Rupee vs dollar

•Download as DOCX, PDF•

1 like•73 views

Weakening Rupee Impact in Indian Economy. Industries which get impact due to weak rupee or strong rupee. MBA , Placements, Academics Use ,

Report

Share

Report

Share

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Indiaenews Oct 24, 2008 Indian Equities Markets Suffer Worst Ever Losses

Indiaenews Oct 24, 2008 Indian Equities Markets Suffer Worst Ever Losses

Devaluation of indian currency and its implications

Devaluation of indian currency and its implications

Similar to Rupee vs dollar

Similar to Rupee vs dollar (20)

Study on money management by rbi for rupee depreciation against us...

Study on money management by rbi for rupee depreciation against us...

10 things to keep you up when the indian market is down

10 things to keep you up when the indian market is down

RBI has to climb highest mountain to control rupee devaluation (2)

RBI has to climb highest mountain to control rupee devaluation (2)

More from Krishna Khandelwal

More from Krishna Khandelwal (20)

Recently uploaded

Recently uploaded (20)

Canvas Business Model Infographics by Slidesgo.pptx

Canvas Business Model Infographics by Slidesgo.pptx

Fintech Belgium General Assembly and Anniversary Event 2024

Fintech Belgium General Assembly and Anniversary Event 2024

Abhay Bhutada: A Journey of Transformation and Leadership

Abhay Bhutada: A Journey of Transformation and Leadership

Maximize Your Business Potential with Falcon Invoice Discounting

Maximize Your Business Potential with Falcon Invoice Discounting

Abhay Bhutada’s Plan to Boost Financial Growth in 2024

Abhay Bhutada’s Plan to Boost Financial Growth in 2024

Rupee vs dollar

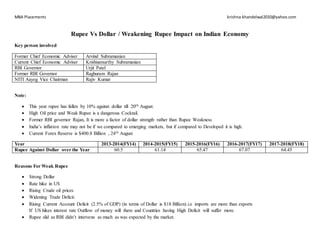

- 1. MBA Placements krishna.khandelwal2010@yahoo.com Rupee Vs Dollar / Weakening Rupee Impact on Indian Economy Key person involved Former Chief Economic Adviser Arvind Subramanian Current Chief Economic Adviser Krishnamurthy Subramanian RBI Governor Urjit Patel Former RBI Governor Raghuram Rajan NITI Aayog Vice Chairman Rajiv Kumar Note: This year rupee has fallen by 10% against dollar till 20th August. High Oil price and Weak Rupee is a dangerous Cocktail. Former RBI governor Rajan, It is more a factor of dollar strength rather than Rupee Weakness India’s inflation rate may not be if we compared to emerging markets, but if compared to Developed it is high. Current Forex Reserve is $400.8 Billion , 24th August Year 2013-2014(FY14) 2014-2015(FY15) 2015-2016(FY16) 2016-2017(FY17) 2017-2018(FY18) Rupee Against Dollar over the Year 60.5 61.14 65.47 67.07 64.45 Reasons For Weak Rupee Strong Dollar Rate hike in US Rising Crude oil prices Widening Trade Deficit. Rising Current Account Deficit (2.5% of GDP) (in terms of Dollar is $18 Billion).i.e imports are more than exports If US hikes interest rate Outflow of money will there and Countries having High Deficit will suffer more. Rupee slid as RBI didn’t intervene as much as was expected by the market.

- 2. MBA Placements krishna.khandelwal2010@yahoo.com Year 2013-2014(FY14) 2014-2015(FY15) 2015-2016(FY16) 2016-2017(FY17) 2017-2018(FY18) Current Account Deficit 1.7 1.3 1.1 0.6 1.9 Industry Involved(Weak Rupee) Oil Marketing Companies Capital Goods Technology Textile OMC like HPCL, Indian Oil, BPCL Importer will see shrinkage in margin Falling Rupee boosted the revenue Exporter of goods will earn more. Payments made in dollar India is 3 Largest importer of Oil Margins will be hit Fuel Price hikes Agriculture Pharmaceuticals Electronics Boost Agriculture exports Generic Medicine Exports getting Strong Electronics goods like mobile phone , battery charger, camera became expensive. Support to Falling Commodity Prices. Impacts Import Costlier But then also due to high consumer demand in festive season ,import will be high Indian Companies has to raise fund through ECB (External Commercial Borrowing) will be at risk Hedging Cost will go higher, Thus Reducing the benefit from borrowing from an overseas market Exporter will enjoy ECB has lower interest rate The Borrowing programme and the open market operations (RBI’s bond purchase) would affect foreign portfolio flows and could stabilize the rupee Domestic Inflation (Rise in fuel price) Finding other channels to borrow money Depreciating Rupee has led to rise in base metal prices Current Account will get hurt CAD is$15.8 billion or 2.4% of GDP Goods will be competitive in International Market Government bond yields rises Foreign investor sold in equity and debt market Private Equity investor could see their returns under pressure IRR is used by private equity firm

- 3. MBA Placements krishna.khandelwal2010@yahoo.com Solutions for Weak Rupee RBI intervene in Forex market for short term. Reducing dependence on import Attracting FDI through friendly policies India’s Internal dynamics are strong. GDP to grow at 8% FY19 India is having lowest (External Debt/GDP) ratio among Major Emerging Economies. Asia’s Biggest drop in reserve is in Indonesia , the Central Bank of Indonesia drained 10% from its foreign reserve to protect its currency. While India offload 2% , Philippine offload 5% In 2013 , RBI uses Hike in MSF rate , Cap on Liquidity window , Forex Swap window for oil companies, FCNR deposit swap facility Issuing of NRI- Bonds can stabilize rupee . This strategy is used by government in 1998,2000, and in 2013 RBI Comments For every 5% fall in rupee , retail inflation goes up by 20 basis point. RBI has spent $6.8 million dollar to intervene market. In Future possibility of rate hike will increase. Former RBI governor Rajan, It is more a factor of dollar strength rather than Rupee Weakness. RBI sold $25 billion forex reserves. RBI , have defended level of 69 rupee per dollar. India is not a currency manipulator (That’s why RBI is not intervene for Rupee Depreciation.) RBI buys gold for 1st time in nearly a decade. Signaling metal could be in demand RBI has sold $34billion in 5 months between April to August 2018.

- 4. MBA Placements krishna.khandelwal2010@yahoo.com Chief Economic Advisor Trade war has become Currency war. Gradual rupee depreciation not undesirable. NITI Aayog: Rising Trade deficit is bigger concern rather than Falling rupee. Let Rupee find its Fair Value The Government is focused on raising Exports both goods and services . Service Exports are beginning to see a newer momentum. Analyst Comments Turkey lira has limited impact on rupee. lira was down by 45% and rupee fall 2% It fell in sympathy. Rupee Slide is Self correcting mechanism.-Hitendra Dave HSBC INDIA Finance Minister Comments No Need for knee jerk reaction on depreciating rupee, reassures Jaitley. On 12th Sep , Modi call for high level meeting to recover market and for fighting depreciating rupee.

- 5. MBA Placements krishna.khandelwal2010@yahoo.com Key Notes: Regarding NRI Bonds While there aren’t any details available on how NRI bonds will be issued (if at all they are issued) – from previous times we know that the branches of Indian banks outside India will allow NRIs to deposit their dollars, which can then be transferred to the Indian branches thereby helping with the Rupee slide. For their trouble – NRIs will get a better interest rate than their domestic banks, and usually an ability to convert their Dollars into Rupees back home. There will likely be a lock in period of 3 – 5 years in the scheme, and history is any indicator it will very likely bring in good inflows from NRIs because the RBI was able to raise $30 billion from a similar NRI bond scheme in 2013.