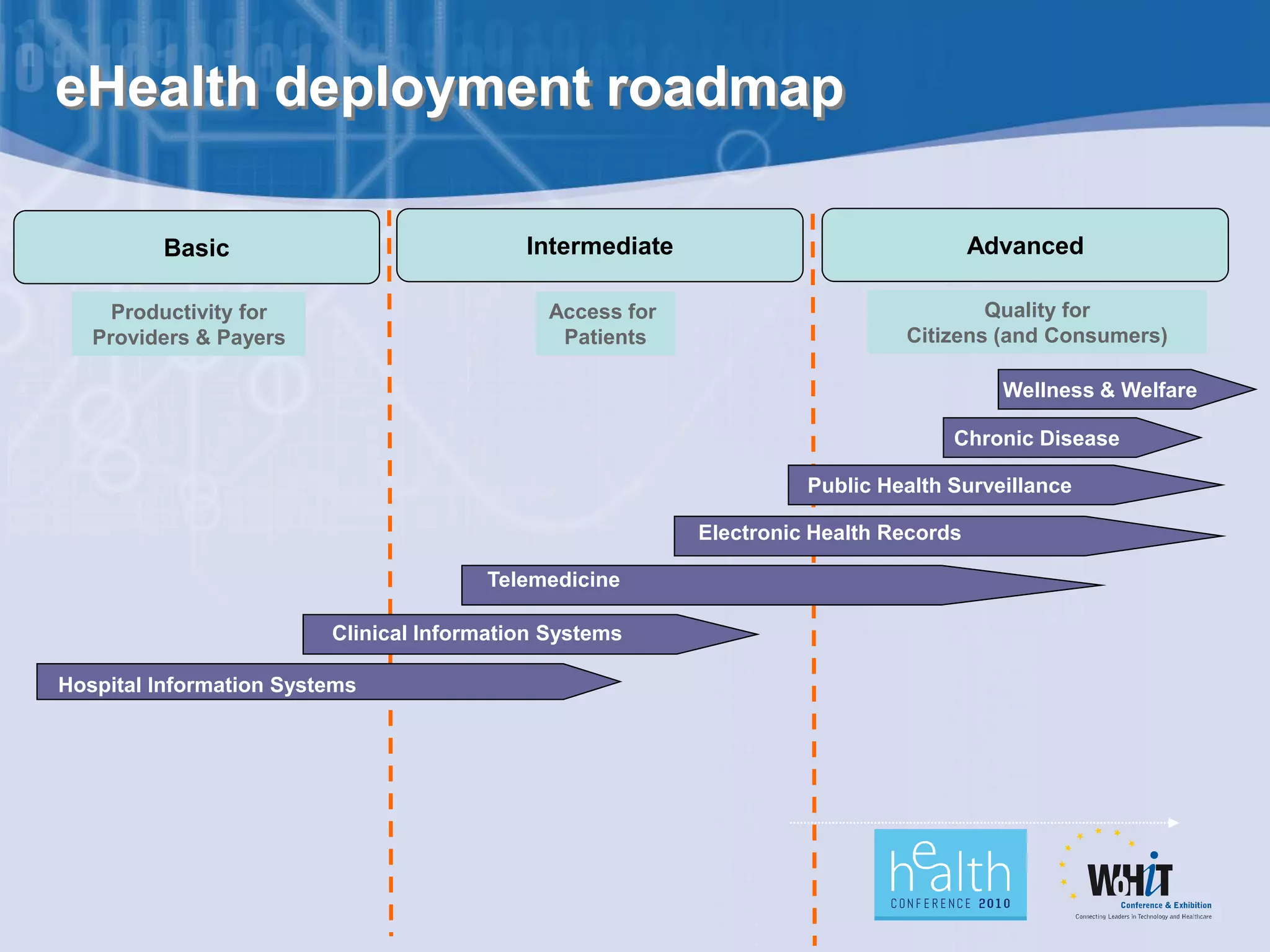

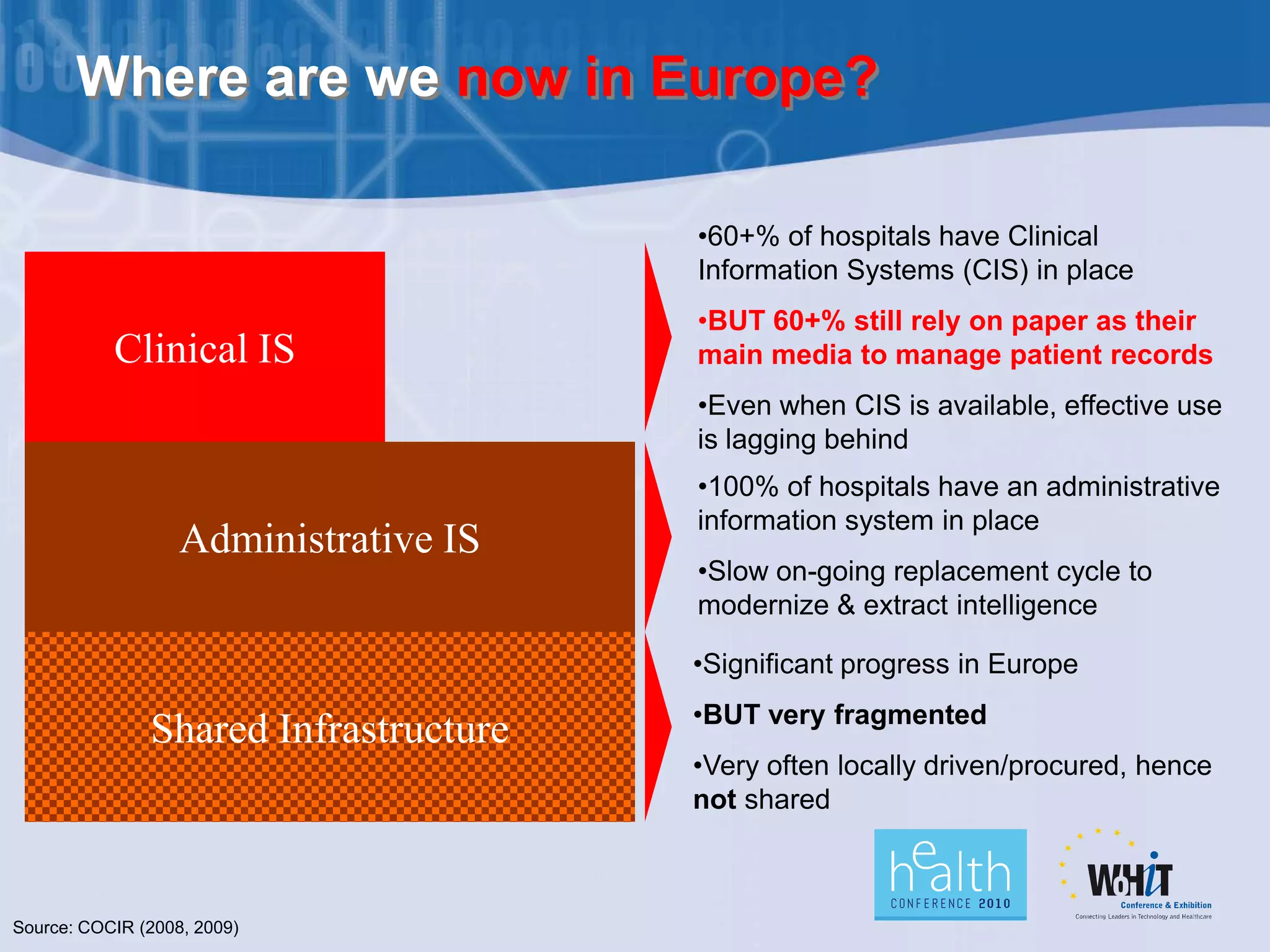

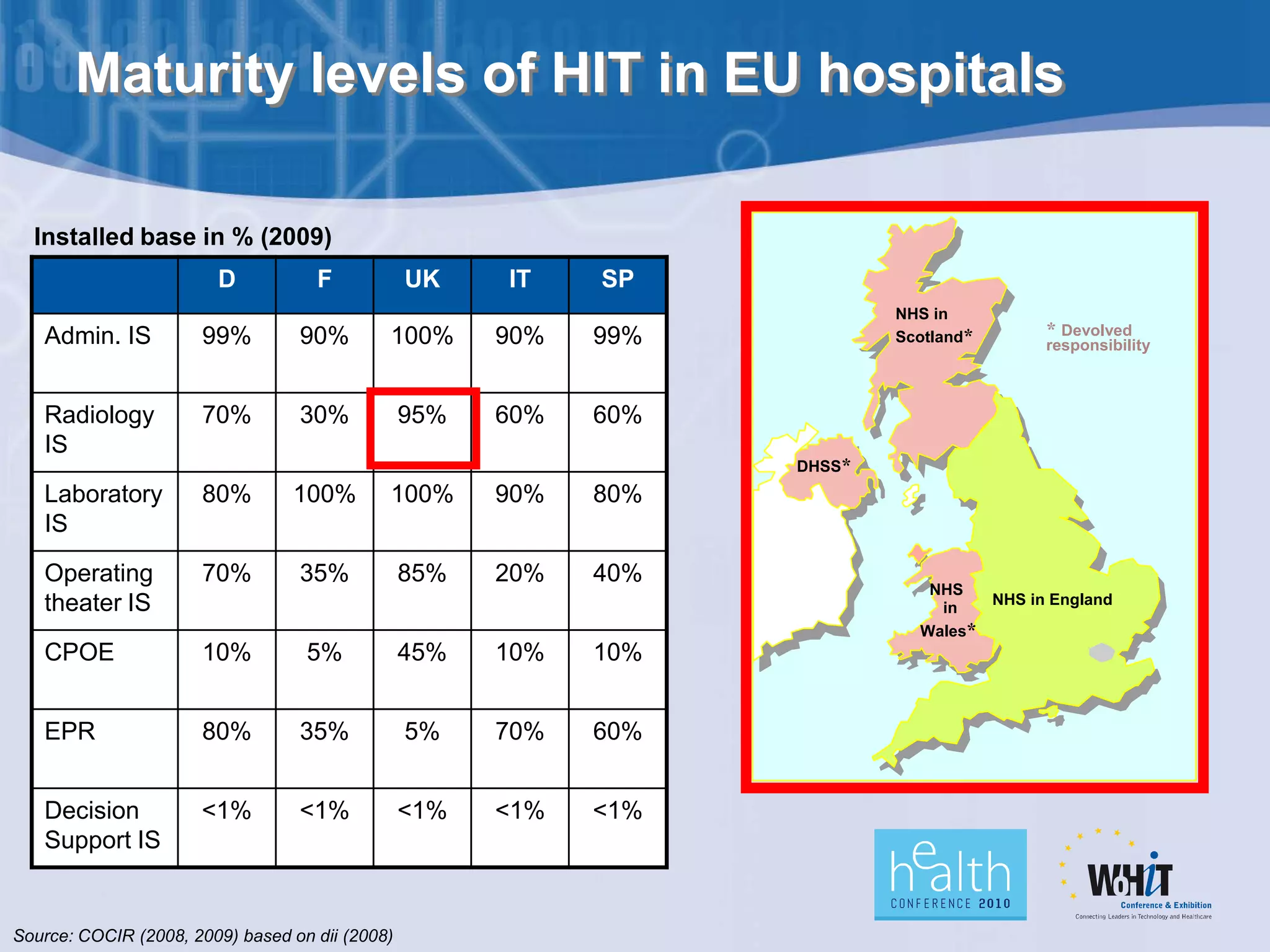

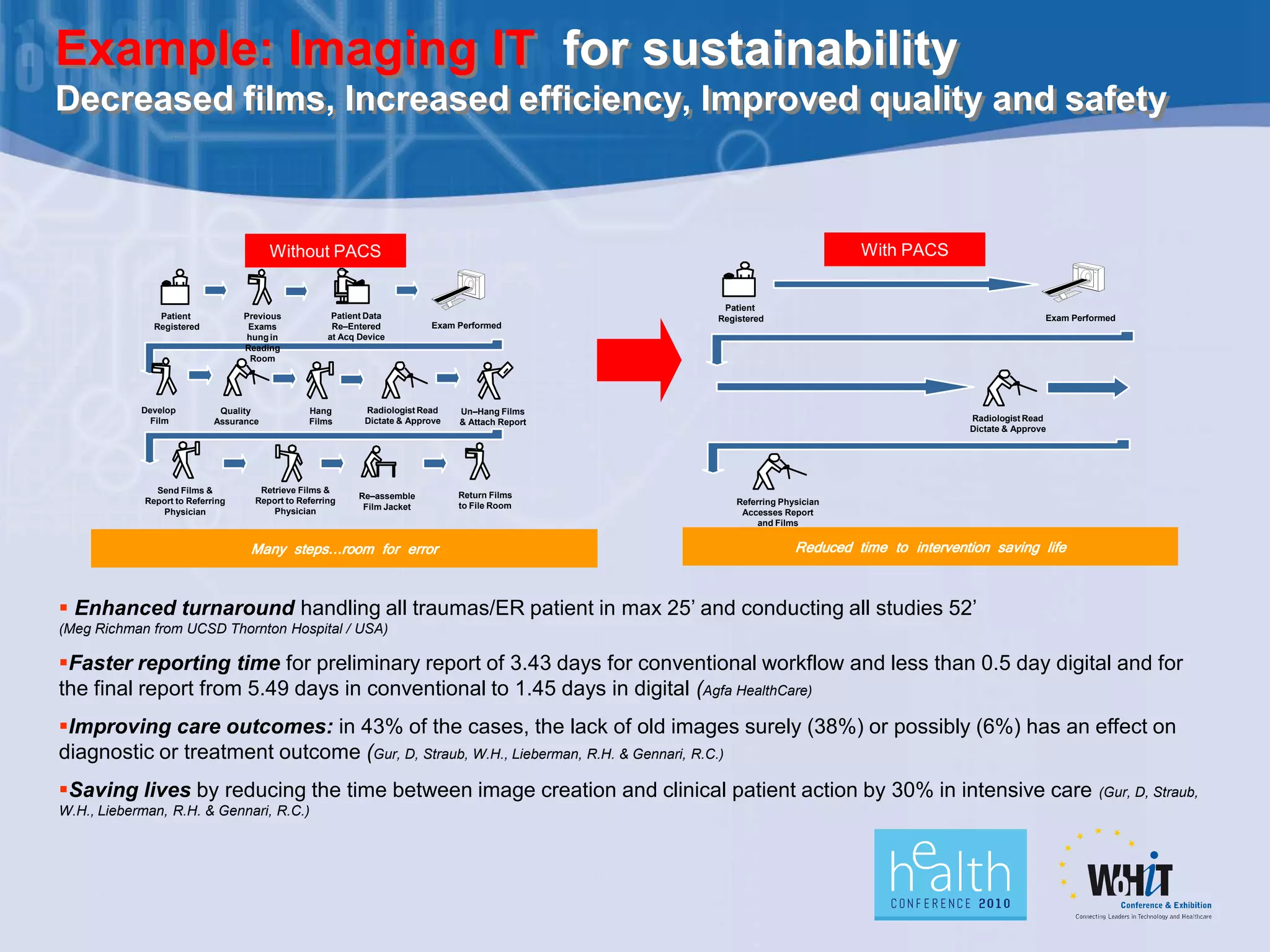

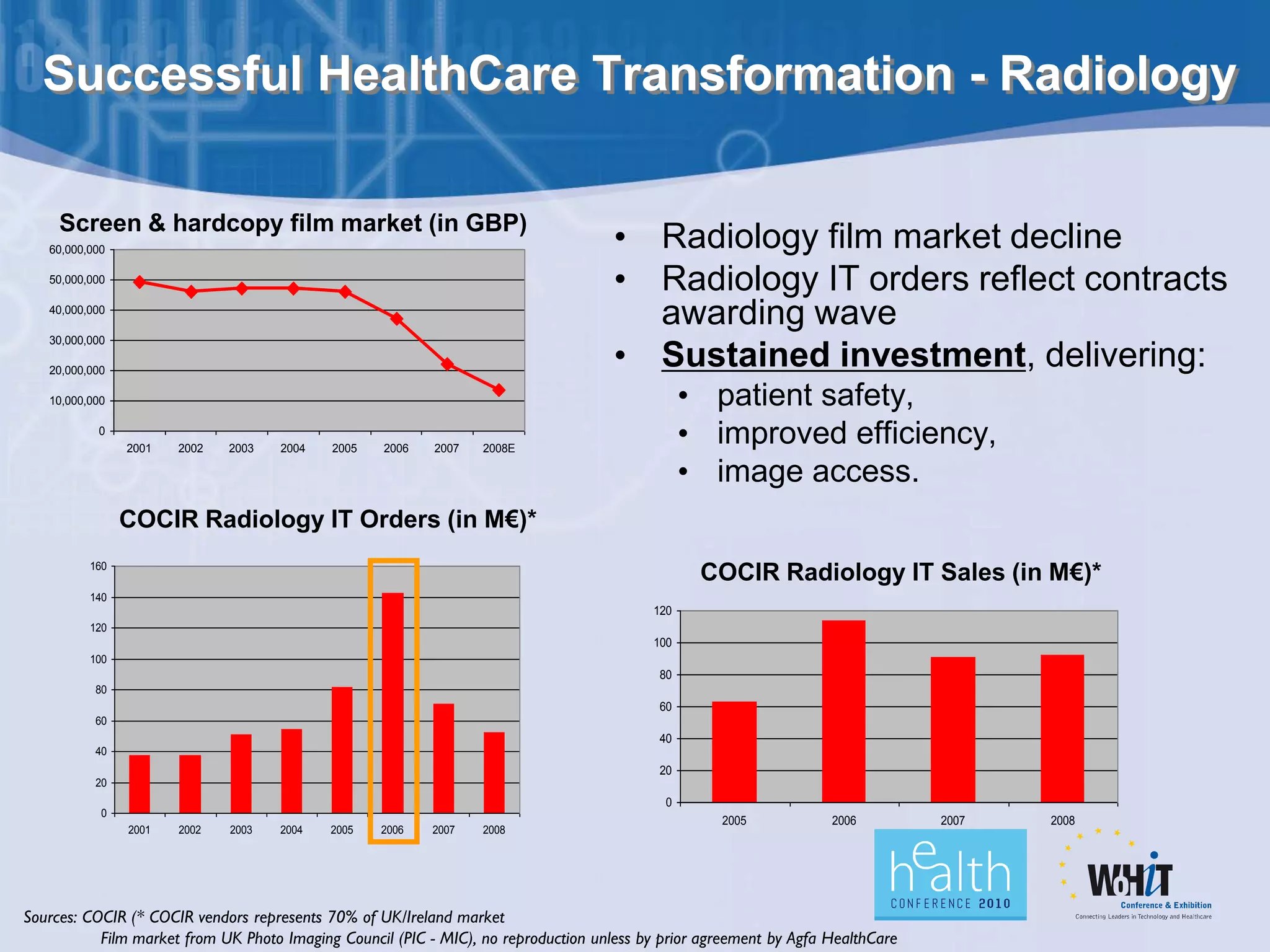

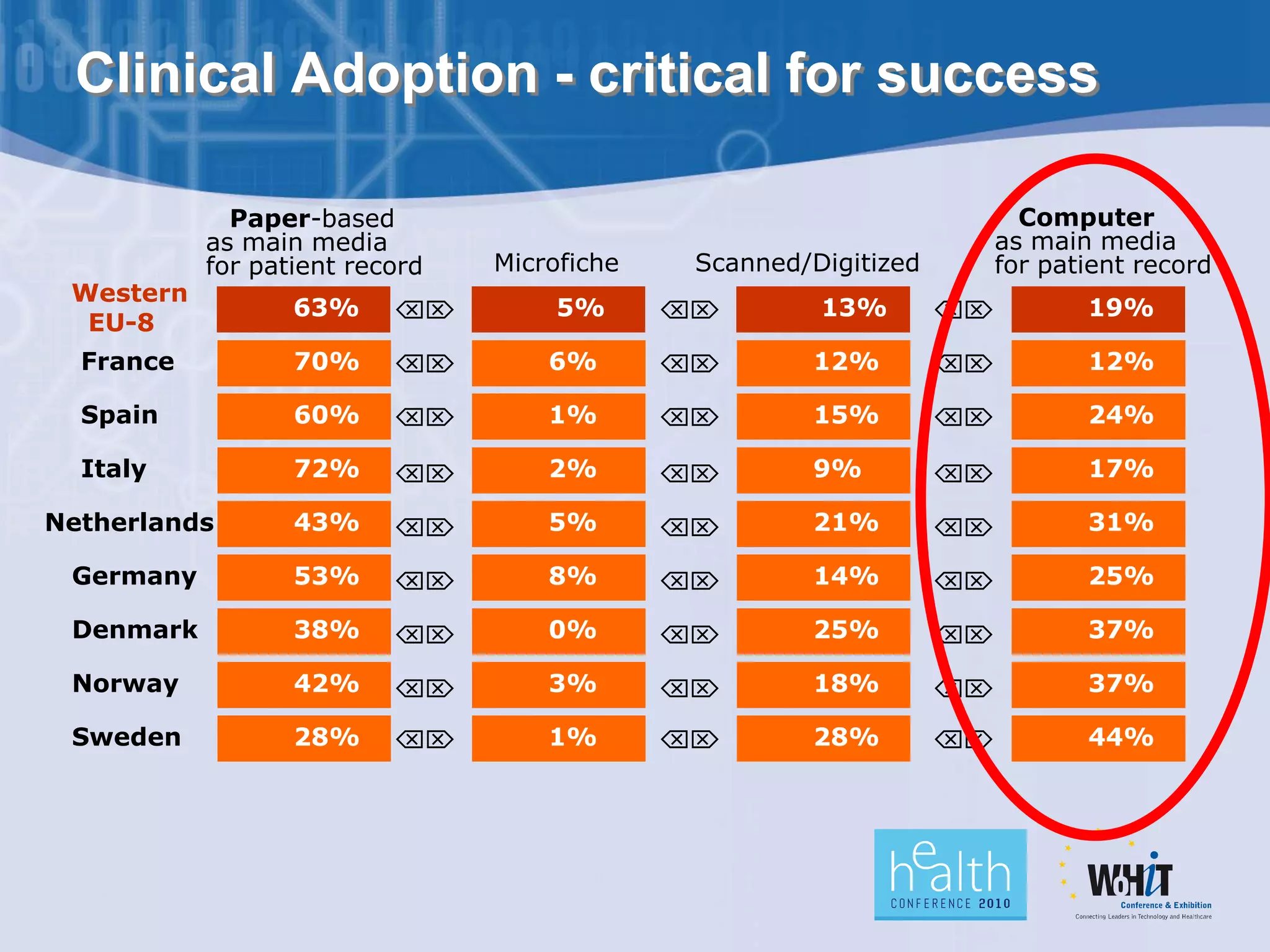

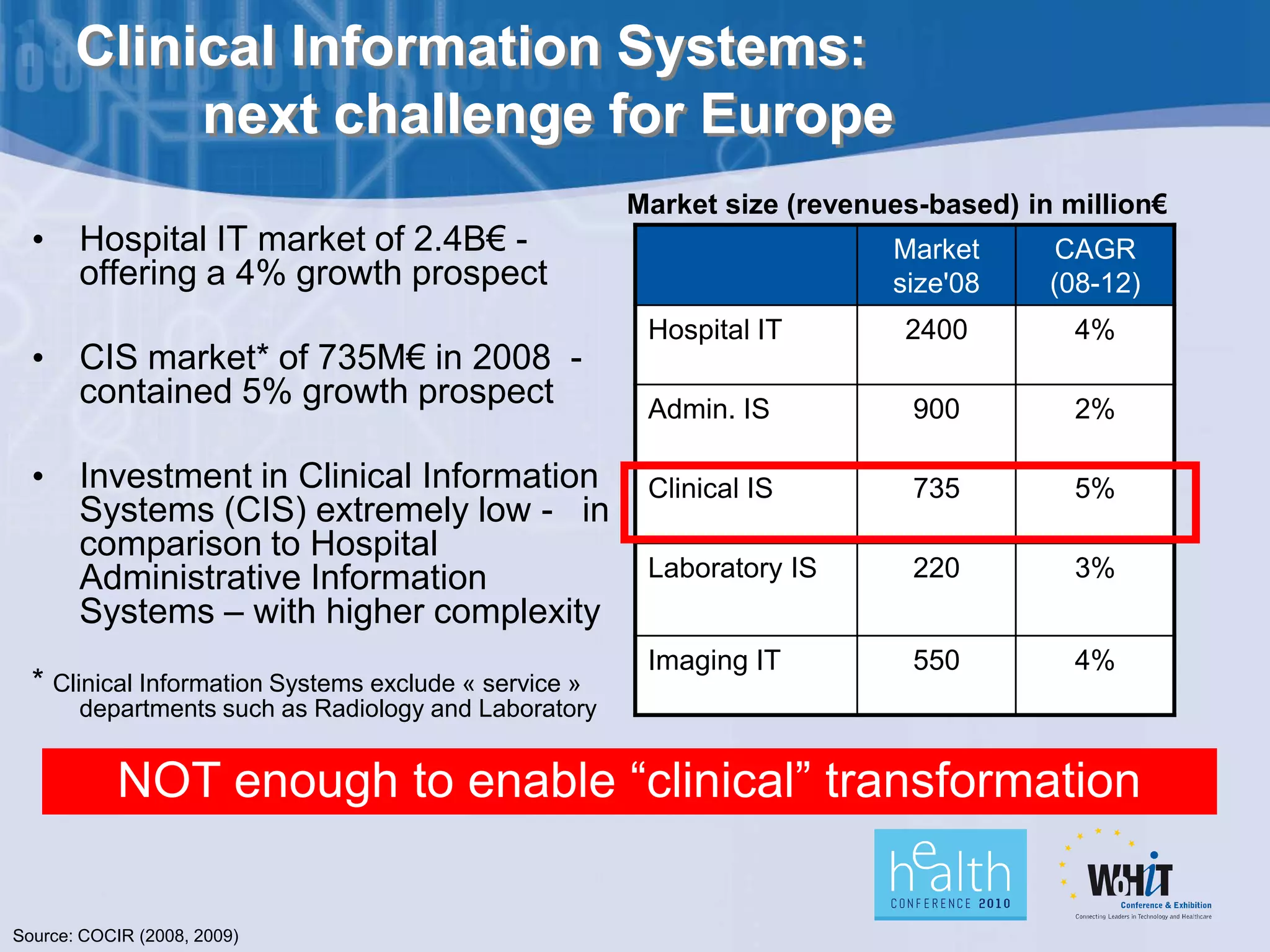

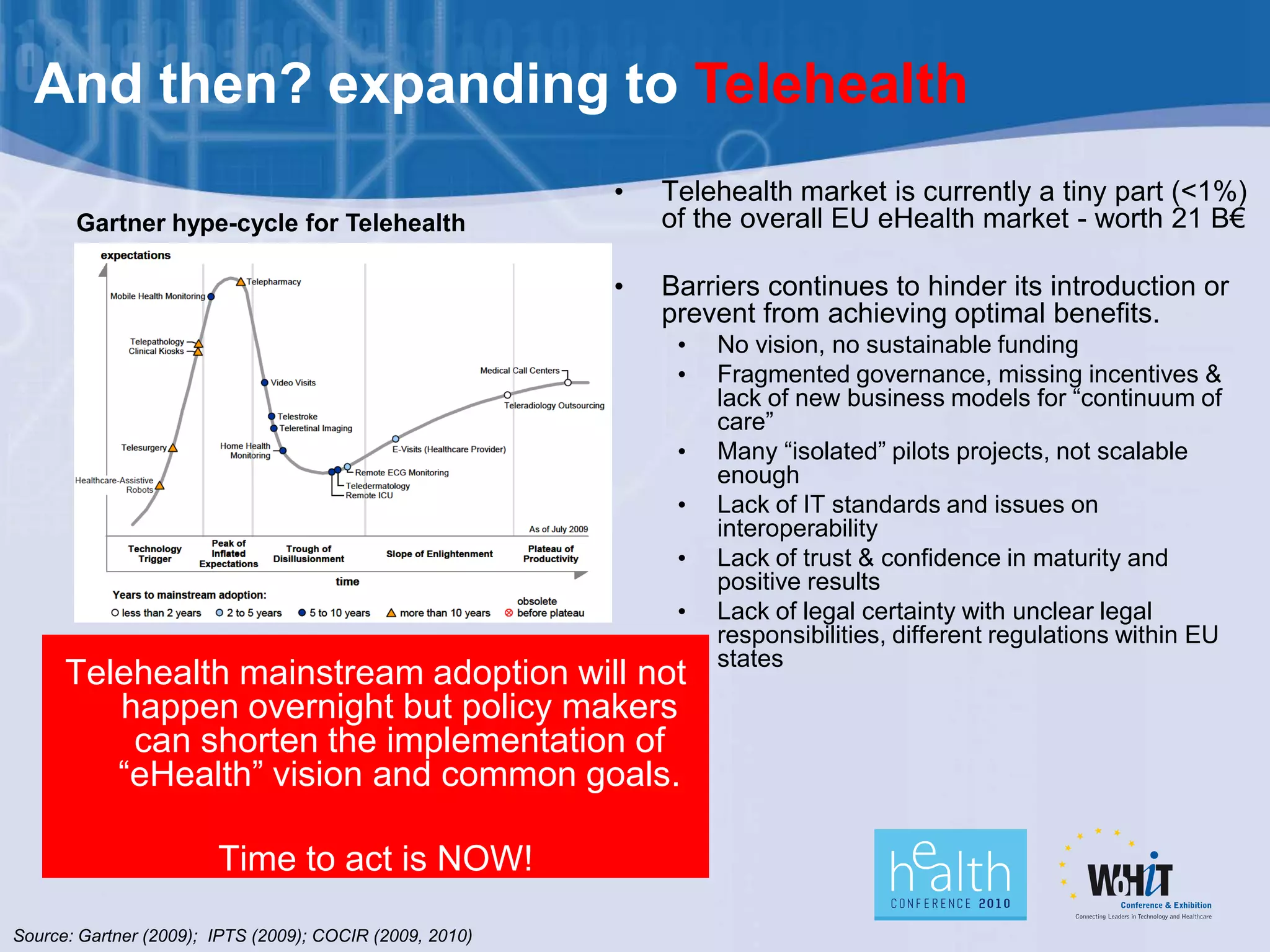

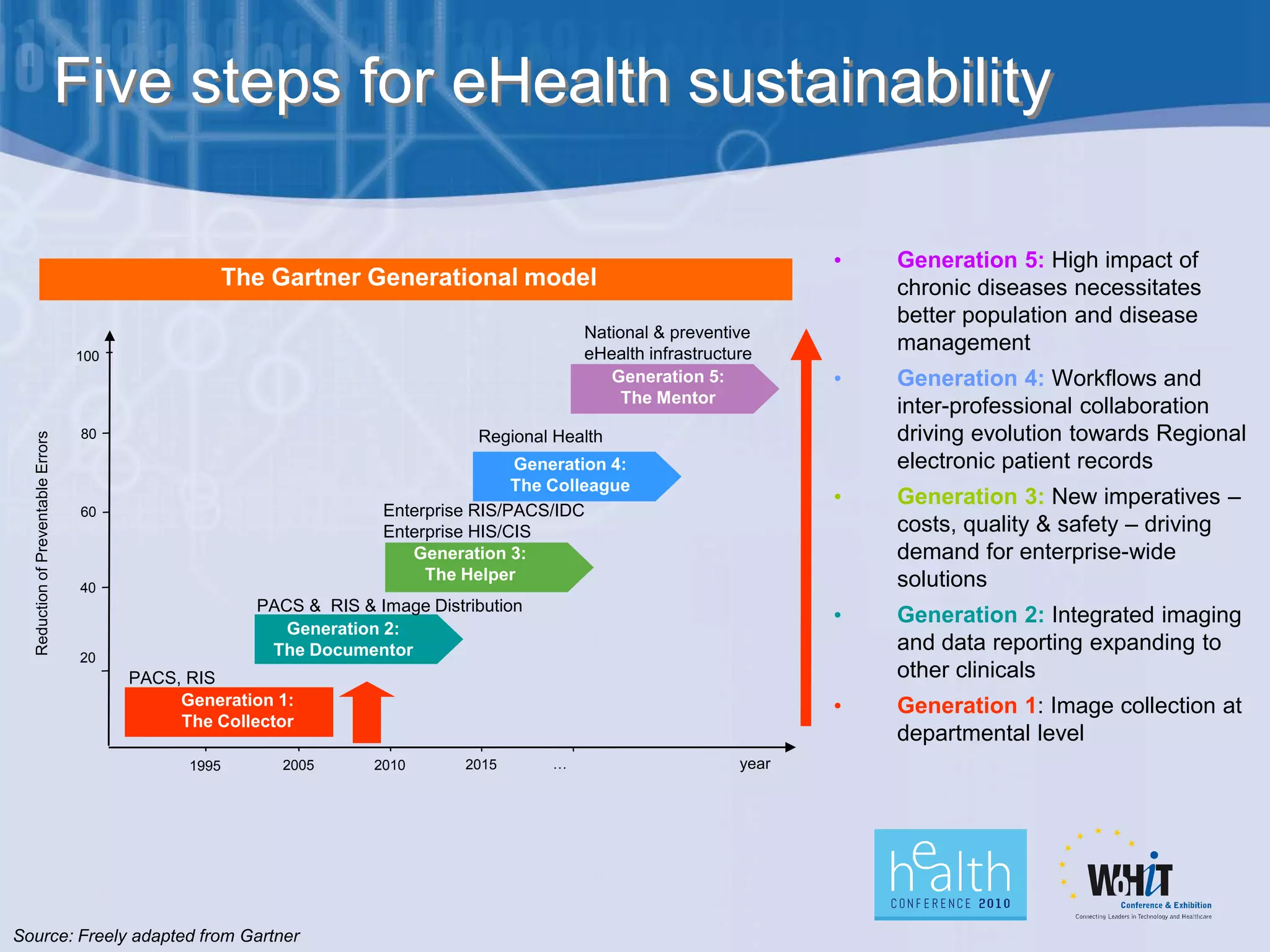

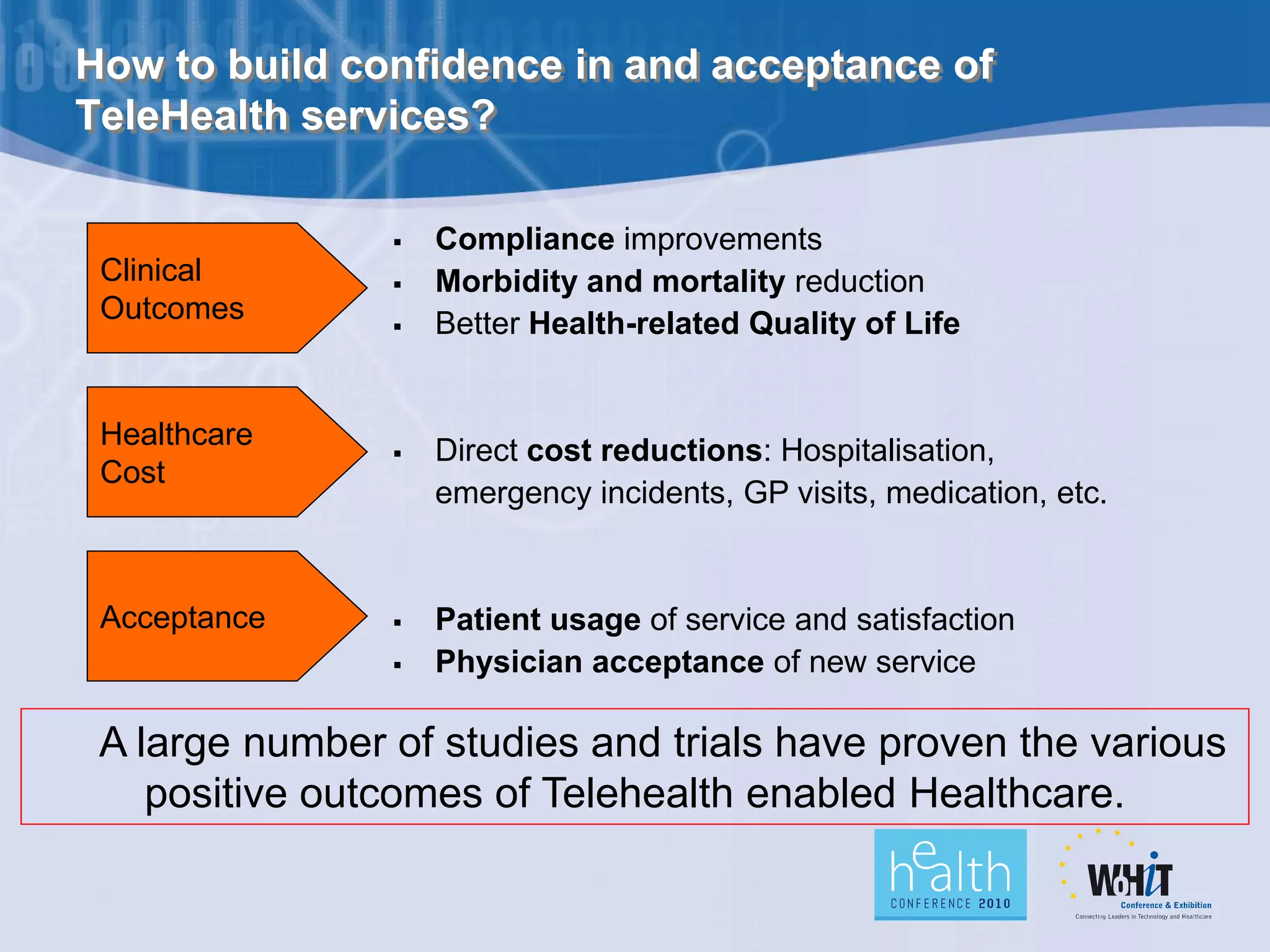

The document discusses the current state and future potential of eHealth in transforming healthcare systems in Europe, highlighting the significant reliance on paper records despite the presence of clinical information systems. It argues for the necessity of a cohesive vision, governance structure, and innovative economic models to enhance telehealth adoption and interoperability. Additionally, it emphasizes the importance of trust, patient empowerment, and sustainable investment to realize the benefits of eHealth.