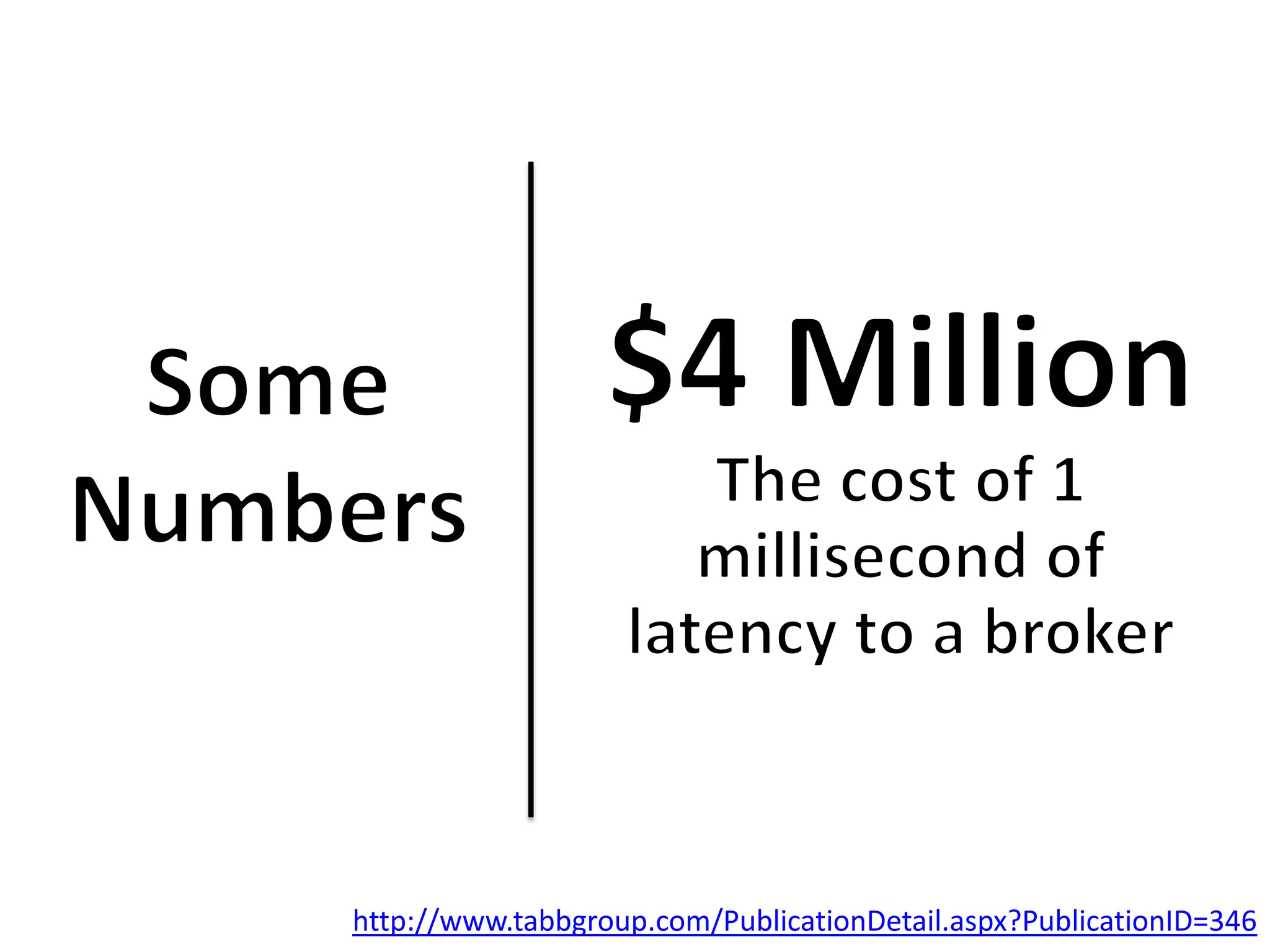

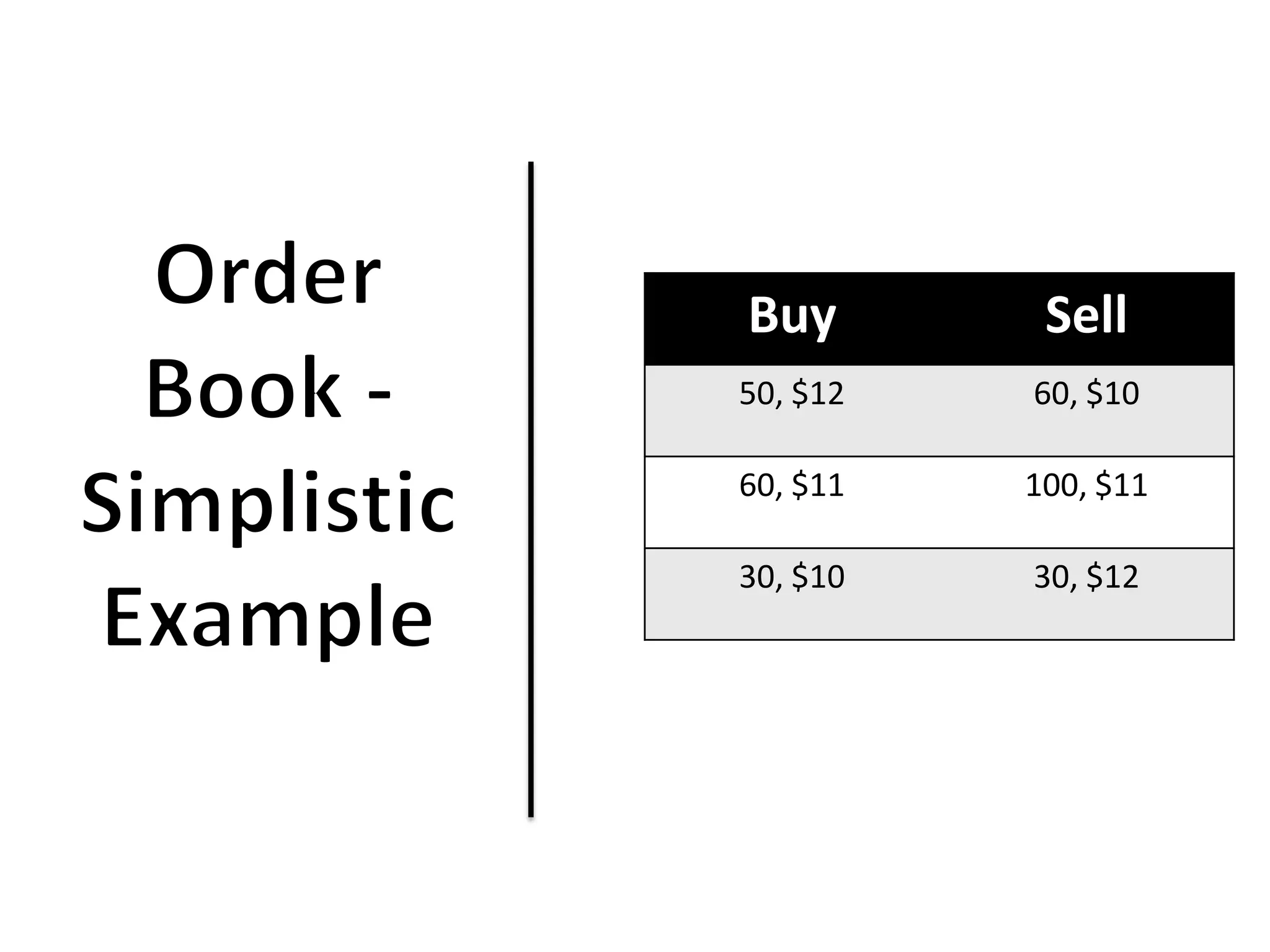

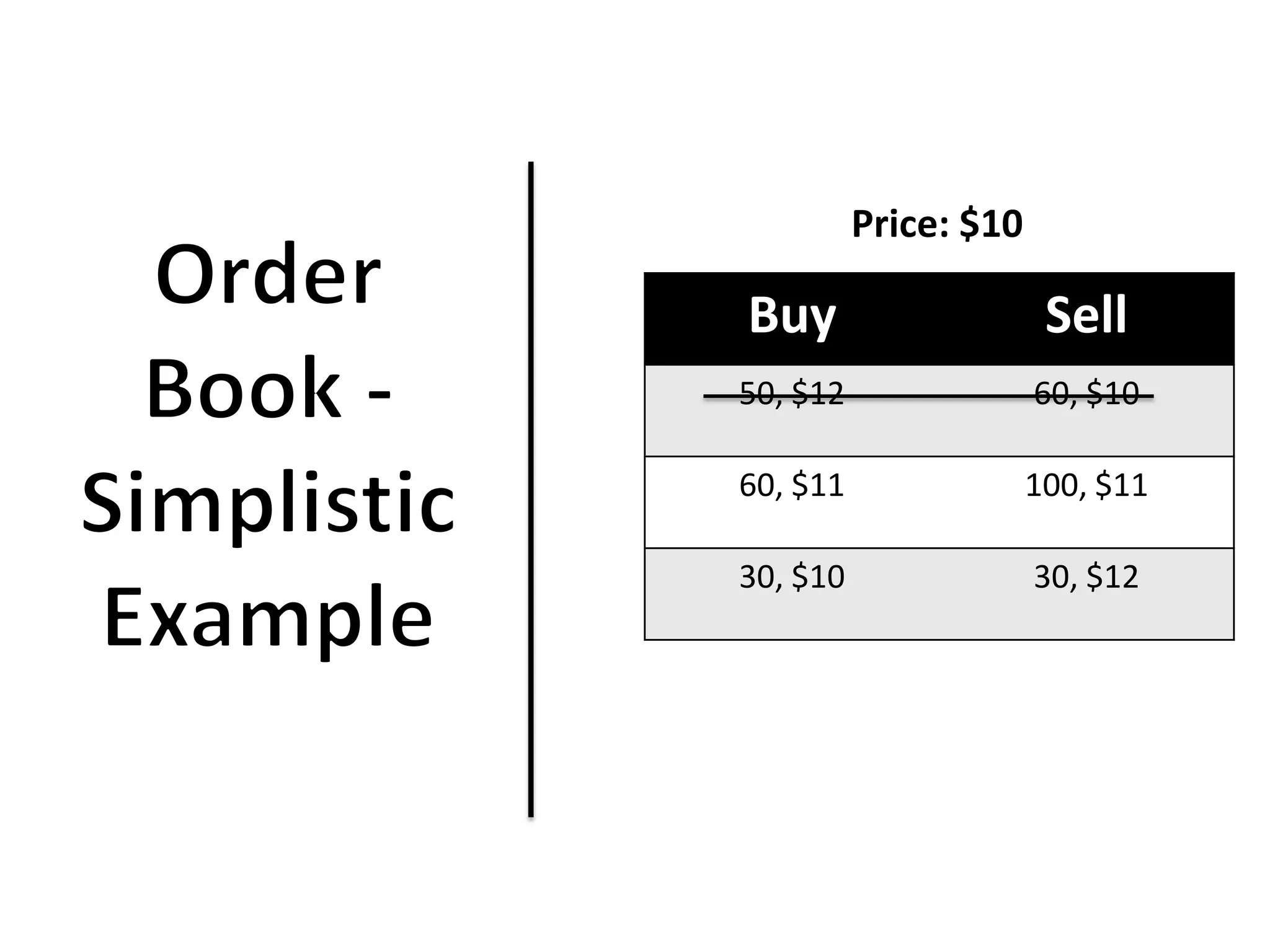

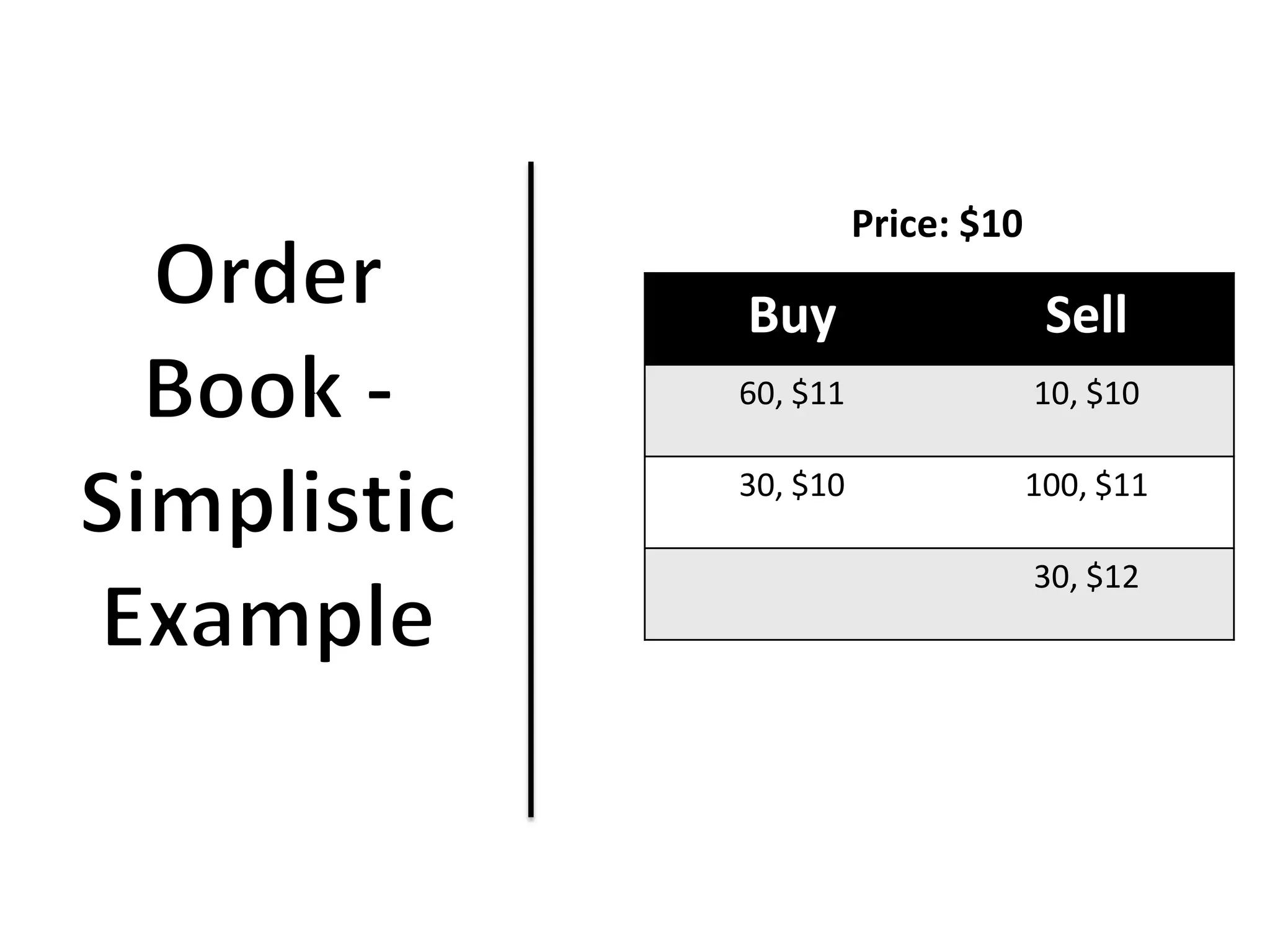

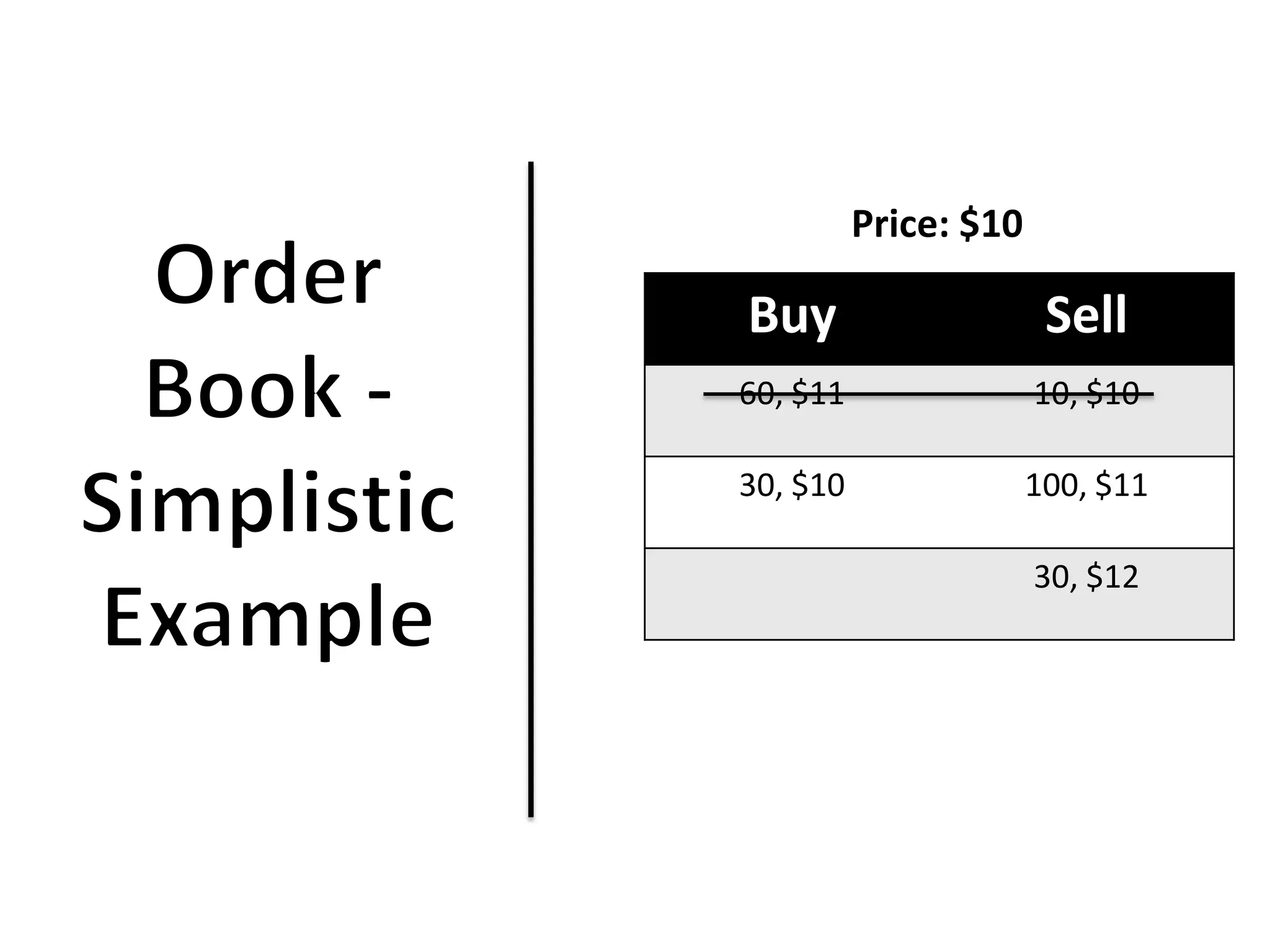

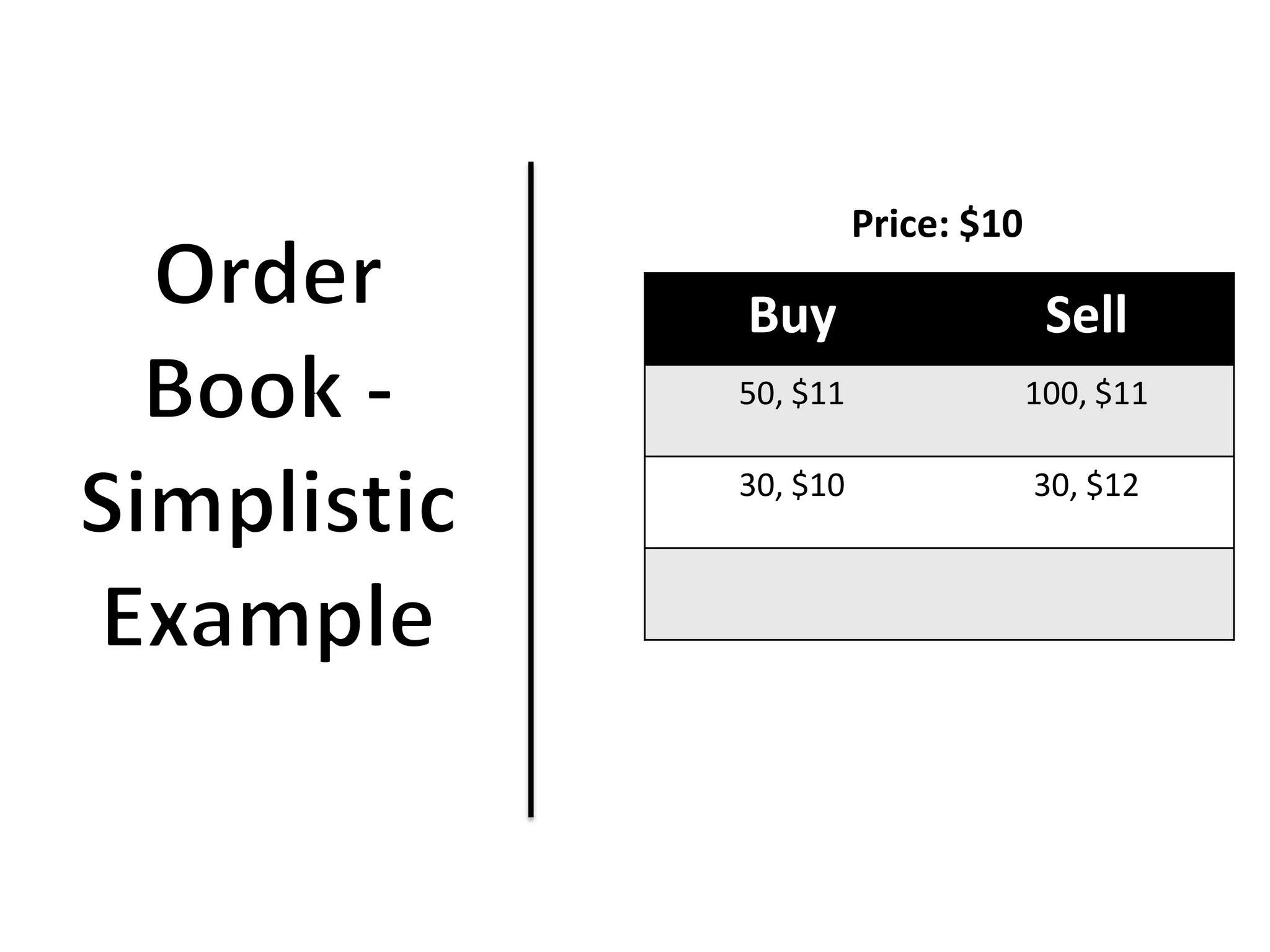

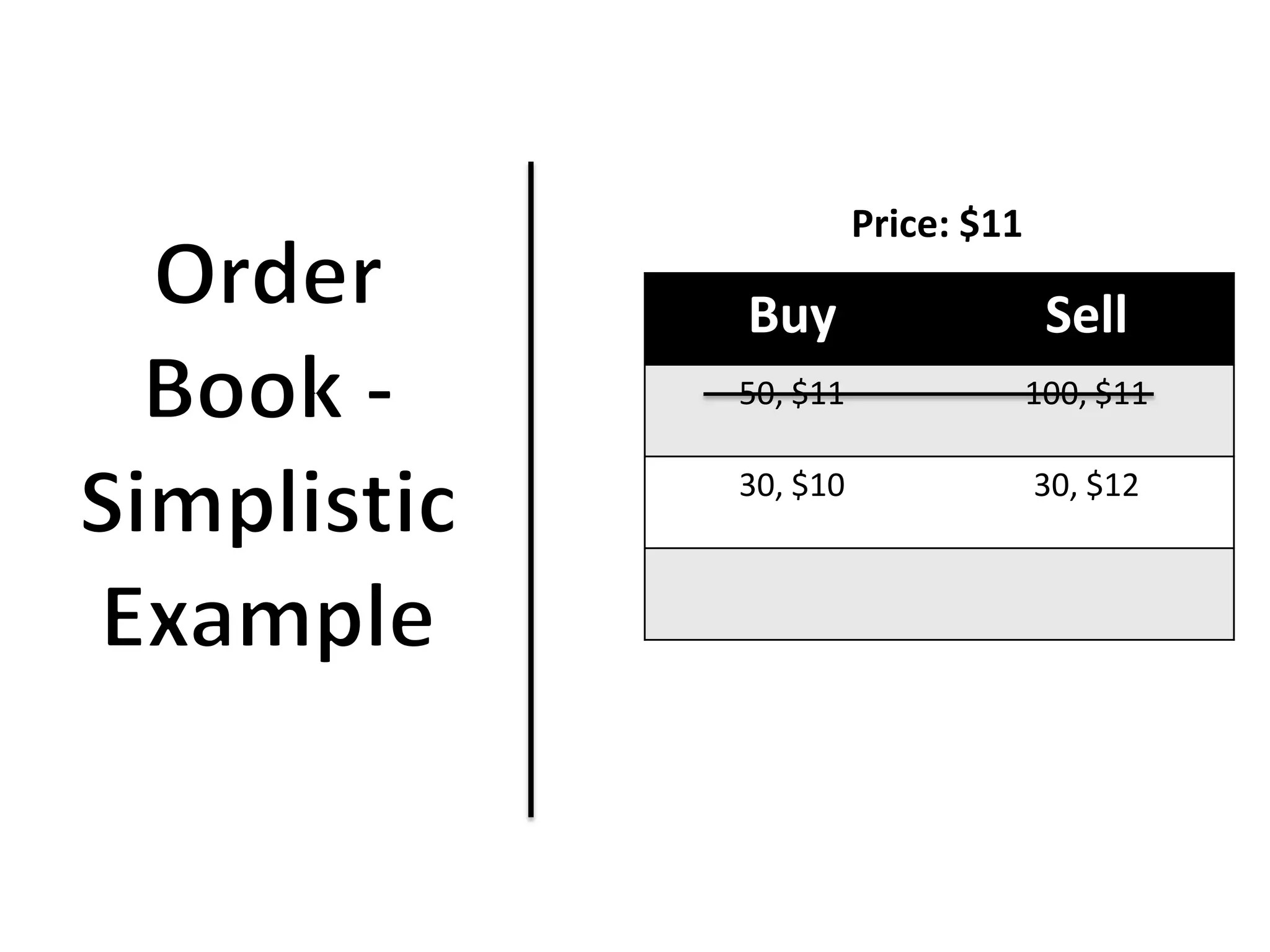

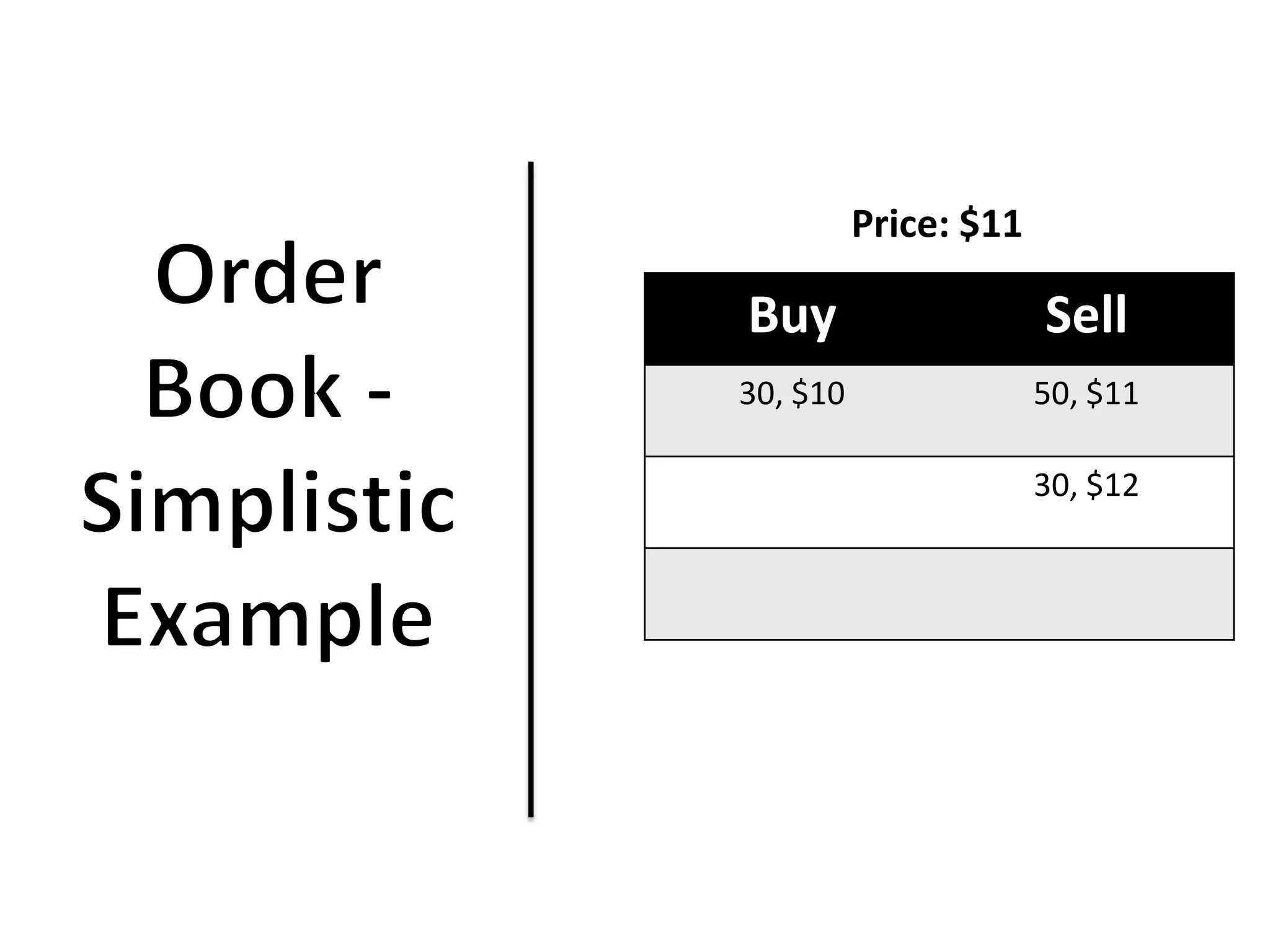

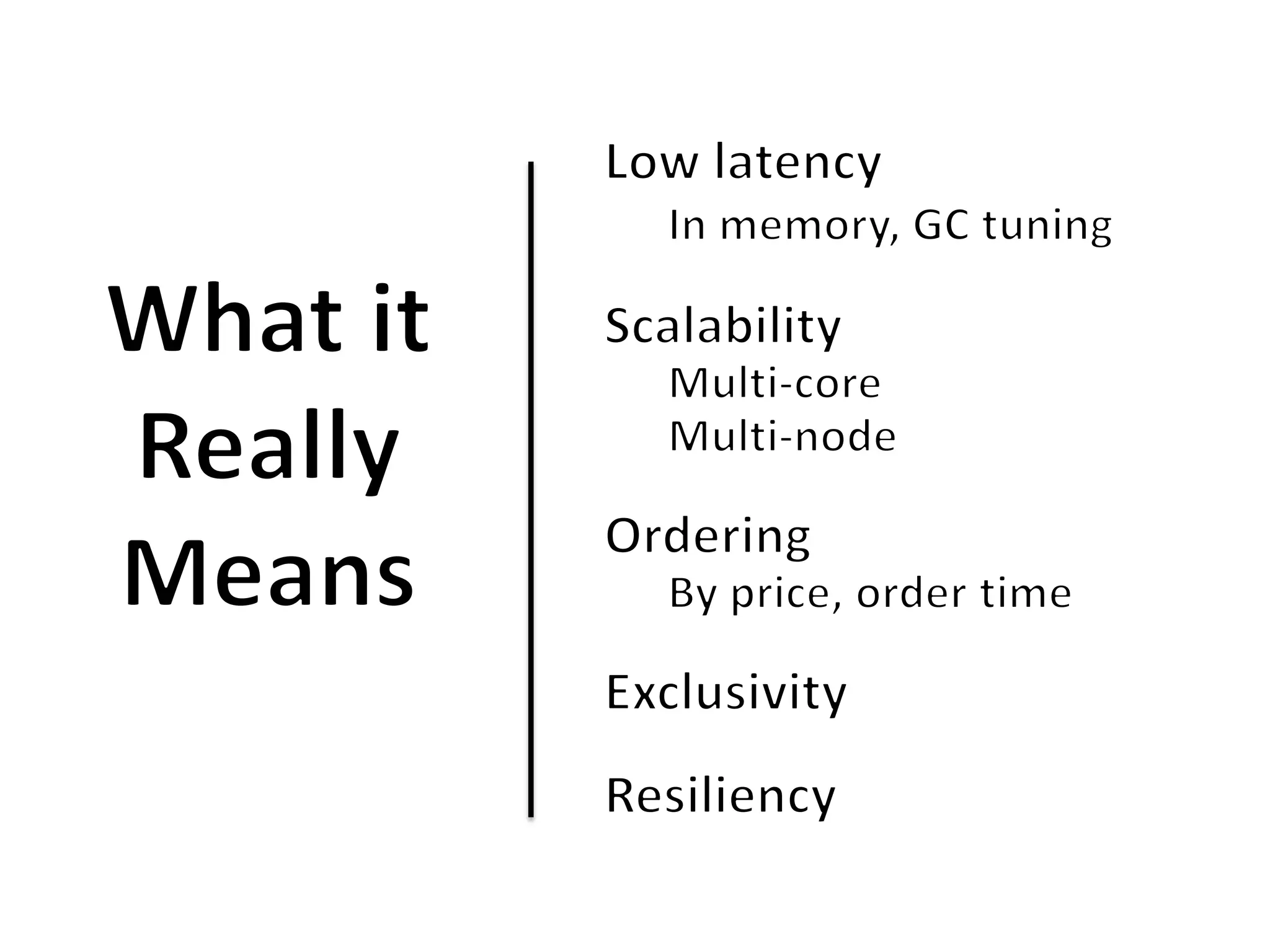

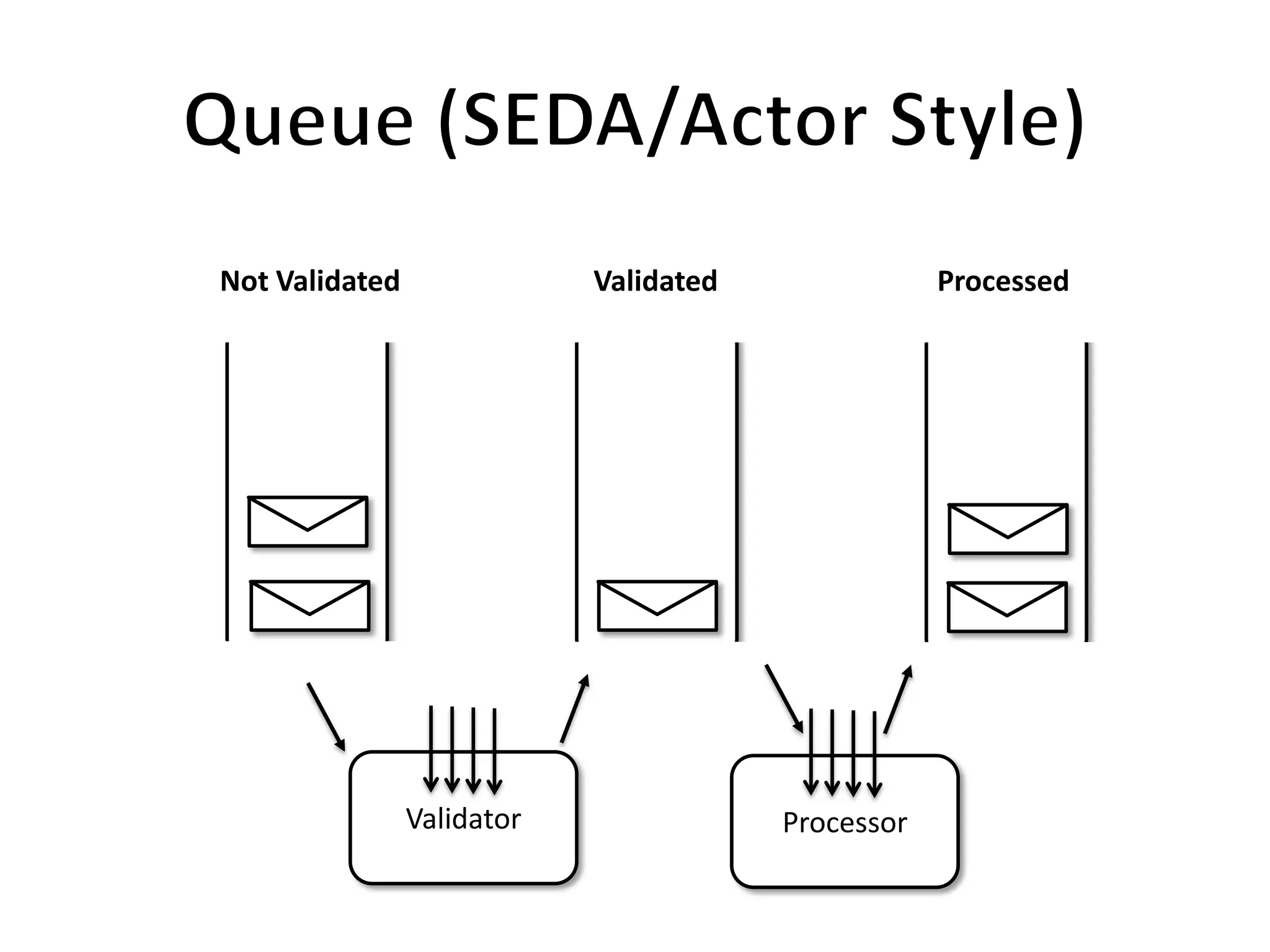

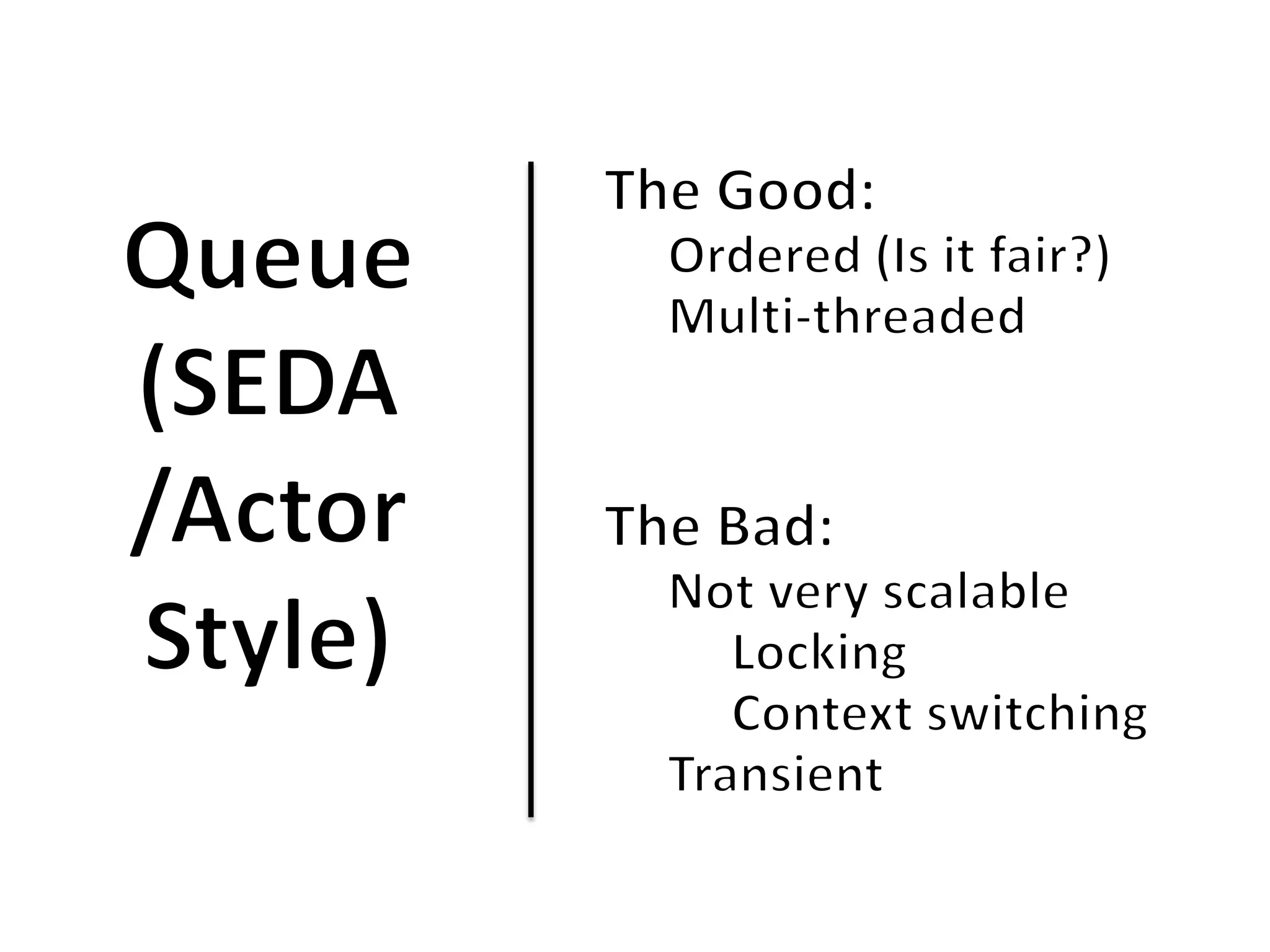

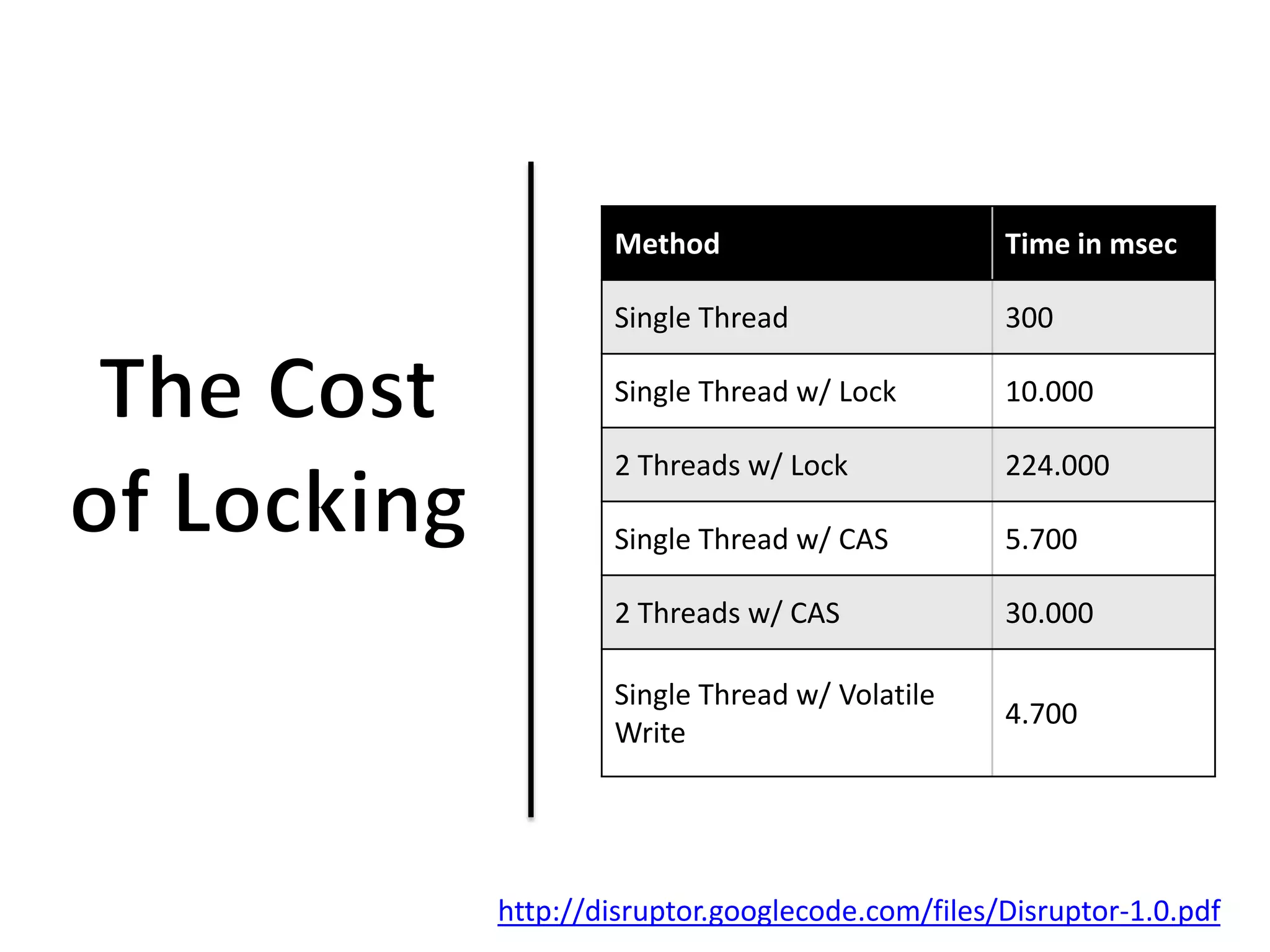

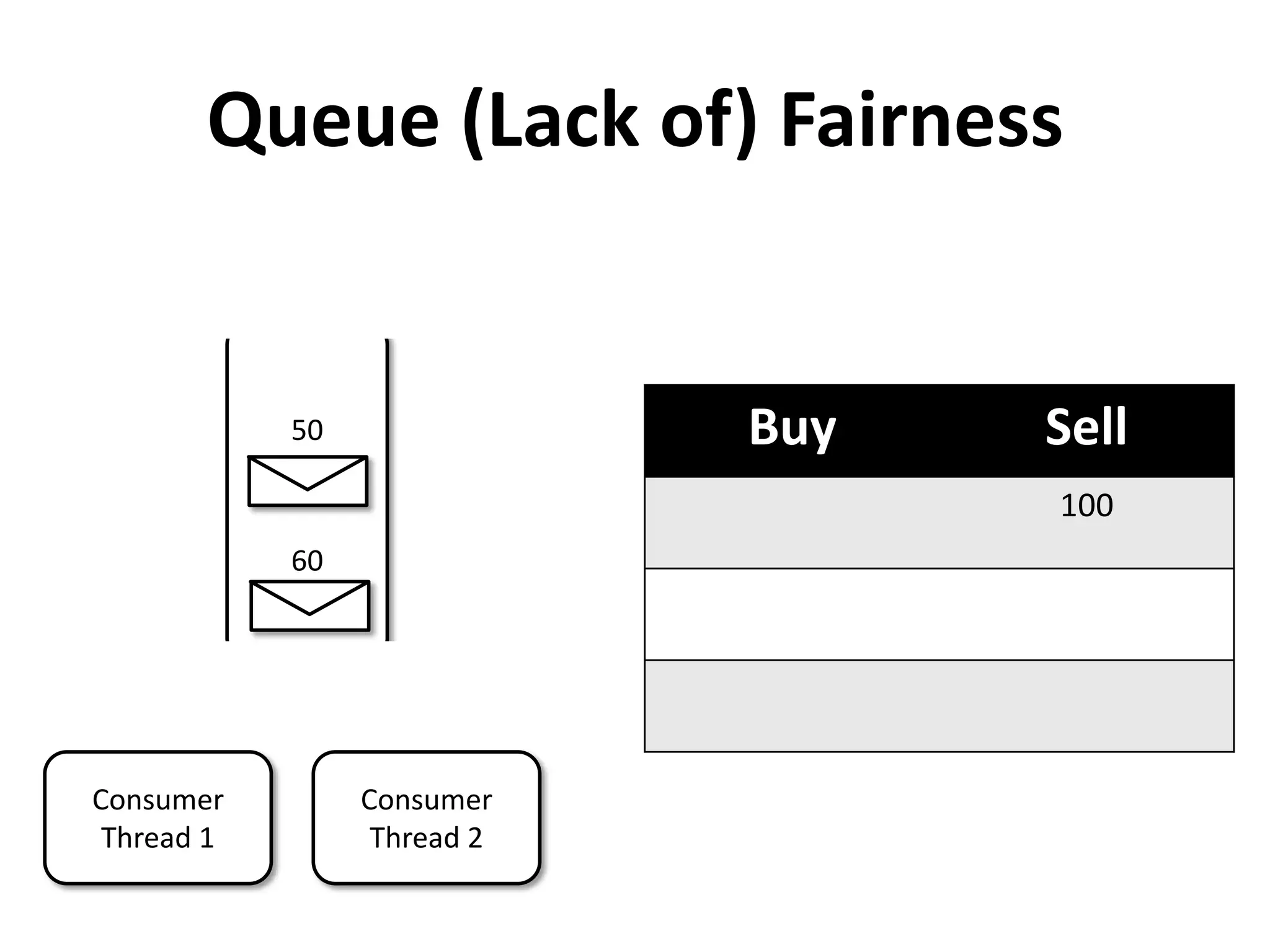

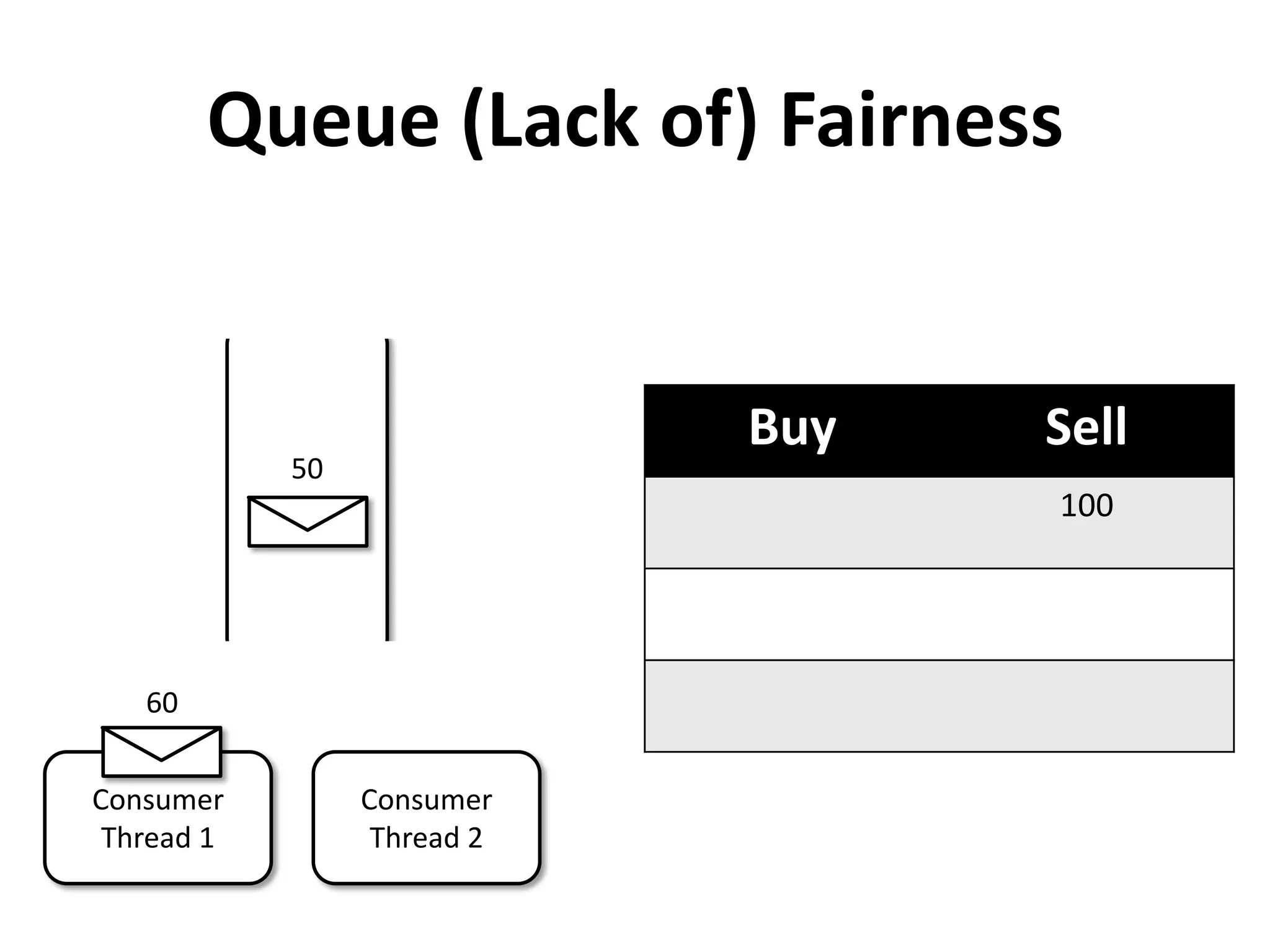

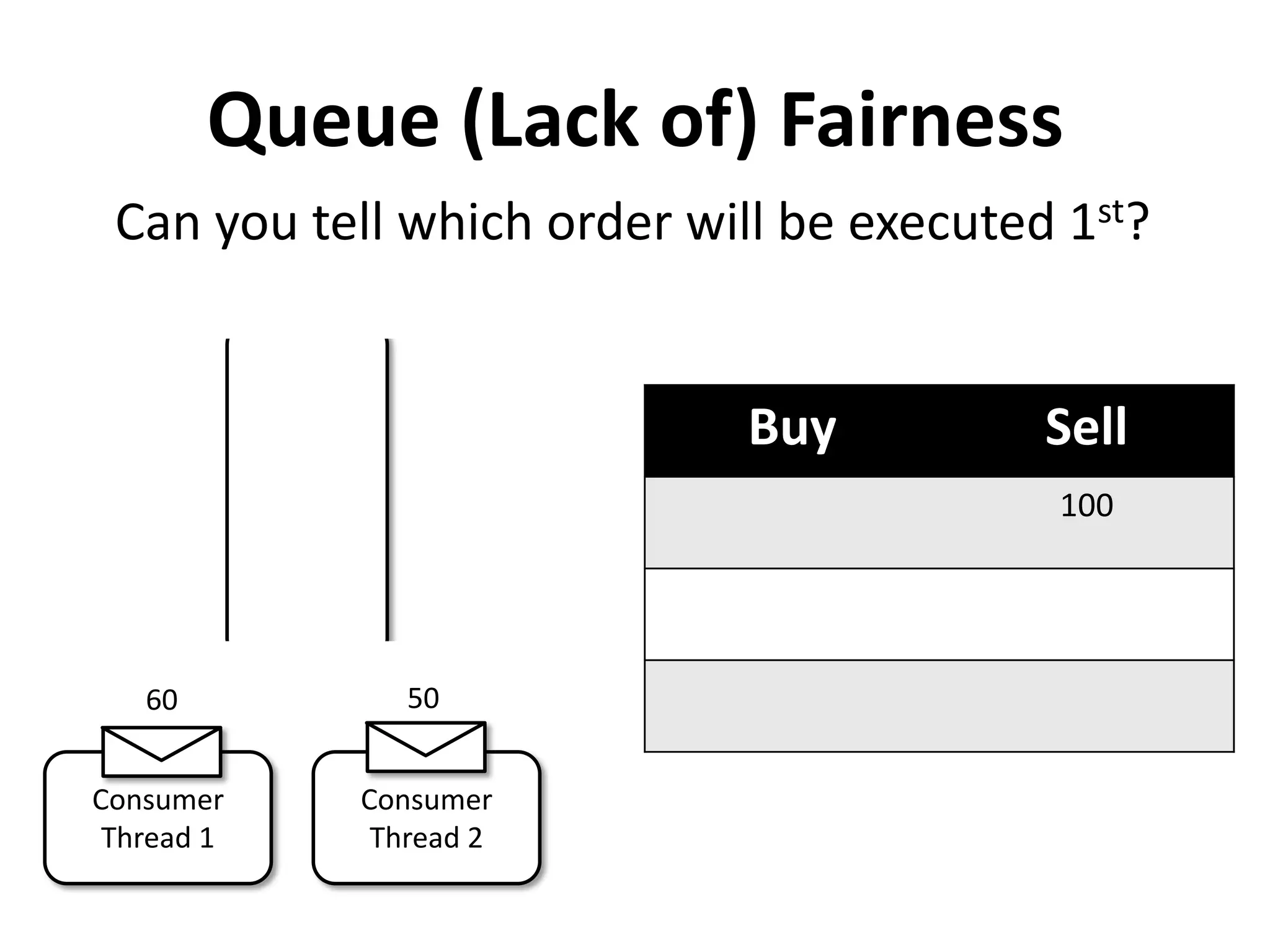

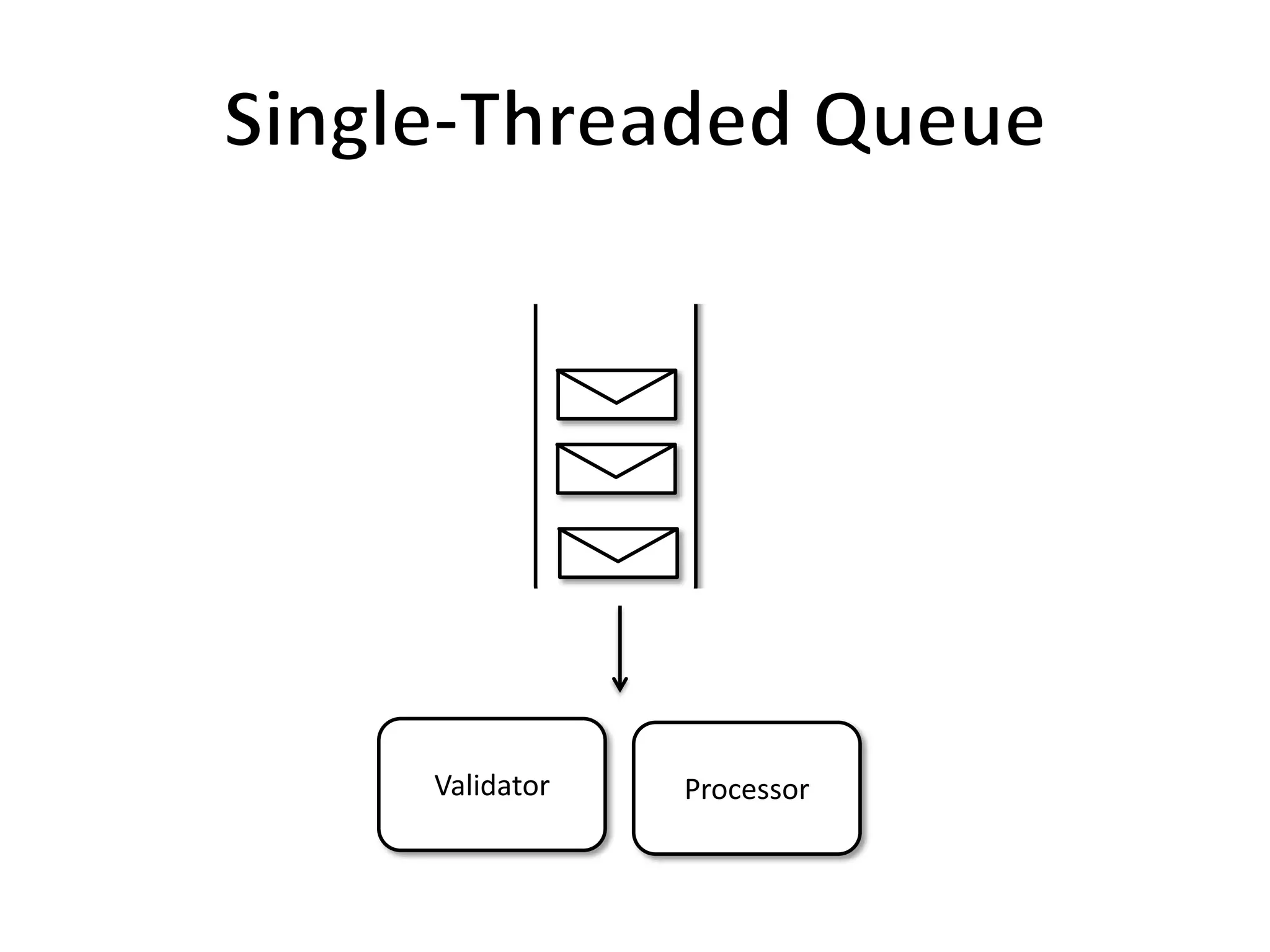

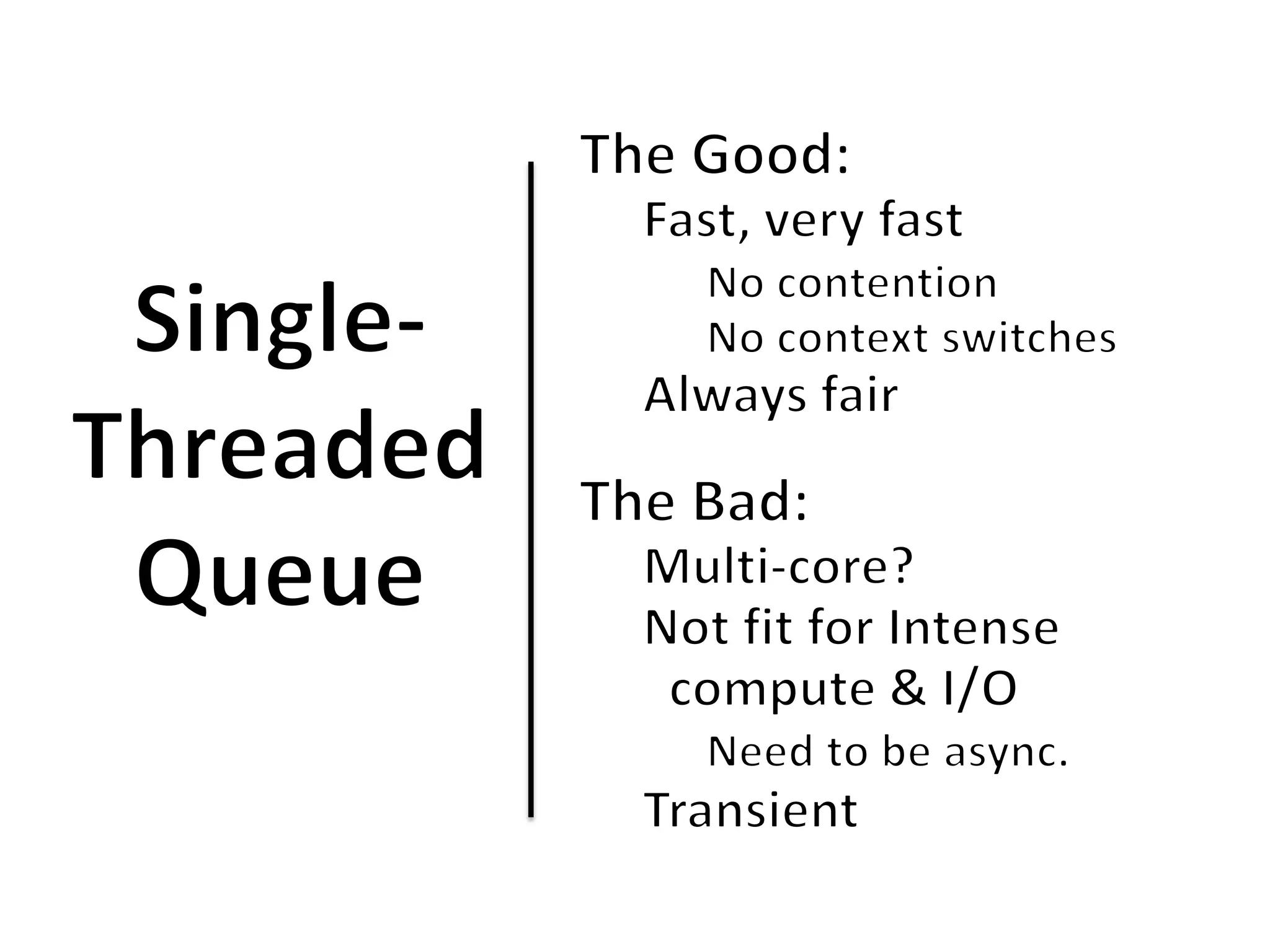

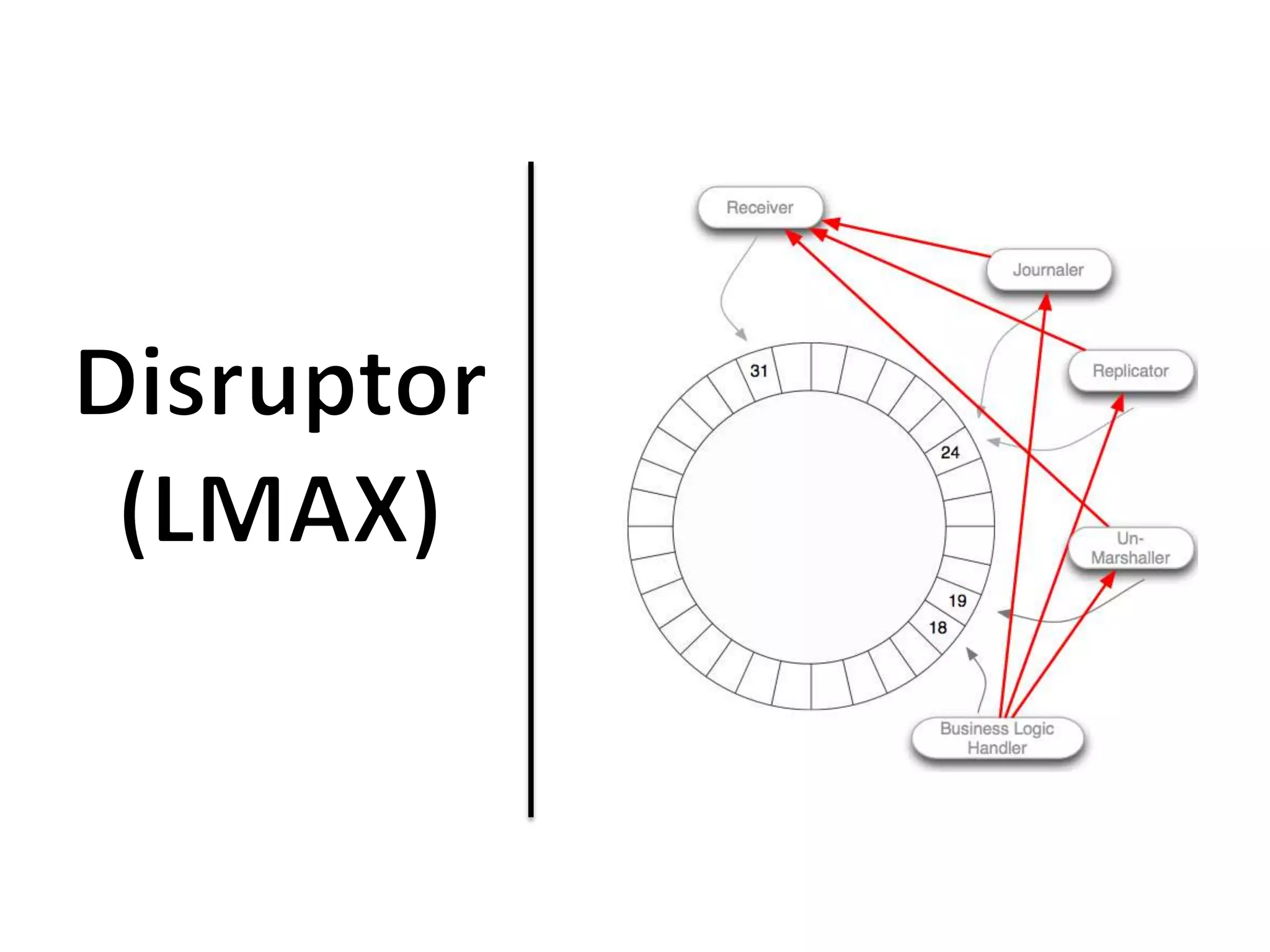

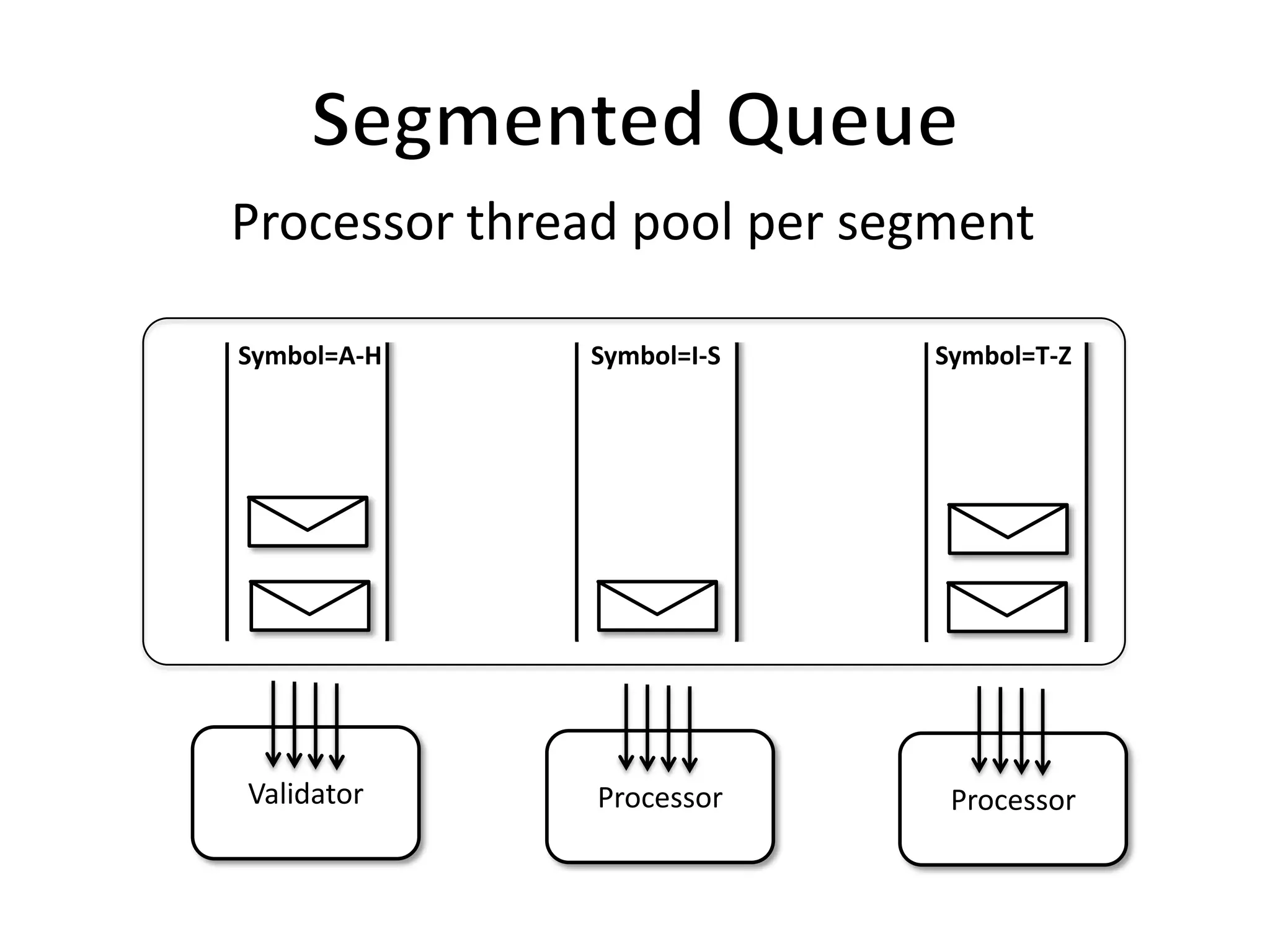

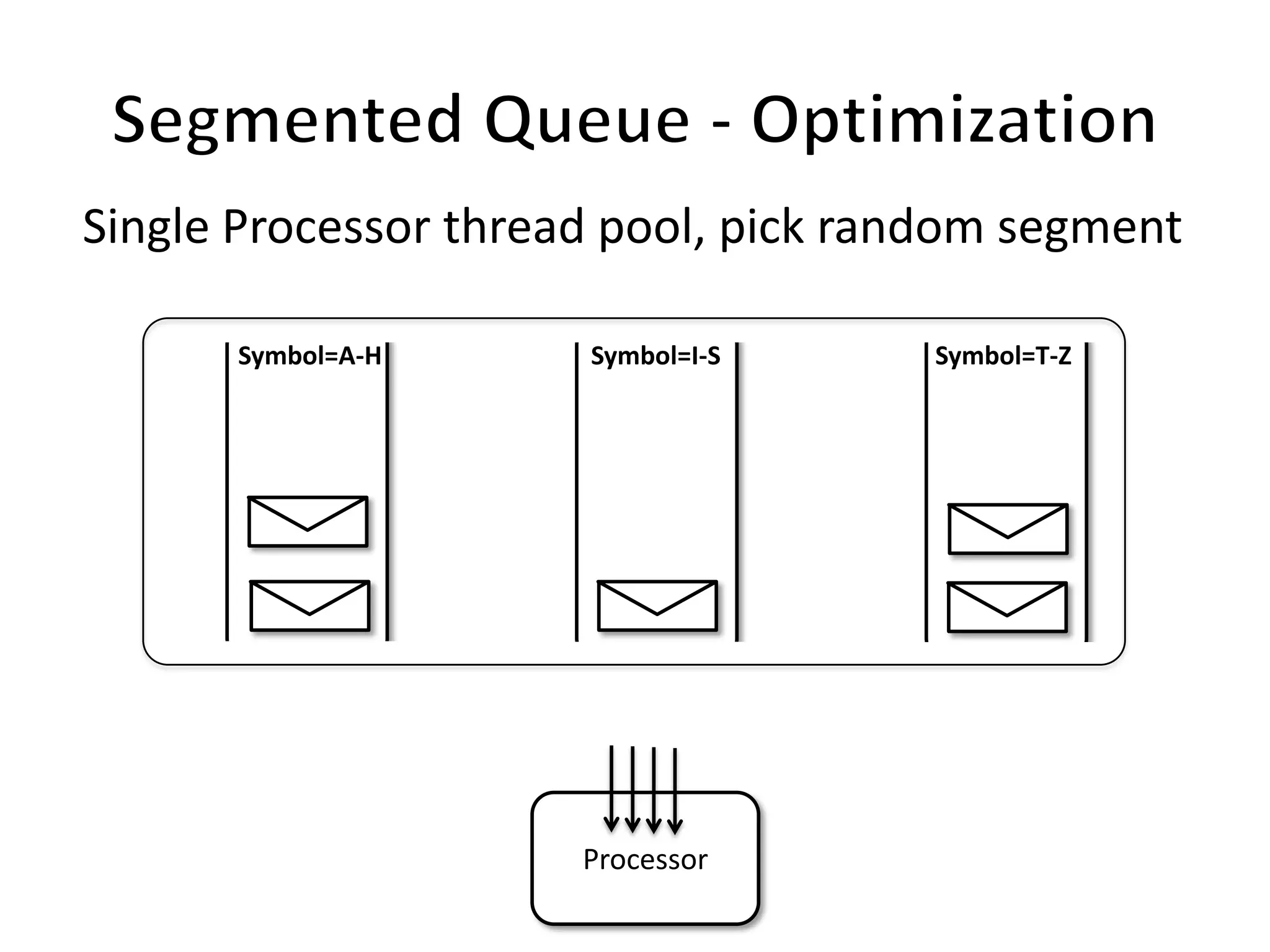

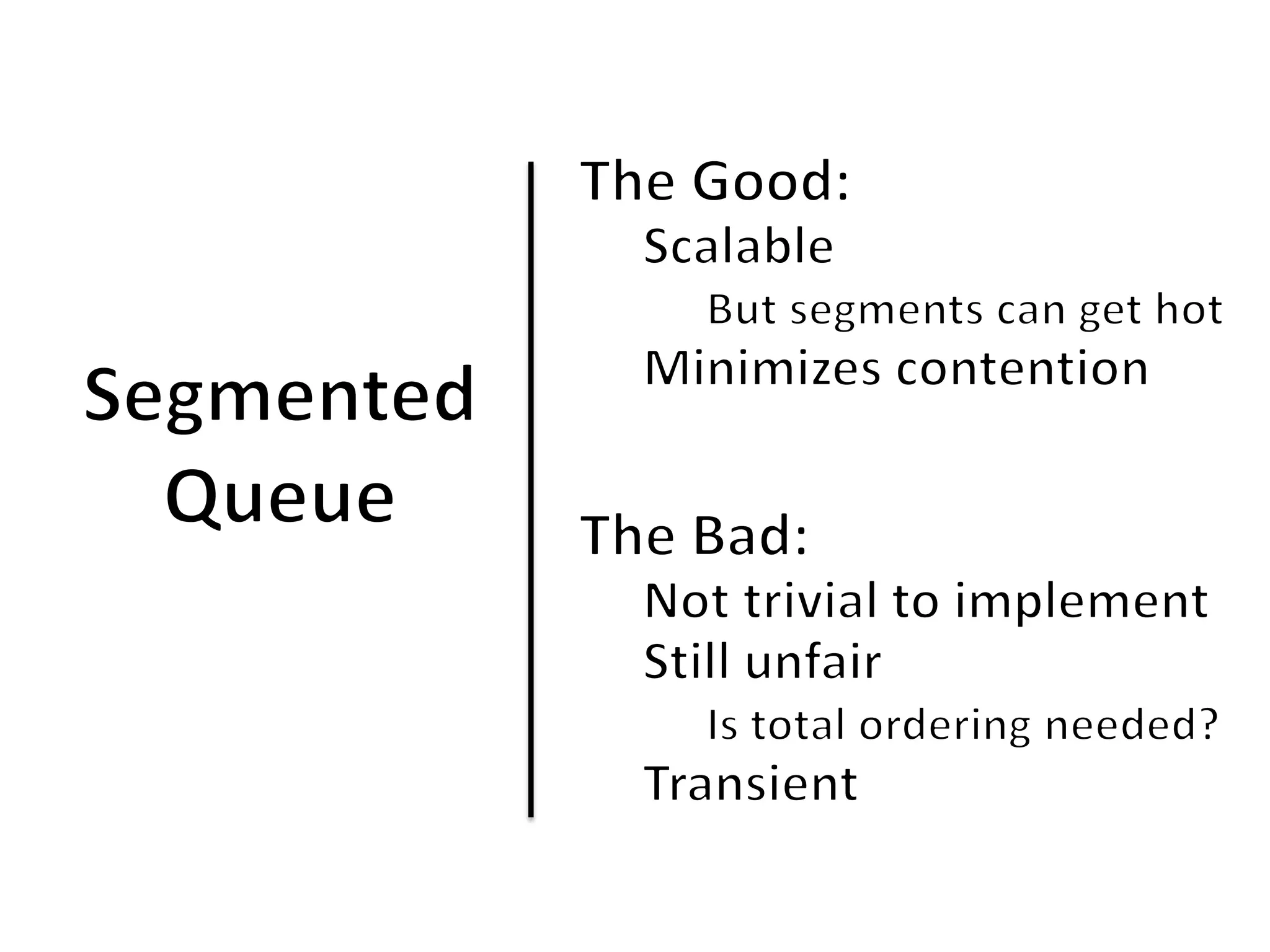

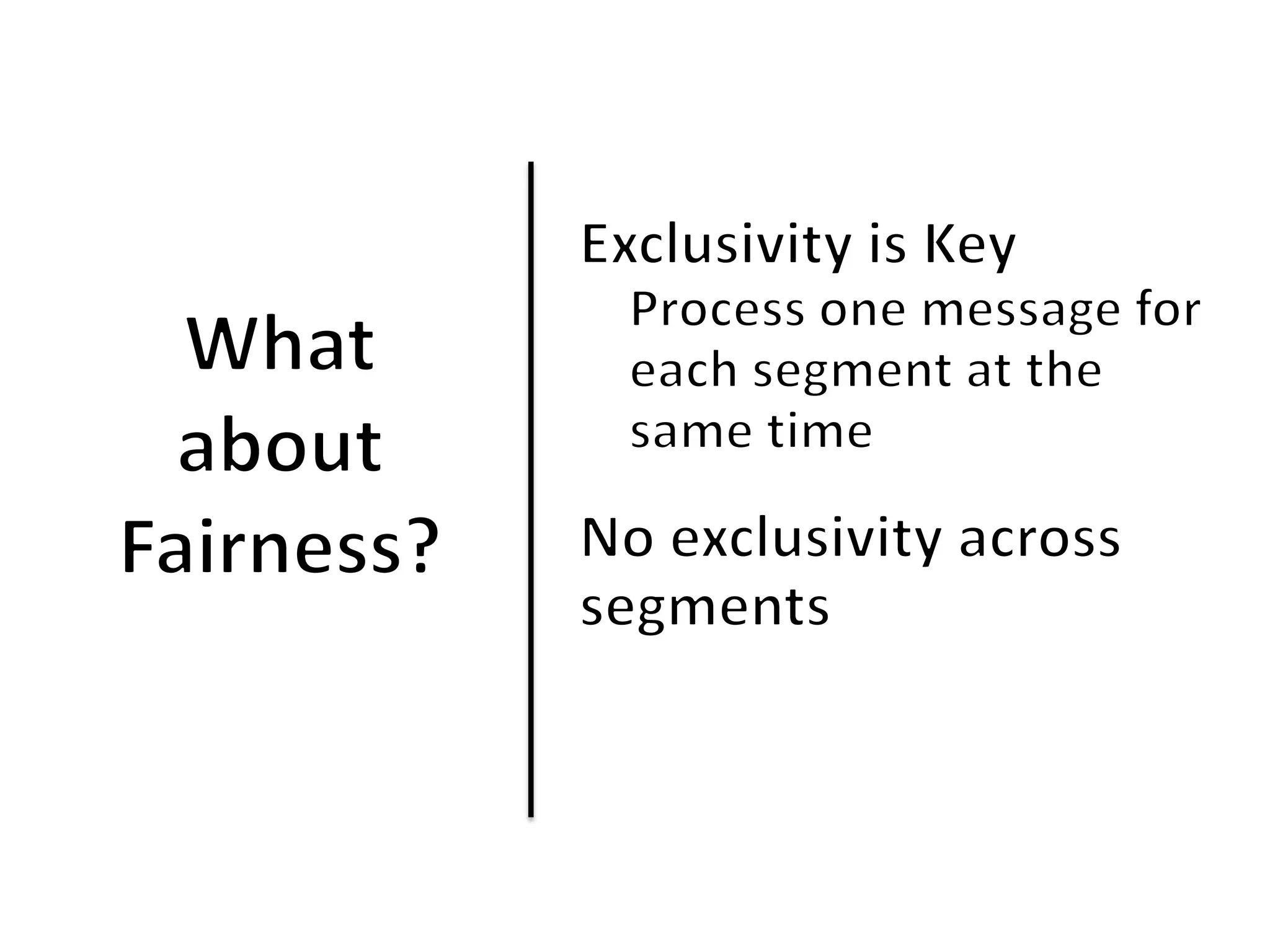

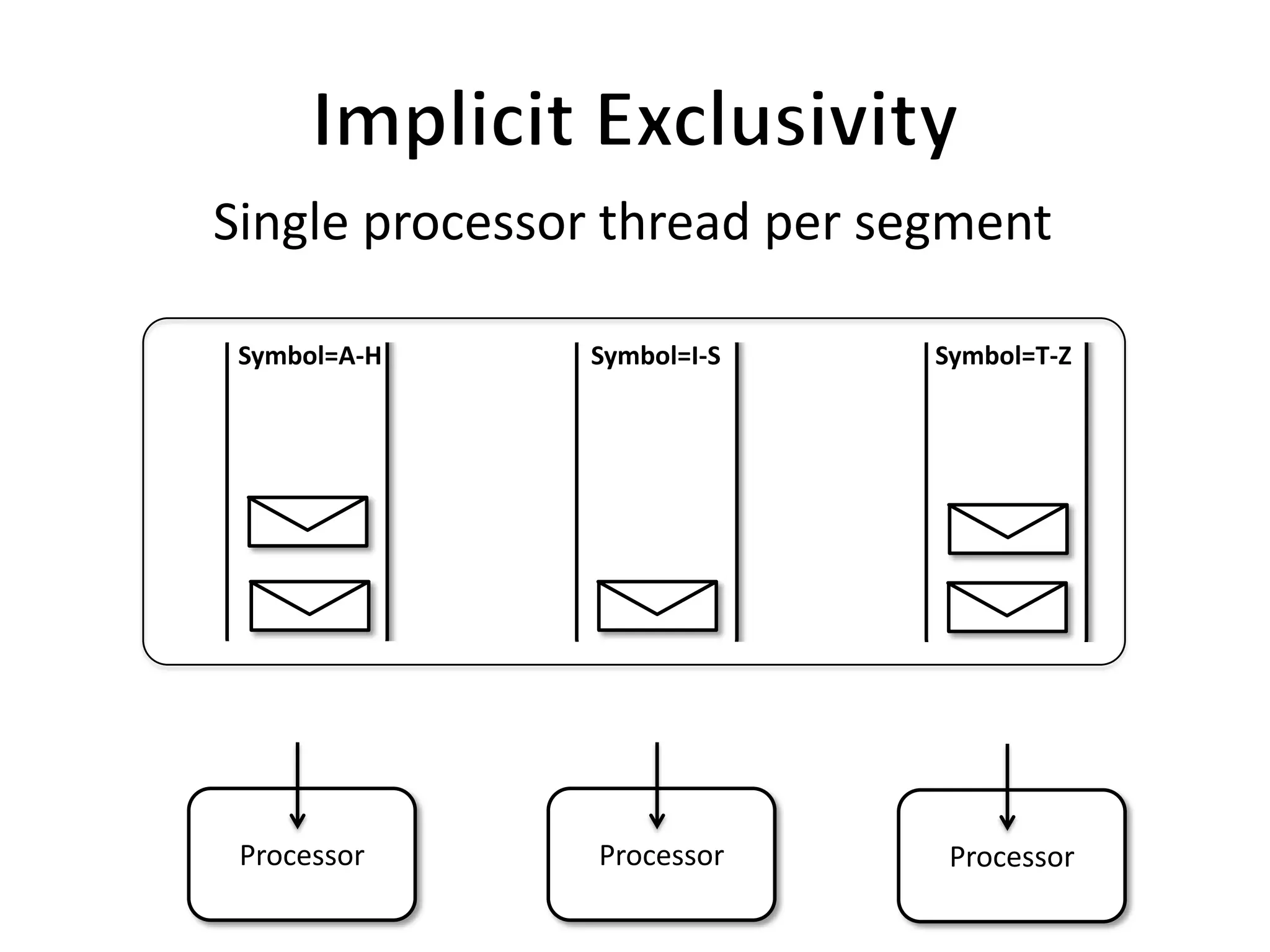

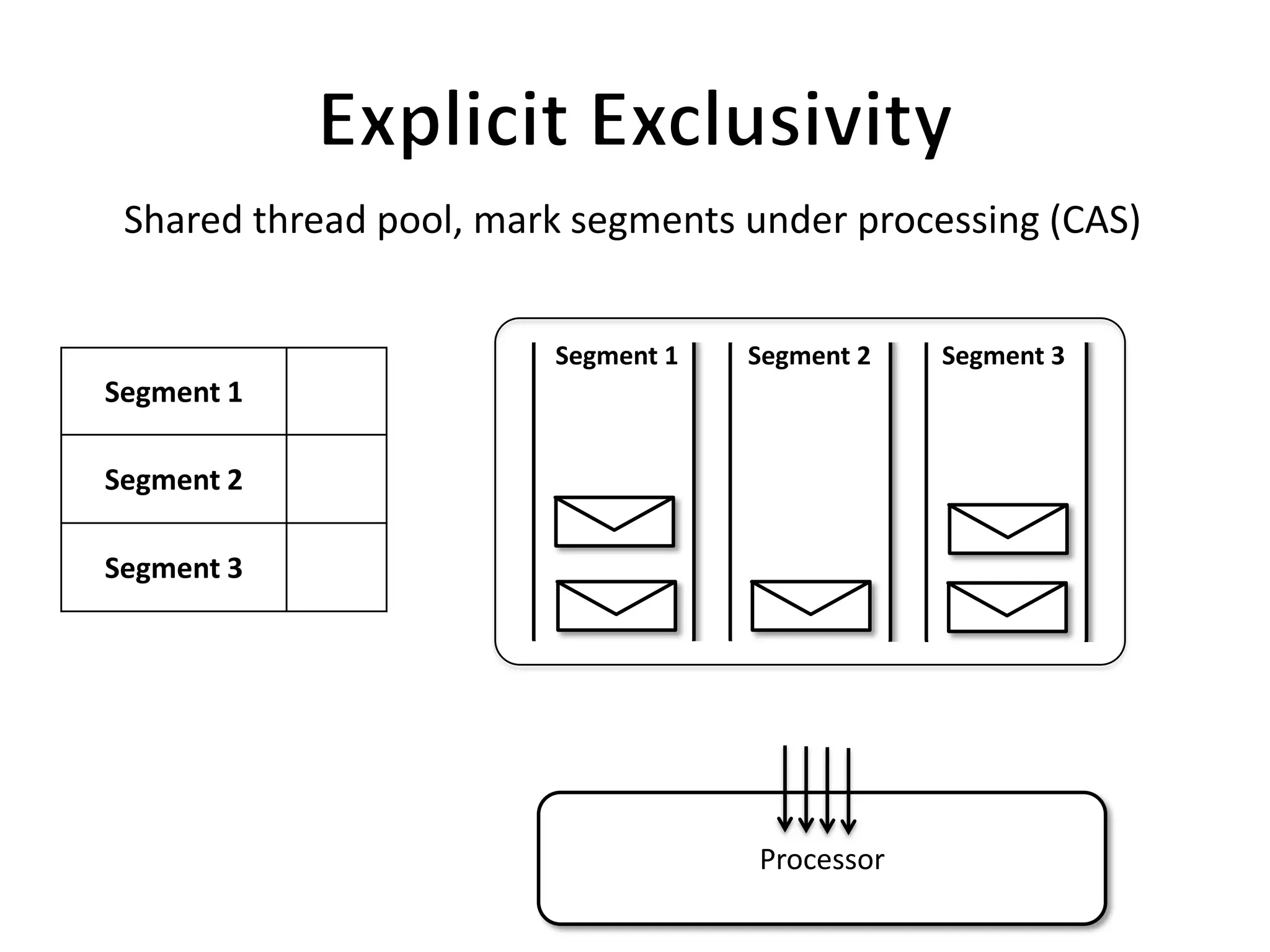

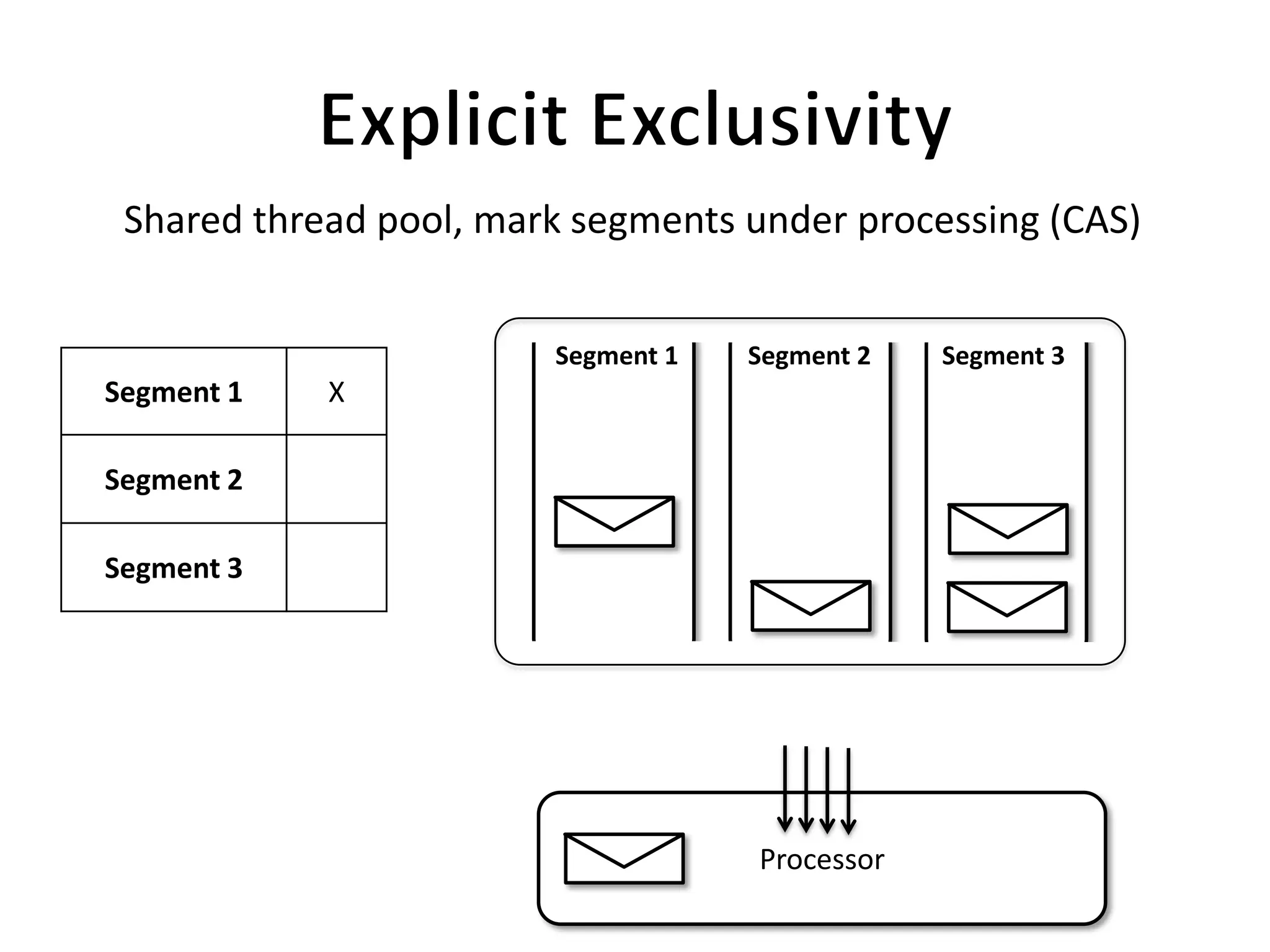

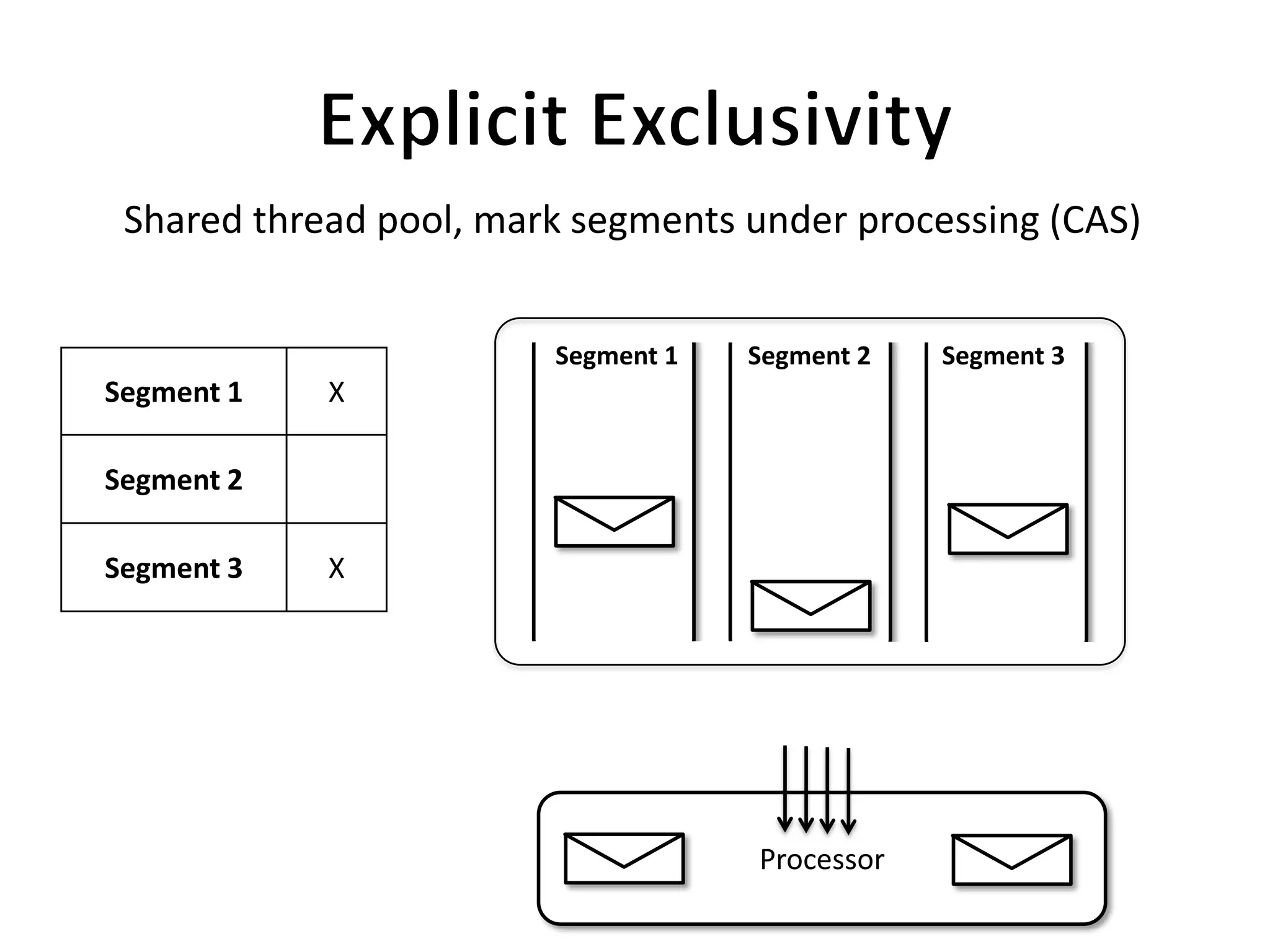

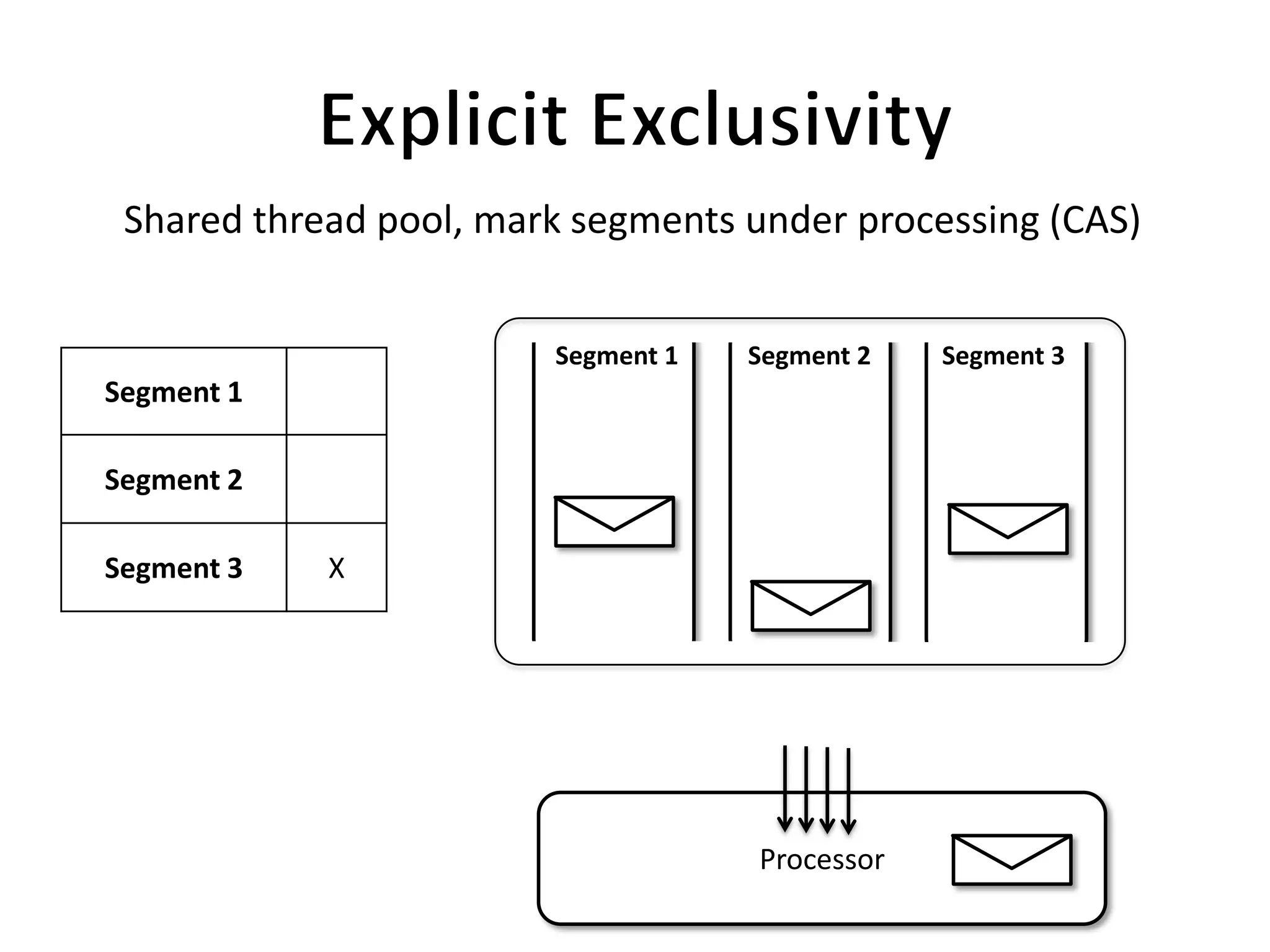

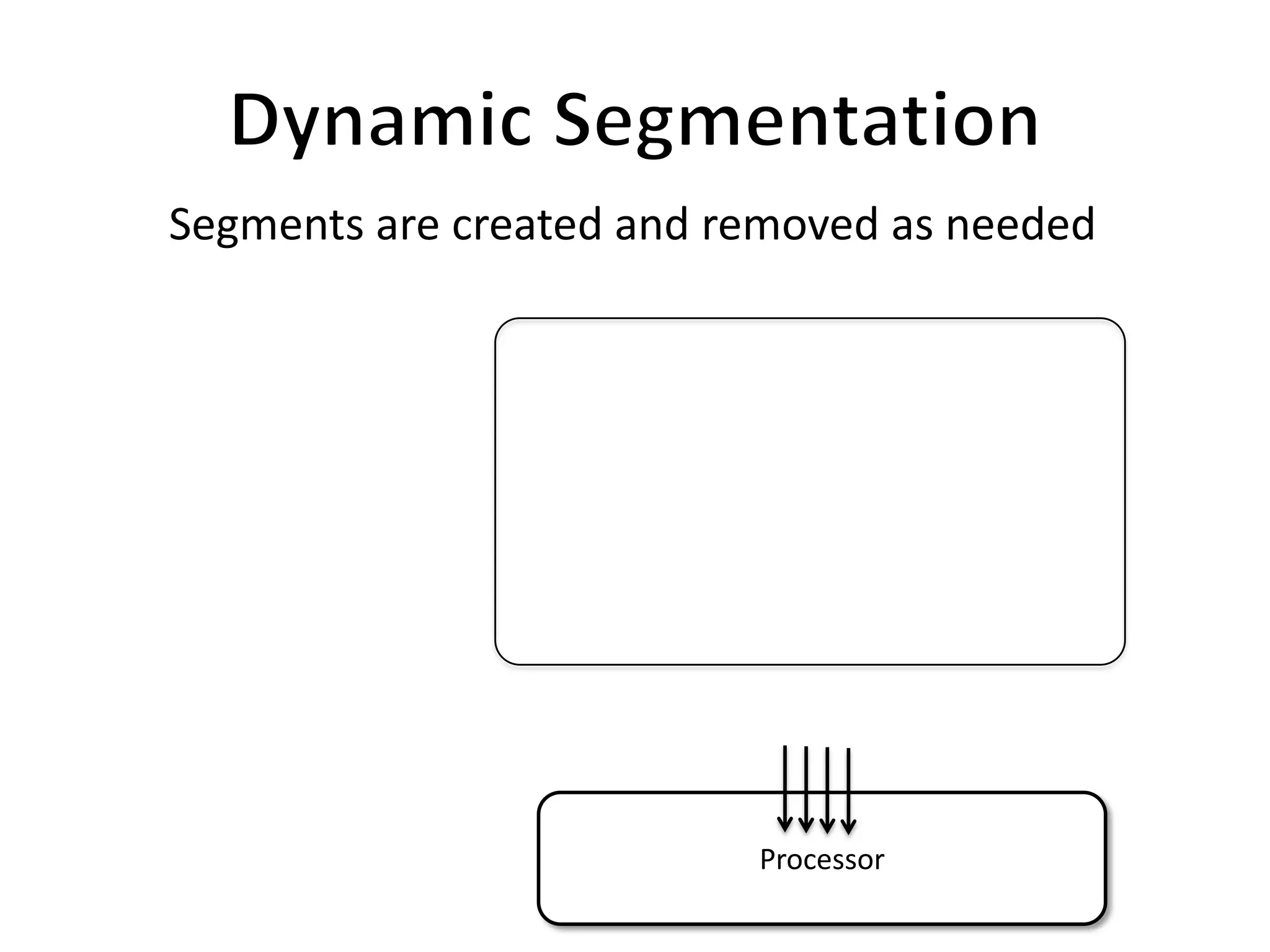

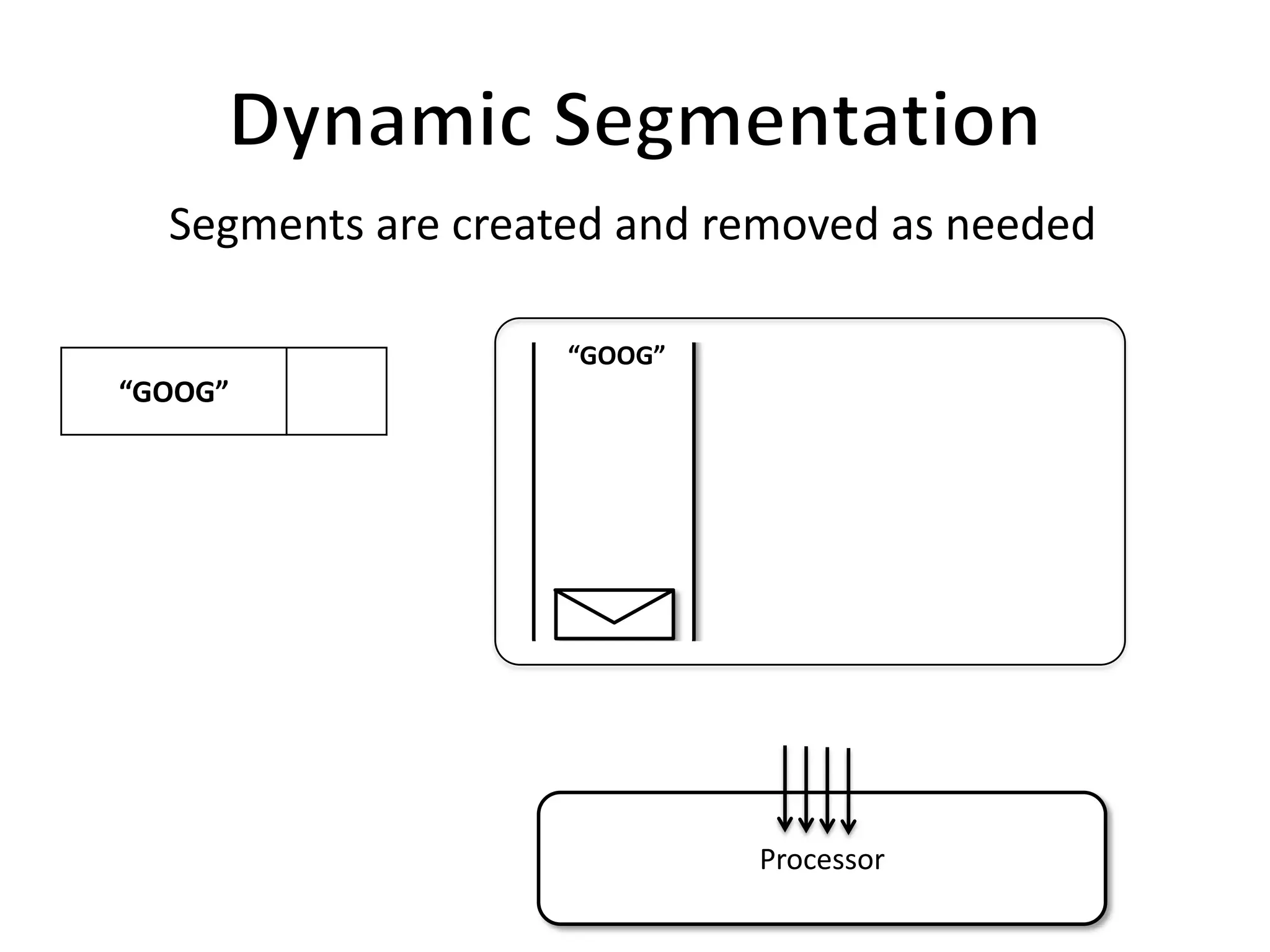

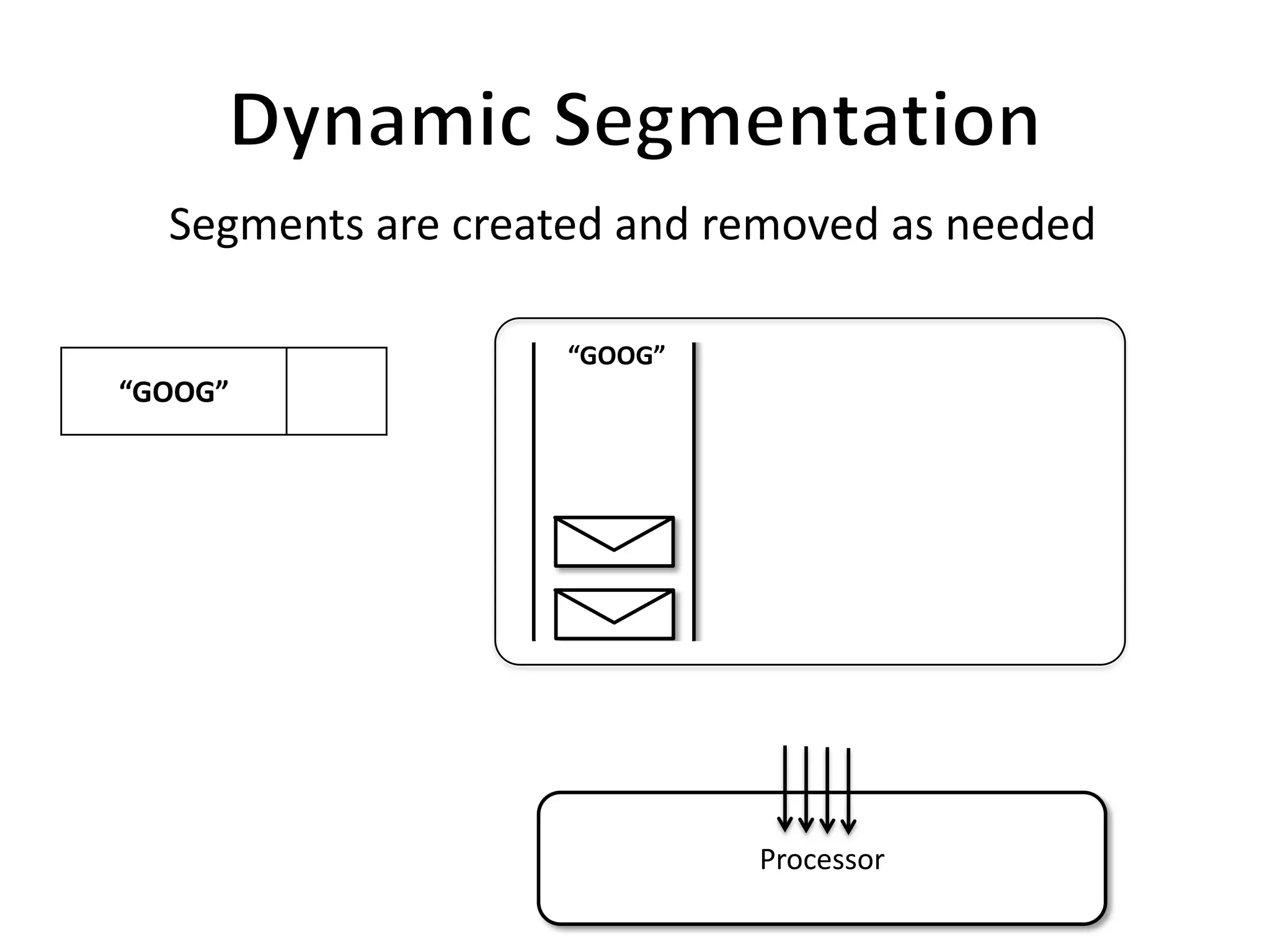

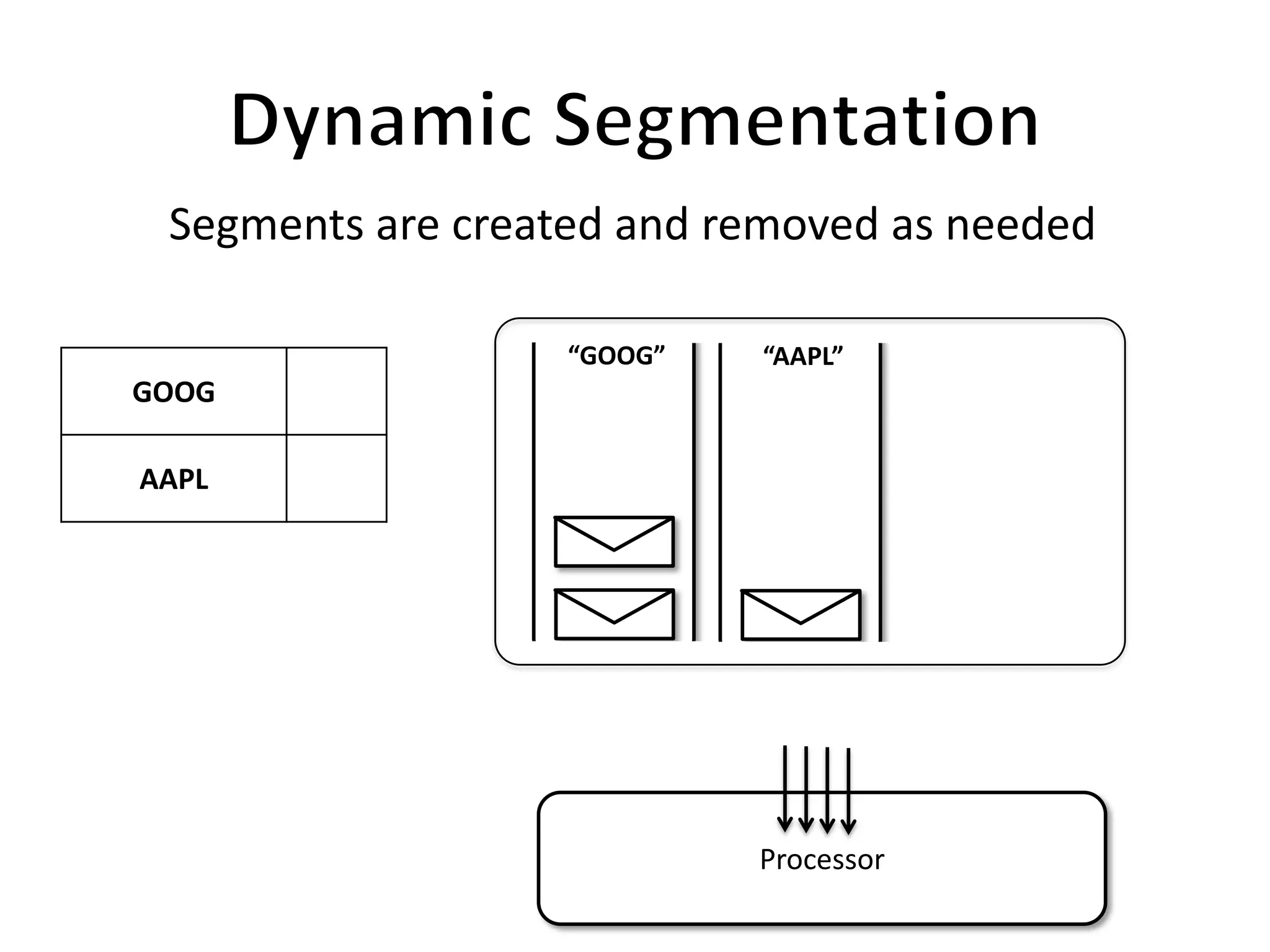

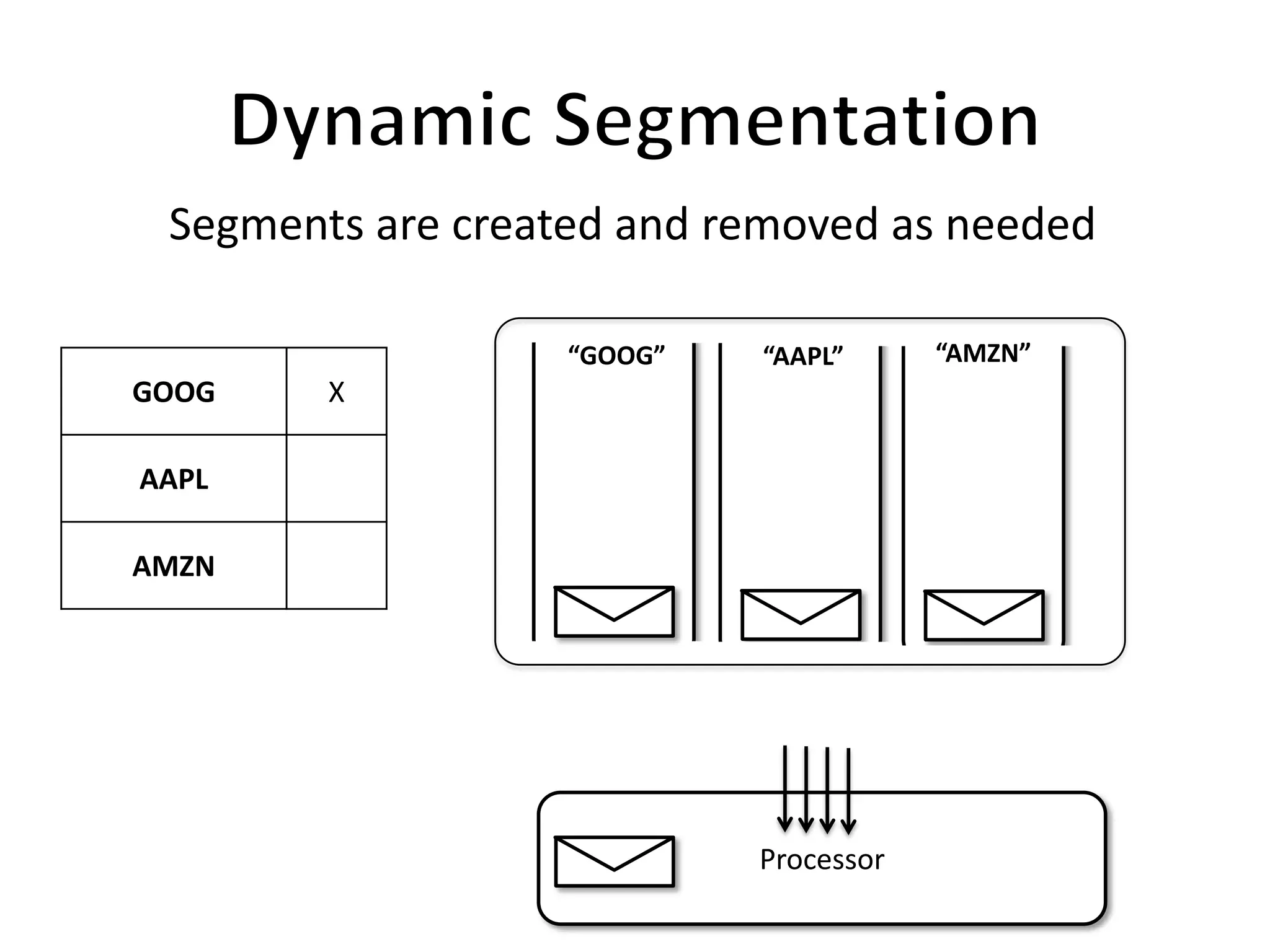

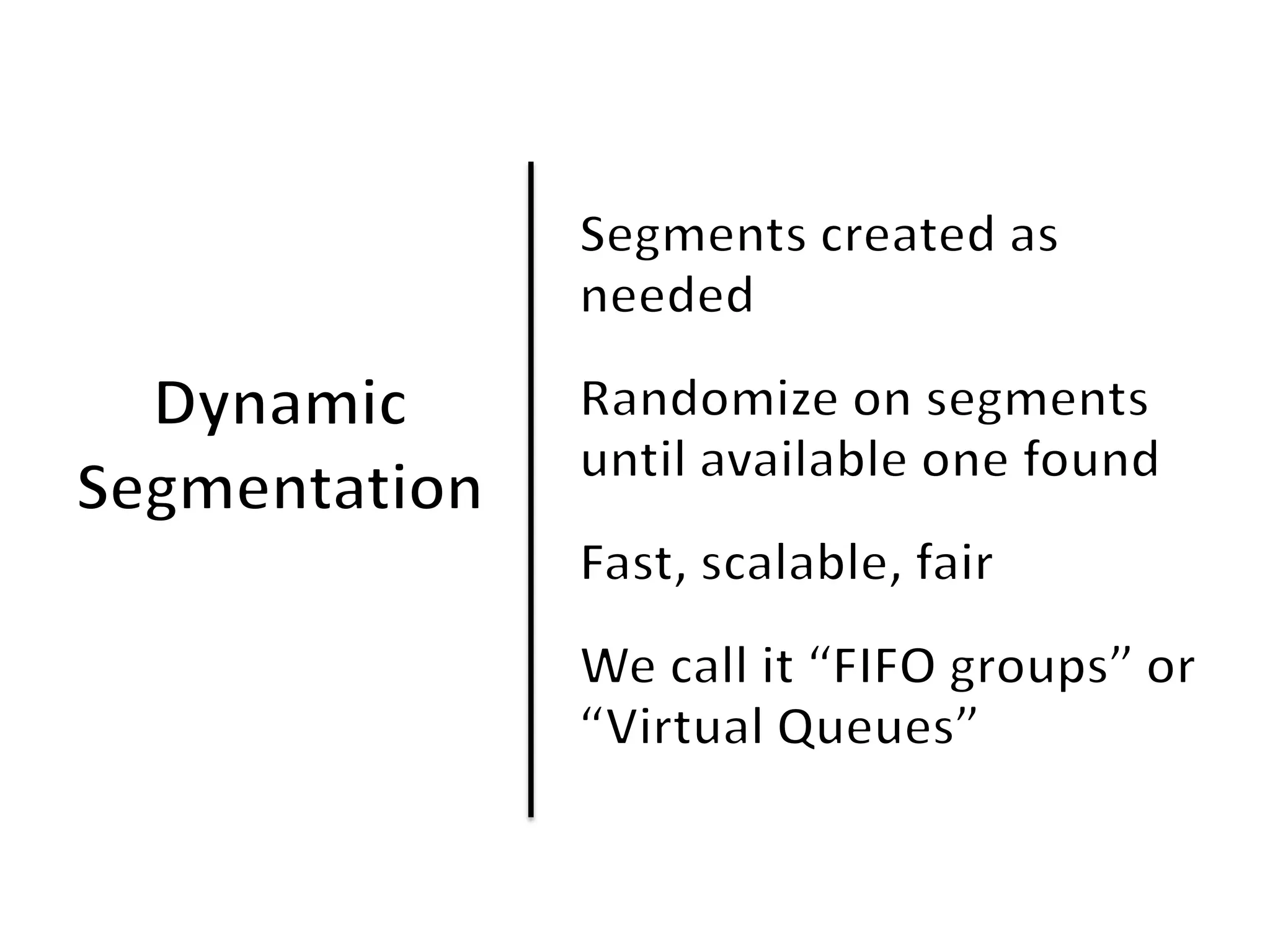

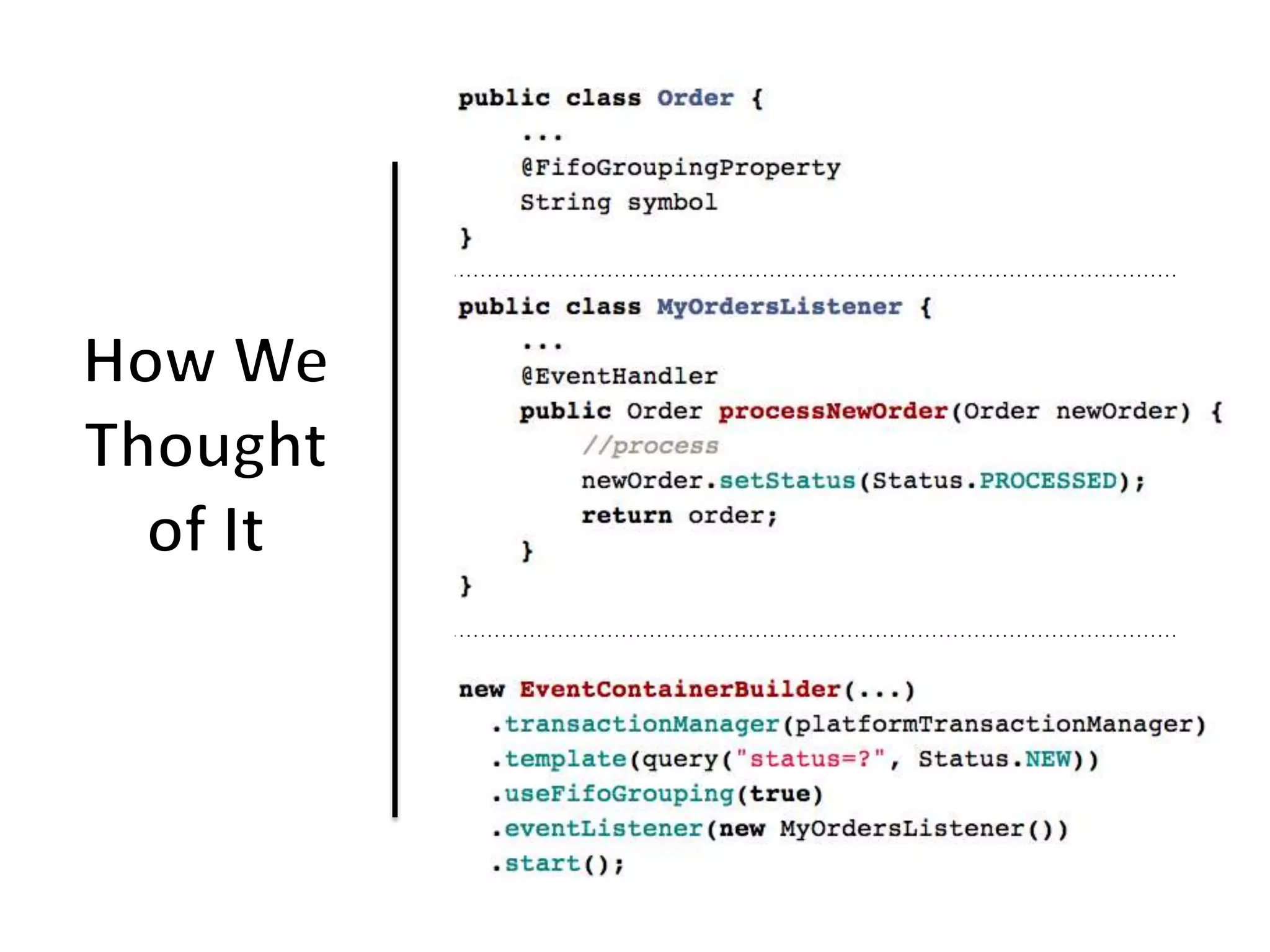

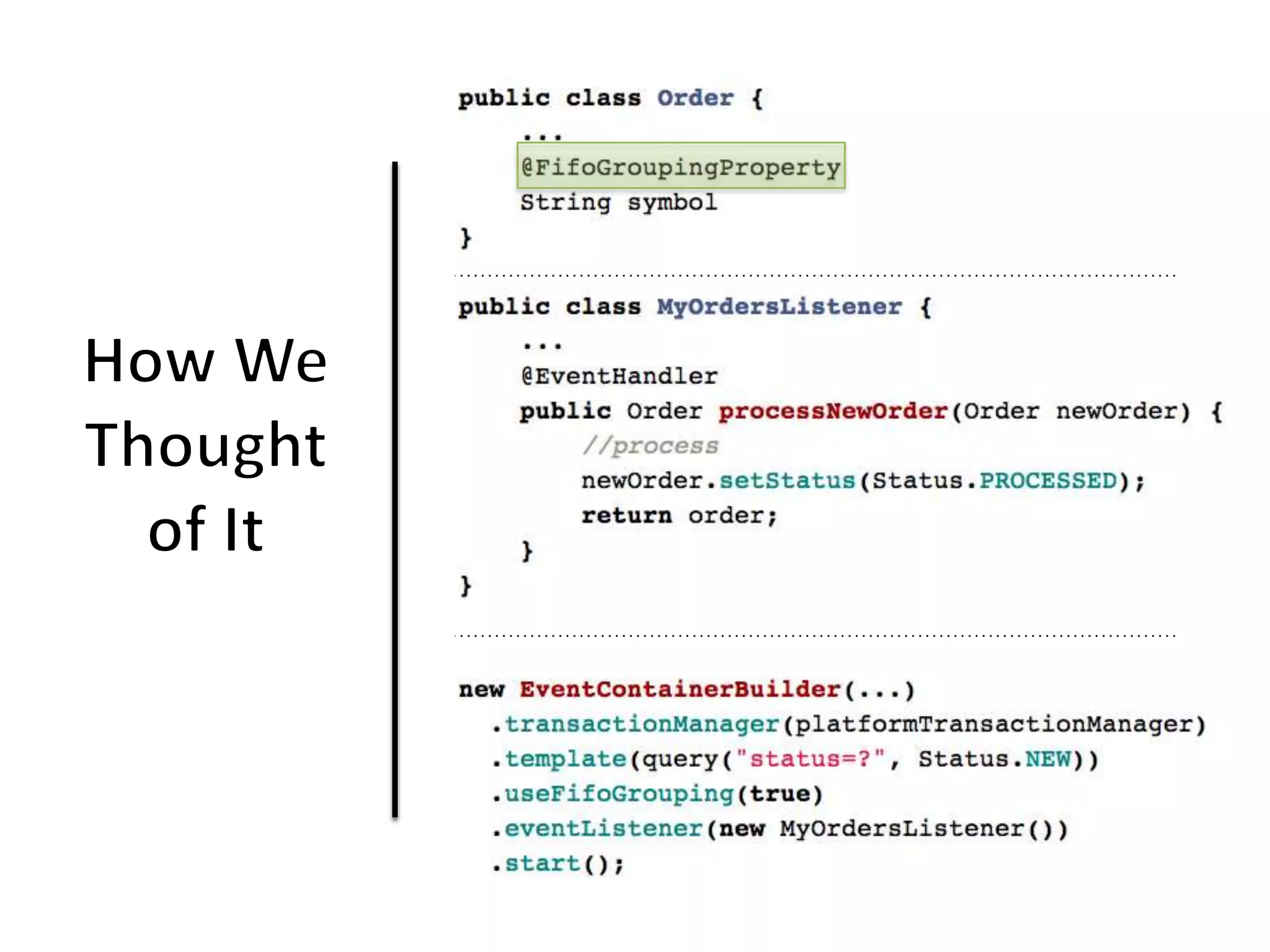

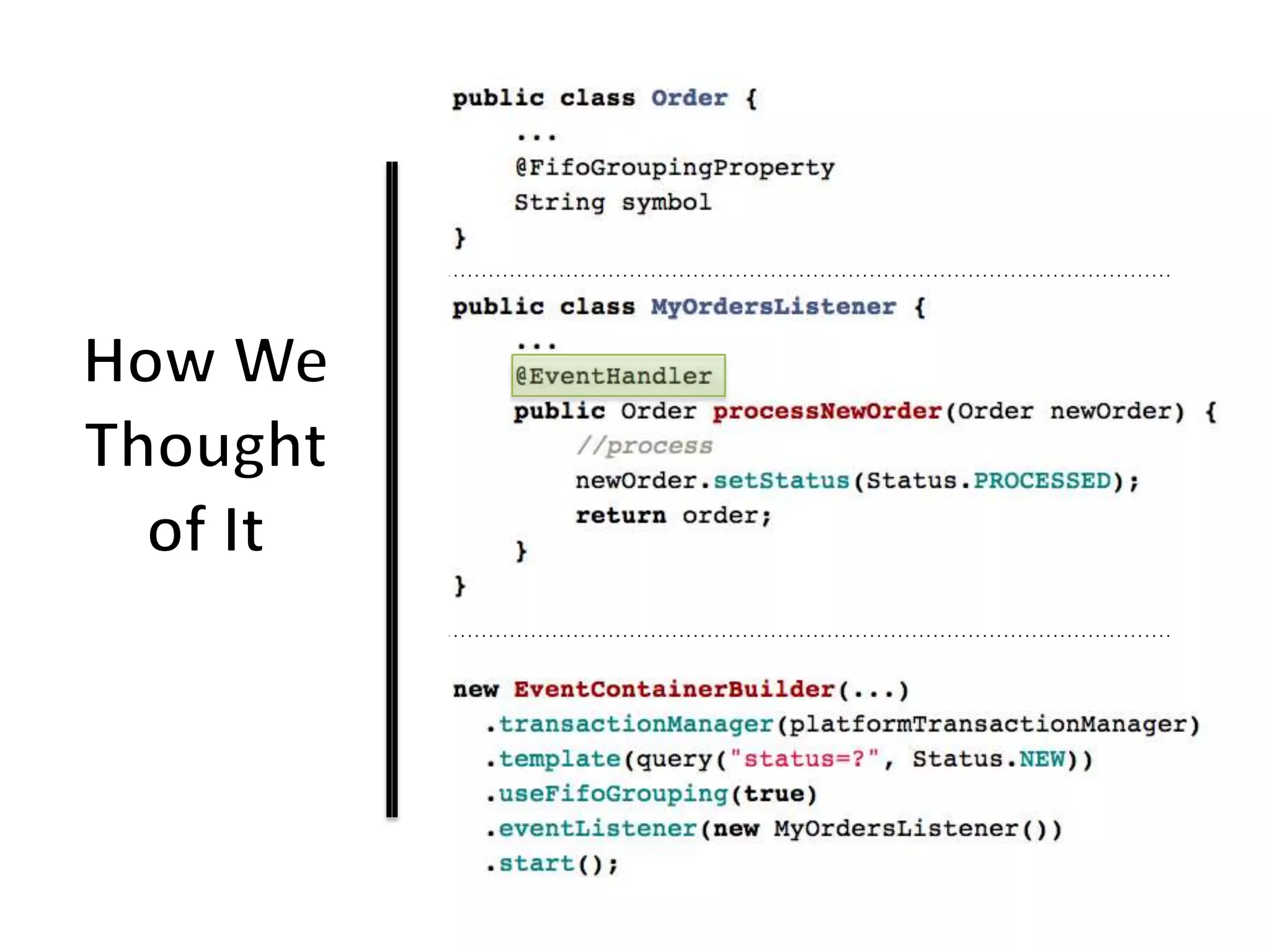

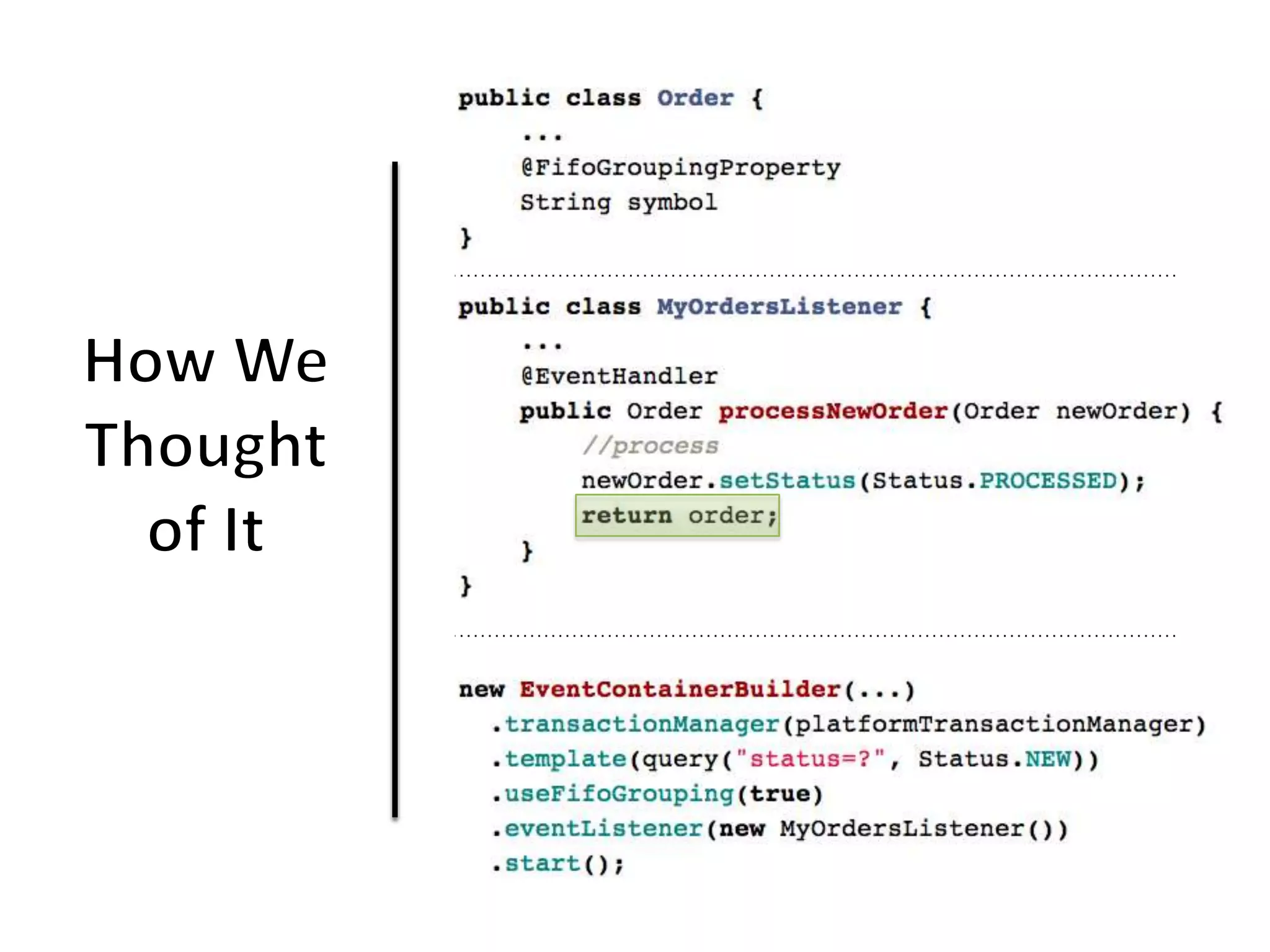

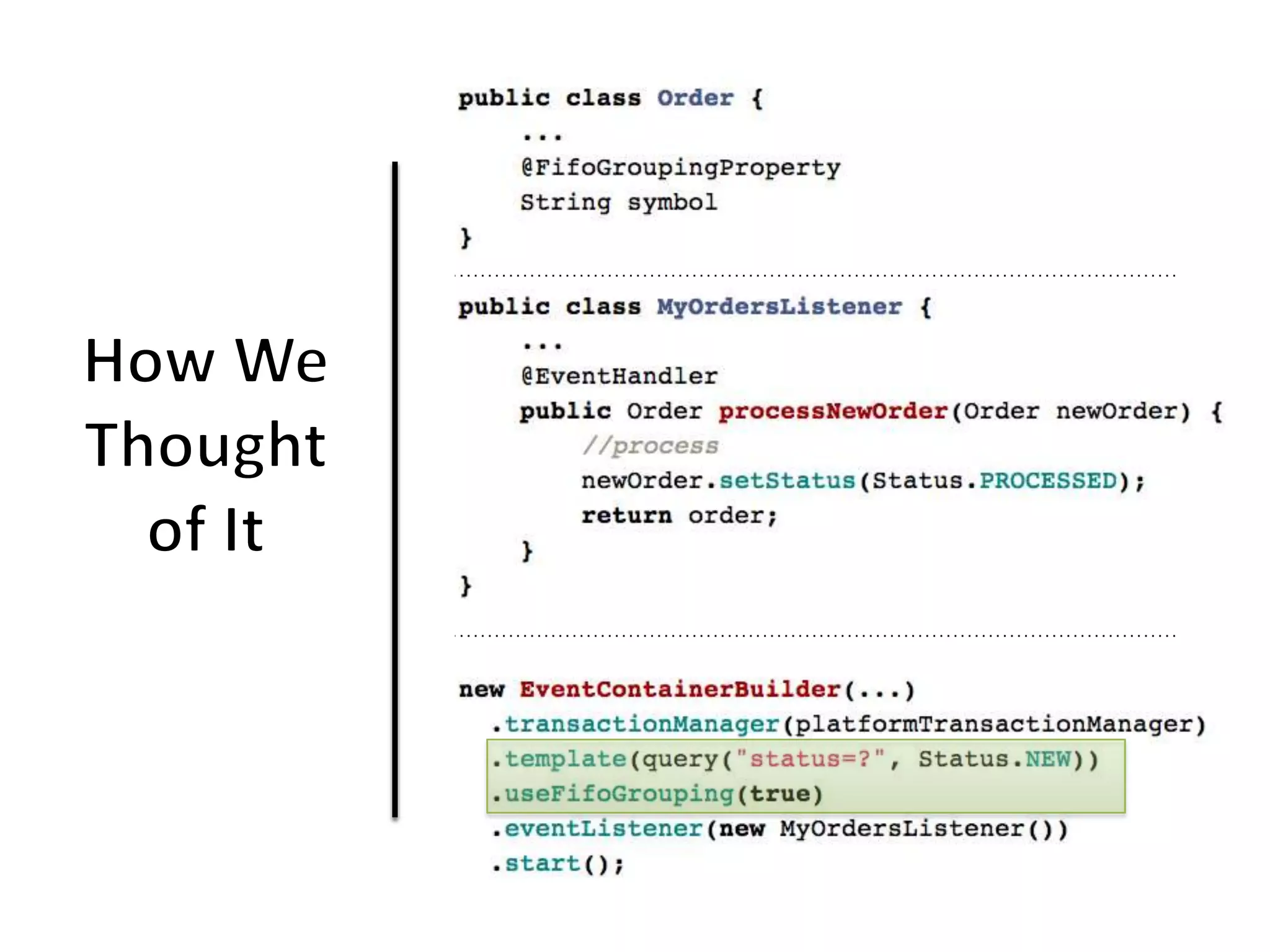

The document discusses various aspects of trading, including price listings and trading volumes, as well as methods for processing trades using multi-threading and different validation techniques. It highlights the performance of single-threaded and multi-threaded operations, noting the lack of fairness in queues. Additionally, it references multiple sources related to trading and processing methodologies.