Turbine Manufacturer M&A paper Offshore 2015

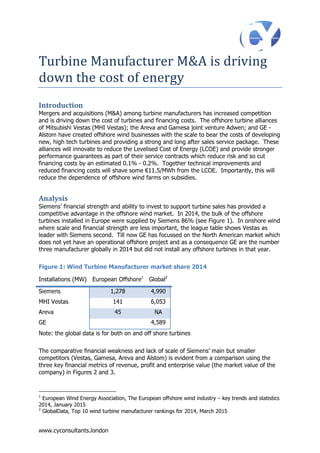

- 1. www.cyconsultants.london Turbine Manufacturer M&A is driving down the cost of energy Introduction Mergers and acquisitions (M&A) among turbine manufacturers has increased competition and is driving down the cost of turbines and financing costs. The offshore turbine alliances of Mitsubishi Vestas (MHI Vestas); the Areva and Gamesa joint venture Adwen; and GE - Alstom have created offshore wind businesses with the scale to bear the costs of developing new, high tech turbines and providing a strong and long after sales service package. These alliances will innovate to reduce the Levelised Cost of Energy (LCOE) and provide stronger performance guarantees as part of their service contracts which reduce risk and so cut financing costs by an estimated 0.1% - 0.2%. Together technical improvements and reduced financing costs will shave some €11.5/MWh from the LCOE. Importantly, this will reduce the dependence of offshore wind farms on subsidies. Analysis Siemens’ financial strength and ability to invest to support turbine sales has provided a competitive advantage in the offshore wind market. In 2014, the bulk of the offshore turbines installed in Europe were supplied by Siemens 86% (see Figure 1). In onshore wind where scale and financial strength are less important, the league table shows Vestas as leader with Siemens second. Till now GE has focussed on the North American market which does not yet have an operational offshore project and as a consequence GE are the number three manufacturer globally in 2014 but did not install any offshore turbines in that year. Figure 1: Wind Turbine Manufacturer market share 2014 Installations (MW) European Offshore1 Global2 Siemens 1,278 4,990 MHI Vestas 141 6,053 Areva 45 NA GE 4,589 Note: the global data is for both on and off shore turbines The comparative financial weakness and lack of scale of Siemens’ main but smaller competitors (Vestas, Gamesa, Areva and Alstom) is evident from a comparison using the three key financial metrics of revenue, profit and enterprise value (the market value of the company) in Figures 2 and 3. 1 European Wind Energy Association, The European offshore wind industry – key trends and statistics 2014, January 2015 2 GlobalData, Top 10 wind turbine manufacturer rankings for 2014, March 2015

- 2. Turbine Manufacturer M&A is driving down the cost of energy © CmY Consultants 2015 All rights reserved. cm.yates@ntlworld.com 2 Figure 2: Key financial metrics for Turbine Manufacturers The huge gulf in financial size and strength between what I have labelled the “Giants” (GE and Siemens) and the “Minnows” (Mitsubishis, Alstom, Vestas, Gamesa and Areva) is clear from Figure 2. This matters in the offshore wind market as project developers value turbine manufacturers who the developers are confident will be around in the long-term to maintain their equipment. Figure 3: Key financial metric for turbine manufacturers €m Revenue Profit Enterprise value General Electric 105,960 9,473 436,596 Siemens AG 82,290 5,690 103,960 Mitsubishi Heavy Industries Ltd 22,760 929 18,117 Alstom SA 20,620 480 13,170 Areva SA 8,620 -617 8,210 Vestas wind systems 6,084 -82 6,528 Gamesa S.A. 2,620 80 3,080 Notes: Latest available data for each company as a whole The competitive weakness of the Minnows and their small share in the rapidly growing market for offshore wind turbines (the top end of the wind turbine product range) was reflected in their share price, for example Vestas’ share price fell 93% from April 2010 to November 2012 (see Figure 5). The estimated compound annual growth rate from 2010 to

- 3. Turbine Manufacturer M&A is driving down the cost of energy © CmY Consultants 2015 All rights reserved. cm.yates@ntlworld.com 3 2020 of installed offshore wind capacity is over 20% pa in Europe and 45% pa in the Rest of the World (see Figure 4).3 Figure 4: Rapidly growing offshore wind capacity In 2011, 2012 and the first part of 2013, the share price of all of the Minnows fell while the share price of the Giants changed little (see Figure 5). However, in the middle of 2013 investors recognised that the Minnows were using alliances to boost their competitive position and profitability. As a result the share price of the Minnows started to rise, although they did not catch up with the Giants. 3 Based upon analysis of forecasts produced by Renewables UK, the European Wind Energy Association and the International Energy Association

- 4. Turbine Manufacturer M&A is driving down the cost of energy © CmY Consultants 2015 All rights reserved. cm.yates@ntlworld.com 4 Figure 5: Share prices of the wind turbine manufacturers Forming strategic alliances The Minnows led by Vestas have successfully formed alliances as a strategy to improve their competitiveness. Other important components of this strategy include innovating and driving down the cost of energy. The principal innovations were selling larger, more cost effective turbines; and offering long-term operations and maintenance (O&M) with performance guarantees which created a new profitable business stream and took risk from wind farm investors. The turbine manufacturers are driving down the LCOE with longer blades which increase energy capture, while reducing operational and maintenance costs by enabling customers to run fewer turbines, with fewer service visits. The largest operational turbines are Siemens’ SWT-7.0 154 and the MHI Vestas V164-8.0 MW, one of which is capable of supplying electricity for 7,500 European households. The SWT-7.0 154 is Siemen’s response to Vesta’s 8MW turbine and a number of manufacturers are working on 10MW turbines which will further drive down the LCOE. Another important step forward for the industry and turbine manufacturers is to provide stronger performance guarantees similar to those available with types of generation. Siemens, GE and Alstom provide long and credible performance guarantees for their gas turbines which drive sales. For example, in 2013 GE signed a service agreement as part of a deal to provide more than 300MW of gas turbines. This 13-year agreement includes power output efficiency, reliability and performance guarantees. The availability of long, strong performance guarantees is a sign of the maturity of the gas turbine market and the wind turbine market is heading in this direction. Industry consolidation allows manufacturers to offer stronger performance guarantees and so reduce risk for investors. This strengthens the industry as manufacturers have the knowledge and the reputational incentive to maintain their products, and for financially strong manufacturers, their long-term guarantees are credit worthy. The €2bn of debt for the Project Gemini offshore wind farm was catalysed by a contract structure which included Siemens signing a 15-year project service and maintenance agreement. This managed risk efficiently with the minimum of interfaces and Siemens’ equity in the project aligned the interests of all parties. This structure is a template for other offshore projects and for long- term turbine support.

- 5. Turbine Manufacturer M&A is driving down the cost of energy © CmY Consultants 2015 All rights reserved. cm.yates@ntlworld.com 5 Impact on the LCOE The analysis of the impact of the turbine manufacturer M&A on the LCOE is based upon the effect on the size of turbines; the strength and length of turbine service contracts available and finally the impact of both factors on the LCOE. The steps in the analysis are set out below. 1. Larger turbines with longer blades deliver economies of scale in construction, installation and O&M. Longer blades increase the Average Energy Production for a turbine by sweeping a larger area. These factors combine and result in a lower LCOE. DTU Orbit estimate that the LCOE for a 5MW offshore turbine is €107/MWh and for an innovative 10 MW turbine it is €85/MWh.4 This is equivalent to a €4.5/MWh LCOE reduction for each increase of 1MW in turbine size. When MHI Vestas introduced the V164-8.0 MW it was 2MW bigger than its largest competitor and had blades 10 metres longer, which I estimate reduced the LCOE by around €10/MWh 2. Competition has also driven longer and stronger service contracts which reduce investor risk and hence the cost of capital required by investors. In the language of the credit rating agencies this is estimated to reduce investor risk by one notch (e.g. increasing the credit rating of a bond from BBB to BBB+). Such a reduction in risk, increase in credit rating, would reduce the interest rate on a 10 year infrastructure bond by some 0.1% to 0.2%. 3. The Crown Estate has estimated that a drop of one percent in the Weighted Average Cost of Capital (WACC) is equivalent to a reduction in LCOE of around 6%.5 Thus a reduction in the WACC of 0.1% to 0.2% would cut the LCOE by 0.6% to 1.2% which is equivalent to some €1.5/MWh 4. Adding together both these saving in give a total reduction in the LCOE of €11.5/MWh Conclusions The conclusions based on this analysis are: • Alliances have resulted in a more competitive market with four or more strong groups able to invest, innovate and provide long-term product support • Innovation and particularly developing large turbines has driven down the LCOE by an estimated €10/MWh • Turbine manufacturers are providing more O&M with performance guarantees as an important sales tool as well as a growing source of income and profits • Credible, long-term performance guarantees gives financial investors comfort, reduce the cost of capital and so cut the LCOE by an estimated €1.5/MWh • Together these reductions in LCOE are an estimated saving of €11.5/MWh or 8% • These changes strengthen the whole industry and are an important contribution towards driving down the LCOE and making offshore wind more competitive with other types of electricity generation 4 DTU Orbit, Key Performance Indicators and Target Values for Multi Megawatt Offshore Turbines, May 2014 5 The Crown Estate, Offshore wind cost reduction pathway studies, May2012

- 6. Turbine Manufacturer M&A is driving down the cost of energy © CmY Consultants 2015 All rights reserved. cm.yates@ntlworld.com 6 • Cutting the LCOE also makes the industry more secure as it is less dependent upon high levels of subsidy which are at the mercy of political whims Charles Yates, March 2015