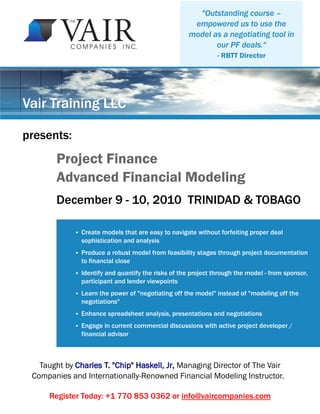

Project Finance Advanced Modeling - Trinidad & Tobago

- 1. "Outstanding course – empowered us to use the model as a negotiating tool in our PF deals." - RBTT Director Vair Training LLC ● Create models that are easy to navigate without forfeiting proper deal sophistication and analysis ● Produce a robust model from feasibility stages through project documentation to financial close ● Identify and quantify the risks of the project through the model - from sponsor, participant and lender viewpoints ● Learn the power of "negotiating off the model" instead of "modeling off the negotiations" ● Enhance spreadsheet analysis, presentations and negotiations ● Engage in current commercial discussions with active project developer / financial advisor Taught by Charles T. "Chip" Haskell, Jr, Managing Director of The Vair Companies and Internationally-Renowned Financial Modeling Instructor. Project Finance Advanced Financial Modeling December 9 - 10, 2010 TRINIDAD & TOBAGO presents: Register Today: +1 770 853 0362 or info@vaircompanies.com

- 2. Vair Training Project Finance Advanced Financial Modeling COURSE OBJECTIVES Project Finance Advanced Financial Modeling is a master-level class and focuses uniquely on project finance and its related modeling issues. After reviewing some basic elements of project finance, the participants are given a full suite of project documents and macroeconomic information that are indicative to any infrastructure project. Immediately following is a step-by-step procedure of building a complex equity case model. This phase of the course is to demonstrate how contracts dovetail and that nothing in project finance is mutually exclusive. Once completed, the delegates review the model from a due-diligence analysis, usually taken from a lender's or third-party equity perspective. The final phase of this module uses sophisticated model techniques to help the practitioner price-the-deal. Special consideration is given to more advanced project-finance issues like liquidated damages analysis and appropriate security packages. The overriding theme of this specialty course is to use the model as a highly-developed financial analysis tool that reviews the appropriate risk-versus-reward profiles of project finance. By employing @RISK software, the course demonstrates the power of Monte Carlo simulation analysis, creating a dynamic decision-making tool and elevating beyond simple static input and output spreadsheets. This is an advanced course and is geared to the intermediate-to-advanced delegate. COURSE OUTLINE Part 1 - Project Finance versus Corporate Finance Part 11 - Depreciation Part 2 - The Role of the Model & Common Rules Part 12 - Financing(s) Part 3 - The Risk Matrix Part 13 - The Income Statement Part 4 - Introduction of a Project for Modeling Part 14 - The Balance Sheet Part 5 - The Project Documents Part 15 - The Statement of Cash Flows Part 6 - The Assumption Page Part 16 - Equity Returns Part 7 - Operations Part 17 - Loan Values Part 8 - Construction Part 18 - "Pricing the Deal" and Scenario Analysis Part 9 - Insurance Part 19 - Monte Carlo Simulations Part 10 - Taxes Part 20 - Running Sensitivities & Documenting Changes For a detailed course syllabus, click here PREVIOUS PARTICIPANTS INCLUDE DELEGATES OF: ● ABN AMRO ● ANSA Merchant Bank Ltd. ● ASCO Trinidad Ltd. ● Banco do Brasil ● Central Bank of Trinidad & Tobago ● Ernst & Young ● Eteck ● First Caribbean Bank ● First Citizens Bank ● Firstline Securities Ltd. ● First Global Ltd. ● General Electric ● Halliburton ● ING Capital ● Inter-American Development Bank ● JP Morgan Chase ● Macquarie ● NEC ● NGC ● NordLB ● OPIC ● PEMEX ● Petrobras ● Petrotrin ● Royal Bank of Trinidad & Tobago ● Shell Gas & Power ● Trinidad & Tobago SEC ● US Export-Import Bank ● WASA ● World Bank/IFC

- 3. About the Instructor Charles “Chip” Haskell, Jr. is a Managing Director with The Vair Companies and author of Advanced Modelling for Project Finance for Negotiations and Analysis. He has taught financial modeling to delegates from hundreds of organizations worldwide. Before founding The Vair Companies, Chip was a Director with Mirant, based in Amsterdam. Prior to joining Mirant, Chip was a Manager with Wärtsilä Development and Finance. Chip has a BA in Economics and French from Hanover College, an MA in French from Middlebury College and a Masters in International Finance and Accounting from Thunderbird School of Global Management. About The Vair Companies, Inc. The Vair Companies offers financial advisory, training and seminar services to organizations and individuals working in the international infrastructure and project development industry. We are active advisors to sponsors, lenders, participants and governments in the infrastructure sector, having advised on the closing of over USD 2.5 billion in assets globally. During training, we use the same real-world methods and industry techniques we employ on behalf of our advisory clients. Our courses are taught by active financial advisors and project developers who impart the same techniques used to drive real projects, valuations and deals. Vair is not a PowerPoint-based training firm. Instead, we apply a “hands-on”, “learn-by-doing” approach to our teaching. For more information, please visit www.vaircompanies.com Vair Training Project Finance Advanced Financial Modeling

- 4. Vair Training Registration Form: TRINIDAD & TOBAGO Fax completed registration form to +1 678 802 3222 or register online at www.vaircompanies.com For more information, please call +1 866 410 VAIR (8247) or email info@vaircompanies.com Registration Form Prefix: First Name: Last Name: Title: Department: Company/Organization: Street Address: Mailing Address: City: State/Prov.: ZIP/Postal: Country: Email: Phone: Fax: How did you hear about us?: Please register the following number of delegates for: Financial Modeling & Analysis Dec. 7-8, 2010 Trinidad & Tobago ___ delegate(s) at US$2,500/ea Project Finance Advanced Financial Modeling Dec. 9-10, 2010 Trinidad & Tobago ___ delegate(s) at US$3,900/ea Combined Course (US$500 savings) Dec. 7-10, 2010 Trinidad & Tobago ___ delegate(s) at US$5,900/ea Early-Bird Special: 10% discount for registrations received at least 8 weeks prior to course start-date Group Rates: 20% discount for the third and subsequent delegates from the same organization Choose one form of payment: Check: Invoice me (applicable discounts will be applied) Credit Card: Charge my card (applicable discounts will be applied) Visa Mastercard Diners Club Card Holder Name: _________________________ Account #: _________________________ Expiration Date: _________________________ Signature: _________________________ Registration Information: Fee: Registration fees include morning coffee/tea, networking lunches and afternoon refreshments. Delegate lodging not included. Billing and Confirmation: Invoices and/or Payment Confirmations are forwarded within three (3) business days of receipt of registrations. Venue: Vair Training courses are held at world-class international venues. Locations, times and meeting places are confirmed two (2) weeks prior to course commencement. Materials: Course materials are provided electronically on Day 1 of on-site registration. Delegates are required to bring a personal laptop computer equipped with Microsoft Excel software. Hours: Courses run 9:00 AM–4:30 PM daily Cancellation Policy: All cancellations must be received in writing. A full refund less a 15% administrative fee will be given for cancellations up to 21 days before the event start-date. Cancellations received less than 21 days before the event will not be eligible for a refund. A comparable future course may be attended in lieu of a refund depending upon availability and location. Delegate replacements are also welcome. Schedule Changes: Vair Training may find it necessary to reschedule or cancel sessions and will give registrants appropriate advance notice of such changes. On such occasions, full refunds will be given. Vair Training will not be responsible for penalties incurred as a result of discounted airfare purchases. For more information regarding Vair Training administrative policies, please contact our offices at +1 770 853 0362.