Family3 Time

•Download as PPT, PDF•

1 like•664 views

Report

Share

Report

Share

Recommended

BpSM 2014.09. - Sebestyén Endre: Alternatív splicing változások elemzése rákg...

BpSM 2014.09. - Sebestyén Endre: Alternatív splicing változások elemzése rákg...Budapest Science Meetup

Costruire la comunicazione di un master in social media marketing

Costruire la comunicazione di un master in social media marketingSocial Media Marketing & Digital Communication - Executive Master SDC IULM

More Related Content

Viewers also liked

BpSM 2014.09. - Sebestyén Endre: Alternatív splicing változások elemzése rákg...

BpSM 2014.09. - Sebestyén Endre: Alternatív splicing változások elemzése rákg...Budapest Science Meetup

Costruire la comunicazione di un master in social media marketing

Costruire la comunicazione di un master in social media marketingSocial Media Marketing & Digital Communication - Executive Master SDC IULM

Viewers also liked (20)

Beatriz Armendariz –Professor at the University College London and Harvard Un...

Beatriz Armendariz –Professor at the University College London and Harvard Un...

BpSM 2014.09. - Sebestyén Endre: Alternatív splicing változások elemzése rákg...

BpSM 2014.09. - Sebestyén Endre: Alternatív splicing változások elemzése rákg...

Mobile growth demands more from content - Future Female Seminar

Mobile growth demands more from content - Future Female Seminar

Costruire la comunicazione di un master in social media marketing

Costruire la comunicazione di un master in social media marketing

Social media in an accessible learning perspective

Social media in an accessible learning perspective

Similar to Family3 Time

Similar to Family3 Time (18)

Strayer UniversityProfessor Dr. Angela ParhamPAD 500.docx

Strayer UniversityProfessor Dr. Angela ParhamPAD 500.docx

Invisible Sweatshop - The Plight of Home Care Workers in NYC

Invisible Sweatshop - The Plight of Home Care Workers in NYC

Insert your surname 3NameInstructorInstitutionDate.docx

Insert your surname 3NameInstructorInstitutionDate.docx

Federal minimum wage, tax transfer earnings supplements and poverty

Federal minimum wage, tax transfer earnings supplements and poverty

More from victoriavernon

More from victoriavernon (19)

Recently uploaded

Recently uploaded (20)

Call Girls in Dwarka Mor Delhi Contact Us 9654467111

Call Girls in Dwarka Mor Delhi Contact Us 9654467111

A Critique of the Proposed National Education Policy Reform

A Critique of the Proposed National Education Policy Reform

BAG TECHNIQUE Bag technique-a tool making use of public health bag through wh...

BAG TECHNIQUE Bag technique-a tool making use of public health bag through wh...

Measures of Central Tendency: Mean, Median and Mode

Measures of Central Tendency: Mean, Median and Mode

Measures of Dispersion and Variability: Range, QD, AD and SD

Measures of Dispersion and Variability: Range, QD, AD and SD

The byproduct of sericulture in different industries.pptx

The byproduct of sericulture in different industries.pptx

Z Score,T Score, Percential Rank and Box Plot Graph

Z Score,T Score, Percential Rank and Box Plot Graph

Ecosystem Interactions Class Discussion Presentation in Blue Green Lined Styl...

Ecosystem Interactions Class Discussion Presentation in Blue Green Lined Styl...

Disha NEET Physics Guide for classes 11 and 12.pdf

Disha NEET Physics Guide for classes 11 and 12.pdf

Separation of Lanthanides/ Lanthanides and Actinides

Separation of Lanthanides/ Lanthanides and Actinides

Family3 Time

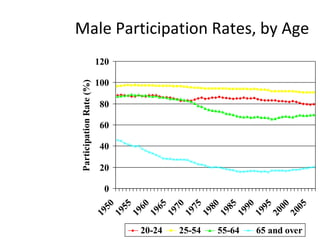

- 1. Male Participation Rates, by Age

- 3. Female Participation Rates, by Age Most of the rise in participation rate is due to a rise in participation among married women . This is a surprising result since the rise in real wages of married men would have tended to decrease participation rates of married women

- 7. Female Participation Rates, by Race

- 8. Male Participation Rates, by Race

- 11. Why Have Hours of Work Remained Stable since 1945

- 19. Budget Constraint Leisure Income/day 24 0 Budget constraint shows the combinations of income and leisure that a worker could get given a wage rate $120 At a wage rate of $5, a worker could get a maximum income of $120 per day ($5/hour * 24 ) At a wage rate of $10, a worker could get a maximum income of $240 per day. At a wage rate of $15, worker could get a maximum income of $360 per day. $240 $360 Slope of budget constraint (rise/run) = wage rate

- 20. Utility Maximization Leisure Income/day 24 0 The optimal or utility maximizing point is where the budget constraint is tangent to the highest attainable indifference curve $240 U 1 U 2 U 3 16 $80 A At a wage rate of $10/hour, the optimal hours of leisure is 16 (8 hours of work) at point A $360

- 21. Utility Maximization Leisure Income/day 24 0 The optimal or utility maximizing point is where the budget constraint is tangent to the highest attainable indifference curve $240 U 2 U 3 16 $80 A If the wage rate rises to $15/hour, the optimal hours of leisure is 15 at point B B At a wage rate of $10/hour, the optimal hours of leisure is 16 (8 hours of work) at point A 15 $360

- 22. Utility Maximization Leisure Income/day 24 0 $240 U 2 U 3 15 16 17 $80 A Income effect is measured through a parallel shift of the old budget constraint, from A to C (from 16 to 17 hours of leisure). Substitution effect is measured by movement along U 3 , from C to B (from 17 to 15 hours of leisure). Net effect is an increase of hours of work by 1 hour. B C Income and substitution effects

Editor's Notes

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09

- 08/31/09