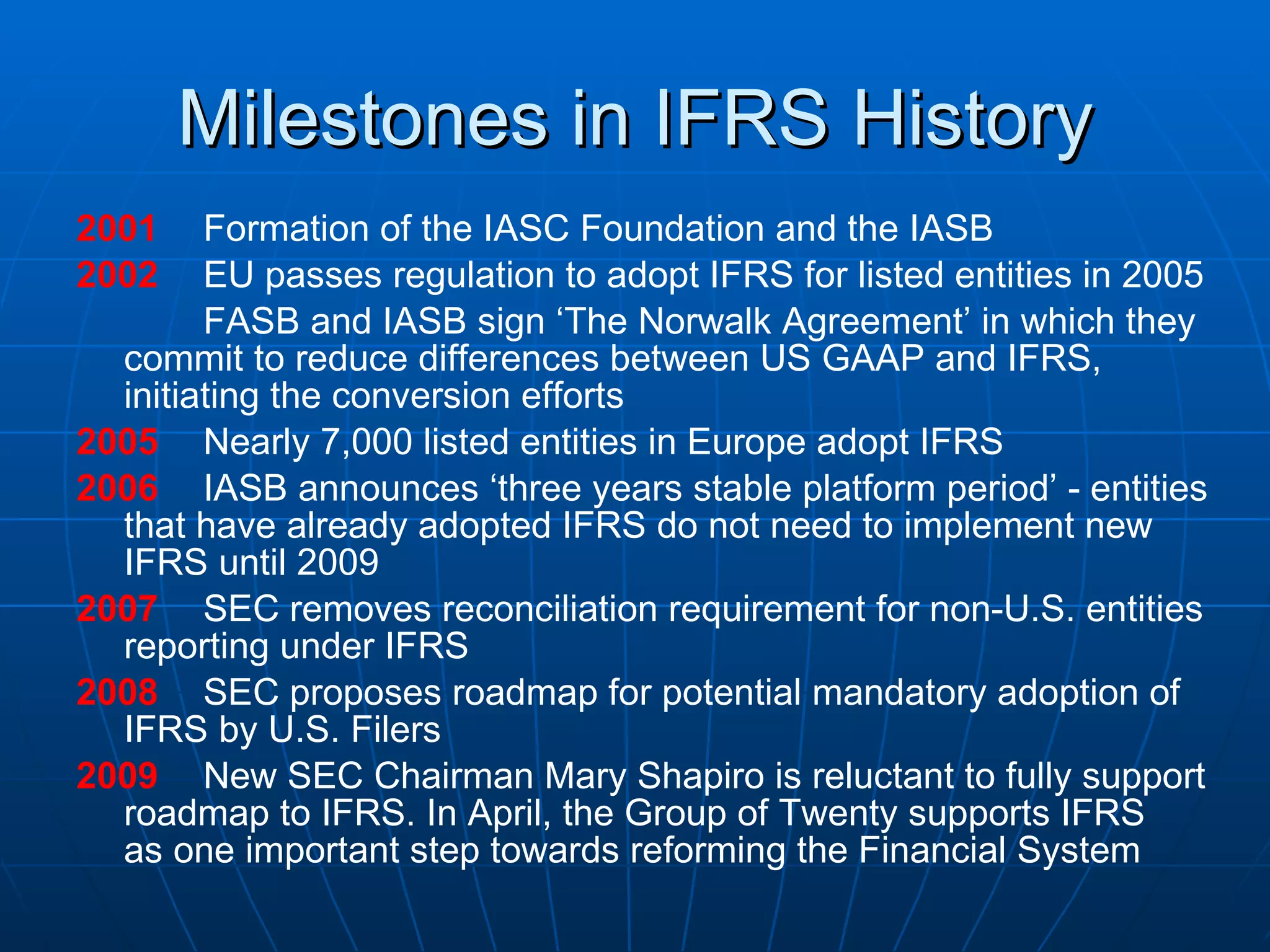

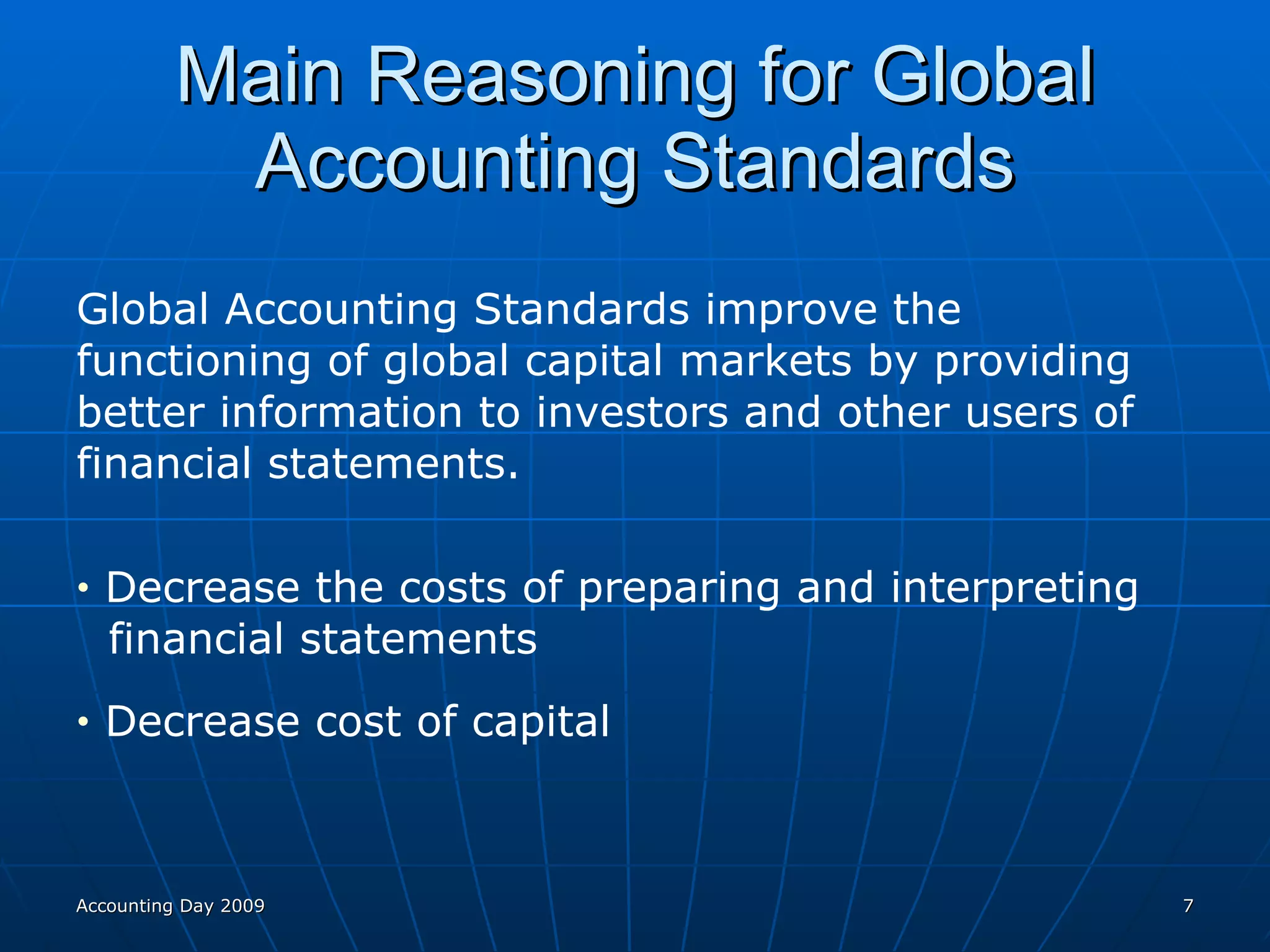

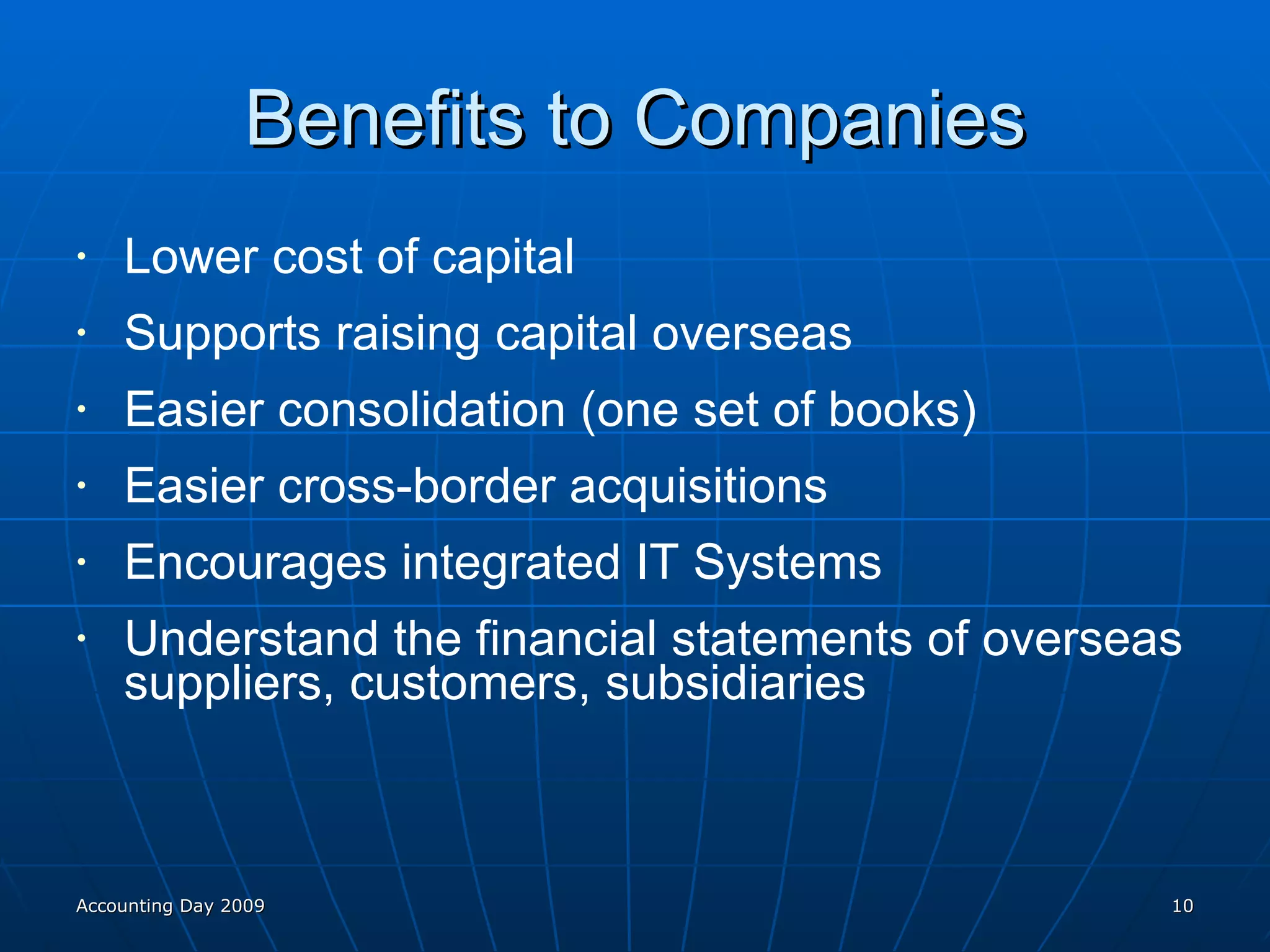

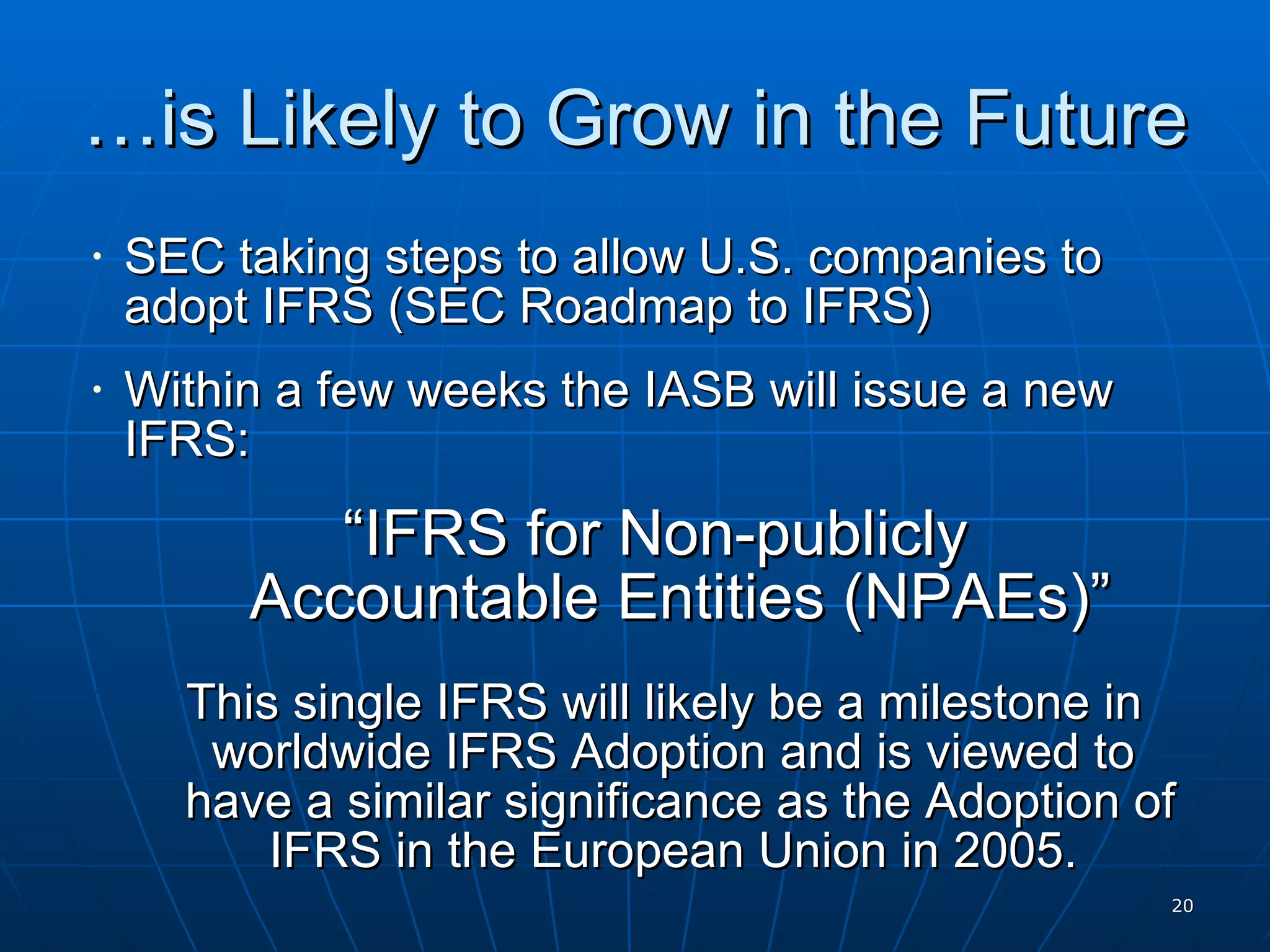

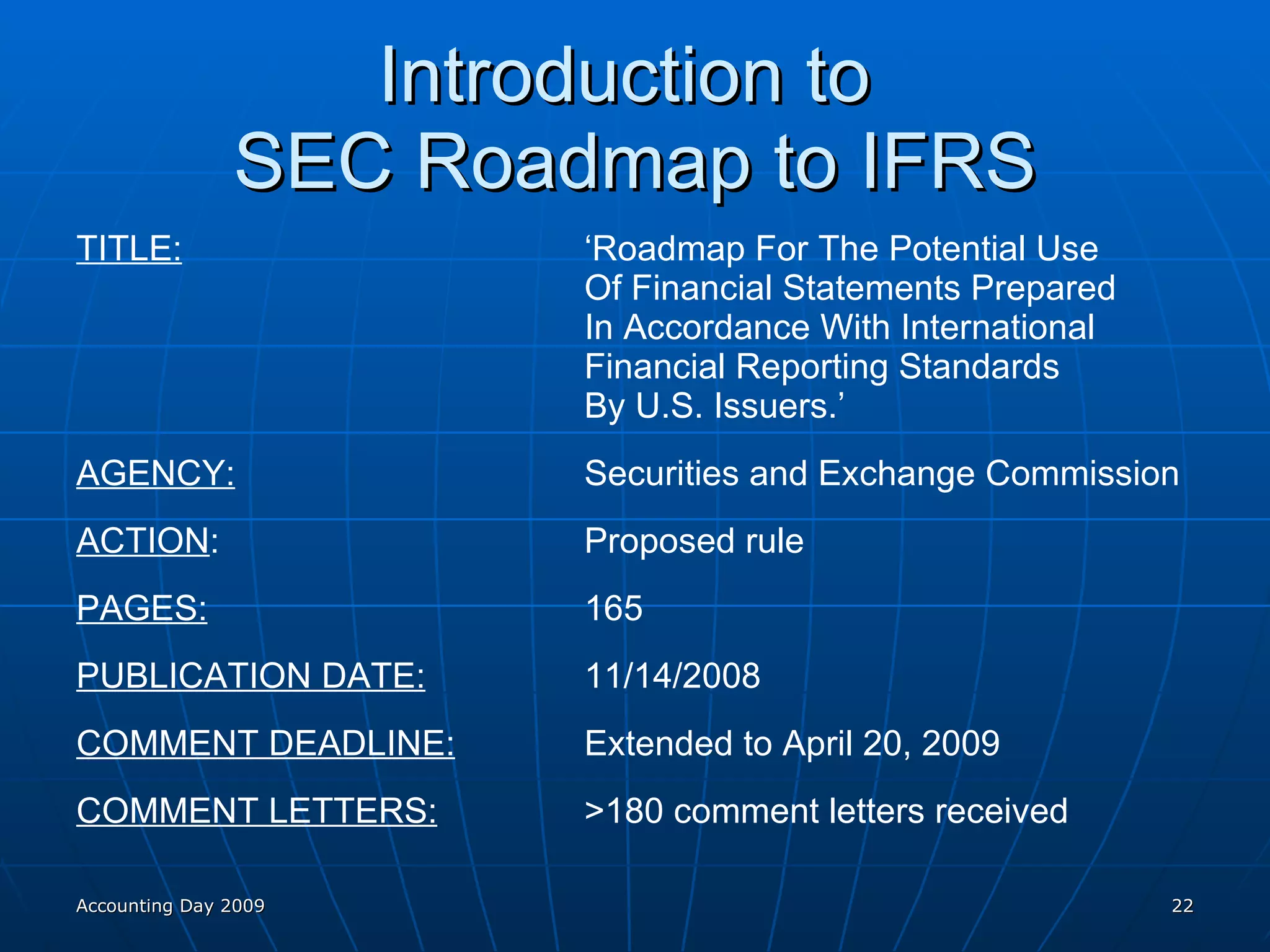

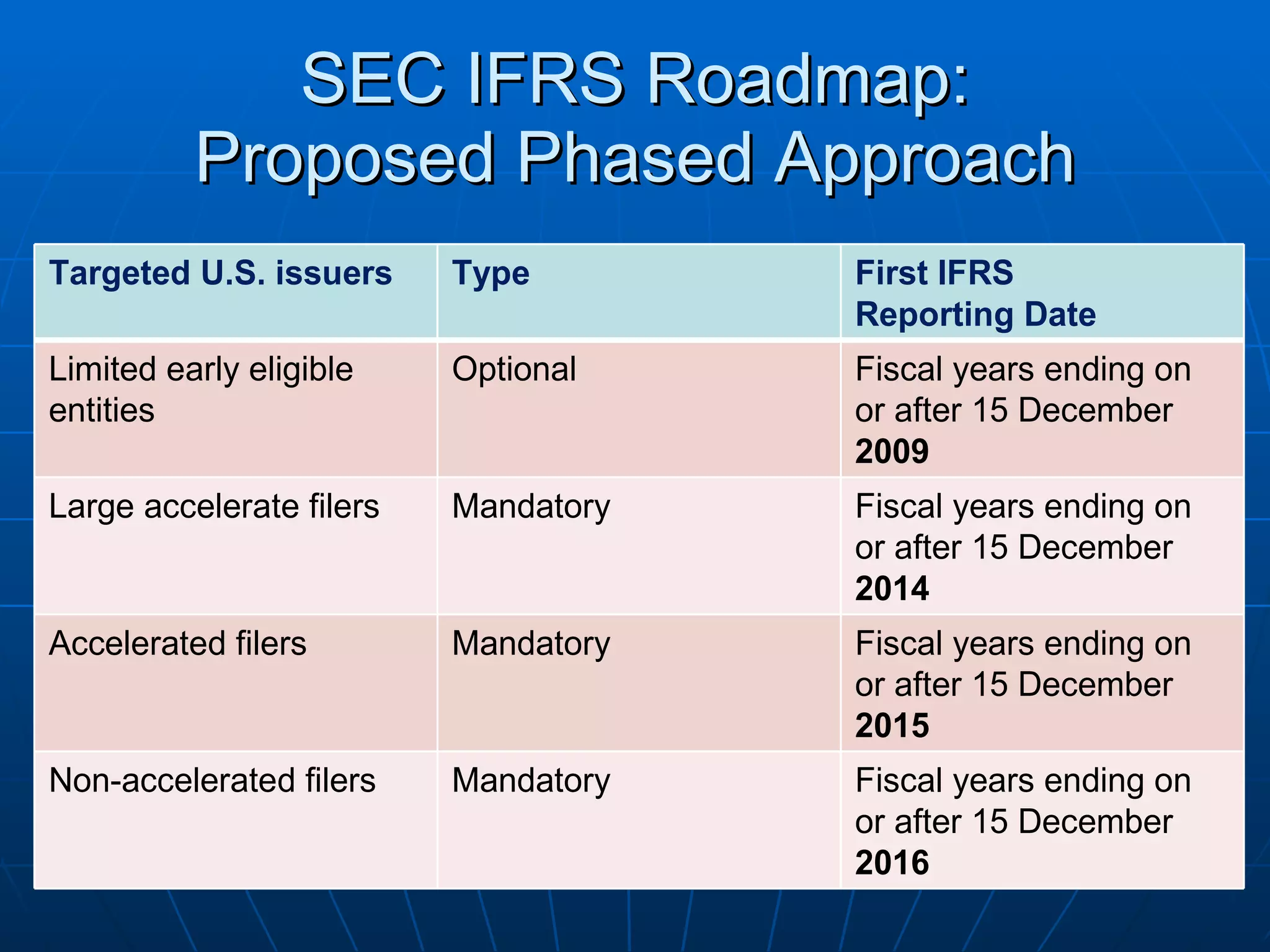

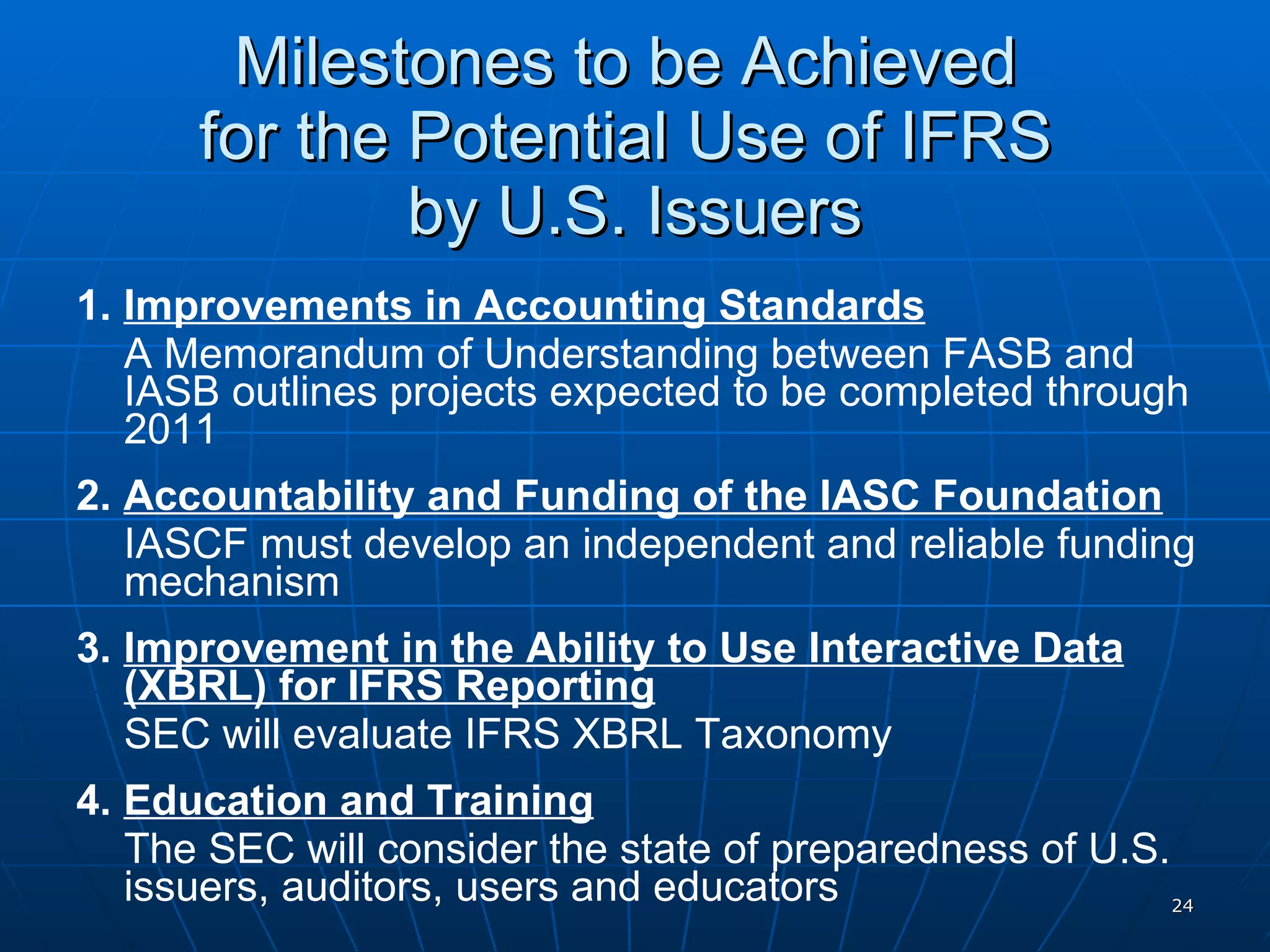

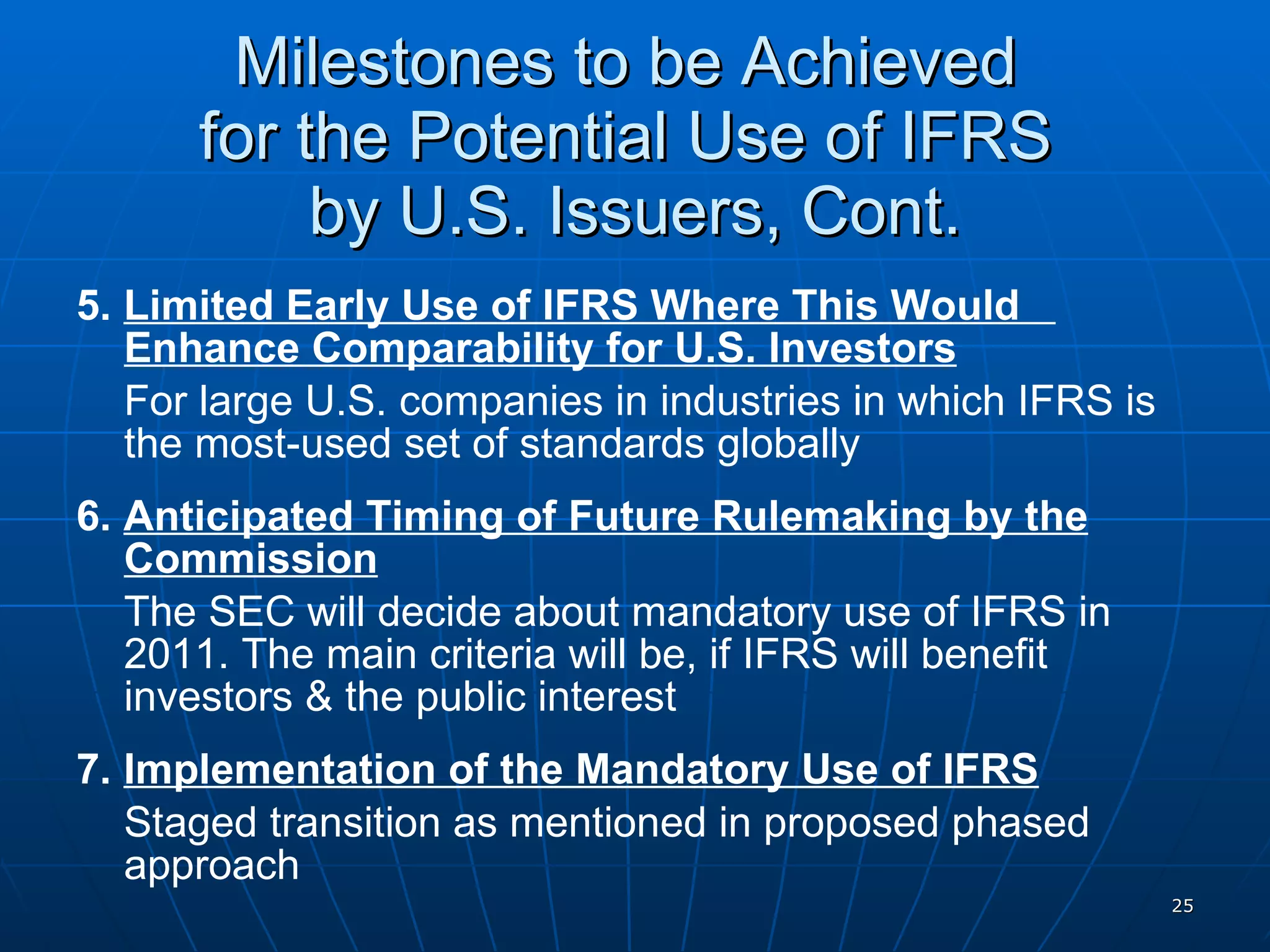

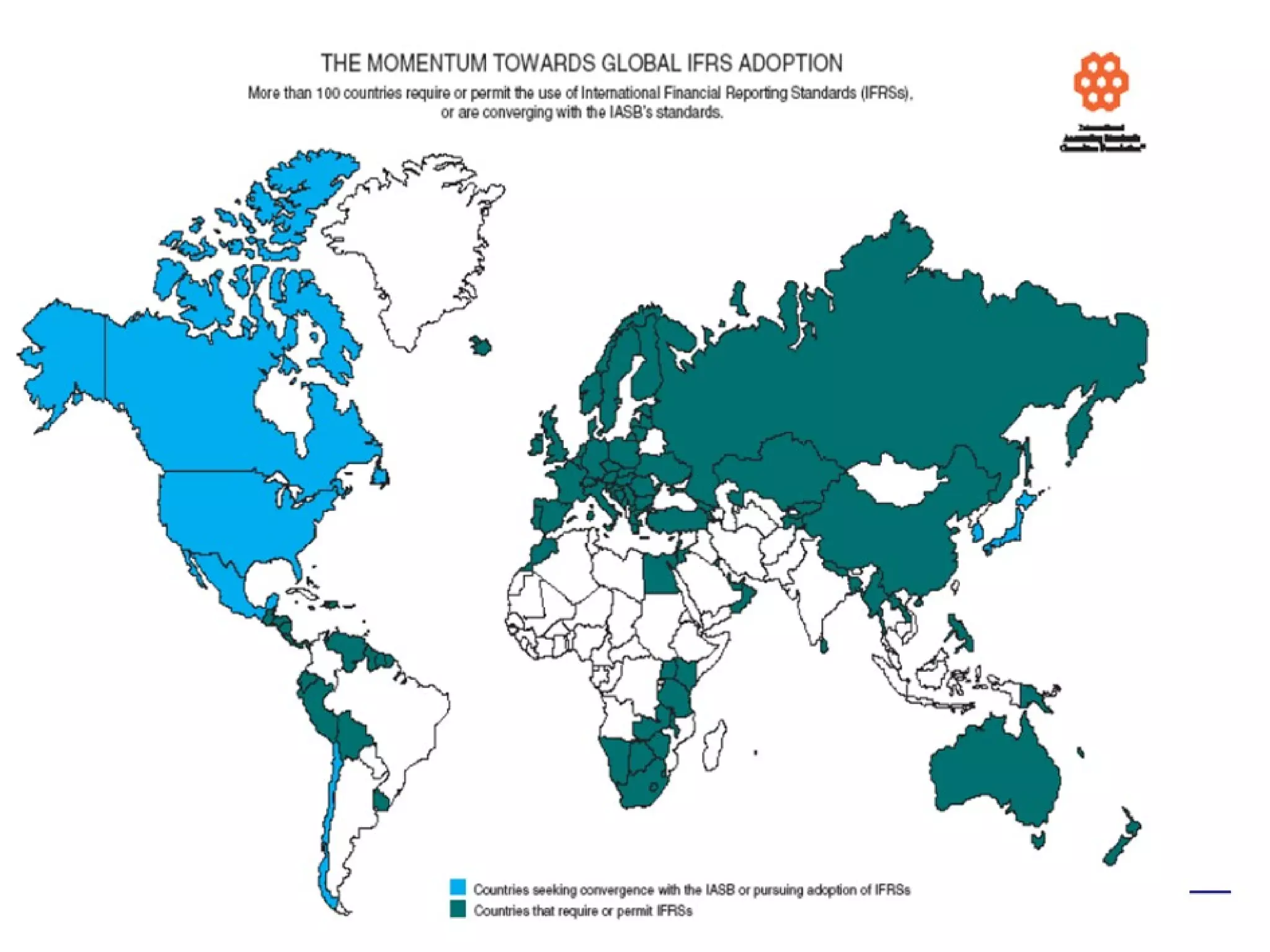

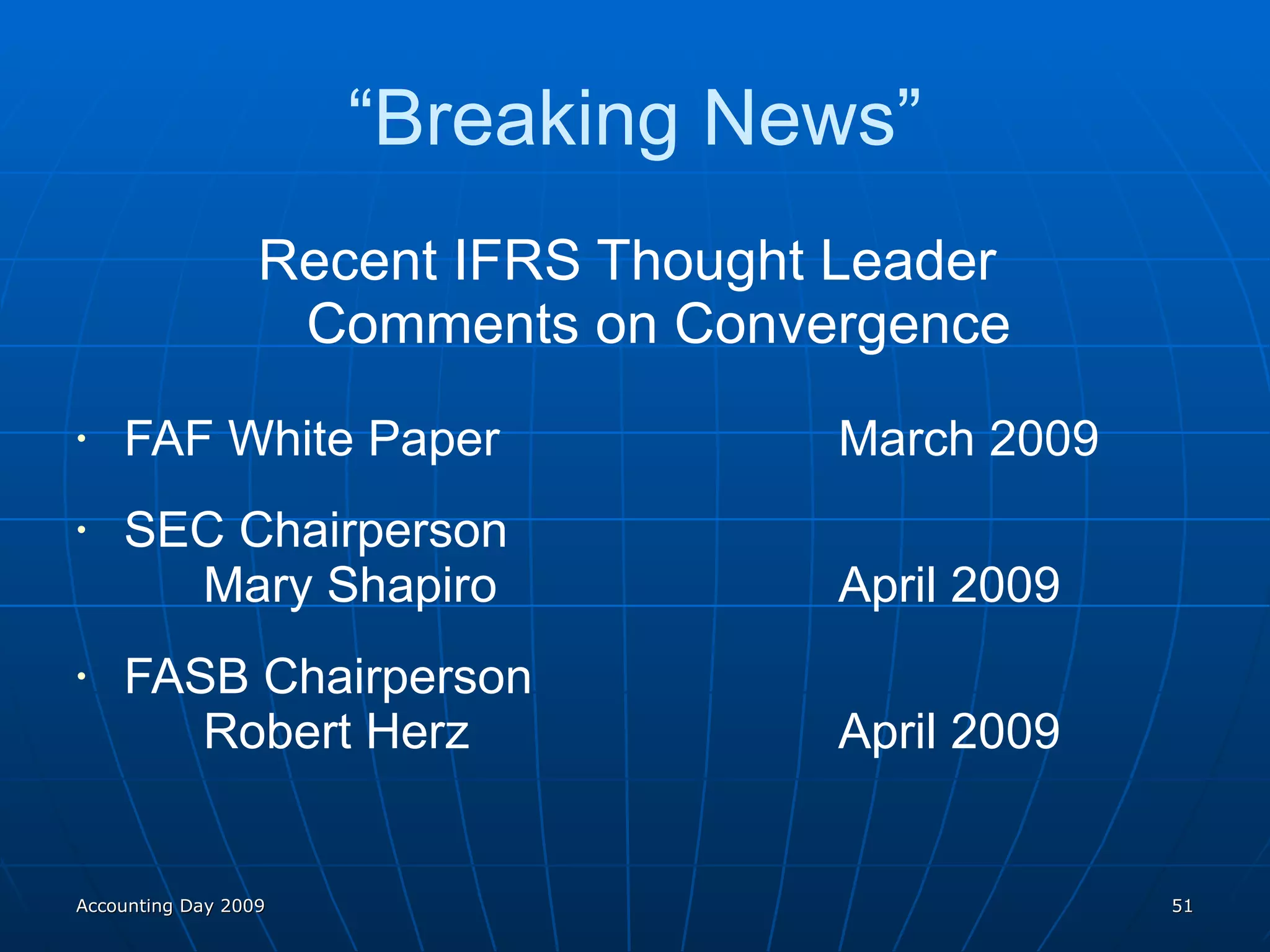

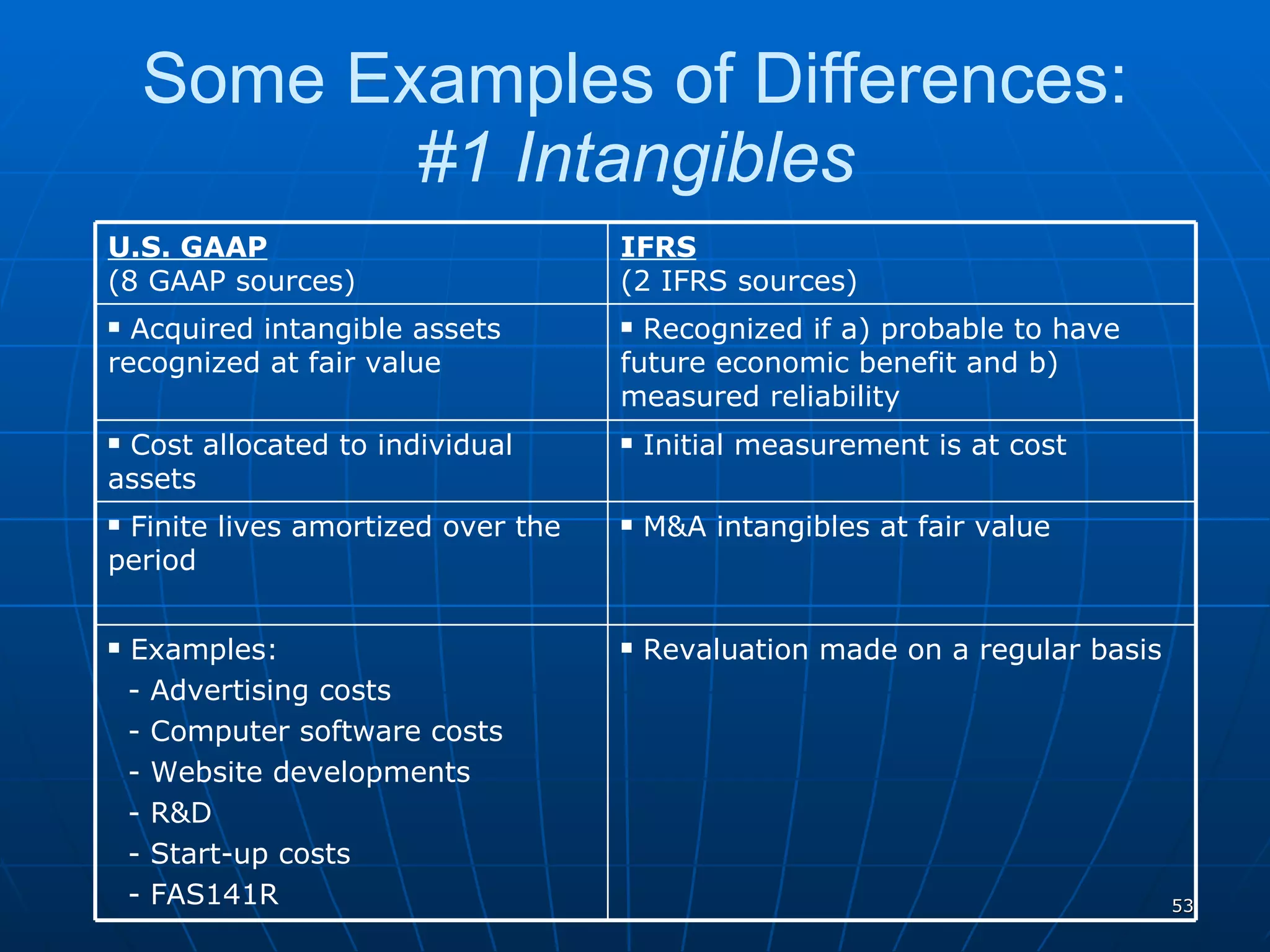

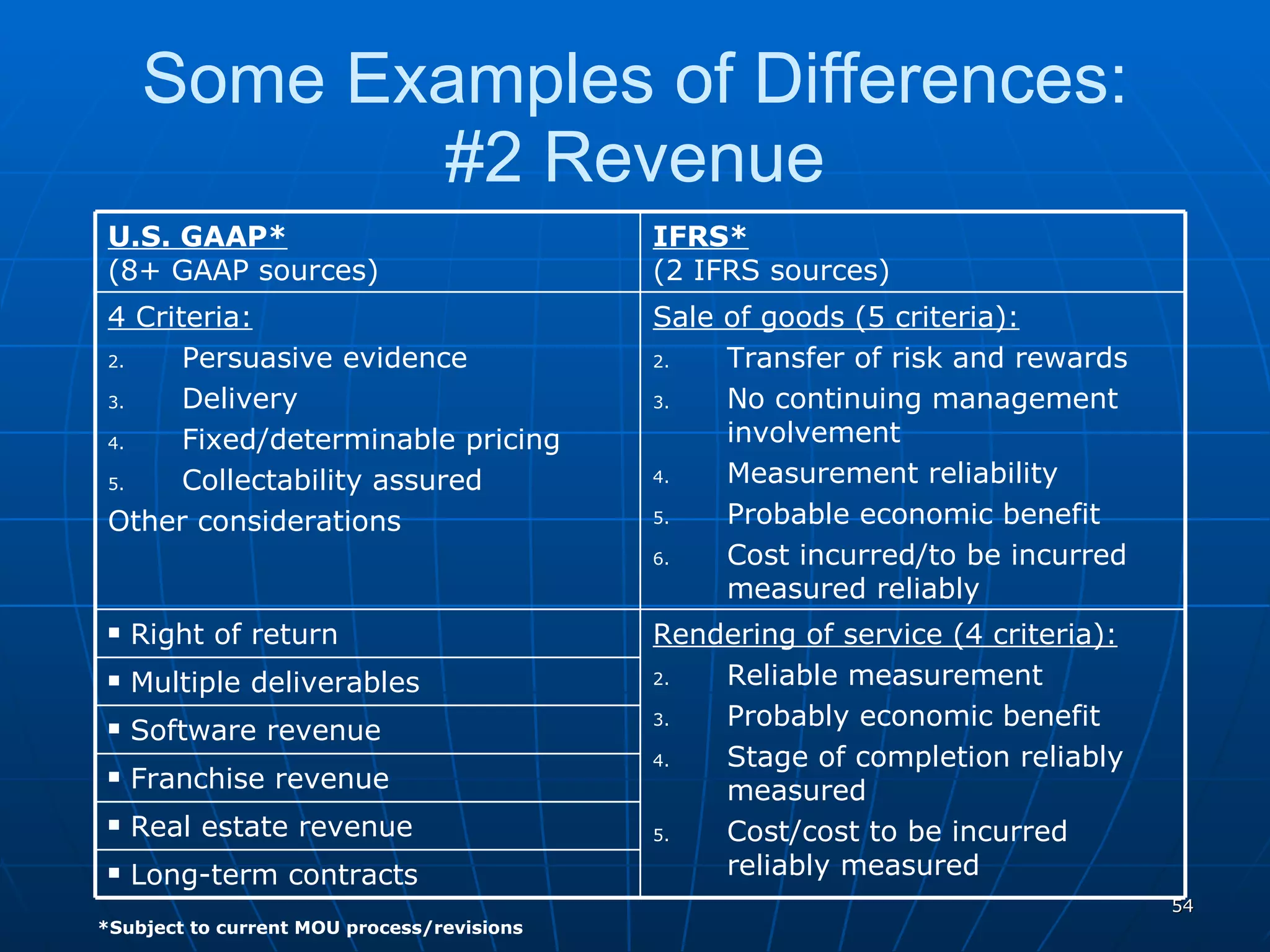

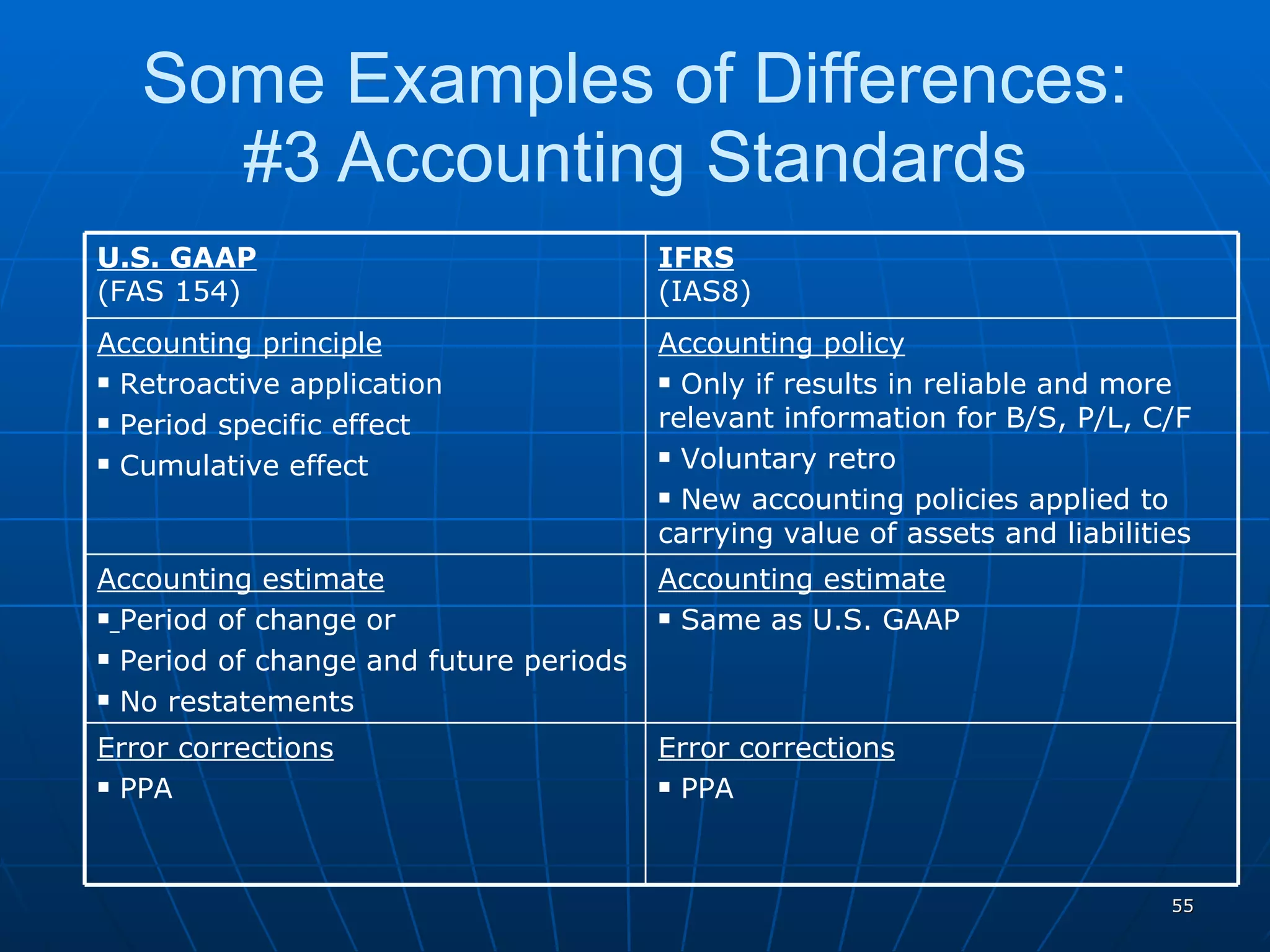

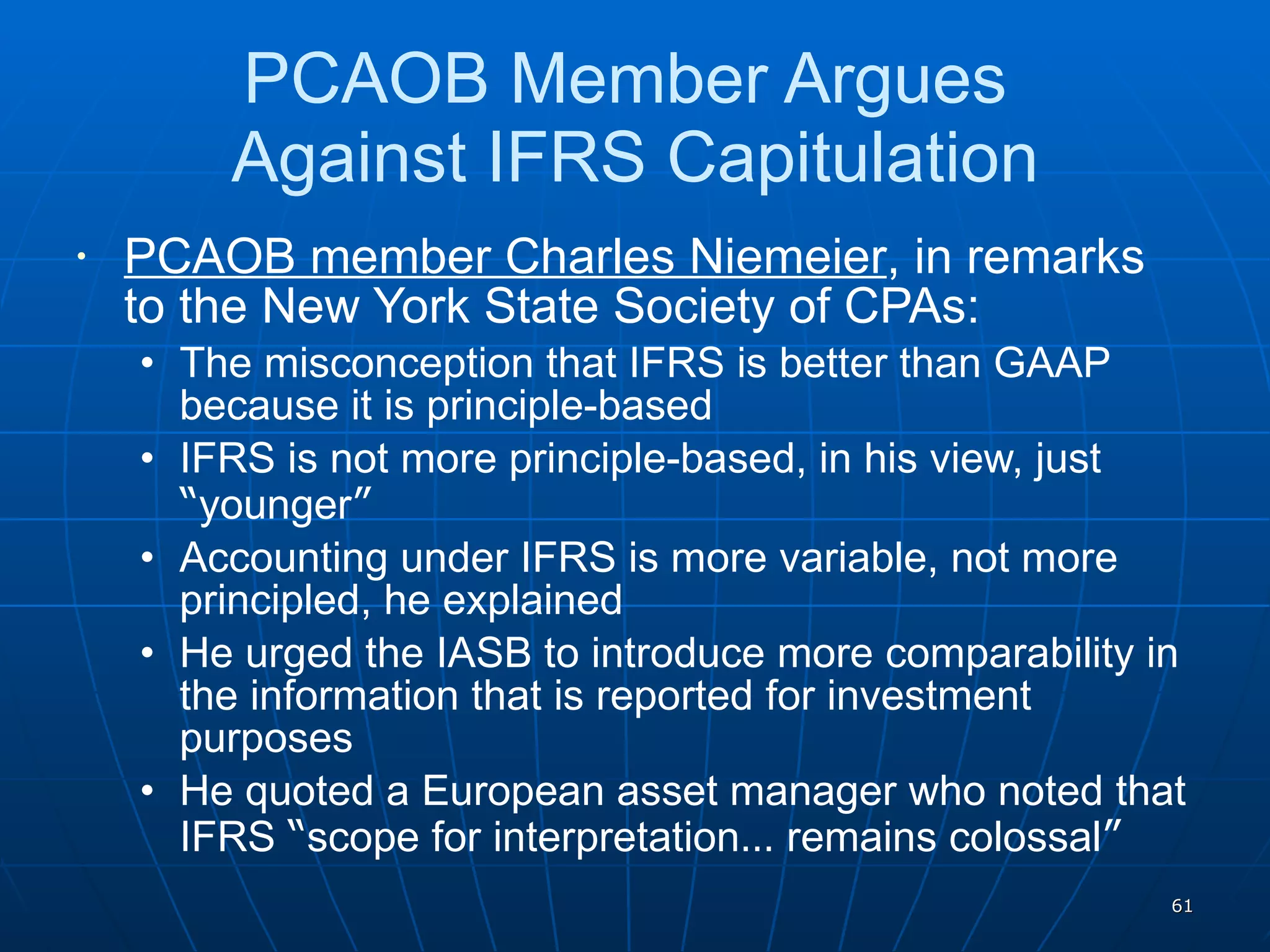

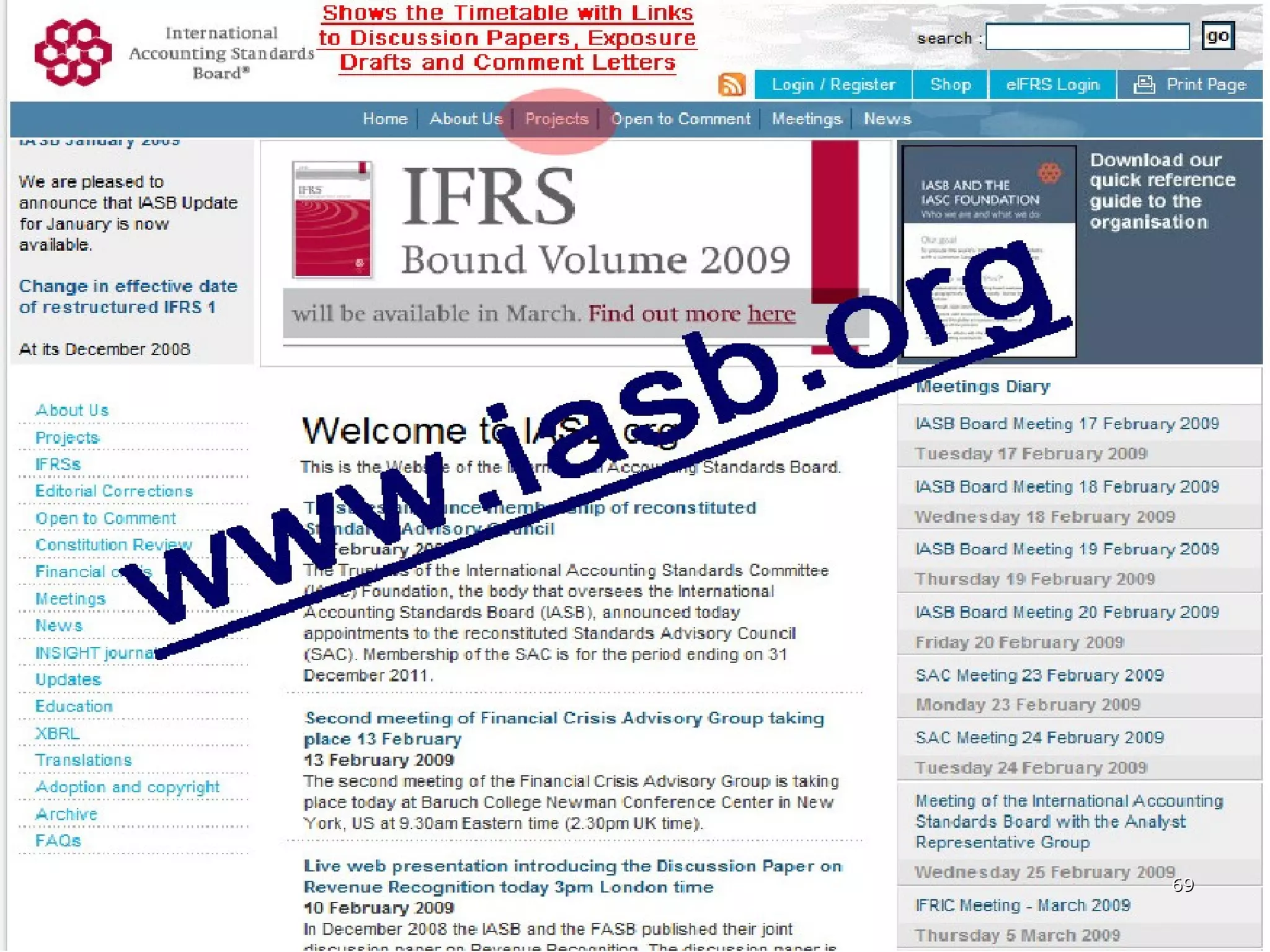

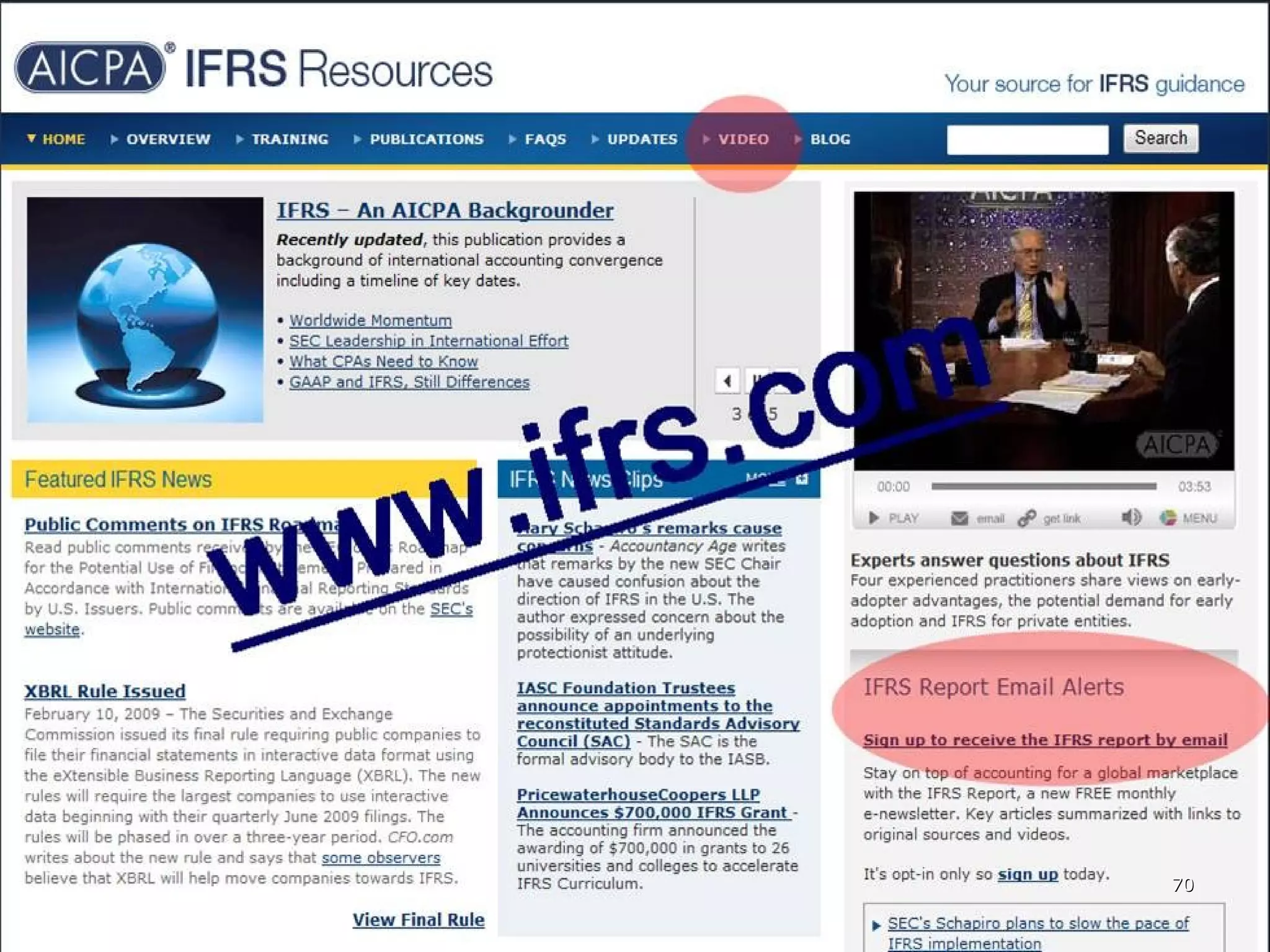

This document provides an overview and summary of a presentation on major differences between U.S. GAAP and IFRS and latest developments. The presentation covers: 1) Introduction to IFRS; 2) Current relevance of IFRS in the U.S.; 3) SEC roadmap to IFRS adoption and projected impact on the U.S.; 4) Major differences between U.S. GAAP and IFRS; and 5) Implications for businesses. Key points include that over 110 countries have adopted IFRS, the SEC is considering a phased mandatory adoption of IFRS for U.S. companies beginning in 2016, and full adoption of a single set of global standards could increase compar

![Thank You! Accounting Day 2009 Stephen G. Austin, CPA, MBA Firm managing Partner Swenson Advisors, LLP [email_address] Phone: 619-237-3400 Norbert Tschakert, Ph.D., CPA, MBA Charles W. Lamden School of Accountancy San Diego State University [email_address] Phone: 619-594-3736](https://image.slidesharecdn.com/majordifferencesbetweenusgaapandifrsupdated-1254168781696-phpapp01/75/Major-Differences-Between-US-Gaap-And-IFRS-76-2048.jpg)