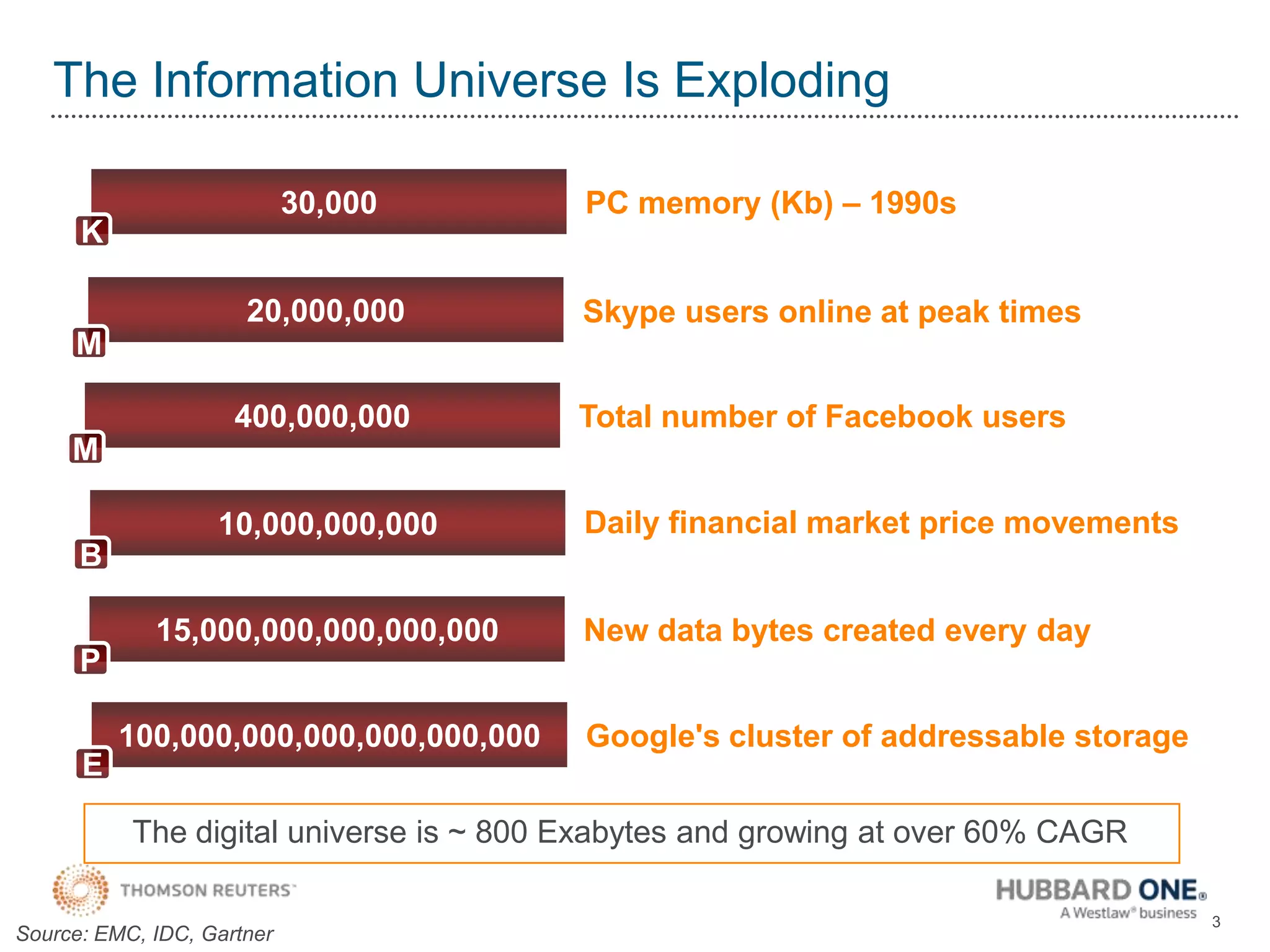

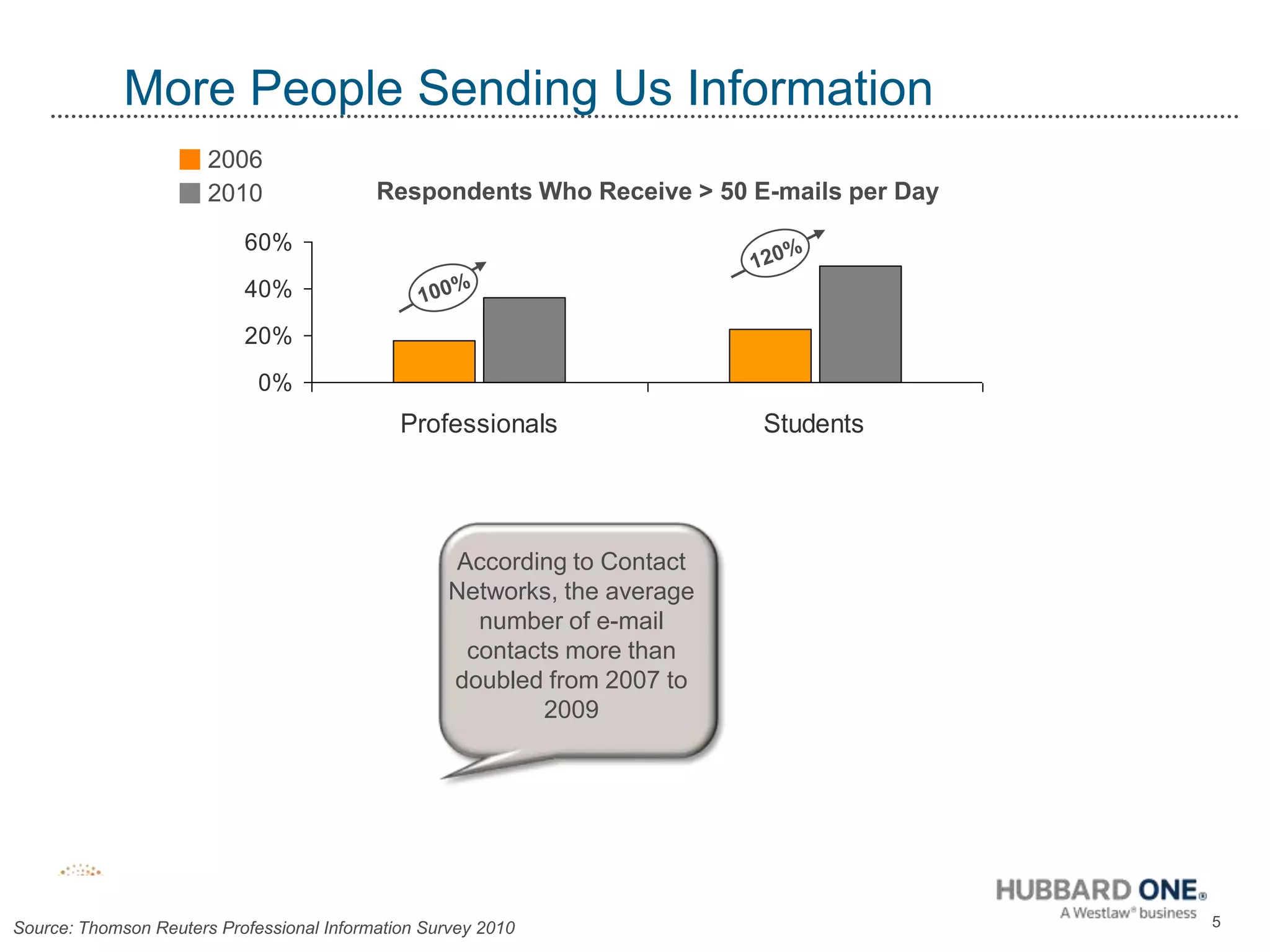

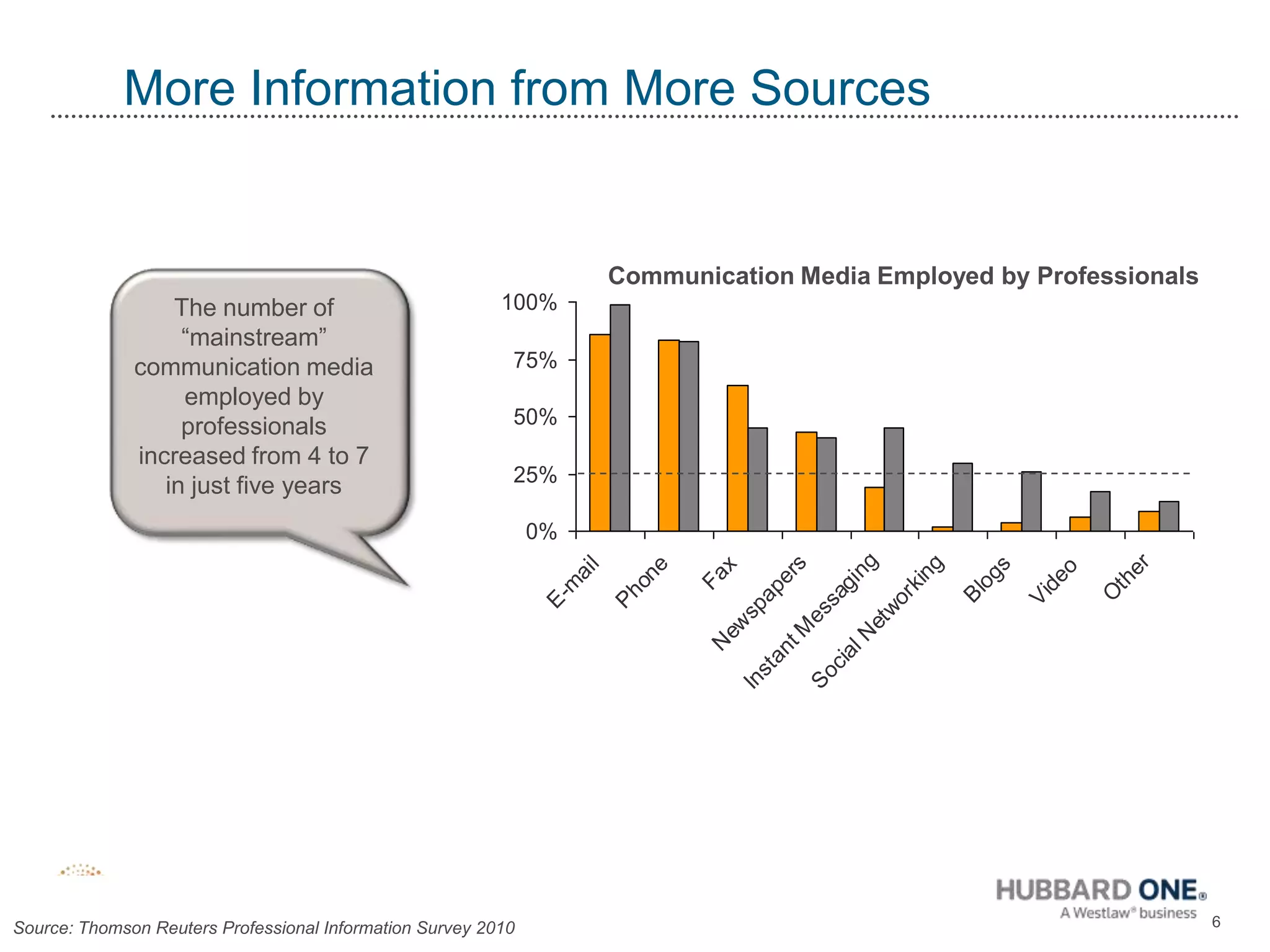

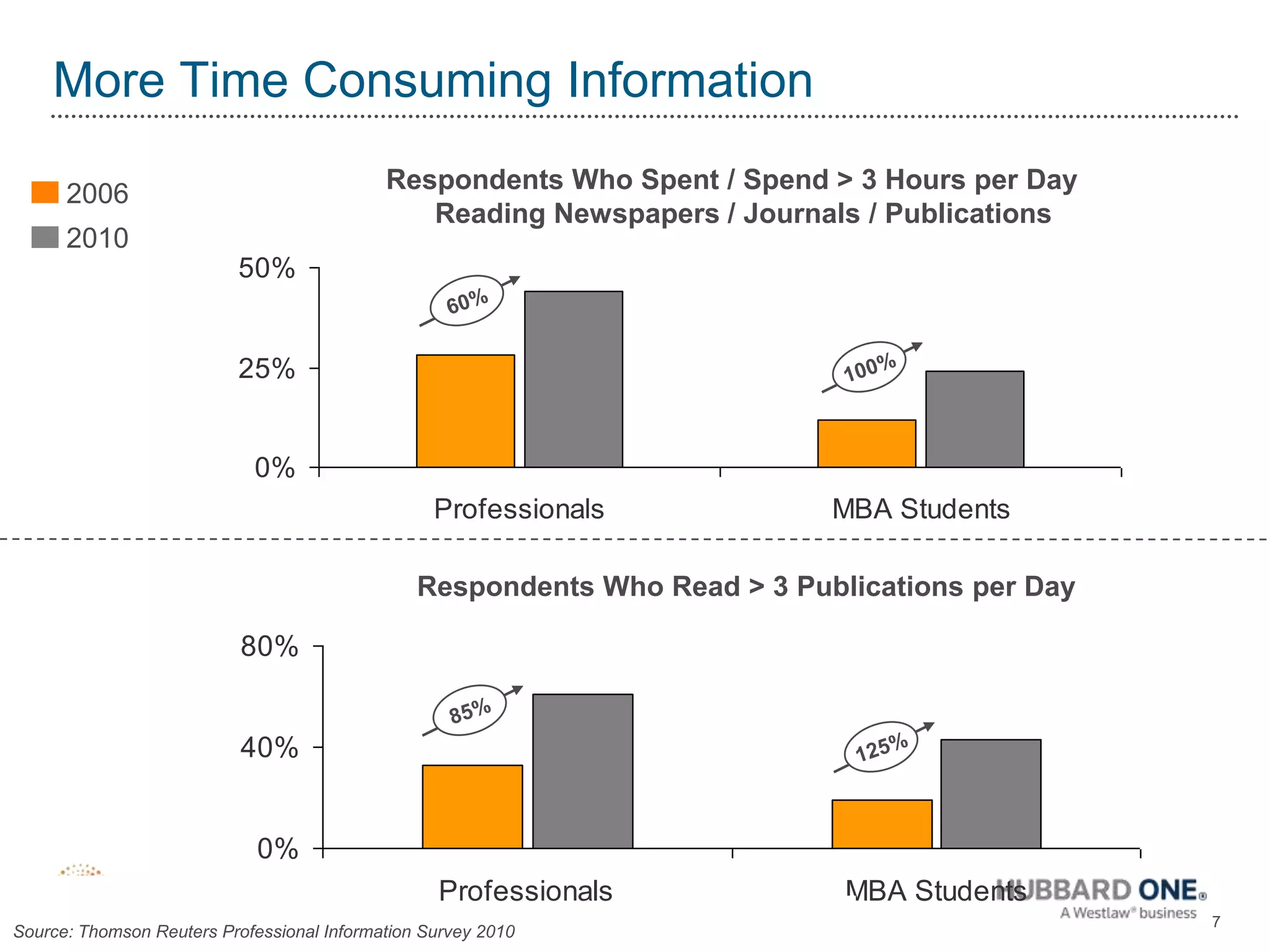

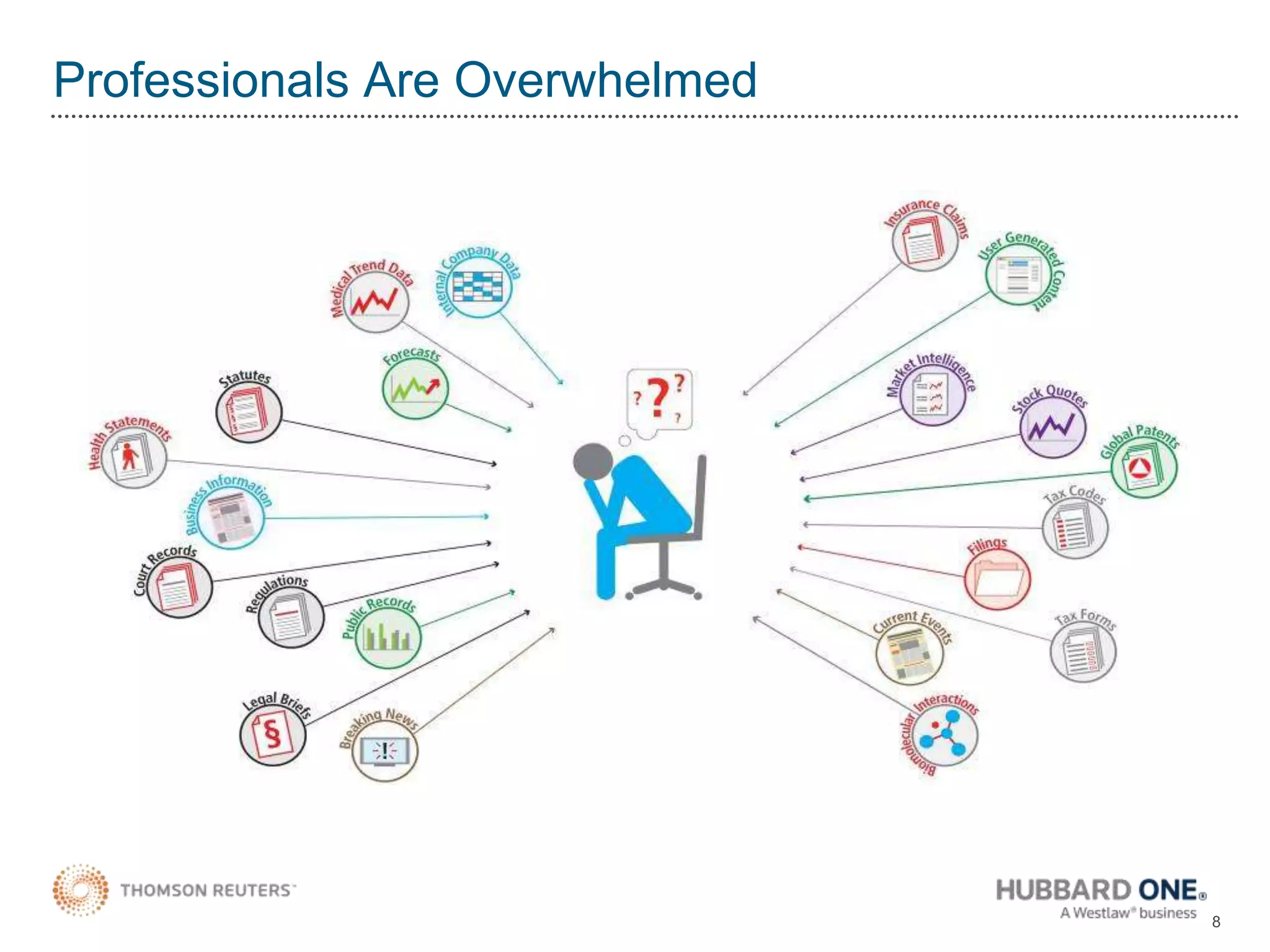

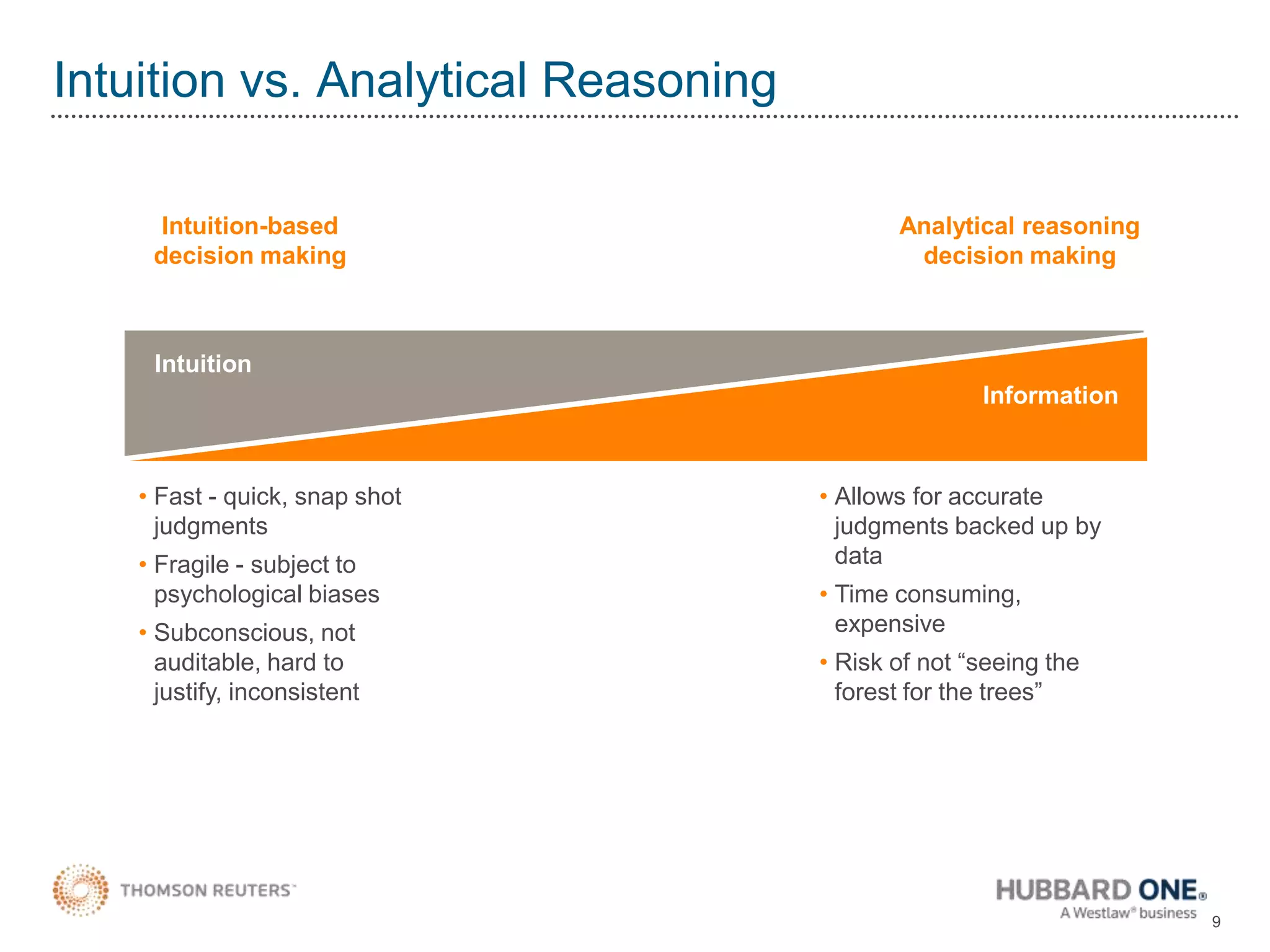

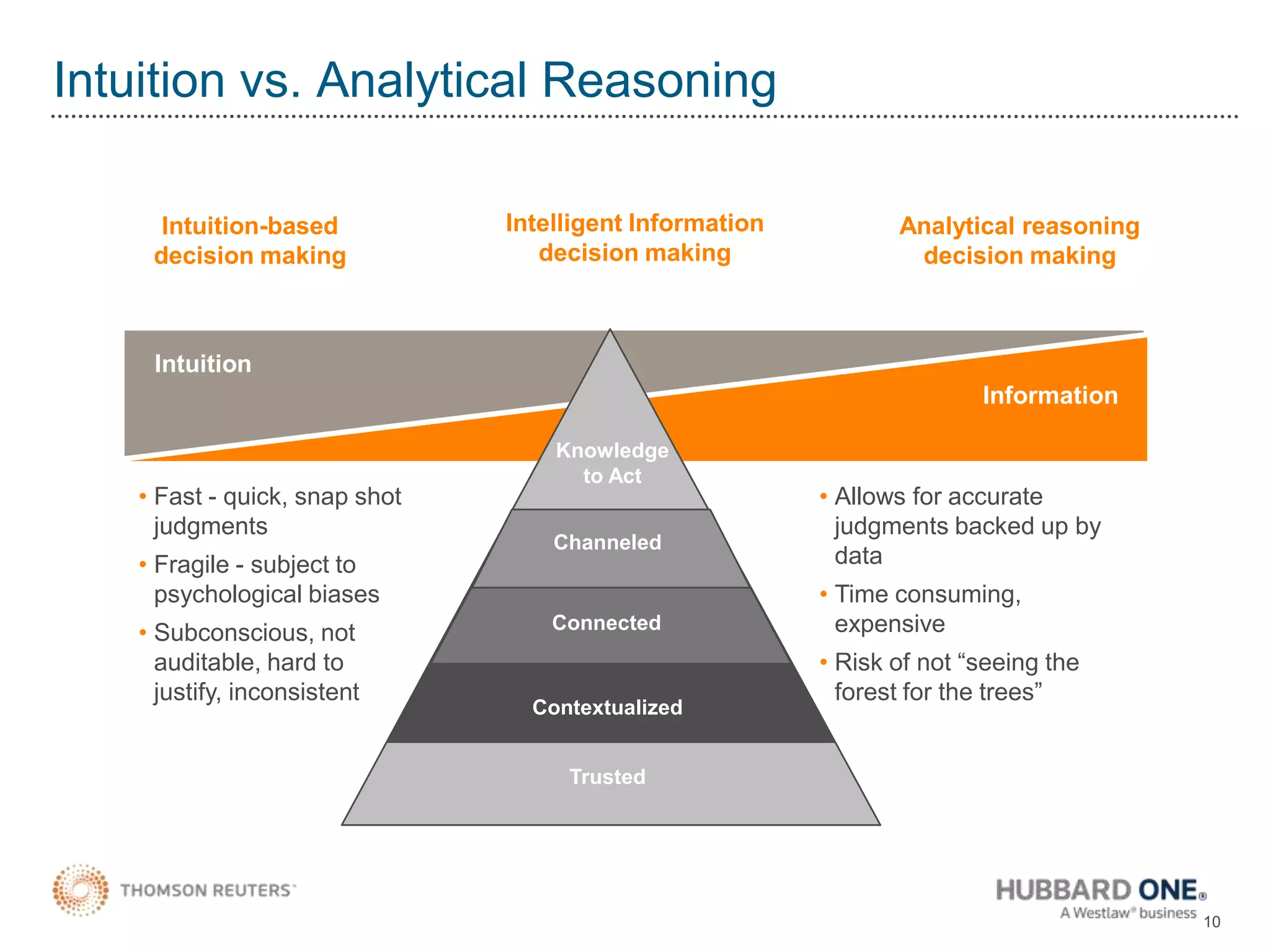

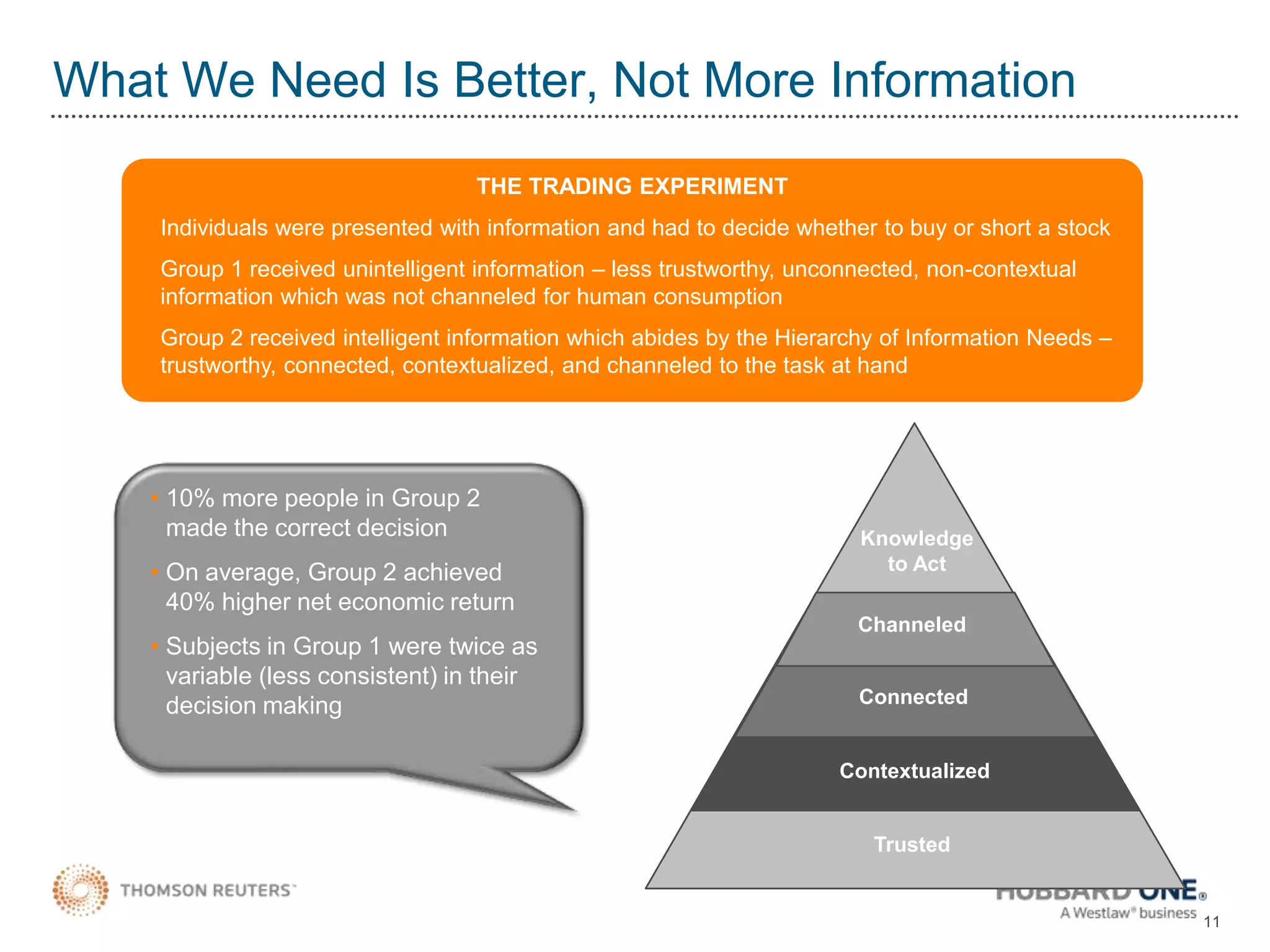

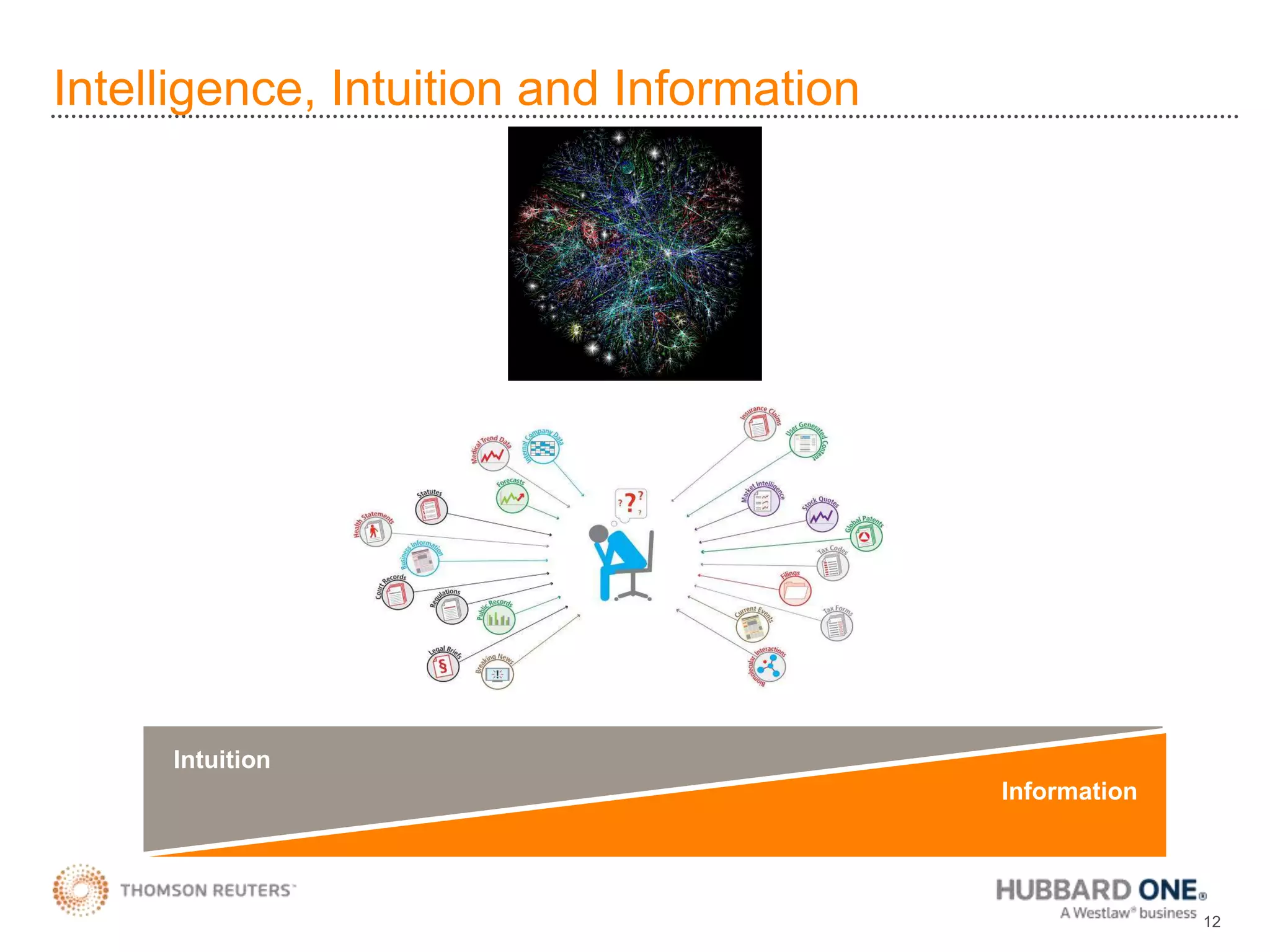

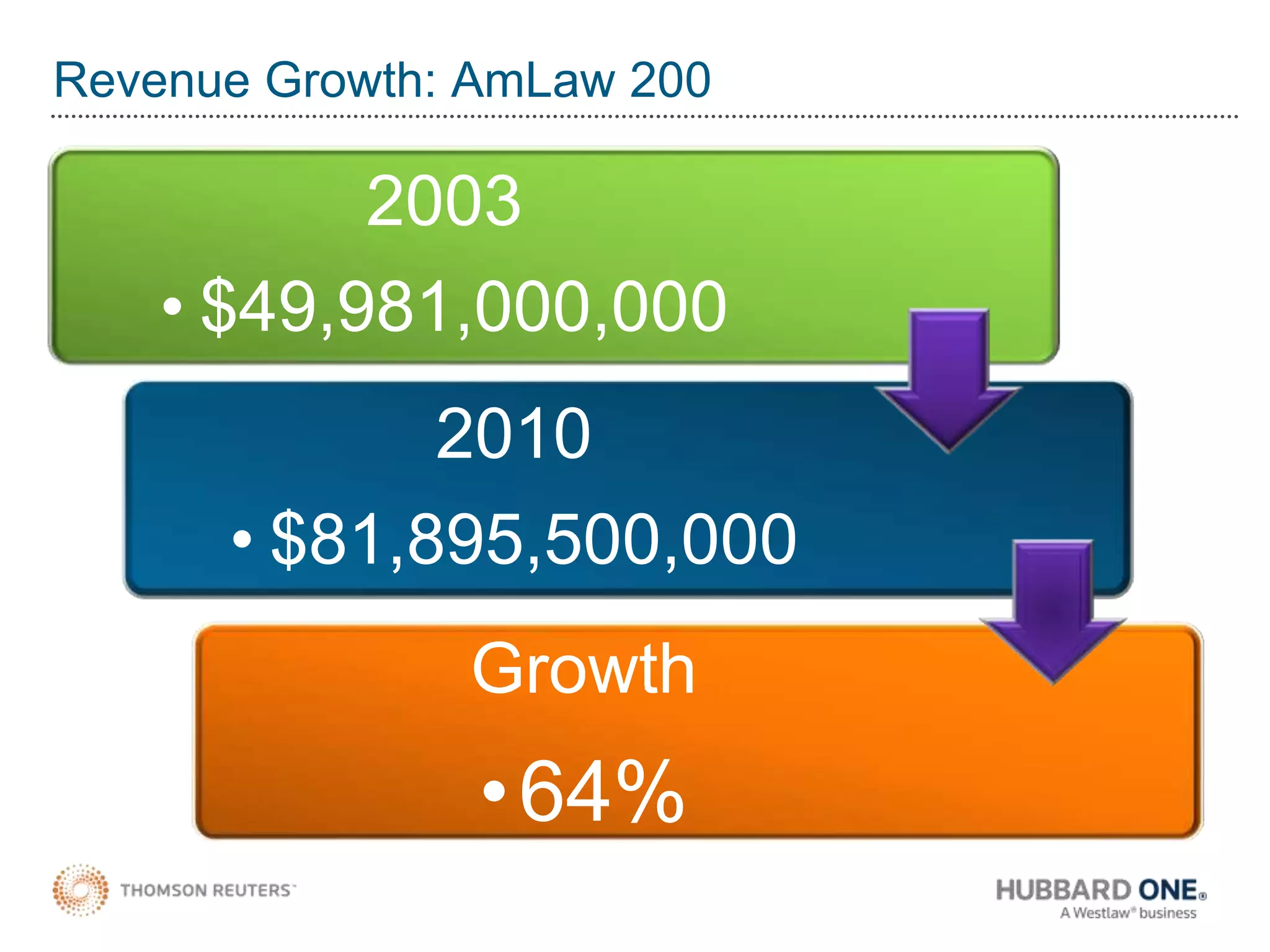

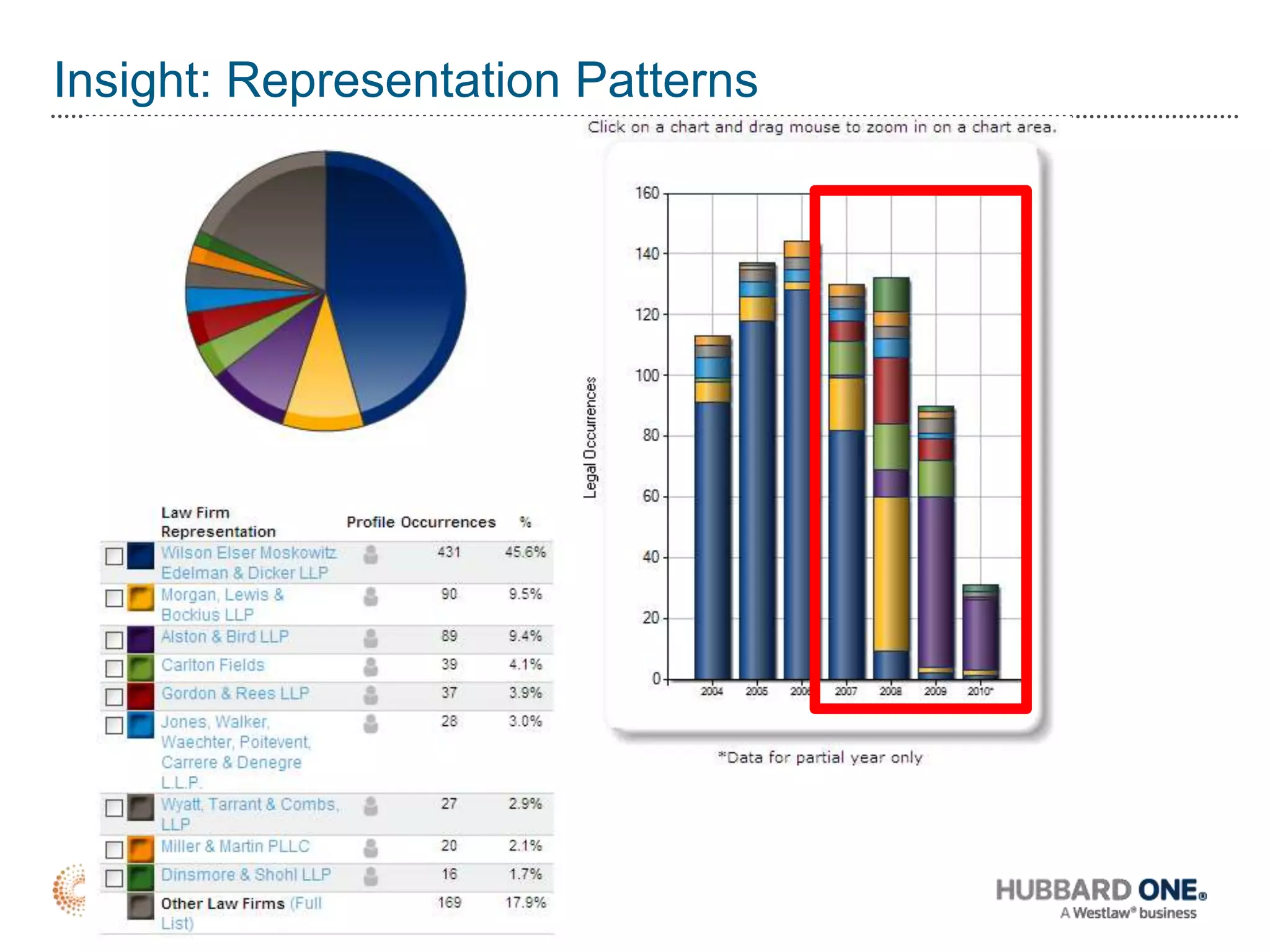

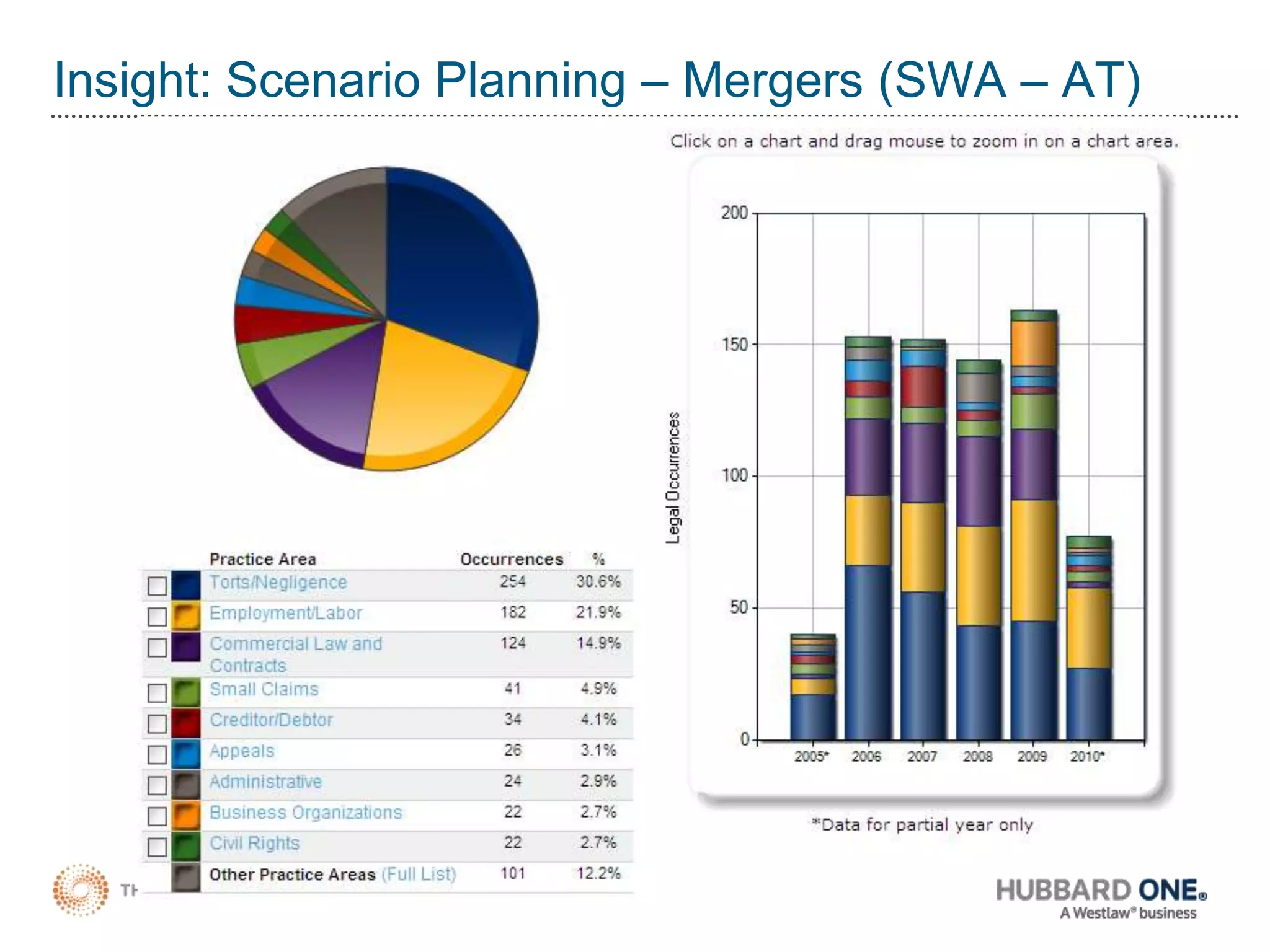

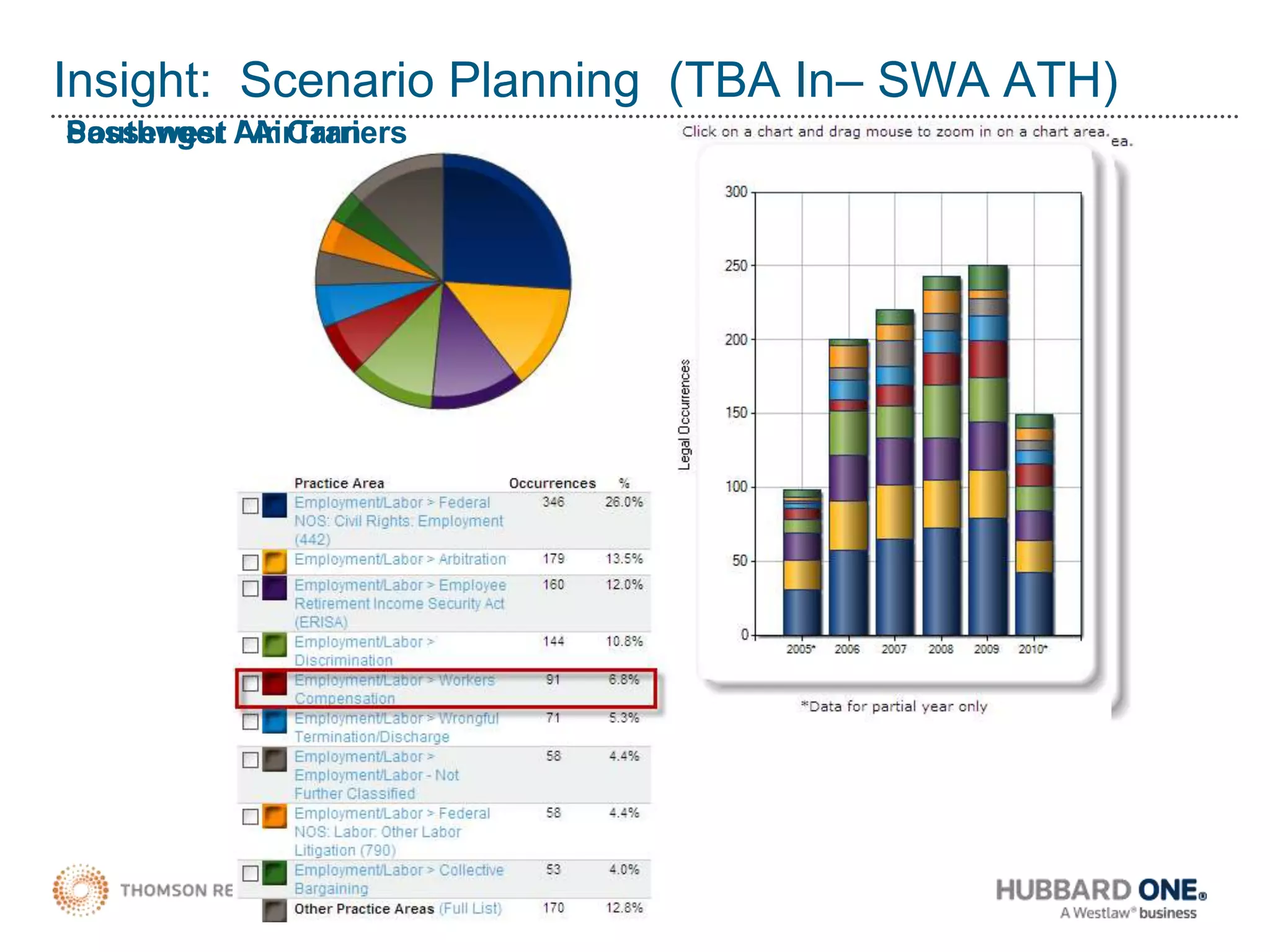

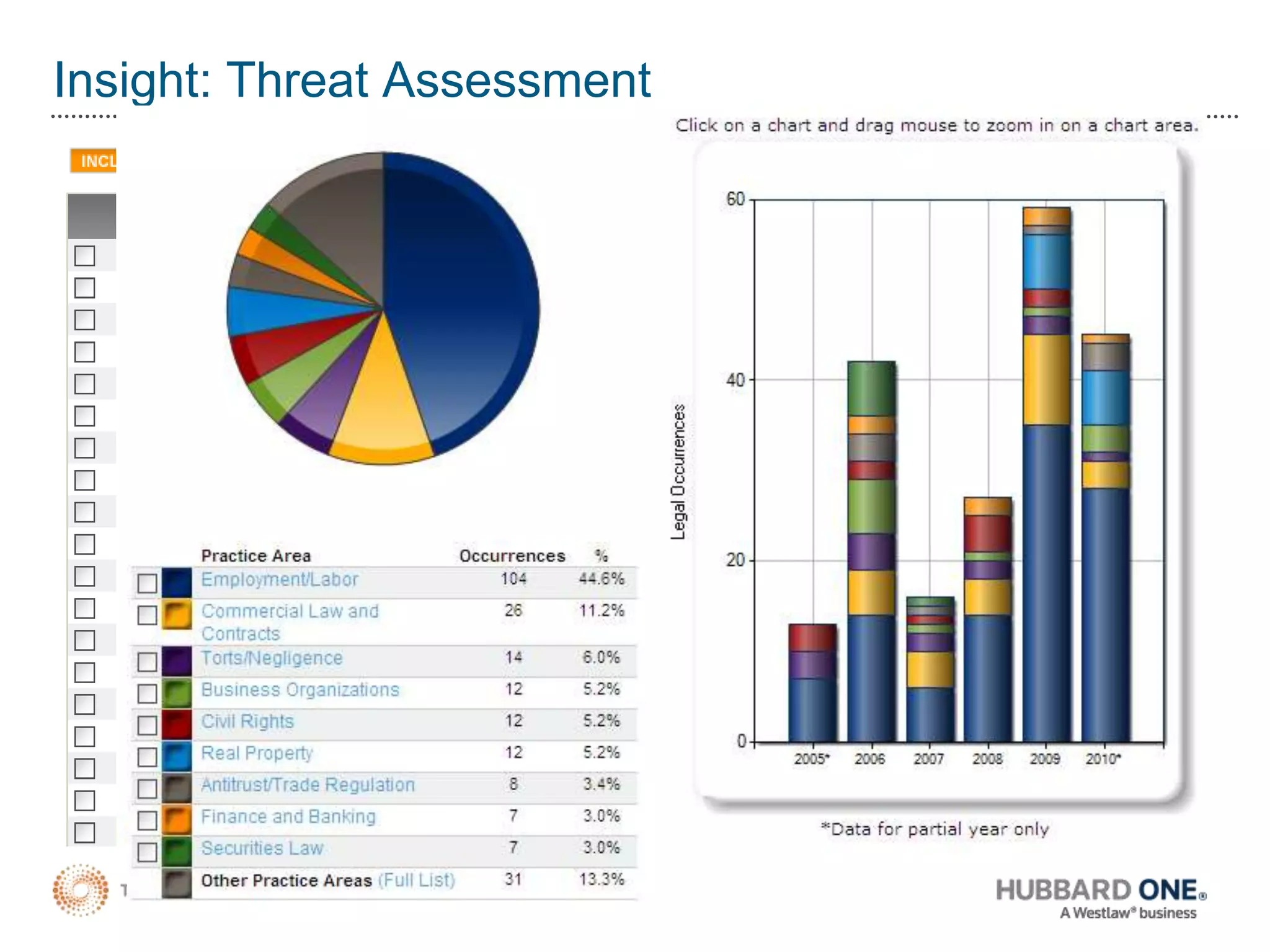

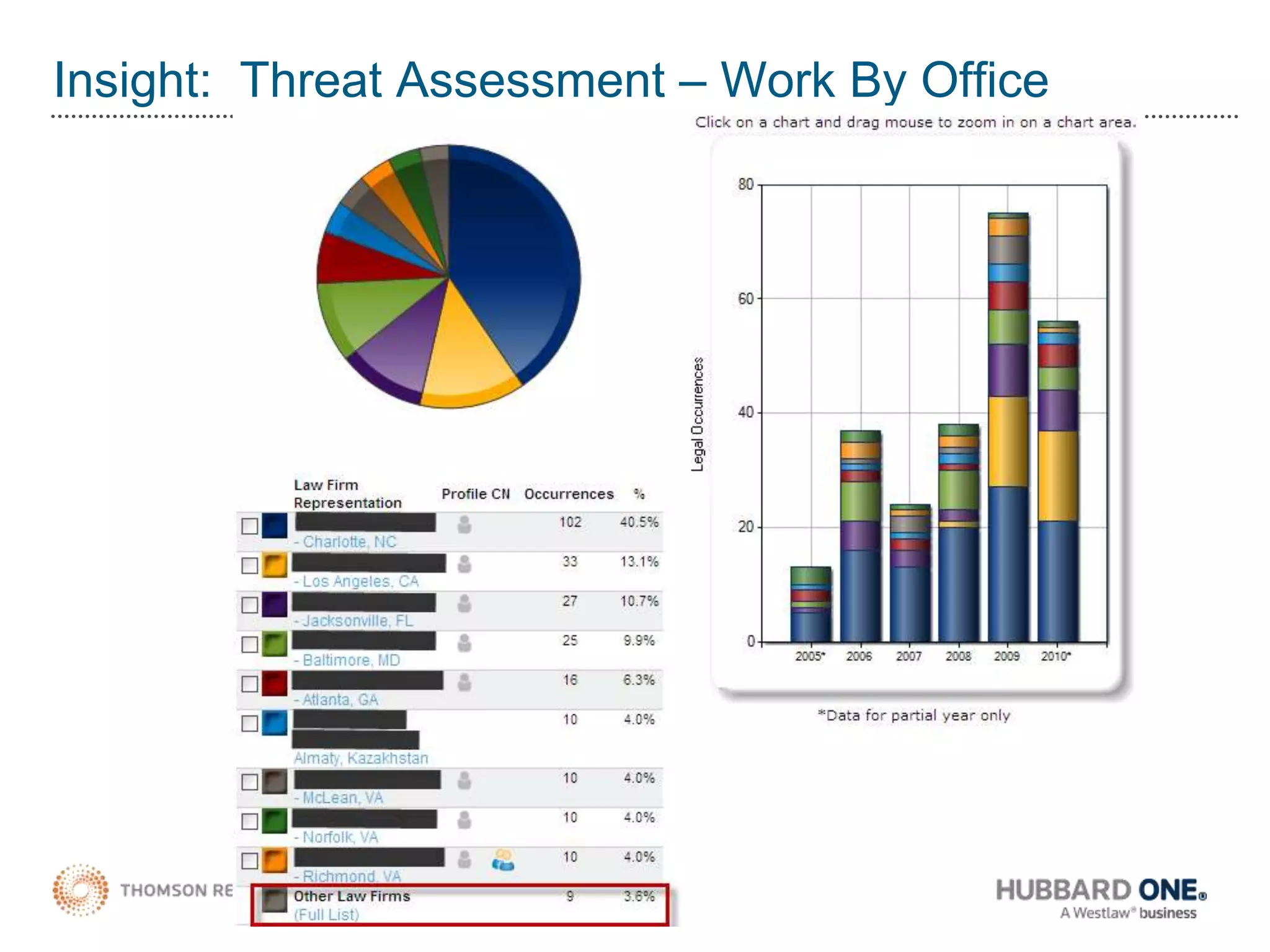

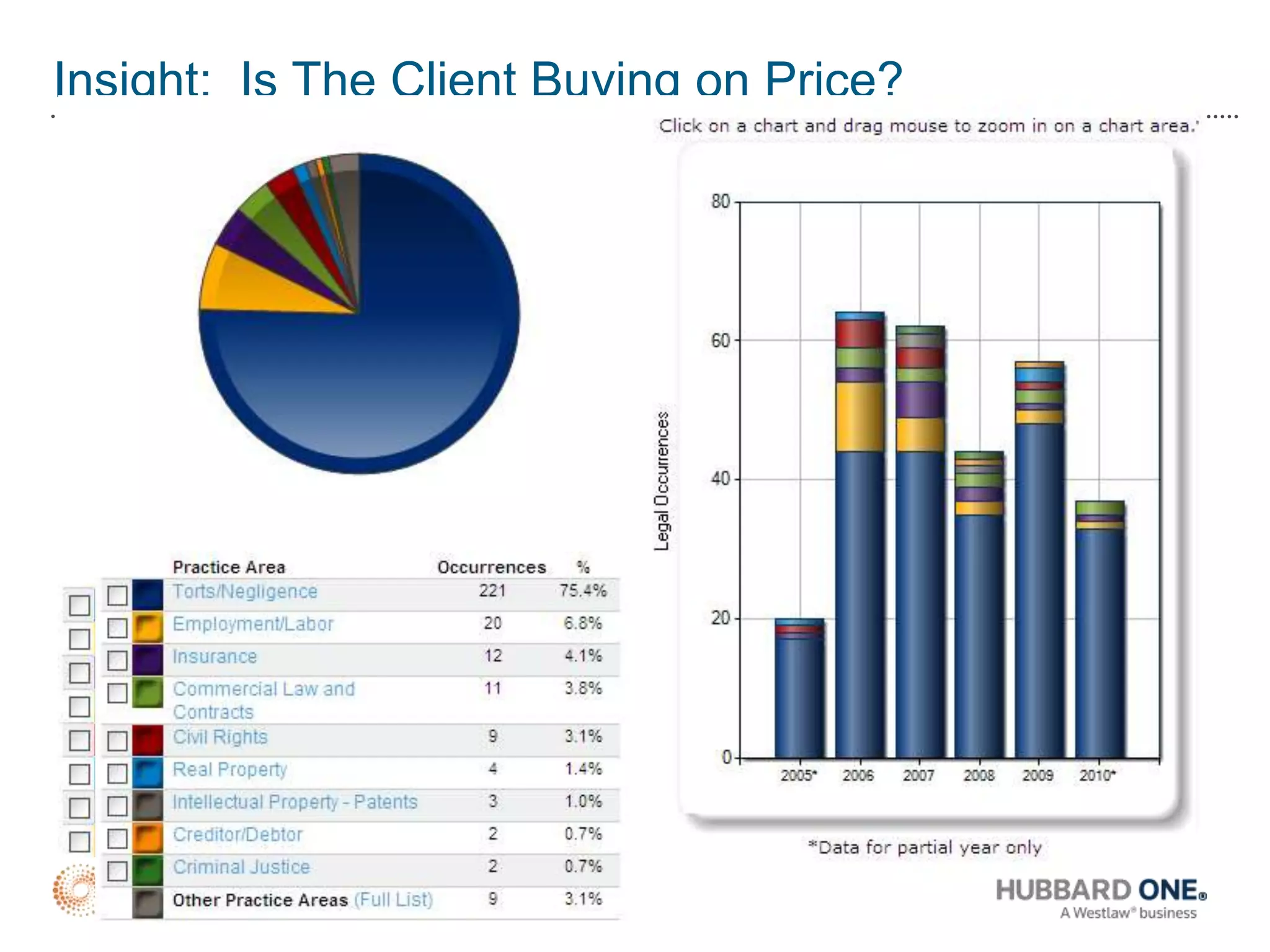

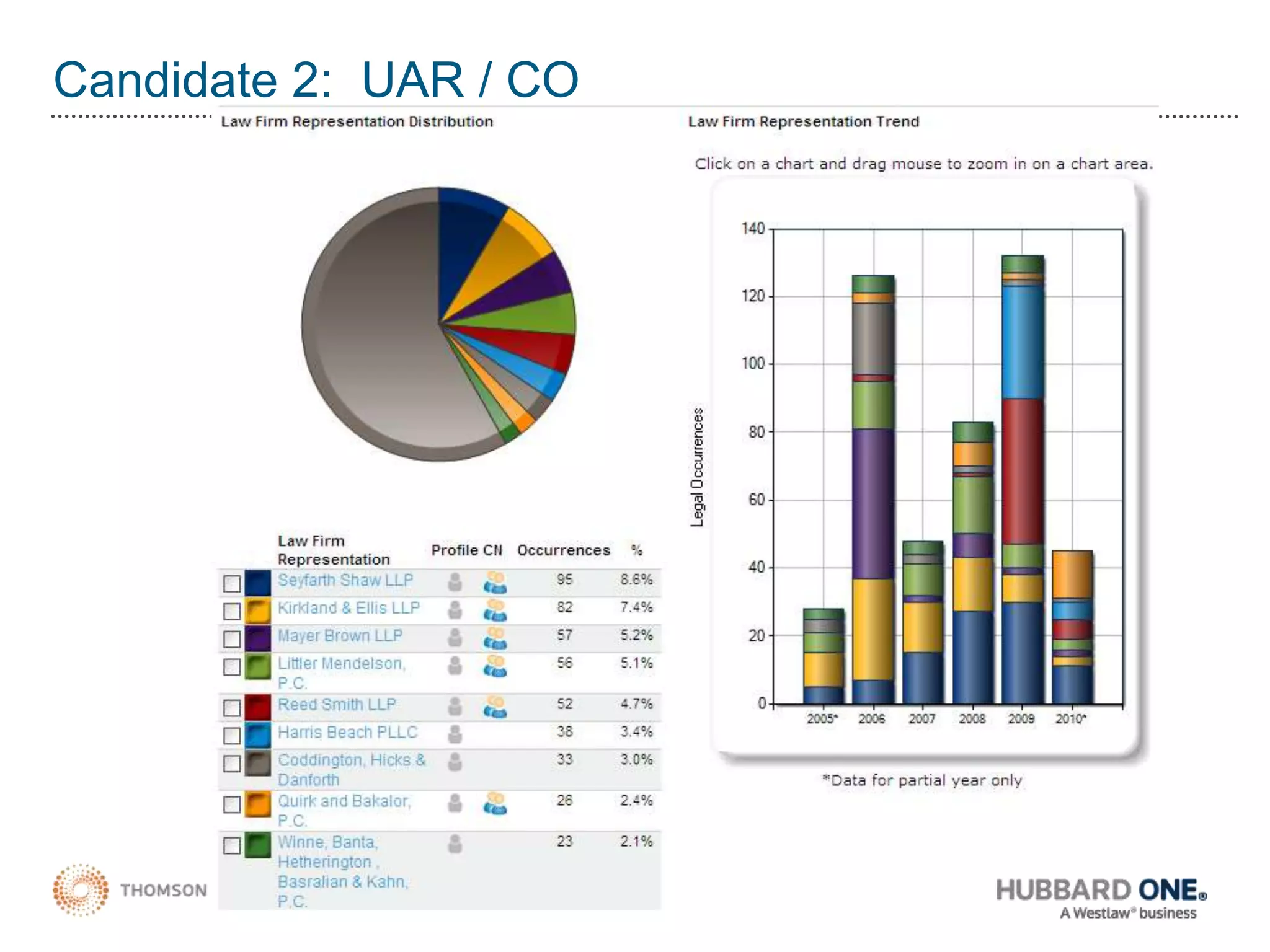

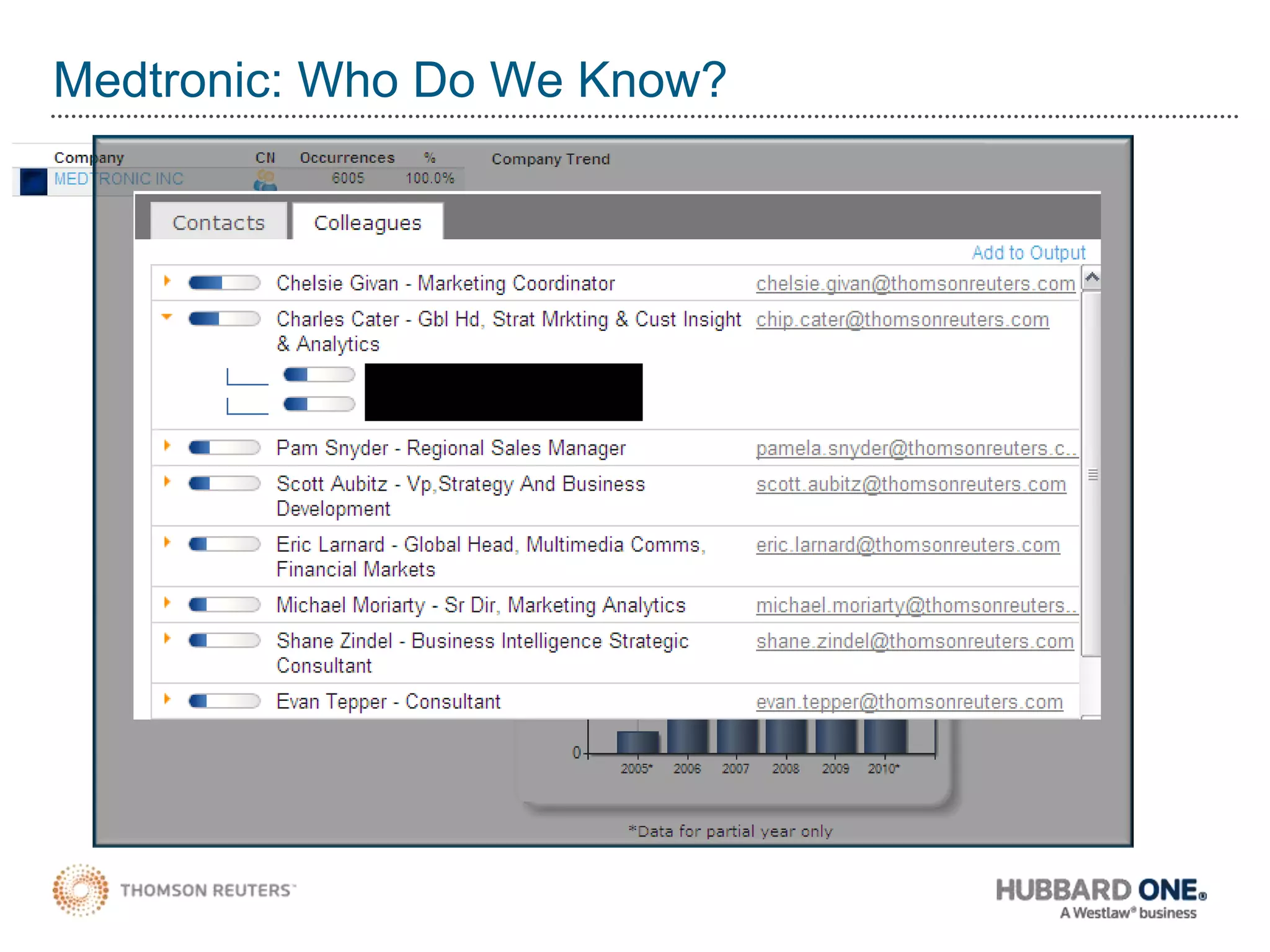

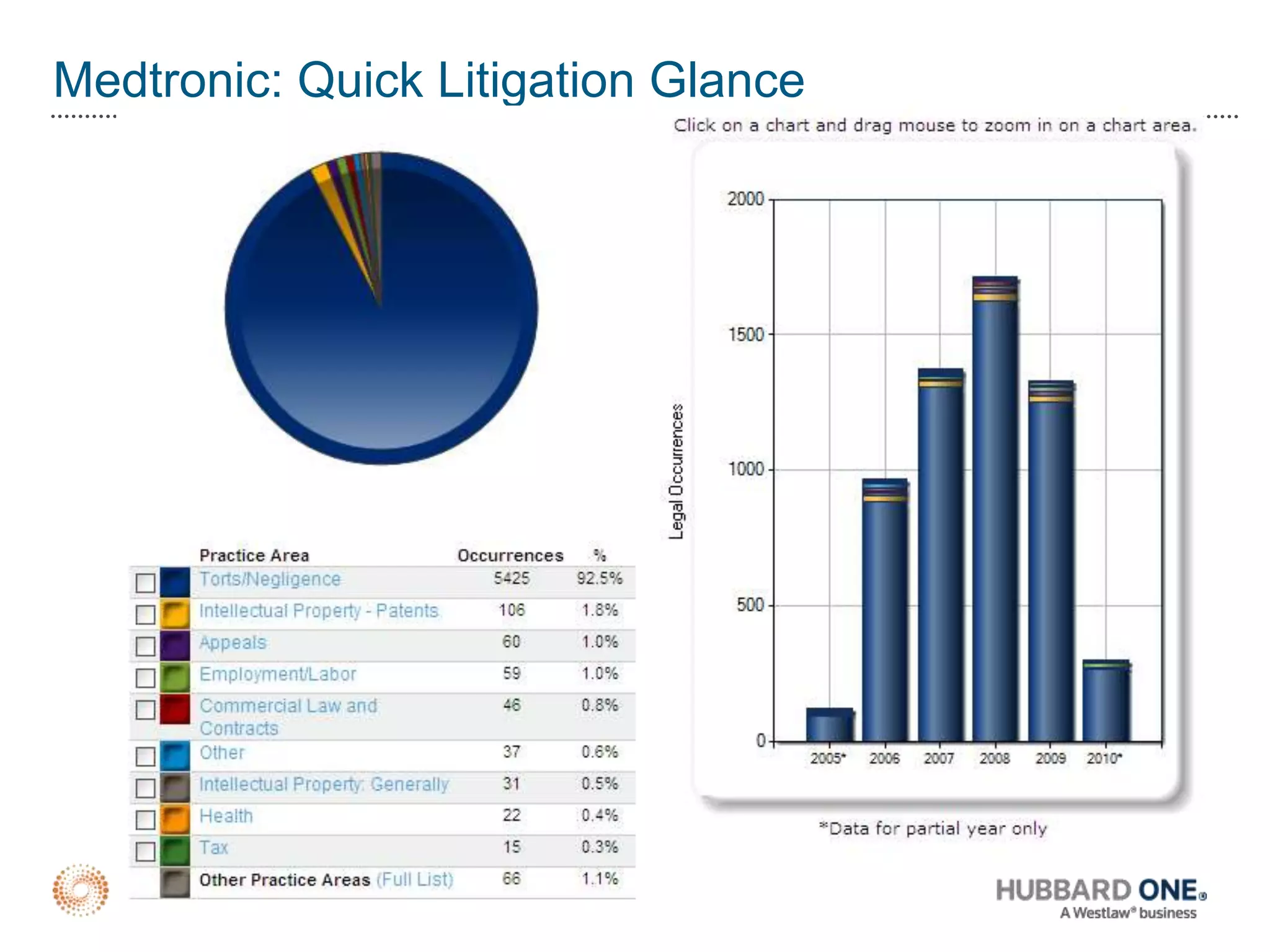

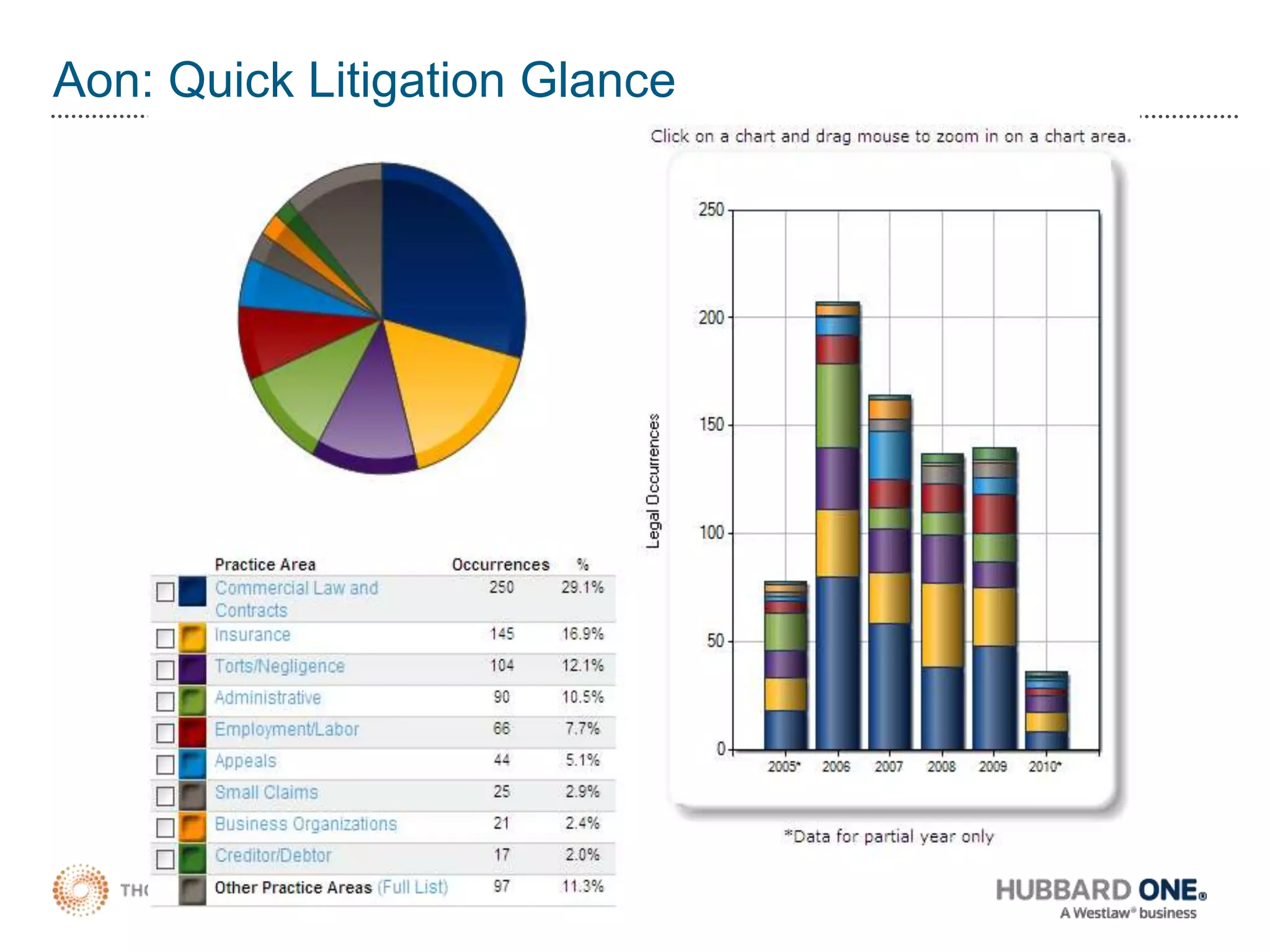

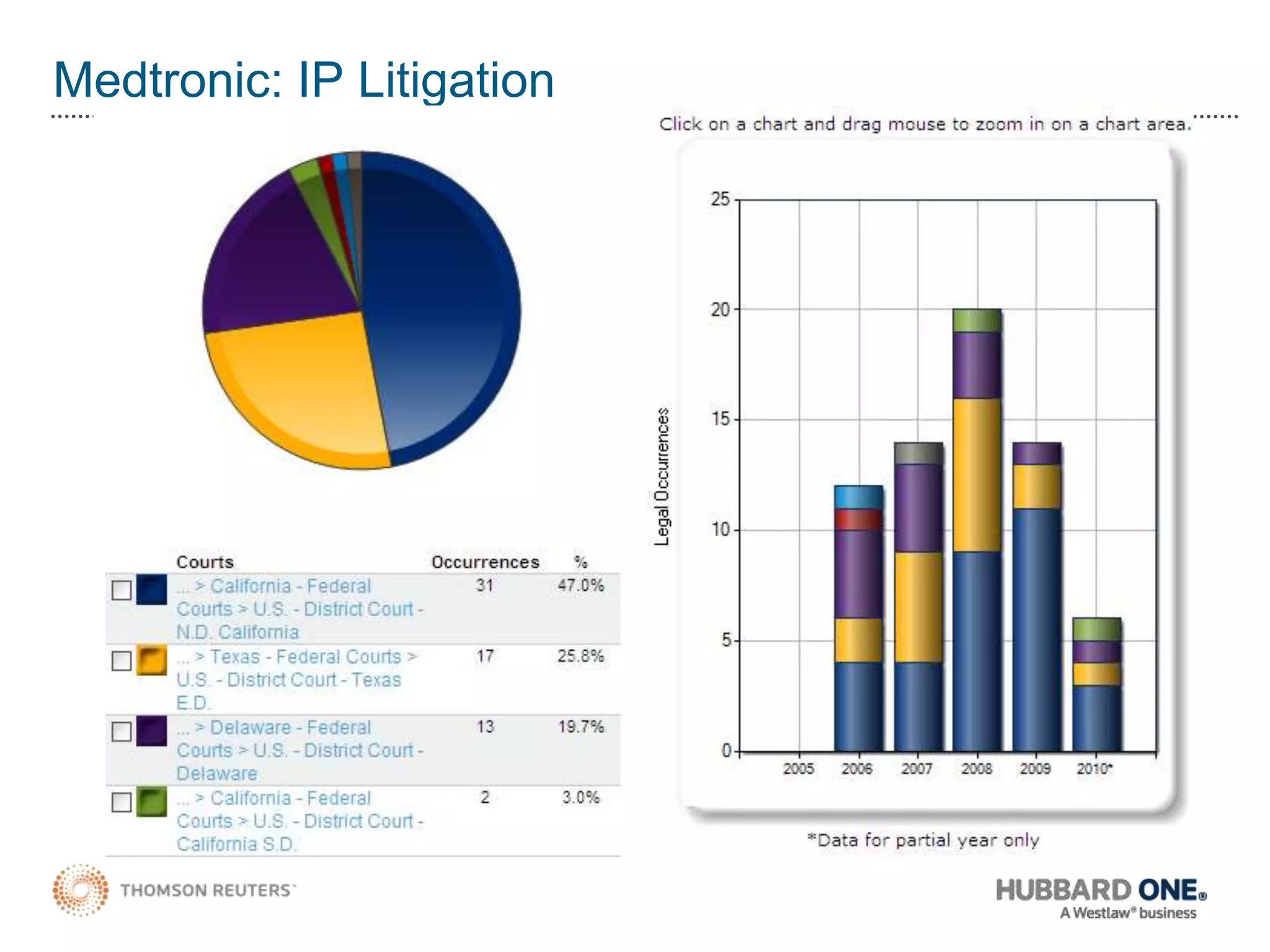

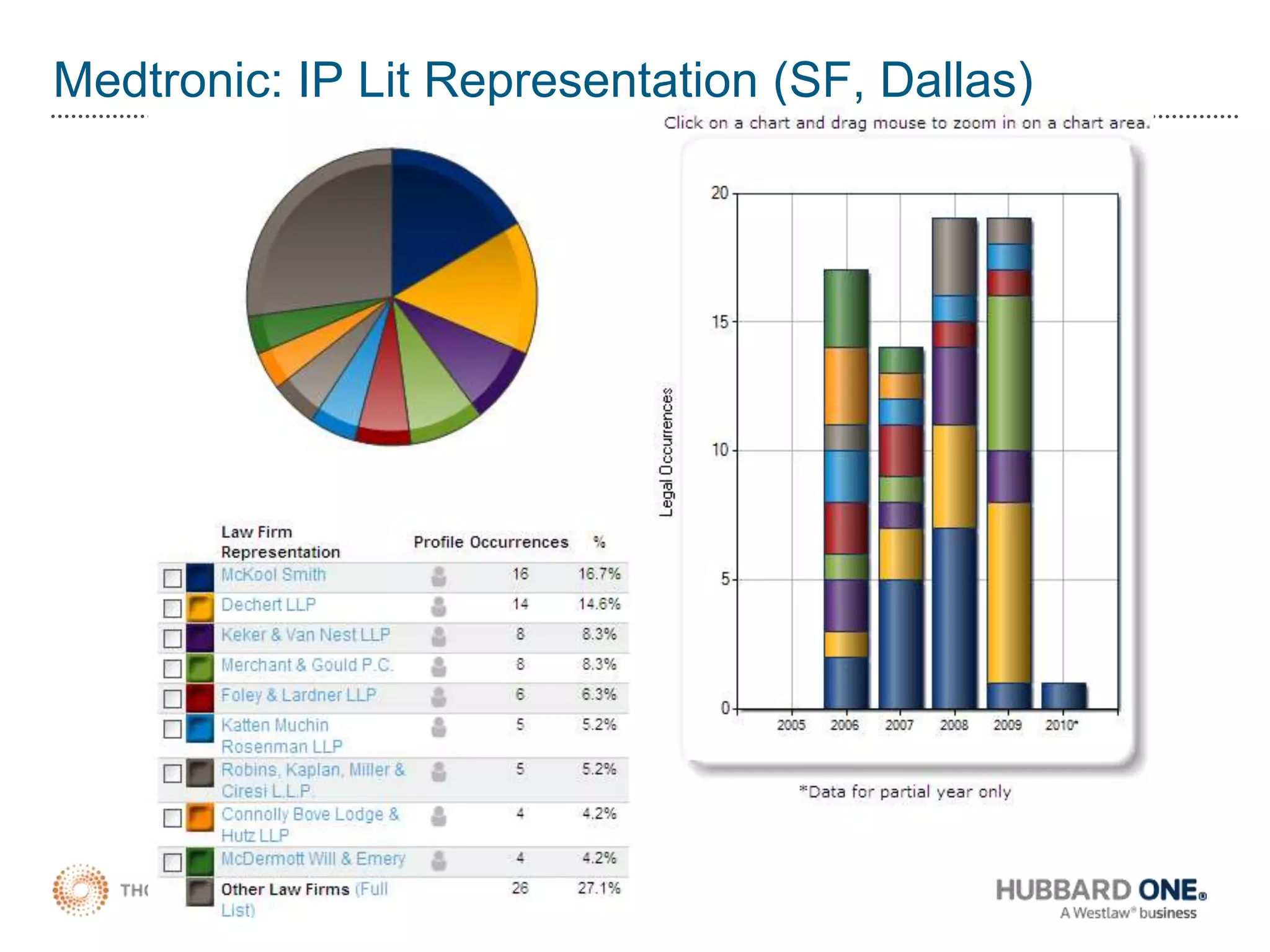

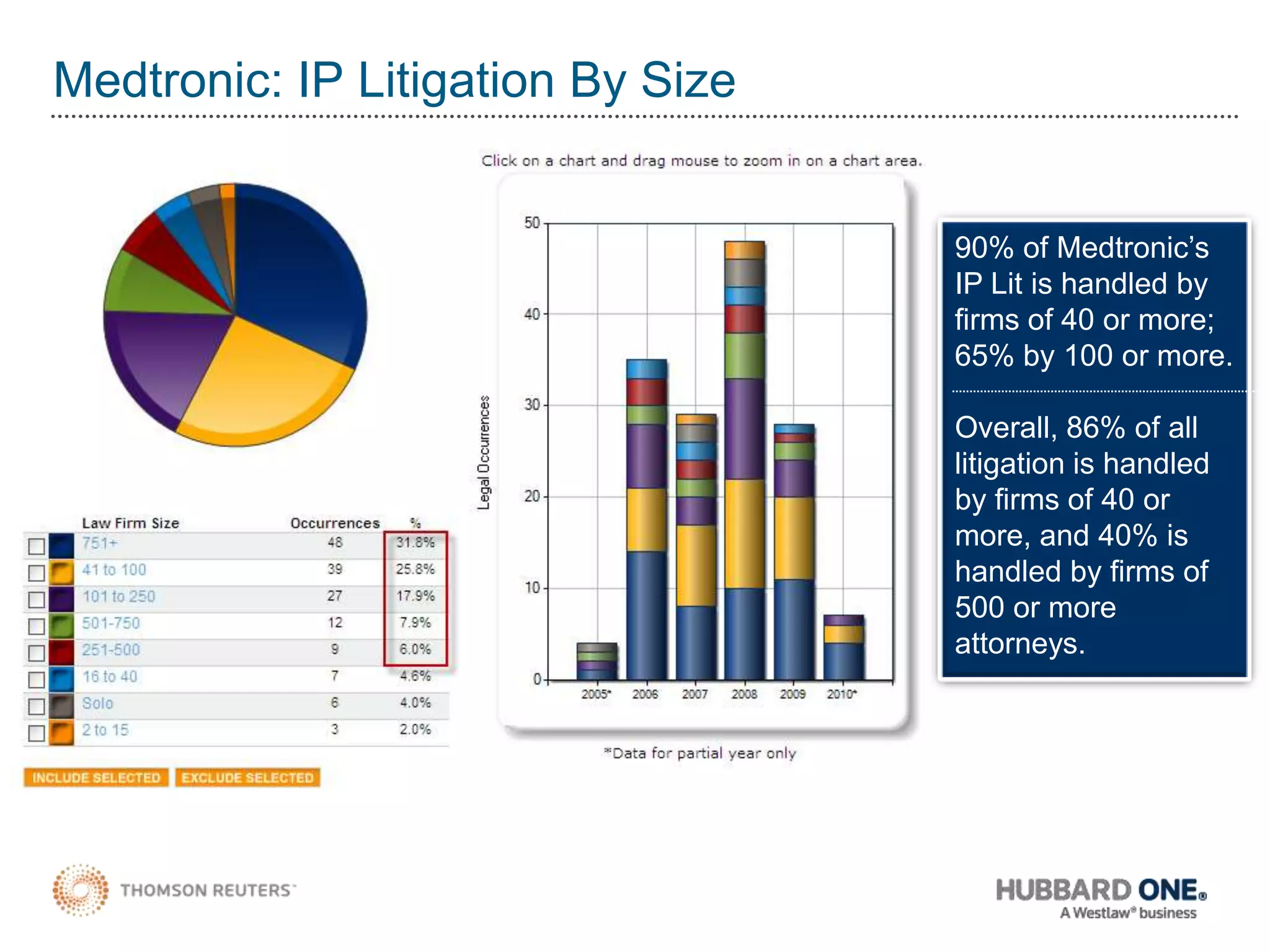

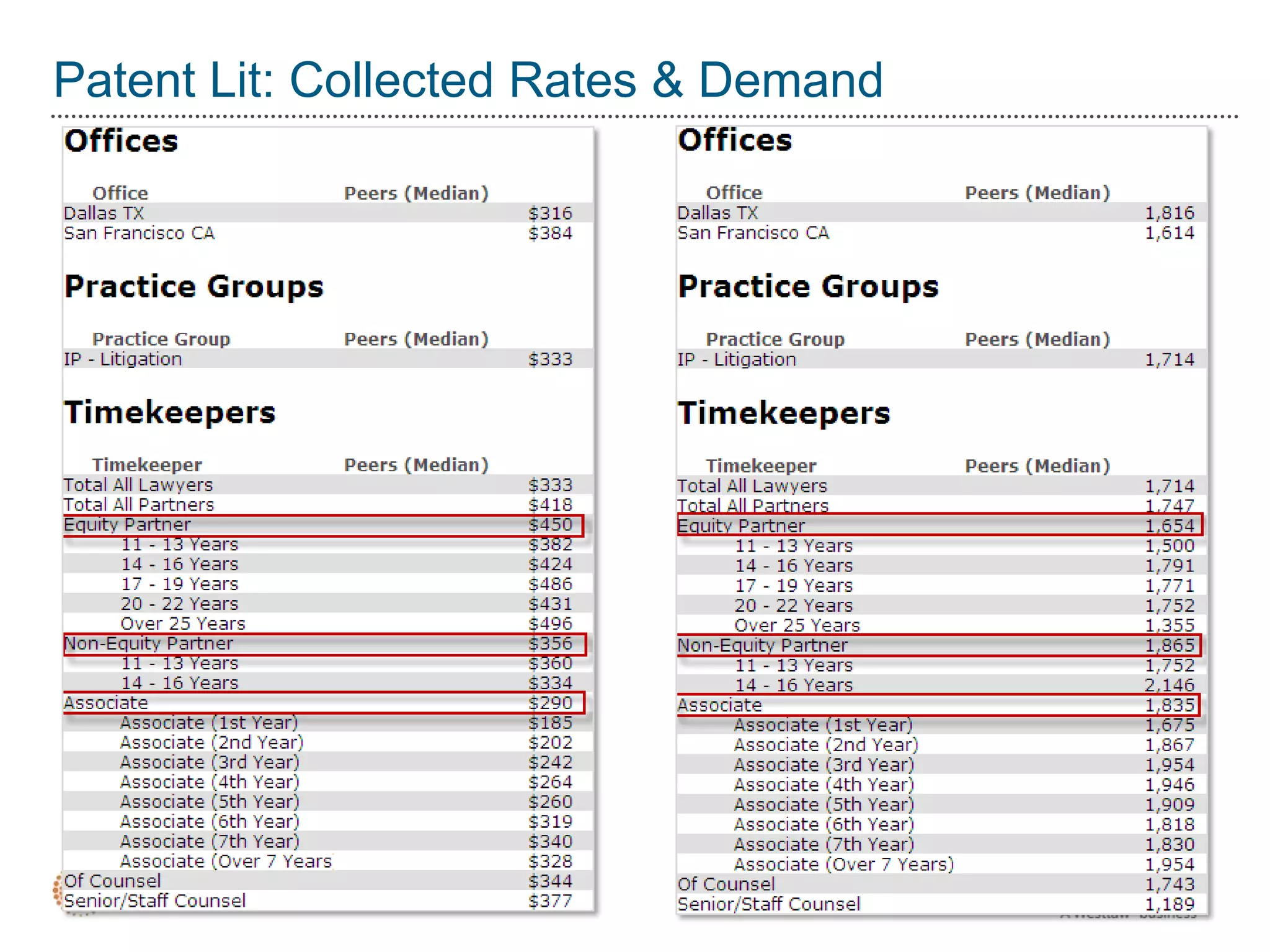

The document discusses how the digital universe is exploding with more data being created every day. Professionals are overwhelmed by the increasing amount of information from more sources. It argues we need better, not just more, information. It provides examples of how competitive and financial intelligence can provide insights into opportunities for client development, market prioritization, and constructing pitches. The examples analyze potential opportunities with BP, UAR/CO, and Medtronic to determine which may be the most profitable. Medtronic is identified as the best opportunity due to the firm's experience and connections as well as Medtronic's litigation spend.