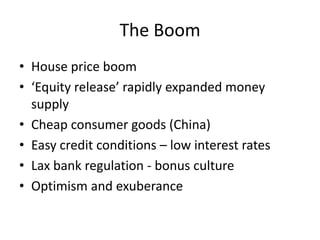

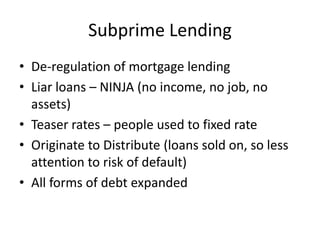

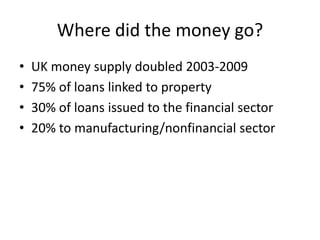

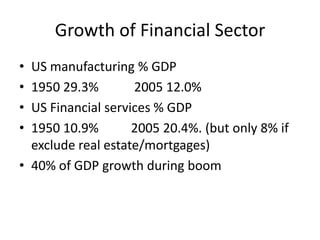

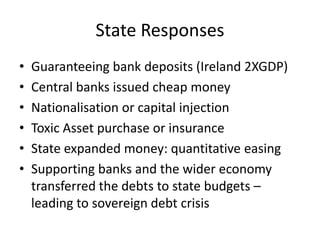

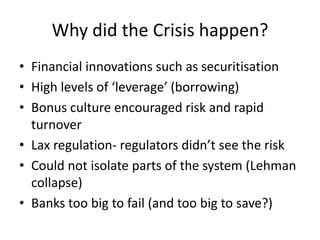

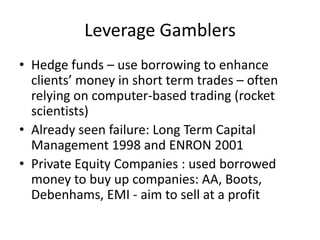

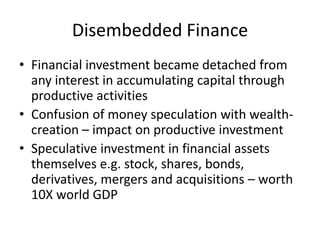

The document outlines the progression and impact of various financial crises from the mid-2000s, detailing the speculative boom that led to a series of economic downturns including the subprime mortgage crisis, sovereign debt issues, and responses from states to stabilize their economies. It highlights factors such as excessive leverage, lax regulation, and the financial sector's detachment from productive investment that exacerbated the crises. Additionally, it discusses the consequences of austerity measures and rising inequality as a result of these financial failures.