Indiana Public Finance Weekly Review - Market Data & Analysis (04-15-19)

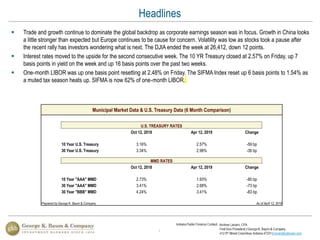

- 1. 1 Municipal Market Data & U.S. Treasury Data (6 Month Comparison) U.S. TREASURY RATES Oct 12, 2018 Apr 12, 2019 Change 10 Year U.S. Treasury 3.16% 2.57% -59 bp 30 Year U.S. Treasury 3.34% 2.98% -36 bp MMD RATES Oct 12, 2018 Apr 12, 2019 Change 10 Year "AAA" MMD 2.73% 1.93% -80 bp 30 Year "AAA" MMD 3.41% 2.68% -73 bp 30 Year "BBB" MMD 4.24% 3.41% -83 bp Prepared by George K. Baum & Company As of April 12, 2019 Trade and growth continue to dominate the global backdrop as corporate earnings season was in focus. Growth in China looks a little stronger than expected but Europe continues to be cause for concern. Volatility was low as stocks took a pause after the recent rally has investors wondering what is next. The DJIA ended the week at 26,412, down 12 points. Interest rates moved to the upside for the second consecutive week. The 10 YR Treasury closed at 2.57% on Friday, up 7 basis points in yield on the week and up 16 basis points over the past two weeks. One‐month LIBOR was up one basis point resetting at 2.48% on Friday. The SIFMA Index reset up 6 basis points to 1.54% as a muted tax season heats up. SIFMA is now 62% of one‐month LIBOR. Headlines

- 2. 2 Current Municipal Market Data Maturity "AAA" "AA" "A" "BBB" 5-year 1.67% 1.73% 1.99% 2.31% 10-year 1.93% 2.05% 2.29% 2.63% 20-year 2.50% 2.70% 2.93% 3.23% 30-year 2.68% 2.88% 3.11% 3.41% Prepared by George K. Baum & Company As of April 12, 2019 Historical Fixed Rate Analysis UST Rates 'AAA' MMD Bond Buyer Indices Data 10-Year 30-Year 10-Year % UST 30-Year % UST 20 GO 25 Rev Spot Rate 2.57 2.98 1.93 75.2 2.68 90.0 3.85 4.32 1-Mo Prior 2.59 3.01 2.04 78.8 2.85 94.6 4.04 4.51 1-Yr Prior 2.83 3.03 2.39 84.5 2.94 97.1 3.85 4.33 5 Yr Avg 2.34 2.92 2.09 89.6 2.91 99.8 3.74 4.16 10 Yr Avg 2.50 3.32 2.28 91.1 3.37 101.5 4.00 4.57 Historical Data Since April 1999 (20 Years) Min 1.36 2.10 1.31 96.4 1.95 92.9 2.80 2.98 Max 6.77 6.70 5.37 79.4 6.04 90.2 6.09 6.48 Avg 3.56 4.19 3.13 87.8 4.11 98.2 4.44 4.92 Prepared by George K. Baum & Company As of April 12, 2019 Rates continue to be lower than historical averages. To date, 30 Year ‘AAA’ MMD is 143 basis points below the 20 year historical average. Today’s Capital Markets

- 3. 3 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 1 5 10 15 20 25 30 % Maturity As of April 12, 2019 'AAA' MMD 'AA' MMD 'A' MMD 'BBB' MMD Current Market "MMD" Yield CurveCurrent MMD Yield Curve The Current MMD yield curve continues to remain positively sloped. Long Term Fixed Interest Rates

- 4. 4 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 1 5 10 15 20 25 30 % Maturity April 2018 to Present Apr 12, 2019 Mar 15, 2019 Oct 12, 2018 Apr 13, 2018 Historical 'AAA' MMD Yield Curve Long Term Fixed Interest Rates Since April 13, 2018, 30 Year ‘AAA’ MMD rates have decreased 26 basis points.

- 5. 5 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % April 1999 to Present UST 2 Yr UST 5 Yr UST 10 Yr UST 30 Yr 20 Year Historical U.S. Treasury Data Long Term Fixed Interest Rates

- 6. 6 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % April 1999 to Present 10 Yr 'AAA' MMD 10 Yr 'AAA' MMD Avg 10 Yr UST 10 Yr UST Avg 10 Yr UST to MMD % Current Market "MMD" Yield Curve20 Year Historical 'AAA' MMD & U.S. Treasury Data 10 Year U.S. Treasuries and 10 Year ‘AAA’ MMD remain highly correlated at 97%. Long Term Fixed Interest Rates

- 7. 7 0.00 2.00 4.00 6.00 8.00 10.00 12.00 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 % August 1986 to Present BB 25 Rev Bond Index Average (5.61%) Current (4.32%) Current Market "MMD" Yield CurveHistorical Bond Buyer 25 Revenue Bond Index The Bond Buyer 25 Revenue Bond Index is currently at 4.32% compared to the average of 5.61%. Long Term Fixed Interest Rates

- 8. 8 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % April 2009 to Present SIFMA Swap 30 Yr SIFMA Swap 20 Yr SIFMA Swap 10 Yr 67% 1M LIBOR Swap 30 Yr 67% 1M LIBOR Swap 20 Yr 67% 1M LIBOR Swap 10 Yr Current Market "MMD" Yield Curve10 Year Hist Swap Rates: 10, 20, 30 Yr SIFMA & 67% of 1M LIBOR The 30 Year SIFMA swap rate increased 5 basis points, while the 30 Year 67% of 1M LIBOR swap rate increased 5 basis points from the prior week. Long Term Swap Rates

- 9. 9 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % April 1999 to Present SIFMA Index 67% of 1M LIBOR SIFMA Index Current Market "MMD" Yield Curve20 Year Variable Rate History: 67% of 1M LIBOR & SIFMA DataCurrent Market "MMD" Yield Curve20 Year Variable Rate History: 67% of 1M LIBOR & SIFMA Data The SIFMA Index set at 1.54, up 6 basis points from the prior week. Short Term Variable Interest Rates

- 10. 10 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 1 5 10 15 20 25 30 % Maturity As of April 12, 2019 BBB SIFMA Swap Rate 67% of 1M LIBOR Swap Rate Current Market "MMD" Yield CurveCurrent Market 'BBB' MMD Yield Curve & Swap Rates Current 30 Year 67% of 1M LIBOR swap rates and 30 Year SIFMA swap rates are showing much lower rates than Current ‘BBB’ rates in the market. Current ‘BBB’ MMD & Variable Interest Rates

- 11. 11 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 % April 1999 to Present SIFMA Index 1M LIBOR BB 25 Rev Index UST 10 Yr 20 Year Historical Benchmark Rates The following data shows the divergence between current variable and fixed rate indices. Historical Benchmark Rates

- 12. 12 0 50 100 150 200 250 300 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 2019 Spread (bps)% April 1999 to Present 30 Yr 'BBB' MMD Spread 30 Yr 'A' MMD Spread 30 Yr 'AA' MMD Spread 30 Yr 'AAA' MMD Current Market "MMD" Yield Curve20 Year Historical 'AAA' MMD Tax -Exempt Credit Spread Data Current Tax Exempt Credit Spreads are 20, 43, and 73, basis points for ‘AA’, ‘A’, and ‘BBB’ respectively ‘AAA’ MMD Tax-Exempt Credit Spreads

- 13. 13 ($4,000) ($2,000) $0 $2,000 $4,000 $6,000 $8,000 2014 2015 2016 2017 2018 2019 $000's April 2014 to Present 5 Year Historical Municipal Bond Fund Flow Changes Municipal Bond Funds increased by $833 Million from the prior week Municipal Bond Fund Flow Changes

- 14. 14 Money Market Fund Flow Changes Tax Exempt Money Market Funds decreased $2.14 Billion from the prior week. Money Market Funds decreased $8.64 Billion from the prior week. $(70,000) $(50,000) $(30,000) $(10,000) $10,000 $30,000 $50,000 2014 2015 2016 2017 2018 2019 $000's April 2014 to Present 5 Year Historical Money Market Fund Flow Changes $(10,000) $(5,000) $- $5,000 $10,000 $15,000 2014 2015 2016 2017 2018 2019 $000's April 2014 to Present 5 Year Historical Tax-Exempt Money Market Fund Flow Changes

- 15. 15 $- $5,000 $10,000 $15,000 $20,000 $25,000 Dec 2015 Jun 2016 Dec 2016 Jun 2017 Dec 2017 Jun 2018 Dec 2018 $ Millions December 2015 to Present Historical Tax-Exempt Bond Issuance Tax Exempt Bond Issuance increased by $6.45 Billion from the prior week. Tax Exempt Bond Issuance

- 16. 16 George K. Baum & Company does not endorse, guaranty or approve, and assumes no responsibility for, the content, accuracy, reliability, or completeness of the information contained in the following presentation. The information in the following presentation was compiled from sources believed to be reliable for informational purposes only. Presentations are intended for educational purposes only and do not replace independent, professional judgment. You should not take, or refrain from taking action based on its content. The opinions expressed by each presenter are theirs alone and may not necessarily represent those of employers, institutions or other entity affiliated with each presenter. Any and all information contained therein is not intended to constitute legal advice and accordingly, you should consult with your own attorneys regarding the application or impact of any of the information for your specific situation, needs or use. Disclaimer