Indiana Public Finance Weekly Review - Market Data & Analysis (02-19-2019)

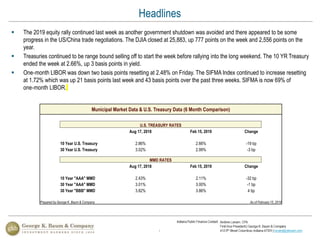

- 1. 1 Municipal Market Data & U.S. Treasury Data (6 Month Comparison) U.S. TREASURY RATES Aug 17, 2018 Feb 15, 2019 Change 10 Year U.S. Treasury 2.86% 2.66% -19 bp 30 Year U.S. Treasury 3.02% 2.99% -3 bp MMD RATES Aug 17, 2018 Feb 15, 2019 Change 10 Year "AAA" MMD 2.43% 2.11% -32 bp 30 Year "AAA" MMD 3.01% 3.00% -1 bp 30 Year "BBB" MMD 3.82% 3.86% 4 bp Prepared by George K. Baum & Company As of February 15, 2019 The 2019 equity rally continued last week as another government shutdown was avoided and there appeared to be some progress in the US/China trade negotiations. The DJIA closed at 25,883, up 777 points on the week and 2,556 points on the year. Treasuries continued to be range bound selling off to start the week before rallying into the long weekend. The 10 YR Treasury ended the week at 2.66%, up 3 basis points in yield. One‐month LIBOR was down two basis points resetting at 2.48% on Friday. The SIFMA Index continued to increase resetting at 1.72% which was up 21 basis points last week and 43 basis points over the past three weeks. SIFMA is now 69% of one‐month LIBOR. Headlines

- 2. 2 Current Municipal Market Data Maturity "AAA" "AA" "A" "BBB" 5-year 1.69% 1.75% 2.10% 2.45% 10-year 2.11% 2.27% 2.59% 2.96% 20-year 2.82% 3.03% 3.32% 3.68% 30-year 3.00% 3.21% 3.51% 3.86% Prepared by George K. Baum & Company As of February 15, 2019 Rates continue to be lower than historical averages. To date, 30 Year ‘AAA’ MMD is 113 basis points below the 20 year historical average. Historical Fixed Rate Analysis UST Rates 'AAA' MMD Bond Buyer Indices Data 10-Year 30-Year 10-Year % UST 30-Year % UST 20 GO 25 Rev Spot Rate 2.66 2.99 2.11 79.2 3.00 100.2 4.24 4.71 1-Mo Prior 2.79 3.10 2.21 79.4 3.06 98.8 4.19 4.66 1-Yr Prior 2.88 3.13 2.46 85.5 3.02 96.4 3.84 4.33 5 Yr Avg 2.34 2.94 2.11 90.0 2.94 100.0 3.75 4.19 10 Yr Avg 2.51 3.33 2.30 91.6 3.40 102.1 4.01 4.58 Historical Data Since February 1999 (20 Years) Min 1.36 2.10 1.31 96.4 1.95 92.9 2.80 2.98 Max 6.77 6.70 5.37 79.4 6.04 90.2 6.09 6.48 Avg 3.58 4.21 3.15 87.8 4.13 98.1 4.44 4.92 Prepared by George K. Baum & Company As of February 15, 2019 Today’s Capital Markets

- 3. 3 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 1 5 10 15 20 25 30 % Maturity As of February 15, 2019 'AAA' MMD 'AA' MMD 'A' MMD 'BBB' MMD Current Market "MMD" Yield CurveCurrent MMD Yield Curve The Current MMD yield curve continues to remain positively sloped. Long Term Fixed Interest Rates

- 4. 4 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 1 5 10 15 20 25 30 % Maturity February 2018 to Present Feb 15, 2019 Jan 18, 2019 Aug 17, 2018 Feb 16, 2018 Historical 'AAA' MMD Yield Curve Since February 16, 2018, 30 Year ‘AAA’ MMD rates have decreased 2 basis points.. Long Term Fixed Interest Rates

- 5. 5 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % February 1999 to Present UST 2 Yr UST 5 Yr UST 10 Yr UST 30 Yr 20 Year Historical U.S. Treasury Data Long Term Fixed Interest Rates

- 6. 6 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % February 1999 to Present 10 Yr 'AAA' MMD 10 Yr 'AAA' MMD Avg 10 Yr UST 10 Yr UST Avg 10 Yr UST to MMD % Current Market "MMD" Yield Curve20 Year Historical 'AAA' MMD & U.S. Treasury Data 10 Year U.S. Treasuries and 10 Year ‘AAA’ MMD remain highly correlated at 97%. Long Term Fixed Interest Rates

- 7. 7 0.00 2.00 4.00 6.00 8.00 10.00 12.00 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 % June 1986 to Present BB 25 Rev Bond Index Average (5.62%) Current (4.71%) Current Market "MMD" Yield CurveHistorical Bond Buyer 25 Revenue Bond Index The Bond Buyer 25 Revenue Bond Index is currently at 4.71% compared to the average of 5.62%. Long Term Fixed Interest Rates

- 8. 8 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % February 2009 to Present SIFMA Swap 30 Yr SIFMA Swap 20 Yr SIFMA Swap 10 Yr 67% 1M LIBOR Swap 30 Yr 67% 1M LIBOR Swap 20 Yr 67% 1M LIBOR Swap 10 Yr Current Market "MMD" Yield Curve10 Year Hist Swap Rates: 10, 20, 30 Yr SIFMA & 67% of 1M LIBOR The 30 Year SIFMA swap rate remained the same, while the 30 Year 67% of 1M LIBOR swap rate increased 2 basis points from the prior week. Long Term Swap Rates

- 9. 9 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % February 1999 to Present SIFMA Index 67% of 1M LIBOR Current Market "MMD" Yield Curve20 Year Variable Rate History: 67% of 1M LIBOR & SIFMA Data The SIFMA Index set at 1.72, up 21 basis points from the prior week. Short Term Variable Interest Rates

- 10. 10 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 1 5 10 15 20 25 30 % Maturity As of February 15, 2019 BBB SIFMA Swap Rate 67% of 1M LIBOR Swap Rate Current Market "MMD" Yield CurveCurrent Market 'BBB' MMD Yield Curve & Swap Rates Current 30 Year 67% of 1M LIBOR swap rates and 30 Year SIFMA swap rates are showing much lower rates than Current ‘BBB’ rates in the market. Current ‘BBB’ MMD & Variable Interest Rates

- 11. 11 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % February 1999 to Present SIFMA Index 1M LIBOR BB 25 Rev Index UST 10 Yr 20 Year Historical Benchmark Rates The following data shows the divergence between current variable and fixed rate indices. Historical Benchmark Rates

- 12. 12 0 50 100 150 200 250 300 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 Spread (bps)% February 1999 to Present 30 Yr 'BBB' MMD Spread 30 Yr 'A' MMD Spread 30 Yr 'AA' MMD Spread 30 Yr 'AAA' MMD Current Market "MMD" Yield Curve20 Year Historical 'AAA' MMD Tax -Exempt Credit Spread Data Current Tax Exempt Credit Spreads are 21, 51, and 86, basis points for ‘AA’, ‘A’, and ‘BBB’ respectively ‘AAA’ MMD Tax-Exempt Credit Spreads

- 13. 13 ($4,000) ($2,000) $0 $2,000 $4,000 $6,000 $8,000 2014 2015 2016 2017 2018 2019 $000's February 2014 to Present 5 Year Historical Municipal Bond Fund Flow Changes Municipal Bond Funds increased by $1.45 Billion from the prior week Municipal Bond Fund Flow Changes

- 14. 14 Money Market Fund Flow Changes Money Market Funds increased $18.69 Billion from the prior week. Tax Exempt Money Market Funds decreased by $2.84 Billion from the prior week. $(70,000) $(50,000) $(30,000) $(10,000) $10,000 $30,000 $50,000 2014 2015 2016 2017 2018 2019 $000's February 2014 to Present 5 Year Historical Money Market Fund Flow Changes $(10,000) $(5,000) $- $5,000 $10,000 $15,000 2014 2015 2016 2017 2018 2019 $000's February 2014 to Present 5 Year Historical Tax-Exempt Money Market Fund Flow Changes

- 15. 15 $- $5,000 $10,000 $15,000 $20,000 $25,000 Oct 2015 Apr 2016 Oct 2016 Apr 2017 Oct 2017 Apr 2018 Oct 2018 $ Millions October 2015 to Present Historical Tax-Exempt Bond Issuance Tax Exempt Bond Issuance increased $8.80 Billion from the prior week. Tax Exempt Bond Issuance

- 16. 16 George K. Baum & Company does not endorse, guaranty or approve, and assumes no responsibility for, the content, accuracy, reliability, or completeness of the information contained in the following presentation. The information in the following presentation was compiled from sources believed to be reliable for informational purposes only. Presentations are intended for educational purposes only and do not replace independent, professional judgment. You should not take, or refrain from taking action based on its content. The opinions expressed by each presenter are theirs alone and may not necessarily represent those of employers, institutions or other entity affiliated with each presenter. Any and all information contained therein is not intended to constitute legal advice and accordingly, you should consult with your own attorneys regarding the application or impact of any of the information for your specific situation, needs or use. Disclaimer