Fin404 Portfolio Project Analysis

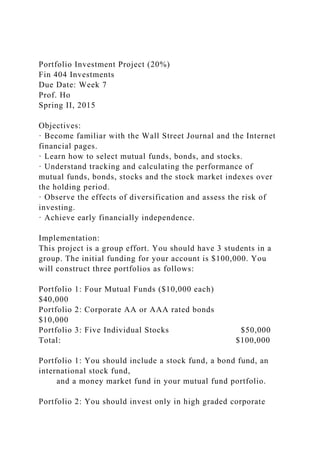

- 1. Portfolio Investment Project (20%) Fin 404 Investments Due Date: Week 7 Prof. Ho Spring II, 2015 Objectives: · Become familiar with the Wall Street Journal and the Internet financial pages. · Learn how to select mutual funds, bonds, and stocks. · Understand tracking and calculating the performance of mutual funds, bonds, stocks and the stock market indexes over the holding period. · Observe the effects of diversification and assess the risk of investing. · Achieve early financially independence. Implementation: This project is a group effort. You should have 3 students in a group. The initial funding for your account is $100,000. You will construct three portfolios as follows: Portfolio 1: Four Mutual Funds ($10,000 each) $40,000 Portfolio 2: Corporate AA or AAA rated bonds $10,000 Portfolio 3: Five Individual Stocks $50,000 Total: $100,000 Portfolio 1: You should include a stock fund, a bond fund, an international stock fund, and a money market fund in your mutual fund portfolio. Portfolio 2: You should invest only in high graded corporate

- 2. bonds. Do not choose high yield (junk) bonds. Portfolio 3: There is no requirement for equal dollar amount investment or number of shares in your stock portfolio. Go to yahoo.com, click finance, and click my portfolio to create your own portfolios. You can also use Excel Spread Sheets to track stock prices daily and performance of each portfolio weekly. Purposes: · Investing in mutual funds will allow you to compare the volatility and performance of your own portfolios to a professionally managed selection of securities. · The purchase of corporate bonds will show the effects of interest rates. · The purchase of individual stocks will help you understand the risk and reward of investing in the stock market, and the portfolio development will help you understand the benefits of diversification. Assumptions · The price of each stock is determined at the close of each trading day as reported in the Wall Street Journal. · Fractional shares may be purchased. · Taxes do not apply.

- 3. · Individual stocks may be bought and sold during holding period. · There are no transaction costs. Requirements · The time horizon of your investment project is from _________to ___________ (cover at least 4 weeks) · Track the price per share of individual stocks and determine the value of your portfolio each Friday (end of closing day). · Liquidate all three portfolios at the end of Week Four. · Calculate annual holding period return and annual holding period yield (see textbook/PPT slides for formulae) Written Analysis See next page (Table of Contents) for the required sections of your paper. You can include more sections if you like. Please go to www.apa.org for paper format. First Page: Include the title, team members, and Mercer University. Second page: Table of Contents. References: Have at least 5 references. Appendixes: Place data sheets, graphs, and tables at the end of

- 4. your paper. Table of Contents · Executive Summary II. Statement of Purpose III. Estimate of the Economic Factors Which Form the Environment for the Selection Of Your Portfolios. VI. Methods of Your Investment Selections · Comment briefly on each mutual fund, each bond and each stock in your portfolios. At a minimum, your comments should include: ` 1. Mutual Funds Types of funds, returns, types of risk and outlook, etc. 2. Bonds Types of bonds, returns, risk, and ratings, etc. 3. Stocks Types of stocks, returns, dividends, earnings, P/E, risk, and

- 5. outlook · Consideration of diversification and discussion of correlations. C. Apply investment models. (see chapters 7 and 8) C. Other factors, if any. · Weekly performance of your mutual fund portfolio relative to the bench marks. · Briefly discuss the volatility and performance · Draw graphs to support your narrative analysis. VI. Weekly performance of your bond portfolio relative to the bond market. · Briefly discuss the volatility and performance. · Draw graphs to support your narrative analysis. VII. Weekly performance of each of your five single stock investment relative to the stock market. · Briefly discuss the volatility and performance. · Draw graphs to support your narrative analysis. VIII. Lessons learned for “next time”. References (At least 5 sources) Appendixes (data sheets, graphs, and tables, etc.) FIN404 Portfolio Investment Project

- 6. Prof. Ho Spring II, 2015 Team # _______ StudentEmail Phone Number 1. _____________________________________________________ ________________ 2.___________________________________________________ ____________________ 3.___________________________________________________ ____________________ Please submit this page no later than week 2. Sheet1Portfolio 3: Five Individual StocksStock name:1-NIKE inc(NKE)Current price:99.5510-Yrstotal returnsHistory (03/31/2015)2005200620072008200920102011201220132014N KE-3.1315.631.7- 19.1531.5530.9814.338.6454.0923.54Footwear & Accessories- 3.0820.421.46-30.0538.8842.2210.169.750.5318.53S&P 500 TR USD4.9115.795.49-3726.4610-yrs dividend historyEx/Eff DateTypeCash AmountDeclaration DateRecord DatePayment Date2/26/15Cash0.282/12/153/2/154/6/1512/11/14Cash0.2811/2 0/1412/15/141/5/158/28/14Cash0.248/11/149/2/1410/6/145/29/1

- 7. 4Cash0.245/12/146/2/147/7/142/27/14Cash0.242/13/143/3/144/7 /1412/12/13Cash0.2411/21/1312/16/131/6/148/29/13Cash0.218/ 12/139/3/1310/7/135/30/13Cash0.215/13/136/3/137/1/132/28/13 Cash0.212/14/133/4/134/1/1312/6/12Cash0.4211/16/1212/10/12 12/26/128/30/12Cash0.368/13/129/4/1210/1/125/31/12Cash0.36 5/14/126/4/127/2/123/1/12Cash0.362/16/123/5/124/2/1212/1/11 Cash0.3611/17/1112/5/111/3/129/1/11Cash0.318/15/119/6/1110/ 3/116/2/11Cash0.315/16/116/6/117/1/113/3/11Cash0.312/17/113 /7/114/1/1112/2/10Cash0.3111/18/1012/6/1012/30/109/2/10Cash 0.278/16/109/7/1010/1/106/3/10Cash0.275/17/106/7/107/1/103/ 4/10Cash0.272/11/103/8/104/1/1012/3/09Cash0.2711/19/0912/7/ 091/4/109/3/09Cash0.258/10/099/8/0910/1/096/4/09Cash0.255/1 2/096/8/097/1/093/5/09Cash0.252/13/093/9/094/1/0912/4/08Cas h0.2511/20/0812/8/081/5/099/4/08Cash0.238/11/089/8/0810/1/0 86/5/08Cash0.235/12/086/9/087/1/083/6/08Cash0.232/14/083/10 /084/1/0812/6/07Cash0.2311/16/0712/10/071/2/089/6/07Cash0.1 858/13/079/10/0710/1/076/7/07Cash0.1855/14/076/11/077/2/073 /8/07Cash0.372/14/073/12/074/2/0712/7/06Cash0.3711/17/0612/ 11/061/2/079/7/06Cash0.318/14/069/11/0610/2/066/8/06Cash0.3 15/15/066/12/067/3/063/9/06Cash0.312/21/063/13/064/3/0612/8 /05Cash0.3111/18/0512/12/051/3/069/8/05Cash0.258/15/059/12/ 0510/3/056/9/05Cash0.255/16/056/13/057/5/053/10/05Cash0.25 Read more: http://www.nasdaq.com/symbol/nke/dividend- history#ixzz3WIiJyi2fProfitabilityProfitability2005-052006- 052007-052008-052009-052010-052011-052012-052013- 052014-05Tax Rate %34.853532.224.7524.0124.242525.4824.6924.01Net Margin %8.829.319.1410.117.7510.0310.229.219.829.69Asset Turnover (Average)1.651.61.591.611.491.371.421.581.531.54Return on Assets %14.5214.9214.5116.2811.5713.7814.514.5915.0414.89Financi al Leverage (Average)1.561.571.521.591.521.481.521.491.581.72Return on Equity %23.2423.3422.4125.361820.6721.7721.9823.0824.5Return on Invested Capital

- 8. %20.220.7720.4924.2216.5619.2120.4920.921.3221.77Interest Coverage————Growth2005-052006-052007-052008-052009- 052010-052011-052012-052013-052014-05Latest QtrRevenue %Year over Year12.138.849.1714.092.95- 0.859.7215.664.919.8214.763-Year Average11.5711.8210.0410.688.645.213.857.9610.0110.04—5- Year Average8.849.5310.5411.739.376.716.888.136.337.71— 10-Year Average11.188.745.926.918.137.778.29.3398.54— Operating Income %Year over Year22.211.381.0714.16- 23.6333.1213.787.997.0413.0920.463-Year Average21.0419.1911.228.72-4.135.094.9717.829.579.34—5- Year Average13.9715.7714.8314.333.75.495.947.365.9814.64— 10-Year Average10.698.024.4510.918.059.6510.7511.0310.089.03—Net Income %Year over Year28.1314.897.1526.28- 21.0628.2511.874.2211.798.37—3-Year Average22.2443.216.4115.842.228.534.2414.359.238.08—5- Year Average15.9118.7417.5931.779.479.498.918.315.712.62— 10-Year Average11.739.676.4816.7712.6612.6613.7212.8618.0211.03— EPS %Year over Year27.6417.8610.9827.65- 18.9827.3913.737.7414.599.5925.423-Year Average22.4543.9518.6318.634.79.625.491611.9810.6—5-Year Average16.719.5719.1533.4111.5411.510.7110.057.714.41—10- Year Average12.6610.858.1418.67Cash flowCash Flow Ratios2005-052006-052007-052008-052009-052010-052011- 052012-052013-052014-05Operating Cash Flow Growth % YOY3.726.1912.643.07-10.3482.26-42.734.859.4-0.79Free Cash Flow Growth % YOY1.011.5717.31-4.99-13.9120.95-51.22- 5.6583.64-11.21Cap Ex as a % of Sales1.872.231.922.412.381.762.072.472.513.17Free Cash Flow/Sales %9.568.929.597.986.6814.886.615.49.457.64Free Cash Flow/Net Income1.080.961.050.79Financial healthBalance Sheet Items (in %)2005-052006-052007-052008-052009- 052010-052011-052012-052013-052014-05Latest QtrCash & Short-Term

- 9. Investments20.7523.3326.6422.3126.0835.6930.2624.2933.9227 .6524.59Accounts Receivable25.7224.2823.3422.4721.7718.3820.9221.2117.7318. 4718.04Inventory20.621.0419.8519.617.7914.1518.121.6619.53 21.2321.65Other Current Assets5.155.915.736.677.837.796.047.46.316.318.94Total Current Assets72.2274.5675.5671.0473.477675.3274.5677.4973.6673.21 Net PP&E18.2616.815.715.214.7813.414.114.7413.9415.2415.27Int angibles6.165.435.069.584.994.544.614.762.922.222.15Other Long-Term Assets3.363.213.684.186.776.065.965.945.658.889.37Total Assets100100100100100100100100100100100Accounts Payable9.69.659.7310.357.798.79.7910.279.3610.3810.82Short- Term Debt0.863.031.231.482.831.012.581.021.010.941.06Taxes Payable————0.650.410.781.591.653.421.48Accrued Liabilities11.1913.0412.1914.1613.4612.313.2410.78.9410.7210 .85Other Short-Term Liabilities1.080.871.020.71—0.91— 1.421.361.581.55Total Current Liabilities22.7326.5824.1826.6924.7323.3326.3924.9922.3327.0 425.76Long-Term Debt7.824.163.843.553.33.091.841.476.886.455.66Other Long- Term Liabilities5.265.586.266.876.365.936.146.417.358.37.54Total Liabilities35.8136.3234.2737.1134.3932.3634.3732.8736.5641.7 938.96Total Stockholders' Equity64.1963.6865.7362.8965.6167.6465.6367.1363.4458.2161 .04Total Liabilities & Equity100100100100100100100100100100100Liquidity/Financi al Health2005-052006-052007-052008-052009-052010-052011- 052012-052013-052014-05Latest QtrCurrent Ratio3.182.813.132.662.973.262.852.983.472.722.84Quick Ratio2.041.792.071.681.932.321.941.822.311.711.65Financial Leverage1.561.571.521.591.521.481.521.491.581.721.64Debt/E quity0.120.070.060.060.050.050.030.020.110.110.09Efficiency

- 10. RatiosEfficiency2005-052006-052007-052008-052009-052010- 052011-052012-052013-052014-05Days Sales Outstanding58.2156.8454.6751.8354.0553.1150.6348.5446.1243 .01Days Inventory82.4584.7983.681.2882.7878.5876.4481.0586.7187.74 Payables Period38.4839.1739.6741.4940.0440.8543.7840.8541.3342.51C ash Conversion Cycle102.18102.4698.691.6296.7990.8483.388.7491.4988.24Re ceivables Turnover6.276.426.687.046.756.877.217.527.918.49Inventory Turnover4.434.34.374.494.414.644.774.54.214.16Fixed Assets Turnover8.619.169.7910.449.969.7810.3110.9810.710.52Asset Turnover1.651.61.591.61Betas: 1.1P/E ratios: 28.18PEG. 1.7S&P 500 indexHistory (03/31/2015)2005200620072008200920102011201220132014S &P 500 TR USD4.9115.795.49-3726.4615.062.111632.3913.69 S&P 500 P/E. 18.6risk Free Rateshare outstanding863,938,522 ———— Sheet2Stock name. Microsoft corpMSFTCurrent price40.7210yrs total returnHistory (03/31/2015)2005200620072008200920102011201220132014M SFT-0.9415.620.6-44.159.47-6.63-4.556.0943.6927.24Software - Infrastructure-2.7918.2122.18-40.1853.8312.09- 9.0614.527.820.1S&P 500 TR USD4.9115.795.49- 3726.4615.062.111632.3913.69+/- Software - Infrastructure1.86-2.61-1.58-3.9310-yrs dividend historyEx/Eff DateTypeCash AmountDeclaration DateRecord DatePayment Date5/19/15Cash0.313/10/155/21/156/11/152/17/15Cash0.3112/ 3/142/19/153/12/1511/18/14Cash0.319/16/1411/20/1412/11/148/ 19/14Cash0.286/10/148/21/149/11/145/13/14Cash0.283/11/145/ 15/146/12/142/18/14Cash0.2811/19/132/20/143/13/1411/19/13C ash0.289/16/1311/21/1312/12/138/13/13Cash0.236/12/138/15/1 39/12/135/14/13Cash0.233/11/135/16/136/13/132/19/13Cash0.2 311/28/122/21/133/14/1311/13/12Cash0.239/18/1211/15/1212/1 3/128/14/12Cash0.26/13/128/16/129/13/125/15/12Cash0.23/13/1

- 11. 25/17/126/14/122/14/12Cash0.212/14/112/16/123/8/1211/15/11 Cash0.29/20/1111/17/1112/8/118/16/11Cash0.166/15/118/18/11 9/8/115/17/11Cash0.163/14/115/19/116/9/112/15/11Cash0.1612/ 15/102/17/113/10/1111/16/10Cash0.169/21/1011/18/1012/9/108/ 17/10Cash0.136/16/108/19/109/9/105/18/10Cash0.133/8/105/20/ 106/10/102/16/10Cash0.1312/9/092/18/103/11/1011/17/09Cash0 .139/18/0911/19/0912/10/098/18/09Cash0.136/10/098/20/099/10 /095/19/09Cash0.133/9/095/21/096/18/092/17/09Cash0.1312/10/ 082/19/093/12/0911/18/08Cash0.139/19/0811/20/0812/11/088/1 9/08Cash0.116/11/088/21/089/11/085/13/08Cash0.113/17/085/1 5/086/12/082/19/08Cash0.1112/19/072/21/083/13/0811/13/07Ca sh0.11-- 11/15/0712/13/078/14/07Cash0.16/27/078/16/079/13/075/15/07 Cash0.13/26/075/17/076/14/072/13/07Cash0.112/20/062/15/073/ 8/0711/14/06Cash0.19/13/0611/16/0612/14/068/15/06Cash0.096 /21/068/17/069/14/065/15/06Cash0.09-- 5/17/066/8/062/15/06Cash0.0912/14/052/17/063/9/0611/15/05C ash0.089/22/0511/17/0512/8/058/15/05Cash0.08-- 8/17/059/8/055/16/05Cash0.08--5/18/056/9/052/15/05Cash0.08- -2/17/053/10/05Read more: http://www.nasdaq.com/symbol/msft/dividend- history#ixzz3WM65D1SrProfitabilityProfitability2005-062006- 062007-062008-062009-062010-062011-062012-062013- 062014-06Tax Rate %26.3131.0130.0325.7526.52517.5323.7519.1820.65Net Margin %30.828.4527.5129.2624.9330.0233.123.0328.0825.42Asset Turnover (Average)0.490.630.770.890.780.760.720.640.590.55Return on Assets %15.0217.9521.1926.0119.3422.8823.7714.7716.5814.02Financ ial Leverage (Average)1.471.742.032.011.971.861.91.831.81.92Return on Equity %19.9328.5639.5152.4838.4243.7644.8427.5130.0926.17Return on Invested Capital %19.9328.5639.5152.4833.3638.7538.6323.4425.721.79Interest

- 12. Coverage————Growth2005-062006-062007-062008-062009- 062010-062011-062012-062013-062014-06Latest QtrRevenue %Year over Year8.0211.2915.4518.19- 3.286.9311.945.45.611.547.963-Year Average11.9411.2211.5414.949.696.9258.057.67.48—5-Year Average11.6311.8512.513.429.679.459.577.65.28.24—10-Year Average20.9517.7116.2315.3511.4610.5310.7110.029.238.95— Operating Income %Year over Year61.1813.1212.4621.42- 9.4718.3412.71-19.8722.983.72-2.423-Year Average6.937.6127.0415.67.329.166.492.243.560.73—5-Year Average5.717.049.2411.2217.6510.610.523.283.546.39—10- Year Average21.7318.2613.712.487.328.138.776.217.3111.88— Net Income %Year over Year50.022.8211.6425.71- 17.628.7723.4-26.6628.770.97—3-Year Average16.118.0319.86134.9610.089.45.235.23-1.57—5-Year Average5.411.3912.4312.0912.278.8912.943.844.348.67—10- Year Average23.7719.0915.0814.696.477.1312.168.058.1410.45— EPS %Year over Year49.337.1418.3331.69-13.3729.6328.1- 25.65291.94-8.973-Year Average16.689.2623.7118.6310.5213.9312.897.287.1-0.75—5- Year Average5.6712.715.0315.2416.6513.417.527.096.6510.18—10- Year Average22.6818.815.7616.18Cash flowCash Flow Ratios2005-062006-062007-062008-062009-062010-062011- 062012-062013-062014-06Operating Cash Flow Growth % YOY13.53-13.2623.5521.44-11.9126.4512.1317.16- 8.8311.79Free Cash Flow Growth % YOY16.84- 18.7921.118.66-13.6338.8111.5119-16.188.83Cap Ex as a % of Sales2.043.564.435.275.343.163.373.135.476.32Free Cash Flow/Sales %39.6928.9630.3830.527.2435.3635.2339.7731.5730.8Free Cash Flow/Net Income1.291.021.11.04Financial healthBalance Sheet Items (in %)2005-062006-062007-062008-062009- 062010-062011-062012-062013-062014-06Latest QtrCash & Short-Term

- 13. Investments53.3149.0837.0632.5140.3742.7248.5551.9854.0849 .7251.62Accounts Receivable10.1413.3917.9518.6714.3715.1113.7913.0112.2811. 349.26Inventory0.692.121.781.350.920.861.260.941.361.541.17 Other Current Assets4.685.836.796.887.615.965.324.233.523.674.5Total Current Assets68.8270.4263.5959.463.2764.6568.9270.1671.2466.2766. 55Net PP&E3.314.376.898.589.678.867.516.827.017.557.78Intangible s5.386.338.9219.3418.3115.7412.2613.7112.4515.7316.67Other Long-Term Assets22.4918.8820.612.688.7410.7511.319.319.2910.458.99To tal Assets100100100100100100100100100100100Accounts Payable2.954.185.145.544.274.673.863.443.394.313.96Short- Term Debt————2.571.16—1.022.111.165.75Taxes Payable————0.931.250.530.650.420.450.41Accrued Liabilities2.352.783.684.034.053.813.293.22.892.781.99Other Short-Term Liabilities18.5425.2828.7831.4822.8919.4718.7918.6517.4717.7 615.01Total Current Liabilities23.8332.2537.641.0634.7130.3626.4726.9526.2726.47 27.12Long-Term Debt———— 4.815.7410.978.838.8511.9810.44Other Long-Term Liabilities8.2210.1313.179.19.6910.2810.059.499.469.479.89To tal Liabilities32.0642.3850.7750.1549.2146.3847.4945.2844.5747.9 247.45Total Stockholders' Equity67.9457.6249.2349.8550.7953.6252.5154.7255.4352.0852 .55Total Liabilities & Equity100100100100100100100100100100100Liquidity/Financi al Health2005-062006-062007-062008-062009-062010-062011- 062012-062013-062014-06Latest QtrCurrent Ratio2.892.181.691.451.822.132.62.62.712.52.45Quick Ratio2.661.941.461.251.581.92.352.412.532.312.24Financial Leverage1.471.742.032.011.971.861.91.831.81.921.9Debt/Equit

- 14. y————0.090.110.210.160.160.230.2Efficiency ratiosEfficiency2005-062006-062007-062008-062009-062010- 062011-062012-062013-062014-06Days Sales Outstanding59.9567.9973.7375.2977.3970.773.0676.1677.9877. 83Days Inventory26.8546.9744.4633.2325.5521.4524.7426.1227.7131.1 6Payables Period111.94119.16105.07114.57110.48108.296.3387.1681.148 3.07Cash Conversion Cycle-25.15-4.213.13-6.04-7.53- 16.051.4815.1324.5625.91Receivables Turnover6.095.374.954.854.725.1654.794.684.69Inventory Turnover13.67.778.2110.9814.2817.0114.7513.9713.1711.72Fix ed Assets Turnover17.0316.4313.8311.418.488.248.868.978.537.55Asset Turnover0.490.630.770.89Betas. 1.37P/E ratios. 16.42PEG. 1.8S&P 500 index returnHistory (03/31/2015)2005200620072008200920102011201220132014S &P 500 TR USD4.9115.795.49- 3726.4615.062.111632.3913.69S&P 500 P/E ratios. 18.6Risk free ratesshare outstanding8,203,785,341 Sheet3Stock name. CVSCurrent price. 102.2610yrs total returnsHistory (03/31/2015)2005200620072008200920102011201220132014C VS17.8817.5829.34-27.0513.149.0318.7220.1649.8936.1Health Care Plans44.6-5.8118.43- 51.5732.9112.2924.847.6340.2731.7S&P 500 TR USD4.9115.795.49-3726.4610yrs dividend historyEx/Eff DateTypeCash AmountDeclaration DateRecord DatePayment Date4/22/15Cash0.353/4/154/24/155/4/151/20/15Cash0.3512/15 /141/22/152/2/1510/21/14Cash0.2759/24/1410/23/1411/3/147/17 /14Cash0.2757/10/147/21/148/1/144/17/14Cash0.2753/6/144/22/ 145/2/141/21/14Cash0.27512/18/131/23/142/3/1410/17/13Cash0 .2259/25/1310/21/1311/1/137/18/13Cash0.2257/10/137/22/138/2 /134/19/13Cash0.2253/6/134/23/135/3/131/22/13Cash0.22512/1 3/121/24/132/4/1310/18/12Cash0.16259/19/1210/22/1211/2/127/ 19/12Cash0.16257/5/127/23/128/3/124/19/12Cash0.16253/7/124

- 15. /23/125/3/121/19/12Cash0.162512/20/111/23/122/2/1210/19/11 Cash0.1259/21/1110/21/1111/1/117/20/11Cash0.1257/6/117/22/ 118/2/114/19/11Cash0.1253/9/114/22/115/3/111/19/11Cash0.12 51/11/111/21/112/2/1110/20/10Cash0.08759/22/1010/22/1011/2/ 107/20/10Cash0.08757/7/107/22/108/2/104/21/10Cash0.08753/1 0/104/23/105/4/101/20/10Cash0.08751/11/101/22/102/2/1010/20 /09Cash0.076259/18/0910/22/0911/3/097/21/09Cash0.076257/8/ 097/23/098/3/094/20/09Cash0.076253/4/094/22/095/4/091/21/09 Cash0.076251/13/091/23/092/3/0910/17/08Cash0.0699/24/0810/ 21/0811/3/087/17/08Cash0.0697/9/087/21/088/1/084/17/08Cash 0.063/5/084/21/085/2/081/17/08Cash0.061/9/081/22/082/1/0810 /18/07Cash0.069/26/0710/22/0711/2/077/19/07Cash0.067/11/07 7/23/078/3/074/20/07Cash0.063/29/074/24/075/4/071/18/07Cash 0.048751/10/071/22/072/2/0710/18/06Cash0.038759/20/0610/21 /0611/1/067/19/06Cash0.038757/6/067/21/068/1/064/20/06Cash 0.038753/1/064/24/065/3/061/19/06Cash0.038751/12/061/23/06 2/3/0610/19/05Cash0.036259/14/0510/21/0511/1/057/19/05Cash 0.036257/6/057/21/058/1/054/20/05Cash0.07253/2/054/22/055/2 /051/20/05Cash0.07251/5/05Read more: http://www.nasdaq.com/symbol/cvs/dividend- history#ixzz3WMBUn6W3ProfitabilityProfitability2005- 122006-122007-122008-122009-122010-122011-122012- 122013-122014-12Tax Rate %35.8538.539.539.637.2938.9139.338.6138.8939.5Net Margin %3.273.093.443.663.743.553.233.153.623.33Asset Turnover (Average)2.482.442.031.511.611.561.691.891.841.91Return on Assets %8.127.566.975.536.035.545.465.946.686.37Financial Leverage (Average)1.882.121.761.771.721.651.71.751.891.96Return on Equity %16.2915.2112.859.7610.549.339.1410.2412.1412.24Return on Invested Capital %12.9211.9510.317.998.667.937.978.839.939.81Interest Coverage————Growth2005-122006-122007-122008-122009- 122010-122011-122012-122013-122014-12Latest QtrRevenue %Year over Year20.9618.474.2114.612.87-

- 16. 2.3511.0814.972.959.9413.033-Year Average15.2418.1235.6333.2131.18.16.987.649.559.18—5-Year Average1314.5225.8526.8926.421.1119.5710.047.77.14—10- Year Average14.342319.6119.0718.4916.9817.0217.6816.916.37— Operating Income %Year over Year38.8320.996.3226.146.48- 4.242.6814.1911.199.485.073-Year Average18.7492.6148.8144.1338.158.751.543.939.2411.6—5- Year Average8.8325.9431.7877.6534.6525.0120.998.565.866.45—10- Year Average26.423.3422.2620.5818.9516.6423.4419.6137.1319.72 —Net Income %Year over Year33.2911.7792.6421.8115.06- 7.280.9912.0218.441.13—3-Year Average19.5617.3442.1137.9139.259.132.521.6110.2510.3—5- Year Average10.4227.0729.7730.5432.122.8520.388.017.414.67—10- Year Average— 33.6352.9223.2719.2616.4723.6818.3918.4117.59—EPS %Year over Year31.8210.342013.5416.97- 2.353.2117.923.435.8810.483-Year Average18.3415.8120.414.5616.819.055.645.9214.5215.5—5- Year Average9.6526.1917.0216.1818.3111.429.949.5511.49.2— 10-Year Average—27.3649.2516.1Cash flowCash Flow Ratios2005-122006-122007-122008-122009-122010-122011- 122012-122013-122014-12Operating Cash Flow Growth % YOY—808——223—————Free Cash Flow Growth % YOY——————————Cap Ex as a % of Sales4.044.042.372.492.582.081.751.651.571.53Free Cash Flow/Sales %0.32-0.061.872.021.512.883.723.7734.31Free Cash Flow/Net Income0.1-0.020.540.55Financial healthBalance Sheet Items (in %)2005-122006-122007-122008-122009-122010- 122011-122012-122013-122014-12Latest QtrCash & Short- Term Investments3.362.581.982.221.772.32.22.095.843.393.39Accou nts

- 17. Receivable12.0411.568.378.838.857.929.379.8212.213.0513.05I nventory37.4234.5614.6315.0116.7817.215.5616.3215.4416.071 6.07Other Current Assets2.091.820.871.041.051.051.681.881.922.492.49Total Current Assets54.9150.5225.8627.1128.4528.4828.8130.1235.4134.9934 .99Net PP&E25.8625.9310.713.3312.8513.3913.1213.112.0411.9111.91 Intangibles1722635958575655505151Other Long-Term Assets2.261.610.670.60.611.111.791.942.122.032.03Total Assets100100100100100100100100100100100Accounts Payable16.1413.926.576.2310.7610.6112.1713.7214.1216.116.1 Short-Term Debt411464211122Taxes Payable———————— ———Accrued Liabilities9.959.484.675.215.274.945.16.156.677.837.83Other Short-Term Liabilities——4.544.62———————Total Current Liabilities29.9934.03202220181921222626Long-Term Debt10.4313.9515.2613.2214.213.9214.2713.8617.9515.7515.75 Other Long-Term Liabilities54888888788Total Liabilities4552434342394143474949Total Stockholders' Equity54.5148.21575758615957535151Total Liabilities & Equity100100100100100100100100100100100Liquidity/Financi al Health2005-122006-122007-122008-122009-122010-122011- 122012-122013-122014-12Latest QtrCurrent Ratio1.831.481.311.231.431.61.561.441.641.371.37Quick Ratio0.510.420.530.50.530.570.620.570.840.640.64Financial Leverage1.882.121.761.771.721.651.71.751.891.961.96Debt/Eq uity0.20.30.270.23Efficiency ratiosEfficiency2005-122006- 122007-122008-122009-122010-122011-122012-122013- 122014-12Days Sales Outstanding17.7717.5716.6320.7920.0419.6518.718.5621.8924. 12Days Inventory75.2373.4545.8145.2745.4150.4243.7437.7338.6436.7 8Payables Period31.9430.5219.5719.517.1518.1817.7117.1218.8219.36Cas h Conversion

- 18. Cycle61.0760.4942.8846.5548.3151.8944.7339.1741.7141.53Re ceivables Turnover20.5420.7821.9417.5618.2118.5719.5219.6716.6815.1 4Inventory Turnover4.854.977.978.068.047.248.349.679.459.92Fixed Assets Turnover9.929.4413.6512.5212.311.8712.7614.414.715.97Asset Turnover2.482.442.031.51Betas. 0.78P/E ratios. 25.82PEG ratios. 1.2S&P500 index returns History (03/31/2015)2005200620072008200920102011201220132014S &P 500 TR USD4.9115.795.49- 3726.4615.062.111632.3913.69S&P 500 P/E. 18.6Risk free ratesshare outstanding1,125,252,739 Sheet4Stock name. Coca ColaCoca Cola co.KOCurrent price. 40.6810yrs total returnsHistory (03/31/2015)2005200620072008200920102011201220132014C VS17.8817.5829.34-27.0513.149.0318.7220.1649.8936.1Health Care Plans44.6-5.8118.43- 51.5732.9112.2924.847.6340.2731.7S&P 500 TR USD4.9115.795.49-3726.4610yrs dividend historyEx/Eff DateTypeCash AmountDeclaration DateRecord DatePayment Date3/12/15Cash0.332/19/153/16/154/1/1511/26/14Cash0.30510 /16/1412/1/1412/15/149/11/14Cash0.3057/15/149/15/1410/1/146 /12/14Cash0.3054/24/146/16/147/1/143/12/14Cash0.3052/20/14 3/14/144/1/1411/27/13Cash0.2810/17/1312/2/1312/16/139/12/13 Cash0.287/18/139/16/1310/1/136/12/13Cash0.284/25/136/14/13 7/1/133/13/13Cash0.282/21/133/15/134/1/1311/28/12Cash0.255 10/18/1211/30/1212/17/129/12/12Cash0.2557/30/129/14/1210/1/ 126/13/12Cash0.514/26/126/15/127/1/123/13/12Cash0.512/16/1 23/15/124/1/1211/29/11Cash0.4710/20/1112/1/1112/15/119/13/1 1Cash0.477/21/119/15/1110/1/116/13/11Cash0.474/28/116/15/1 17/1/113/11/11Cash0.472/17/113/15/114/1/1111/29/10Cash0.44 10/21/1012/1/1012/15/109/13/10Cash0.447/22/109/15/1010/1/10 6/11/10Cash0.444/22/106/15/107/1/103/11/10Cash0.442/18/103/ 15/104/1/1011/27/09Cash0.4110/22/0912/1/0912/15/099/11/09C ash0.417/23/099/15/0910/1/096/11/09Cash0.414/23/096/15/097/

- 19. 1/093/11/09Cash0.412/19/093/15/094/1/0911/26/08Cash0.3810/ 16/0812/1/0812/15/089/11/08Cash0.387/17/089/15/0810/1/086/1 1/08Cash0.384/17/086/15/087/1/083/12/08Cash0.382/21/083/15/ 084/1/0811/28/07Cash0.3410/18/0712/1/0712/15/079/12/07Cash 0.347/19/079/15/0710/1/076/13/07Cash0.344/19/076/15/077/1/0 73/13/07Cash0.342/15/073/15/074/1/0711/29/06Cash0.3110/19/ 0612/1/0612/15/069/13/06Cash0.317/20/069/15/0610/1/066/13/0 6Cash0.314/20/066/15/067/1/063/13/06Cash0.312/16/063/15/06 4/1/0611/29/05Cash0.2810/20/0512/1/0512/15/059/13/05Cash0. 287/21/059/15/0510/1/056/13/05Cash0.284/20/056/15/057/1/053 /11/05Cash0.282/17/05Read more: http://www.nasdaq.com/symbol/ko/dividend- history#ixzz3WMHje6cjProfitabilityProfitability2005-122006- 122007-122008-122009-122010-122011-122012-122013- 122014-12Tax Rate %35.8538.539.539.637.2938.9139.338.6138.8939.5Net Margin %3.273.093.443.663.743.553.233.153.623.33Asset Turnover (Average)2.482.442.031.511.611.561.691.891.841.91Return on Assets %8.127.566.975.536.035.545.465.946.686.37Financial Leverage (Average)1.882.121.761.771.721.651.71.751.891.96Return on Equity %16.2915.2112.859.7610.549.339.1410.2412.1412.24Return on Invested Capital %12.9211.9510.317.998.667.937.978.839.939.81Interest Coverage————Growth2005-122006-122007-122008-122009- 122010-122011-122012-122013-122014-12Latest QtrRevenue %Year over Year20.9618.474.2114.612.87- 2.3511.0814.972.959.9413.033-Year Average15.2418.1235.6333.2131.18.16.987.649.559.18—5-Year Average1314.5225.8526.8926.421.1119.5710.047.77.14—10- Year Average14.342319.6119.0718.4916.9817.0217.6816.916.37— Operating Income %Year over Year38.8320.996.3226.146.48- 4.242.6814.1911.199.485.073-Year Average18.7492.6148.8144.1338.158.751.543.939.2411.6—5-

- 20. Year Average8.8325.9431.7877.6534.6525.0120.998.565.866.45—10- Year Average26.423.3422.2620.5818.9516.6423.4419.6137.1319.72 —Net Income %Year over Year33.2911.7792.6421.8115.06- 7.280.9912.0218.441.13—3-Year Average19.5617.3442.1137.9139.259.132.521.6110.2510.3—5- Year Average10.4227.0729.7730.5432.122.8520.388.017.414.67—10- Year Average— 33.6352.9223.2719.2616.4723.6818.3918.4117.59—EPS %Year over Year31.8210.342013.5416.97- 2.353.2117.923.435.8810.483-Year Average18.3415.8120.414.5616.819.055.645.9214.5215.5—5- Year Average9.6526.1917.0216.1818.3111.429.949.5511.49.2— 10-Year Average—27.3649.2516.1Cash flowCash Flow Ratios2005-122006-122007-122008-122009-122010-122011- 122012-122013-122014-12Operating Cash Flow Growth % YOY—808——223—————Free Cash Flow Growth % YOY——————————Cap Ex as a % of Sales4.044.042.372.492.582.081.751.651.571.53Free Cash Flow/Sales %0.32-0.061.872.021.512.883.723.7734.31Free Cash Flow/Net Income0.1-0.020.540.55Financial healthBalance Sheet Items (in %)2005-122006-122007-122008-122009-122010- 122011-122012-122013-122014-12Latest QtrCash & Short- Term Investments3.362.581.982.221.772.32.22.095.843.393.39Accou nts Receivable12.0411.568.378.838.857.929.379.8212.213.0513.05I nventory37.4234.5614.6315.0116.7817.215.5616.3215.4416.071 6.07Other Current Assets2.091.820.871.041.051.051.681.881.922.492.49Total Current Assets54.9150.5225.8627.1128.4528.4828.8130.1235.4134.9934 .99Net PP&E25.8625.9310.713.3312.8513.3913.1213.112.0411.9111.91

- 21. Intangibles16.9621.9462.7858.9658.0957.0356.2854.8450.4351. 0651.06Other Long-Term Assets2.261.610.670.60.611.111.791.942.122.032.03Total Assets100100100100100100100100100100100Accounts Payable16.1413.926.576.2310.7610.6112.1713.7214.1216.116.1 Short-Term Debt3.8910.633.96.073.922.261.251.050.781.71.7Taxes Payable———————————Accrued Liabilities9.959.484.675.215.274.945.16.156.677.837.83Other Short-Term Liabilities——4.544.62———————Total Current Liabilities29.9934.0319.6722.1319.9517.8118.5220.9221.5725.6 225.62Long-Term Debt10.4313.9515.2613.2214.213.9214.2713.8617.9515.7515.75 Other Long-Term Liabilities5.073.87.837.947.817.648.258.027.447.57.5Total Liabilities45.4951.7942.7643.2841.9739.3641.0542.846.9648.88 48.88Total Stockholders' Equity54.5148.2157.2456.7258.0360.6458.9557.253.0451.1251. 12Total Liabilities & Equity100100100100100100100100100100100Liquidity/Financi al Health2005-122006-122007-122008-122009-122010-122011- 122012-122013-122014-12Latest QtrCurrent Ratio1.831.481.311.231.431.61.561.441.641.371.37Quick Ratio0.510.420.530.50.530.570.620.570.840.640.64Financial Leverage1.882.121.761.771.721.651.71.751.891.961.96Debt/Eq uity0.20.30.270.23Efficiency ratiosEfficiency2005-122006- 122007-122008-122009-122010-122011-122012-122013- 122014-12Days Sales Outstanding17.7717.5716.6320.7920.0419.6518.718.5621.8924. 12Days Inventory75.2373.4545.8145.2745.4150.4243.7437.7338.6436.7 8Payables Period31.9430.5219.5719.517.1518.1817.7117.1218.8219.36Cas h Conversion Cycle61.0760.4942.8846.5548.3151.8944.7339.1741.7141.53Re

- 22. ceivables Turnover20.5420.7821.9417.5618.2118.5719.5219.6716.6815.1 4Inventory Turnover4.854.977.978.068.047.248.349.679.459.92Fixed Assets Turnover9.929.4413.6512.5212.311.8712.7614.414.715.97Asset Turnover2.482.442.031.51Betas. 0.68P/E ratios. 25.58PEG ratios. 3.2S&P500 index returnsHistory (03/31/2015)2005200620072008200920102011201220132014S &P 500 TR USD4.9115.795.49- 3726.4615.062.111632.3913.69S&P500 P/E. 18.6Risk free rates Sheet5Stock name. CVSHelmerich & Payne IncHPCurrent price. 102.2668.2110yrs total returnHistory (03/31/2015)2005200620072008200920102011201220132014H P82.84-20.3964.49-42.7576.1822.1220.92-3.5552.44-16.69Oil & Gas Drilling53.852.2945.19-60.7782.474.16- 14.0611.8813.82-46.93S&P 500 TR USD4.9115.795.49- 3726.4610yrs dividend historyEx/Eff DateTypeCash AmountDeclaration DateRecord DatePayment Date5/13/15Cash0.68753/4/155/15/156/1/152/11/15Cash0.68751 2/2/142/13/153/2/1511/12/14Cash0.68759/3/1411/14/1412/1/148 /13/14Cash0.68756/4/148/15/149/2/145/13/14Cash0.6253/5/145/ 15/146/2/142/12/14Cash0.62512/3/132/14/143/3/1411/13/13Cas h0.59/4/1311/15/1312/2/138/13/13Cash0.56/5/138/15/138/30/13 5/13/13Cash0.153/6/135/15/135/31/132/13/13Cash0.1512/4/122/ 15/133/1/1311/13/12Cash0.079/5/1211/15/1211/30/128/13/12Ca sh0.076/6/128/15/128/31/125/11/12Cash0.073/7/125/15/126/1/1 22/13/12Cash0.0712/6/112/15/123/1/1211/10/11Cash0.079/7/11 11/15/1112/1/118/11/11Cash0.076/1/118/15/119/1/115/11/11Cas h0.063/2/115/13/116/1/112/11/11Cash0.0612/7/102/15/113/1/11 11/10/10Cash0.069/1/1011/15/1012/1/108/11/10Cash0.066/2/10 8/13/109/1/105/12/10Cash0.053/3/105/14/106/1/102/10/10Cash0 .0512/1/092/15/103/1/1011/10/09Cash0.059/2/0911/13/0912/1/0 98/12/09Cash0.056/3/098/14/099/1/095/13/09Cash0.053/4/095/1 5/096/1/092/11/09Cash0.0512/2/082/13/093/2/0911/12/08Cash0.

- 23. 059/3/0811/14/0812/1/088/13/08Cash0.056/4/088/15/089/2/085/ 13/08Cash0.0453/5/085/15/086/2/082/13/08Cash0.04512/4/072/ 15/083/3/0811/13/07Cash0.0459/5/0711/15/0712/3/078/13/07Ca sh0.0456/6/078/15/079/4/075/11/07Cash0.0453/7/075/15/076/1/ 072/13/07Cash0.04512/5/062/15/073/1/0711/13/06Cash0.0459/6 /0611/15/0612/1/068/11/06Cash0.0456/7/068/15/069/1/065/11/0 6Cash0.08253/1/065/15/066/1/062/13/06Cash0.082512/6/052/15 /063/1/0611/10/05Cash0.08259/7/0511/15/0512/1/058/11/05Cas h0.08256/1/058/15/059/1/055/11/05Cash0.0825Read more: http://www.nasdaq.com/symbol/hp/dividend- history#ixzz3WMKNSPsFProfitabilityProfitability2005-092006- 092007-092008-092009-092010-092011-092012-092013- 092014-09Tax Rate %41.1335.0136.3636.5140.3634.7236.7436.4535.2535.35Net Margin %15.9423.9927.5722.6718.678.3417.0718.4421.7519.05Asset Turnover (Average)0.520.650.650.630.490.450.550.590.570.57Return on Assets %8.3115.4717.914.279.123.719.3710.8412.2910.91Financial Leverage (Average)1.541.541.591.581.551.521.531.491.411.37Return on Equity %12.823.8828.122.6314.295.6914.2916.3617.815.18Return on Invested Capital %11.7220.6123.8818.7412.135.3412.915.2517.0114.81Interest Coverage————Growth2005-092006-092007-092008-092009- 092010-092011-092012-092013-092014-09Latest QtrRevenue %Year over Year28.9652.9633.0524.97-7- 135.6623.97.489.818.833-Year Average16.1633.4637.9436.515.644.797.718.521.7913.5—5- Year Average4.888.1826.1131.6324.9918.5515.7414.110.7114.45— 10-Year Average9.4112.212.1512.3312.8711.5111.8919.9620.7219.6— Operating Income %Year over Year148.17132.8551.539.57-

- 24. 15.77-22.5855.4929.485.1710.2625.673-Year Average24.8108.21106.1256.9511.83- 10.60.4615.9528.4114.51—5-Year Average5.0912.1646.9771.8551.8820.3110.987.546.6712.57— 10-Year Average28.8620.5316.9916.323.3812.4411.5725.7235.3930.75 —Net Income %Year over Year2827.41130.2952.882.78-23.43- 55.79177.7733.8226.78-3.79—3-Year Average26.18154.28368.8553.526.36-29.67- 2.0318.0167.6617.74—5-Year Average9.1715.2947.8891.62140.894.148.125.289.7914.92—10- Year Average29.2615.0218.2316.3923.516.6311.6524.7845.0566.38 —EPS %Year over Year—126.1254.151.64-23.5- 56.33175.1733.8327.15-4.8616.353-Year Average24.81151.08356.1152.456.22-30.23- 2.7617.1767.317.42—5-Year Average8.3614.346.6390.06136.373.437.574.579.3614.24—10- Year Average28.4714.1917.5915.81Cash flowCash Flow Ratios2005-092006-092007-092008-092009-092010-092011- 092012-092013-092014-09Operating Cash Flow Growth % YOY———887———233-31—Free Cash Flow Growth % YOY——————————Cap Ex as a % of Sales10.8443.1854.8734.6546.517.5827.2934.8323.8825.62Free Cash Flow/Sales %15.66-18.98-20.44-4.660.877.0811.14- 3.095.554.45Free Cash Flow/Net Income0.98-0.79-0.74- 0.21Financial healthBalance Sheet Items (in %)2005-092006- 092007-092008-092009-092010-092011-092012-092013- 092014-09Latest QtrCash & Short-Term Investments17.363.873.13.393.71.487.281.687.155.373.7Accou nts Receivable9.7813.5611.7812.95.9310.739.210.851010.4910.8In ventory1.281.231.010.921.071.021.091.381.421.581.63Other Current Assets1.631.431.42.041.862.081.541.751.521.561.67Total Current

- 25. Assets30.0520.0817.2919.2512.5715.319.1115.6520.081917.79 Net PP&E59.0469.4874.674.7678.4976.7873.4876.0674.6477.1979.3 9Intangibles———————————Other Long-Term Assets10.9210.448.168.947.917.48.295.283.812.82Total Assets100100100100100100100100100100100Accounts Payable2.76.54.324.291.691.892.082.792.32.712.48Short-Term Debt—1.35—0.752.52—2.30.71.840.60.6Taxes Payable——— ——1.05—0.650.610.79—Accrued Liabilities2.684.553.543.583.041.863.852.011.923.093.45Other Short-Term Liabilities—————0.660.10.520.540.360.05Total Current Liabilities5.3812.397.858.617.265.458.336.667.227.556.58Long -Term Debt12.028.215.4213.2410.098.444.73.411.280.60.59Other Long-Term Liabilities17.7114.6813.815.0118.1720.2921.6322.920.5719.092 0.48Total Liabilities35.1235.2737.0836.8635.5234.1834.6532.9729.0727.2 427.65Total Stockholders' Equity64.8864.7362.9263.1464.4865.8265.3567.0370.9372.7672 .35Total Liabilities & Equity100100100100100100100100100100100Liquidity/Financi al Health2005-092006-092007-092008-092009-092010-092011- 092012-092013-092014-09Latest QtrCurrent Ratio5.591.622.22.241.732.812.292.352.782.522.7Quick Ratio5.041.411.891.891.332.241.981.882.382.12.2Financial Leverage1.541.541.591.581.551.521.531.491.411.371.38Debt/E quity0.190.130.250.210.160.130.070.050.020.010.01Efficiency ratiosEfficiency2005-092006-092007-092008-092009-092010- 092011-092012-092013-092014-09Days Sales Outstanding67.4467.3770.2571.7568.3863.9162.4562.666.9165. 09Days Inventory15.8813.111.7110.4514.041512.4613.8916.5117.72Pay ables Period27.4650.6555.7346.7640.4325.6723.4927.4529.9229.64C

- 26. ash Conversion Cycle55.8629.8226.2335.4541.9953.2551.4249.0353.4953.17Re ceivables Turnover5.415.425.25.095.345.715.845.835.465.61Inventory Turnover22.9827.8731.1834.922624.3329.2926.2922.120.6Fixe d Assets Turnover0.810.990.90.840.640.570.730.790.750.75Asset Turnover0.520.650.650.63Betas. 1.08P/E ratios. 10.15PEG ratios. 49.9S&P 500 index returnsHistory (03/31/2015)2005200620072008200920102011201220132014S &P 500 TR USD4.9115.795.49- 3726.4615.062.111632.3913.69S&P 500 P/E. 18.6Risk free rates1.89%SHARE107.64 Sheet1portfolio #2corporate bond name : Exxon Mobilcurrent price : $84.30coupon rates2.7091.8191.3050.9211.9122.3973.5673.1760.2810.3910.63 40.3140.15Maturity dates3/6/253/15/193/6/183/15/173/6/203/6/223/6/453/15/243/15 /173/15/193/6/223/1/1810/12/54YTM2.651.521.150.761.752.28 3.352.43Current Yields3.27%Bond RatingAAA Sheet2Portfolio # 2Corporate bond name:Johnson & JohnsonCurrent Price$99.64Coupon Rates04.755.955.552.155.154.3753.3750.3315.55.851.1251.654. 52.951.8754.54.953.550.72.454.856.953.3756.730Maturity Dates7/28/2011/6/198/15/378/15/175/15/167/15/1812/5/3312/5/ 2311/28/1611/6/247/15/3811/21/1712/5/189/1/409/1/2012/5/191 2/5/435/15/335/15/2111/28/1612/5/215/15/419/1/2912/5/2311/1 5/237/28/20YTM---0.293.470.930.521.273.222.4--- 3.823.461.071.273.381.741.663.423.521.860.542.113.543.11--- 2.5539.86Current Yields2.81%Bond RatingAAA Sheet3 Sheet1Portfolio # 1Fidelity® Mega Cap Stock Fundcurrent fund price$16.3910 yrs total returnHistory (03/31/2015)200520062007200820092010201120

- 27. 1220132014FGRTX7.4812.8411.05- 39.4128.6114.412.3419.4233.2311.66S&P 500 TR USD4.9115.795.49-3726.4615.062.111632.3913.6910 yrs Annual report Net Expense RatioHistory (03/31/2015)2005200620072008200920102011201 2201320140.810.820.810.740.780.790.780.750.70.68mpt statistic 10 yrs measureR-SquaredBetaAlphaTreynor RatioCurrency3/31/15vs. Standard IndexFGRTXS&P 500 TR USD97.331.040.076.58Volatility Measure (10yrs measure)StandardReturnSharpe RatioSortino RatioBear MarketDeviationPercentile Rank3/31/15FGRTX15.638.30.50.72—S&P 500 TR USD14.768.010.50.71 Sheet2nameGuideStone Funds ExtendedDuration Bond Fund Investor Class"current fund price$18.5610 yrs total returnHistory (03/31/2015)200520062007200820092010201120 1220132014YTDGEDZX5.544.498.36- 8.2924.9712.0613.1415.06-5.2917.392.62Barclays US Agg Bond TR USD2.434.336.975.245.936.547.844.21-2.025.9710 yrs Annual report Net Expense RatioHistory (03/31/2015)2005200620072008200920102011201 220132014YTDGEDZX5.544.498.36- 8.2924.9712.0613.1415.06-5.2917.392.62Barclays US Agg Bond TR USD2.434.336.975.245.936.547.844.21-2.025.97mpt statistic 10 yrs measureIndexR-SquaredBetaAlphaTreynor RatioGEDZXBarclays US Agg Bond TR USD68.492.46- 1.142.91Volatility Measure (10yrs measure)StandardReturnSharpe RatioSortino RatioBear MarketDeviationPercentile Rank9.88.610.741.15 Sheet3nameDodge & Cox International Stock current fund price$44.0010 yrs total returnHistory (03/31/2015)200520062007200820092010201120 1220132014DODFX16.7528.0111.71-46.6947.4613.69- 15.9721.0326.310.08MSCI ACWI Ex USA NR USD16.6226.6516.65-45.5341.4511.15-13.7116.8315.29-3.8710 yrs annual report Net Expense

- 28. RatioHistory (03/31/2015)2005200620072008200920102011201 2201320140.70.660.650.640.650.650.640.640.640.64MPT statistic 10 yrs measure10-Year TrailingIndexR- SquaredBetaAlphaTreynor RatioDODFXMSCI ACWI Ex USA NR USD95.751.071.395.2Volatility Measure10-Year TrailingStandardSharpe RatioSortino RatioDeviationDODFX20.50.360.52MSCI ACWI Ex USA NR USD18.810.30.42 Sheet4nameFidelity® Government MMktcurrent fund price$1.0010 yrs total returnHistory (03/31/2015)200520062007200820092010201120 1220132014YTDSPAXX2.874.734.882.310.320.010.010.010.01 0.010USTREAS T-Bill Auction Ave 3 Mon3.345.064.771.510.160.140.060.090.060.0310 yrs Annual Report Net Expense RatioHistory (03/31/2015)2005200620072008200920102011201 2201320140.420.420.420.410.440.350.260.160.190.11MPT Statistics 10 yrs measure10-Year TrailingIndexR- SquaredBetaAlphaTreynor RatioSPAXXUSTREAS T-Bill Auction Ave 3 MonVolatility Measures (10 yrs)10-Year TrailingStandardSharpe RatioSortino RatioDeviationSPAXX0.560.10.19USTREAS T-Bill Auction Ave 3 Mon0.57 FIN 404 Project Raw Data Due Week 4 Ho, 2015 Please collect the following raw data for your investment project. Portfolio #1: Four Mutual Funds · Fund Names · Current Fund Prices · 10-year total returns for each fund · 10-year Annual Report Net Expense Ratios for each fund.

- 29. MPT statistics (Choose the 10-year measure) for each of your four funds. · R-Squared · Beta · Alpha · Treynor Volatility Measures (Choose the 10-year measure) for each of your four funds. · Standard Deviation · Sharpe Ratio · Sortino Ratio Portfolio #2:Corporate Bonds · Corporate Bond Names · Current Prices · Coupon Rates · Maturity Dates · YTM · Current Yields · Bond Ratings Portfolio #3: Five Individual Stocks · Stock Names (Ticker Symbols) · Current Stock Prices · 10-year total returns for each of your five stocks. · 10-year dividend history for each of your five stock Other Key Ratios for each of your five stocks: · Profitability · Growth · Cash Flow · Financial Health · Efficiency Ratios · Betas · P/E ratios · PEG ratios

- 30. Market and Other Data (10-year history) · S&P500 Index returns · S&P500 P/E · Risk Free Rates (Treasurys)