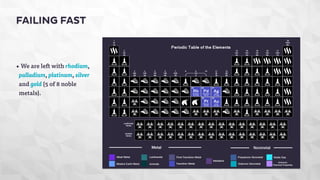

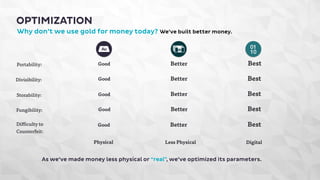

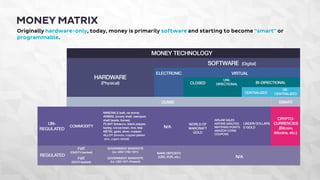

The document discusses the evolution of money and its role as a technology that facilitates trade, highlighting the limitations of the barter system and the advantages of money. It argues that while traditional forms of money, like gold and fiat, have served well, advancements in technology, particularly cryptocurrencies like Bitcoin, represent a new frontier for value exchange. The future of money is envisioned as increasingly digital, enabling smart contracts and transactions between autonomous agents, which could revolutionize trade and economic interactions.