7, 8 tax invoice & accounts and records

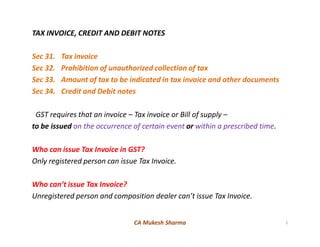

- 1. TAX INVOICE, CREDIT AND DEBIT NOTES Sec 31. Tax invoice Sec 32. Prohibition of unauthorized collection of tax Sec 33. Amount of tax to be indicated in tax invoice and other documents Sec 34. Credit and Debit notes GST requires that an invoice – Tax invoice or Bill of supply – to be issued on the occurrence of certain event or within a prescribed time.to be issued on the occurrence of certain event or within a prescribed time. Who can issue Tax Invoice in GST? Only registered person can issue Tax Invoice. Who can’t issue Tax Invoice? Unregistered person and composition dealer can’t issue Tax Invoice. CA Mukesh Sharma 1

- 2. Sec 31(1): In case of Supply of Taxable Goods: Where supply involves movement of goods Before or at the time of removal of the goods In other case At the time of delivery of goods or making available thereof to the recipient. Sec 2(96) “Removal’’ in relation to goods, means—Sec 2(96) “Removal’’ in relation to goods, means— (a) dispatch of the goods for delivery by the supplier thereof or by any other person acting on behalf of such supplier; or (b) collection of the goods by the recipient thereof or by any other person acting on behalf of such recipient; CA Mukesh Sharma 2

- 3. Sec 31(2): In case of Supply of Taxable Services: - Tax Invoice should be issued before or after the provision of services but with in prescribed time. Situation Time Limit as per Rule 2 In Normal case Tax invoice shall be issued within a period of thirty days from the date of supply of service In case of insurer or a banking company Tax invoice or any document in lieu CA Mukesh Sharma 3 In case of insurer or a banking company or a financial institution, including a non-banking financial company Tax invoice or any document in lieu thereof shall be issued within a period of forty five days from the date of supply of service In case of an insurer or a banking company or a financial institution, including a non- banking financial company, or a telecom operator…making taxable supplies of services between distinct persons as specified in section 25 May issue the invoice before or at the time such supplier records the same in his books of account or before the expiry of the quarter during which the supply was made.

- 4. Rule 1 Contents or Particulars of Tax Invoice In terms of the relevant Rule 1, a tax invoice referred to in section 31 shall be issued by the registered person containing the following: - (a) Name, address and GSTIN of the supplier, (b) A consecutive serial number not exceeding sixteen characters , in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year,year, (c) Date of its issue, (d) Name, address and GSTIN or UIN, if registered, of the recipient, (e) Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un- registered and where the value of taxable supply is fifty thousand rupees or more, (f) HSN code of goods or Accounting Code of services, CA Mukesh Sharma 4

- 5. Rule 1 Contents or Particulars of Tax Invoice……Cont. (h) Quantity in case of goods and unit or Unique Quantity Code thereof, (i) Total value of supply of goods or services or both, (j) Taxable value of supply of goods or services or both considering discount or abatement, if any, (k) Rate of tax (central tax, State tax, integrated tax, UT tax or cess), (l) Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess),(central tax, State tax, integrated tax, Union territory tax or cess), (m) Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce, (n) Address of delivery where the same is different from the place of supply; (o) Whether the tax is payable on reverse charge basis, (p) Signature or digital signature of the supplier or his authorized representative. CA Mukesh Sharma 5

- 6. HSN The Harmonized Commodity Description and Coding System generally referred to as “Harmonized System of Nomenclature” or simply “HSN” is a multipurpose international product nomenclature developed by the World Customs Organization (WCO). Under GST there is a 3-tiered structure of HSN. Those with a turnover of less than INR 1.5 Crores need not follow HSNThose with a turnover of less than INR 1.5 Crores need not follow HSN Those with a turnover exceeding INR 1.5 Crores but less than INR 5 Crores shall be using the 2 digit HSN codes Those with a turnover exceeding INR 5 Crores shall be using the 4 digit HSN codes Please Note: Those dealers who are into imports or exports shall mandatorily follow the 8 digit HSN codes while exporting or importing. CA Mukesh Sharma 6

- 7. Case of Export of Goods & Services In case of exports of goods or services, the invoice shall carry an endorsement: “Supply meant for export on payment of Integrated Tax” or “Supply meant for export under bond or letter of undertaking without payment of Integrated Tax”, as the case may be, and shall, in lieu of the details specified in clause (e) cited in Rule 1, contain the following details: (i) Name and address of the recipient, (ii) Address of delivery, and (iii) Name of the country of destination, CA Mukesh Sharma 7

- 8. Rule 3 Manner of issuing invoice (1) The invoice shall be prepared in triplicate, in case of supply of goods, in the following manner:– (a) The original copy being marked as Original for Recipient, (b) The duplicate copy being marked as Duplicate for Transporter, (c) The triplicate copy being marked as Triplicate for Supplier. (2) The invoice shall be prepared in duplicate, in case of supply of services, in(2) The invoice shall be prepared in duplicate, in case of supply of services, in the following manner:- (a) The original copy being marked as Original for Recipient, (b) The duplicate copy being marked as Duplicate for Supplier. (3) The serial number of invoices issued during a tax period shall be furnished electronically through the Common Portal in FORM GSTR-1. CA Mukesh Sharma 8

- 9. Special Cases: Sec 31(3) clause (a) to (g) Notwithstanding anything contained in sub-section (1) and (2) Sec 31(3)(a) Revised Invoice A registered person may, within one month from the date of issuance of certificate of registration and in such manner as may be prescribed, issue a revised invoice against the invoice already issued during the periodrevised invoice against the invoice already issued during the period beginning with the effective date of registration till the date of issuance of certificate of registration to him. Rule 8 prescribes the contents and particulars of Revised Invoice CA Mukesh Sharma 9

- 10. Rule 8(1) A revised tax invoice referred to in section 31 shall contain the following particulars – (a) the word “Revised Invoice”, wherever applicable, indicated prominently; (b) name, address and GSTIN of the supplier; (c) nature of the document; (d) a consecutive serial number not exceeding 16 characters……. (e) date of issue of the document; (f) name, address and GSTIN or UIN, if registered, of the recipient; (g) name and address of the recipient and the address of delivery, along with(g) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered; (h) serial number and date of the corresponding tax invoice or, as the case may be, bill of supply; (i) value of taxable supply of goods or services, rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient; and (j) signature or digital signature of the supplier or his authorized representative. CA Mukesh Sharma 10

- 11. Sec 31(3)(b) Supplies not exceeding Rs.200/- A registered person may not issue a tax invoice in accordance with the provisions of clause (b) of sub-section (3) of section 31 i.e. in respect of supply of goods or services or both where the value therein does not exceed a sum of Rs.200/- subject to the following conditions, namely: - (a) The recipient is not a registered person and the recipient(a) The recipient is not a registered person and the recipient does not require such invoice and (b) shall issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies. CA Mukesh Sharma 11

- 12. Sec 31(3)(c) Bill of supply (Read with Rule 4) A registered person supplying exempted goods or services or both or paying tax under the provisions of section 10 shall issue, instead of a tax invoice, a bill of supply containing such particulars and in such manner as may be prescribed. Rule 4 prescribes particulars of bill of supply (a) Name, address and GSTIN of the supplier, (b) A consecutive serial number not exceeding sixteen characters, …..(b) A consecutive serial number not exceeding sixteen characters, ….. (c) Date of its issue, (d) Name, address and GSTIN or UIN, if registered, of the recipient, (e) HSN Code of goods or Accounting Code for services, (f) Description of goods or services or both, (g) Value of supply of goods or services or both taking into account discount or abatement, if any, (h) Signature or digital signature of the supplier or his authorized representative. CA Mukesh Sharma 12

- 13. Sec 31(3)(d) Receipt Voucher (Read with Rule 5) A registered person shall, on receipt of advance payment with respect to any supply of goods or services or both, issue a receipt voucher or any other document, containing such particulars as may be prescribed, evidencing receipt of such payment. (a) Name, address and GSTIN of the supplier; (b) A consecutive serial number not exceeding sixteen characters……..(b) A consecutive serial number not exceeding sixteen characters…….. (c) Date of its issue, (d) Name, address and GSTIN or UIN, if registered, of the recipient, (e) Description of goods or services; CA Mukesh Sharma 13

- 14. Sec 31(3)(d) Receipt Voucher (Read with Rule 5)……Cont. (f) Amount of advance taken, (g) Rate of tax (central tax, State tax, integrated tax, Union territory tax or cess), (h) Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union territory tax or cess) (i) Place of supply along with the name of State and its code, in case of a supply in the course of inter-State trade or commerce, (j) Whether the tax is payable on reverse charge basis, (k) Signature or digital signature of the supplier or his authorized representative. CA Mukesh Sharma 14

- 15. Sec 31(3)(d) Receipt Voucher (Read with Rule 5)……Cont. Whenever a transaction envisages issue of Receipt Voucher, but thereafter does not translate into a transaction of supply will require issue of a refund voucher. Note: Where at the time of receipt of advance, (i) If the rate of tax is not determinable, the tax shall be paid at the rate of(i) If the rate of tax is not determinable, the tax shall be paid at the rate of eighteen per cent ; (ii) If the nature of supply is not determinable, the same shall be treated as inter-State supply. CA Mukesh Sharma 15

- 16. Sec 31(3)(e) Refund Voucher where, on receipt of advance payment with respect to any supply of goods or services or both the registered person issues a receipt voucher, but subsequently no supply is made and no tax invoice is issued in pursuance thereof, the said registered person may issue to the person who had made the payment, a refund voucher against such payment. Sec 54(8)(c) ……..Sec 54(8)(c) …….. Rule 6 prescribes particulars of Refund Voucher CA Mukesh Sharma 16

- 17. Sec 31(3)(f) Tax Invoice in case of RCM by recipient A registered person who is liable to pay tax under sub-section (3) or sub- section (4) of section 9 shall issue an invoice in respect of goods or services or both received by him from the supplier who is not registered on the date of receipt of goods or services or both. Sec 31(3)(g) Payment Voucher A registered person who is liable to pay tax under sub-section (3) or sub- section (4) of section 9 shall issue a payment voucher at the time of making payment to the supplier. Rule 7 prescribes particulars of Payment Voucher CA Mukesh Sharma 17

- 18. Sec 31(4) Continuous supply of goods In case of continuous supply of goods, where successive statements of accounts or successive payments are involved, the invoice shall be issued before or at the time: When such statement is issued, or When such payment is received, whichever is earlier. 2(32) “continuous supply of goods” means a supply of goods which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, whether or not by means of a wire, cable, pipeline or other conduit, and for which the supplier invoices the recipient on a regular or periodic basis and includes supply of such goods as the Government may subject to such conditions, as it may, by notification, specify. CA Mukesh Sharma 18

- 19. Sec 31(5) Continuous supply of services In case of continuous supply of services, A where the due date of payment is ascertainable from the contract the invoice shall be issued on or before the due date of payment B where the due date of payment is not ascertainable from the contract The invoice shall be issued before or at the time when the supplier of service receives the payment; C where the payment is linked to the completion of an event the invoice shall be issued on or before the date of completion of that event. 2(33) “continuous supply of services” means a supply of services which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, for a period exceeding three months with periodic payment obligations and includes supply of such services as the Government may, subject to such conditions, as it may, by notification, specify. CA Mukesh Sharma 19

- 20. Sec 31(6) Cessation of services On cessation of a contract for supply of services, the invoice is required to be issued to the extent supply is complete prior to cessation. Sec 31(7) Goods sent on approval Invoice in respect of goods sent ‘on approval’ is required to be issuedInvoice in respect of goods sent ‘on approval’ is required to be issued before or at the end of 6 months from the date of removal or the time of supply, whichever is earlier. CA Mukesh Sharma 20

- 21. Sec 32 Prohibition of unauthorized collection of tax (1) A person who is not a registered person shall not collect in respect of any supply of goods or services or both any amount by way of tax under this Act. (2) No registered person shall collect tax except in accordance with the provisions of this Act or the rules made there under. Sec 33 Amount of tax to be indicated in tax invoice and other documentsSec 33 Amount of tax to be indicated in tax invoice and other documents Notwithstanding anything contained in this Act or any other law for the time being in force, where any supply is made for a consideration, every person who is liable to pay tax for such supply shall prominently indicate in all documents relating to assessment, tax invoice and other like documents, the amount of tax which shall form part of the price at which such supply is made. CA Mukesh Sharma 21

- 22. Sec 34 Credit and Debit Notes Sec 34(1) Credit Notes Credit note may be issued in the following cases: 1. When value charged in Tax Invoice is greater than actual taxable value in respect of such supply, 2. When tax charged in Tax Invoice is greater than actual tax payable in respect of such supply, 3. When goods supplied are returned by the recipient, 4. When goods or services supplied are deficient. Sec 34(2) Credit Note can’t be issued beyond 30 Sept. of following financial year or date of filling annual return, whichever is earlier. To be shown in the return GSTR 1 for the month during which such credit note has been issued The tax liability shall be adjusted accordingly. CA Mukesh Sharma 22

- 23. Sec 34 Credit and Debit Notes Sec 34(3) Debit Note Debit Note shall be issued in the following cases: 1. When value charge in Tax Invoice is less than actual taxable value in respect of such supply, 2. When tax charge in Tax Invoice is less than actual tax payable in respect of such supply. Sec 34(4) There is ??? Time Limit to issue Debit note To be shown in the return for the month during which such Debit note has been issued The tax liability shall be adjusted accordingly. CA Mukesh Sharma 23

- 24. Rule 8 Revised Tax Invoice and Credit or debit notes Rule 8(1) A revised tax invoice referred to in section 31 and credit or debit note referred to in section 34 shall contain the following particulars – (a) the word “Revised Invoice”, wherever applicable, indicated prominently, (b) name, address and GSTIN of the supplier, (c) nature of the document, (d) a consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/” respectively,, and any combination thereof, unique for a financial year, slash symbolised as “-” and “/” respectively,, and any combination thereof, unique for a financial year, (e) date of issue of the document, (f) name, address and GSTIN or UIN, if registered, of the recipient, (g) name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered, (h) serial number and date of the corresponding tax invoice or, as the case may be, bill of supply, (i) value of taxable supply of goods or services, rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient (j) signature or digital signature of the supplier or his authorized representative CA Mukesh Sharma 24

- 25. Rule 8(2)Revised Invoice Already covered in Sec 31(3) Rule 8(3)“Input Tax Credit not Admissible”. Any invoice or debit note issued in pursuance of any tax payable in accordance with the provisions of section 74 or section 129 or section 130 shall prominently contain the words “Input Tax Credit not Admissible”. Section 74 Determination of tax not paid or short paid or erroneously refunded or inputDetermination of tax not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any wilful misstatement or suppression of facts. Section 129 Detention, seizure and release of goods and conveyances in transit. Section 130 Confiscation of goods or conveyances and levy of penalty. CA Mukesh Sharma 25

- 26. Rule 9 Tax Invoice in special cases Rule 9(1) In case of ISD An ISD invoice or, as the case may be, an ISD credit note issued by an Input Service Distributor shall contain the following details:- (a) name, address and GSTIN of the Input Service Distributor, (b) a consecutive serial number not exceeding sixteen characters….. (c) date of its issue,(c) date of its issue, (d) name, address and GSTIN of the recipient to whom the credit is distributed, (e) amount of the credit distributed, (f) signature or digital signature of the Input Service Distributor or his authorized representative CA Mukesh Sharma 26

- 27. Rule 9(2) Where the supplier of taxable service is an insurer or a banking company or a financial institution, including a non-banking financial company, the said supplier shall issue a tax invoice or any other document in lieu thereof, by whatever name called, whether issued or made available, physically or electronicallyphysically or electronically whether or not serially numbered, and whether or not containing the address of the recipient of taxable service but containing other information as prescribed under rule 1. CA Mukesh Sharma 27

- 28. Rule 9(3) GTA Case In case of Goods Transport Agency transporting goods by road the following additional information is also a. All particulars cited in Rule 1. b. Gross weight of consignment c. Consignor and Consignee name d. Regn. No. of Vehicle e. Details of goods transported f. Origin and destination details g. GSTIN of person liable to pay tax whether as consignor / consignee or GTA CA Mukesh Sharma 28

- 29. Rule 9(4) Passenger Transportation Service Where the supplier of taxable service is supplying passenger transportation service, a tax invoice shall include ticket in any form, by whatever name called, whether or not serially numbered, and whether or not containing the address of the recipient of service but containing other information as prescribed under rule 1. Rule 9(5) The provisions of sub-rule (2) or sub-rule (4) shall apply, mutatis mutandis, to the documents issued under - rule 4 or rule 5 or rule 6 or rule 7 or rule 8. CA Mukesh Sharma 29

- 30. List of Invoice Rules Rule 1 Tax invoice Rule 2 Time limit for issuing tax invoice Rule 3 Manner of issuing invoice Rule 4 Bill of supply Rule 5 Receipt voucherRule 5 Receipt voucher Rule 6 Refund voucher Rule 7 Payment voucher Rule 8 Revised tax invoice and credit or debit notes Rule 9 Tax invoice in special cases Rule 10 Transportation of goods without issue of invoice CA Mukesh Sharma 30

- 31. Rule 10 Transportation of goods without issue of invoice Rule 10(1) For the purposes of (a) supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known, (b) transportation of goods for job work, (c) transportation of goods for reasons other than by way of supply, or (d) such other supplies as may be notified by the Board, the consignor may issue a delivery challan, serially numbered not exceeding sixteen characters, in one or multiple series, in lieu of invoice at the time of removal of goods for transportation, CA Mukesh Sharma 31

- 32. Contents of Delivery Challan i. date and number of the delivery challan, ii. name, address and GSTIN of the consigner, if registered, iii. name, address and GSTIN or UIN of the consignee, if registered, iv. HSN code and description of goods, v. quantity (provisional, where the exact quantity being supplied is not known), vi. taxable value,vi. taxable value, vii. tax rate and tax amount – central tax, State tax, integrated tax, Union territory tax or cess, where the transportation is for supply to the consignee, viii. place of supply, in case of inter-State movement, and ix. signature. CA Mukesh Sharma 32

- 33. Rule 10(2) The delivery challan shall be prepared in triplicate, in case of supply of goods, in the following manner:– (a) the original copy being marked as Original for Consignee; (b) the duplicate copy being marked as Duplicate for Transporter; a (c) the triplicate copy being marked as Triplicate for Consignor. Rule 10(3)Rule 10(3) Where goods are being transported on a delivery challan in lieu of invoice, the same shall be declared in FORM [WAYBILL]. Rule 10(4) Where the goods being transported are for the purpose of supply to the recipient but the tax invoice could not be issued at the time of removal of goods for the purpose of supply, the supplier shall issue a tax invoice after delivery of goods. CA Mukesh Sharma 33

- 34. Rule 10(5) Where the goods are being transported in a semi knocked down or completely knocked down condition, (a) the supplier shall issue the complete invoice before dispatch of the first consignment; (b) the supplier shall issue a delivery challan for each of the subsequent consignments, giving reference of the invoice; (c) each consignment shall be accompanied by copies of the(c) each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and (d) the original copy of the invoice shall be sent along with the last consignment. CA Mukesh Sharma 34

- 35. E-Way Bill Rule 1 Information to be furnished prior to commencement of movement of goods and generation of e-way bill ……Selected Part only….. Rule 1(1) Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees — (i) In relation to a supply, (ii) For reasons other than supply, (iii) Due to inward supply from an unregistered person, Shall, before commencement of movement, furnish information relating to the said goods in Part A of FORM GST INS-01, electronically, on the common portal CA Mukesh Sharma 35

- 36. Rule 1(2) Unique EBN Upon generation of the e-way bill on the common portal, a unique e-way bill number (EBN) shall be made available to the supplier, the recipient and the transporter on the common portal. Rule 1(3) generate a new e-way bill Any transporter transferring goods from one conveyance to another in the course of transit shall, before such transfer and further movement of goods, generate a new e-way bill on the common portal in FORM GST INS- 01 specifying therein the mode of transport. CA Mukesh Sharma 36

- 37. Rule 1(4) Consolidated e-way bill The Multiple consignments are intended to be transported in one conveyance, the transporter shall indicate the serial number of e-way bills generated in respect of each such consignment electronically on the common portal and a consolidated e-way bill in FORM GST INS-02 shall be generated by him on the common portal prior to the movement of goods. Rule 1(5) The information furnished in Part A of FORM GST INS-01 shall be made available to the registered supplier on the common portal who may utilize the same for furnishing details in FORM GSTR-1: Rule 1(6) Cancellation Provisions Where an e-way bill has been generated under this rule, but goods are either not being transported or are not being transported as per the details furnished in the e-way bill, the e-way bill may be cancelled electronically on the common portal, either directly or through a Facilitation Centre notified by the Commissioner, within 24 hours of generation of the e-way bill Provided that an e-way bill cannot be cancelled if it has been verified in transit in accordance with the provisions of rule 3. CA Mukesh Sharma 37

- 38. Rule 1(7) Period Validity of E-Way Bill An e-way bill or a consolidated e-way bill generated under this rule shall be valid for the period as mentioned in column (3) of the Table below from the relevant date, for the distance the goods have to be transported, as mentioned in column (2):- Sr. No Distance Validity Period 1 Less Than 100 km One day 2 100 km or more but less than 300km Three days 3 300 km or more but less than 500km Five days Explanation: — For the purposes of this rule, the “relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated. CA Mukesh Sharma 38 3 300 km or more but less than 500km Five days 4 500 km or more but less than 1000km Ten days 5 1000 km or more Fifteen days

- 39. Rule 1(8) Communication by Recipient The details of e-way bill generated under sub-rule (1) shall be made available to the recipient, if registered, on the common portal, who shall communicate his acceptance or rejection of the consignment covered by the e-way bill. Rule 1(9) Deemed Acceptance The recipient referred to in sub-rule (8) does not communicate his acceptance or rejection within seventy two hours of the details being made available to him on the common portal, it shall be deemed that he has accepted the said details. made available to him on the common portal, it shall be deemed that he has accepted the said details. Rule 1(10) The e-way bill generated under rule 1 of the CGST rules or GST rules of any other State shall be valid in the State. Explanation. - The facility of generation and cancellation of e-way bill may also be made available through SMS. CA Mukesh Sharma 39

- 40. Rule 2 Documents and devices to be carried by a person-in-charge of a conveyance The person in charge of a conveyance shall carry — (a) The invoice or bill of supply or delivery challan, as the case may be, (b) A copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device (RFID) embeddedmapped to a Radio Frequency Identification Device (RFID) embedded on to the conveyance in such manner as may be notified by the Commissioner. Commissioner may, by notification require certain class of transporters to obtain a Unique RFID CA Mukesh Sharma 40

- 41. Rule 3 Verification of documents and conveyances The Commissioner or an officer empowered by him in this behalf may authorise the proper officer to intercept any conveyance to verify the e- way bill or the e-way bill number in physical form for all inter-State and intra-State movement of goods. The Commissioner shall get RFID readers installed at places where verification of movement of goods is required to be carried out and verification of movement of vehicles shall be done through such RFIDverification of movement of vehicles shall be done through such RFID readers where the e-way bill has been mapped with RFID. On receipt of specific information of evasion of tax, physical verification of a specific conveyance can also be carried out by any officer after obtaining necessary approval of the Commissioner or an officer authorized by him in this behalf. CA Mukesh Sharma 41

- 42. Rule 4 Inspection and verification of goods A summary report of every inspection of goods in transit shall be recorded online by the proper officer in Part A of FORM GST INS - 03 within twenty four hours of inspection and the final report in Part B of FORM GST INS - 03 shall be recorded within three days of the inspection. The physical verification of goods being transported on any conveyance has been done during transit at one place within the State or in any other State, no further physical verification of the said conveyance shall be carried out again in the State, unless specific information relating to State, no further physical verification of the said conveyance shall be carried out again in the State, unless specific information relating to evasion of tax is made available subsequently. Rule 5 Facility for uploading information regarding detention of vehicle A vehicle has been intercepted and detained for a period exceeding thirty minutes, the transporter may upload the said information in FORM GST INS- 04 on the common portal. CA Mukesh Sharma 42

- 43. List of E-Way Bill Relevant Forms Sr. No. Form on GST Descriptions 1 FORM GST INS – 01 Part-A Part-B Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees shall….. Furnish information prior to Commencement of movement of goods. CA Mukesh Sharma 43 movement of goods. 2 FORM GST INS – 02 Furnish information regarding consolidated e-way bill in case of multiple consignments. 3 FORM GST INS – 03 Summary report of every inspection of goods in transit recorded by proper officer. 4 FORM GST INS – 04 Uploading of information regarding detention of vehicle.

- 44. CHAPTER VIII ACCOUNTS AND RECORDS Sec 35. Accounts and other records. Sec 36. Period of retention of accounts.Sec 36. Period of retention of accounts. CA Mukesh Sharma 44

- 45. Sec 35. Accounts and other records. 35. (1) Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of— (a) Production or manufacture of goods; (b) Inward and outward supply of goods or services or both; (c) Stock of goods; (d) Input tax credit availed; (e) Output tax payable and paid; and(e) Output tax payable and paid; and (f) Such other particulars as may be prescribed: Provided that where more than one place of business is specified in the certificate of registration, the accounts relating to each place of business shall be kept at such places of business: Provided further that the registered person may keep and maintain such accounts and other particulars in electronic form in such manner as may be prescribed. CA Mukesh Sharma 45

- 46. 35 (2) Persons owning or operating a warehouse or godown Every owner or operator of warehouse or godown or any other place used for storage of goods and every transporter, irrespective of whether he is a registered person or not, shall maintain records of the consigner, consignee and other relevant details of the goods in such manner as may be prescribed. Rule 3(1) if not already registered under the Act, shall get himself enrolled withif not already registered under the Act, shall get himself enrolled with GSTN and submit the details regarding his business electronically on the Common Portal in FORM GST ENR-01, and, upon validation of the details furnished, a unique enrollment number shall be generated and communicated to the said person. CA Mukesh Sharma 46

- 47. 35 (3) Additional Accounts or Documents The Commissioner may notify a class of taxable persons to maintain additional accounts or documents for such purpose as may be specified therein. 35 (4)35 (4) Where the Commissioner considers that any class of taxable persons is not in a position to keep and maintain accounts in accordance with the provisions of this section, he may, for reasons to be recorded in writing, permit such class of taxable persons to maintain accounts in such manner as may be prescribed. CA Mukesh Sharma 47

- 48. 35 (5) Audit and Reconciliation Statement Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed. Rule21 (3) of Return Rules Every registered person whose aggregate turnover during a financial yearEvery registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR-9C, electronically through the Common Portal either directly or through a Facilitation Centre notified by the Commissioner. CA Mukesh Sharma 48

- 49. 35 (6) Subject to the provisions of clause (h) of sub-section (5) of section 17, where the registered person fails to account for the goods or services or both in accordance with the provisions of sub-section (1), the proper officer shall determine the amount of tax payable on the goods or services or both that are not accounted for, as if such goods or services or both had been supplied by such person and the provisions of section 73 or section 74, as the case may be, shall, mutatis mutandis, apply for determination of suchthe case may be, shall, mutatis mutandis, apply for determination of such tax. CA Mukesh Sharma 49

- 50. Sec 36. Period of retention of accounts. Every registered person required to keep and maintain books of account or other records in accordance with the provisions of sub-section (1) of section 35 shall retain them until the expiry of seventy two months from the due date of furnishing of annual return for the year pertaining to such accounts and records. For example: For accounts and records pertaining to Financial Year ’2017-’18, annual return must be filed by 31st December ’2018. These accounts and records must be retained till 31st December ’24. Provided that a registered person, who is a party to an appeal or revision or any other proceedings before any Appellate Authority or Revisional Authority or Appellate Tribunal or court, whether filed by him or by the Commissioner, or is under investigation for an offence under Chapter XIX, shall retain the books of account and other records pertaining to the subject matter of such appeal or revision or proceedings or investigation for a period of one year after final disposal of such appeal or revision or proceedings or investigation, or for the period specified above, whichever is later. CA Mukesh Sharma 50

- 51. Thanks & Regards CA Mukesh Sharma E-mail id: - ca.mukeshsharma@yahoo.comE-mail id: - ca.mukeshsharma@yahoo.com Mob: 9911204002 CA Mukesh Sharma 51