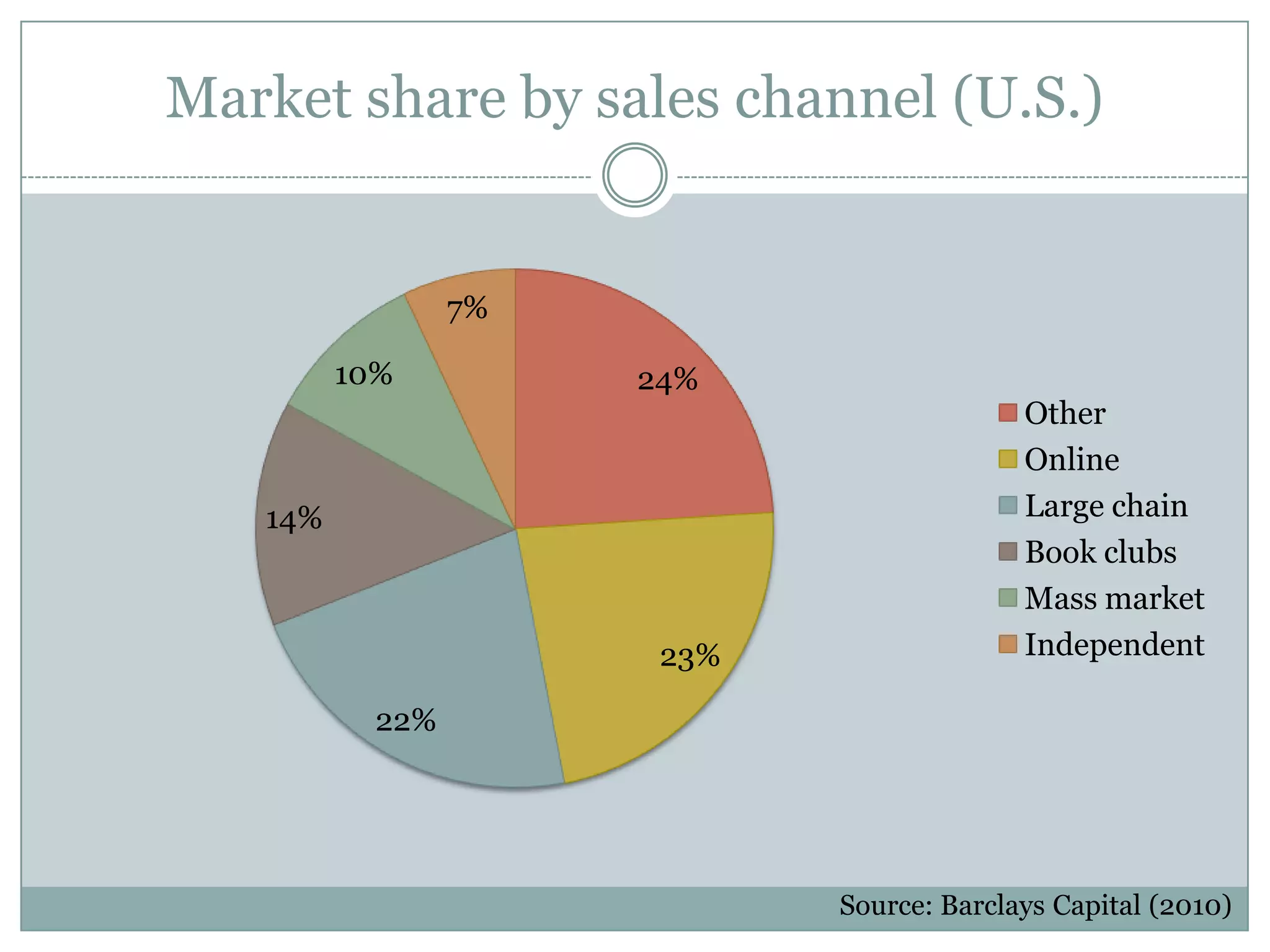

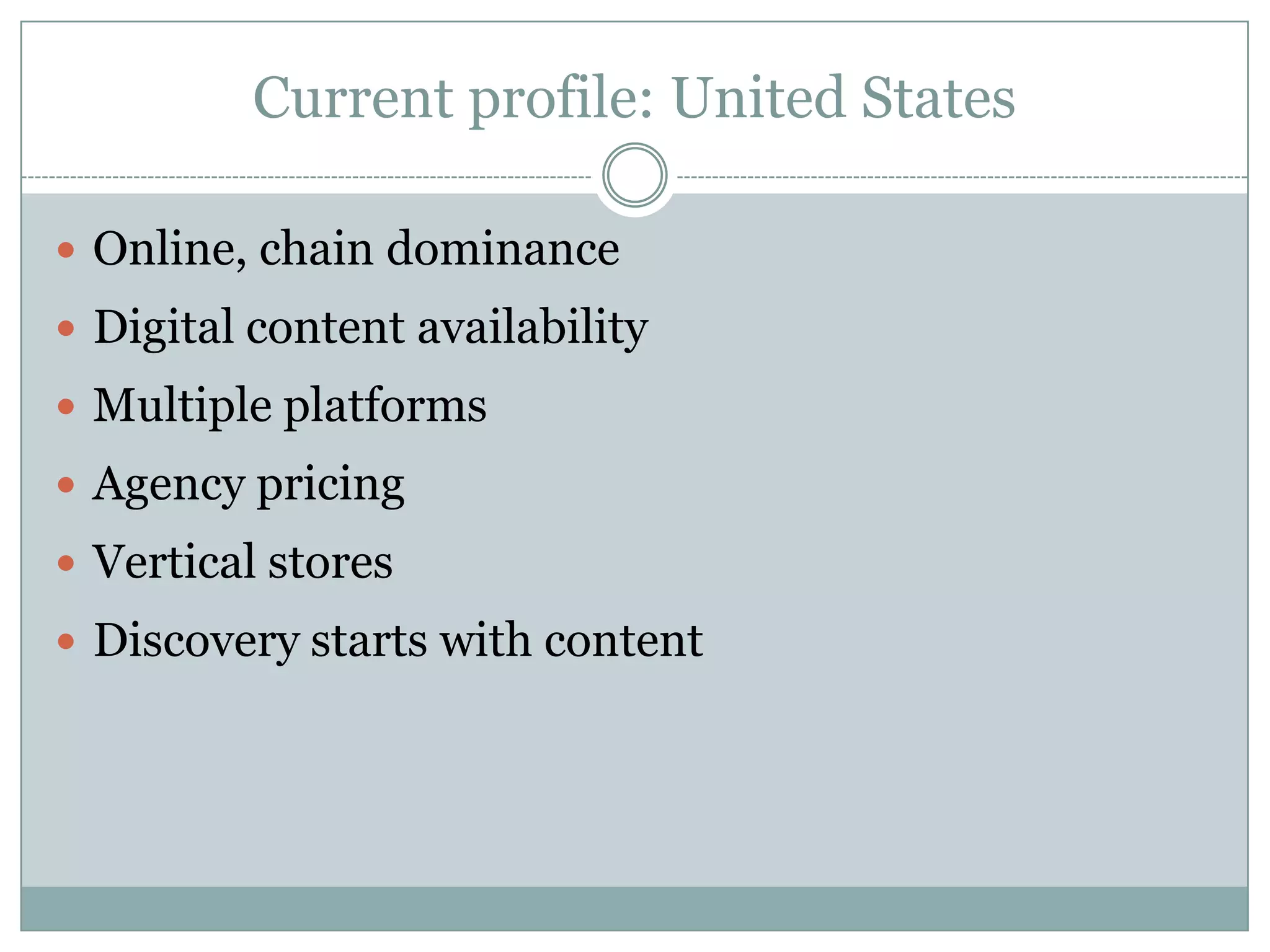

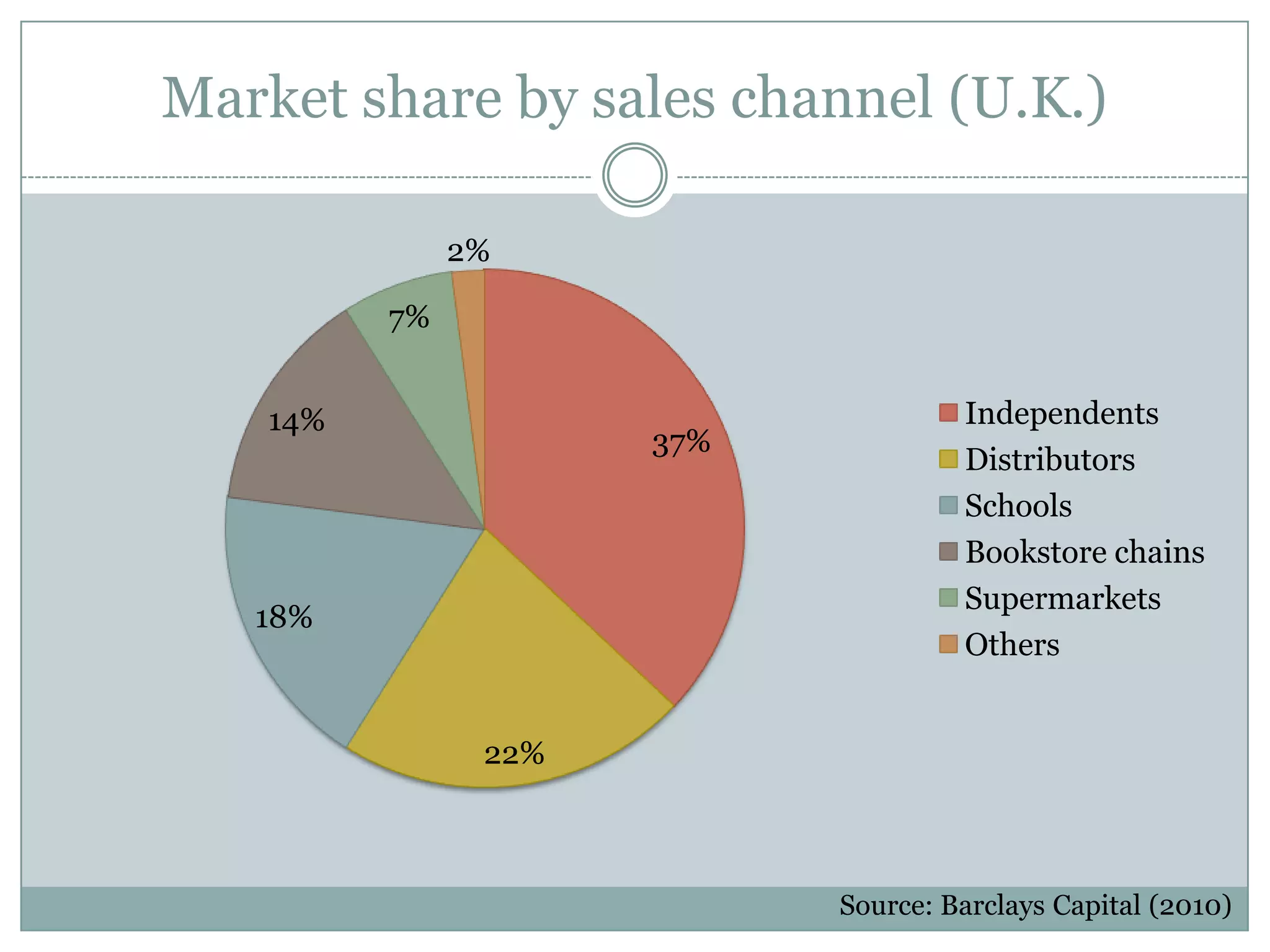

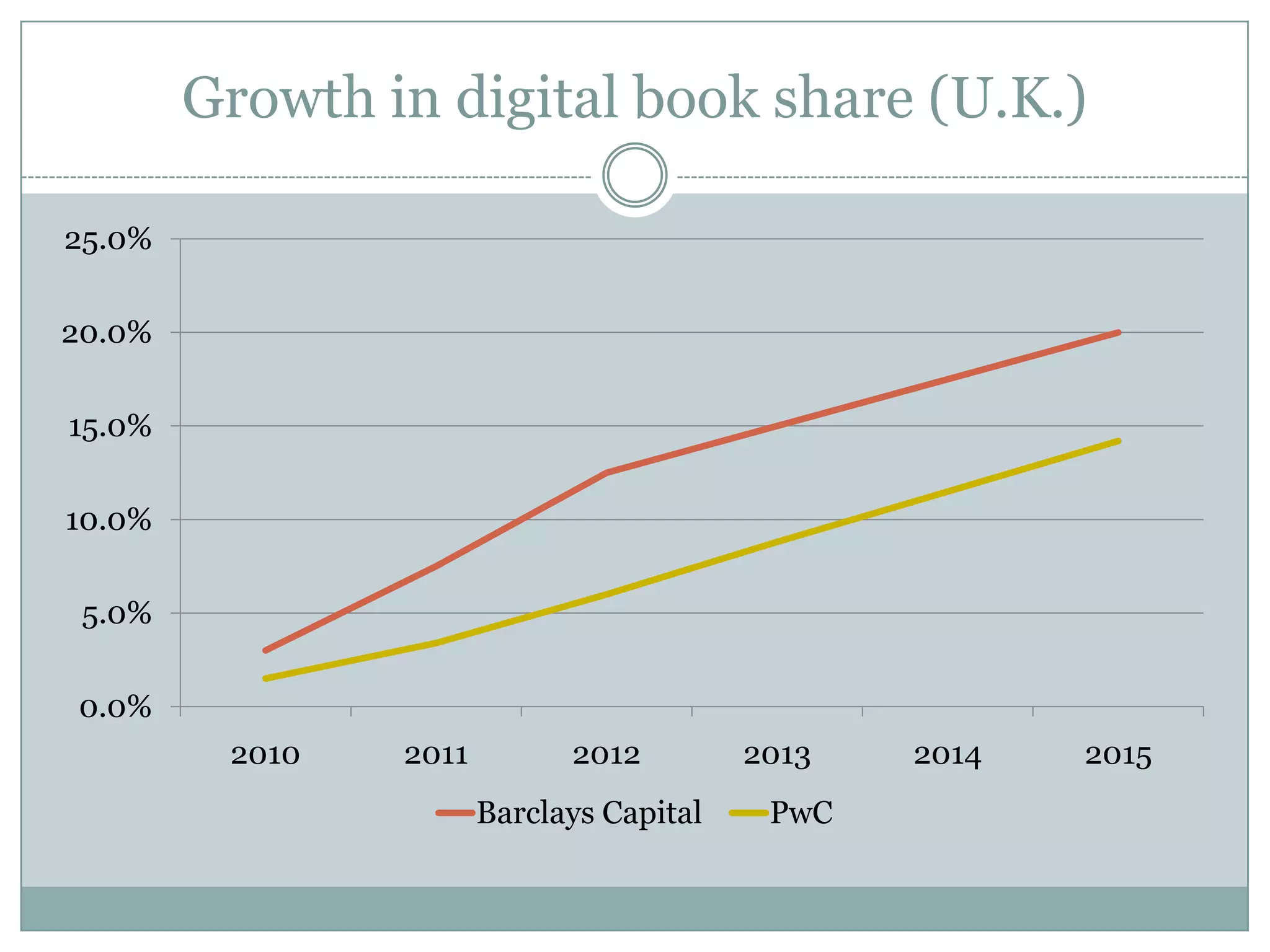

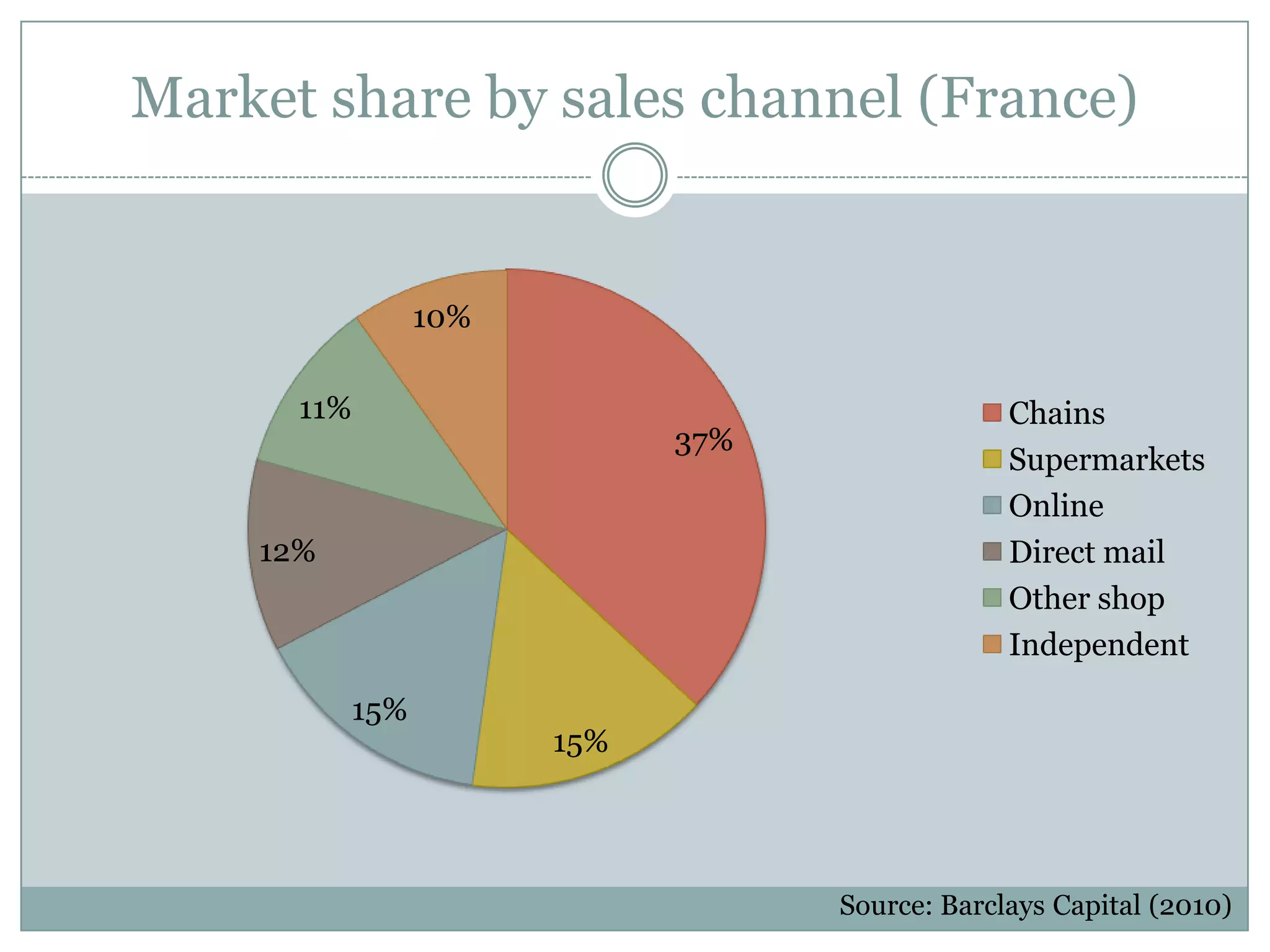

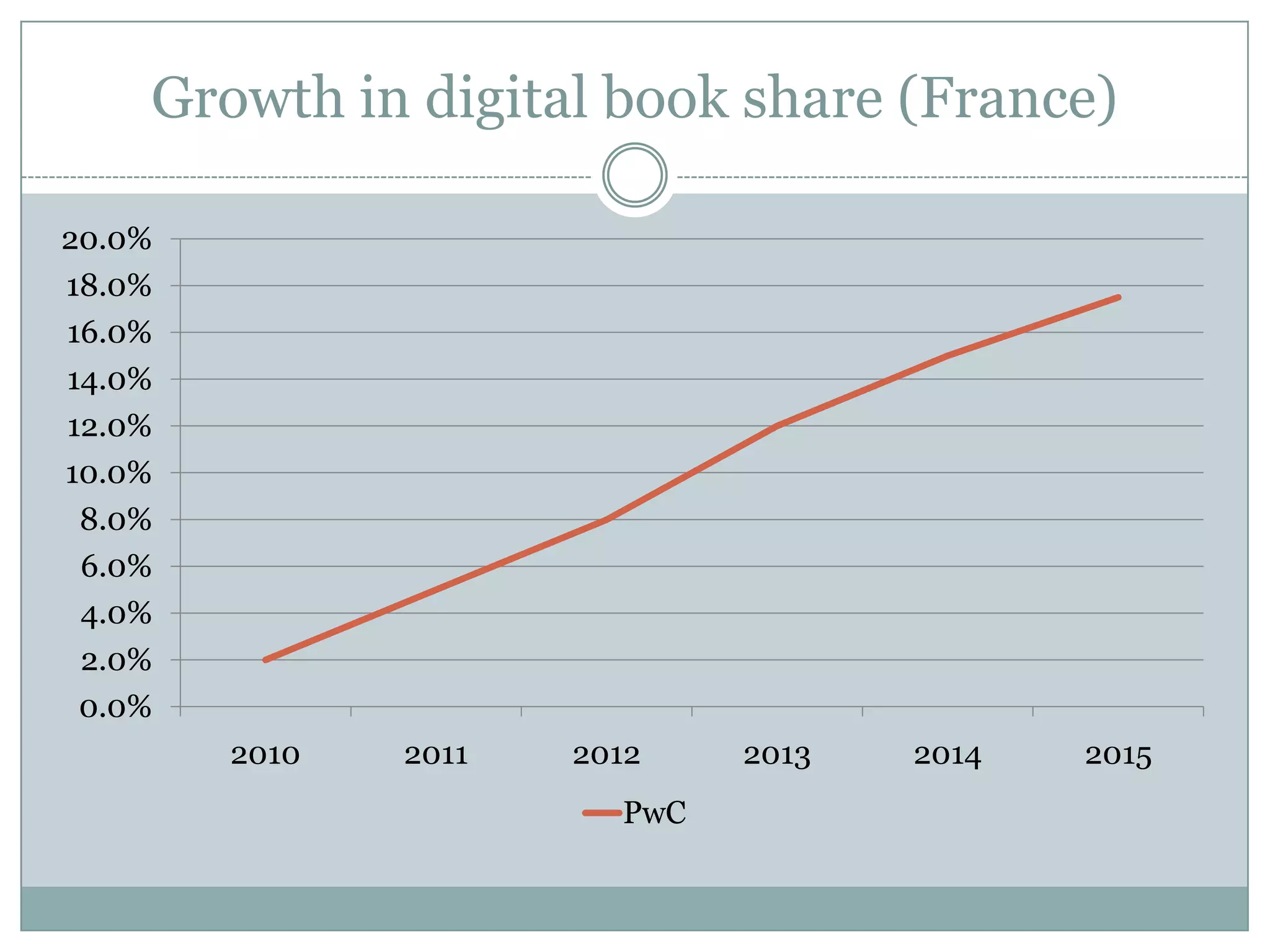

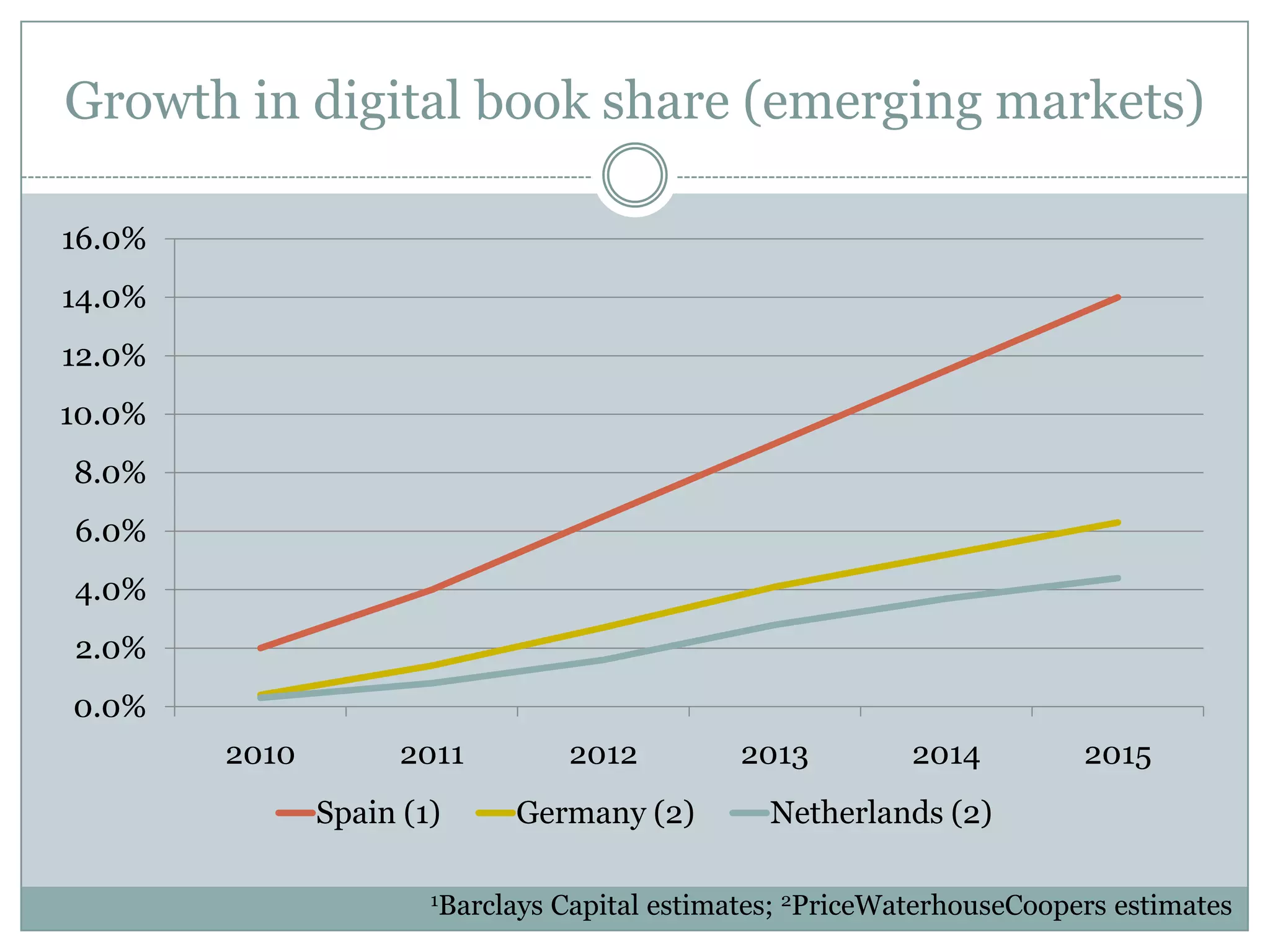

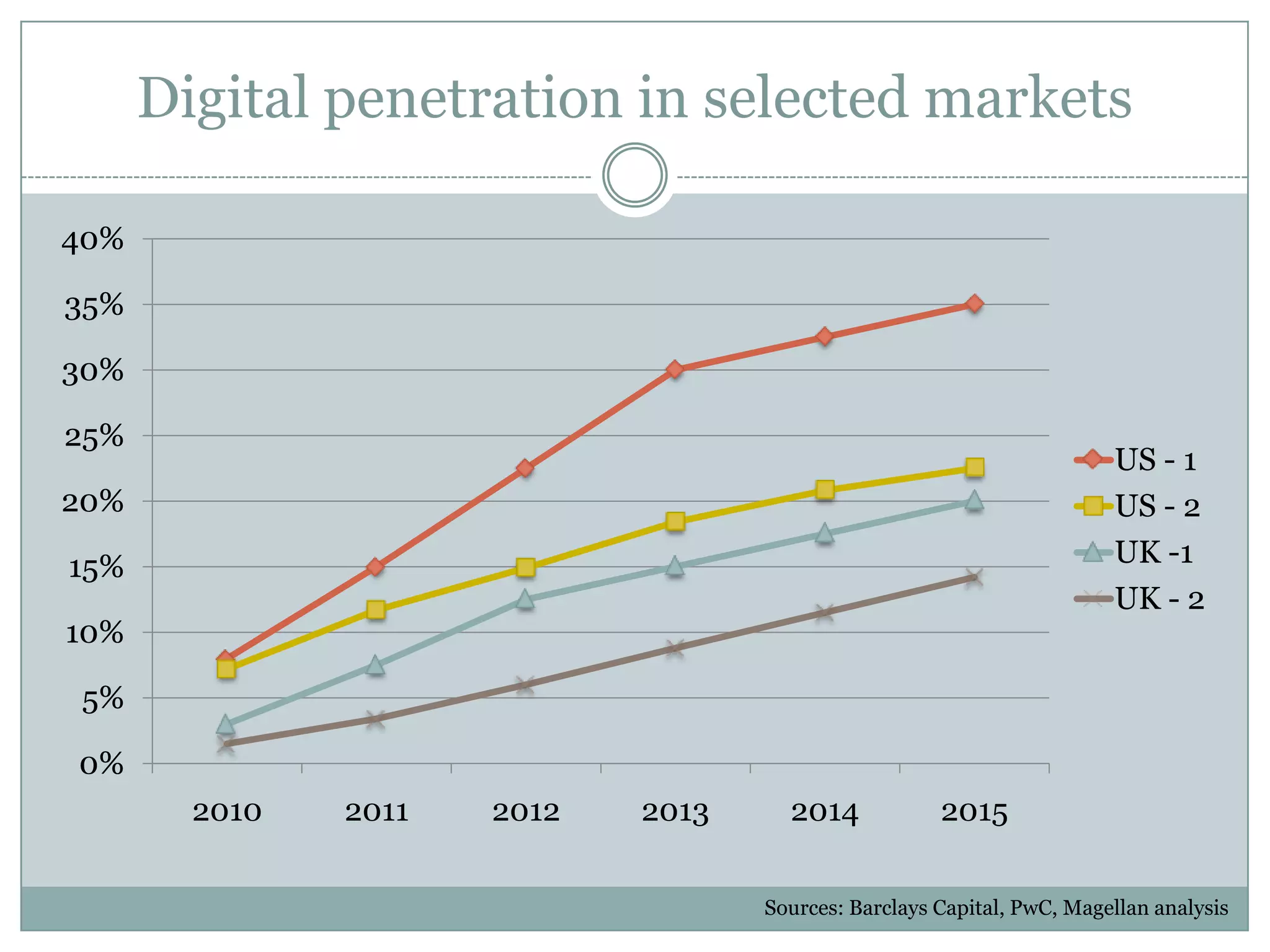

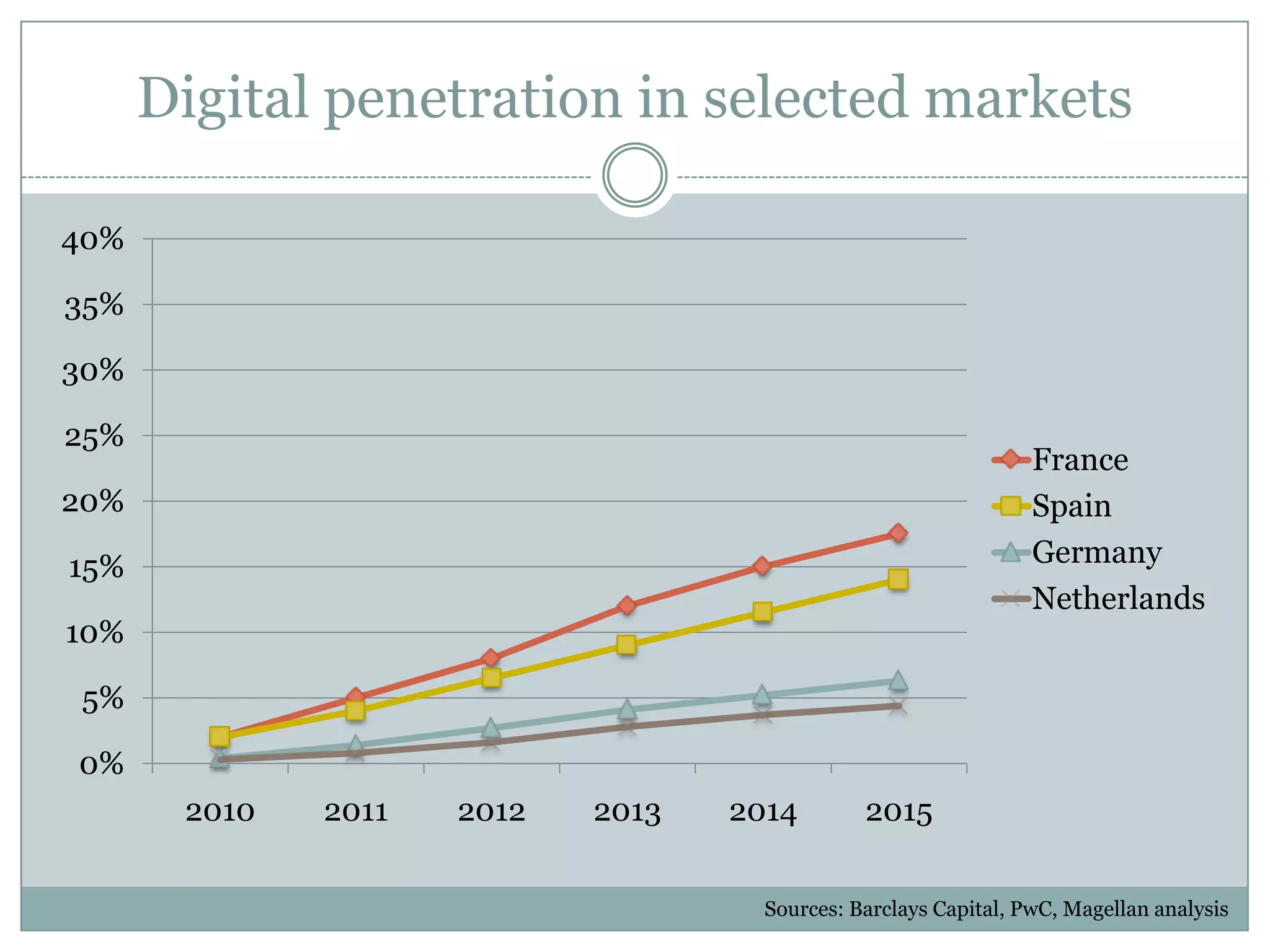

The document discusses best practices for exporting digital books, emphasizing the impact of new technologies and market intelligence across different regions, particularly the U.S., U.K., and emerging markets. It provides recommendations for maximizing digital income, navigating international rights, and adapting to evolving content forms and market profiles. Key findings suggest significant growth opportunities in international markets, driven by the rise of affordable e-reading devices and changing consumer behavior.