Embed presentation

Download to read offline

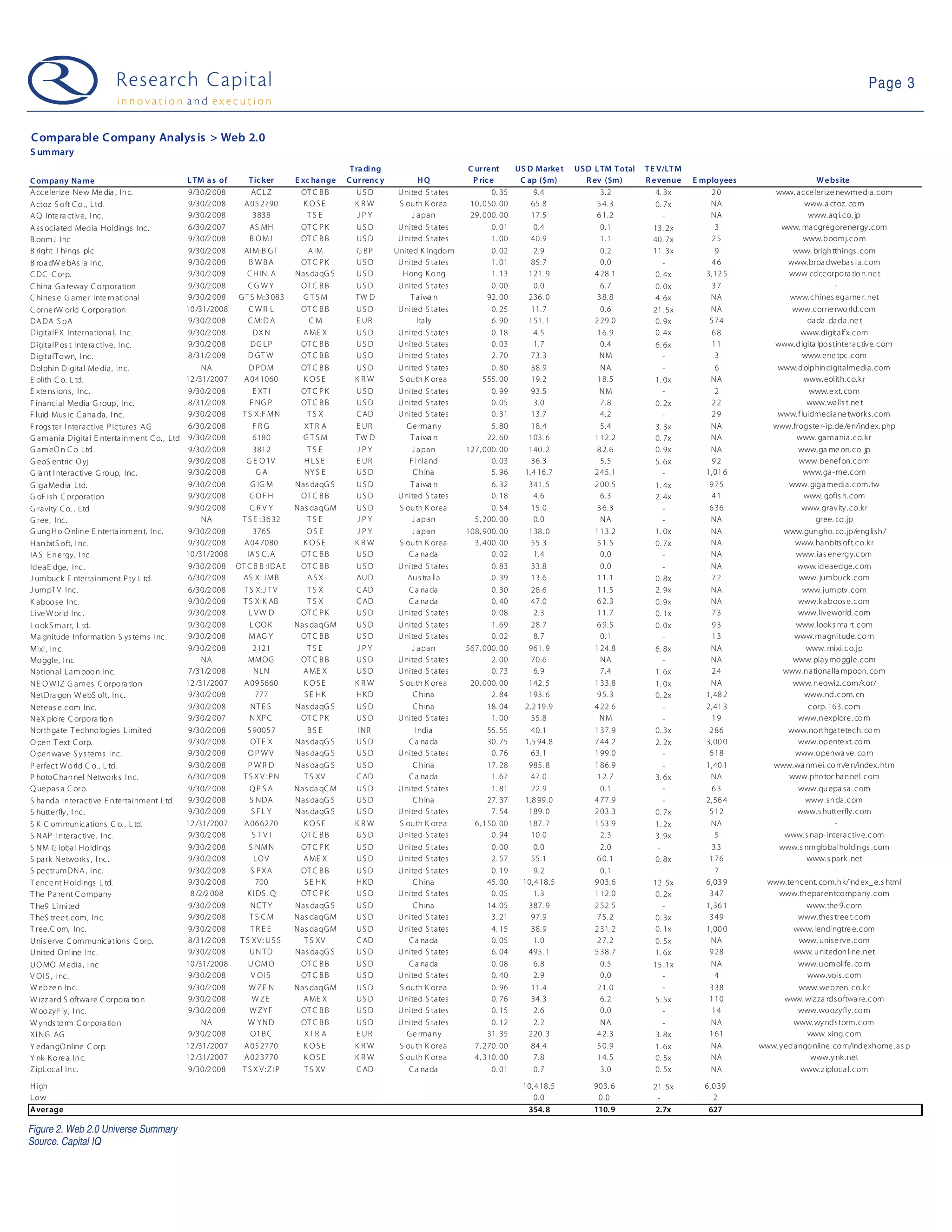

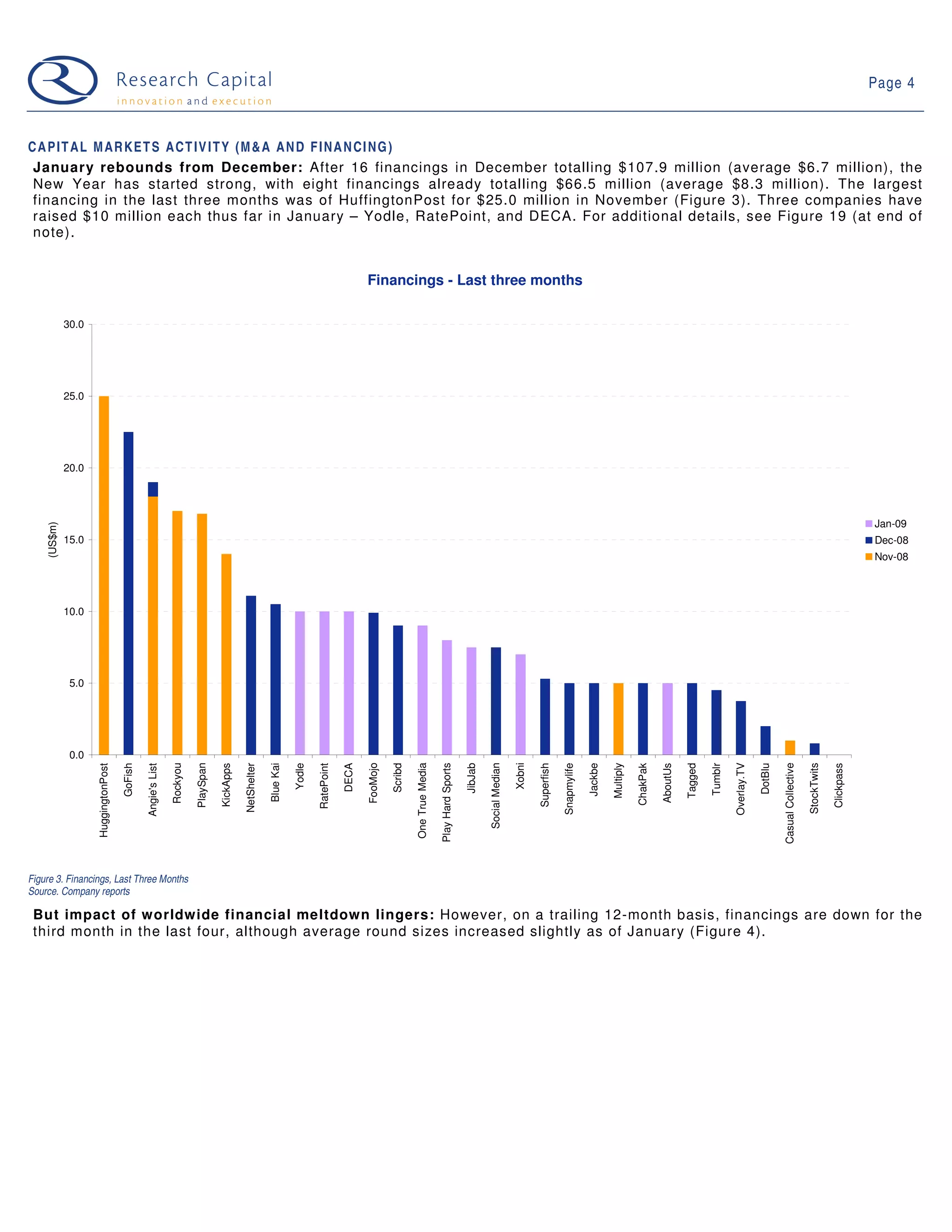

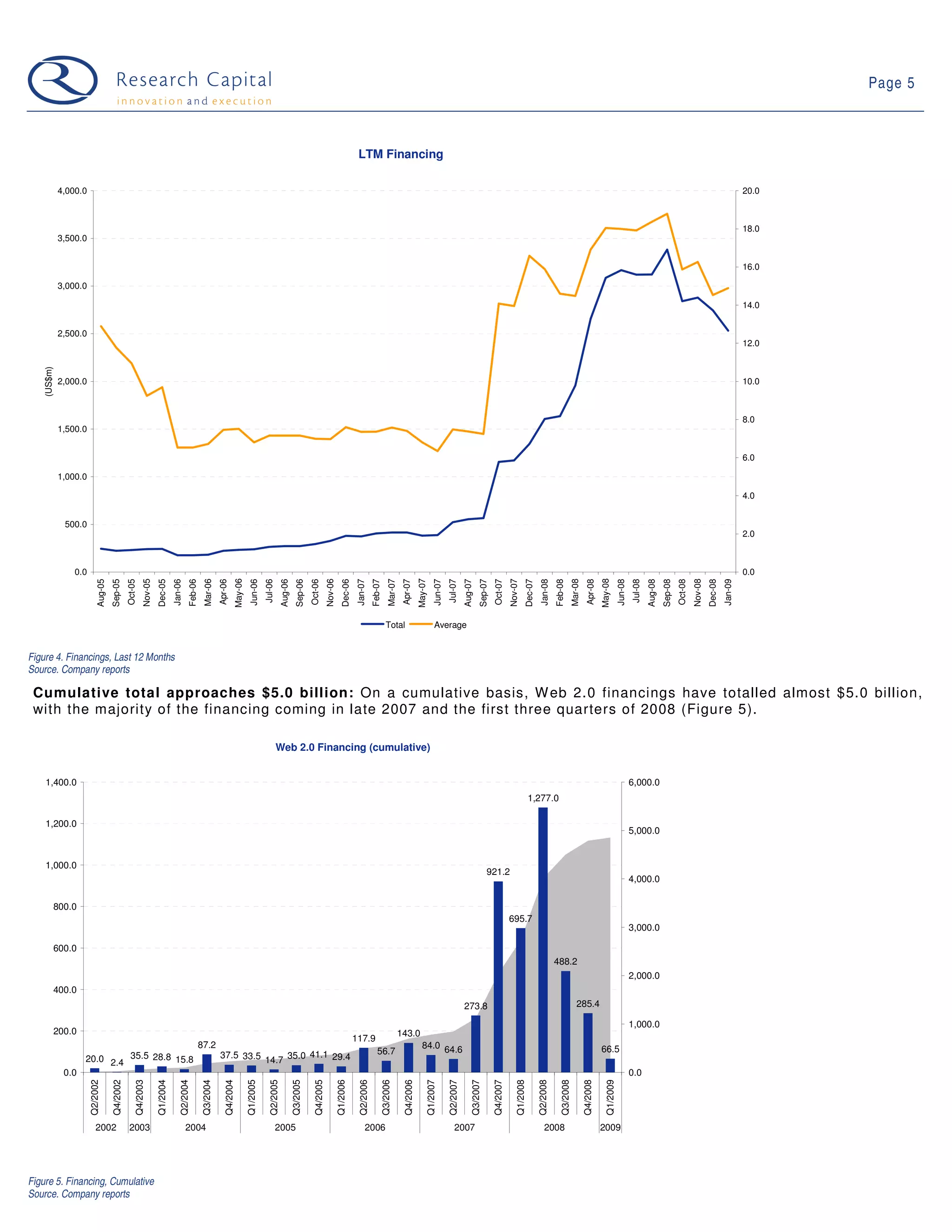

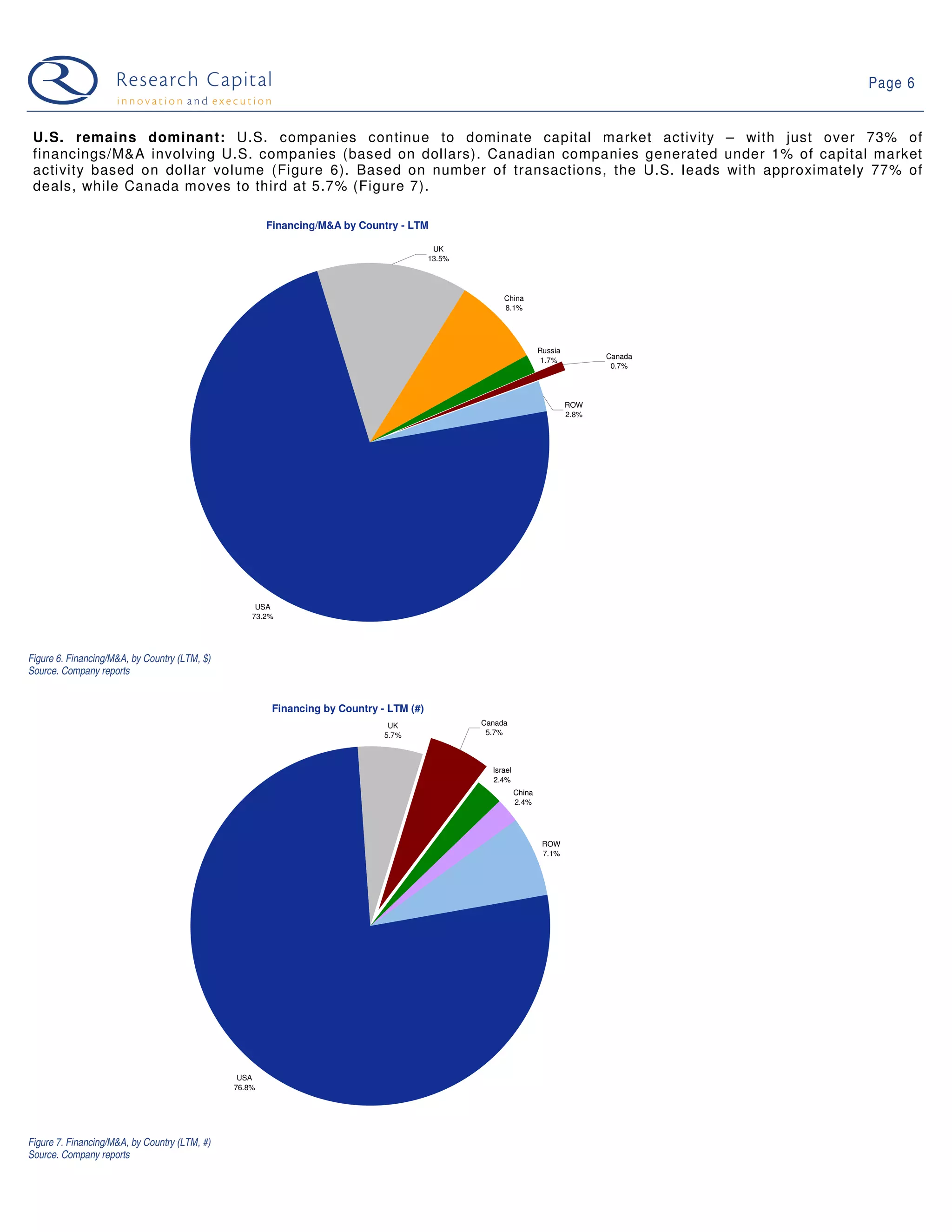

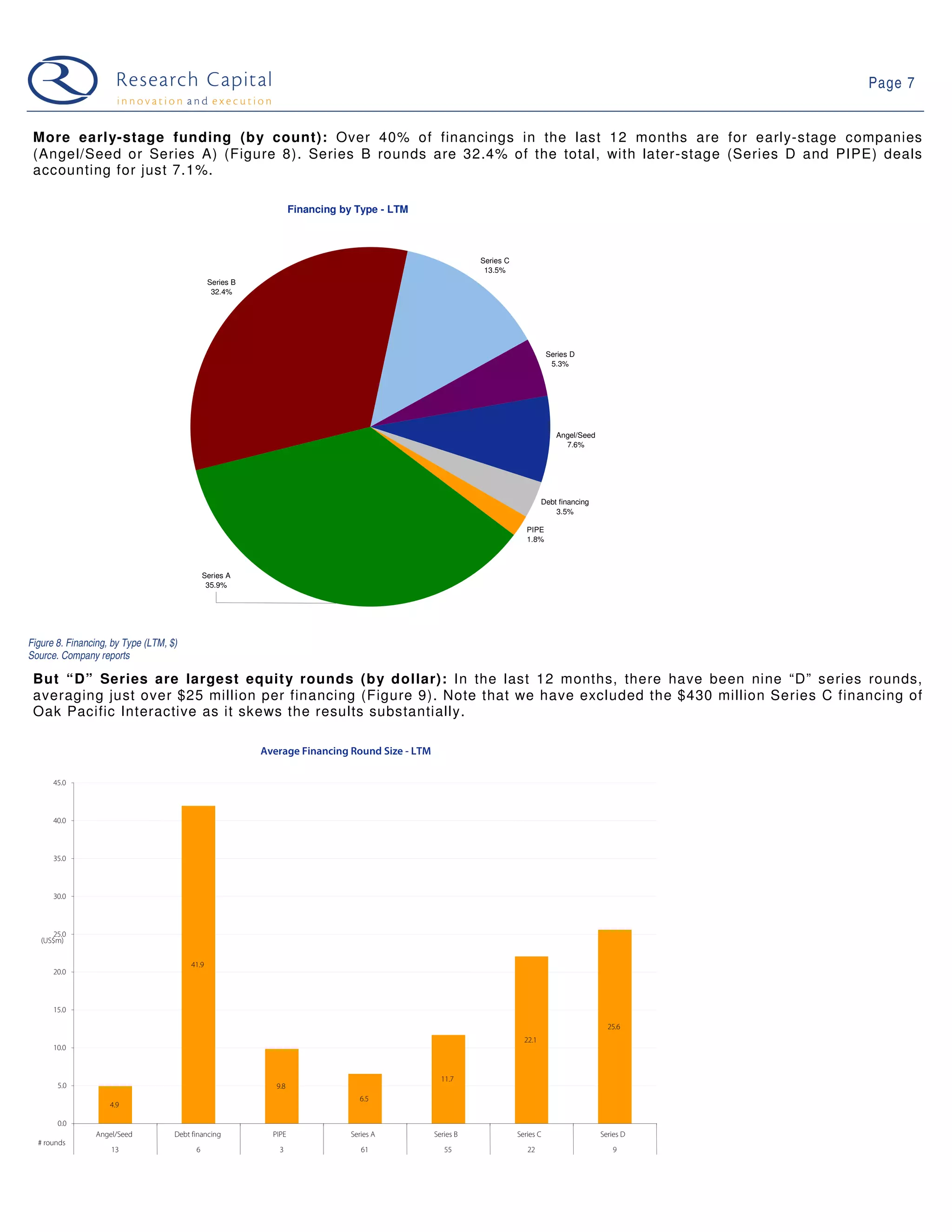

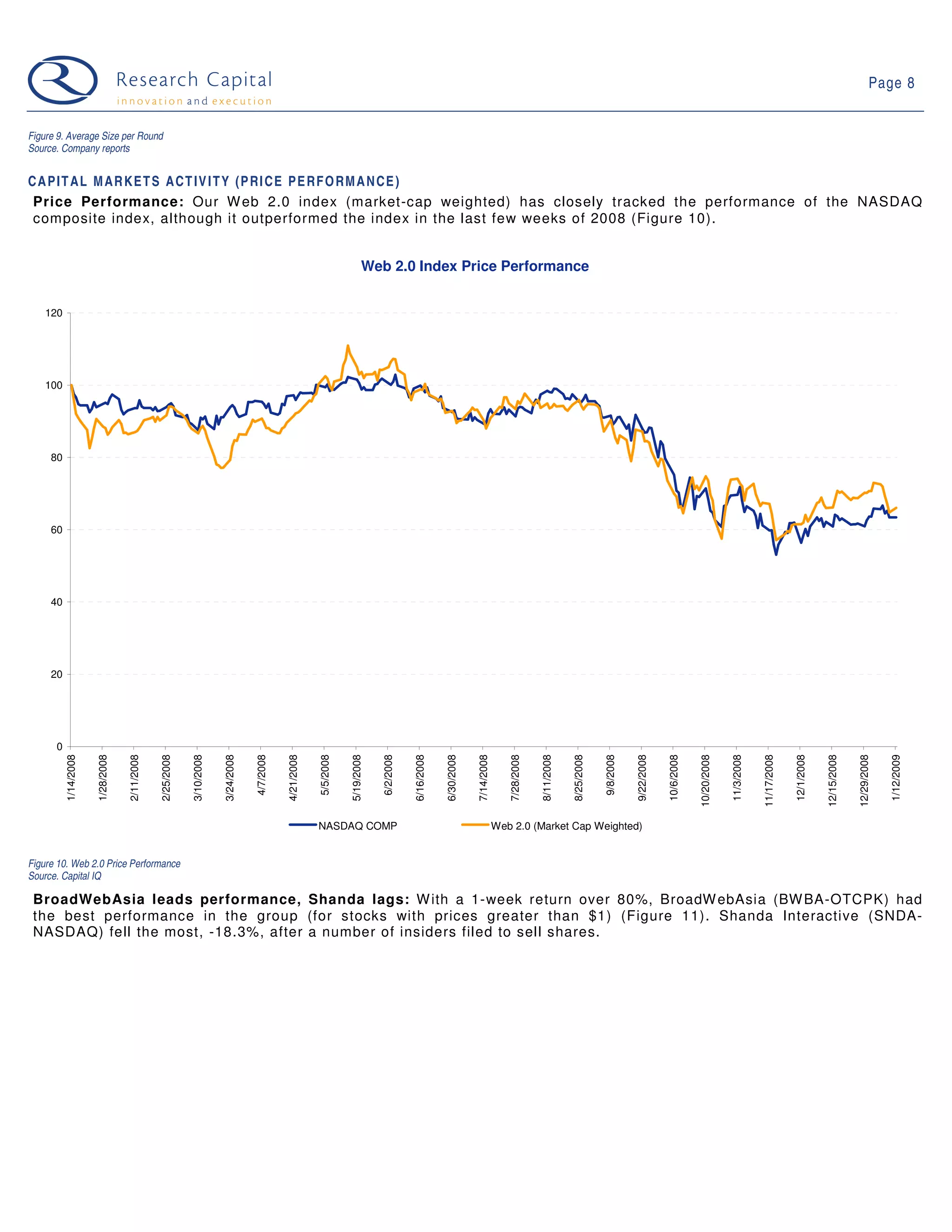

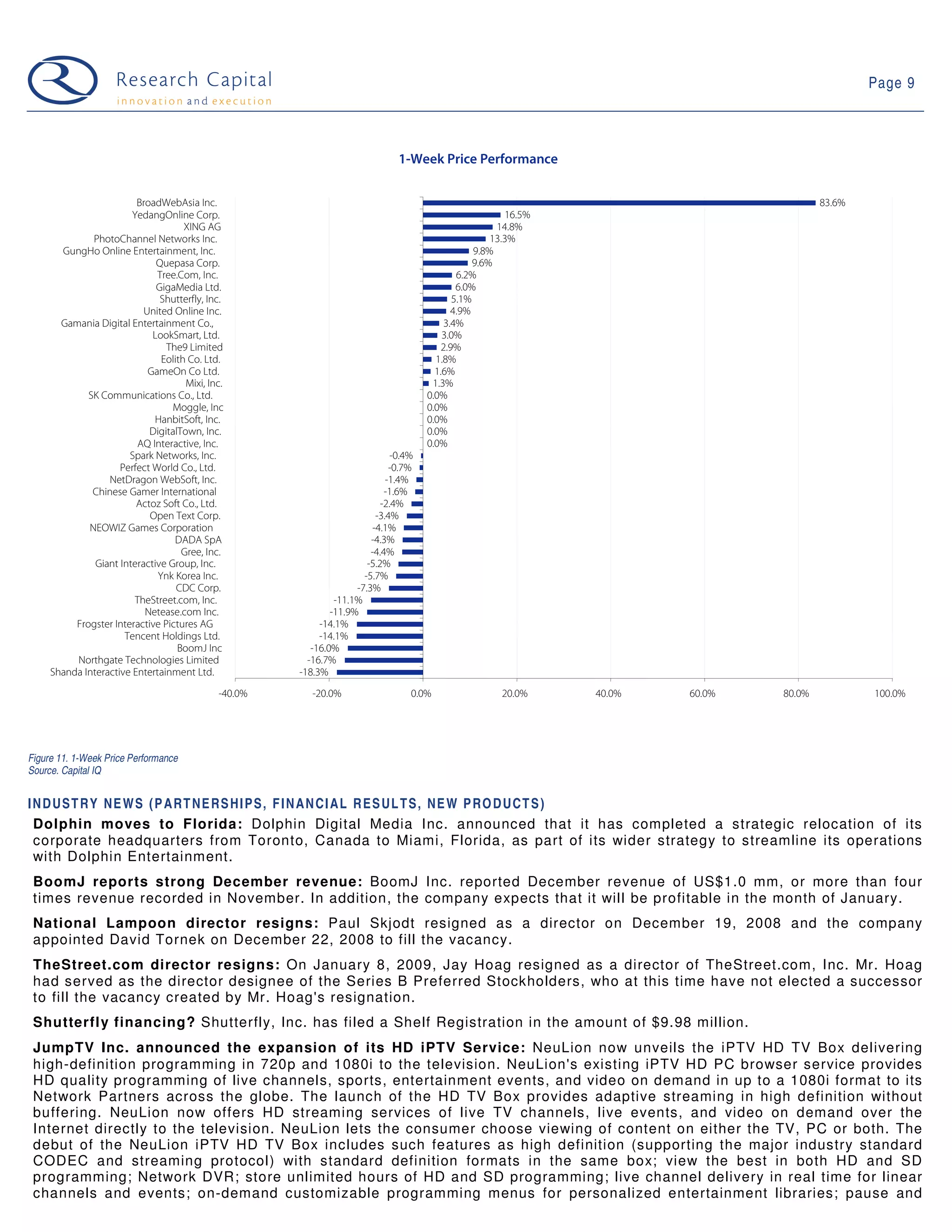

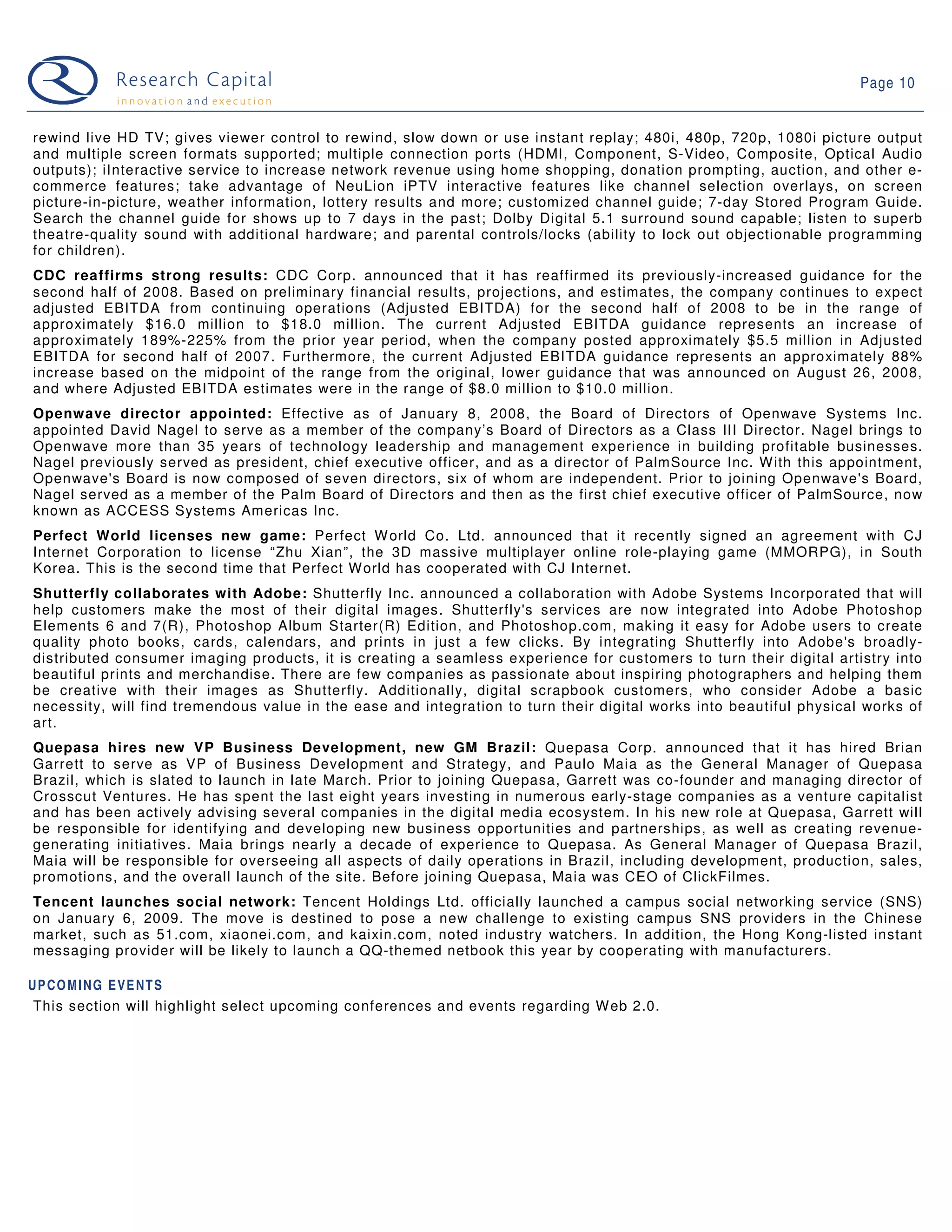

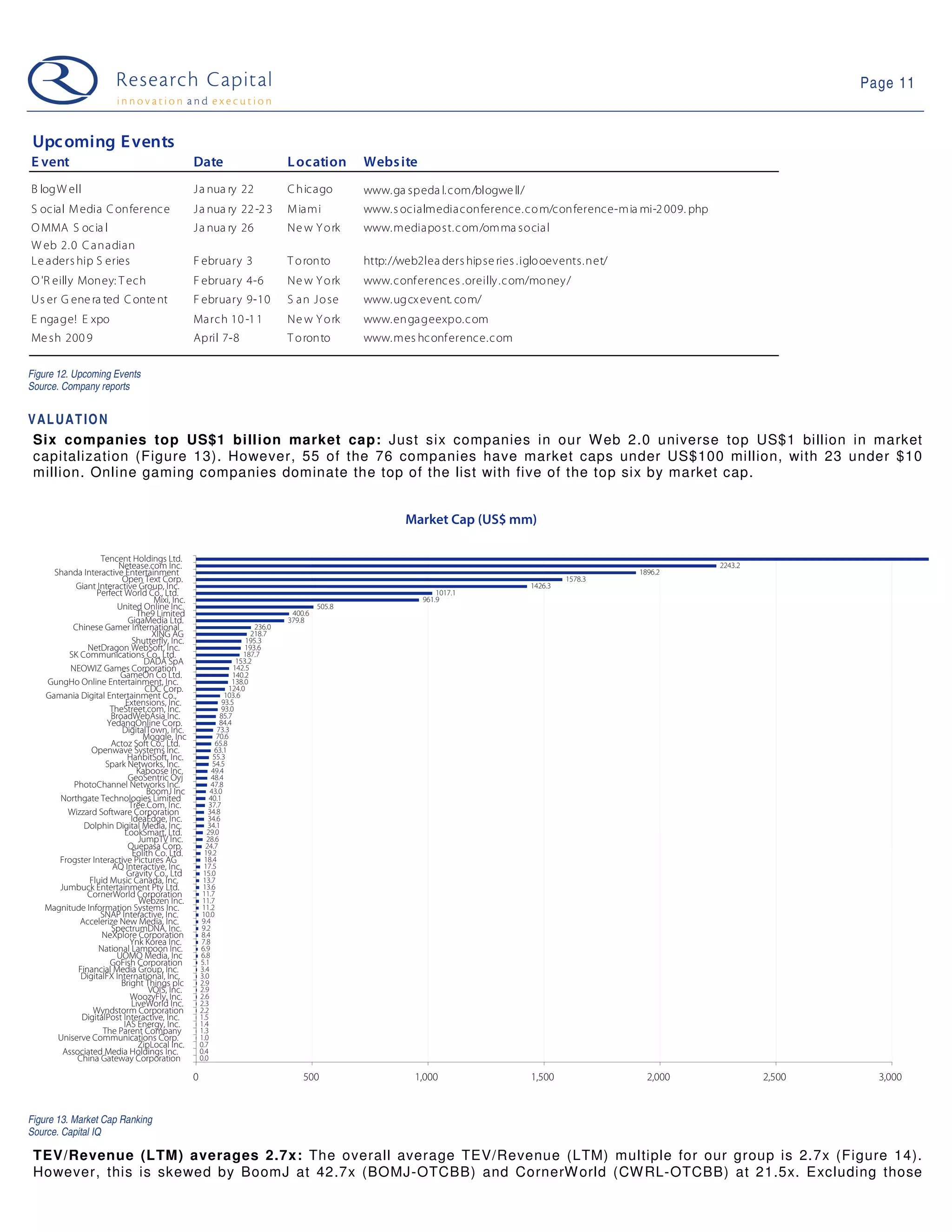

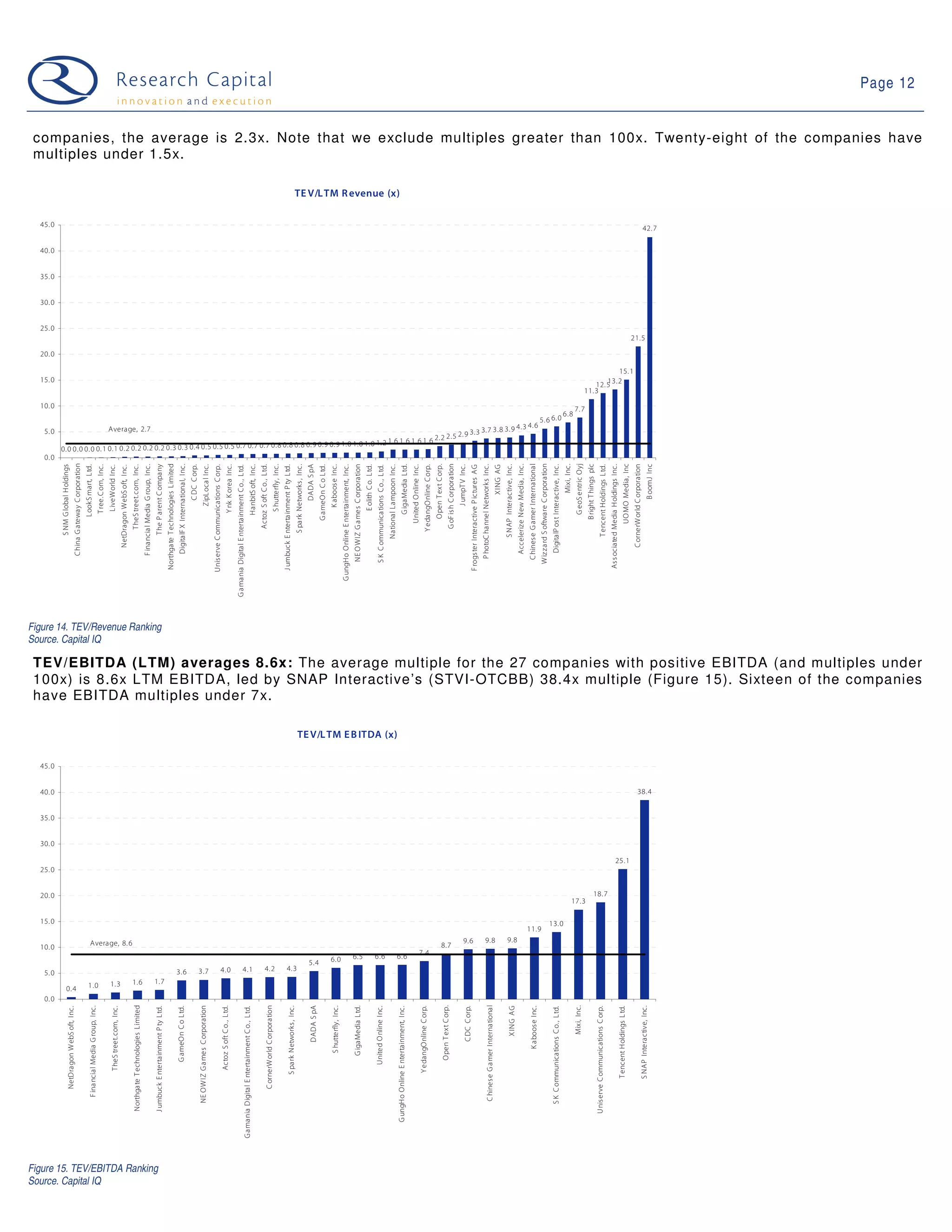

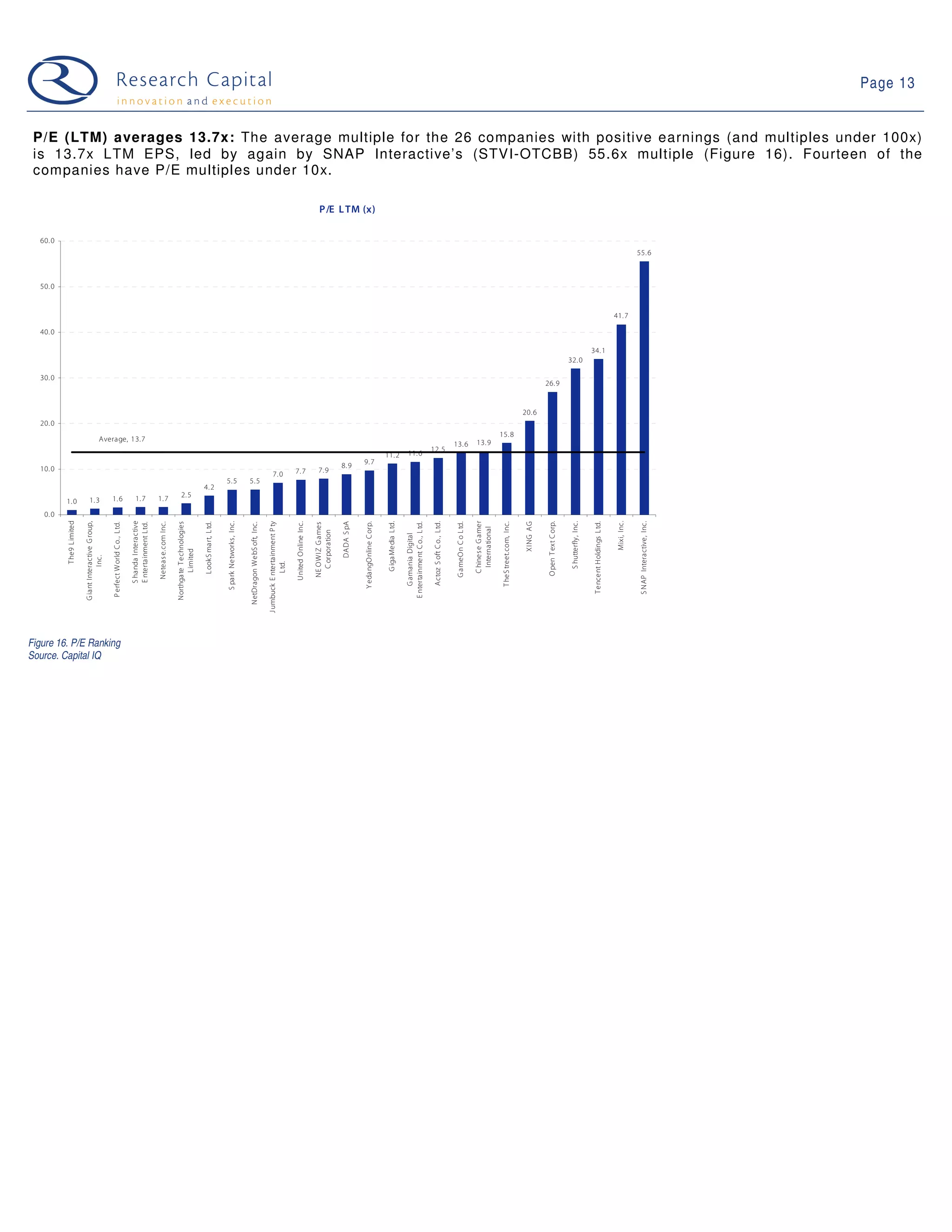

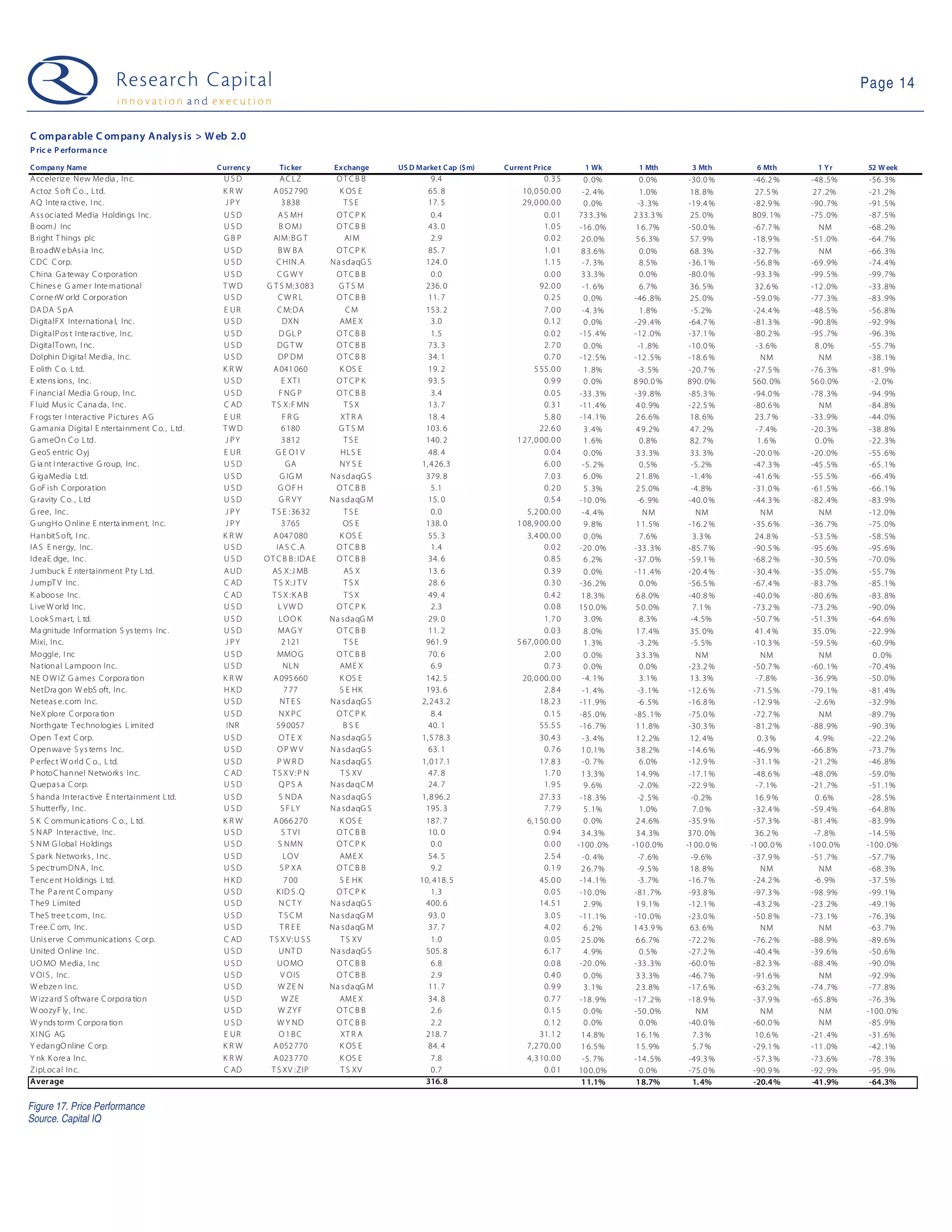

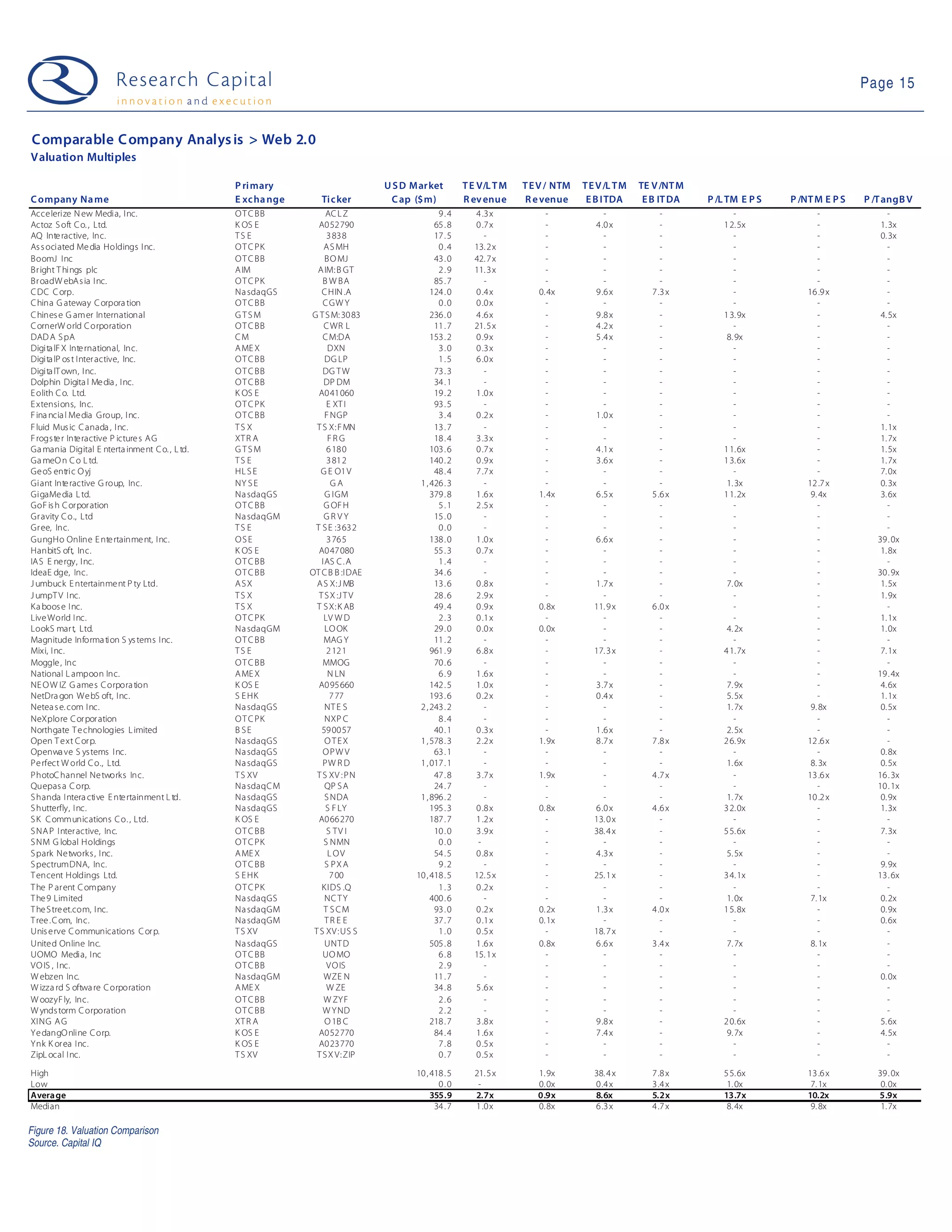

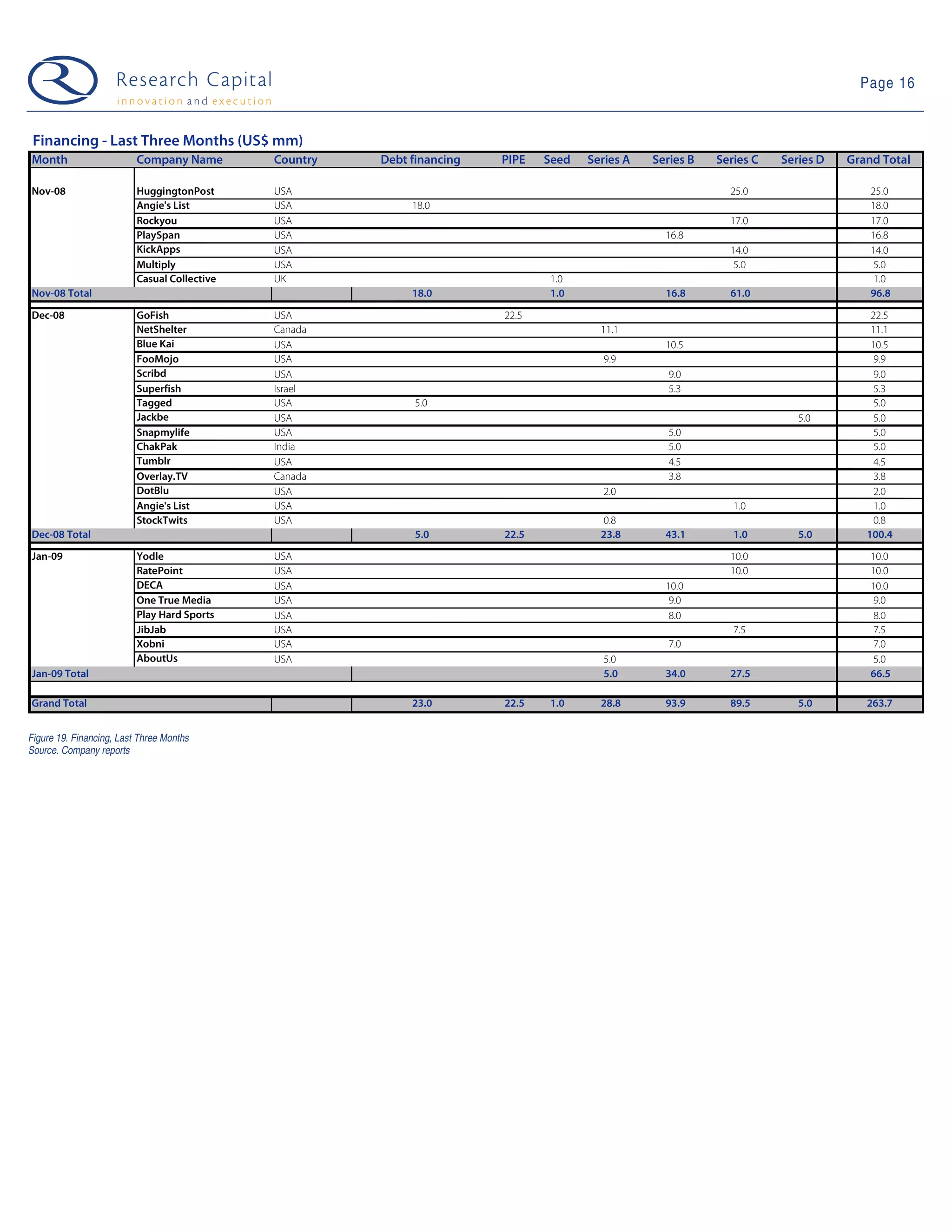

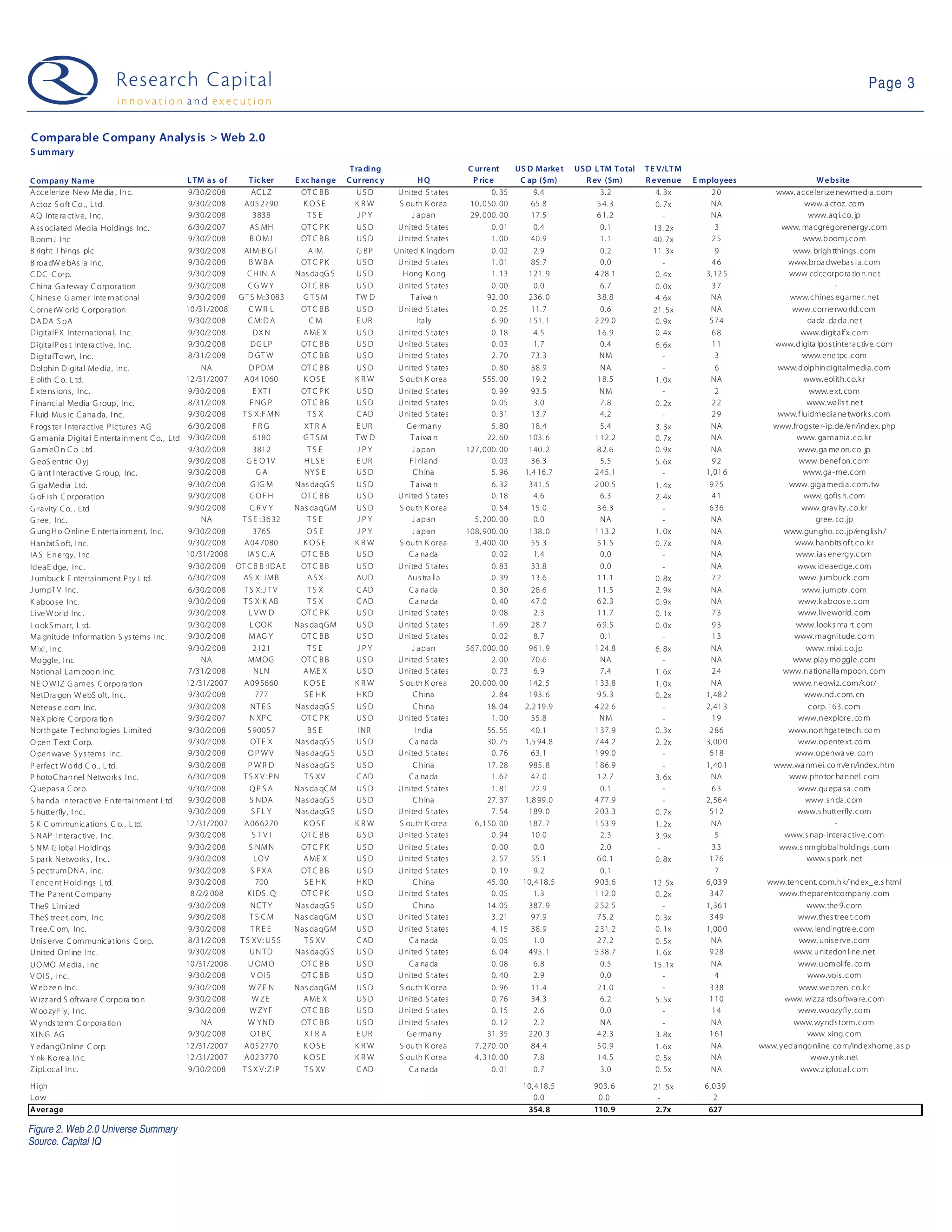

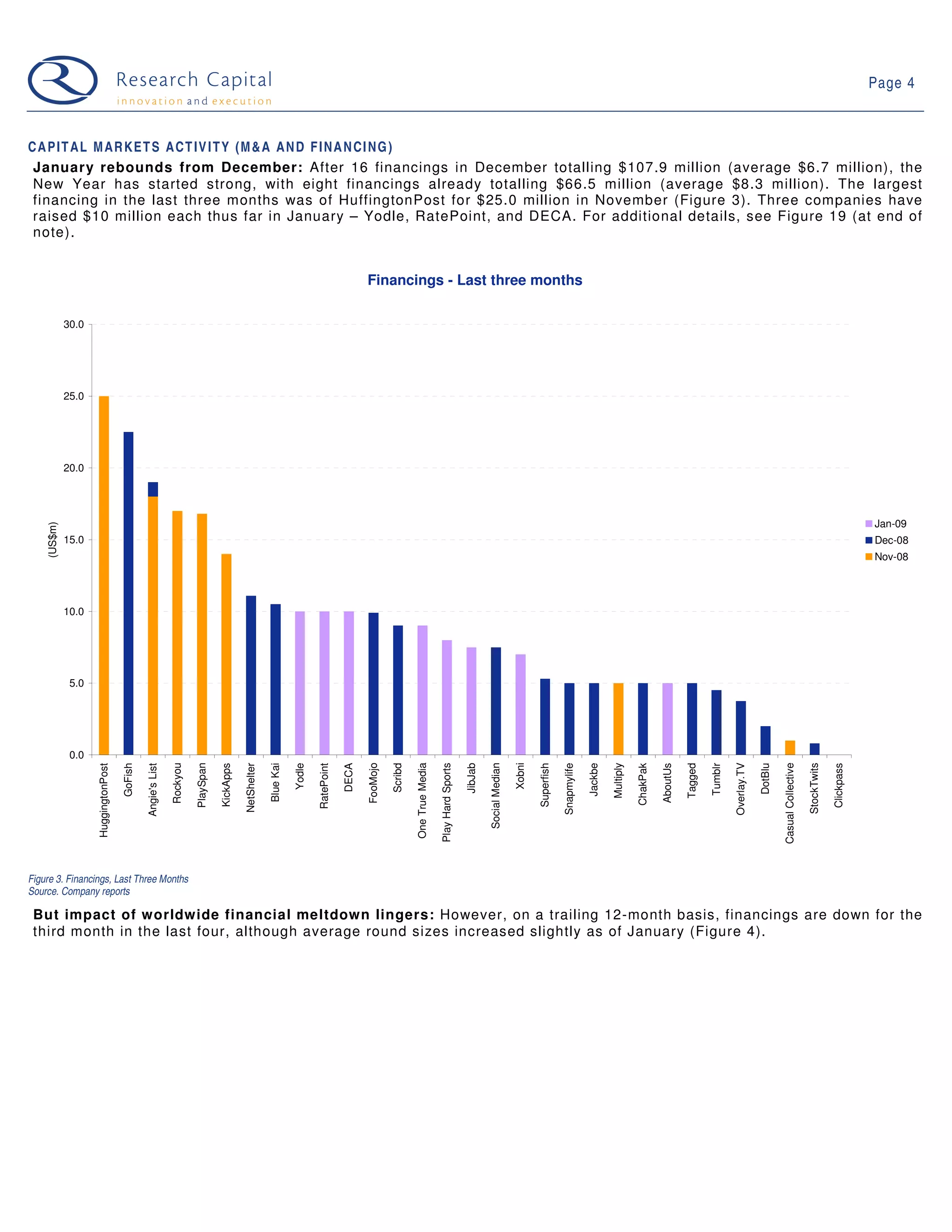

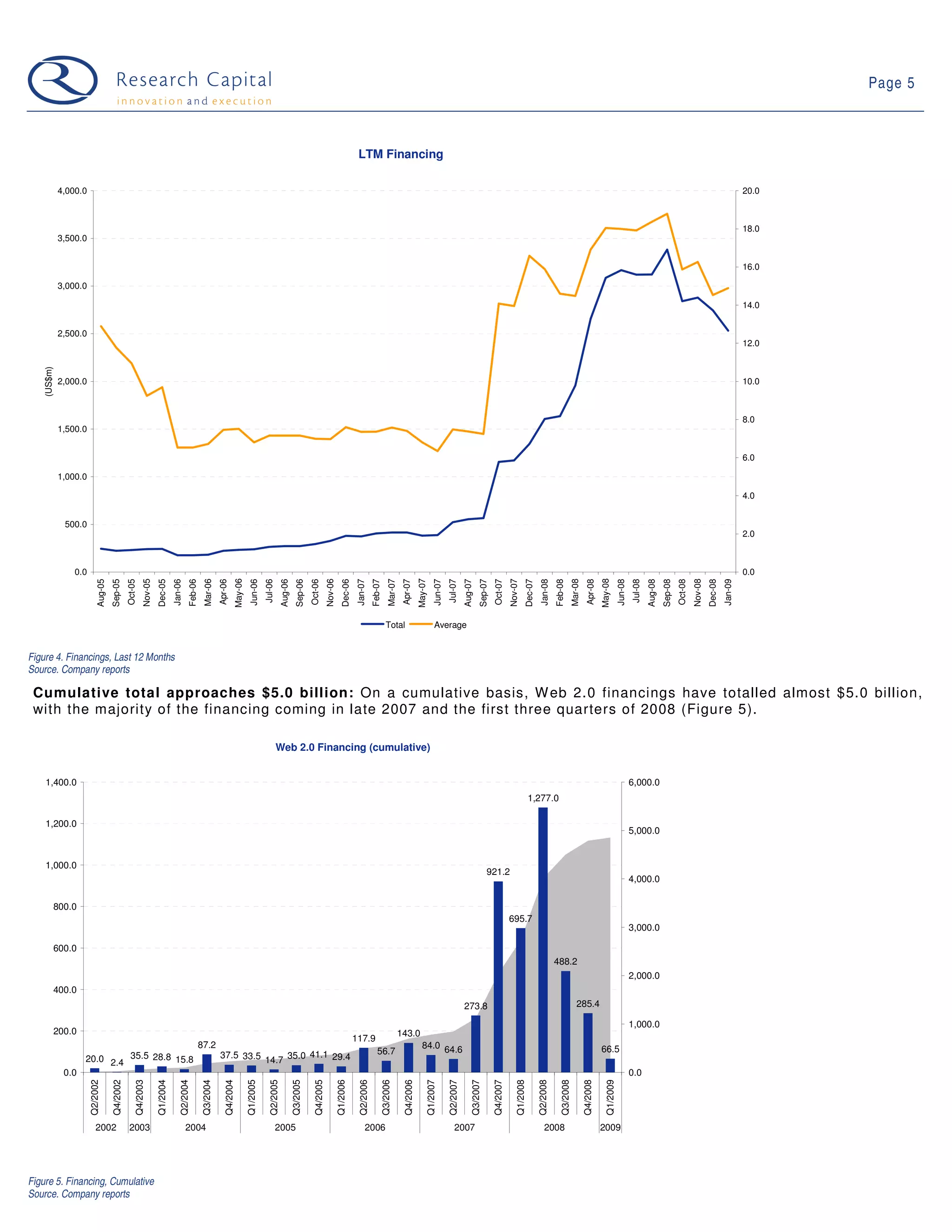

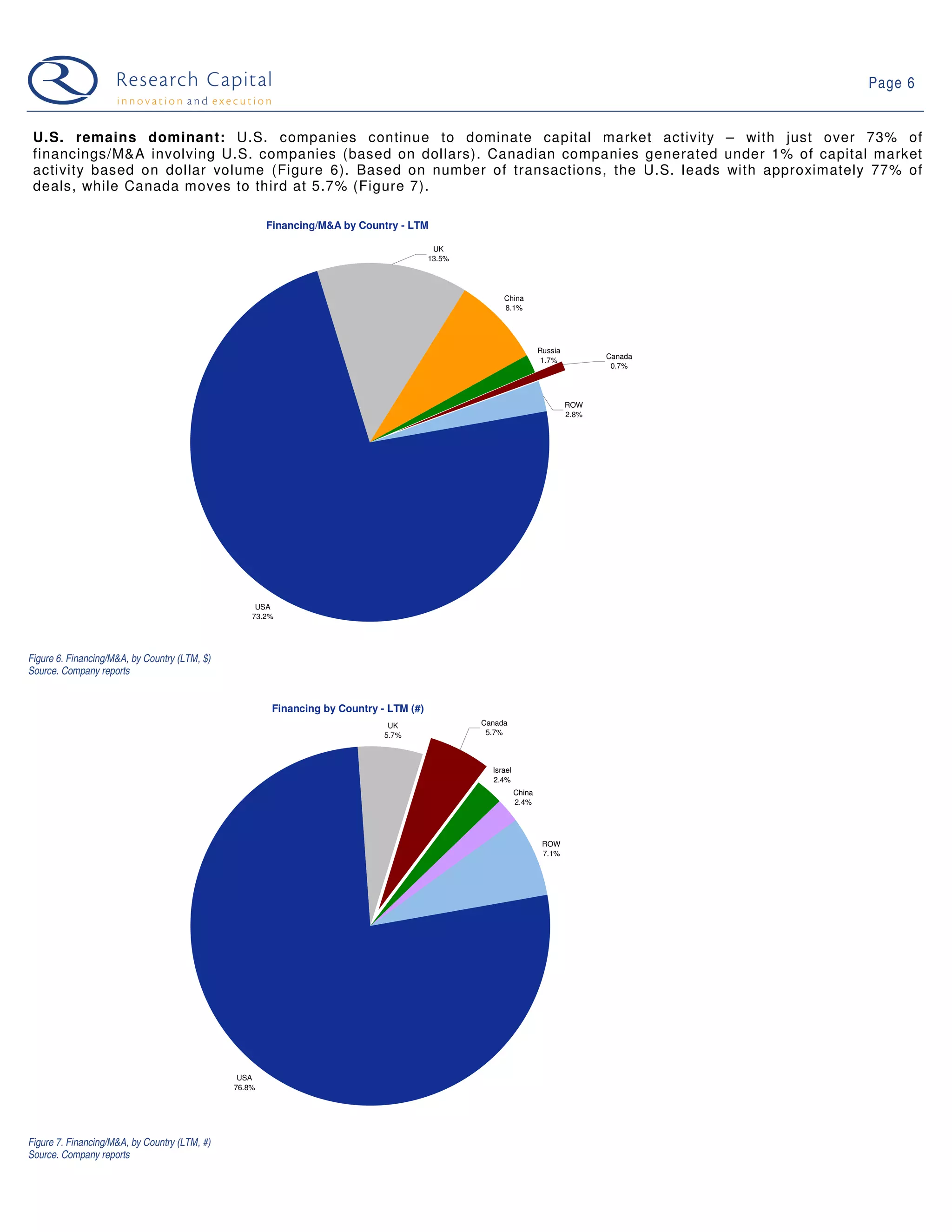

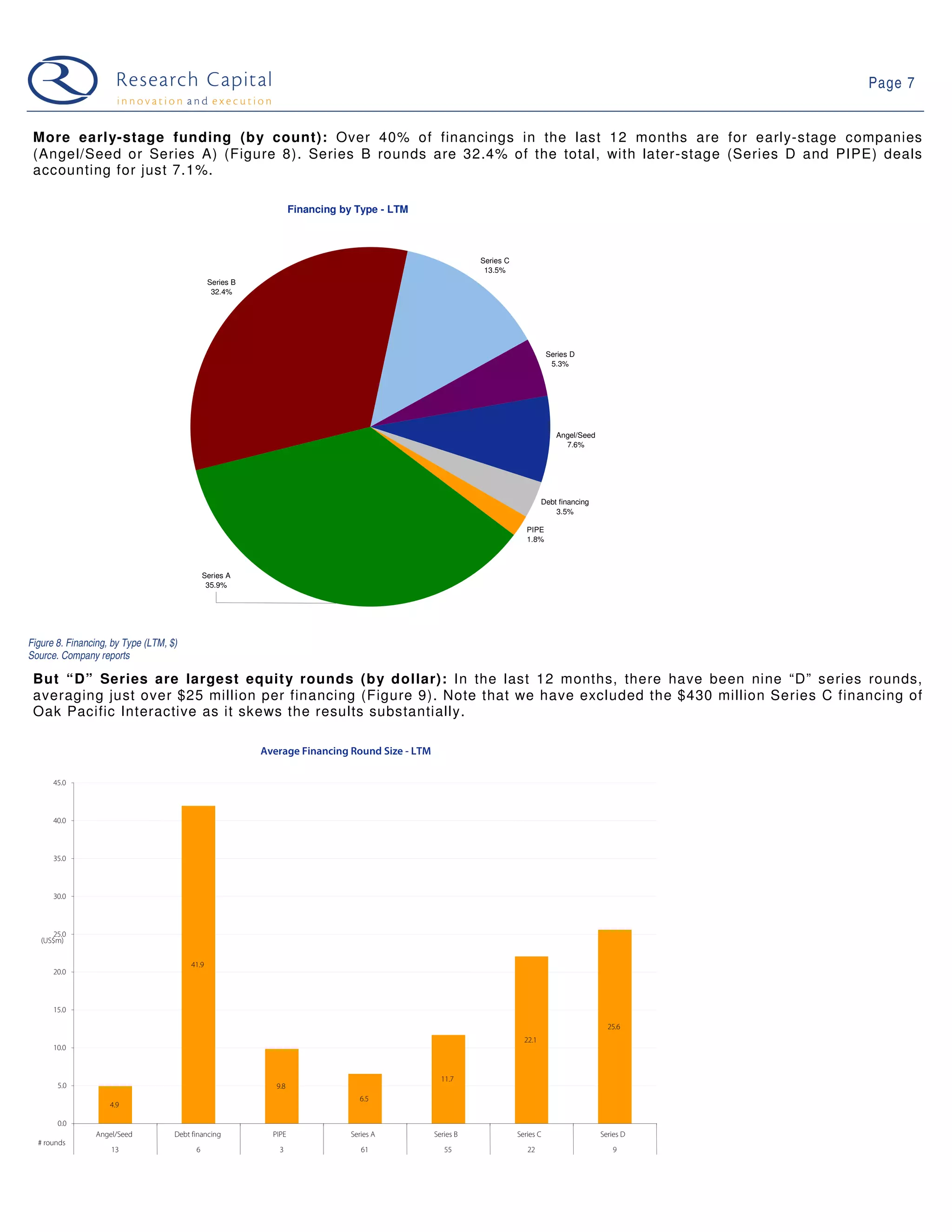

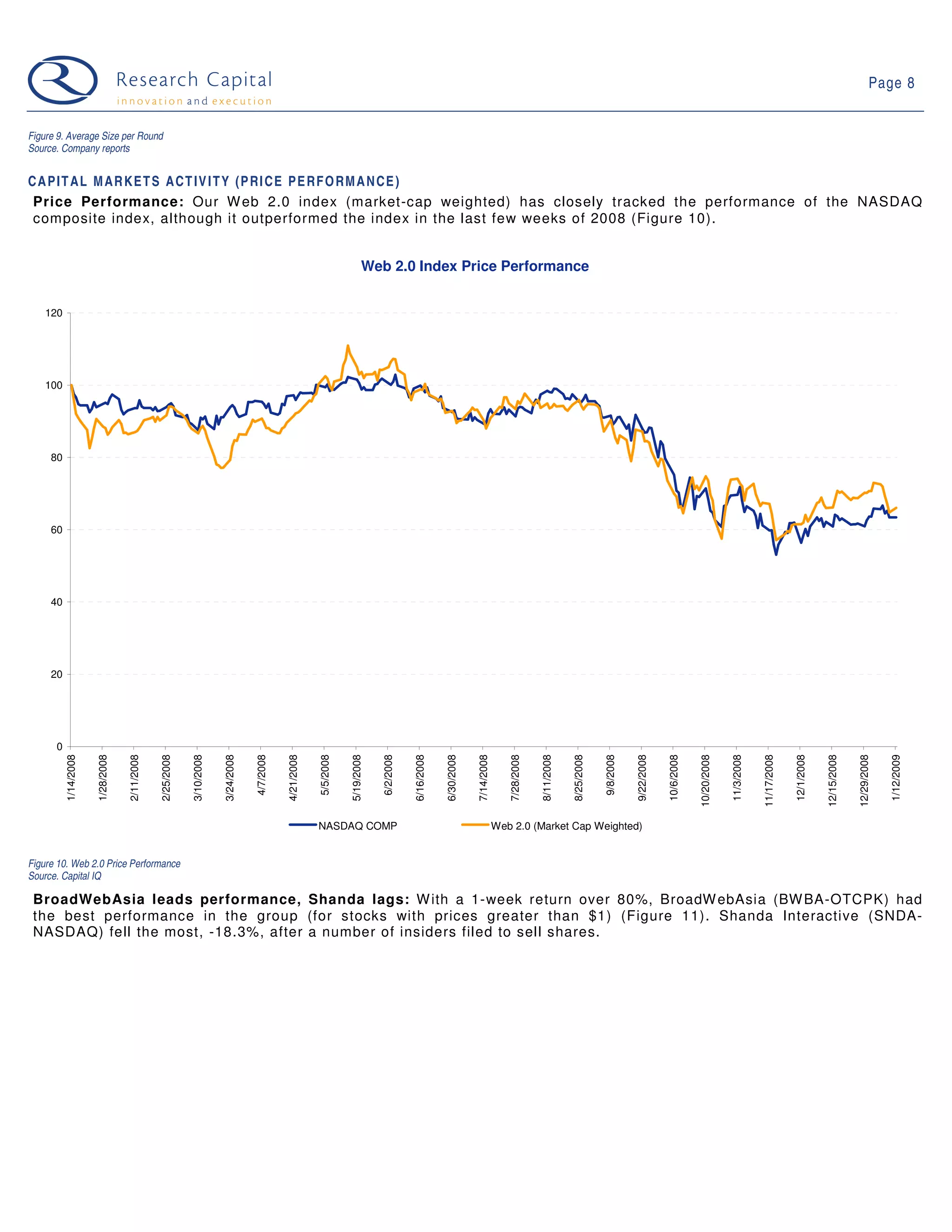

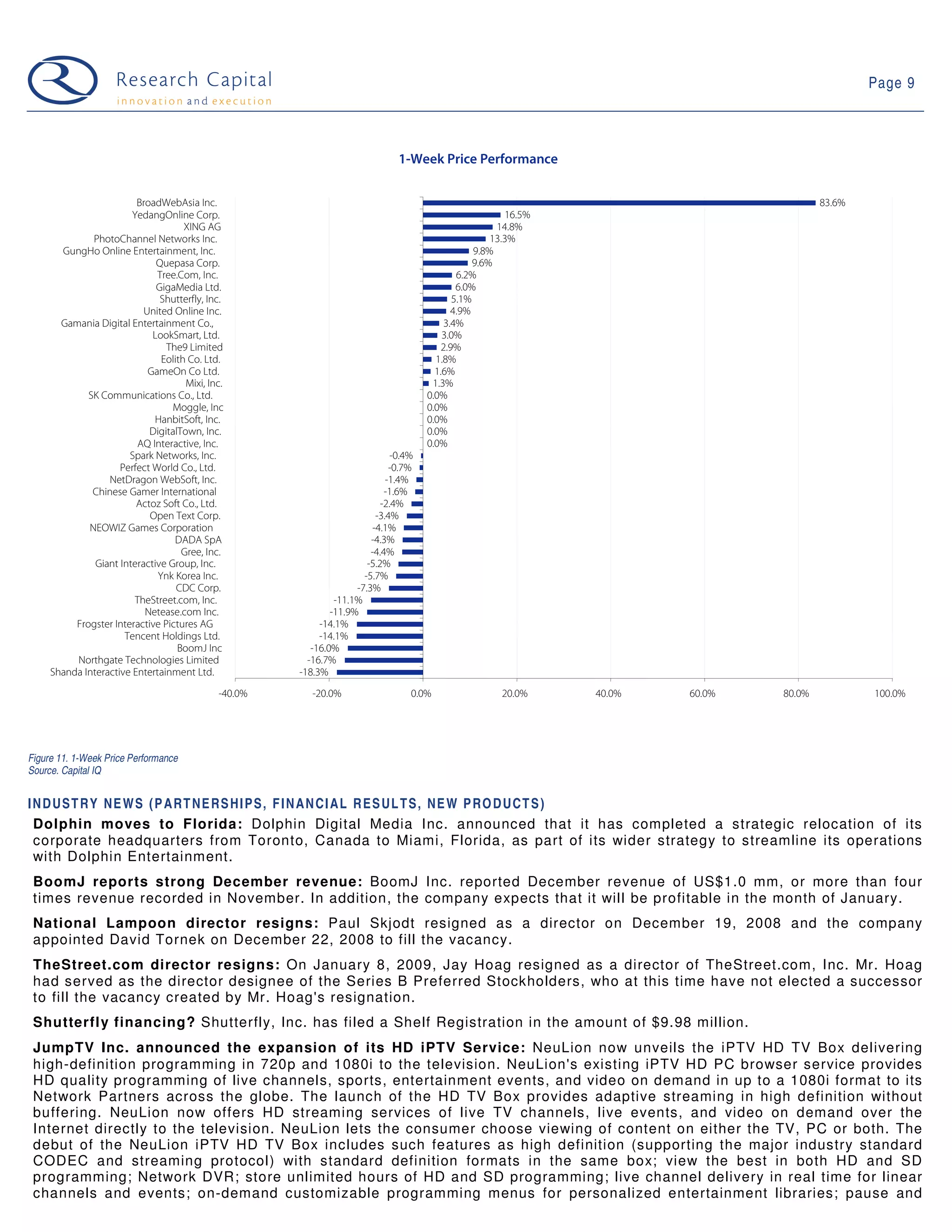

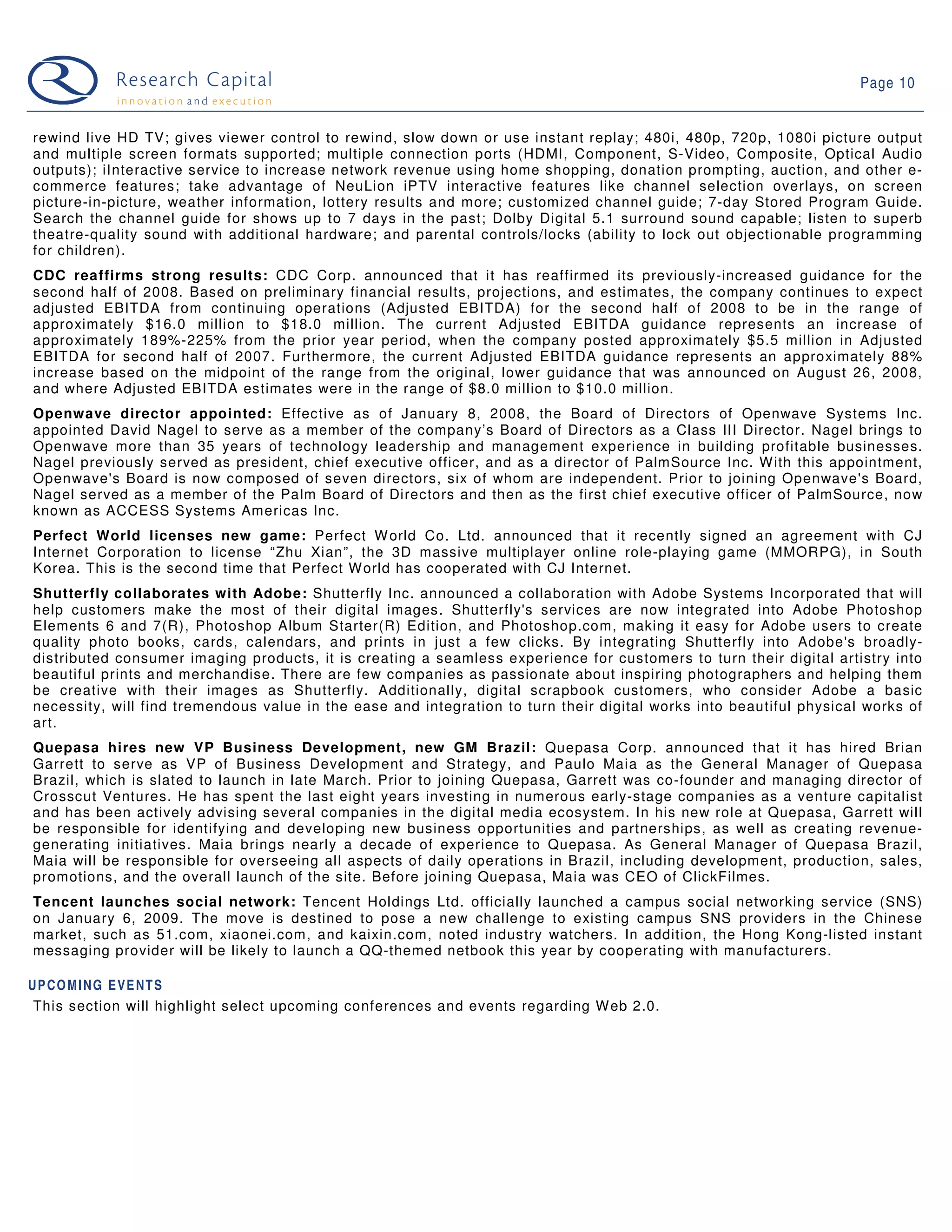

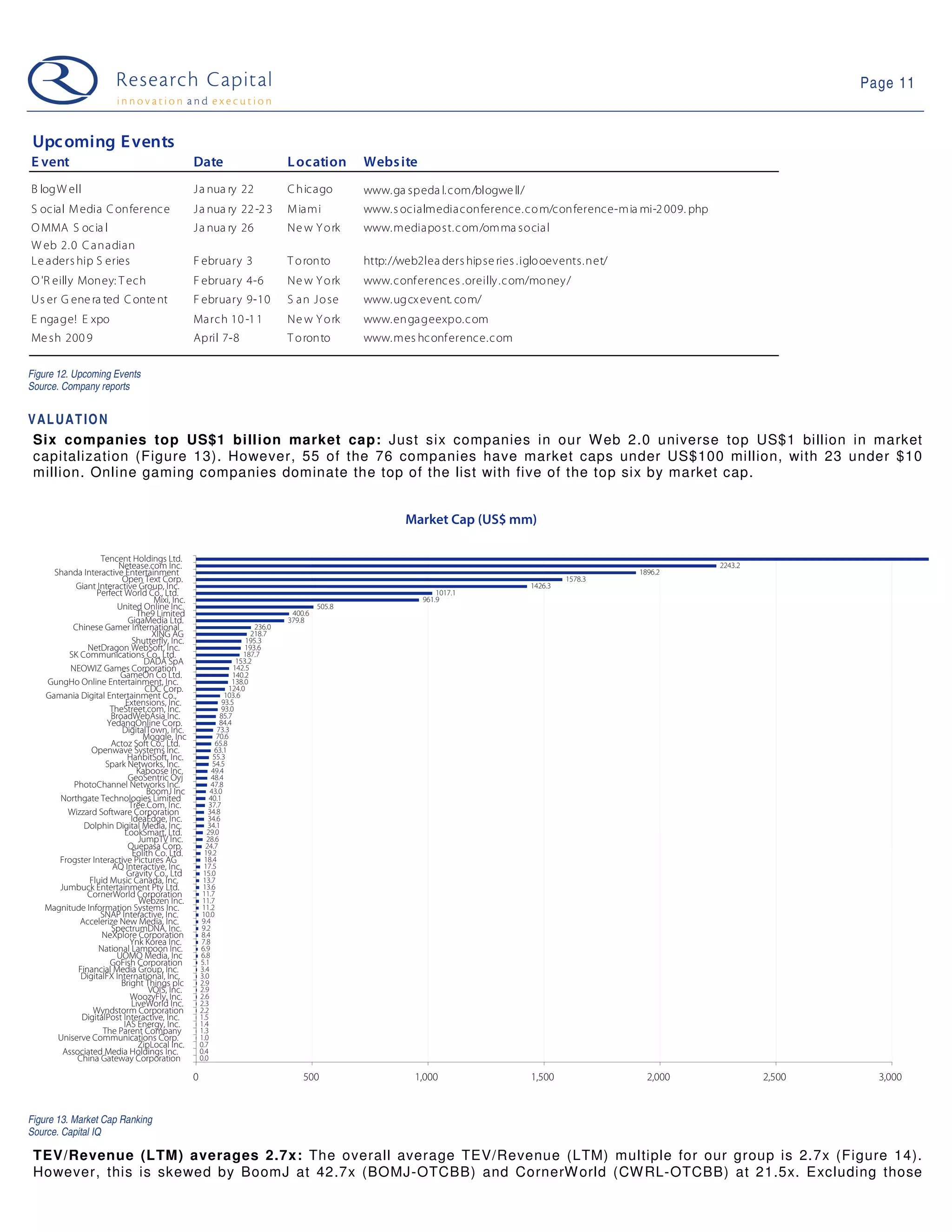

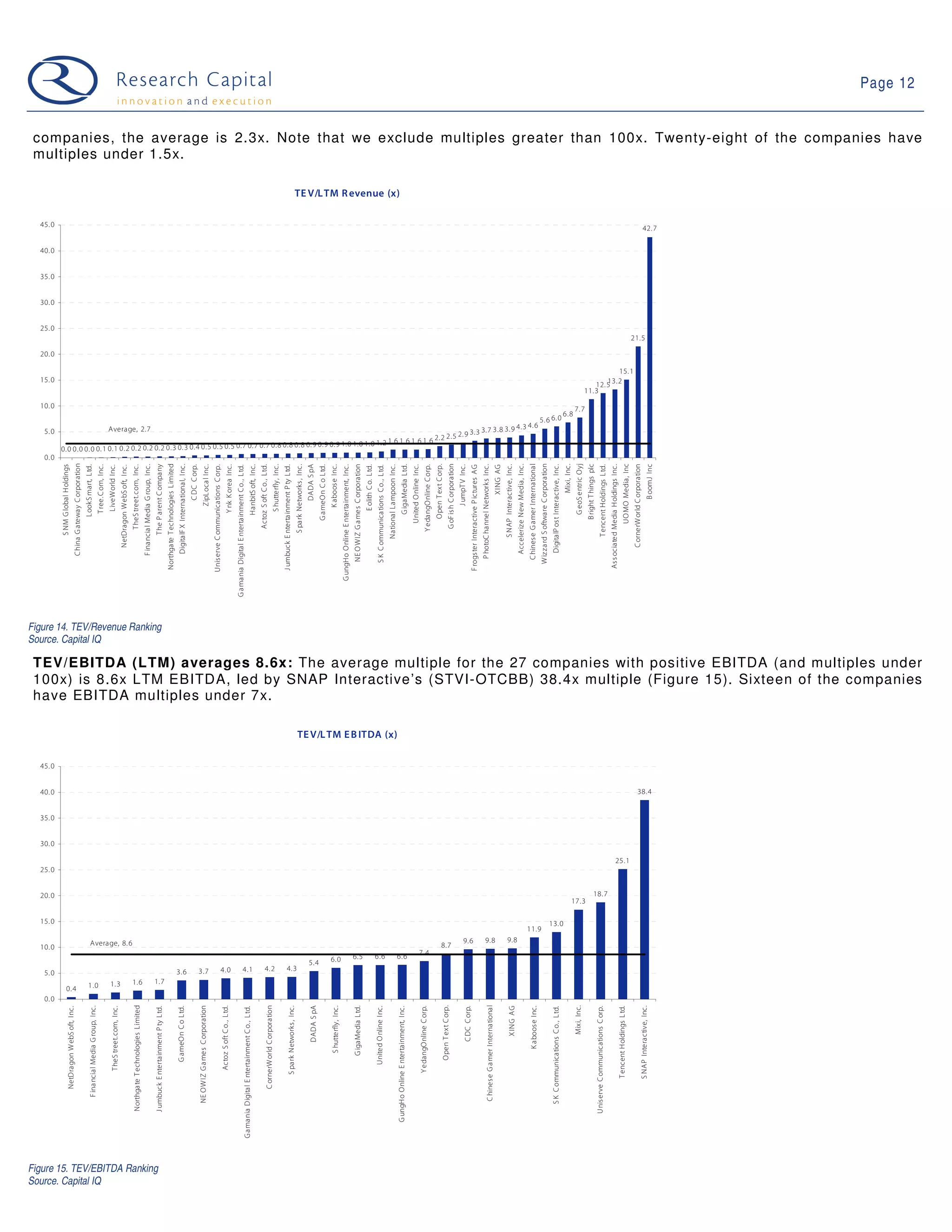

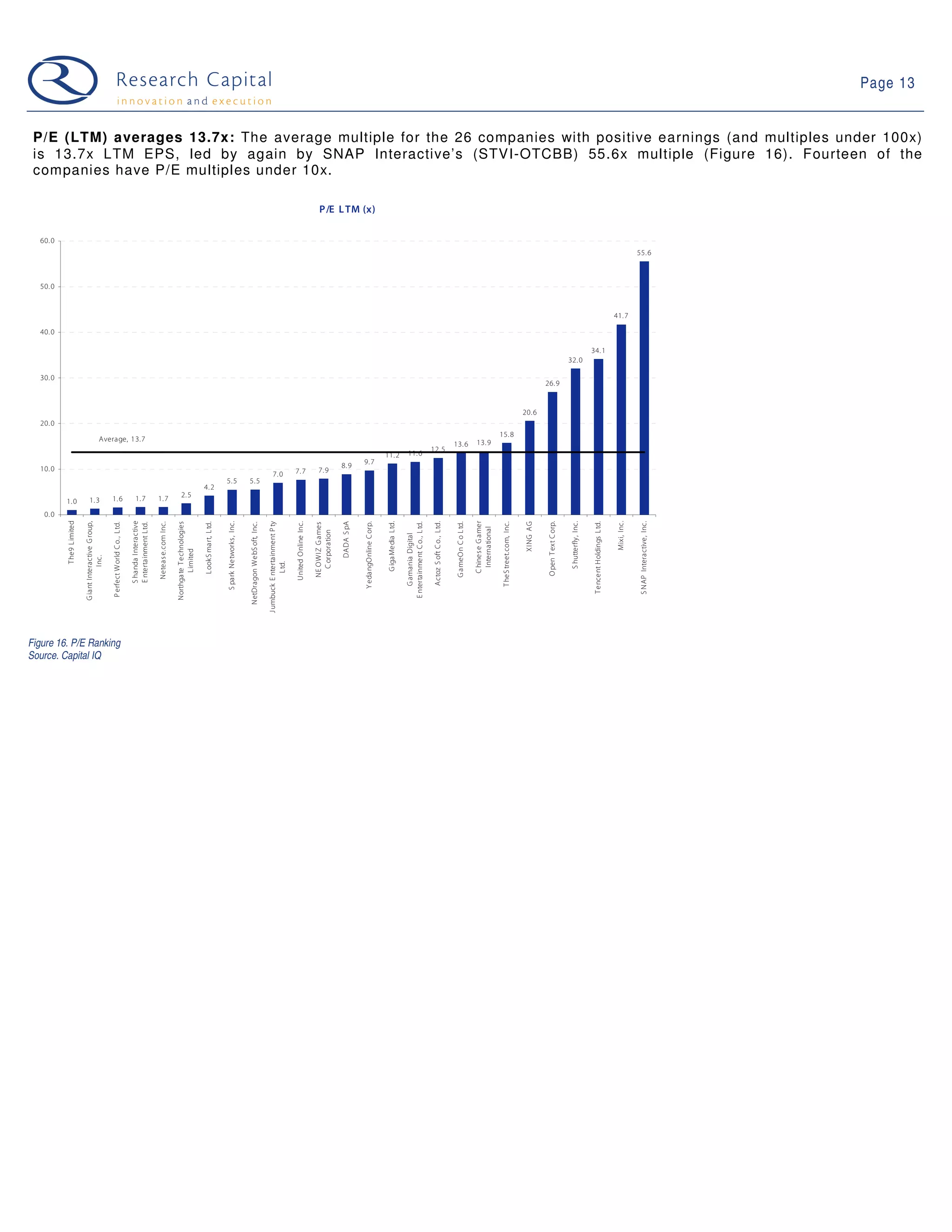

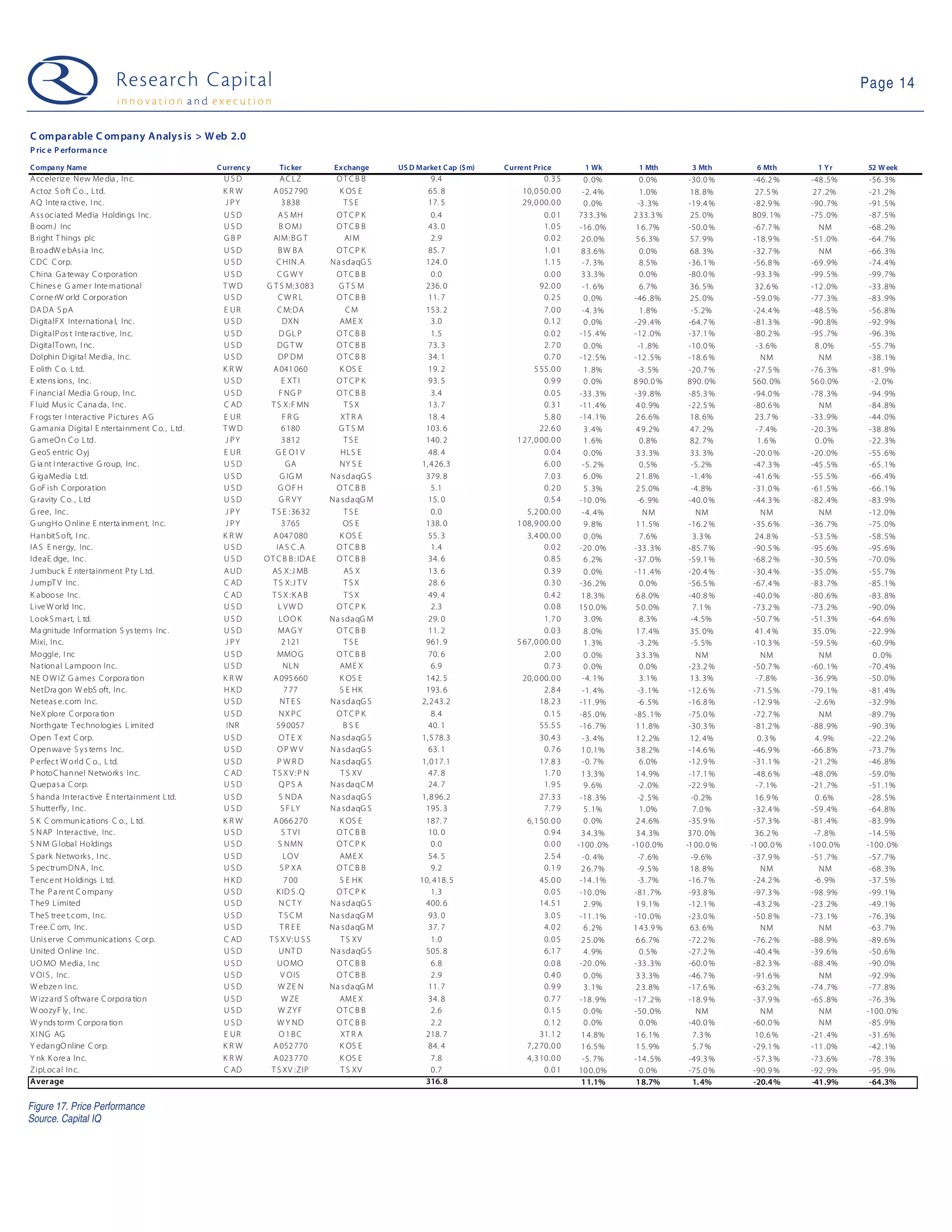

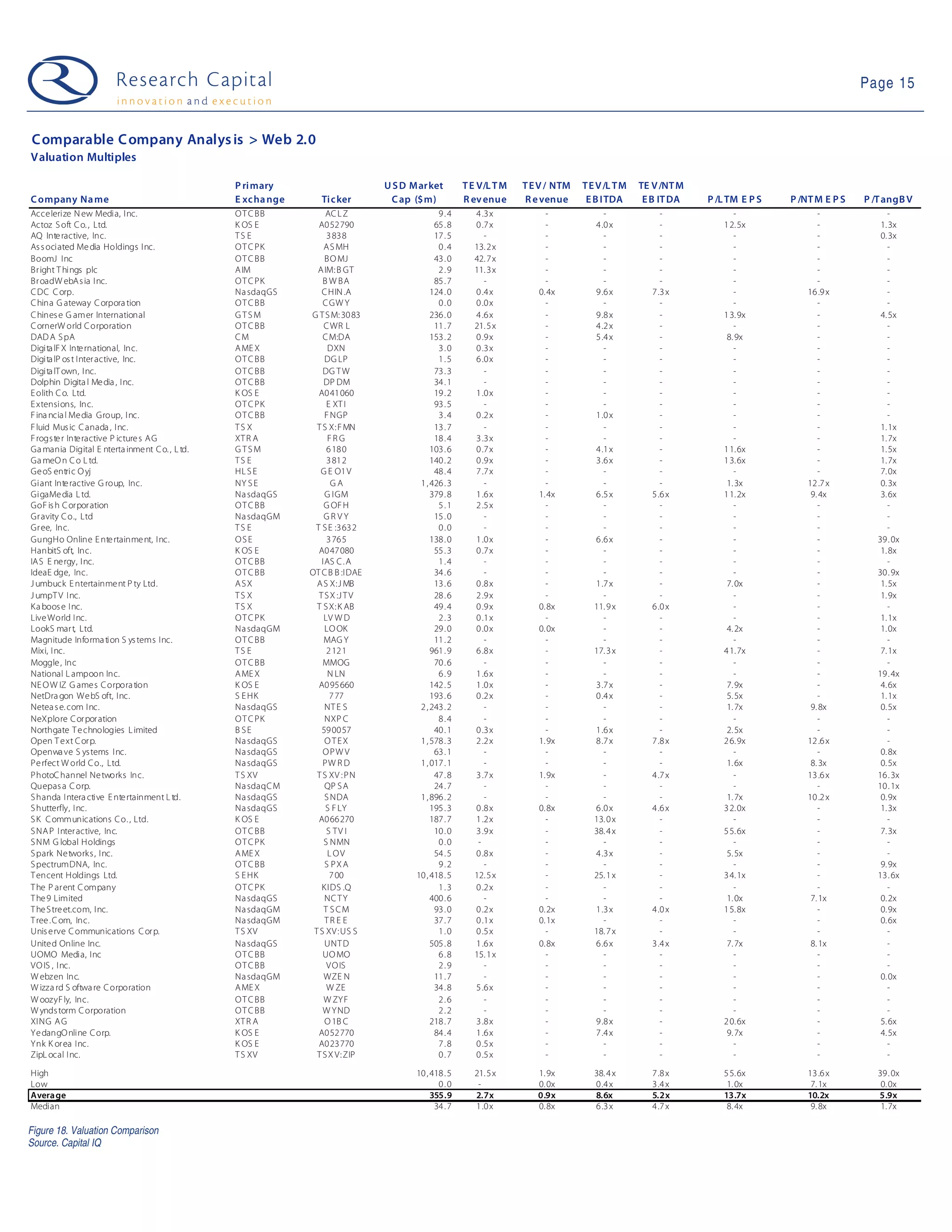

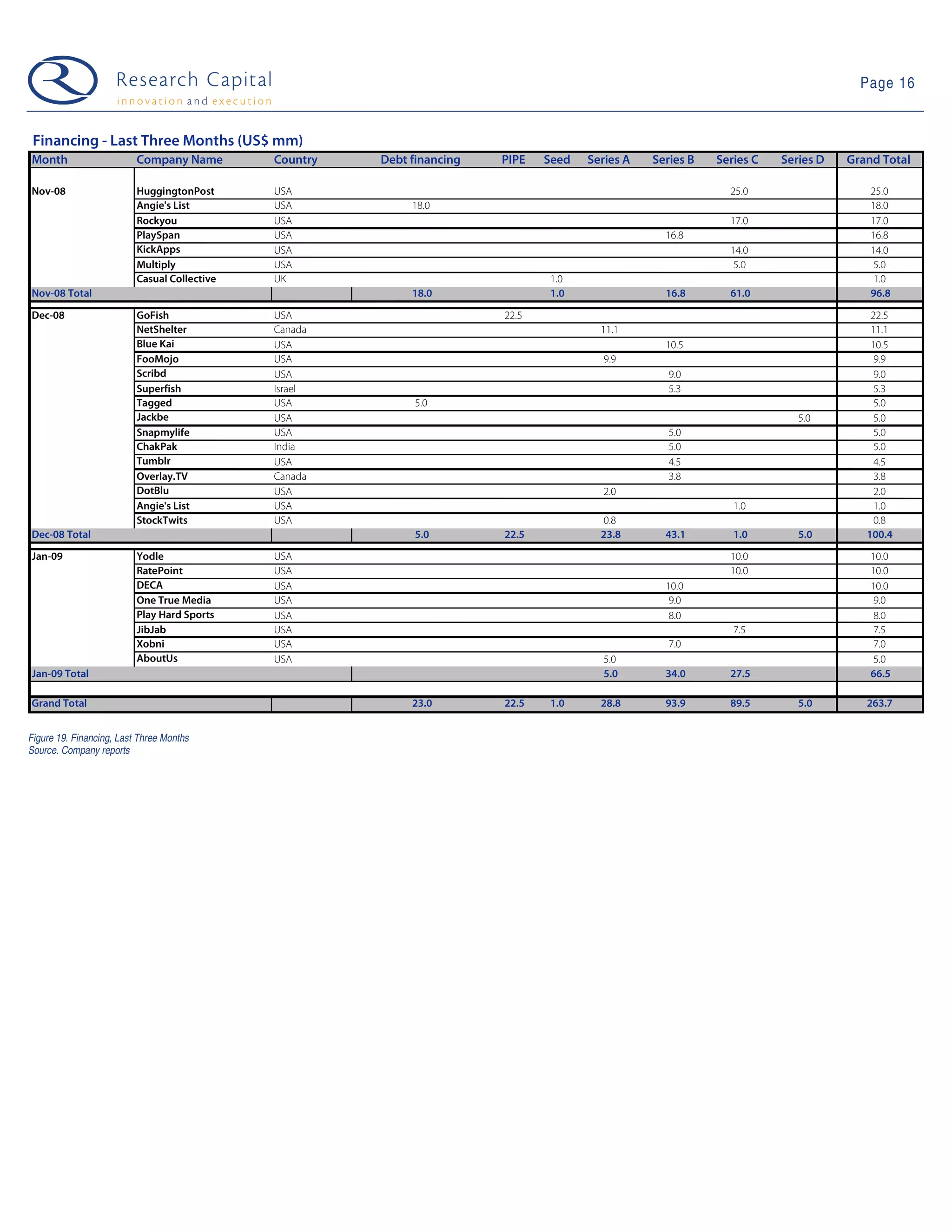

This document introduces a new weekly publication from Research Capital called "The Web 2.0 Weekly". The report will highlight key events and news in the global Web 2.0 sector, including capital market activity, industry news, upcoming events, and valuation metrics for the 76 public Web 2.0 companies identified. It provides an overview of the diverse universe of Web 2.0 companies and technologies, from social networking to online gaming.