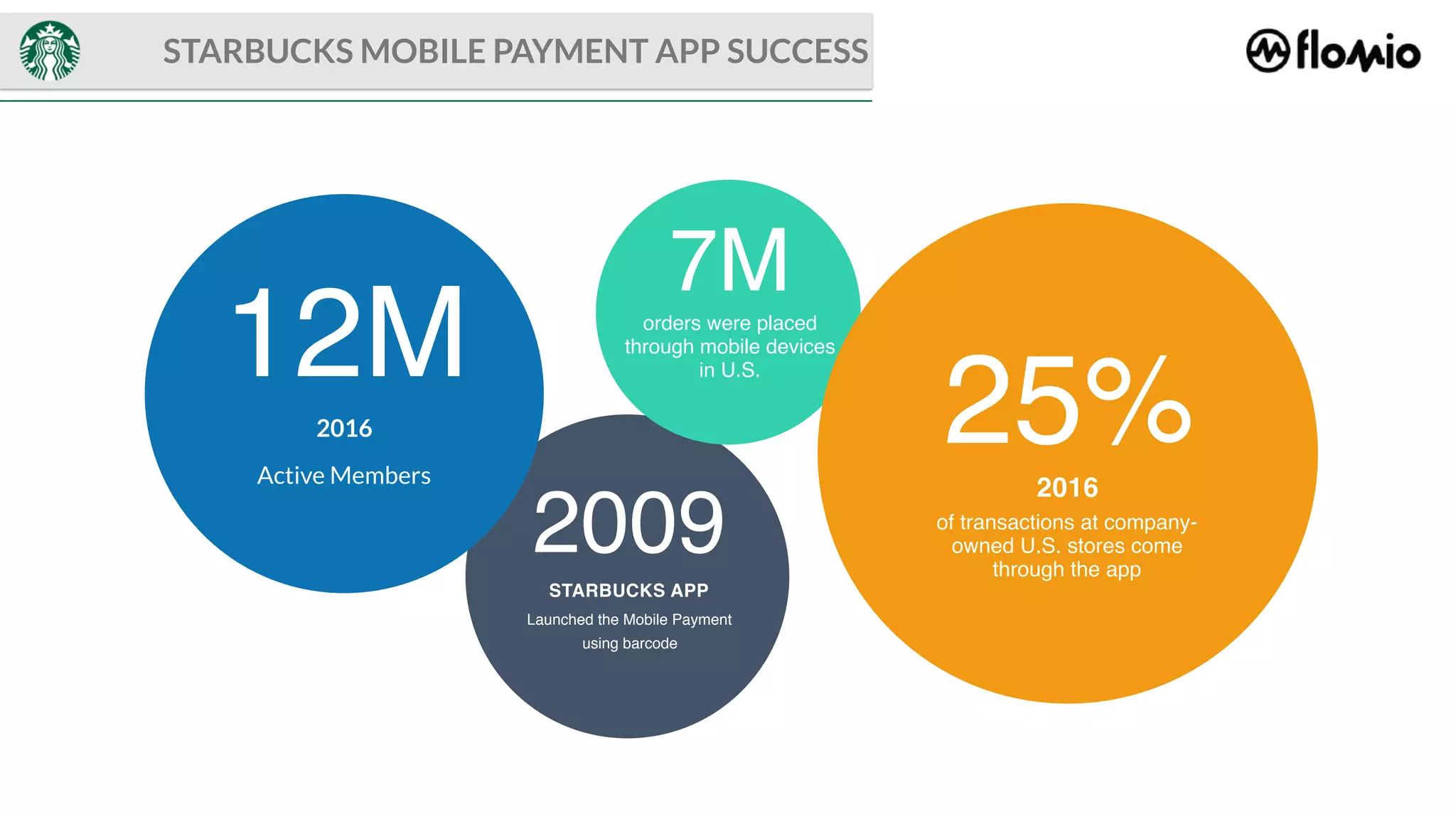

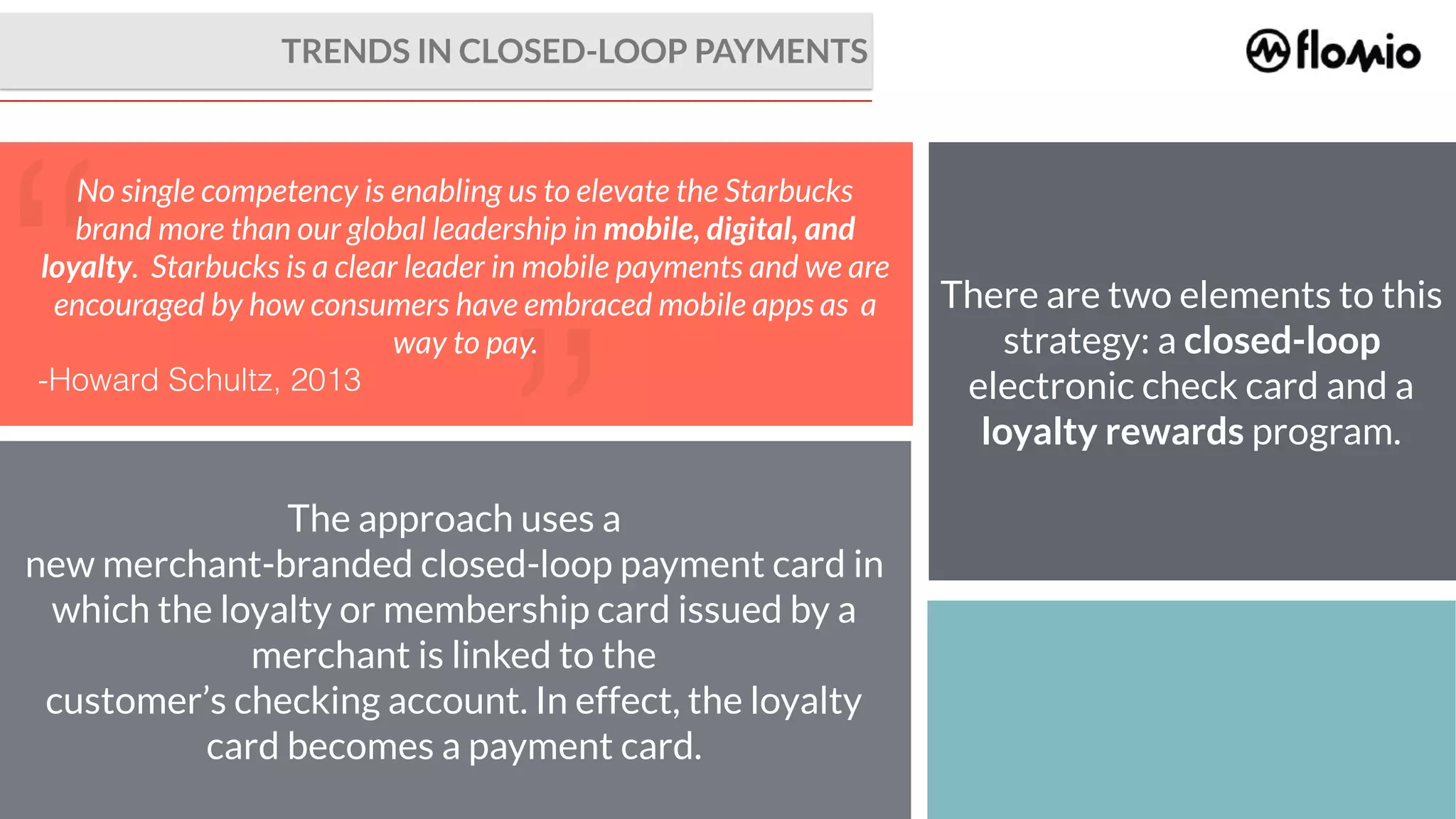

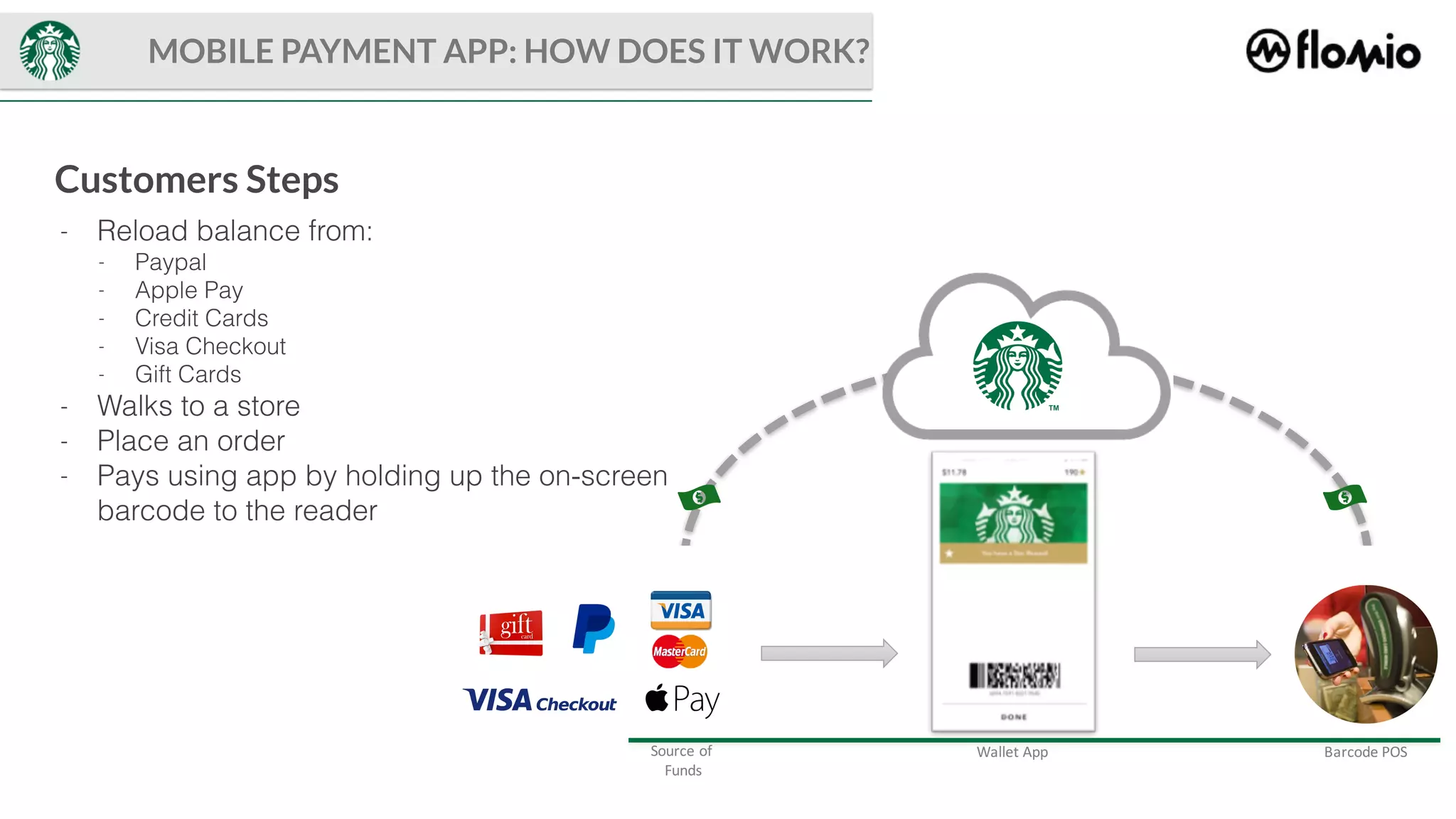

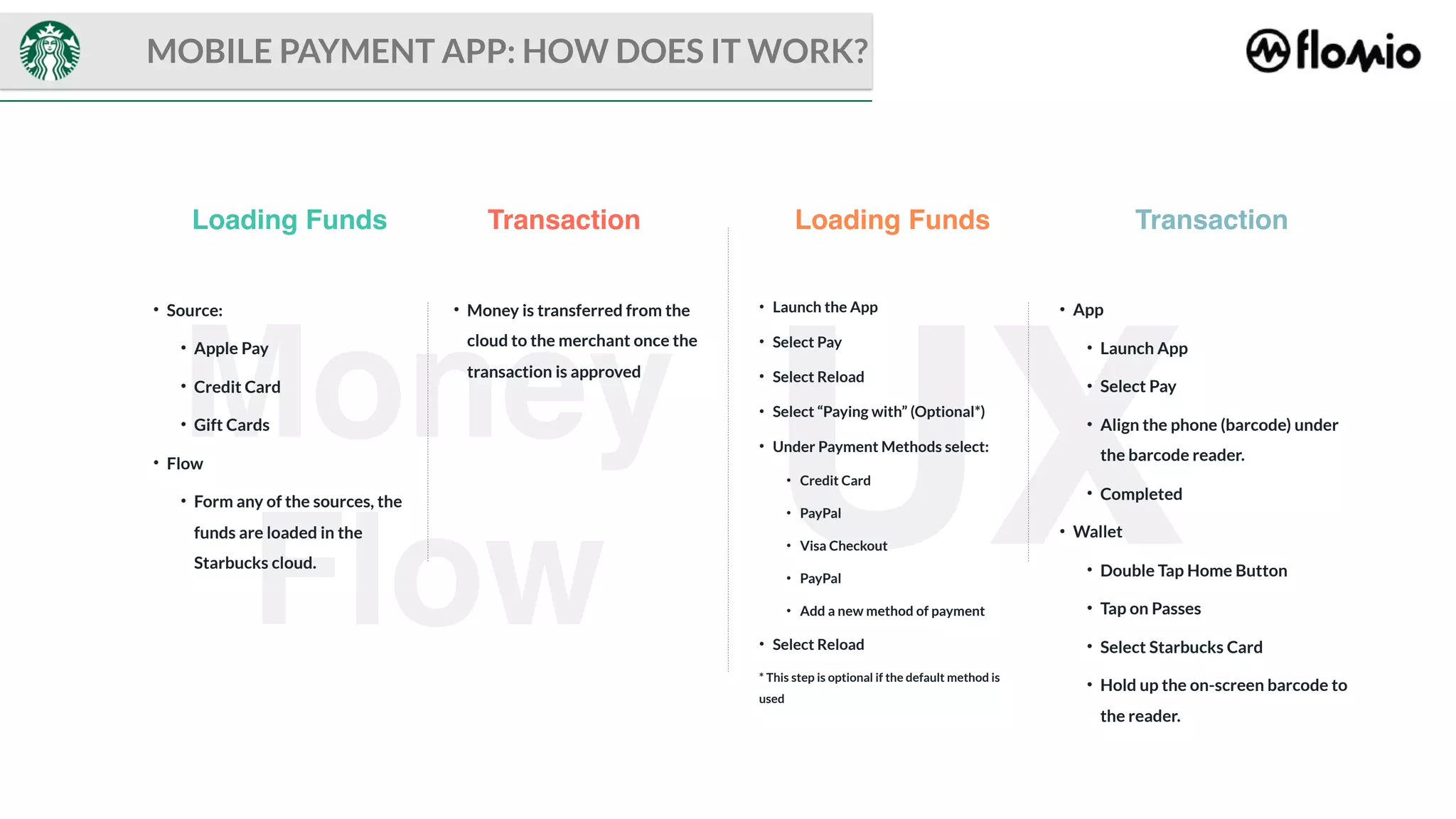

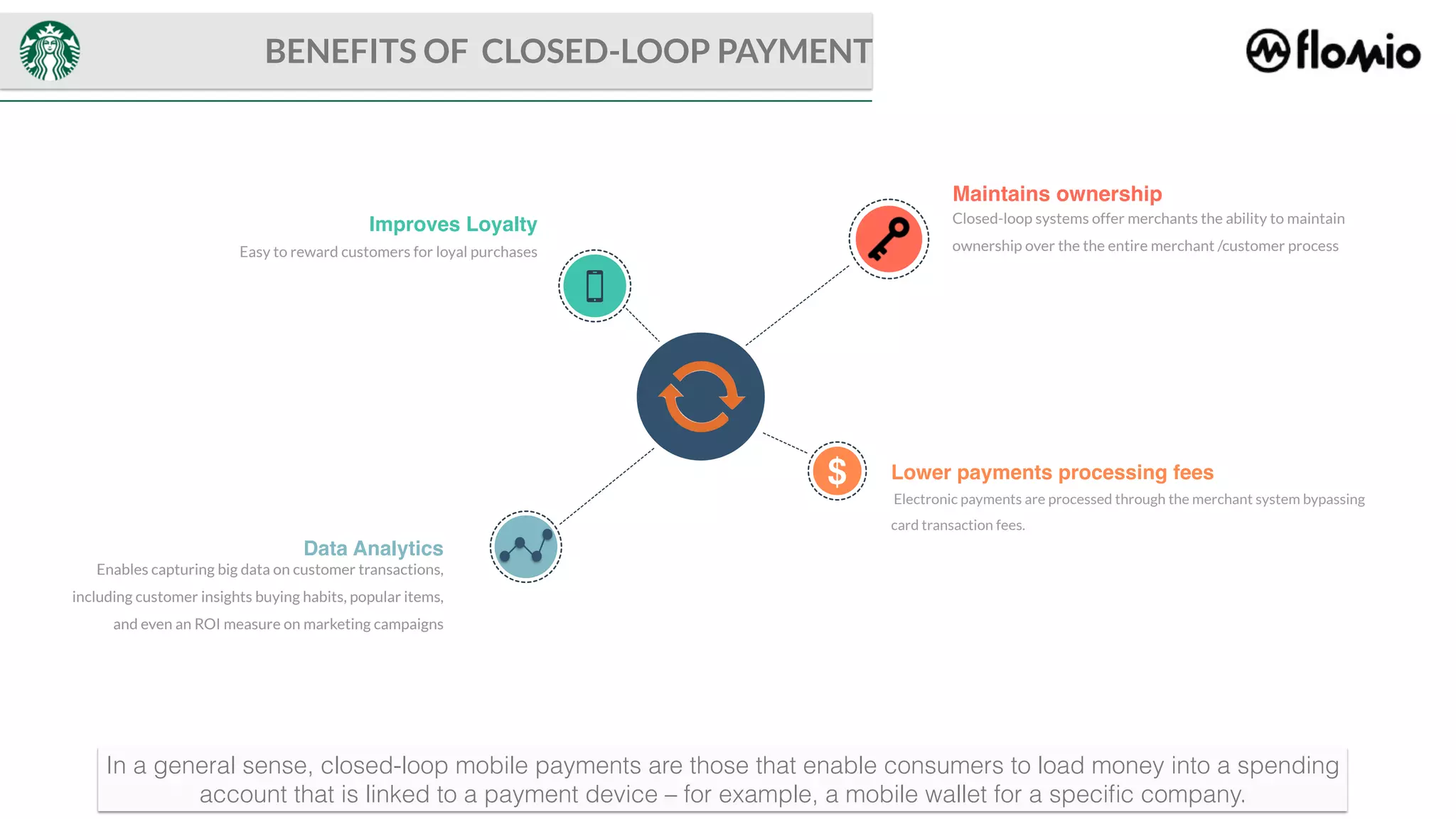

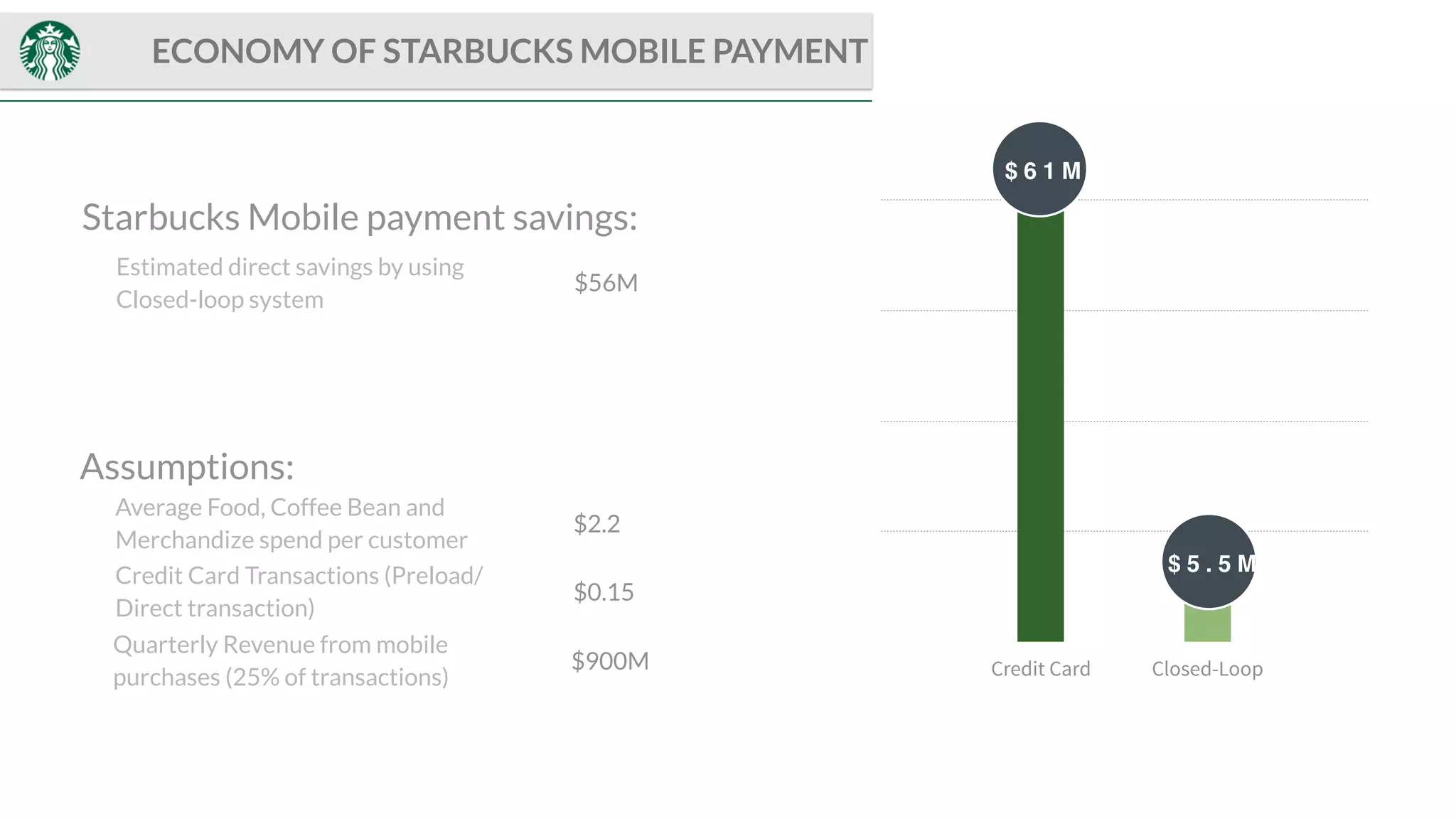

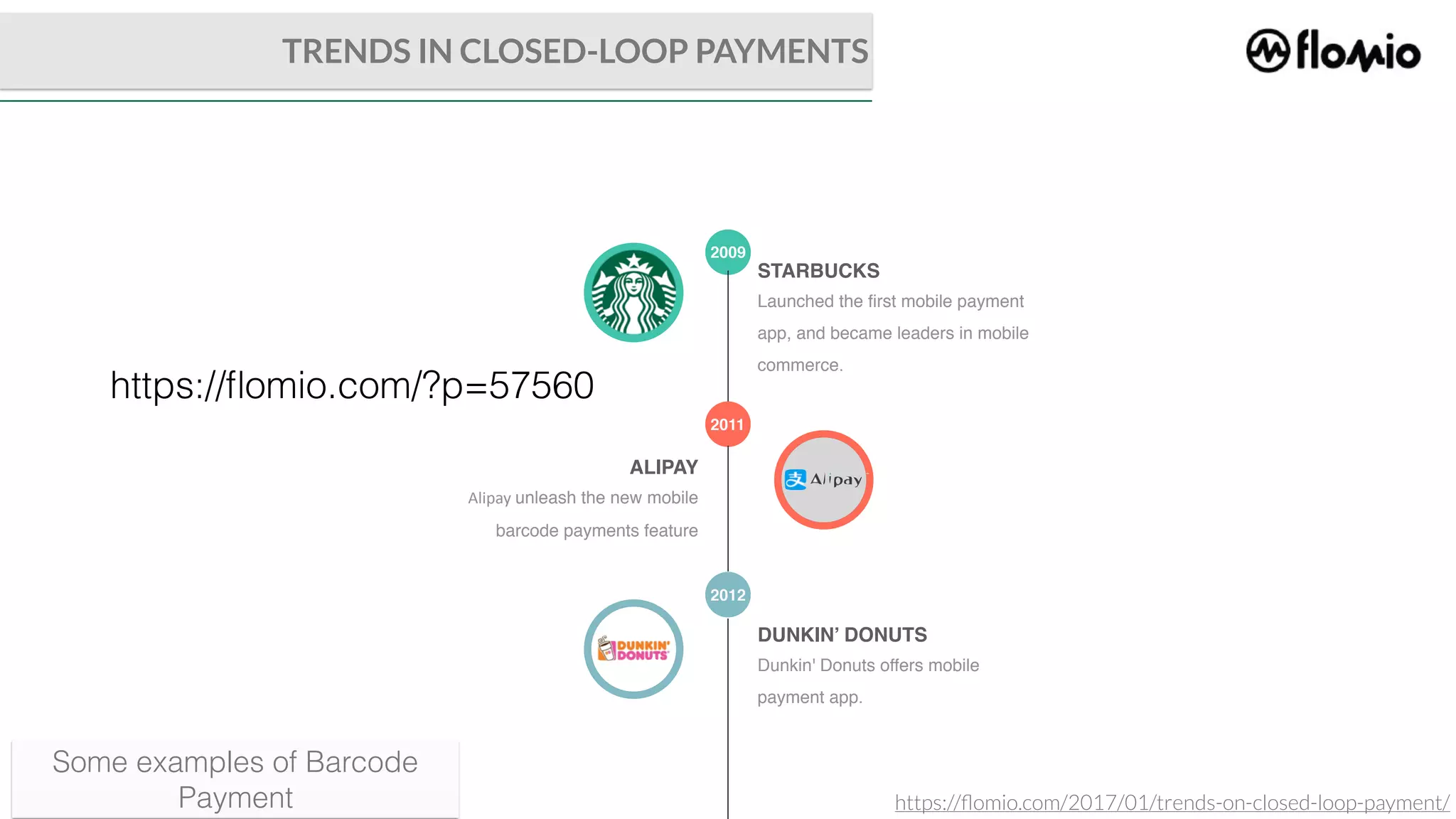

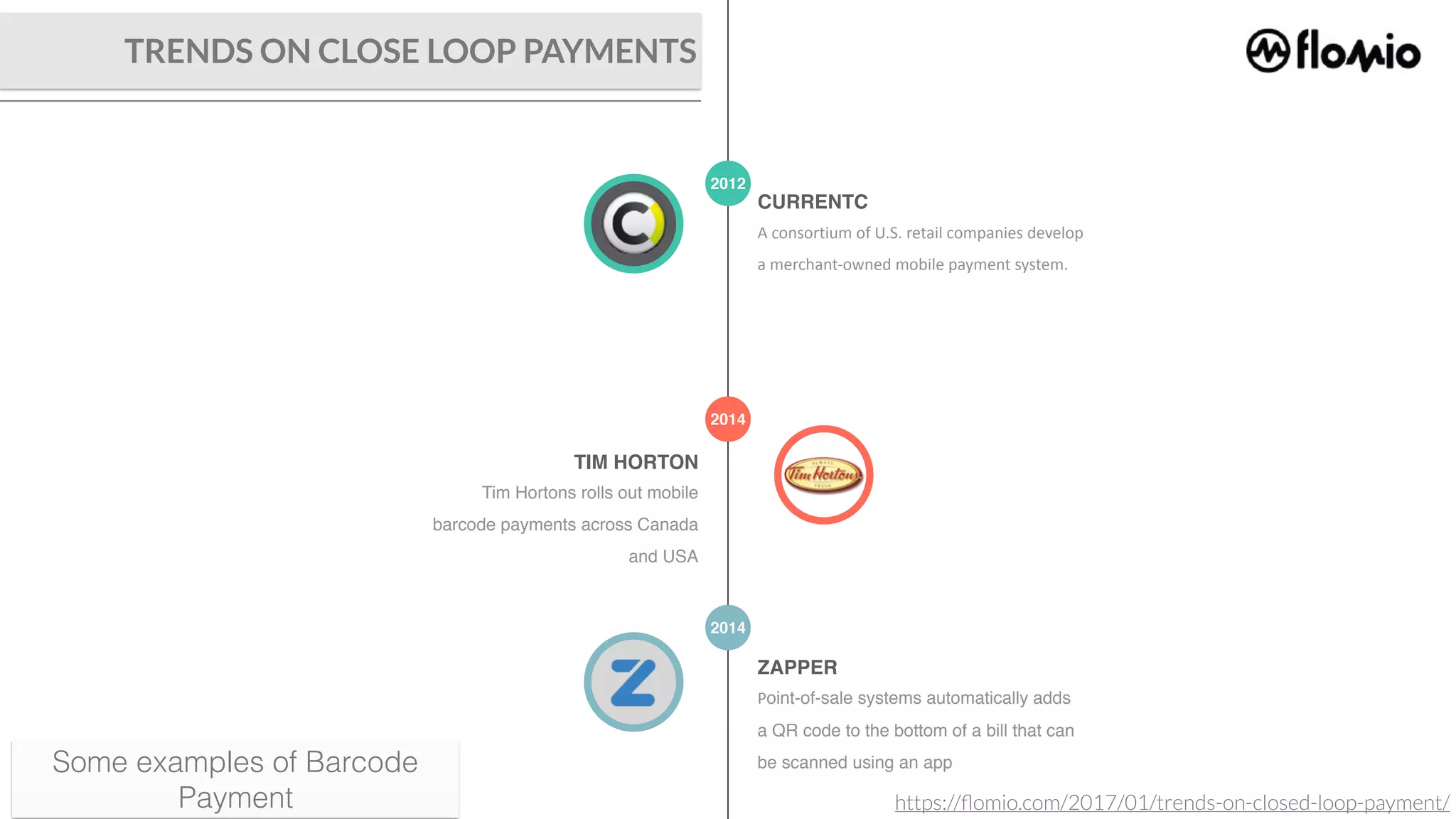

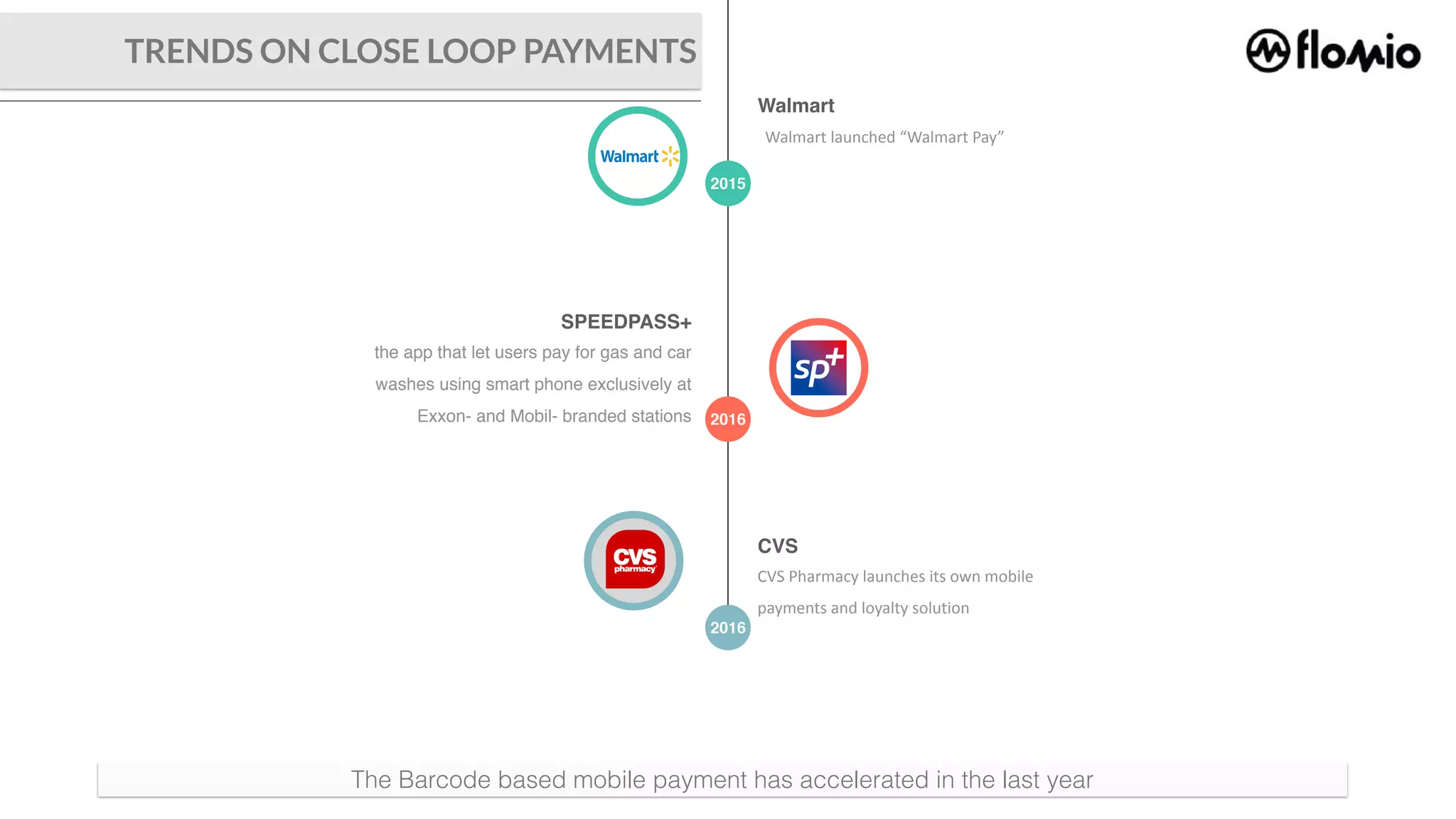

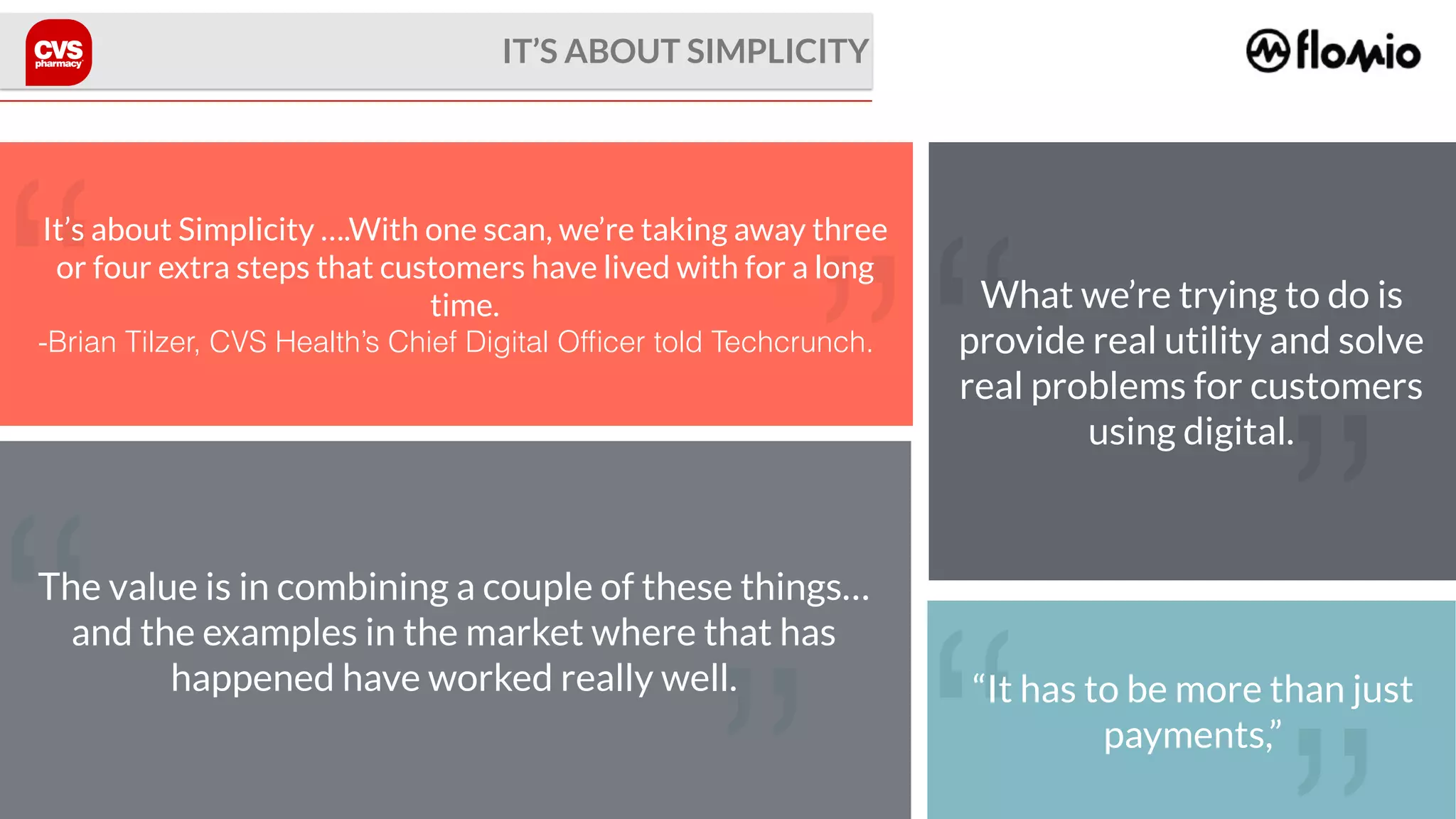

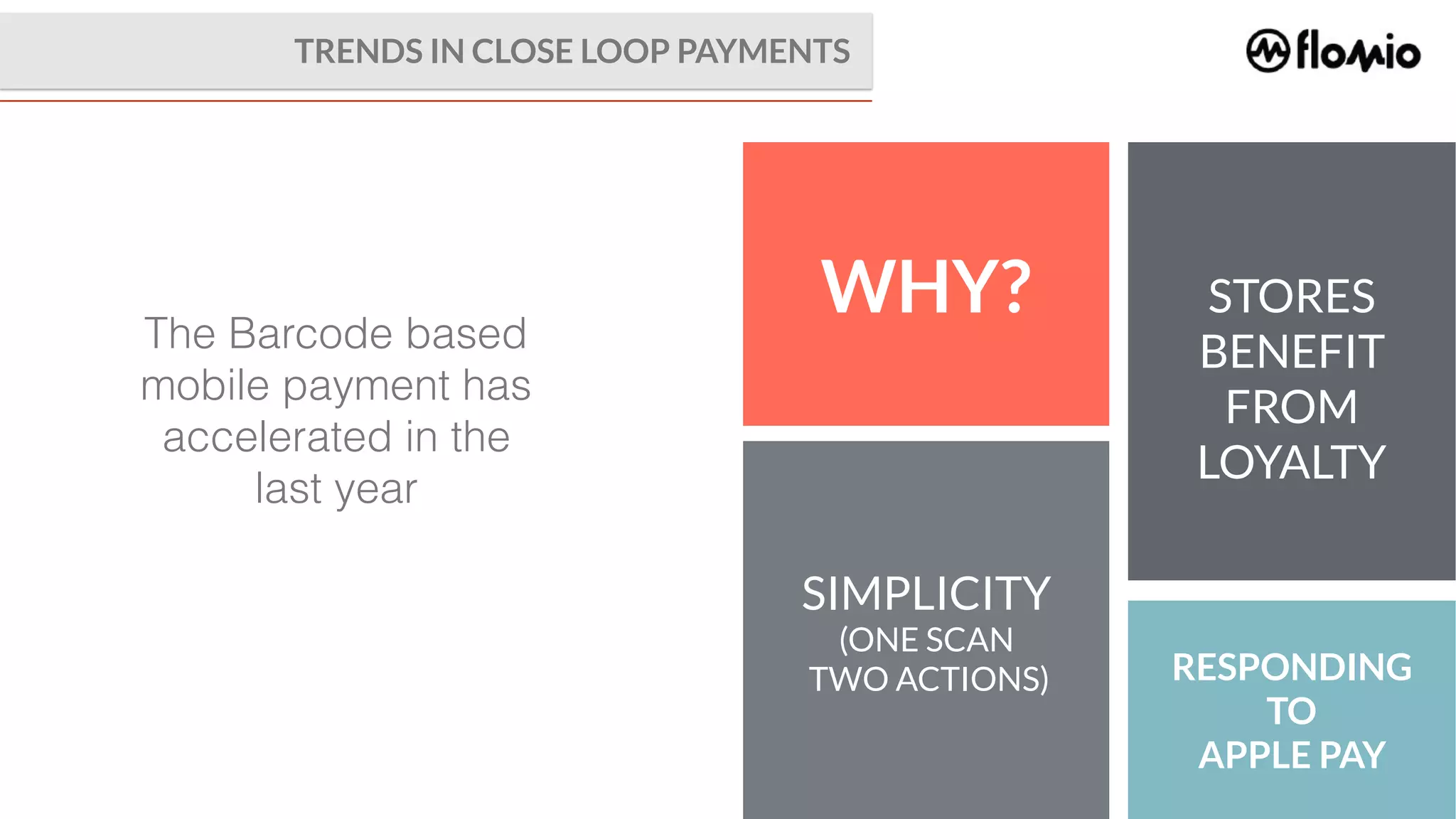

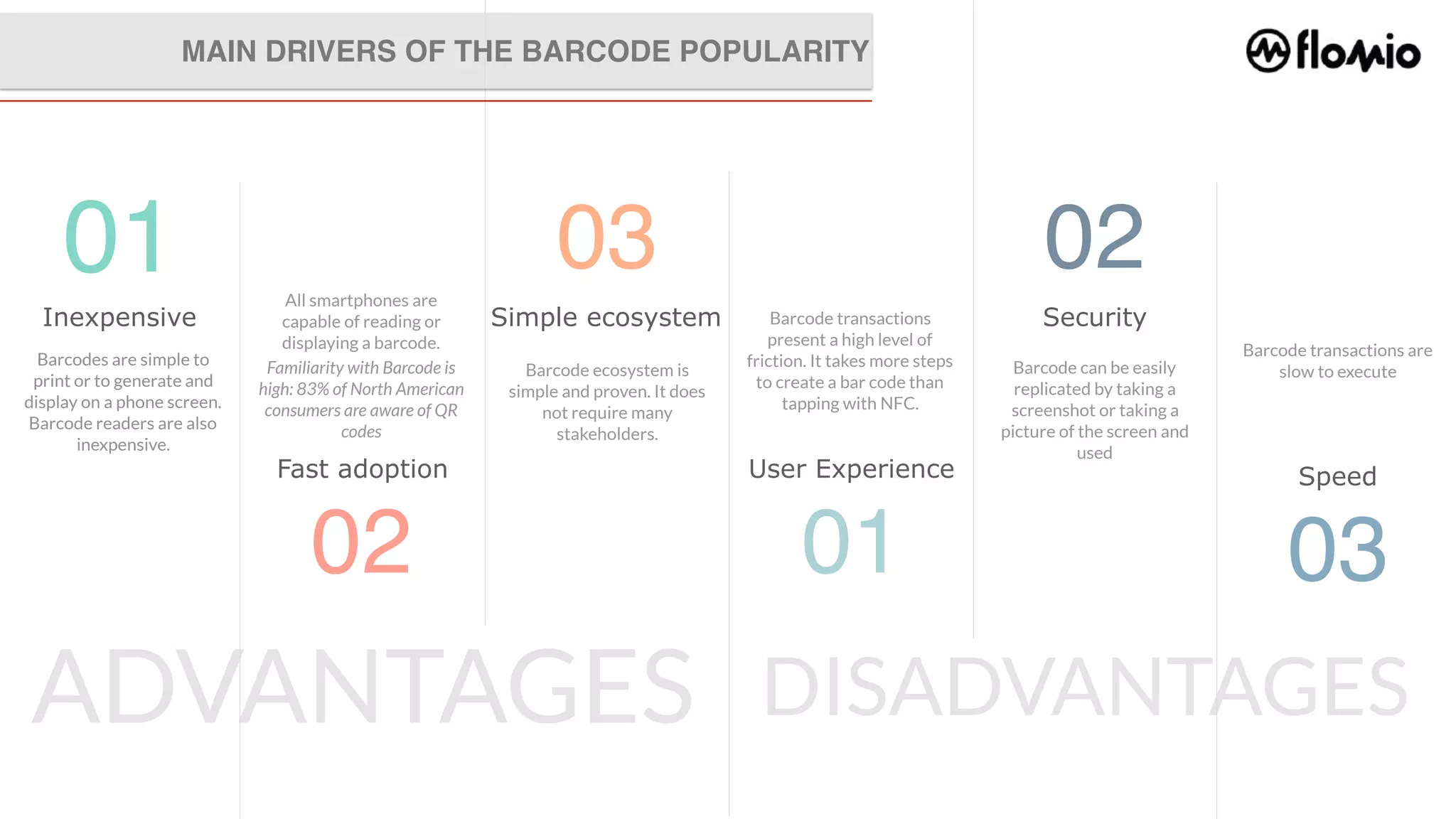

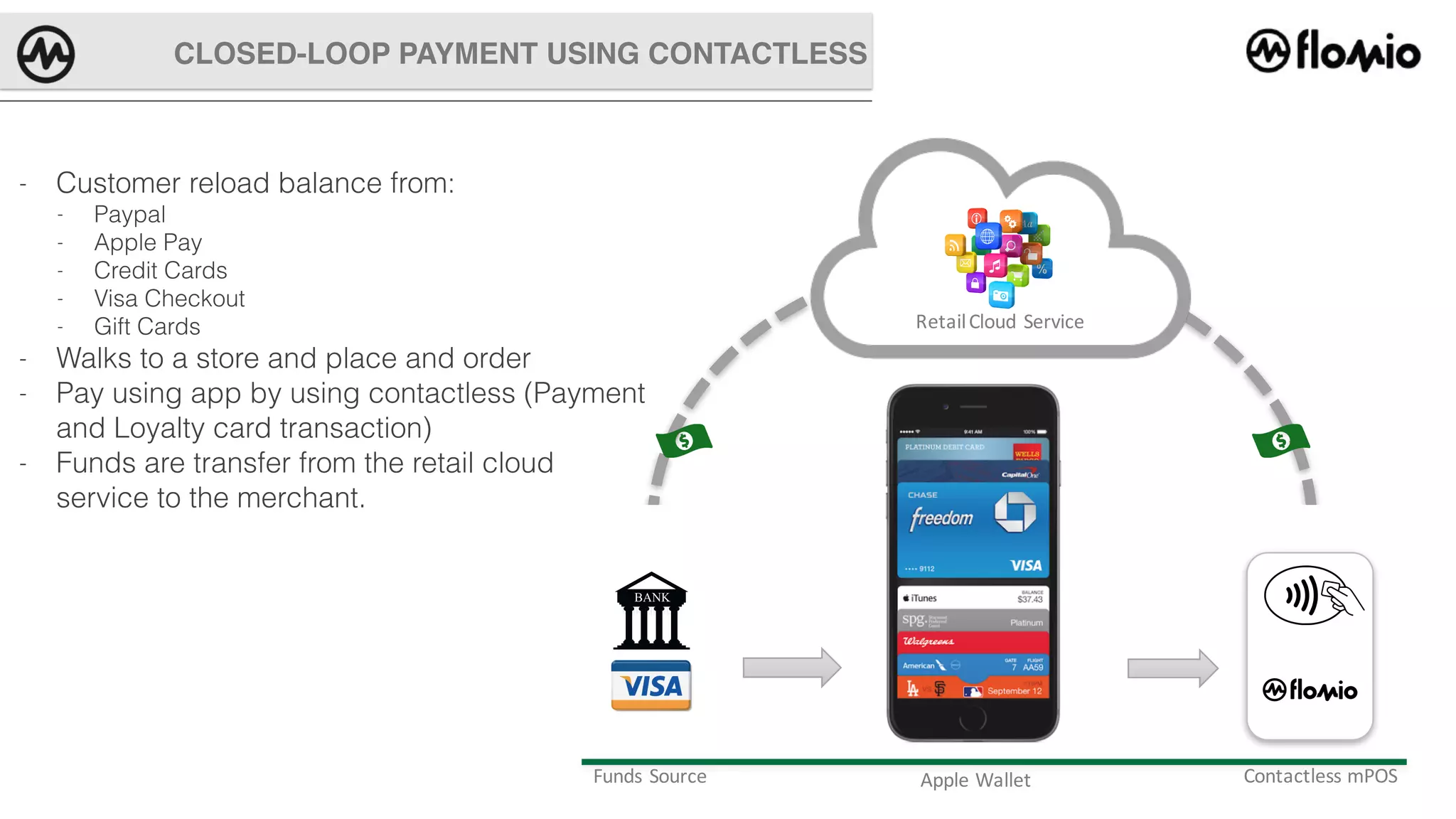

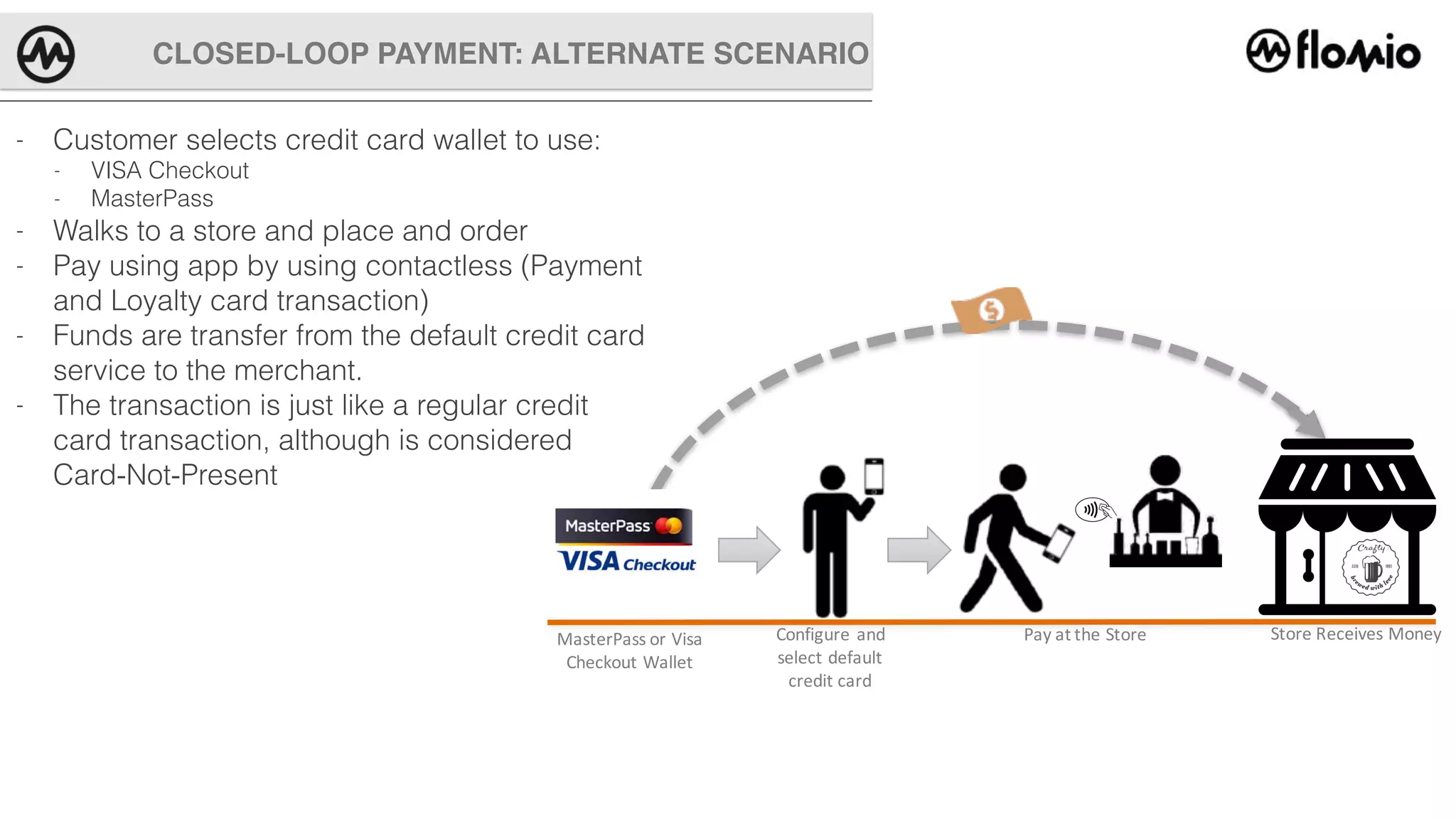

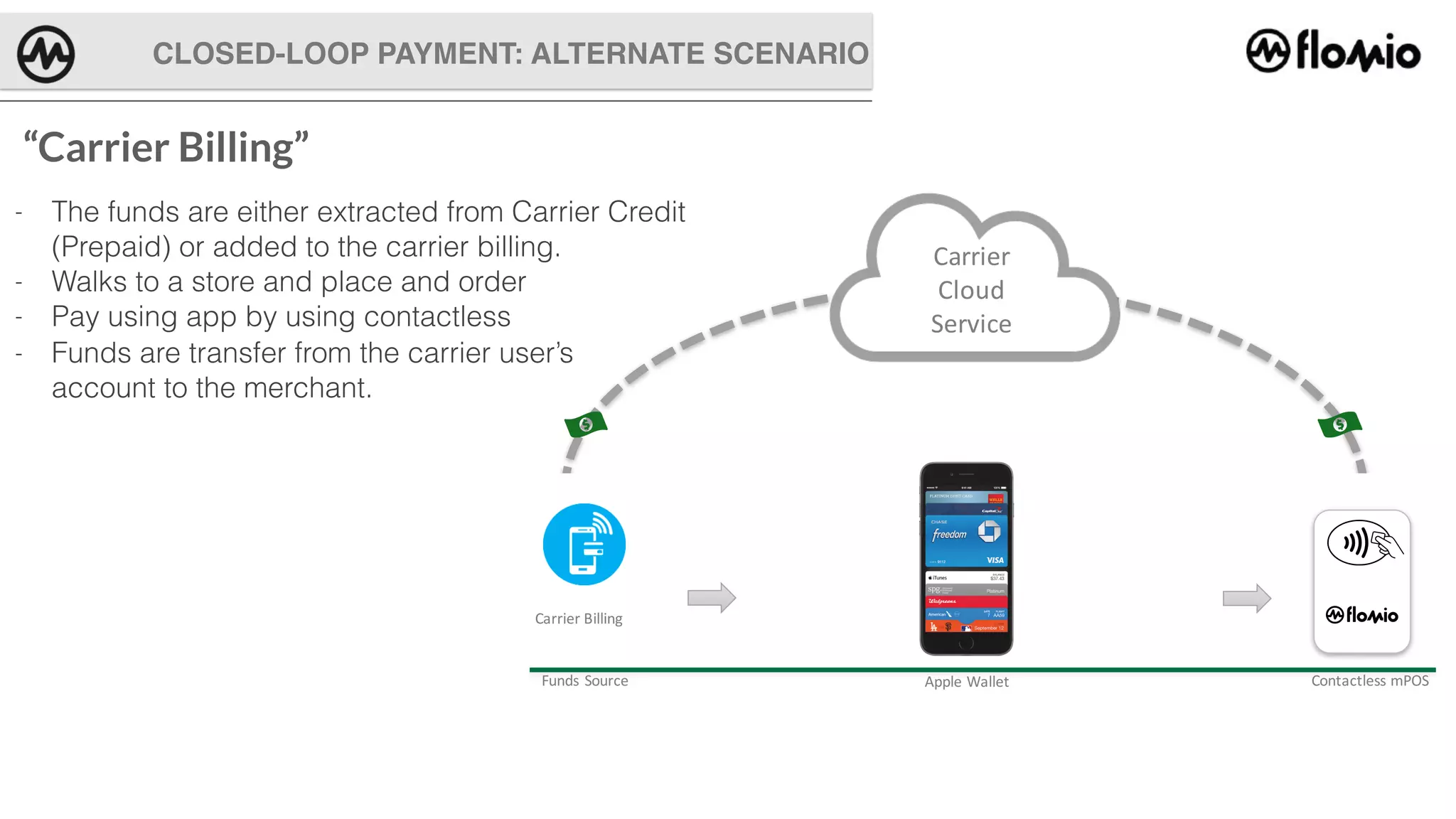

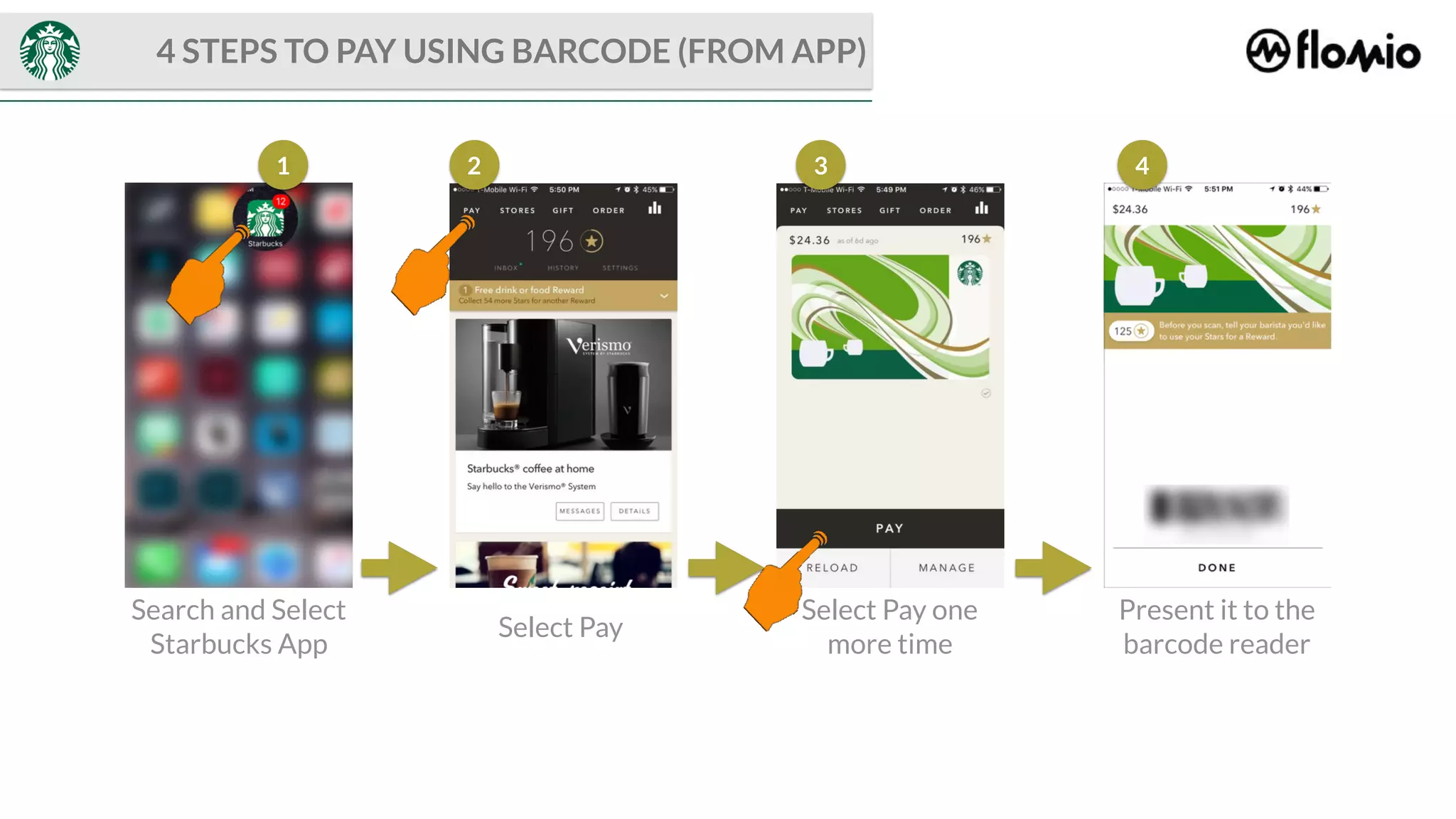

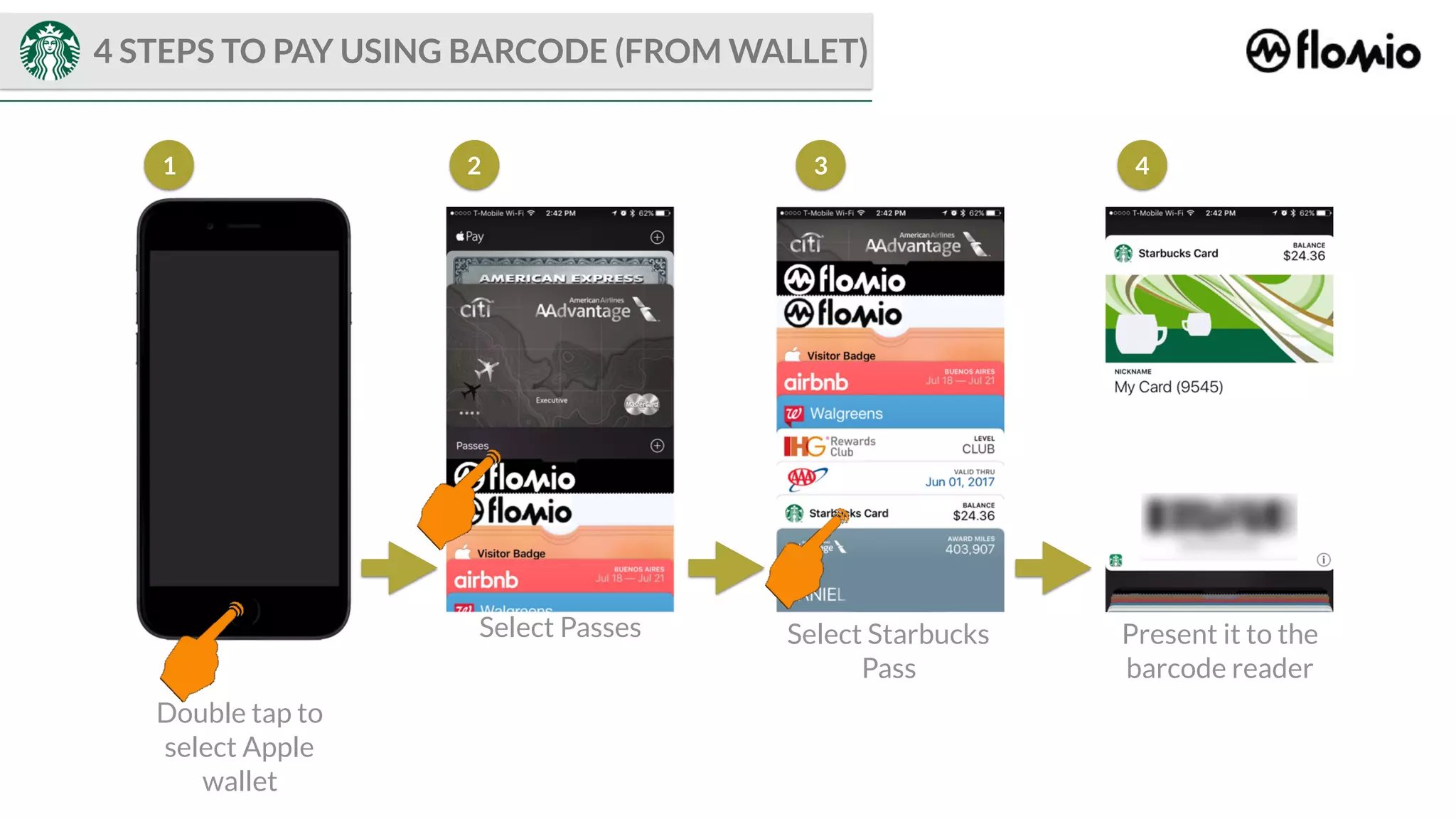

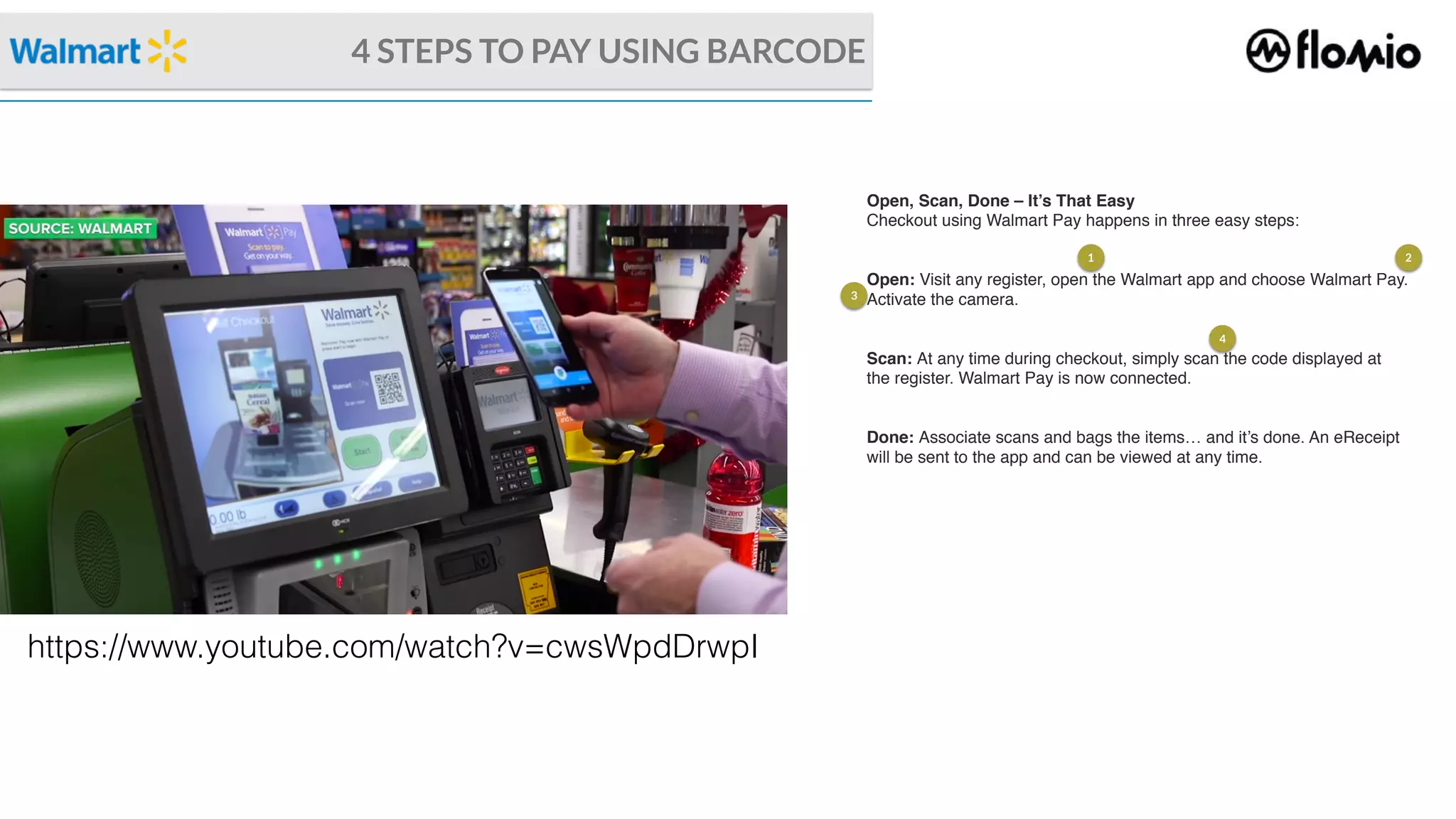

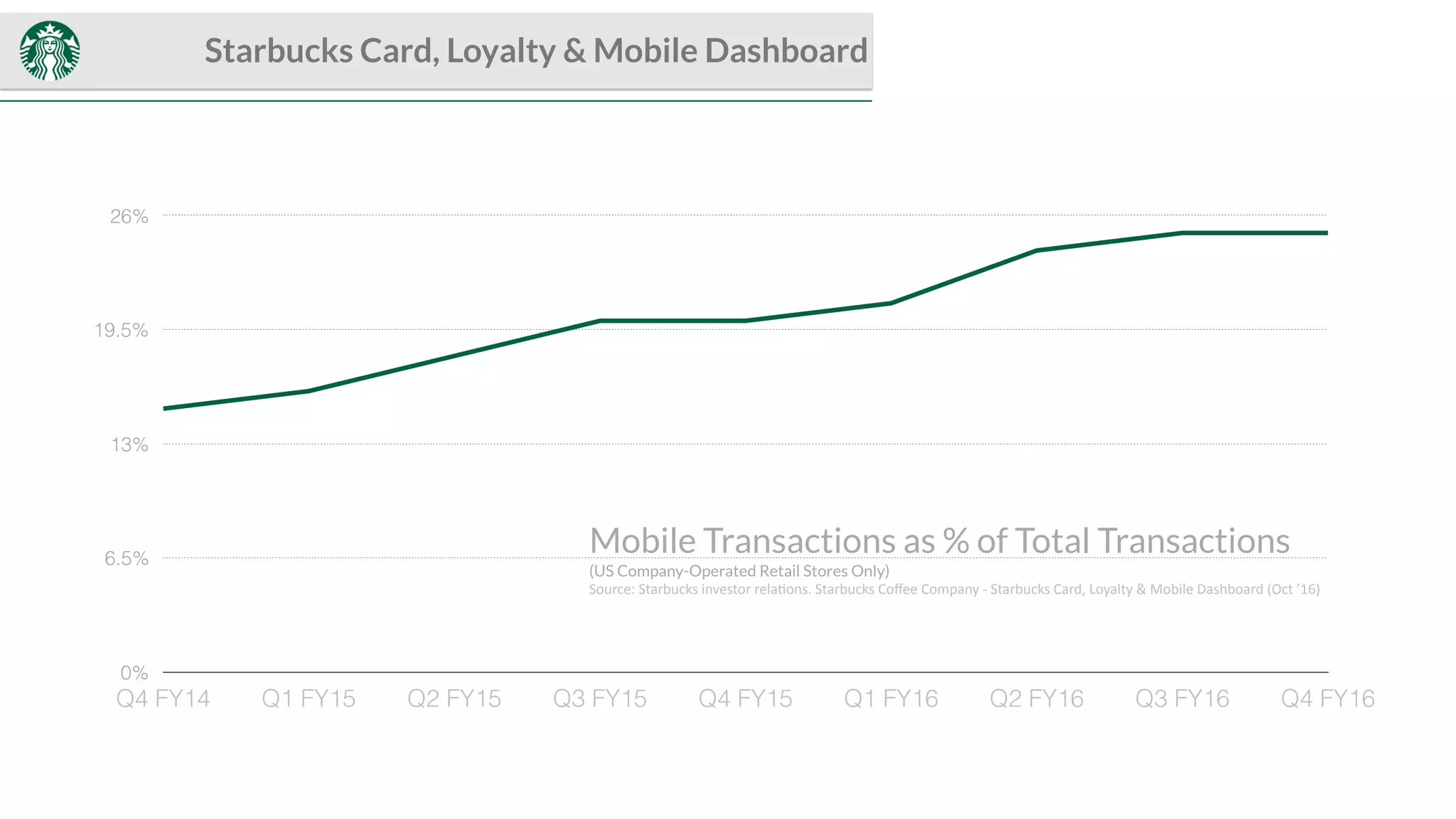

Starbucks has successfully implemented a closed-loop mobile payment system using their mobile app. By 2016, 25% of transactions in U.S. Starbucks stores were made through the mobile app. The system allows customers to load funds from various sources like credit cards and PayPal into their Starbucks account. To make a purchase, customers scan a barcode from the Starbucks app at the register. This closed-loop system provides Starbucks with benefits like lower payment processing fees and valuable customer data insights. As mobile payment usage increased, other retailers like Dunkin Donuts and CVS also launched their own closed-loop mobile apps.