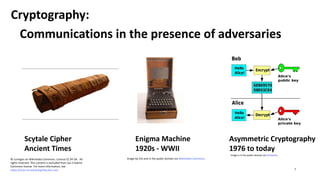

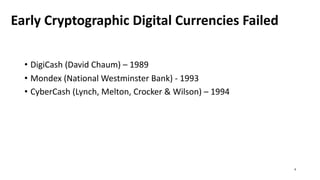

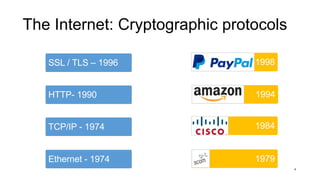

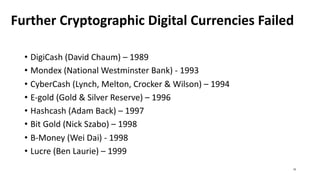

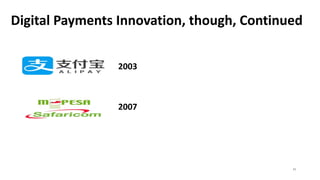

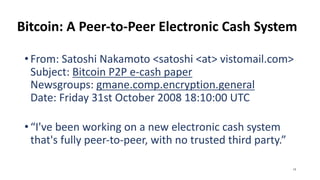

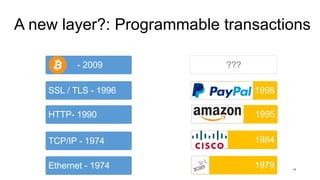

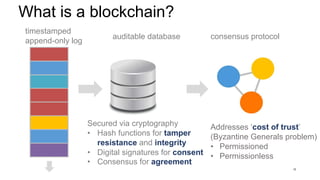

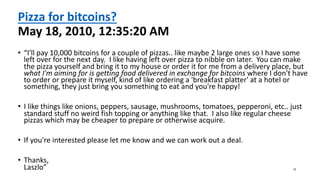

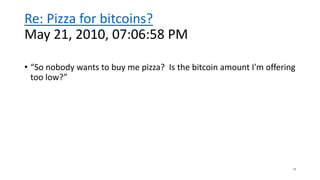

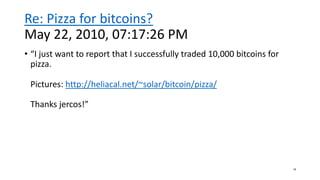

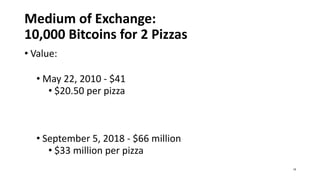

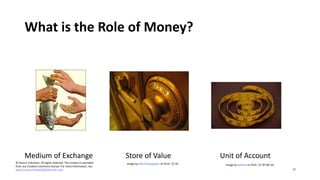

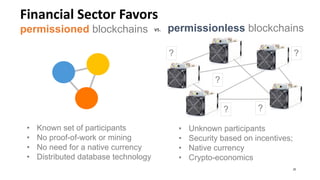

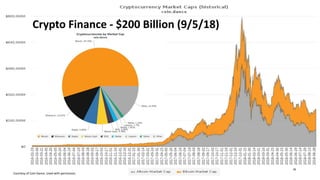

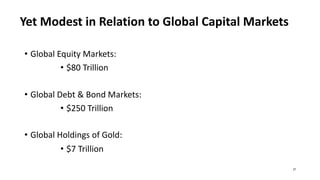

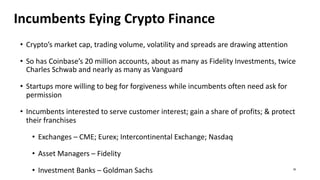

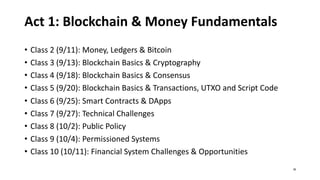

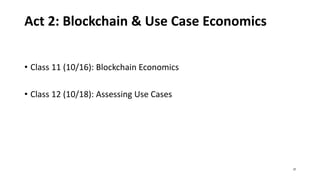

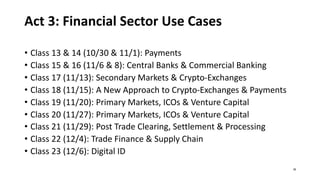

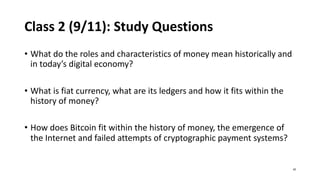

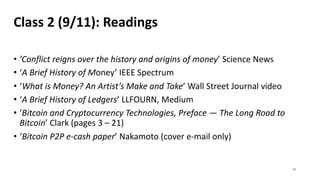

The document introduces a course on blockchain technology and its implications for the financial sector, highlighting its potential as a catalyst for change. It discusses the evolution of digital currencies, challenges within the financial system, and the role of blockchain in addressing these issues. Key topics include the nature of money, financial sector opportunities, and technical hurdles for broader adoption.