Rane (Madras): Buy at CMP and add on dips to Rs274-Rs295

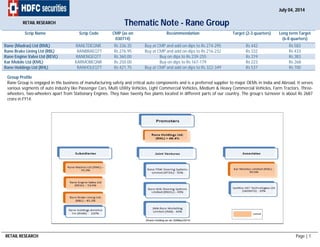

- 1. RETAIL RESEARCH Page | 1 Thematic Note - Rane Group4 Scrip Name Scrip Code CMP (as on 030714) Recommendation Target (2-3 quarters) Long term Target (6-8 quarters) Rane (Madras) Ltd (RML) RANLTDEQNR Rs 336.35 Buy at CMP and add on dips to Rs 274-295 Rs 442 Rs 583 Rane Brake Lining Ltd (RBL) RANBRAEQTT Rs 276.95 Buy at CMP and add on dips to Rs 216-232 Rs 332 Rs 433 Rane Engine Valve Ltd (REVL) RANENGEQTT Rs 360.00 Buy on dips to Rs 239-255 Rs 319 Rs.383 Kar Mobile Ltd (KML) KARMOBEQNR Rs 250.00 Buy on dips to Rs 167-179 Rs 223 Rs.268 Rane Holdings Ltd (RHL) RANHOLEQTT Rs 421.75 Buy at CMP and add on dips to Rs 322-349 Rs 537 Rs 700 Group Profile Rane Group is engaged in the business of manufacturing safety and critical auto components and is a preferred supplier to major OEMs in India and Abroad. It serves various segments of auto industry like Passenger Cars, Multi Utility Vehicles, Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, Farm Tractors, Three- wheelers, two-wheelers apart from Stationary Engines. They have twenty five plants located in different parts of our country. The group’s turnover is about Rs 2687 crore in FY14. RETAIL RESEARCH July 04, 2014

- 2. RETAIL RESEARCH Page | 2 Rane group recently organised an analyst meet and uploaded an investor/analyst presentation. This gave attractive projections about sales growth expected over FY14- FY17 and the ROCEs to be reached in each company by FY17. The group has in the past held such meets and uploaded presentations giving attractive projections. Some of these have not been met due to unexpected slowdown in the industry but the companies did perform better than peers in the past few years. While preparing our estimates, we have been guided by the projections to some extent but our estimates are conservative and are based on much lower sales growth/ROCE numbers. As Per June 2014 PPT RML RBL REVL KML RTSSL RNSSL Capex (Rs in Crore) 196 67 41 32 21.4 110 Future/expected CAGR in Sales (%) 23.8 22 20 25 4 21 Expected RoCE target of 2016-17 30% 25% 25% 25% 25% 30% (Source: Company) Investment Rationale Auto Industry: hiccups in near term, positive in future The Indian auto industry has been recording tremendous growth over the years and has emerged as a major contributor to India’s gross domestic product (GDP). The industry currently accounts for almost 7 per cent of our GDP and employs about 19 million people both directly and indirectly. The country is emerging as a sourcing hub for engine components. The Indian auto component sector covers a wide range of industries, including engine parts, drive transmission and steering parts, body and chassis, suspension and braking parts, equipment and electrical parts, besides others. But for a shorter term, the auto component sector will continue to face subdued demand. However, exports of auto components are expected to increase in FY15 given a pick‐up in demand in the overseas market. Also for a longer term period, domestic players in the automotive OEMs are adding capacities to meet future demand, driven by both buoyant domestic market and growing vehicle export market, particularly for small cars, two wheelers and light commercial vehicles. New Global players are also entering the market and setting up huge capacities which will increase the breadth of the domestic market and boost vehicle exports from India. According to the Automotive Component Manufacturers Association of India (ACMA) the Indian Auto Component Industry will grow from $43 bn to $112 bn by 2020 and out of this, exports will grow from $7 bn to $35 bn To better absorb cyclical shocks, Rane Group has been diversifying into related industries such as construction equipment (through Kar Mobile Ltd), leveraging their core strengths to cater to related industries with similar technology requirements. Awards Rane Group’s all seven auto component companies (Rane Holdings, Rane (Madras) Ltd (RML), Rane Brake Linings Ltd (RBL), Rane Engine Valve Ltd (REVL), Kar Mobile Ltd (KML), Rane TRW Steering System Ltd (RTSSL) and Rane NSK Steering System Ltd (RNSSL) are ISO/TS16949 certified (The ISO/TS16949 is an ISO technical specification aiming to the development of a quality management system that provides for continuous improvement, emphasizing defect prevention and the reduction of variation and waste in the supply chain). For Quality, 3 companies of the Rane group (RTSSL-Steering Gear Division (SGD), RML and RBL) have got Deming Grand prizes which only 27 companies have across the world, 24 companies from India and 4 out of the Rane group (RBL, REVL, RTSSL-SGD and RML) have. This shows us the emphasis of the management on quality and ensures its huge clientele base for reliable products.

- 3. RETAIL RESEARCH Page | 3 Overview of Management – Restructuring, Transparent, Focused and Prudent The Rane Group, in April 2004, had kick-started one of the most complicated restructuring programmes in Corporate India, to ease the complex cross-holdings within the group, involving a de-merger and open offers, aimed at increasing shareholder value. The then Rs 800 crore Chennai-based group, which had a bouquet of listed and unlisted companies engaged in the auto component sector, had taken up Phase-I of the restructuring plan, which involved streamlining of the promoters' and inter-corporate cross holdings in group companies. Though all the Companies are in the auto component industry, there are fine distinctions amongst them in terms of manufacturing processes, market profiles and technical collaborations resulting in the need to maintain distinct identities In this background, the first phase of consolidation was undertaken in April 2004. Through a process of de-merger of the then composite RML, RHL became the holding Company for the Group. This removed cross holdings in RML. The Promoters moved all their holdings in other Companies except in RML, to RHL. The next step in March 2007 entailed transfer of the Promoters Holding in RML to RHL, thereby making it a subsidiary. The concluding phase (around Feb-March 2008) aimed at elimination of residual cross holdings and consolidation of group Company investments held by RBL and REVL into RHL. The scheme envisaged de-merger of the manufacturing undertakings of RBL and REVL into two new manufacturing Companies which were to be listed and merger of the residual non-manufacturing businesses (mainly investments) of RBL and REVL into RHL. Under the restructuring scheme, shareholders of REVL were allotted one equity share in the new Rane Engine Valve and 0.56 shares in RHL for every one share held in REVL while the shareholders of RBL were allotted one equity share in the new Rane Brake Lining and 0.75 shares in RHL for every one share held in RBL The benefits arising out of this scheme were: Removal of cross holding, which would enhance value of all the listed Companies shares. The then shareholders of REVL and RBL in addition to getting equal number of shares in the new manufacturing company, also get proportionate number of shares in RHL. A shareholder in RHL gets a diversified portfolio reflecting full value of the group. During FY14 and for FY15, Rane group is again going for some consolidation amongst its companies. In FY14, Rane Diecast Ltd (RDL) which was engaged in the manufacture of precision high pressure aluminum die casting products for the automobile industry was merged with RML. In FY15, Rane Group is merging Kar Mobile Ltd with REVL as they offer complementary products. The Group has recently roped in McKinsey & Co for preparing the Vision 2020 plan. The three-month-long exercise by the consulting major is expected to result in a fresh plan that could provide long-term direction for the group. However, it is expected to take a call on embarking on any new investment or expansion programme only around September under its mid-term business review plans. So we feel that the Group as a whole is focused, transparent, quality conscious and investor friendly by not only unlocking value for shareholders by restructuring exercise, but also maintaining consistent dividend payout ratio and concentrating on the RoCEs in all its businesses.

- 4. RETAIL RESEARCH Page | 4 The Rane group is a transparent (detailed annual report and presentations at analyst meets) and focused group which has its sole interest in Auto Ancillaries industry and has not ventured into any other sector/industry. Also, it is a very prudent group which works as per the ground reality of the Auto industry and spends money wisely, for instance, it did slowdown on its capex plans for few companies on the basis of the slowdown in the Auto industry and the current capex is a maintenance capex and few expansion plans, as per its customers future plans. However now the management is reasonably confident of the next 2-3 years and has laid down the biggest capex spending plan in its history. The group has also implemented various cost control methods by value engineering initiatives, alternate sourcing of raw materials and localization, productivity improvement initiatives like Lean production systems and by training manpower to do multi-tasking activities thus rationalizing its manpower cost. Surplus Land available for monetization and improving the balance sheet Rane Group companies do have surplus land in their kitty, which when sold off, would result in a significant amount of cash which can either be used to pay off the debts or for further expansion plans. Three of its companies, RML, KML and REVL have unused land at different locations, mostly in South. Current capacities can cater to future demand The group has been spending a sufficient amount of its capex to expand the capacities across some of the 25 manufacturing plants present across India. The management is of the view that though FY15 might not see a great reversal in the Auto industry and thus in their products demand, FY16 and FY17 will certainly be years of growth. The companies have made themselves ready to meet any sudden spike in demand of its products which ensures us that they will not lose out on meeting customers’ orders. Due to the sluggish demand in the auto industry in FY13 and FY14, the sales growth in the group was affected. Even then it kept increasing capacities wherever essential resulting into a situation where the growth in the sales was less than the growth in the net block. Particulars FY10 FY11 FY12 FY13 FY14 Net Block 475 558 688.8 790.6 853.8 Net Block % Growth 17.5% 23.4% 14.8% 8.0% Revenue 1590.7 2090.8 2506.9 2709.3 2687.2 Revenue % Growth 31.4% 19.9% 8.1% -0.8% (Source: Company, HDFCSec Research) Now if there is a sustained revival in the fortunes of the auto industry, the situation could well reverse (especially in FY15 and early part of FY16) and the sales growth could be faster than that of the net block. Conservative accounting practice Two of the group companies has initiated a VRS scheme in FY14 and spent a sum of Rs. 9.4 cr (RML) and Rs. 40.8 cr (REVL). The entire spend was written off in the same year.

- 5. RETAIL RESEARCH Page | 5 R&D and Technology Rane Group partners with a wide spectrum of auto majors to provide concept to product solutions. This is made possible by well integrated design, manufacturing & testing facilities at each of the group companies. Being manufacturers of safety and critical components, technology development has been a focus area in all the Rane Group companies. Rigorous testing, continuous upgradation of in-house technology and support from strategic development partners has enabled Rane to enhance technical competencies at all levels. The Group leverages the technology portfolio of 3 major partners – TRW, NSK and Nisshinbo. With a vision to become technologically self sufficient, Rane Group is steadily increasing their R&D Investments – from 0.8% of sales in FY13 to 1.3 % in FY14. Some of the technologies developed in recent past are Hydrostatic Steering Unit, New generation pumps‐drooping flow, Seat belts‐Pre‐tensioner & Child restraint, Tilt & Telescopic column with integrated collapse, NVH reduction and lower telescopic load and Electric Power Steering. End of Periodic Call Auction period As per SEBI guidelines, few of the illiquid stocks in exchanges, according to certain pre-determined criteria, were shifted into the Periodic call auction category with effect from April 2013. So, according to the rules set by SEBI, RBL, REVL and KML were introduced in the Periodic call auction category from 1st April 2013 and RML was shifted into this category with effect from 8th July 2013. In this category, the transactions of buying and selling happen in an interval of one hour during the trading session where the price of transaction is decided by the buyers and sellers. This led to a dip in volume and also to a crash in the stock prices due to lack of buying interest. During this period, the stock prices of these companies hit a low of Rs 106 for RML, Rs 87.35 for RBL, Rs 85.50 for REVL and Rs 71.05 for KML. However, with effect from 13th January 2014, all of the above mentioned stocks are out of this category and are now available for trading on a continuous basis on the stock exchanges. This would help the stock prices of these companies to reflect their fair value. Risks/Concerns Slowdown in the Automobile Industry due to macroeconomic situations like slow growth, inflation, rise in interest rate, increase in diesel/petrol prices, etc will hamper the prospects of Rane Group as all the companies provide products which are used in automobiles across segments. Any fluctuation in the raw material prices and power shortages in the manufacturing plants (as majority of plants are located in South which does face power cuts) could not only hamper the revenue generation of the group companies, but also would result in a rise in the cost of production (as the inputs have to be purchased at higher price and to cover up power shortage, power from DG Sets/third party would be required to be taken), thus affecting profitability and margins. Rane group derives 17% of its aggregate revenue from exports (as per FY14). This leads to foreign exchange currency risks for the companies. However the companies do have a natural hedge from imports and they do take forward contracts to hedge their positions, but still the risk pertains. As mentioned earlier, majority of the 25 manufacturing units of the group are located in the south of India in Chennai, Andhra Pradesh and Karnataka. Thus the group faces geographical concentration risks. Any regulations introduced by the State Governments which can affect the manufacturing units in their respective states, would be negative for Rane Group. Also the surplus land parcels the group has are located in these states only. So any interference from the Government with respect to its sale, would delay its land monetization process.

- 6. RETAIL RESEARCH Page | 6 Scrip Name Scrip Code CMP Recommendation Target (2-3 quarters) Long term Target (6-8 quarters) Rane (Madras) Ltd (RML) RANLTDEQNR 336.35 Buy at CMP and add on dips to Rs 274-295 Rs 442 Rs 583 Company Profile • The Company is a manufacturer of Steering & Suspension Linkage Products and Steering Gear Products to passenger cars, commercial vehicles and farm tractors. • Rane Diecast Limited (RDL), one of the Rane Group Companies, engaged in the manufacture of precision high pressure aluminum die casting products for the automobile industry was merged with RML during FY14. Production Plants Location Products Customer Segments Velachery (Chennai) SSLP, SGP Light commercial vehicle, heavy commercial vehicle and utility vehicle segments Varanavasi (Chennai) SSLP Passenger Car, utility vehicle mainly caters to exports market Mysore SSLP, SGP & Hydraulic Products Tractor, commercial vehicle segments, and hydraulic products Puducherry SSLP, SGP Passenger car segment Uttarakhand SSLP, SGP Tractors and small commercial vehicles catering to customers in North India Hyderabad Diecasting Products Passenger car segment, Medium and heavy commercial vehicle mainly caters to exports market (Source: Company) Sales Breakup by Market Markets FY12 FY13 FY14 % to Sales Actual Sales (Rs in Cr) % to Sales Actual Sales (Rs in Cr) % to Sales Actual Sales (Rs in Cr) OEM 65% 427.2 63% 393.3 54% 383.3 OES 7% 46.0 7% 43.7 8% 56.8 After Market 16% 105.2 15% 93.6 15% 106.5 Exports 12% 78.9 15% 93.6 23% 163.3 Total Sales 100% 657.2 100% 624.3 100% 709.8 (Source: Company, HDFCSec Research) Price Chart A A N M07 J S J08 A A N M09 J O J10 A A N M11 J O J12 M A N M13 J O J14 M 400 380 360 340 320 300 280 260 240 220 200 180 160 140 120 100 80 60 40 20 -20 D D D D D D D D D D D D 1-532661.RANE MADRAS.BSE - 02/07/14 Trend7 Weekly Stock Details BSE Code 532661 NSE Code RML Bloomberg RML:IN Price (Rs) as on 3 July, 2014 336.35 Equity Capital (Rs Cr) 10.51 Face Value (Rs) 10 Eq. Shares O/s (Cr) 1.05 Market Cap (Rs.) 353.18 Book Value (Rs) 133.41 Avg. Volume (52 Week) 3219 52 wk H/L (Rs) 350.35/105.50 Shareholding Pattern (As on Mar 31, 2014) Promoters 57.78 Institutions - Non Institutions 42.22 Total 100

- 7. RETAIL RESEARCH Page | 7 Triggers • RML holds 39% market share in Steering Gear Products (SGP), 72% market share (except Passenger Cars segment) in Suspension & Steering Linkage Products (SSLP) in India. • RML has in FY12 ventured into hydraulic products. A hydraulic machine derives its power from the motion or pressure of water or some other liquid. The popularity of hydraulic machinery is due to the very large amount of power that can be transferred through small tubes and flexible hoses, and the high power density and wide array of actuators that can make use of this power. • Cost control and productivity improvement initiatives were taken in FY14 which resulted in the operating profit to rise by 21% to Rs 68.3 crore. This trend could continue going ahead. Also as per management, modernization and higher capacity utilization (currently around 70%) will lead to around 100 bps improvement in margins for Rane Madras. The bottomline in FY15 would also be benefited from the tax impact of accumulated loss of Rane Diecast which was merged in FY14 with RML. • The management expects sales to grow by about 22% CAGR in next couple of years through new customers, new products (generated about 18% of total revenue in FY14), growth from existing customers and exports. • Management has highlighted that going forward, more automation will be introduced and a sizable capex of about Rs 196 crore is planned for next 3 years. About 30% of capex will be towards steering business while rest will be on die-casting business which would add to the growth of RML’s business. Diecasting business has a lot of scope and with Rane Diecast (who was facing liquidity issues in the past and hence was constrained from growing) being merged in RML and the business having access to RML’s liquidity; one could see sharper growth in the diecasting business over the next few years. • RML proposes to move its Velachery, Chennai factory to Varanavasi (outskirts of Chennai) and sell the land of about 4.41 acres (1, 92,000 sq ft) in Velachery - the proceeds of which will improve the credit profile in the medium-term. Concerns • Any fluctuations in raw material prices and shortage of power in any of its plants would hamper its operations and in turn its margins. Also, pricing pressure from OEMs would have a negative impact on its margins. • As the company is engaged into exports also (23% of sales in FY14), foreign currency fluctuation risk exists, but the company is engaged into hedging. • The company has planned a capex of Rs 196 crore for next 18-24 months which would increase its debt (which is already high due to the merger of Rane Diecast wit itself), thus impacting its balance sheet. • A cyclical downturn in the automobile industry would hamper its revenue growth and margins. Financials Particulars (Rs in Cr) FY12 FY13 FY14 FY15E FY16E FY17E CAGR FY14-FY17E Net Sales 657.2 624.3 709.8 787.9 937.6 1143.8 17.2% Operating Profit 60.6 56.4 68.3 86.2 105.3 123.2 21.7% OPM (%) 9.2 9.0 9.6 10.9 11.2 10.8 EBIT 49.1 41.1 44.1 55.2 68.5 80.8 22.4%

- 8. RETAIL RESEARCH Page | 8 EBIT Margin (%) 7.5 6.6 6.2 7.0 7.3 7.1 Adjusted Profit After Tax 27.6 23.4 26.2 29.5 35.9 44.8 19.6% Reported Profit After Tax 27.4 23.4 16.8 29.5 35.9 44.8 38.7% PATM (%) 4.2 3.7 2.4 3.7 3.8 3.9 EPS (Rs.) 27.0 23.0 15.5 27.5 33.7 42.2 RoCE (%) 22.6 18.2 15.5 17.9 19.3 20.4 (Source: Company, HDFCSec Research) Balance Sheet (Rs in Cr) FY12 FY13 FY14 FY15E FY16E FY17E Shareholders’ Funds 115.1 130.1 148.5 164.0 185.8 215.8 Share Capital 10.2 10.2 18.7 18.7 18.7 18.7 Reserves & Surplus 104.9 119.9 129.7 145.3 167.1 197.1 Noncurrent liabilities 50.2 40.8 49.9 54.9 61.3 69.1 Long Term borrowings 39.9 29.6 43.9 47.0 51.7 57.9 Deferred Tax Liabilities (Net) 5.4 6.7 0.8 2.0 2.5 3.0 Other Long Term Liabilities 0.6 0.3 0.1 0.5 1.0 1.2 Long Term Provisions 4.3 4.2 5.0 5.4 6.0 6.9 Current liabilities 175.8 190.2 256.3 299.4 345.1 384.3 Short Term Borrowings 57.1 59.9 91.7 116.2 136.2 141.2 Trade Payables 84.2 99.7 110.7 124.0 142.6 166.8 Other Current Liabilities 27.3 22.3 43.9 48.3 54.1 62.2 Short Term Provisions 7.2 8.3 10.0 11.0 12.3 14.2 Total Equity & Liabilities 341.0 361.1 454.6 518.3 592.2 669.2 Assets Non-Current Assets 165.5 179.1 245.1 283.6 317.5 347.9 Fixed Assets 152.5 164.8 223.7 260.0 291.1 317.6 Gross Block 259.3 291.2 373.0 438.3 503.7 569.0 Less: Depreciation 119.1 132.2 157.3 187.1 222.4 262.8 Net Block 140.2 159.1 215.7 251.2 281.3 306.2 Capital WIP 12.2 5.8 8.0 8.8 9.9 11.3 Long -term Loans and Advances 13.1 14.3 21.4 23.5 26.4 30.3 Current Assets 175.5 182.0 209.5 234.8 274.7 321.4 Inventories 53.9 65.4 79.9 89.5 102.9 120.4

- 9. RETAIL RESEARCH Page | 9 Trade Receivables 110.4 92.0 102.3 114.6 134.1 160.9 Cash & Cash Equivalents 1.6 10.4 3.1 5.2 10.4 9.6 Short Term Loans & Advances 9.3 12.2 19.1 20.1 21.5 24.1 Other Current Assets 0.3 2.1 5.1 5.4 5.8 6.5 Total Assets 341.0 361.1 454.6 518.3 592.2 669.2 (Source: Company, HDFCSec Research) Conclusion We feel that the Automobile and auto ancillaries space is on the verge of exciting times. We think the Rane group and within it RML is well placed to capitalize on these opportunities. We feel that investors could look at buying RML at the CMP (Rs 336.35) and add on dips in Rs 274-295 (6.5-7x FY17E EPS) band for a target of Rs 442 (10x FY17E EPS) over 2-3 quarters. Investors willing to hold for longer term (i.e. 6-8 quarters) can hold the stock for a larger target of Rs 583 provided there are no hiccups in the sector story and the company performs in line or better than our estimates as in such a case while EPS could be better , the stock could also get rerated.

- 10. RETAIL RESEARCH Page | 27 RML Products RBL Products

- 11. RETAIL RESEARCH Page | 28 REVL Products KML Products – Valves Analyst: Zececa Mehta; Email ID: zececa.mehta@hdfcsec.com RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com Disclaimer: This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients