New base 496 special 14 december 2014

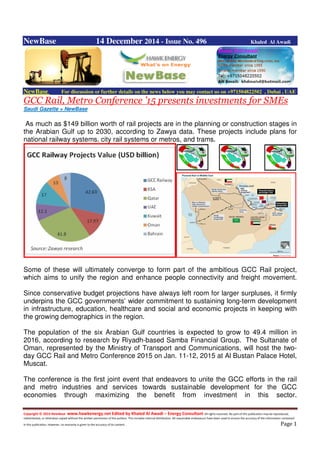

- 1. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 1 NewBase 14 December 2014 - Issue No. 496 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE GCC Rail, Metro Conference ’15 presents investments for SMEs Saudi Gazette + NewBase As much as $149 billion worth of rail projects are in the planning or construction stages in the Arabian Gulf up to 2030, according to Zawya data. These projects include plans for national railway systems, city rail systems or metros, and trams. Some of these will ultimately converge to form part of the ambitious GCC Rail project, which aims to unify the region and enhance people connectivity and freight movement. Since conservative budget projections have always left room for larger surpluses, it firmly underpins the GCC governments’ wider commitment to sustaining long-term development in infrastructure, education, healthcare and social and economic projects in keeping with the growing demographics in the region. The population of the six Arabian Gulf countries is expected to grow to 49.4 million in 2016, according to research by Riyadh-based Samba Financial Group. The Sultanate of Oman, represented by the Ministry of Transport and Communications, will host the two- day GCC Rail and Metro Conference 2015 on Jan. 11-12, 2015 at Al Bustan Palace Hotel, Muscat. The conference is the first joint event that endeavors to unite the GCC efforts in the rail and metro industries and services towards sustainable development for the GCC economies through maximizing the benefit from investment in this sector.

- 2. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 2 The conference will present the manufacturing, service and training opportunities available for investors and the private sector including SMEs in all GCC projects. Further, the conference will tackle the challenges facing the private sector to effectively participate in the railways sector. It will also discuss developing policies and plans to overcome such impediments and encouraging the private sector's participation. Along with decision-makers in the rail and metro sectors in the GCC countries, elite speakers and experts in the related industries, services and training will take part in the conference. The conference is the first joint event that endeavors to unite the GCC efforts in the rail and metro industries and services towards sustainable development for the GCC economies through maximizing the benefit from investment in this sector. The conference will present the manufacturing, service and training opportunities available for investors and the private sector including SMEs in all GCC projects.Further, the conference will tackle the challenges facing the private sector to effectively participate in the railways sector. It will also discuss developing policies and plans to overcome such impediments and encouraging the private sector's participation. Along with decision-makers in the rail and metro sectors in the GCC countries, elite speakers and experts in the related industries, services and training will take part in the conference.

- 3. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 3 UAE: Alsa engineering to spend $100 million in expansion + NewBAse Abu Dhabi: Alsa engineering and construction is planning to spend over $100 million in the next 18 months as part of its expansion strategy in the UAE. It is eyeing new projects and get into offshore sector to increase its presence in the country. Chief executive officer, Gassan S Arbid said that the company is growing from strength to strength. “In the UAE, the next push from our side is to get into offshore. We acquired two million square meters of land to start our work in shallow water pipe laying and fabrication,” Arbid told Gulf News. The company, which is active in the oil and gas sector in Abu Dhabi, has completed projects including supplying gas to Emal’s aluminium smelter plant and Ruwais refinery. “There are other projects in the pipeline which we are bidding. They are good size projects. We are doing it on our own as well as joining hands with our partners.” The company is also planning to start its operations in Kuwait and Saudi Arabia by mid-next year. According to Arbid, the biggest strength has been its workforce. “Sky is the limit if you have right kind of people working for you. The company employs 2,500 people. We have camps in all the major oilfield areas.” On the falling oil prices and whether it would have any impact on the company’s operations, he said that if the price slides below $65 per barrel then they might see some kind of impact. “Drop in prices is good for oil producing countries because in the long run, it could put a break to shale oil production as it is too expensive to operate,” he said. Oil prices closed at $61.85 on Friday. The Organisation of Petroleum Exporting Countries (Opec), cut the forecast for how much crude it will need to produce next year by about 300,000 barrels a day to 28.9 million, the least since many years. In January this year, the company was has been awarded the $300 million Abu Dhabi Company for Onshore oil Operations (Adco) CO2 injection project. The 25-month project, Alsa’s biggest to date — will see the company construct the facilities and pipelines to enable the first CO2 injection project of its kind in the Middle East from Masdar to Rumaitha North and Bab Far North fields. The growth of the company has been good over the years, he said. “We have never allowed ourselves to grow beyond the level what we cannot maintain. We have been careful to take up a project that fits into our capability and financial strength. The growth is coming. We will continue to grow at a pace that we will be maintain without any difficulty.”

- 4. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 4 Kurds and Iraq reach significant deal to share oil revenues The Kurdish Globe 2014 + NewBase The Iraqi Government agreed to a long-term accord with the autonomous Kurdish Region to share the country's oil wealth and military resources in a far-reaching deal that helps reunite the country in the face of a bitter war with Islamic extremists. The Iraqi Government agreed to a long-term accord with the autonomous Kurdish Region to share the country's oil wealth and military resources in a far-reaching deal that helps reunite the country in the face of a bitter war with Islamic extremists. The deal settles a long dispute between Baghdad and Erbil, the Kurdish capital, over oil revenue and budget payments. In a news conference here Tuesday, Nechirvan Barzani, the Kurdish Region's Prime Minister, alluded to the tensions of the Maliki era and praised Abadi. Abadi's desire to reach an agreement was motivational,' he said. 'We hope to turn this into a new chapter in the relations between Baghdad and Erbil, and we never accepted the threatening tone which was commonly used before.' Barzani added that the agreement includes 200 billion Iraqi dinars for the Kurdish Peshmerga forces. 'The money which will be sent by Baghdad will not be counted on the KRG budget but on the budget of Iraqi Defense Ministry,' he revealed. 'What we have done is not enough but it is a good beginning for solving other pending issues,' Barzani said. 'I am happy with the agreement and it is a good achievement for all the parties.' As the jihadists marched toward Baghdad in June, routing Iraqi Army forces, the Kurds took control of Kirkuk and its rich oil fields. And they intensified efforts to market Kurdish oil independently, arguing that the government had withheld payments to Kurdistan that were badly needed to keep up the fight against the Islamic State in the army's absence. Now, Prime Minister Haider al-Abadi's Government has agreed to pay the salaries of Kurdish security forces, known as the Peshmerga, and will also allow the flow of weapons from the United States to the Kurds, with the government in Baghdad as intermediary. 'Now the priority really is to confront ISIS,' Hoshyar Zebari, Iraq's Finance Minister, said in an interview after emerging from the cabinet meeting to complete the deal after several days of talks. In reaching a deal, Abadi, who has been Prime Minister for less than three months, has further distanced his government from a legacy of bitter sectarian and ethnic division under his predecessor, Nuri Kamal al-Maliki. As the Prime Minister, Maliki deeply alienated the Kurds and enraged Iraq's Sunni Arab minority with his confrontational personality and policies that were seen as exclusive and abusive. 'The new team, under Abadi, is a cooperative team, a positive team,' said Zebari, a Kurdish politician who was Iraq's Foreign Minister in the Maliki Government.

- 5. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 5 Reconciling Sunnis with the Central Government is widely seen as an essential step to retaking land from the Islamic State. Mr. Abadi has backed a plan, supported by the United States, to set up local National Guard forces that would fight alongside the Iraqi army. But that plan has stalled, as have intermediate steps to arm Sunni tribes in the face of opposition by some Shiite factions. Those factions worry that the Government would be raising a Sunni army that could then turn on the Shiites. The oil deal, which put a final imprimatur on a temporary pact that was agreed to three weeks ago, also represented a significant victory for the United States, which has made a priority of pushing the Kurds and the Central Government to settle their political and economic differences. American officials had expressed fear that if the two parties did not reach an arrangement, the country would break up, with the Kurds pushing forward on longstanding ambitions for independence. The deal also appeared to be a blow to the ambitions of Turkey, which had positioned itself as the saviour of the Kurds by reaching deals during the impasse of the Maliki years in which the Kurds would export their oil and gas unilaterally through Turkey. Those agreements were considered illegal by Baghdad and the United States. The rapprochement between Baghdad and the autonomous Kurdish region also appeared to validate one element of President Obama's strategy in confronting the Islamic State: the push for a more inclusive leader of Iraq. When the extremists swept into Mosul, Obama decided that Maliki had to go before the United States would ramp up its military efforts against the Islamic State. He has removed corrupt officials and military officers who were seen as loyalists to Maliki, and has reached out to Sunni Arab countries like Saudi Arabia that has historically been hostile to the Shiite-led government here. He has even reduced his salary and those of his ministers, in a bow to public anger over the compensation for lawmakers. Under the deal, the Kurdistan region will provide 550,000 barrels of oil a day that will be sold through government channels, with the proceeds divided between Baghdad and Erbil. This includes 300,000 barrels a day from the disputed region of Kirkuk, which the Kurds took control over in June after the onslaught by the Islamic State forced the retreat of Iraq's Army. At a time when oil revenue is so critical to Iraq, the unlocking of those oil shipments may actually have a temporarily negative effect for the country as a whole: with prices recently hitting a five- year low, adding more Iraqi oil to a glutted market may drive them down even further, industry experts say. The deal signed also stipulates that Baghdad will permanently resume payments to the Region which had been halted under Maliki that amount to 17 percent of the national budget, and another $1 billion to pay for salaries and weapons for the Peshmerga, who are on the front lines fighting ISIS, sometimes with Iraqi security forces and Shiite militias.

- 6. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 6 UAE:Italian firm( Maire Tech) wins $2.25bn Adco project The National + NewBase Italy’s Maire Tecnimont has won a US$2.25 billion contract for an oil and gas project from the Abu Dhabi National Company for Onshore Oil Operations (Adco), the Milan-listed firm said on Thursday. The contract is for implementing process and associated units for the Al Dabb’iya Surface Facilities Phase III project in Abu Dhabi, the company said. Adco, a unit of Abu Dhabi National Oil Company (Adnoc), operates the Al Dabb’iya field, which is located 40 kilometre south-west of the capital. The project is part of Adco’s North East Bab development programme and includes gathering crude oil through a network of pipelines, oil and gas export pipelines and a central process plant, the company said. “For its magnitude and technical standing, this can be considered Maire Tecnimont Group’s flagship project in terms of oil and gas business experience, following the successful completion of Gasco Habshan 5,” the firm said. “Moreover, it will consolidate the long lasting presence in the country and will represent the top reference for the group.” Pierroberto Folgiero, the firm’s chief executive, said the project confirmed Maire Tecnimont’s strategy of pursuing opportunities in “selective, well known geographies”. In March the firm won a contract to develop facilities for a petrochemicals complex in Egypt worth between $1.7bn and $1.95bn. The project is split evenly with the Dutch group Archirodon. Adco is set to invest up to $7bn to meet its production target of 1.8 million barrels per day (bpd) by the end of 2017 from the current capacity of 1.6 million bpd. Adco operates the largest onshore oilfields, which are currently responsible for about 40 per cent of the country’s output of 2.8 million bpd. The country aims to increase its total output to 3.5 million bpd by 2017. Adnoc took 100 per cent ownership of the onshore fields when the concessions with major oil companies expired in January after 75 years. The most pressing issue for reaching the 2017 target is the renewal of the concessions and any uncertainty surrounding their tenure and the partners that will be involved, analysts have said. “[The Italian producer] Eni is keen to be a part of the UAE market and made an excellent technical offer [to Adnoc], and we await the decision of the UAE authorities,” said Giorgio Starace, Italy’s ambassador to the UAE. “These are all strategic agreements that are in the framework in the growing bilateral partnership between Italy and the UAE,” he said after the announcement of the Maire Tecnimont deal, which he said gave “prestige” to Italian companies looking to work in the region.

- 7. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 7 GCC energy subsidy lowest in Qatar at 5.5% of GDP: StanChart Gulf Times + NewBase Energy subsidy in the GCC region is the lowest in Qatar at 5.5% of the country’s gross domestic product, a new report has shown. Saudi Arabia has a very high energy subsidy, totalling nearly 11.5% of the kingdom’s GDP, shows a report by Standard Chartered bank. In the case of Saudi Arabia, the bank estimates that energy subsidies may cost $71bn in 2014 alone. For the GCC (Gulf Co-operation Council) as a whole, the bill has been estimated at $150bn for this year. “Energy-subsidy reform should be a regional priority in 2015 given the tighter fiscal environment,” StanChart said in its “Global focus 2015”. The International Monetary Fund estimates that energy subsidies in the Mena (Middle East and North Africa) region totalled nearly $237bn in 2011, equivalent to 8.6% of regional GDP, 22% of government revenues, and 48% of global energy subsidies. “Subsidies create distortions. The current strategy of providing household energy subsidies in order to encourage lower fuel and energy consumption is ineffective,” the bank said. In wealthy oil-exporting countries like in the GCC, the benefit of fuel subsidies is questionable. This is especially true given high per-capita GDP and the fact that even in the absence of subsidies, oil prices would still be significantly lower than anywhere else in the world (without subsidies) due to the tax-free environment, it said. Subsidies in the GCC place a burden on budgets, especially in an environment of falling oil prices, StanChart said. “With GCC countries committed to improving infrastructure and diversifying their economies, energy-subsidy reform should be considered in order to free up energy and fiscal resources for more productive investments,” the report said. Steps are being taken to rationalise subsidies, it said. Egypt and Jordan have already moved to reduce power and energy subsidies, and Abu Dhabi has announced higher utility tariffs as of 1 January 2015. In Saudi Arabia, policy makers are discussing the possibility of adopting smart tariffs that apply energy subsidies according to income brackets. While more needs to be done, these are steps in the right direction. “The recent decline in oil prices is a timely reminder that government expenditure cannot rise indefinitely,” StanChart said. It also highlights the fact that while there has been a strong push to diversify GCC economies, government revenues remain heavily dependent on oil. “In our view, diversifying sources of budget financing is a key step GCC countries can take to mitigate the impact of lower oil prices. We have long argued that the region should be pushing strongly to establish local-currency debt capital markets. “This would provide financing for sovereigns and improve access to funding for local corporates and smaller businesses. As fiscal surpluses fall and the potential for deficits increases, 2015 should be a year of greater progress towards discipline and prioritisation of spending; tackling subsidies should be a starting point,” the report said.

- 8. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 8 Qatar SNC-Lavalin , Kentz awarded four-year contract by Qatar Shell SNC-Lavalin + NewBase SNC-Lavalin is pleased to announce that Qatar Kentz, a member of the SNC-Lavalin Group, has been awarded a four-year multi-million-dollar call-off contract, with a possible two-year extension, by Qatar Shell for its Pearl Gas-To-Liquids (GTL) onshore and offshore facilities in Qatar. As EPCM and construction contractor for onshore and offshore Pearl GTL facilities, Kentz will manage the EPCM work for all services related to plant changes, as well as minor, base and medium projects. This will include project management, engineering and specialist studies, procurement and logistics, construction and commissioning management, and the execution of construction works. Located in Ras Laffan Industrial City, Pearl GTL is the world’s largest source of GTL products, capable of producing 140,000 barrels of GTL products each day. The plant also produces 120,000 barrels per day of natural gas liquids and ethane. The new phase of the project will allow Qatar Shell to continue to enhance local development. The project award follows the acquisition of Kentz by SNC-Lavalin on August 22, 2014. The acquisition of one of the world’s top oil and gas service providers has transformed SNC-Lavalin's capabilities in the sector, creating a group of approximately 20,000 high-caliber employees with end-to-end expertise for large and complex projects. SNC-Lavalin and Kentz are now combining their industry leading capabilities for the direct benefit of clients. “We are thrilled to have an opportunity to strengthen our excellent relationship with Qatar Shell, which began with our first contract for Pearl several years ago,” said Christian Brown, President, Oil & Gas, SNC-Lavalin Group Inc. “This is a highly strategic contract for us since we will be providing complete EPCM services to our client as needed for at least four years.”

- 9. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 9 About SNC-Lavalin Founded in 1911, SNC-Lavalin is one of the leading engineering and construction groups in the world and a major player in the ownership of infrastructure. From offices in over 50 countries, SNC- Lavalin’s employees provide EPC and EPCM services to clients in a variety of industry sectors, including mining and metallurgy, oil and gas, environment and water, infrastructure and clean power. SNC- Lavalin can also combine these services with its financing and operations and maintenance capabilities to provide complete end-to-end project solutions. www.snclavalin.com About Qatar Shell Qatar Petroleum and Shell delivered two of the largest energy projects in the world in Ras Laffan Industrial City. Pearl Gas to Liquids (GTL) is the world’s largest GTL plant and cements Qatar’s position as the GTL capital of the world. The Qatargas 4 Liquefied Natural Gas project (QP (70%) and Shell (30%)) combines Shell’s global leadership in LNG with Qatar’s position as the world’s largest LNG supplier. Shell has established a world-class research and development facility and a learning centre, the Qatar Shell Research & Technology Centre, at the Qatar Science & Technology Park. Shell has a financial commitment to invest up to $100 million on programmes at the Centre over a 10-year period. In December 2011 Shell and QP signed a HOA to jointly develop a world-class petrochemicals complex in Ras Laffan Industrial City. For more information visit: www.shell.com.qa

- 10. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 10 UK: Wood Group secures major BP contract Source: Wood Group + NewBase Wood Group has been awarded a five year contract with an estimated value of $750million from BP. Under the contract Wood Group PSN (WGPSN) will deliver engineering, procurement and construction services to six UK continental shelf (UKCS) offshore upstream assets and the Forties Pipeline System (FPS) onshore midstream facilities in Grangemouth. Effective January 2015, the contract will create 150 new jobs and secure more than 700 existing positions. This is WGPSN’s largest contract award in 2014 and includes an option for two, one- year extensions. WGPSN already provide engineering, procurement and construction services for six BP offshore assets - Clair, Magnus, ETAP, Andrew, Bruce, and its new Glen Lyon FPSO which is currently being constructed and is due to come online in 2016. This is the first time WGPSN has secured a contract for the FPS onshore facilities and adds to the company’s current contract to support BP’s Sullom Voe Terminal in Shetland. Dave Stewart, UK managing director of WGPSN said: 'Wood Group has more than 40 years of experience working with BP globally and this new contract is testament to the partnership and understanding we have developed. Providing this combined service across upstream and midstream operations for the first time positions us well for continued excellence in delivering safe, collaborative and innovative services directed at maximizing productivity and efficiency across BP’s assets in the UK.' In the UK, Wood Group now employs more than 10,000 people working onshore and offshore.

- 11. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 11 Finland grants EUR 27.6 mln for HaminaKotka LNG terminal FME&E + NewBase The Finnish Ministry of Employment and Economy has granted €27.6 million to support the construction of an LNG terminal at the port of HaminaKotka. Earlier this year, the Ministry granted financial support totaling €65.2 for three LNG terminals for Manga LNG, Skangass and Aga AB. The Finnish state set aside €124 million for investment in LNG terminals this year with the aim to build a comprehensive network of terminals along the Finnish coast, creating the alternative supply routes for the transportation industry, said Minister of Economic Affairs, Jan Vapaavuori. The terminal is part of the country’s push to improve the infrastructure that would enable the use of LNG in marine and road transport. Hamina Energia plans to complete the terminal at the port of HaminaKotka by 2018. The terminal would consist of one 30,000 cbm storage tank and the accompanyin g LNG receiving and unloading facilities.

- 12. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 12 Oil Price Drop Special Coverage Oil market free fall unbridled THE carnage continues! Markets are in free fall. Benchmark US oil price dropped this week below $60 a barrel for the first time since July 2009, whereas Brent for January settlement appeared hovering at around $63 on the London-based ICE Futures Europe Exchange. This was its lowest close since July 16, 2009. Crude took this fresh drubbing when, in view of the surging US output, OPEC had to reduce the estimates of call on its crude for 2015 and Kuwait offered new discounts to Asian customers, offering the biggest discount to its Asian customers since December 2008. It announced setting the price of its crude at $3.95 a barrel below a Middle East benchmark for next month. Growing US crude output continued to add to the glut. US production expanded to 9.12 million barrels a day in the week ending December 5, the Energy Information Administration reported. That’s the fastest rate in weekly records that started in January 1983, according to the EIA. Major stakeholders are also getting another message, clearly and boldly – global crude demand growth is softening. Demand for crude from the Organization of Petroleum Exporting Countries will drop next year by about 300,000 barrels a day to 28.9 million, the least since 2003, OPEC said in a report last week. In its monthly oil report, OPEC forecast for call on its output was down 280,000 bpd from its previous expectation and over 1 million bpd less than it is currently producing. OPEC output was 30.56 million barrels a day in November, exceeding its target for a sixth straight month, a Bloomberg survey of companies, producers and analysts showed. The US Energy Information Administration too has revised down its forecast for global consumption by 200,000 barrels per day next year. According to the EIA’s estimates, global oil consumption will climb by only 880,000 bpd next year. Previously it had assumed an increase of 1.12m bpd. At the same time the EIA has said that US oil production growth would slow too and it now expects US oil production to only increase by between 130,000 bpd and 720,000 bpd, to average 9.3 million bpd in 2015. And in the meantime, adding to the overall gloom is the Saudi insistence that crude is a cyclical market and that it would ultimately stabilize without any interference in the form of output cut. “Why should I cut production?” Minister Al-Naimi asked reporters in Lima, Peru. “This is a market and I’m selling in a market,” he insisted, reiterating that the Kingdom produced 9.6 to 9.7 million bpd of crude in November, a figure consistent with October estimates.

- 13. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 13 “That is not going to change unless other customers come and say they want more oil,” he underlined. Asked whether the market was oversupplied, he said, “you can see from the price. You know what a market does for any commodity: It goes up and down and up and down.” A bearish sentiment is hence getting hold of the markets. Crude market prices will slump to $50 a barrel over coming months as market forces shake out the weakest producers, Bank of America is now warning. With $60 mark already there, some others too are now saying that $50 is in sight. “That’s not out of the question. It’s happening faster than I thought it would happen. I was calling for $50 but I was envisioning that happening in February,” said John Kilduff, oil analyst at Again Capital. “It seems like the market can’t find a bottom yet,” said Gene McGillian, analyst at Tradition Energy was quoted as saying. “Right now the market is in free fall status. ... It appears we’re going to break $60 and get near the $50 mark.” Analysts at investment bank Morgan Stanley too are warning that oil could fall to $43 a barrel in the second quarter of next year unless output is reduced. “Without OPEC intervention, markets risk becoming unbalanced, with peak oversupply likely in the second quarter of 2015,” it said in a report. Morgan Stanley also slashed its 2015 base case forecast for Brent to $70 from $98 a barrel and for 2016 to $88 from $102 a barrel. In its bear-case scenario, the bank sees the crude benchmark falling to a low of $43 a barrel in the second quarter of next year. A top Iranian oil official too underlined at an industry conference in Dubai last week that unless leading producers can find common ground, the world could be looking at prices as low as $40 a barrel in the coming months. “Any break in OPEC solidarity or a price war will lead to an enormous price dive-shock” that would push prices to that level, Mohammad Sadegh Memarian, head of market analysis for Iran’s oil ministry, told the audience at the conference in Dubai. Trade data from China has also not been very encouraging. The growing evidence of economic weakness in the world’s No. 2 oil consumer seems likely to pile more pressure on crude markets. China’s imports fell 6.7 percent in November from a year earlier, coming in well below expectations and adding to concerns the world’s second-largest economy could be facing a sharper slowdown. Oil prices will stay around $60 a barrel for the next five years as China’s economy cools down, economist Andy Xie, the former Morgan Stanley and IMF senior economist told CNBC on Thursday. Oil prices had been rising because of China’s boom, Xie said in CNBC’s “Squawk Box” program.

- 14. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 14 China is now transitioning from a 15-year super cycle that built up a massive industrial machine, and the economy must cool down to digest overinvestment, which will drag down commodity prices, he said. “When China goes into normal situation, I think that the oil price will become normal, so $60 would be the normal price for the next five years or so,” he said, adding over the next four to five years, China will experience deflation and sluggish demand. Markets continue to slide, as gloom is taking over. Sentiments stand altered – all around! Hedging separates the winners in shale plays Reuters + NewBase Oil’s slide to the lowest price in more than five years is carving a divide between US shale drillers who heavily hedged future production and those who didn’t. While financial hedges are commonly required by many oilfield lenders, the industry’s mid-sized US-focused shale field producers pursued varied strategies when it came to protecting future revenues. Those decisions are now coming back to haunt some drillers. Best-known is Continental Resources, which lifted its hedges in early November, when oil was trading at around $83 a barrel, leaving it unprotected as prices slipped another $20, the most dramatic drop since the 2008 crisis. Continental’s share price has been more than halved since late June. Apache Corp and Whiting Petroleum are also exposed to lower prices and have underperformed some peers over the past two weeks. Oil producers typically hedge against lower prices by locking

- 15. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 15 in some of their future production at favourable prices through swap transactions sold by banks, or by buying options as insurance against lower prices. Among major and mid-sized exploration and production companies, some 35 per cent of all 2014 oil production was hedged at an average of $95.5 a barrel as of November, according to an analysis prepared by RBC. Yet only 14.3 per cent of 2015 production was hedged. With Opec kingpin Saudi Arabia refusing to cut supply and shore up prices any time soon, firms face the prospect of lower revenues for months to come. US crude fell below $60 a barrel on Thursday for the first time since 2009. At Devon Energy Corp, the effect of tumbling prices “may not be nearly as large as you think” because of hedging, said Dave Hager, Devon’s chief operating officer. “We’re in outstanding shape as a company.” Devon, which pumped over 80 per cent of its oil from US shale fields last quarter, stands out as the most aggressive hedger among the larger-cap US oil drillers. It has hedged about 140,000 barrels per day (bpd) of crude for all of next year, equivalent to 80 per cent of its third quarter output, according to company filings. If US crude prices were to remain at about $65 a barrel next year, those hedges could net Devon an extra $1.3 billion in revenue, according to Reuters calculations. Devon has been “very good at not drinking the Kool-Aid” in an industry that had been counting on years of high prices, said Rick Rule, chairman of Sprott US Holdings, an asset management firm. For the past several years, hedging was a relatively minor consideration for investors. Oil prices stayed fairly steady at about $100 a barrel, meaning most hedged positions were neither heavily in nor out of the money. Now that the crude price has almost halved in the past six months, and predictions grow for a prolonged slump in prices, investors are scrutinising filings to understand which corporations were clever enough to have locked in prices before the slump and therefore have enough cash on hand to pay increasingly expensive service contracts. “The purpose of hedging is to secure cash flow regardless of price scenario,” said Robert Campbell, head of oil products research at Energy Aspects in New York. “The whole thing with (shale drillers) is cash preservation.” Most large-cap producers, unlike Devon, don’t hedge as a rule, and many such as Occidental Petroleum and ConocoPhilips have even outperformed Devon in recent months, aided in part by their refinery holdings, which generate additional revenue when oil prices are down. Some analysts point to Apache as an example of the perils of not hedging. While Devon’s shares have fallen by 32 per cent since June, Apache’s have dropped by 44 per cent as investors raise alarms about a potential cash crunch. “They’re basically naked and don’t have any cash flow protection,” said Leo Mariani, a senior analyst at Capital Markets. While hedging helps producers stem losses when prices are low, it also caps their potential gains. Many lenders require their clients to place some hedges on future production in order to smooth out revenue volatility. But others have much more flexibility.

- 16. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 16 Whiting Petroleum, which like its peer and rival Continental is heavily focused on the Bakken shale fields in North Dakota, had hedged only about 3,000 bpd in 2015, according to the firm’s third-quarter SEC filings, or about 4 per cent of its current daily production. Its acquisition of Kodiak Energy Inc, expected to close early next year, will add another 6,000 barrels a day of hedged production through 2015, a spokesman said — still only 7 per cent of the combined company’s output at current levels. That may explain why Whiting’s stock has fallen almost 65 per cent from all-time highs in late August, though the pending acquisition and its exposure to the higher-cost Bakken play are also likely considerations. Qatar to remain resilient to low oil prices: QNB The Peninsula + NewBase Qatar’s economy is expected to remain resilient to lower oil prices. Oil prices are widely expected to recover gradually once the current supply glut is absorbed, QNB Group analysis noted yesterday. Qatar has ample resources to continue implementing its infrastructure investment programme. The sizeable investments should therefore continue to drive non-hydrocarbon growth and lead to further economic diversification. The fundamental shift that has driven the drop in oil prices in recent weeks has been an upward shift in expectations for a supply glut in 2015, combined with weaker than expected demand, particularly in China. In July, the IEA estimated that the world oil market would be oversupplied by around 0.1 million bpd on average in 2015. However, the IEA’s latest report increased its estimate for this supply glut to 1.3 million bpd, driven by both lower expectations for demand and higher expectations for supply.

- 17. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 17 Firstly, lower expectations for demand in 2015 are the result of weaker than expected global growth. Projections for demand from OECD economies have been revised down by 0.4 million bpd since July, reflecting the recession in Japan and a weaker eurozone recovery. For Emerging Markets, the slowdown in China has led to a downward revision in global demand of 0.3 million bpd. Secondly, on the supply side, expectations for a supply glut are being driven by higher production from Opec countries and stronger US output. According to the IEA, Opec production increased by 0.4 million bpd in Q3, 2014, mainly reflecting resumption in Libya’s production. Meanwhile, production in the US has been rising faster than expected. The IEA has raised its expectations for overall US production by 0.5 million bpd since June. This is mainly the result of new technologies to extract oil from shale rock formations. As a result, total US crude oil production has risen by 67 percent from an average of 5.6 million bpd in 2011 to a projected 9.4 million bpd in 2015. Prices are expected to recover gradually. This is partly because lower oil prices will stimulate greater demand but also because lower prices will discourage investment in new production. The impact on Qatar is expected to be small. Non-hydrocarbon real GDP growth is expected to continue accelerating as the government implement its investment programme ahead of the 2022 World Cup. While lower oil prices will inevitably lead to lower hydrocarbon exports and fiscal revenues, the government has ample resources to finance its investment programme. As a result, the overall economic outlook remains positive amid a continued drive to diversify the economy and thus reduce reliance on the hydrocarbon sector.

- 18. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 18 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your Guide to Energy events in your area

- 19. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 19 NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MSc. & BSc. Mechanical Engineering (HON), USA ASME member since 1995 Emarat member since 1990 Mobile : +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years , he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation , operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally , via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase 14 December 2014 K. Al Awadi

- 20. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 20

- 21. Copyright © 2014 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content . Page 21