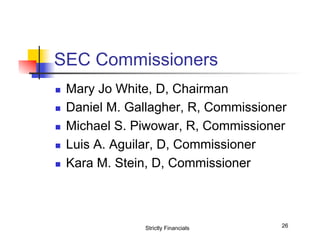

The document discusses the role and functions of the Securities and Exchange Commission (SEC). The SEC was created in the 1930s to restore investor confidence following the stock market crash and regulates companies that issue securities. It requires these companies to disclose important information so investors have access to basic facts. Key SEC filings include annual 10-K reports, quarterly 10-Q reports, and current 8-K reports of material events. The SEC faces challenges in overseeing thousands of public companies with limited resources and staff turnover.