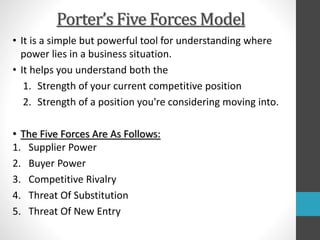

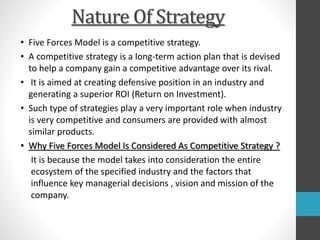

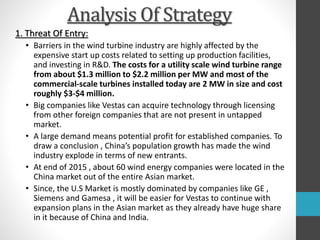

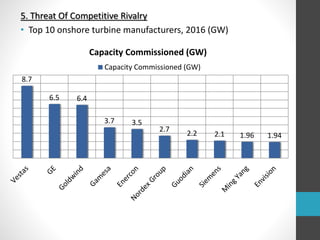

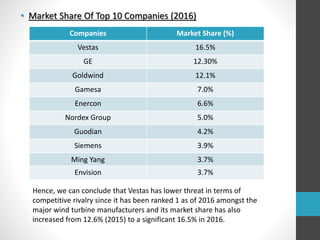

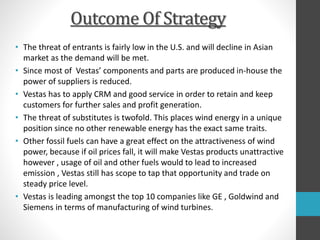

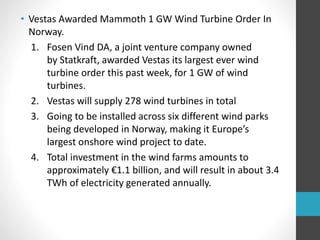

Vestas is a leading Danish manufacturer of wind turbines, founded in 1945, and is currently the largest wind turbine company globally, operating in multiple countries and employing over 21,000 people. The company focuses on delivering top-tier energy solutions while navigating competitive dynamics through strategies outlined in Porter's Five Forces model, emphasizing supplier relations and customer satisfaction. Recently, Vestas has reorganized its Asia-Pacific operations to enhance market understanding and secured a significant 1 GW wind turbine order in Norway, bolstering its position in the renewable energy sector.