 ü Low: A$2.57 on 23 Mar 2020 ü High: A$ 5.22 on 9 Nov 2020 ü Tourism EV/FY+1 EBITDA: 7.9x ü Transit System EV/ FY+1 EBITDA: 8.0x ü Dividend Payout Ratio: 60% ü Projection Period: 5 Years ü Exit Multiple (EV/EBITDA): 8.0x ü Projection Period: 5 Years ü Terminal Growth Rate: 1% Potential contract wins are not factored into our estimates and thus represent upside risk ✓ Transit Systems Group is targeting a tender pipeline of over A$ 3.5 billion across existing end markets and the US before 2025 ✓ This provides potential significant revenue opportunities for the group SeaLink is expected to grow in line/outperform the inbound tourism industry ✓ SeaLink’s growth rate has been outperforming the industry over the last 4 years with a CAGR of 22% from FY15 to FY19 (vs. industry growth rate: c.5%) ✓ Assumed SeaLink to grow in line with the inbound tourism industry after the recovery of Covid-19 Established track record of re- contracting and re-tendering history ✓ 20 successful tenders and renewals over its 24 year history in Australia, with only 2 non-renewals ✓ Long-term relationship with governments as incumbent operator on routes ✓ Hence, we expect SeaLink to succeed in renewing all TransLink contracts 8.13% Cost of Equity & 2.51% After–tax Cost of Debt Sources: Capital IQ, sell-side reports, X Capital Estimates, MergerMarket, Sell-side reports, Factset Target Price A$ 4.33 CAPM Inputs Source Risk Free Rate 1.50% Australia 20-Years Government Bond Rate Market Return 7.50% Sum of equity risk premium and risk free rate Equity Risk Premium 6.00% FMAA & Yahoo Finance Country Risk Premium 0.04% Aswath Damodaran Adjusted Beta 1.2 Bottom up from peers Cost of Equity 8.74% ü Cost of Equity Used: 8.74% Long run D/E ratio of 0.56 WACC of 6.51% 8.74% Cost of Equity & 2.51% After–tax Cost of Debt Page 11

- 13. C A P I T A L Investment Catalysts and Risk X Capital’s investment recommendation presents a 1:4.2 risk to reward ratio and follows a one-year horizon due to the main catalysts being the successful expansion in US and NZ and the continued efforts of strategic acquisitions. Key catalysts Scenario Analysis Key investment risks 1 Cancellation of contracts by Government due to Covid-19 ✓ Many of Transit Systems’ contracts are terminable for convenience and are non-exclusive. As a result, cessation of government bus contracts when Transit Systems is not at default is possible. Termination of convenience clauses are commonplace in government ✓ This is unlikely as: An offshore competitor, ComfortDelGro, who has exposure to London, Singapore and Australia has advised that they have never experienced a transportation authority counterparty terminating without cause SeaLink Group’s lost of key personnel ✓ The unexpected departure of any key members of management or operating personnel may prevent or delay completion of the Acquisition and / or may have a material adverse effect on the financial performance of Transit Systems Group and SeaLink after completion of the Acquisition ✓ Conflict in efforts to integrate management team due to various factors such as difference in culture and silo-ed communication 3 Competitive Industry Landscape ✓ SLK enjoys sole operator status on a large number of the routes it operates. Entrants of new competitors or aggressive campaigns from existing competitors could impact both SLK’s passenger numbers and/or pricing power and could impact financial performance ✓ This is unlikely as: The public transportation industry has extremely high barriers to entry. With its extensive market share and its potential to scale up in the tourism industry, it will be difficult for new entrants to compete LikelihoodofOccurrence Impact on Business Source: Macquarie Research 1 1 2 2 3 3 Continued efforts of strategic acquisitions: Increased market exposure and ability to become a multi-modal transportation provider 2 Successful expansion in US and NZ markets: Submitting tenders for bus contracts in the United States and New Zealand being a near term target 1 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 Oct-01-2019Jul-01-2019Apr-01-2019 Oct-01-2020Apr-01-2020 Apr-01-2021Jul-01-2020 Jan-01-2021Jan-01-2020 AUD 4.33 Base: 68.4% AUD 1.92 Base: -25.2% AUD 5.28 Base: 105.4% Risk to Reward 1 to 4.2 Page 12

- 14. End of main deck C A P I T A L March 2020 School: The University of Melbourne Team Members: Hun Yao Chong, Hwa Jin Soh, Eugene Shao, Andrew Eo Page 13

- 16. C A P I T A L Valuation: Peers Comparison Summary Valuation Multiples Company name Ticker Mkt Cap (USD m) EV (USD m) P/E EV/EBIT EV/EBITDA EBITDA margin (%) EBITDA growth (%) FY+1 FY+2 FY+1 FY+2 FY+1 FY+2 FY+1 FY+2 FY+1 FY+2 Tourism & Travel Exposed Helloworld Travel Ltd ASX:HLO 76.9 63.3 7.3x 6.7x 4.4x 4.0x 3.1x 2.8x 23.2% 24.1% 11.0% 7.7% Experience Co Ltd ASX: EXP 26.6 47.3 51.6x 12.1x 31.1x 10.7x 8.8x 6.0x 11.7% 15.8% -48.4% 46.5% Event Hospitality & Entertainment Limited ASX:EVT 556.7 1,109.9 16.2x 14.1x 17.3x 15.2x 10.7x 9.7x 24.2% 25.1% 1.7% 9.9% Flight Centre Travel Group Limited ASX:FLT 576.9 894.1 13.9x 10.9x 11.7x 9.1x 6.9x 5.9x 14.6% 16.1% 5.9% 18.0% Webjet Limited ASX:WEB 293.5 313.3 10.1x 8.5x 9.6x 8.0x 6.7x 5.8x 37.5% 38.9% 22.7% 15.6% Apollo Tourism & Leisure Ltd ASX:ATL 49.0 408.0 5.6x 4.5x 14.1x 12.6x 7.3x 6.8x 16.0% 16.5% -9.7% 7.0% Tourism Holdings Limited NZSE:THL 377.0 648.0 15.6x 12.0x 11.3x 10.7x 5.6x 5.5x 26.2% 26.8% -3.4% 2.4% Global Public Transport - bus (limited rall exposure) National Express Group PLC LSE:NEX 652.3 2,164.4 9.6x 9.0x 10.9x 10.4x 6.6x 6.3x 16.9% 16.7% 0.8% 3.7% Comfortdelgro Corporation Limited SGX:C52 2,058.3 2,507.9 14.0x 13.4x 11.2x 10.7x 5.6x 5.4x 21.6% 21.7% -2.9% 2.8% Nobina AB OM:NOBINA 351.0 901.8 15.1x 13.7x 19.2x 18.1x 6.6x 6.4x 16.5% 16.2% 2.7% 4.2% Global Public Transport - bus (substantial rail exposure) Go-Ahead Group plc LSE:GOG 328.3 841.8 10.3x 9.8x 5.0x 4.7x 3.0x 2.9x 5.4% 6.3% -5.1% 3.1% Stagecoach Group plc LSE:SGC 419.0 873.1 7.2x 8.4x 8.5x 8.9x 4.5x 4.6x 15.1% 16.4% -0.8% 1.2% FirstGroup plc LSE:FGP 557.5 2,957.3 6.4x 6.5x 9.4x 9.4x 3.7x 3.9x 11.5% 11.1% -3.7% 0.6% SeaLink Travel Management Group (Pro forma group) ASX:SLK 323.1 295.0 9.4x 7.0x 9.0x 7.0x 4.6x 4.6x 11.2 12.2 52.7 25.0 Tourism & Travel Exposed Weighted Average 14.4x 11.4x 13.6x 11.6x 7.9x 7.1x 23.3% 24.5% 4.5% 12.0% Global Public Transport - bus Weighted Average 13.2x 12.5x 12.4x 11.8x 6.2x 5.9x 20.0% 20.0% -1.5% 3.2%

- 17. C A P I T A L Valuation: Precedent Transaction Analysis Precedent Transaction Analysis Date Target Acquirer Stake (%) EV/Sales EV/EBITDA EV/EBIT Domestic Tourism Transactions and Bids Minority Oct-03 Hamilton Island Enterprises Voyages Hotels & Resorts 100% 1.7x 8.1x 12.4x Oct-03 Hamilton Island Enterprises 21st Century Resorts 100% 2.1x 9.8x 15.2x Jun-10 FreightLink (Asia Pacific Transport Finance) Genesee & Wyoming 100% 8.0x Nov-11 Captain Cook Cruises Sydney Harbour SeaLink 100% 9.0x Dec-12 Airtrain Holdings Universities Superannuation Scheme 100% 16.6x Nov-14 Sheraton Noosa Resort Valad Property Group (Blackstone) 100% Mar-15 Perisher Blue Vail Resorts 100% 8.8x Sep-15 Transit Systems (Marine business) SeaLink 100% 6.6x Feb-16 Captain Cook Cruises WA SeaLink 100% 9.2x Oct-17 Mantra Group AAPC Limited (Accor S.A.) 100% 11.3x Dec-17 Big Cat Green Island Reff River Cruises and Tropical Journeys Experience Co 100% 5.6x Feb-18 Kingfisher Bay Resort SeaLink 100% 5.4x Feb-19 Australian Alphine Enterprises (Hotham Ski Resort and Falls Creek Ski Resort) Vail Resorts 100% 9.7x Median 1.9x 8.9x 13.8x Mean 1.9x 9.0x 13.8x Australia & New Zealand Bus Transport Dec-14 Forest Coach Lines Next Capital 75% 7.4x Apr-18 Tullamarine Bus Lines CDC Victoria (Comfort DelGro) 100% 9.9x Aug-18 FCL Holdings (Foerst Coach Lines) ComfortDelGro (Australia) 100% 8.1x Aug-18 Coastal Linear Coaches ComfortDelGro (Australia) 100% Nov-18 Buslink ComfortDelGro 100% 7.9x Dec-18 NZ Bus Next Capital 100% 8.9x Apr-19 B&E Branch ComfortDelGro (Australia) 100% 7.6x Aug-19 Howick & Eastern Buses (NZ) Transdec Australasia (Voelia) 100% Oct-19 Mana Coach Services (NZ) Transdec Australasia (Voelia) 100% Median N.A 8.0x N.A Mean N.A 8.3x N.A International Bus Transport Apr-10 Arriva Plc Deutsche Bahn AG 100% 0.7x 6.9x 13.8x Mar-12 Hedingham & District Omnibuses Go-Ahead 100% May-12 Coach America Inc Stagecoach Group 5.5x Apr-13 FirstGroup Plc - London bus business Transit Systems 100% Jul-16 SMRT Corporation Temasek Holdings 46% 2.4x 12.9x 30.9x Jul-18 Ric-tat Travel & Coach Services ComfotyDelGro 100% Feb-18 Student Transportation Caisse de Depot et Pleacement du Quebec and Ullico 92% 1.5x 11.3x 23.1x Dec-18 Coach USA LLC (North American operations of Stagecoach Group) Variant Equity Advisors 100% 3.2x Feb-19 Queens Road Bus Depot (seller FirstGroup) Go-Ahead 100% Jul-19 A Bjorks AB Transdev 100% Median 1.5x 6.9x 23.1x Mean 1.5x 8.0x 22.6x

- 18. C A P I T A L Valuation: Discounted Cash Flow Analysis Discounted Cash Flow Valuation Upside (EMM): 19.13% Upside (GGM): 68.39% Cost of Equity Units Terminal Value: Gordon Growth Model Units Equity Value AUD'000 555,915 FY24 Free Cash Flow AUD'000 68,384 Risk Free Rate % 1.50% Terminal Growth Rate % 1.00% Market Risk Premium % 6.00% Terminal Value AUD'000 1,254,514 Adjusted Beta % 1.20 Implied Exit Multiple x 11.0x Country Risk Premium % 0.04% Present Value of Terminal Value AUD'000 944,714 Cost of Equity % 8.74% Terminal Value: Exit Multiple Method Units Cost of Debt Units FY24 EBITDA AUD'000 114,472 Debt Value AUD'000 311,297 Exit Multiple: EV/EBITDA x 8.0x Pre-tax Cost of Debt % 3.47% Terminal Value AUD'000 915,777 Tax Shield % 27.6% Implied TGR % -0.9% After-tax Cost of Debt % 2.51% Present Value of Terminal Value AUD'000 668,234 Capital Structure Units DCF Valuation (Gordon Growth) Proportion of Equity Capital % 64.1% Present Value of Cumulative FCFF AUD'000 236,515 Proportion of Debt Capital % 35.9% Present Value of Terminal Value AUD'000 944,714 Weighted Average Cost of Capital % 6.51% Terminal Value as a % of Total Value % 80.0% Implied Enterprise Value AUD'000 1,181,230 DCF Valuation (Exit Multiple) Less: Debt AUD'000 (311,297) Present Value of Cumulative FCFF AUD'000 236,515 Less: Non-controlling Interest AUD'000 - Present Value of Terminal Value AUD'000 668,234 Add: Cash AUD'000 75,211 Terminal Value as a % of Total Value % 73.9% Add: Investments AUD'000 - Implied Enterprise Value AUD'000 904,749 Implied Equity Value AUD'000 945,143 Implied Equity Value AUD'000 668,663 Fair Value per Share AUD 3.06 Fair Value per Share AUD 4.33 Upside % 19.1% Upside % 68.4% Free Cash Flow to Equity Units 2018 A 2019 A 2020 E 2021 E 2022 E 2023 E 2024 E Earnings before Interest and Taxes (EBIT) AUD'000 34,774 93,000 59,326 88,177 99,662 101,363 103,107 Less: Taxes AUD'000 (10,076) (21,390) (16,360) (24,353) (27,542) (28,031) (28,532) Net Operating Profits after Taxes (NOPAT) AUD'000 24,698 71,610 42,966 63,824 72,120 73,332 74,575 Add: Depreciation AUD'000 14,418 18,713 6,404 11,107 11,190 11,276 11,365 Add: Amortisation AUD'000 1,560 1,944 12,808 22,213 22,380 22,553 22,730 Less: Capital Expenditure AUD'000 (13,654) (17,645) (40,000) (40,000) (40,000) (40,000) (40,000) Less: Changes in Net Operating Working Capital AUD'000 1,287 (31,171) 16,312 (15,162) (269) (278) (286) Free Cash Flow to Firm (FCFF) AUD'000 28,309 43,451 38,490 41,982 65,421 66,883 68,384 Discount Factor Period 0.5 1.5 2.5 3.5 4.5 Present Value of Free Cash Flows AUD'000 37,296 38,195 55,884 53,643 51,497

- 19. C A P I T A L Valuation: Discounted Dividend Model Valuation & Residual Income Model Valuation Discounted Dividend Model Valuation Residual Income Model Valuation Discounted Dividend Model Valuation Upside (DDM): 55.08% Terminal Value: Gordon Growth Model Units DDM Valuation (Gordon Growth) FY24 Dividends Paid AUD'000 42,653 Present Value of Cumulative Dividends AUD'000 145,804 Terminal Growth Rate % 4.52% Present Value of Terminal Value AUD'000 724,618 Terminal Value AUD'000 1,056,533 Terminal Value as a % of Total Value % 83.2% Present Value of Terminal Value AUD'000 724,618 Implied Equity Value AUD'000 870,422 Fair Value per Share AUD $ 3.99 Upside % 55.08% Dividends Units 2018 A 2019 A 2020 E 2021 E 2022 E 2023 E 2024 E Net Income AUD'000 22,371 62,841 36,264 59,483 68,015 69,535 71,088 Dividend Payout Ratio AUD'000 65.6% 23.4% 60% 60% 60% 60% 60% Total Dividends Paid AUD'000 14,667 14,685 21,758 35,690 40,809 41,721 42,653 Dividend per Share AUD 0.0672 0.0672 0.0996 0.1634 0.1869 0.1910 0.1953 Discount Factor Period 0.5 1.5 2.5 3.5 4.5 Present Value of Dividends AUD'000 20,865 31,474 33,096 31,115 29,253 Residual Income Model Valuation Upside (RIM): 6.28% RIM Assumptions Units RIM Valuation Units Abnormal Earnings in FY24 AUD'000 1,387 Cumulative PV of Abnormal Earnings AUD'000 (9,493) Growth Rate % 4.52% PV of Terminal Value of Abnormal Earnings AUD'000 50,113 Terminal Value AUD'000 73,067 Current Net Asset Value AUD'000 555,915 Present Value of Terminal Value AUD'000 50,113 Implied Equity Value AUD'000 596,535 Cost of Equity Used % 8.74% Fair Value per Share AUD $ 2.73 Upside % 6.28% Abnormal Earnings Units 2018 A 2019 A 2020 E 2021 E 2022 E 2023 E 2024 E a) PAT AUD'000 22,371 62,841 36,264 59,483 68,015 69,535 71,088 Expected Earnings Cost of Equity Assumptions % 8.74% 8.74% 8.74% 8.74% 8.74% 8.74% 8.74% Shareholders' Book Value (T-1) AUD'000 147,683 152,222 555,915 718,007 741,890 769,322 797,384 b) Less: Expected Earnings AUD'000 (12,909) (13,306) (48,594) (62,763) (64,850) (67,248) (69,701) c) Abnormal Earnings [a-b] AUD'000 9,462 49,535 (12,330) (3,279) 3,165 2,287 1,387 Discount Factor Period 0.5 1.5 2.5 3.5 4.5 Present Value of Abnormal Earnings AUD'000 (11,824) (2,892) 2,567 1,705 951

- 20. C A P I T A L Valuation: SOTP Valuation & Sensitivity Analysis SOTP Assumptions Units Tourism EV/FY+1 EBITDA x 7.9x Tourism FY+1 EBITDA AUD'000 40,795 Implied Enterprise Value AUD'000 320,419 Transit Systems Group FY+1 EV/EBITDA x 8.0x Transit Systems Group FY+1 EBITDA AUD'000 83,606 Implied Enterprise Value AUD'000 668,849 Total Implied Enterprise Value AUD'000 989,268 Less: Debt AUD'000 (311,297) Less: Non-controlling Interest AUD'000 - Add: Cash AUD'000 75,211 Implied Equity Value AUD'000 753,182 Fair Value per Share AUD 3.45 Upside % 34.2% Sensitivity Analysis (SOTP Valuation) Transit Systems Group FY+1 EV/EBITDA $ 3.45 5.0x 6.0x 7.0x 8.0x 9.0x Tourism EV/FY+1 EBITDA 5.9x 1.93 2.31 2.69 3.08 3.46 6.9x 1.74 2.12 2.51 2.89 3.27 7.9x 1.74 2.12 2.51 2.89 3.27 8.9x 1.93 2.31 2.69 3.08 3.46 9.9x 2.30 2.68 3.07 3.45 3.83 Target Price Sensitivity Analysis (Gordon Growth) TGR $ 4.33 0.0% 0.5% 1.0% 1.5% 2.0% 5.5% 4.50 4.11 4.11 4.50 5.54 6.0% 5.07 4.59 4.59 5.07 6.38 WACC 6.5% 5.07 4.59 4.59 5.07 6.38 7.0% 4.50 4.11 4.11 4.50 5.54 7.5% 3.63 3.35 3.35 3.63 4.33 Target Price Sensitivity Analysis (Exit Multiple) Exit Multiple $ 3.06 6.0x 7.0x 8.0x 9.0x 10.0x 4.5% 2.58 2.16 2.16 2.58 3.42 5.5% 2.74 2.30 2.30 2.74 3.62 WACC 6.5% 2.74 2.30 2.30 2.74 3.62 7.5% 2.58 2.16 2.16 2.58 3.42 8.5% 2.30 1.91 1.91 2.30 3.06 Sensitivity Analysis (Dividend Discount Model) TGR $ 3.99 3.5% 4.0% 4.5% 5.0% 5.5% 7.7% 4.11 3.73 3.73 4.11 5.22 8.2% 4.66 4.17 4.17 4.66 6.17 COE 8.7% 4.66 4.17 4.17 4.66 6.17 9.2% 4.11 3.73 3.73 4.11 5.22 9.7% 3.32 3.08 3.08 3.32 3.99 Sensitivity Analysis (Residual Income Model Valuation) Growth Rate $ 2.73 3.5% 4.0% 4.5% 5.0% 5.5% 7.7% 3.65 3.50 3.50 3.65 4.18 8.2% 4.15 3.94 3.94 4.15 4.91 COE 8.7% 4.15 3.94 3.94 4.15 4.91 9.2% 3.65 3.50 3.50 3.65 4.18 9.7% 2.65 2.63 2.63 2.65 2.73

- 21. C A P I T A L Accounting Analysis I Accounting Analysis Revenue Growth by Segment 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Transit Systems % -49.6% 100.0% 17.1% 7.1% 0.0% Sealink South Australia & Tasmania (SA) % 3.7% -4.8% 2.7% -30.0% 10.0% 4.1% 4.0% 3.9% Captain Cook Cruises, New South Wales & Western Australia % 34.5% 8.2% -3.3% -30.0% 10.0% 4.8% 4.7% 4.6% Sealink Queensland & NT % 11.6% -5.4% -0.8% -20.0% 10.0% 2.8% 2.8% 2.8% Sealink Fraser Island (Fraser Island) 369.4% -20.0% 10.0% 5.0% 5.0% 5.0% Profitability Metrics 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E EBITDA Margin % 26.4% 26.1% 23.5% 11.1% 12.7% 11.2% 12.2% 12.7% 12.8% EBIT Margin % 20.5% 19.4% 16.6% 8.1% 9.3% 7.9% 9.0% 9.5% 9.6% PBT Margin % 19.0% 17.7% 15.0% 7.7% 7.8% 7.4% 8.5% 9.1% 9.2% PAT Margin % 13.3% 12.3% 10.7% 5.5% 5.7% 5.4% 6.3% 6.7% 6.8% Efficiency Metrics 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Return on Equity % 17.2% 16.8% 14.7% 11.3% 5.1% 8.0% 10.4% 11.2% 10.9% PAT Margin % 13.3% 12.3% 10.7% 5.5% 5.7% 5.4% 6.3% 6.7% 6.8% Asset Turnover x 0.68x 0.81x 0.67x 1.01x 0.55x 0.92x 1.03x 1.07x 1.06x Equity Multiplier x 1.90x 1.67x 2.05x 2.04x 1.62x 1.63x 1.60x 1.56x 1.52x Return on Assets [NOPAT / TA] % 9.7% 11.0% 7.9% 6.3% 3.7% 5.3% 6.8% 7.5% 7.4% Returns on Invested Capital [NOPAT / Total Capital] % 12.4% 13.0% 9.5% 8.4% 4.7% 6.8% 8.8% 9.6% 9.5% Working Capital Ratios 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Receivables Turnover x 11.86x 19.53x 19.03x 12.15x 12.15x 12.15x 12.15x 12.15x 12.15x Payables Turnover x 18.16x 23.43x 17.52x 14.97x 14.97x 14.97x 14.97x 14.97x 14.97x Inventory Turnover x 56.20x 59.17x 44.20x 76.83x 76.83x 76.83x 76.83x 76.83x 76.83x Days Receivables Outstanding Days 30.79 18.69 19.18 30.04 30.04 30.04 30.04 30.04 30.04 Days Payables Outstanding Days 20.10 15.58 20.83 24.38 24.38 24.38 24.38 24.38 24.38 Days Inventory Outstanding Days 6.49 6.17 8.26 4.75 4.75 4.75 4.75 4.75 4.75 Cash Conversion Cycle Days 17.19 9.28 6.61 10.41 10.41 10.41 10.41 10.41 10.41 Operating Cycle Days 37.28 24.86 27.44 34.79 34.79 34.79 34.79 34.79 34.79

- 22. C A P I T A L Accounting Analysis II Short Term Liquidity Ratios 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Current Ratio x 0.57x 0.63x 0.87x 1.31x 2.24x 1.90x 2.00x 2.19x 2.52x Quick Ratio x 0.45x 0.53x 0.56x 1.13x 0.98x 1.14x 1.17x 1.18x 1.22x Capitalization Ratios 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Debt to Total Assets x 0.30x 0.28x 0.39x 0.27x 0.18x 0.17x 0.15x 0.14x 0.13x Debt to Capitalization x 0.38x 0.33x 0.46x 0.37x 0.23x 0.21x 0.20x 0.18x 0.16x Debt to Equity x 0.57x 0.47x 0.79x 0.56x 0.30x 0.27x 0.24x 0.22x 0.19x Total Liabilities to Total Assets x 0.47x 0.40x 0.51x 0.51x 0.38x 0.38x 0.37x 0.36x 0.34x Coverage Ratios 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Debt / EBITDA (Total Debt / EBITDA) x 1.66x 1.31x 2.44x 2.46x 2.61x 1.61x 1.21x 1.02x 0.94x Debt / EBIT (Total Debt / EBIT) x 2.14x 1.76x 3.46x 3.35x 3.58x 2.27x 1.64x 1.37x 1.25x EBITDA / Gross Interest Expense x 17.20x 15.10x 14.89x 25.69x 8.74x 19.52x 25.87x 30.55x 33.05x EBIT / Gross Interest Expense x 13.35x 11.21x 10.53x 18.85x 6.37x 13.84x 19.03x 22.83x 24.74x Supporting Calculations 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Capitalization [Debt + Shareholders Equity] AUD'000 205,052 208,815 260,759 852,694 919,007 932,840 955,673 983,192 1,011,811 Total Debt AUD'000 77,596 68,920 120,226 311,297 212,447 200,435 188,216 176,025 163,716 Interest Expense AUD'000 2,717 3,486 3,304 4,933 9,314 6,373 6,013 5,646 5,281 Interest Expense as a % of Borrowings % 3.5% 5.1% 2.7% 1.6% 5.0% 5.0% 5.0% 5.0% 5.0% Interest Income as a % of Beginnning Cash Balance % 0.4% 0.3% 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% Net Operating Profits after Taxes (NOPAT) AUD'000 25,358 27,133 24,698 71,610 42,966 63,824 84,576 94,753 96,009 Total Capital Expenditure AUD'000 6,829 6,078 12,995 5,040 40,000 40,000 40,000 40,000 40,000 Changes in Net Working Capital AUD'000 (1,838) 3,079 1,287 (31,171) 16,312 (15,162) (5,235) (2,696) (286) Free Cash Flow to Firm AUD'000 27,138 37,683 27,408 54,112 25,682 19,769 52,072 65,623 69,378 Tax Rate % 30.1% 30.6% 29.0% 23.0% 27.6% 27.6% 26.1% 26.5% 26.5% Accounting Analysis

- 23. C A P I T A L SeaLink Operating Model (Income Statement) Income Statement 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Transit Systems AUD'000 - - - 895,000 451,330 902,660 902,660 902,660 902,660 SA AUD'000 65,114 67,496 64,234 65,970 46,179 50,797 52,880 54,995 57,140 CCC AUD'000 37,962 51,052 55,213 53,375 37,363 41,099 43,071 45,096 47,170 QLD AUD'000 74,293 82,877 78,435 77,833 62,266 68,493 70,411 72,382 74,409 KBR AUD'000 - - 11,527 54,106 43,285 47,613 49,994 52,494 55,118 Other AUD'000 (113) (61) - 37 - - - - - Revenue AUD'000 177,256 201,364 209,409 1,146,321 640,423 1,110,662 1,119,016 1,127,627 1,136,497 Opex (excl. D&A) AUD'000 (130,533) (148,745) (160,217) (1,014,479) (558,980) (986,261) (982,879) (989,531) (996,391) EBITDA AUD'000 46,723 52,619 49,192 126,710 81,442 124,401 136,136 138,095 140,106 Depreciation & Amortisation AUD'000 (10,447) (13,549) (14,418) (34,713) (22,116) (36,224) (36,474) (36,732) (36,999) Operating Income AUD'000 36,276 39,070 34,774 93,000 59,326 88,177 99,662 101,363 103,107 Interest income AUD'000 203 43 27 38 60 376 341 398 459 Finance costs AUD'000 (2,717) (3,486) (3,304) (4,933) (9,314) (6,373) (6,013) (5,646) (5,281) Profit before tax AUD'000 33,762 35,627 31,498 88,105 50,072 82,180 93,990 96,114 98,286 Income tax expense AUD'000 (10,162) (10,885) (9,127) (20,264) (13,808) (22,696) (25,975) (26,579) (27,198) Profit, net of tax AUD'000 23,600 24,742 22,371 62,841 36,264 59,483 68,015 69,535 71,088 Other comprehensive (loss) income: Items that may be reclassified subsequently to profit or loss: Net (loss) / gain on cash flow hedge (interest rate swap) AUD'000 (1,070) 607 (724) (2,588) - - - - - Deferred Tax AUD'000 321 (182) 217 776 - - - - - Net other comprehensive loss to be reclassified to Profit and Loss in subsequent financial periods (749) 425 (507) (1,812) - - - - - Total comprehensive income AUD'000 21,600 24,257 19,058 19,731 36,264 59,483 68,015 69,535 71,088 Basic, profit for the year attributable to ordinary equity holders of the parent 0.24 0.24 0.19 0.21 0.17 0.27 0.31 0.32 0.33 Diluted, profit for the year attributable to ordinary equity holders of the parent 0.23 0.24 0.19 0.21 0.17 0.27 0.31 0.32 0.33

- 24. C A P I T A L SeaLink Operating Model (Balance Sheet) Balance Sheet 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E ASSETS Non-current assets Property, plant and equipment AUD'000 175,037 170,787 210,101 399,396 432,992 461,885 490,695 519,419 548,054 Intangible assets AUD'000 47,748 46,188 55,327 580,383 567,575 545,361 522,981 500,428 477,699 Deferred tax assets AUD'000 4,693 3,894 4,539 5,936 5,936 5,936 5,936 5,936 5,936 Right of use assets AUD'000 8,220 7,788 14,963 16,155 11,615 8,711 5,807 2,904 - Total non-current assets AUD'000 235,698 228,657 284,930 1,001,870 1,018,117 1,021,894 1,025,419 1,028,687 1,031,688 Current assets Inventories AUD'000 3,154 3,403 4,738 14,921 8,336 14,457 14,566 14,678 14,793 Trade and other receivables AUD'000 14,951 10,310 11,004 94,355 52,714 91,420 92,107 92,816 93,546 Prepayments AUD'000 1,810 1,958 2,000 4,263 2,382 4,130 4,161 4,193 4,226 Cash and cash equivalents AUD'000 5,208 2,923 3,242 11,904 75,211 68,143 79,561 91,887 105,037 Current tax asset AUD'000 - - 6,334 5,684 5,684 5,684 5,684 5,684 5,684 Total current assets AUD'000 25,123 18,594 27,318 131,127 144,327 183,834 196,080 209,258 223,287 Total assets AUD'000 260,821 247,251 312,248 1,132,997 1,162,444 1,205,728 1,221,499 1,237,945 1,254,975 EQUITY AND LIABILITIES Equity Share capital AUD'000 95,557 95,557 95,557 96,057 243,644 243,644 243,644 243,644 243,644 Retained earnings AUD'000 42,234 53,533 59,631 471,452 485,958 509,751 536,957 564,771 593,206 Reserves AUD'000 (230) 322 (36) (6,510) (6,510) (6,510) (6,510) (6,510) (6,510) Capital lease plug AUD'000 (606) (1,729) (2,930) (5,085) (5,085) (4,995) (4,769) (4,521) (4,210) Total equity AUD'000 136,955 147,683 152,222 555,915 718,007 741,890 769,322 797,384 826,131 570,420 Non-current liabilities Deferred tax liabilities AUD'000 5,514 4,140 9,293 9,132 9,132 9,132 9,132 9,132 9,132 Other financial liabilities, non-current AUD'000 840 340 1,050 2,832 2,832 2,832 2,832 2,832 2,832 Lease Obligations, non-current AUD'000 5,823 5,665 8,603 11,447 9,485 6,813 3,692 - - Provisions AUD'000 989 1,017 1,649 70,813 70,813 70,813 70,813 70,813 70,813 Contract and other liabilities AUD'000 1,149 977 805 776 776 776 776 776 776 Interest bearing loans and borrowings AUD'000 65,233 58,072 107,187 295,957 201,000 190,950 181,403 172,332 163,716 Other liabilities AUD'000 86,000 86,000 86,000 86,000 86,000 86,000 Total non-current liabilities AUD'000 79,548 70,211 128,587 476,957 380,038 367,316 354,648 341,885 333,269 Current liabilities Current tax liabilities AUD'000 14,264 2,020 - - - - - - - Trade and other payables AUD'000 9,759 8,594 11,952 76,578 42,782 74,196 74,754 75,329 75,922 Other financial liabilities, current AUD'000 230 123 137 943 943 943 943 943 943 Lease Obligations, current AUD'000 3,676 2,123 3,085 3,071 1,962 2,671 3,121 3,692 - Contract and other liabilities AUD'000 5,000 5,487 5,314 7,684 7,684 7,684 7,684 7,684 7,684 Interest bearing loans and borrowings AUD'000 2,864 3,060 1,350 822 - - - - - Provisions AUD'000 8,525 7,950 9,600 11,027 11,027 11,027 11,027 11,027 11,027 Total current liabilities AUD'000 44,318 29,357 31,438 100,125 64,399 96,521 97,529 98,675 95,576 Total liabilities AUD'000 123,866 99,568 160,026 577,082 444,436 463,838 452,177 440,561 428,844 Total equity and liabilities AUD'000 260,821 247,251 312,248 1,132,997 1,162,444 1,205,728 1,221,499 1,237,945 1,254,975

- 25. C A P I T A L SeaLink Operating Model (Cash Flow Statement) Cash Flow Statement 2016 A 2017 A 2018 A 2019 A 2020E 2021E 2022E 2023E 2024E Cash flows from operating activities Profit before tax AUD'000 31,972 34,317 27,547 24,950 50,072 82,180 93,990 96,114 98,286 Adjustments for: Depreciation of plant and equipment AUD'000 10,447 13,549 14,418 18,713 6,404 11,107 11,190 11,276 11,365 Amortisation of intangible assets AUD'000 965 1,560 1,560 1,944 12,808 22,213 22,380 22,553 22,730 Interest income AUD'000 (203) (43) (27) (38) (60) (376) (341) (398) (459) Interest expense AUD'000 2,470 3,239 3,070 4,582 9,314 6,373 6,013 5,646 5,281 (Gain)/Loss from sale of assets AUD'000 - - - 1,637 - - - - - (Gain)/Loss on sale of investments AUD'000 - - (100) - - - - - Other operating activities AUD'000 (952) (3,320) (932) - - - - - Operating cash flows before changes in working capital AUD'000 44,699 49,302 45,536 51,788 78,539 121,497 133,233 135,192 137,202 Trade and other receivables AUD'000 (939) 4,641 (694) (83,351) 41,641 (38,706) (688) (709) (730) Prepayments AUD'000 (100) (148) (42) (2,263) 1,881 (1,749) (31) (32) (33) Inventories AUD'000 (237) (249) (1,335) (10,183) 6,585 (6,121) (109) (112) (115) Trade and other payables AUD'000 (562) (1,165) 3,358 64,626 (33,796) 31,414 558 575 593 Net cash flows from operations AUD'000 41,217 50,737 45,265 20,617 94,851 106,335 132,963 134,914 136,916 Income taxes paid AUD'000 (8,158) (23,485) (15,127) (3,539) (13,808) (22,696) (25,975) (26,579) (27,198) Net cash flows from operating activities AUD'000 33,059 27,252 30,138 17,078 81,042 83,639 106,989 108,335 109,718 Cash flows from investing activities Acquisition of subsidiaries (net of cash acquired) AUD'000 (115,273) - (44,728) - - - - - - Proceeds from disposal of plant and equipment AUD'000 26 389 659 12,605 - - - - - Purchase of plant and equipment AUD'000 (6,855) (6,467) (13,654) (17,645) (40,000) (40,000) (40,000) (40,000) (40,000) Investment in unlisted entity AUD'000 - - (3,274) - - - - - - Net cash flows used in investing activities AUD'000 (122,102) (6,078) (60,997) (5,040) (40,000) (40,000) (40,000) (40,000) (40,000) Cash flows from financing activities Proceeds from issue of shares AUD'000 50,299 - - 147,587 - - - - Dividends paid to equity owners AUD'000 (7,624) (13,654) (14,667) (14,685) (21,758) (35,690) (40,809) (41,721) (42,653) New borrowings AUD'000 50,280 (8,244) 47,405 (12,758) (95,779) (10,050) (9,548) (9,070) (8,617) Finance Lease Repayment AUD'000 (2,397) (2,397) (2,123) (3,085) (3,071) (1,962) (2,671) (3,121) (3,692) Other financing activities AUD'000 (4,810) (3,004) (2,542) (2,097) (1,607) Net cash flows (used in) from financing activities AUD'000 90,558 (24,295) 30,615 (30,528) 22,169 (50,707) (55,570) (56,009) (56,568) Net increase (decrease) in cash and cash equivalents AUD'000 1,515 (3,121) (244) (18,491) 63,211 (7,068) 11,418 12,326 13,150 Cash and cash equivalents, statement of cash flows, beginning balance AUD'000 9,884 11,399 8,277 8,033 12,000 75,211 68,143 79,561 91,887 Cash and cash equivalents, statement of cash flows, ending balance AUD'000 11,399 8,277 8,033 12,000 75,211 68,143 79,561 91,887 105,037 Credit Revolver Minimum Cash Balance AUD'000 8,033 8,033 8,033 8,033 8,033 Surplus (Deficit) Cash before RCF AUD'000 67,178 60,110 71,528 83,854 97,004 Add: Revolving Credit Facility AUD'000 - - - - - Less: Principal Repayment AUD'000 - - - - - Ending Cash Balance after Credit Revolver Changes AUD'000 75,211 68,143 79,561 91,887 105,037

- 26. C A P I T A L Scenario Analysis: Base Case Base Case 2016 2017 2018 2019 2020 2021 2022 2023 2024 Revenue Assumptions SeaLink Sealink South Australia & Tasmania (SA) AUD'000 3.7% -4.8% 2.7% -30.0% 10.0% 4.1% 4.0% 3.9% Captain Cook Cruises, New South Wales & Western Australia (CCC) AUD'000 34.5% 8.2% -3.3% -30.0% 10.0% 4.8% 4.7% 4.6% Sealink Queensland & NT (QLD) AUD'000 11.6% -5.4% -0.8% -20.0% 10.0% 2.8% 2.8% 2.8% Sealink Fraser Island (Fraser Island) AUD'000 5.5% 5.8% -20.0% 10.0% 5.0% 5.0% 5.0% Transit Systems Contracted Revenue AUD'000 624,000 642,000 895,000 451,330 902,660 902,660 902,660 902,660 Australia (excl. R6 & Sita Group) AUD'000 267,000 287,000 358,000 465,580 465,580 465,580 465,580 465,580 Region 6 AUD'000 - - 185,000 181,076 181,076 181,076 181,076 181,076 Sita Group AUD'000 41,000 44,000 44,000 38,356 38,356 38,356 38,356 38,356 Singapore AUD'000 121,000 127,000 137,000 125,772 125,772 125,772 125,772 125,772 UK AUD'000 195,000 184,000 171,000 91,876 91,876 91,876 91,876 91,876 Tender pipeline Australia AUD'000 240,000 200,000 950,000 Singapore AUD'000 200,000 US AUD'000 129,000 418,000 119,000 UK AUD'000 205,000 New Contracted Revenue from tender pipeline AUD'000 - - - - Australia AUD'000 - - - - Singapore AUD'000 - - - - US AUD'000 - - - - UK AUD'000 - - - - Total Revenue Transit Systems AUD'000 451,330 902,660 902,660 902,660 902,660 EBITDA Assumptions SeaLink EBITDA Margin SA AUD'000 24.5% 26.8% 28.7% 26.3% 26.3% 26.3% 26.3% 26.3% 26.3% CCC AUD'000 9.8% 11.4% 4.9% 1.1% 1.1% 1.1% 25.0% 25.0% 25.0% QLD AUD'000 34.8% 34.6% 36.5% 32.0% 32.0% 32.0% 32.0% 32.0% 32.0% KBR AUD'000 NM 10.6% 10.6% 10.6% 10.6% 10.6% 10.6% EBITDA SA AUD'000 15,929 18,107 18,453 17,358 12,150 13,366 13,914 14,470 15,034 CCC AUD'000 3,719 5,843 2,694 580 406 447 10,768 11,274 11,793 QLD AUD'000 25,858 28,702 28,613 24,922 19,938 21,931 22,545 23,177 23,826 KBR AUD'000 5,740 4,592 5,051 5,304 5,569 5,847 Transit Systems EBITDA Margin Australia % 10% 5% 10% 10% 10% 10% Region 6 % 4% 2% 4% 4% 4% 4% Australia (excl. R6) % 13% 6% 13% 13% 13% 13% Singapore & UK % 7% 5% 7% 7% 7% 7% US % 5% 5% 5% 5% 5% 5% EBITDA AUD'000 64,601 69,220 78,110 44,357 83,606 83,606 83,606 83,606 Australia (excl. R6 & Sita Group) AUD'000 38,381 43,050 44,750 27,935 58,198 58,198 58,198 58,198 Region 6 AUD'000 - - 7,400 3,622 6,338 6,338 6,338 6,338 Sita Group AUD'000 4,100 4,400 4,400 1,918 3,836 3,836 3,836 3,836 Singapore AUD'000 8,470 8,890 9,590 6,289 8,804 8,804 8,804 8,804 UK AUD'000 13,650 12,880 11,970 4,594 6,431 6,431 6,431 6,431 US AUD'000 - - - -

- 27. C A P I T A L Scenario Analysis: Bull Case Bull Case 2016 2017 2018 2019 2020 2021 2022 2023 2024 Revenue Assumptions SeaLink Sealink South Australia & Tasmania (SA) AUD'000 3.7% -4.8% 2.7% -30.0% 20.0% 6.1% 6.0% 4.0% Captain Cook Cruises, New South Wales & Western Australia AUD'000 34.5% 8.2% -3.3% -30.0% 20.0% 6.8% 6.7% 6.6% Sealink Queensland & NT AUD'000 11.6% -5.4% -0.8% -20.0% 10.0% 4.8% 4.8% 4.8% Sealink Fraser Island (Fraser Island) AUD'000 5.5% 5.8% -20.0% 10.0% 7.0% 7.0% 7.0% Transit Systems Contracted Revenue AUD'000 624,000 642,000 895,000 451,330 902,660 902,660 902,660 902,660 Australia (excl. R6 & Sita Group) AUD'000 267,000 287,000 358,000 465,580 465,580 465,580 465,580 465,580 Region 6 AUD'000 - - 185,000 181,076 181,076 181,076 181,076 181,076 Sita Group AUD'000 41,000 44,000 44,000 38,356 38,356 38,356 38,356 38,356 Singapore AUD'000 121,000 127,000 137,000 125,772 125,772 125,772 125,772 125,772 UK AUD'000 195,000 184,000 171,000 91,876 91,876 91,876 91,876 91,876 Tender pipeline Australia AUD'000 240,000 200,000 950,000 Singapore AUD'000 200,000 US AUD'000 129,000 418,000 119,000 UK AUD'000 205,000 New Contracted Revenue from tender pipeline AUD'000 - - - - Australia AUD'000 Singapore AUD'000 US AUD'000 UK AUD'000 Total Revenue Transit Systems AUD'000 451,330 902,660 902,660 902,660 902,660 EBITDA Assumptions SeaLink EBITDA Margin SA AUD'000 24.5% 26.8% 28.7% 27.6% 26.3% 26.3% 26.3% 26.3% 26.3% CCC AUD'000 9.8% 11.4% 4.9% 2.4% 1.1% 1.1% 25.0% 25.0% 25.0% QLD AUD'000 34.8% 34.6% 36.5% 33.4% 32.0% 32.0% 32.0% 32.0% 32.0% KBR AUD'000 NM 11.9% 10.6% 10.6% 10.6% 10.6% 10.6% EBITDA SA AUD'000 15,929 18,106 18,453 18,238 12,150 13,366 13,914 14,470 15,034 CCC AUD'000 3,719 5,843 2,694 1,292 406 447 10,768 11,274 11,793 QLD AUD'000 25,858 28,702 28,613 25,960 19,938 21,931 22,545 23,177 23,826 KBR AUD'000 6,462 4,592 5,051 5,304 5,569 5,847 Transcript System EBITDA Margin Australia % 10% 5% 12% 12% 12% 12% Region 6 % 4% 2% 4% 4% 4% 4% Australia (excl. R6) % 13% 6% 15% 15% 15% 15% Singapore & UK % 7% 5% 7% 7% 7% 7% US % 5% 5% 5% 5% 5% 5% EBITDA AUD'000 64,601 69,220 78,110 44,357 96,918 96,918 96,918 96,918 Australia (excl. R6 & Sita Group) AUD'000 38,381 43,050 44,750 27,935 69,837 69,837 69,837 69,837 Region 6 AUD'000 - - 7,400 3,622 7,243 7,243 7,243 7,243 Sita Group AUD'000 4,100 4,400 4,400 1,918 4,603 4,603 4,603 4,603 Singapore AUD'000 8,470 8,890 9,590 6,289 8,804 8,804 8,804 8,804 UK AUD'000 13,650 12,880 11,970 4,594 6,431 6,431 6,431 6,431 US AUD'000 - - - -

- 28. C A P I T A L Scenario Analysis: Bear Case Bear Case 2016 2017 2018 2019 2020 2021 2022 2023 2024 Revenue Assumptions SeaLink Sealink South Australia & Tasmania (SA) AUD'000 3.7% -4.8% 2.7% -30.0% -10.0% 20.0% 4.0% 3.9% Captain Cook Cruises, New South Wales & Western Australia AUD'000 34.5% 8.2% -3.3% -30.0% -15.0% 25.0% 4.7% 4.6% Sealink Queensland & NT AUD'000 11.6% -5.4% -0.8% -20.0% -5.0% 10.0% 2.8% 2.8% Sealink Fraser Island (Fraser Island) AUD'000 5.5% 5.8% -20.0% -5.0% 10.0% 5.0% 5.0% Transit Systems Contracted Revenue AUD'000 624,000 642,000 895,000 451,330 867,874 849,499 723,727 723,727 Australia (excl. R6 & Sita Group) AUD'000 267,000 287,000 358,000 465,580 442,301 442,301 442,301 442,301 Region 6 AUD'000 - - 185,000 181,076 181,076 181,076 181,076 181,076 Sita Group AUD'000 41,000 44,000 44,000 38,356 26,849 26,849 26,849 26,849 Singapore AUD'000 121,000 127,000 137,000 125,772 125,772 125,772 - - UK AUD'000 195,000 184,000 171,000 91,876 91,876 73,501 73,501 73,501 Tender pipeline Australia AUD'000 240,000 200,000 950,000 Singapore AUD'000 200,000 US AUD'000 129,000 418,000 119,000 UK AUD'000 205,000 New Contracted Revenue from tender pipeline AUD'000 - - - - Australia AUD'000 - Singapore AUD'000 - - - - US AUD'000 - - - - UK AUD'000 - - - - Total Revenue Transit Systems AUD'000 451,330 867,874 849,499 723,727 723,727 EBITDA Assumptions SeaLink EBITDA Margin SA AUD'000 24.5% 26.8% 28.7% 27.6% 24.9% 24.9% 24.9% 24.9% 24.9% CCC AUD'000 9.8% 11.4% 4.9% 2.4% 2.2% 2.2% 2.2% 2.2% 2.2% QLD AUD'000 34.8% 34.6% 36.5% 33.4% 30.0% 30.0% 30.0% 30.0% 30.0% KBR AUD'000 NM 11.9% 10.7% 10.7% 10.7% 10.7% 10.7% EBITDA SA AUD'000 15,929 18,106 18,453 18,238 11,490 12,639 13,157 13,683 14,217 CCC AUD'000 3,719 5,843 2,694 1,292 814 896 939 983 1,028 QLD AUD'000 25,858 28,702 28,613 25,960 18,691 20,561 21,136 21,728 22,336 KBR AUD'000 6,462 4,652 5,118 5,373 5,642 5,924 Transport Transcript EBITDA Margin Australia % 10% 5% 9% 9% 9% 9% Region 6 % 4% 2% 2% 4% 4% 4% Australia (excl. R6) % 13% 6% 10% 10% 10% 10% Singapore & UK % 7% 5% 7% 7% 7% 7% US % 5% 5% 5% 5% 5% 5% EBITDA AUD'000 64,601 69,220 78,110 44,357 65,503 67,839 59,035 59,035 Australia (excl. R6 & Sita Group) AUD'000 38,381 43,050 44,750 27,935 44,230 44,230 44,230 44,230 Region 6 AUD'000 - - 7,400 3,622 3,622 7,243 7,243 7,243 Sita Group AUD'000 4,100 4,400 4,400 1,918 2,416 2,416 2,416 2,416 Singapore AUD'000 8,470 8,890 9,590 6,289 8,804 8,804 - - UK AUD'000 13,650 12,880 11,970 4,594 6,431 5,145 5,145 5,145 US AUD'000 - - - -

- 29. C A P I T A L SeaLink’s Global Contract Portfolio & Tender Pipeline Overview of Transit Systems Group's Global Contract Portfolio Route Location Country Contract first held Renewals % of pro forma FY19A revenue Contracted revenue p.a. (A$ m) Contract delivered (years) Remaining Government extension option (years) Midland (Perth) WA Australia Jan-96 üü 1.7% 15.2 24.0 5.0 Canning (Perth) WA Australia Sep-96 ü 4.2% 37.5 23.0 0.5 Southern River (Perth) WA Australia Sep-96 ü 2.1% 18.7 23.0 0.5 East West (Adelaide) SA Australia Apr-00 üü 7.6% 67.8 19.0 8.5 2.0 Claremont (Perth)4 WA Australia Sep-02 üüü 2.0% 17.8 18.0 10.5 Marmion (Perth)4 WA Australia May-11 ü 4.4% 39.2 8.0 10.5 DoE Special Schools VIC Australia Jun-11 0.3% 2.7 8.0 0.5 25 / N25 London United Kingdom Jun-13 ü 3.4% 30.3 6.0 0.5 23 / N23 London United Kingdom Jun-13 ü 1.6% 14.3 6.0 1.0 328 London United Kingdom Jun-13 ü 1.3% 11.6 6.0 2.0 28 / N28 London United Kingdom Jun-13 ü 1.2% 10.7 6.0 2.0 W15 London United Kingdom Jun-13 ü 1.1% 9.8 6.0 3.0 2.0 SMBSC Region 3 (Sydney) NSW Australia Oct-13 7.3% 65.1 5.5 2.5 1.0 Darwin NT Australia Oct-14 1.0% 8.9 5.0 2.0 Busselton WA Australia Jan-15 0.3% 2.7 5.0 5.0 Bunbury WA Australia Jan-15 0.5% 4.5 5.0 5.0 Bulim Singapore Singapore May-15 14.1% 125.8 4.5 2.0 Westbourne College VIC Australia Jun-16 0.2% 1.8 3.0 4.0 13 / N13 London United Kingdom Apr-17 1.7% 15.2 2.5 3.0 Albany WA Australia Jul-17 0.2% 1.8 2.0 8.0 NS & Outer NE (Adelaide) SA Australia Jul-18 ü 7.8% 69.6 1.0 8.5 2.0 SMBSC Region 6 (Sydney) NSW Australia Jul-18 20.3% 181.1 1.0 4.0 3.0 Public Transport Victoria VIC Australia Jul-18 3.8% 33.9 1.0 7.0 2.0 Outer North (Adelaide) SA Australia Mar-20 33.9 0.0 8.0 2.0 Joondalup (Perth) WA Australia Nov-19 82.9 0.0 10 Tender Pipeline (A$ million) Contract Location Start date Approx. revenue p.a. (A$ million) Contract 1 NSW, Australia 2022 500 Contract 2 VIC, Australia 2020 240 Contract 3 London, UK 2020-21 205 Contract 4 NSW, Australia 2021 200 Contract 5 Las Vegas, US 2021 162 Contract 6 NSW, Australia 2022 150 Contract 7 NSW, Australia 2022 150 Contract 8 NSW, Australia 2022 150 Contract 9 Denver, US 2021 148 Contract 10 Phoenix, US 2020 129 Contract 11 Tempe / Phoenix, US 2023 119 Contract 12 West Covina, US 2021 108 Contract 13 Singapore 2021 100 Contract 14 Singapore 2021 100 Total 2,461 Other Australia 705 Other rest of world 395 Tender Pipeline (A$ million) 3,561