Embed presentation

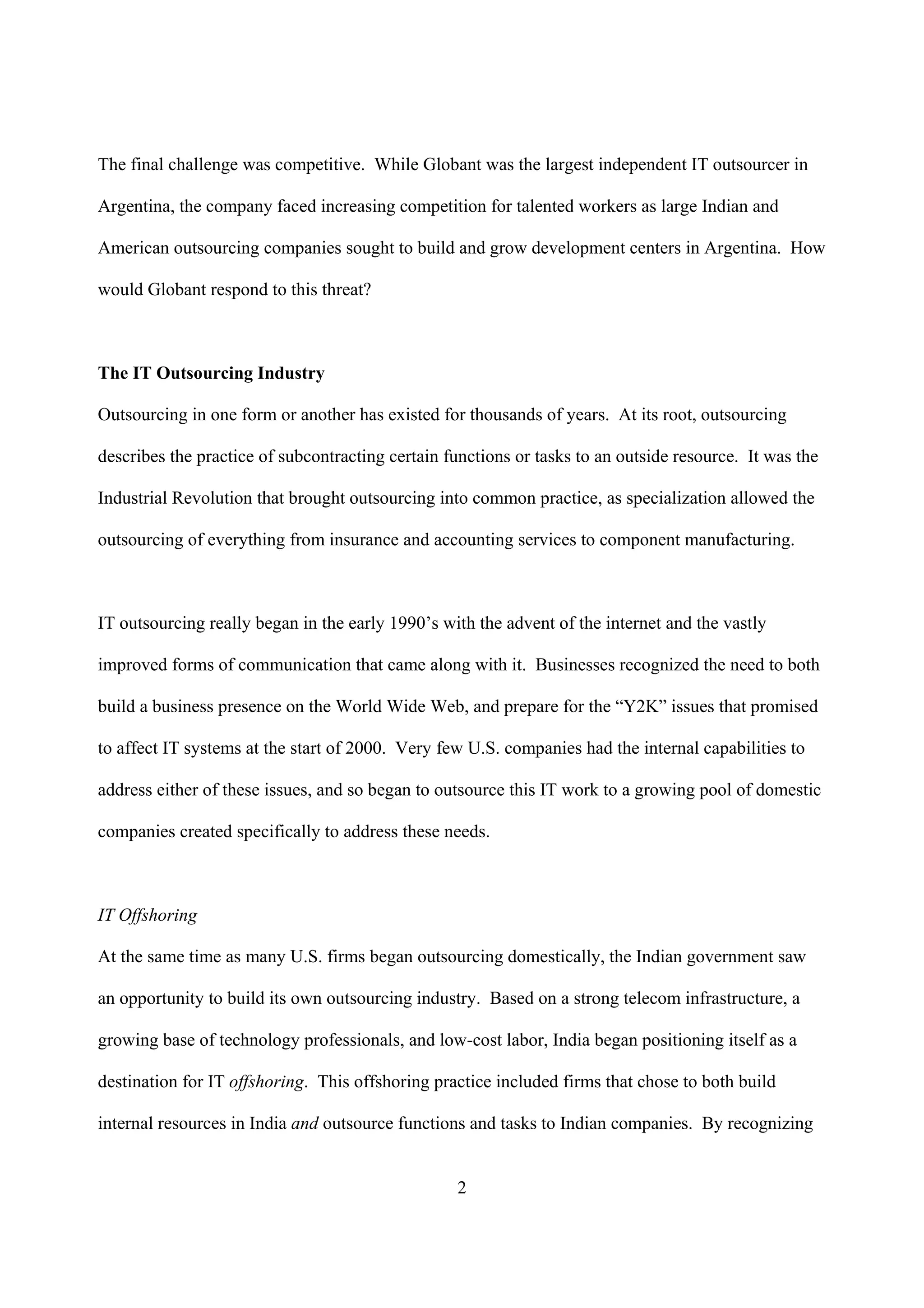

Downloaded 468 times

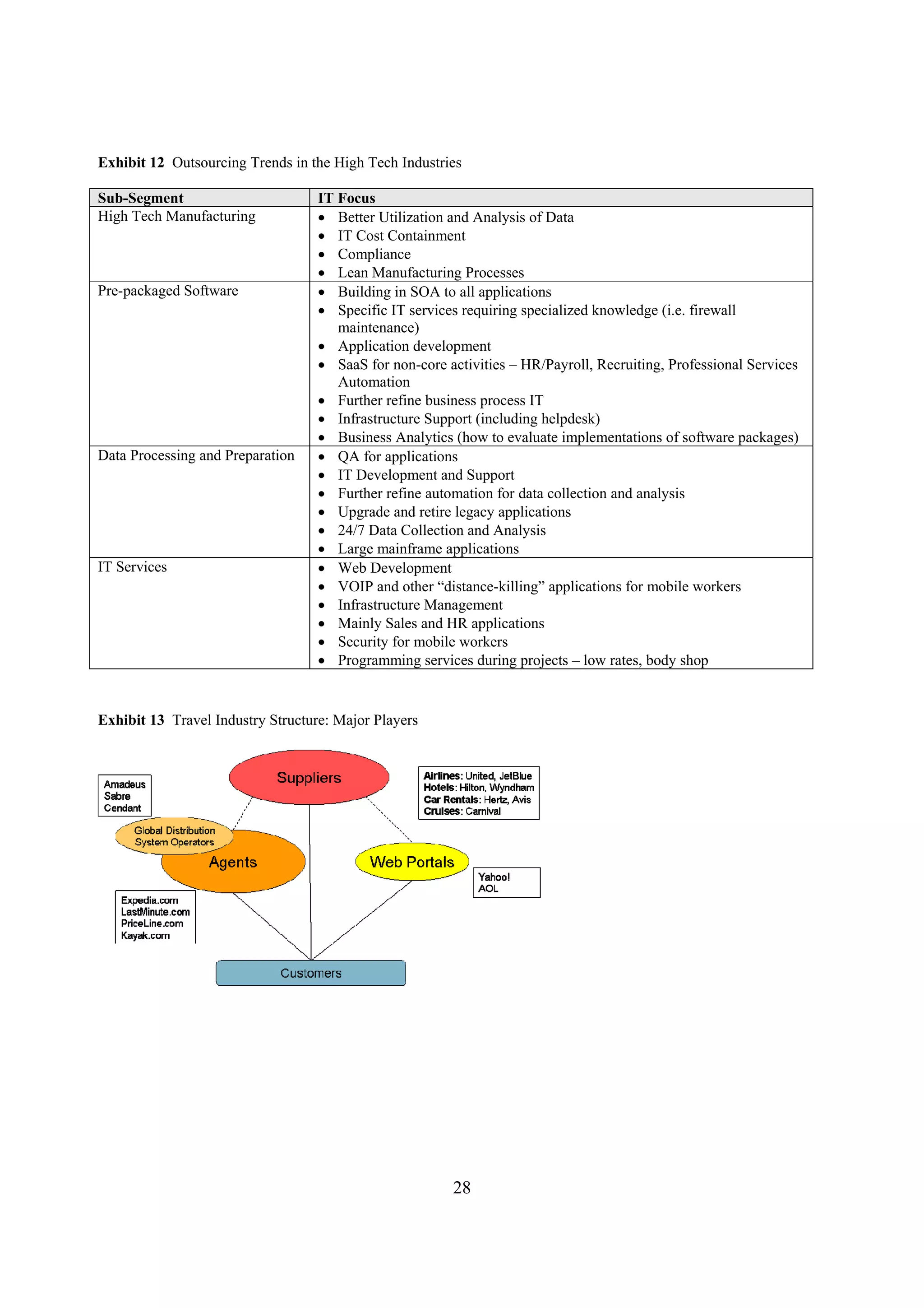

Globant is an IT outsourcing company based in Buenos Aires, Argentina that was founded in 2003. It has grown rapidly to over 240 employees with projected sales of over $12 million in 2006. Martin Migoya, the CEO, wants to further expand the company's sales system and address challenges around focus, competition, and structure of client relationships. Direct competitors include large Indian outsourcing firms like Tata and Infosys as well as Accenture. Globant focuses on the high tech, travel, and telecom industries based on past experience and aims to target both specific industries and geographic regions going forward.