Indian business environment www.it-workss.com

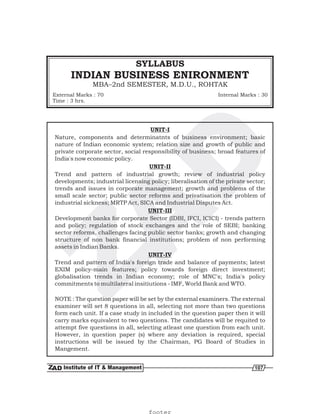

- 1. UNIT-I UNIT-II UNIT-III UNIT-IV Nature, components and determinatnts of business environment; basic nature of Indian economic system; relation size and growth of public and private corporate sector, social responsibility of business; broad features of India's now economic policy. Trend and pattern of industrial growth; review of industrial policy developments; industrial licensing policy; liberalisation of the private sector; trends and issues in corporate management; growth and problems of the small scale sector; public sector reforms and privatisation the problem of industrial sickness; MRTP Act, SICA and Industrial Disputes Act. Development banks for corporate Sector (IDBI, IFCI, ICICI) - trends pattern and policy; regulation of stock exchanges and the role of SEBI; banking sector reforms, challenges facing public sector banks; growth and changing structure of non bank financial institutions; problem of non performing assets in Indian Banks. Trend and pattern of India's foreign trade and balance of payments; latest EXIM policy-main features; policy towards foreign direct investment; globalisation trends in Indian economy; role of MNC's; India's policy commitments to multilateral insitiutions - IMF, World Bank and WTO. NOTE : The question paper will be set by the external examiners. The external examiner will set 8 questions in all, selecting not more than two questions form each unit. If a case study in included in the question paper then it will carry marks equivalent to two questions. The candidates will be requited to attempt five questions in all, selecting atleast one question from each unit. However, in question paper (s) where any deviation is required, special instructions will be issued by the Chairman, PG Board of Studies in Mangement. INDIAN BUSINESS ENIRONMENT MBA–2nd SEMESTER, M.D.U., ROHTAK SYLLABUS 107 External Marks : 70 Time : 3 hrs. Internal Marks : 30 footer

- 2. Q. What is business environment? What are its various components ? Meaning of Business Environment :– Acc. to Wheeler, Acc. to Keith Davis, Components of Business Environment :– a) Internal Environment b) External Environment Ans. Business environment refers to those aspects of the surroundings of business enterprise which have influence on the funtioning of business. An organisation can survive and grow only when it continuously and quickly adopts to changing environment. “Business Environment is the total of all things external to business firms and industries which affect their organisation and operations.” “Business Environment is the aggregate of all conditions, events and influence that surround and affect the business.” Business Environment has two components :- UNIT – I INDIAN BUSINESS ENVIRONMENT MBA 2nd Semester (DDE) Internal Environment External Environment Components of Business Environment 108 footer

- 3. a) Internal Environment :– b) External Environment :– Internal Environment refers to environment within the organisation. It includes internal factors of the business which can be controlled by business. It includes objectives of business, managerial policies, management and employees of the organistion, labour management relationship, brand image and corporate image, working conditions in the organistion, technological and research and development capabilities etc. Internal environment includes 5 M's i.e. men, material, money, machinery, management available with business. These components are usually within the control of business. External Environment refers to external aspects of the surroundings of business enterprise which have influence on the functioning of business. These factors beyond the control of business. External environment includes factors outside the firm which can provide opportunities or pose threats to the firm. External environment has two types :- i) Micro Environment ii) Macro Environment Research Development Technological Capabilities Work Environment Managerial Policies Objectives of Business Human Resources Financial Resources Internal Environment Micro Environment Macro Environment External Environment 109 INDIAN BUSINESS ENVIRONMENT footer

- 4. Micro Environment :– Macro Environment :– The micro environment of a company consists of elements that directly affect the company.It includes suppliers, customers, market intermediaries, competitors and public etc., which is explained as below :- Suppliers are those who supply raw materials and components of the company. Every business requires the suppliers. If our supplier is reliable, our business will run smoothly. If our supplier is not reliable, we have to maintain high inventories. Customer is the central point of the business. The success of a business organisation depends upon the customers, their needs, tastes etc. Now a days the competition is growing so it is very essential to satisfy the customer. For attracting new customers companies conduct consumer research, provide after sale services etc. Market Intermediaries which include agents and brokers who help the company to find customers. It is a link between company and consumer. Market intermediaries help the company to promote sell and distribute its goods to final buyers. Market intermediaries include middlemen, marketing agencies, financial intermediaries, physical intermediaries etc. Competitors means other business units which are producing similar products or a very close substitute of our product. Now a days competition has increased. No business units enjoys monopoly in the market. So the business has to satisfy the customer for the success in the market. Public is group that has actual or potential interest in the business. So public also affect the business. Media also affect the business. It includes al newspaper, megazines, journals etc. Media also affects the reputation of the company. Macro Environment means general environment of business. These factor are uncontrollable. These factors create opportunities and pose threats to the business. It includes economic, demographic, natural, technological, political and cultural environments. i) Suppliers :– ii) Customer :– iii) Market Intermediaries :– iv) Competitors :– v) Public :– vi) Media :– Macro Environment Economic Environment Political Environment Natural Environment Human Environment Financial Resources Technological Environment Socio Cultural Environment 110 footer

- 5. i) Economic Environment :– ii) Political Environment :– iii) Socio Cultural Environment :– iv) Technological Environment :– Economic Environment refers to those economic factors which have impact on the working of business. Economic environment is very complex in nature. It is very dynamic. It has three elements :- Economic conditions of the economy the business. Economic conditions includes income level, distribution of income, demand and supply trends etc. If the economy is in boom conditions, it positively affect demand and market share. On the other hand if the economy is in depression, it will have negative effect on the business. Economic policies are framed by government. These policies establish relationship between business and government. The effect of these policies may be favourable or unfavourable. Different economic system prevail in different countries. These system affect the business. The economic system includes capitalism, socialism and mixed economy. Political Environment affect the different business units. A stable and dynamic political environment is very necessary for business growth. Political environment includes political stability in the country, relation of the govrnment with other countries, welfare activities of government, centre state relationship, thinking of opposition parties towards business. If the political system is stable and efficient then the business grows. In the lack of political stability long terms plans cannot be formulated. Thus business is adversely affected if the government is not stable. Similarly relations of government with other countries also affect business. If a country enjoys friendly relations with other nations, then it has favourbal effect on foreign trade. Socio- Cultural Environment refers to social and cultural factors which are beyond the control of business unit. Such factors includes attitute of people ot work, family system, caste system, education, habits, language, religion etc. Socio-cultural environment is one of the important non-economic external components of business environment. Religion has considerable effect on business. Some religions restrict their followers from doing a particular type of business, e.g. Jain religion does not allow its followers to engage in leather industry, wine making etc. Similarly difference in language is another problem area in national level and international level business. The businessman must be familiar with the local language of the place where business is to be operated. Technological environment is most important factor which affect the business enterprise. The faster changes a) Economic Conditions :– b) Economic Policies :– c) Economic System :– 111 INDIAN BUSINESS ENVIRONMENT footer

- 6. in technology create problems for business enterprise. Product have shorter life span than the past because of rapid technological development. Technology provides a various advantage. Success in many industries depends on a innovation and research. For promote innovation and research some companies establish research and development department in their enterprise. For example Japanese industries have achieved a great success because of innovation and rapid technological upgradation. Natural Environment refers to geographical and ecological factors which are beyond the control of the enterprise. It includes natural resources, weather and climatic conditions, landforms rainfall, environmental pollution etc. Climate and weather conditions affect the location certain industries like textile industry. Similarly environment pollution in the form of air pollution, water pollution and noise pollution have caused disturbances in ecological balance. Government has framed various Acts for the control of environmental pollution. The business enterprise must keep in mind these factors. Demographical environment affect the business externally. Demographic environment differs from country to country and from place to place within the same country. Demographic factors includes size of population and population growth, family size, age composition, sex composition, urban-rural population education level etc. Huge population size indicate cheap labour and more demand in the economy. If population size is large then there will be more demand for goods and services. It will have favourable effect on business. Similarly, Education level is also important demographic factor affecting business. If public is highly educated, supply of unskilled labour will decrease. On the other hand if education level is low then supply of unskilled labour will increase. International Environment is the important component of the business environment. International environment affect the business differently. International environment is very important for certain types of business. It is particularly important for industries directly depending on imports or exports. Recession in foreign market may create difficulties for industries depending on exports. Liberalisation of imports may help some industries but may adversely affect other industries. For eg. the entry of multinationals such as LG, Samsung in electronics industry has adversely affected the market share of domestic business firms. A ns. Economic system usually are classified as capitalist, socialist or mixed. No company is purely market or purely v) Natural Environment :– vi) Demographical Environment :– vii) International Environment :– Q. How economic system can be described ? ECONOMIC SYSTEM :– 112 footer

- 7. commands, but they tend to lean to one direction or another. If an economy is considered to be a market economy with a private ownership, it is so classified because the market and private ownership dominate the economy. When an economy moves to more balance between market and command or between public and private ownership, it is considered mixed. In a command economy, resources are allocated and controlled by governmental decision. It is also possible to classify economic system according to the other criteria: private or public. a market economy or a command economy. These two criteria can be expanded to melude mixed ownership and control with private ownership, individuals own the resources with public ownership, the govt. owns the resources. Interrelationship between control of economic activity and ownership of production factor:- Market A B C Mixed D E F Command G H I As the matrix is suggesting that there can be 9 kinds of economic environment. The business manager has to consider these before taking an investment decision. These economic environments are:- Market-Private Market-Mixed Market-Public Mixed-Private Mixed-Mixed Market-Public Command-Private Command-Mixed Command-public In a market economy two societal units play important roles :– The Individual The Company Individual owns resources and consumer products. Companies use i. Type of property ownership:- ii. Methods of resources allocation and control:- Control Ownership Private Mixed Public Market Economy :– Ø Ø Ø Ø Ø Ø Ø Ø Ø Ø Ø 113 INDIAN BUSINESS ENVIRONMENT footer

- 8. resources and produce products. The market mechanism involves an interaction of price, quantity, supply and demand for resources and produces as follows:- Labour is supplied by the individual if the company offers an adequate wage. Products are consumed if the price is within a certain acceptable range. Company sets its wages on the basis of quantity of labour available. Resources are allocated as a result of constraint interplay between individuals and companies. The key factor that makes the market economy work is consumer sovereignty. Consumer sovereignty is the freedom of consumer to influence production by exercising their power of choice regarding purchases. Companies are free to make economic decision. The demand and supply ensure proper allocation of resources. Freedom from govt. restraints/ restrictions. Legal and Institutional frameworks to safeguard economic freedoms. Examples :– USA, UK, Singapore, Hong Kong etc. In a command economy the govt. co-ordinates the activities of the different economic sector. Goals are set for every enterprise in the country. The govt. determines how much is produced by whom and for whom. In this economy the govt. is assured to be a better Jude of How resources should be allocated than are business or consumed. As a result of the recent changes few countries strict central planning today. Ex-North Korea, Russia. In actually, no economy is either purely market determined as completely centrally planned. In practice, however what mixed economy generally have a higher degree of govt. intervention and also a greater degree of govt. intervention. Countries in the mixed categories would be ‘partly free’ mostly not free’. Examples of ‘partly free are :– Hungry, Israel, and Taiwan. Examples of ‘Mostly not free’ are :– India, Mexico, and Brazil. Mixed economies are characterized by different mixtures of market and central planning control and public and private ownership of resources. Ans:1990s public sector expenditure gave some stimulus to demand for the production of large industry. The private corporate sector also soaked up cheap Ø Ø Ø Ø Ø Ø Market Economy implies a degree of economic freedom from :– Command economy :– Mixed Economy :– Q. Write a short note on development of public and private corporate sector in India 114 footer

- 9. finance from State agencies, and enjoyed partial protection from imports of finished goods. Despite this comfortable environment, the – reflecting the condition of the vast majority of people – restricted the rate of industrial growth in India. And the of demand (i.e., for what types of products) skewed the pattern of growth, away from items of mass consumption such as cheap textiles, and toward elite consumption. This skewed, import-dependent pattern of production restricted employment creation by industry; and the sluggish growth of industrial employment in turn restricted the market for mass consumption goods. Thus when spells of rapid growth occurred, they were distorted and self- limiting. The high industrial growth rates of the 1980s were unleashed by the relaxation of controls on industry, imports, and external borrowing. Given the Indian elite’s insatiable desire for foreign goods, and the propensity of Indian big business to operate as merchants rather than as industrialists, this relaxation was accompanied by a surge of foreign collaborations; this resulted in large imports and large trade deficits; this was in turn funded by foreign debt (not coincidentally, international banks in this period were hunting for borrowers). This culminated in the debt crisis of 1990-91. The further liberalisation post-1991 unleashed another bout of growth in the mid-1990s oriented toward elite demand; this petered out by the late 1990s, and was followed by another bout of stagnation. It is yet to be seen how long the present bout of growth can be sustained. The proponents of the current policies argue that it is broad-based compared to earlier such bouts, that Government finances are in better shape, and that long-term trends in the international economy (in particular the growth of outsourcing) imply that growth of services exports will continue indefinitely. Let us assume there is some merit in these arguments. Regardless of whether or not growth continues, however, the pattern of industrial development taking place has some striking features which we need to note. These features help us understand whether, either now or in the future, the present trends will translate into the betterment of the people of India. In fact the pattern of corporate sector growth, whether in industry or services, not only fails to pull up the rest of the economy; the present pattern of growth is based on exclusion, the fencing-off of the ‘growth’ sectors from the rest of the economy. Ans. Fifty year ago the business was considered very good for earning profit to underlying paucity of domestic demand nature Q. What is social responsibility of Business ? Are the Indian corporates fulfulling this responsibility ? Give example. Or What is social responsibility of business ? How is it being implemented by business houses in India ? 115 INDIAN BUSINESS ENVIRONMENT footer

- 10. its owner but now a days the situation is completely changed. Today the business’s responsibility is not limited to its owner but it has assumed large dimension. Business has to look to the interest of other parties like shareholders, employees, competitors, consumers, suppliers, government, community and world etc. The responsibility of business which includes the satisfaction of these parties along with the owner is called the social responsibility of business. Managers have a social responsibility towards various parties of the society. In Indian corporates almost every firm fulfilling this responsibility towards shareholders, competitors, employees, consumers, suppliers, government etc. For example :– LG company fulfill their responsibility towards various parties of the society. LG company provide different variety of product to consumer at low cost and also provide quality product to the customer. On the other hand the company fulfill the responsibility towards employees. It provide incentives to the employees as well as various facilities. The company pay tax to the government at time and follow the rules and regulations of the government. So we can say that the Indian Corporates fulfilling the social responsibility towards various parties of the society. The main responsibility of various parties in the society is explained are as follows :– If the management and the owner happen to be different the managers have the following responsibility towards the shareholders :- a) To ensure safety of the capital. b) To ensure proper dividend. c) To ensure proper utilization of invested capital. d) To ensure timely payment of dividend. e) To inform about the progress of the organization. Employees is very important for success of the business. Employees is the key of success. If employees are satisfied the enterprise can achieve their goals. The main responsibility towards employees are explained as below :- a) Giving the appropriate Remuneration. b) Giving participation in Management. c) Provide good work atmosphere. d) Giving them a share of profit. e) Provide education and training. f) Provide opportunities for promotion. g) Solve labour problem in time. Consumers are so important for running the Social Responsibility of business towards various parties of the society :– i) Towards Owners :– ii) Towards Employees :– iii) Towards Consumers :– 116 footer

- 11. business. Without consumers business is meaningless. Following are the responsibility of business towards consumers:- a) To provide good quality products at cheap rates. b) To provide after sale services. c) Polite to consumers. d) To solve their problems politely. e) To treate consumers like God. f) To make available goods according to the taste of the consumer. A manager also has a responsibility towards the supplier. If the supplier do not supply the raw material in time so the production will be hindered and the reputation of the organisation will suffer. There are many responsibility towards suppliers are explains as follow :- a) To make timely payments. b) Informing about the taste of consumers. c) Informing about future development plans. d) Give appropriate price of the material. A managers has the following responsibility towards the competing organisation :– a) To encourage mutual cooperation. b) To encourage market research. c) To work jointly for the development of business. A manager’s towards his own self may also considered. They are the following :– a) To earn sufficient profit. b) To earn reputation. c) To enter new market. d) To take interest in research. The people of society have the following expectations from business :– a) To provide opportunities for employment. b) To contributing to the raising of the standard of living. c) To avoid indecent advertisement. d) To avoid polluting the environment. A manager has also responsibility towards the world. The following responsibility is explained as follow :- a) To do business honestly. Ans. Since July 1991, the government iv) Towards Suppliers :– v) Towards Competitors :– vi) Towards Self :– vii) Towards Community :– viii) Towards World :– Q. Explain the brand features of the New Economic Policy? Meaning of New Economic Policy :– 117 INDIAN BUSINESS ENVIRONMENT footer

- 12. has initiated a services of radical changes in its policies relating to industry, trade, finance, foreign investment and fiscal aspects. The objective of the new economic policy is to improve the efficiency of the business mechanism involving multitudes of control, fragmented capacity and reduced competition in the private sector. The thrust of new economic policy is creating a more competitive environment in the economy as a means to improving the productivity and efficiency of the system. The main features of New Economic Policy is :– It is explained by the figure. The new economic policy provides freedom to the enterepreneur to enter any industry, produce any product and each any amount of money. The Liberalisation measures are :- a) Licensing abolished except for 13 industries. b) Limit for foreign equity stake has been hiked to 51 percent. c) Basic telecommunication services opened to private participation, including foreign investments. d) Minimum lending rates for amounts exceeding Rs. 2 Lakh abolished. e) Reforms in custom duties. f) Rupee made fully convertible in current account through the introduction of the Liberalised Exchange Rate Management System. g) Setting up of private banks allowed. h) Private investment allowed in Power Sector. i) Greater thrust on exports to manage balance of Payment. j) CCI abolished, FERA relaned. k) Automatic approval for 100 percent export oriented units and units in export processing zones. Glablisation refers to the process of integration of the world into one huge market. In other words Globalisation means Main features of New Economic Policy :– 1. Liberalisation 2. Privatisation 3. Globalisation 1. Liberalisation :– 2. Globalisation :– Libearlisation Features of New Economic Policy Privatisation Globalisation 118 footer

- 13. integration with the world economy. Glabalisation is the new phenomenon. Now a days every company want to enter to global market. Globalisation manifests itself in many ways. The more important of them are :- An MNC can locate its different operations in different countries on the basis of raw material availability, consumer markets and low cost labour. An MNC locate their business where trade tarriffs and custom barriers are getting lowered, resulting in cheaper and abundant supply of goods. Government are everywhere withdrawing from owning and running business enterprises. Private enterpreneurs are given greater access and freedom to run business units. Skilled labour was considered to the decisive factor in plant location. Modern factories use highly skilled labour which is freely mobile. Where labour is unskilled managements are spending vast sums of money to train workers become skilled in their jobs. The enterpreneur and his unit become central figures in the process of economic growth and development of a nation. Given the right environment he is able to innovate, bring in new products and contribute the nation’s wealth. Privatisation of industries means opening the gates of public sector to private sector. Private sector comes to play significant role in the economic development of the country. Thus tranferring of public sector industries to private sector is called privatisation. The main causes of privatisation is explained are as follows :- 1. Inefficient Public Sector 2. Burden on the Government 3. For promoting Industrial Growth 4. For promoting Glabalisation 5. To solve Financial crisis of Government 1. Increase the efficiency 2. Increase in competition 3. Increase in financial resources of Government Manifestations of Globalisation :– i) Configuring Anywhere in the World :– ii) Lowering of Trade and Tarriff Barriers :– iii) Increasing Trend Towards Privatisation :– iv) Mobility of Skilled Resources :– v) Entrepreneur and his Unit have a Central Economic Role :– 3. Privatisation :– Causes of Privatisation :– Advantages of Privatisation :– 119 INDIAN BUSINESS ENVIRONMENT footer

- 14. 4. Increase in foreign investment 5. Encouragement of New inventions. 6. Reduction in Economic Burden of Government 7. Increase in Industrial Growth Rate 8. Reduction in Political interferences. 1. Increase in Rate of Growth 2. Increase in competitiveness of industrial sector 3. Reduction in Poverty and inequality 4. Fall in Fiscal deficit 5. Control on Prices 6. Development of Small Scale Industries 7. Decline in disequilibrium of balance of payment 8. Favourable to Middle Class 1. Less importance to Agriculture 2. More dependence on foreign debt 3. Dependence of foreign technology 4. More importance to privatisation 5. Problem of unemployment b) To contributes towards international peace. c) To observed rules of international market. d) To help in the development of economically backward countries. A manager should help the govt. in the development of the country by observing these laws. A manager has the following responsibility towards the government. a) To pay tax honesty. b) To help the govt. by establishing new industries. c) To observe rules laid down the government. Evaluation of New Economic Policy Merits :- Demerits :- ix) Towards Government :– 120 footer

- 15. Q. Critically examine the New Industrial Policy ? Main features of New Industrial Policy :– 1. Contraction of Public Sector :– 2. Delicensing :– 3. Abolition of Registration :– 4. Technical Experts :– 5. Foreign Capital :– 6. Encouragement to Industries in Backward Areas :– Ans. Government of India announced its new industrial policy on July 24, 1991. The main aim of the policy is to be liberalise the Indian industrial economy from administrative and legals controls. Its main aim is to increase industrial efficiency to the international level. The main features of New Industrial Policy is explained are as follows :- In new industrial policy only three industries will be reserved for public sector namely atomic mineral, atomic energy and railways. All other areas will be thrown open to the private sector. Under this policy the industrial licensing has been abolished. Only 5 industries which are required to obtain compulsory industrial license. These industries are alcoholic products, tobacco products, aerospace and defence equipments, industrial explosives, hazardous chemicals. All existing registration schemes have been abolished. Only entrepreneurs will have to give only a memorandum of information about new projects and substantial expansion of existing units. There will need no permission for hiring foreign technicians. For these payments, foreign exchange can be easily purchased from reserve bank of India without any restrictions. The limit of foreign capital investment has been raised from 40% to 51% equity. Now a days a country encourage the foreign capital. Now our government is welcoming foreign investment. The government offered special incentives to industries in backward regions, for reducing regional disparities. UNIT – II INDIAN BUSINESS ENVIRONMENT MBA 2nd Semester (DDE) 121 footer

- 16. 7. Freedom for Administrative Controls :- 8. Location of Industries :– 9. Public enterprise Incurring Losses :– 10. Reservation for Small Scale Industries :– 11. New Definition of Micro, Small and Medium Enterprises :– Evaluation of New Industrial Policy :– Expansion preogrammes of new units will be exempted from administrative control. The existing units will be free to produce any commodity on the basics of the license already issued. In cities with populations of less than 10 lakh, location clearance will not be required except those industries where licensing is compulsory. Public enterprise incurring losses will be investigated by the Board for Industrial and Financial. Reconstructions (BIFR). Government will formulate different schemes for sick public sector units. Interest of the workers affected by these schemes will be protected. Under new industrial policy production of 239 items has been reserved for Small Scale Industries. Large industries and medium enterpeises will not be allowed to go in for their production. In new definition both manufacturing and service enterprise are covered in meaning of micro, small and medium enterprise. The investment limit have been fixed. This is explained are as follow :- Based on investment in plant and Machinery. i) Micro Enterprise - upto Rs. 25 Lakh ii) Small Enterprise - above Rs. 25 Lakh and upto Rs. 5 Crore iii) Medium Enterprise - above Rs. 5 Crore and upto Rs. 10 Crore Based on investment in equipments. i) Micro Enterprise - upto Rs. 10 Lakh ii) Small Enterprise - above Rs. 10 Lakh and upto Rs. 2 Crore iii) Medium Enterprise - above Rs. 2 Crore and upto Rs. 5 Crore For providing social security to the Workers National Renewal Fund is set up. This fund provide relief to the workers affected by technological changes, closure of public sector units and privatisation of public sector units. New Industrial Policy is a very liberal policy. Its main objective is to liberalise industry from legal and administrative control. a) Manufacturing Enterprises :– b) Service Enterpirse :– c) Facilities to Labourers :– 122 footer

- 17. Merit of New Industrial Policy :– Shortcoming of New Industrial Policy :– Q. Define New Industrial Licensing Policy ? And critically explain objectives and working of Industrial Licensing Policy ? Introduction :– Objectives of Licensing :– Compulsion for Licensing :– 1. For setting up New Industrial Units :– The main merit of new industrial policy is explained are as follow :- 1. Increase in Production. 2. Increase in Welfare of Workers. 3. Increase in Exports 4. Increase in Competitions. 5. Balance Regional Development. 6. Increase in efficiency of public sector. 7. Provide proper significance to Small Scale Industries. The shortcoming of New Industiral Policy is explained are as follow :– 1. Reduction in the Role of Public Sector. 2. Adverse affect on Small Scale Industries. 3. Increase in Unemployment. 4. Increase in Regional Imbalances. 5. Ignore Social Objectives. 6. Adverse affect on Economic Sovereignity. Ans. The Indian Government established a licensing system in Order to maintain control over industries according to the Industries development and Regulation Act 1951. A license is a written permission granted to an enterprise by the government, according to which the product mentioned therein can be manufactured by the enterprise. The licence also includes many other particulars such as :– a) The name of the product to be produced. b) The place where the factory is to be established. c) Expansion of the enterprise. d) The limit of the production capacity. The main aim of the licensing policy is to regulate the industrial sector. The main aims of the licensing system are :- 1. Encouraging small scale industry. 2. Encouraging new entrepreneurs for setting industries. 3. Regulating location of industrial units. 4. To ensuring balanced regional development. 5. Promoting technological advancements in industries. 6. Development and control of Industrial Investment and production. As per the licensing policy, it is necessary to obtain licence in the following circumstances :– If any industrial unit is to be set 123 INDIAN BUSINESS ENVIRONMENT footer

- 18. up in the category of licensing industries it has to obtain licence under Industries Development and Regulation Act, 1951. Under Industrial Licensing Policy, if any industrial unit which is covered under licensing wants to expand its production capacity then it will have to obtain prior approval under this act. Any Industrial Unit wants to change it location then it will have to take prior approval. An Industrial License is required for projects which are to be located in large cities with a population of more than 10 lakhs. Only after obtaining approval, the location can be changed. An industrial undertaking wants to manufacture an item reserved for small- scale sector it is required to obtain industrial license. The list of items reserved for small scale industries is reviewed from time to time. At this time 239 items were reserved for small scale sector. An existing Industrial Units which were existing before enforcement of this act and are covered under industrial licensing will have to obtain registration under this act. Present position of licensing policy explain are as follows:- According to the New Industrial Policy of 1991, it is necessary to obtain license only in case of 15 industries which are engaged in the field of defence-equipments, luxury goods and hazardous commodities. In the wake of liberalization this number has been reduced to 5. The five industries for which licensing is compulsory are :- a) Alcoholic Products d) Aerospace and defence equipments b) Industrial Explosives e) Tobacco products c) Hazardous Chemicals In order to protect the small scale industries and save them from competition with large industries, the production of certain products was reserved for the small industries. Only 239 items are reserved for small scale industries. Some industries had been resrved for the public sector. These industries could be established in the public sector only and the private sector was not granted licences for the establishment of these industries. Only 3 industries reserve for the public sector such as atomic minerals, atomic energy and railway. In the new industrial policy fo 1991, the limit on holding assets was completely abolished and there is no restrictions on size of large business houses. The new policy lays greater 2. For Expansion :– 3. Location of Industrial Units :– 4. For producing Articles Reserved for Small Scale Industries :– 5. Registration of Existing Industrial Units :– Present Position of Licensing Policy :– 1. Compulsory Licensing :– 2. Protection to Small Industries :– 3. Industries Reserved for Public Sector :– 4. Definition of Large Industrial Houses :– 124 footer

- 19. stress on preventing unfair trade practices rather than on the size of business houses. In 2002 the government abolished MRTP Act. According to the new policy of 1991, No license is required for the expansion of production capacity of MRTP companies. In the present situation, there is no restriction on expansion of production-capacity except five licensed industries. Under Industrial Licensing Policy, industries have to obtain licences for setting up new unit, change location etc. So excessive control discourages the entrepreneurs. Licensing involves conflicting objectives. Like on one hand government wants to increase industrial production in the economy on the other hand government is restricting the activities of industrial units like substantial expansion, production of new articles etc. For obtaining industrial license the entrepreneur has to take approval from various government departments. So all this involves lengthy procedure and many formalities. Licenses are given to such entrepreneurs who have either political links or who can bribe the corrupt officials. Licences are not granted on merit basis. Efficient entreprenurs are ignored. After granting license, authorities do not check whether the business unit is following the provisions of licensing or not. So the basic objective of licensing policy is defeated. Ans. Liberatlisation of private sector. The new economic policy provides freedom to the enterepreneur to enter any industry, produce any product with each any amount of money. The Liberalisation measures are :– a) Licensing abolished except for 13 industries. b) Limit for foreign equity stake has been hiked to 51 percent. c) Basic telecommunication services opened to private participation, including foreign investments. d) Minimum lending rates for amounts exceeding Rs. 2 Lakh abolished. e) Reforms in custom duties. f) Rupee made fully convertible in current account through the introduction of the Liberalised Exchange Rate Management System. g) Setting up of private banks allowed. h) Private investment allowed in Power Sector. i) Greater thrust on exports to manage balance of Payment. 5. Licensing for the Expansion of Production Capacity :– Criticism of Licensing Policy :– 1. Discourages the Entrepreneurs :– 2. Conflicting Objectives :– 3. Lengthy Procedure :– 4. Corruption while Granting Licenses :– 5. Poor Followup :– Q. Write short note on liberalization of private sector. 125 INDIAN BUSINESS ENVIRONMENT footer

- 20. j) CCI abolished, FERA relined. k) Automatic approval for 100 percent export oriented units and units in export processing zones. Ans.Sustainable development will steadily advance over the next 10 years, with six major trends influencing industry world-wide, according to a new Pricewaterhouse Coopers’ report, “Corporate Responsibility: Strategy, Management and Value.” The challenge of creating strategies that meet immediate needs without sacrificing the needs of future generations will be driven by the growing influence of :– global market forces; revisions in corporate governance; high speed innovation; large scale globalisation; evolving societal requirements and communication, the report says: “Sustainable businesses balance their economic interests with the need to be socially and environmentally responsible. The companies that succeed over the long term are those that integrate ethical considerations into company decision-making, and manage on the basis of personal integrity and widely-held organisational values,” said Sunny Misser, Pricewaterhouse Coopers’ global leader of sustainable business solutions. The report identifies the following major trends :– Growing influence of global market forces, rather than government policy. The influence of the markets in decision-making will grow as they reflect rising demand, shrinking supply, and changing patterns of demand for natural resources. Revisions in the financial model used to set corporate and government strategy. The new model will include new scenarios, new risk factors, and a growing number of intangible and non-financial factors. Innovation, particularly in core industries. Changing economic conditions will expand the rate of innovation exponentially to include changes in behaviour, product design, supply chains and geopolitical structure, in addition to technology. Globalisation. International institutions will be responsible for formulating global policies; the role of national or local institutions will be limited to implementation. Evolution, not revolution. Progress toward sustainable development will be largely incremental. Barriers to rapid change will die hard, but specific catalysts may cause spurts of great change. Q. Write short note on trends and issue in corporate management. Ø Ø Ø Ø Ø Ø Ø Ø Ø Ø 126 footer

- 21. Ø Communication. The global media may influence which issues governments and industries focus on and accelerate the speed of changes in policy and behaviour. Misser advises that the business sector needs an elemental approach — integration, action and communication. First, companies must formulate a clear strategy for behaving responsibly and integrate that strategy within their core business operations — like a gene that is encoded in their DNA and copied to each cell in the corporate body. Second, they must adhere to the values and standards they have articulated for themselves. Long-term sustainable performance does not come from proclaiming a code of conduct but from putting it into daily action. And last, they must tell the world clearly what they are doing — both their successes and their challenges. Only then can they close the gap in perceptions, maintain their reputations and act as an example to other organisations. “Sustainability has moved from the fringes of the business world to the top of the agenda for shareholders, employees, regulators, and customers. Any miscalculation of issues related to sustainability can have serious repercussions on how the world judges a company and values its shares,” Misser said. “There is mounting evidence that companies that act in a responsible manner consistently do better in the long run. Research by Pricewaterhouse Coopers shows that more than half of institutional investors and analysts believe that good governance and disclosure about sustainability issues are critical indicators of a company’s value.” Ans. The main problems of small scale industries are related to finance and credit. All kinds of business enterprises require sufficient funds in order to meet their fixed as well as working capital requirements. Finance is one of the critical inputs for growth and development of the micro,small and medium enterprises. They need credit support not only for running the enterprise and operational requirements but also for diversification, modernization/upgradation of facilities, capacity expansion, etc. Inadequate access to credit is a major problem facing micro, small and medium enterprises. Generally, such enterprises operate on tight budgets, often financed through owner’s own contribution, loans from friends and relatives and some bank credit. They are often unable to procure adequate financial resources for the purchase of machinery, equipment and raw materials as well as for meeting day-to-day expenses. This is because, on account of their low goodwill and little fixed investment, they find it difficult to Q. What are the major problems of small scale industries and what major steps are taken by govt. to solve their problem? Problem of finance :– Problem of credit :– 127 INDIAN BUSINESS ENVIRONMENT footer

- 22. borrow at reasonable interest rates. As a result, they have to depend largely on internal resources. In respect of MSMEs, the problem of credit becomes all the more serious whenever any difficult situation occurs such as a large order, rejection of consignment, inordinate delay in payment, etc. Sometimes, they have to close down their operations due to shortage of funds. Also, there is little or no scope for expansion and growth due to dearth of capital. Hence, economies of scale are not available. Provision of finance to the sector is a part of the ‘Priority Sector Lending Policy’ of the banks (both domestic and foreign banks operating in India. For the public and private sector banks, 40% of the net bank credit (NBC) is earmarked for the priority sector. For the foreign banks, 32% of the NBC is earmarked for the priority sector, of which 10% is earmarked for the small scale sector. In the case of foreign banks operating in India which fail to achieve the priority sector lending target or sub-targets, an amount equivalent to the shortfall is required to be deposited with SIDBI for one year at the interest rate of 8 percent per annum. SIDBI has been set up with the mission to empower the Micro, Small and Medium Enterprises (MSME) sector with a view to contributing to the process of economic growth, employment generation and balanced regional development. It is the principal financial institution responsible for promotion, financing and development of the sector. Apart from extending financial assistance to the sector, it coordinates the functions of institutions engaged in similar activities. The four basic objectives of SIDBI for orderly growth of industry in the small scale sector are: Financing Promotion Development Co-ordination SIDBI’s major operations are in the areas of (i) refinance assistance (ii) direct lending and (iii) development and support services. Taking into account the fact that a majority of such enterprises which are at the lower-end of the sector are outside the ambit of institutional finance. Hence, concerted efforts have been made by SIDBI to promote micro finance Recognising the importance of easy and adequate availability of credit for ensuring sustainable growth of the MSME sector, the government has undertaken several measures :– Priority Sector Lending Small Industries Development Bank of India (SIDBI) Ø Ø Ø Ø 128 footer

- 23. across the country to enable the unemployed persons to set up their own ventures. There are more than 100 Micro Finance Institutions (MFIs) developed by SIDBI that are engaged in implementation of its micro finance programme. SIDBI has disbursed about Rs.1700 crore (cumulative) under its programme, benefiting around 50 lakh beneficiaries. At the State level, State Financial Corporations (SFCs) along with the State Industrial Development Corporations (SIDCs) are the main sources of long- term finance for the sector. State Financial Corporations, the state-level institutions have played an important role in the development of small and medium enterprises in their respective states with the main objectives of financing and promoting these enterprises for achieving balanced regional growth, catalyse investment, generate employment and widen the ownership base of industry. Credit Guarantee Cover Fund Scheme for Small Industries was launched jointly by the Government of India and SIDBI (on a 4:1 contribution basis) in August 2000, with a view to ensure greater flow of credit to the sector without collateral security. It picked up during the last two years of the Tenth Plan and till the end of March 2007, 68062 proposals were approved and guarantee covers for Rs 1705 crore were issued. up during the last two years of the Tenth Plan and till the end of March 2007, 68062 proposals were approved and guarantee covers for Rs 1705 crore were issued. Policy Package for Stepping up Credit to Small and Medium Enterprises (SMEs), was launched with the objective of doubling the flow of credit to this sector within a period of five years. The measures in the policy package, inter alia, include banks to achieve a minimum 20% year-on-year growth in credit to the MSME sector and cover on an average at least 5 new MSMEs at each of their semi-urban/urban branches per year Ans. Since the early 1990s, privatisation, in its many guises, has become a cornerstone of economic reform strategies across the world Increasingly, however, serious flaws are perceived to be accompanying the privatisation model, particularly when it comes to the delivery of services which have traditionally been provided by the state such as water, electricity, education and health. Social priorities have been found to conflict with those of private enterprise. Answerable to shareholders, private firms are rarely interested in delivery to those on low incomes who cannot afford to pay. Rather than simply reducing the role of the ineffective state, privatisation has increasingly placed additional and new demands on the public sector, especially in the monitoring of, and remedying of, private-sector performance. While empirical research often finds in favour of the private sector, research methods are typically skewed against the public sector by, for Q. Explain in brief that private sector reforms leads to privatization. Introduction :– 129 INDIAN BUSINESS ENVIRONMENT footer

- 24. example, using such indicators as profit levels to show that private firms perform better than state-run alternatives. Furthermore there are a growing number of cases of effective state-led service providers, demonstrating that ownership is not the defining determinant of enterprise performance. The phenomenal growth of private sector of India can be attributed to political will, financial reforms, usage of more advanced technology, young and large English speaking working class. The 7-8 % of annual GDP growth rate India is the one of the highest growth rate in the world. The last 15 years witnessed a phenomenal rise of the growth of private sector in India. The opening up of Indian economy has led to free inflow of foreign direct investment (FDI) along with modern cutting edge technology, which propelled India’s economic growth. Previously, the Indian market were ruled by the government enterprises but the scene in Indian market changed as soon as the markets were opened for investments. This saw the rise of the Indian private companies which prioritized customer’s need and speedy service. This further fueled competition amongst same industry players and even in government organizations. Further, the government of India also divested some of its enterprises to ensure smooth operation of these companies which was otherwise were loss making. It also went further and forged joint venture private Indian companies, especially in sectors like, telecommunication, petroleum, housing and infrastructure. This inculcated healthy competition and benefited the end consumers, since the cost of service or products come down substantially. B grade private Indian companies are also offering lucrative and competitively priced products or service, whose quality is at par with A grade companies. Big players of Indian markets have been forced to lower their price bands to remain alive in the competition. Further, these big private Indian companies are offering mouth watering benefits in the form of gifts, rebates and even holding lucky draws to stay ahead in the race of ‘market supremacy’. Gone are the days when ‘brand loyalty, accounted for big customer base. Today, general Indian customers are trendy, flexible and are extremely flexible with their choice. Steady growth of private sector has sent a sense of urgency and insecurity amongst main market players. Defensive methods of protection of Brands against competitors are becoming popular. Legal instruments like patents, trademarks, industrial designs and copyrights filing has increased many fold and so is counter claim and litigation. Further, Mergers and Acquisitions, collaborations and licensing has become a popular amongst private Indian companies. The best thing that has happened to the overall Indian market with the growth of private sector is that it has helped to shed bureaucracy and lengthy official process and supplemented it by customer eccentric service, good work ethics, professionalism and transparency of accounts. Growth of private sector in India 130 footer

- 25. Some positive effect of the growth of private sector in India are as follows :– Manufacturing registered 11.9% growth The passenger vehicles sector grew by 11.61% during April-May 2007 Electricity, gas & water supply performed well and recorded an impressive growth rate of 8.3% Construction growth rate rose to 10.7% Trade, hotels, transport and communication registered a growth rate of 12% Financing, insurance, real estate and business services recorded an impressive growth rate of at 11% during the 1st quarter of this fiscal Exports grew by 18.11% during the 1st quarter of 2007-2008 and the imports shoot up by 34.30% during the same period The food sector is estimated to be of US$ 200 billion and it is expected to grow to $310 billion by 2015 Merchandise Exports recorded strong growth Ans. Industrial Sickness is a Universal Phenomenon. It is a major problem of all industries in the world whether it is developed or developing countries. It is a serious matter of the countries. A sick unit is one which is not healthy. To an industrialist, it is a unit which is making losses. To an investor it is one which skips dividends. To a banker, it is one which is not repaying its loan or interest. “A sick unit is that unit which fails to generate internal surplus on a continuing basis and depends for its survival on frequent infusion of external funds. “A sick unit is that which has incurred cash loss for previous year and is likely to incur losses for the current year as well as in following year and the unit has an imbalance in its financial structure such as current ratio is even less than 1:1 and there is a worsening trend in debt equity ratio. Industrial units born sick are those which are destined for disaster right from their conception due to various causes. e.g Lack of experience of promoters, Lack of funds, Lack of good location, Wrong plant layout. Ø Ø Ø Ø Ø Ø Ø Ø Ø Q. Short note on Industrial Sickness. Meaning of Industrial Sickness :– Definition of Industrial Sickness :– Sickness are two types, namely:- 1. Born Sickness 2. Achieved Sickness 1. Born Sickness: - Acc. to State Bank of India, Acc. to Reserve Bank of India, 131 INDIAN BUSINESS ENVIRONMENT footer

- 26. 2. Achieved Sickness:- Causes of Industrial Sickness :– Steps taken by the Govt. for Sickness :– Q. Short note on MRTP Act and SICA Establishment of the Competition Commission :– Industries which achieve sickness are those which fail after becoming operational due to internal causes. e.g Bad Management, Poor inventory management, Poor labour managenment. There are many causes for becoming sick units. The main reasons of Industrial sickness is explained are as follows :– i) Management Problems ii) Financial Problems iii) Labour Problems iv) Technological Factors v) Personal Wasteful Expenditure vi) Faulty Demand Forecasting vii) Government Policy viii) Power Cuts ix) Shortage of Raw Material x) Infrastructure Problems i) Takeover by Management ii) Setting up of Industrial Investment Bank of India iii) Amalgamation with healthy units iv) Diversification v) Research and Development vi) Soft Loans for Sick Units vii) Periodical Review viii) Avoid Excessive investment in Unproductive Capital Assets ix) Strick Penalties to persons responsible for sick units Ans. MRTP Act stands for Monopolies and Restrictive Trade Practices Act, 1969. The MRTP Act has been replaced by the Competition Act 2002 on the recommendations of the SVS Raghvan Committee. With the coming into effect of the competition act 2002, the Monopolies and Restrictive Trade Practices (MRTP) Act 1969 was repealed and the Monopolies and Restrictive Trade Practices Commission was dissolved. The MRTP Act applies to the whole of India except the state of Jammu and Kashmir. The Act provides for the establishment of Competition Commission of India consisting of a chairman and 2-10 members to be appointed by the Central Government and having a term of five years. There is also the provision for the appointment of a Director-General to assist the commission. The basic duties of the commission as provided in the art are :- 132 footer

- 27. a) To eliminate practices have adverse impact on competition. b) To promote and sustain competition. c) To protect the interest of customers. The Act prohibits persons and enterprises from entering into any agreement which has adverse impact on competition in any area of production, supply, distribution, storage, acquisition or control of goods or provision of services in the country. The act prohibits the following agreements as these have anti-competitive effects :- 1. Decision taken by an association of persons or enterprises. 2. Tie in arrangement. 3. Refusal to deal. 4. Excessive supply arrangements. 5. Resale price maintanance. The commission has following powers which are explained as follows :– a) Making enquiry and passing appropriate orders in matters related to restrictive trade practices and unfair trade practices. b) Making enquiry into monopolist trade practices and submitting report to the Central Government. c) The power of entry, search and seizure. d) Granting of temporary injunctions. e) Monitors the enforcement of its orders. f) The power to amend or revoke any order passed by it SICA 1985 was a special legislation enacted in public interest with the twin objects of securing the timely detection of sick and potentially sick companies and speedy determination and enforcement of remedial measures. But some companies perceived SICA as an official exit route, thereby resulting into losses to creditors and increased NPA’s in the banking sector SICA, 1985, was repealed by sick industrial companies (special provisions) Repeal Act, 2003. Many processions of SICA have been incorporated in chapter VIA (Section 424A-424L) is a considerably diluted form. The article below is a section wise Comparison between old provisions of SICA, 1985 and new provisions in Companies Act, 1956 with explanatory remarks on it, which indicates that the new Act has made an attempt to remove the bottlenecks and curb the practice of turning an operationally fit company into a sick unit. The objectives of this Act (SICA) as incorporated in its preamble, emphasises the following points :– The SICA had been enacted in the public interest to deal with the problems of industrial sickness with regard to the crucial sectors where public money is locked up. Prohibition of Anti Competitive Agreements :– Powers of the Commission :– SICA :– Ø 133 INDIAN BUSINESS ENVIRONMENT footer

- 28. It contains special provisions for timely detection of sick and potentially sick industrial companies, speedy determination and enforcement of preventive, remedial and other measures with respect to such companies. Those measures are to be taken by a body of experts. The measures are mainly (a) Legal b) Financial restructuring (c) Managerial Ans. – “An Industrial disputes is any dispute or difference between employees and employees, or between employees and employers, or between employers and employers, which is connected with the employment or non-employment, or the terms of employment or with the conditions of work of any person.” The industrial disputes has various forms such as strikes, lockouts, gherao and picketing and boycott. The main characteristic of Industrial Disputes is explained as below :- 1. The dispute could be between employer-employer, employee-employee or employer-employee. 2. The dispute must pertain to some work-related issue. 3. There should be difference or dispute. For example, labour demands something, management does not grant the same. 4. Dispute between one or two workmen and their employers is not an industrial dispute. It must be raised by a group or class of workmen. The various forms of industrial disputes may be stated :- Strike is a collective stoppage of work by a group of workers for pressuring their employers to accept certain demands. Lockouts may be defined as the closing of a place of an employment or the suspension of work or the refusal of an employer to continue to employ any number of persons employed by him. Gherao means to surround. In this method a group of workers Ø Ø Q. Short note on Industrial Disputes Act. Meaning of Industrial Disputes : Forms of Industrial Disputes :– 1. Strikes 3. Gherao 2. Lockouts 4. Picketing and Boycott 1. Strike :– 2. Lockouts :– 3. Gherao :– Strikes Forms of Industrial Disputes Lockouts Gheroa Picketing and Boycott 134 footer

- 29. initiate collective action aimed at preventing members of the management from leaving the office. When picketing workers display banners prevent others from the entering the place of work and persuade others to join the strike. There are many causes of Industrial disputes. The main causes state below :– 1. Employment 2. Administration related issues 3. Institutional Causes 4. Political Causes 5. Recognition 6. Social Causes Employment is main cause of the industrial disputes. It includes disputes over wages, allowances, bonus, benefits, working conditions, change in method of production, method of job evaluation etc. Administration-related issues is the another cause of the industrial disputes. It includes ill treatment, undeserved punishment and verbal abuse etc. It includes recognition of unions, membership of unions, scope of collective bargaining, unfair practices etc. It is also causes of industrial disputes. It is main cause of industrial disputes political leaders have used unions as powerful weapons to build tensions inside the plant industry. This disputes arises when employers failed to recognise a union as a bargaining agent. Social cause is also cause which affect the industry or firm. It is very important cause which is create the problem for firm. 4. Picketing and Boycott :– Causes of Industrial Disutes :– 1. Employment :– 2. Administration-related Issues :– 3. Institutional Causes :– 4. Political Causes :– 5. Recognitions :– 6. Social Causes :– Employment Related Issues Institutional Causes Social Causes Recognition Political Causes Causes of Industrial Disputes Administration Causes 135 INDIAN BUSINESS ENVIRONMENT footer

- 30. Q. What are the major source of finance for industrial sector in India? Are those adequate. A) Industrial Finance Corporation of India :– Ans. Following are the main financial institutions which provide finance for industrial sector in India. A) Industrial Finance Corporate of India (IFCI) B) Industrial Credit and Investment Corporation of India (ICICI) C) Industrial Development Bank of India (IDBI) Industrial Finance Corporation of India was established on July 1, 1948 under the Industrial Finance Corporation Act. This corporator gives short term and logn term loans to both public and private sector units. At the time of establishment its authorised capital was of Rs. 10 crores divided into equal parts of Rs. 5000 each. It’s shares were purchased by the Central Government, LIC, Reserve Bank of India and various institutions of public sector. Shares purchased by the government of India and Reserve Bank of India well transfered to the Industrial Development Bank of India when it was established in 1964. Presently 50% of the shrares of IFCI are with IDBI. This corporation gives financial assistance in various forms :- i) Gives loans for a maximum period of 25 years. ii) Gives loans in foreign exchange. Main Financial Institutions IFCI IDBI ICICI UNIT – III INDIAN BUSINESS ENVIRONMENT MBA 2nd Semester (DDE) 136 footer

- 31. iii) Buys stocks and shares. iv) Underwrites shares and debentures. v) Gives security for the loan raised by an industry in the open market. vi) Gives security regarding payments for the import of capital goods. 1. The corporation is finding it difficult to recover the loans. 2. Its administration is inefficient. 3. Underwriting job of the corporation has been highly unsatisfactory. 4. The corporation has failed in supervising the industries taking loans. 5. Less assistance has been offered to basic and capital goods industries. Industrial Credit and Investment Corporation was established on January 5, 1955. The main objective of the corporation are to give loans for the development and modernisation of private sector industries. The corporation is managed by the Board of Directors. There are presently 14 members of this Board. ICICI has been very successful in providing loans of large amount to industries. It has provided loans in foreign exchange. 1. To purchase new shares and debentures of the private sector. 2. Underwrite shares and debentures. 3. To give technical assistance to industries. 4. To guarantee the loans. 5. To give managerial assistance to industries. 6. To give loans for a period upto 15 years. 7. To help modernisation and expansion of Industries. 8. To give foreign exchange for the import of capital goods. Industrial Development Bank was established in 1964. This development bank was started by the government of India as a subsidiary of Reserve Bank of India. On February 16, 1976 it became independent of the Reserve bank of India. The bank is managed by the board of Directors Comprising of 24 members. Of these the chairman is appointed by the Central Government and the Vice-Chairman by the Reserve Bank. 18 other members of the board are also appointed by the Central Government and remaining 4 members are appointed by shareholders. Main objective of IDBI are as follows :– a) To give loans both private and public undertaking. b) To invest in shares of Industrial companies. c) Underwrites the shares. d) To provide technicaland managerial assistance to industries. Criticism :– B) Industrial Credit and Investment Corporation of India (ICICI) :– Functions of ICICI :– C) Industrial Development Bank of India (IDBI) :– Objective :– 137 INDIAN BUSINESS ENVIRONMENT footer

- 32. e) To promote export-oriented industries and import substitution industries. f) To encourage growth of small and medium sized industries. g) To promote industrial development of backward areas. 1. It has not given much emphasis on provide technical and managerial assistance. 2. Its role in underwriting shares and debentures of industrial units is not very encouraging. 3. IDBI has sanctioned most of its loans to large scale industries. Small units have not gained much from this bank. In conclusion we can say that these institution provide finance for Industrial Sector. These institution are not adequate for industrial sector. These institution performing a significant role in promoting industrial development, but these institution is not adequate. So for the development of the industrial sectors new corporations are opened for promoting industrial sectors Ans. The market where existing securities are traded is referred as stock market. It is also called the secondary market. In stock market purchases and sale of securities whether of government or semi government bodies or other public bodies and also shares and debentures issued by joint stock companies are effected. The growth or health of the economy is dependent on the stock market. Stock market is very essential for the economy. Because it performs several economic functions and renders invalueable services to the investors, companies and to the economy as a whole. They may be explained as follows :- The stock exchange provide liquidity to securities. The securities can be converted into cash at any time according to the discretion of the investor by selling them at listed prices. They also facilitates buying and selling of securities at listed prices by providing continuously marketability to the investors. Stock exchange ensure safety of funds invested because they have to function under strict rules and regulations and the bye-laws, are meant to ensure safety of investible funds. The changing business conditions in the economy are immediately reflected on the stock exchange. Booms and Criticism :– Conclusion :– Q. Why are stock exchanges essential ? What steps have been taken to regulate stock exchange in India? Also explain the main reasons of fluctuations in the Stock Market in India ? Introduction :– 1. Liquidity and Marketability of Securities :– 2. Safety of Funds :– 3. Reflection of Business Cycle :– 138 footer

- 33. depressions can be identified through the dealings on the stock exchanges. A stock market helps in the marketing of new issues. If the new issues are listed, they are readily acceptable to the public. The performance of the company is reflected on the prices quoted in the stock market. The stock exchange helps the company to improve their performance. Stock exchange supplies securities of different kinds with different maturities and yields. It enables the investors to diversity their risks by wider portfolio investment. Stock exchange mobilise the savings of the public and promote investment through capital formation. The stock market guides the investors in choosing securities by supplying the daily quotation of the listed dealings on the stock exchange. There are certain factors which influence the stock market. These are explained are as follow :- Interest rate is affected by the stock exchange. If interest rate high then stock market low and vis-a-visa. Inflation is most important factor which influence the stock market. Political condition also affected the stock market. If the government of the country is not stable so the stock market fluctuates. Exchange rate is that rate at which one unit of currency of a country can be exchanged for the number of units of current of another country. It is also affected stock exchange. Speculation is also causes of fluctuation is the stock market. Economic conditions such as protection policy, war or peace, fiscal policy etc. which prevailing in the country is also affected the stock market. For the effective functioning of secondary market, proper control must be excercised. At present control is exercised through the following three important processes :– i) Recognition of Stock Exchange. ii) Listing of Securities. 4. Marketing of New Issues :– 5. Motivation for Improved Performance :– 6. Diversity the Risk :– 7. Promotion of Investment :– 8. Guide the investors :– Main Reasons of Fluctuations in the Stock Market :– 1. Interest Rate :– 2. Inflation :– 3. Political Conditions :– 4. Exchange Rate :– 5. Speculation :– 6. Economic Conditions :– Steps taken to Regulate Stock Exchange :– 139 INDIAN BUSINESS ENVIRONMENT footer

- 34. iii) Registration of brokers. This is explained are as follow :– The stock exchange in India have to be recognised by the Central Government under SCRA and SEBI, and they have to comply with the provisions of the SCRA and SEBI, and also the bye-laws and regulations duly approved by the government. Any stock exchange which needs recognition under SEBI Act has to submit an application in the prescribed manner to the Central Government. The application must be accompanied by the following documents :- a) A copy of the bye-laws of the stock exchange for its operation. b) A copy of rules relating to its constitution, governing body, powers and duties of the office bearers, the admission procedure etc. If any stock exchange intends to renew its recognition it must once again make an application to the control government in the aforesaid manner three months before the expiry of the period of recognition. The Central Government may withdraw the recognition granted to any stock exchange at any time if it opines that the recognition granted is against the interest of trade or public interest. Listing of securities means that the securities are admitted for trading on a recognised stock exchange. Securities become eligible for trading only through listing. Listing is compulsory for those companies which intend to offer shares/debentures to the public for subscription by means of issuing a prospectus. The companies which have got there shares/debentures listed in one or more recognised stock exchanges must submit themselves to the various regulatory must submit themselves to the various regulatory measures of the stock exchange concerns as well as the SEBI. They must maintain necessary books, documents etc. and disclose any information which the stock exchange may call for. A company which desires its securities to be listed on a recognised stock exchange must satisfy the following conditions :- 1. At least 60% of each class of securities issued must be offered to the public for the subscription and the minimum issued capital should be Rs. 3 crores. 2. The minimum public offer for subscription must be at least 25% of each issue and it must be offered through advertisement in newspapers at least for a period of 2 days. 3. A company having more than Rs. 5 crore paid up capital must list its securities or more than the one stock exchange. 1. Recognition of Stock Exchange :– 2. Listing of Securities :– Criteria for Listing :– 140 footer

- 35. 4. The existing companies must adhere to the ceiling in expenditure of public issues. 5. A certificate to the effect that shares from promoter’s quota are not sold or anferred for a period of 3 years must be submitted. 6. The company must pay interest one the excess application money received at the rates ranging between 4% and 15% depending on the delay beyond 10 weeks from the date of closure of the subscription list. A broker is a commission agent who transact the business in securities on behalf of his clients who are non- members of stock exchange. A non-member can purchase and sell securities only through a broker who is a member of the stock exchange. To deal in securities on recognised stock exchanges, the broker should register his name as a broker with the SEBI. A stock broker must posses the following qualifications to register as a broker :- a) He must be an Indian Citizen with 21 years of age. b) He should not have been convicted for any fraud etc. c) He should neither be a bankrupt nor compounded with creditors. d) He should not have engaged in any other business other than that of a broaker in securities. e) He should have completed 12 standard examination. f) He should not be a defaulter of any stock exchange. An individual, corportae and institutional members can also become brokers. Brokers will be selected by the selection committee of the stock exchange on the basis of their qualifications, experience, financial status, their performance in the written test interview etc. A stock broker is the main prayers in the stock market. They may act in different capacities as a principal, as an agent, as a speculator and so on. Hence it is essential to study the different kinds of brokers and their assistants. Ans. The Securities and Exchange Board of India was set up on April 12, 1988. The primary objective of the SEBI is to promote healthy and orderly growth of the securities market and secure investor protection. For this purpose SEBI monitors the activities is not only stock exchange but also merchant bankers. The SEBI Act provides for the establishment of a Statutory Board consisting of six members. The chairman and two members are to be appointed by the Central Government, one member to be appointed by the Reserve Bank and two members having experience of securities market to be appointed by the Central Government. SEBI has divided its activities into four Operational departments namely Issue Management and Intermediaries Departments, Primary Market 3. Registration of Stock Brokers :– Q. Short note on SEBI. Introduction :– th 141 INDIAN BUSINESS ENVIRONMENT footer

- 36. Department, Secondary Market Department and Institutional Department each headed by an Executive Director. SEBI performs various functions. The function of the SEBI are explained as follows :– a) Regulatory Function b) Development Function i) Regulation of stock exchange and self regulatory organisation. ii) Prohibition of fraud and unfair trade practices. iii) Prohibition of insider trading in securities. iv) Regulating take over of companies. v) Registration and regulation of stock brokers, sub-broker, merchant bankers, underwriters, portfolio managers etc. i) Promoting investors education. ii) Promoting self regulatory organisations. iii) Promotion of fair practices. iv) Training of intermediaries. v) Conducting Research and published information. The SEBI has following powers which explained are as follows :- 1. Power to control and Regulate stock exchange. Functions of the SEBI :– a) Regulatory Function :– b) Development Function :– Powers of the SEBI :– Function of SEBI Regulatory Function Development Function 142 footer

- 37. 2. Power to call periodical returns from recognised stock exchanges. 3. Power to grant approval to bye laws of recognised stock exchange. 4. Power to compel listing of securities by public companies. 5. Power to call any information from recognised stock exchange. 6. Power to levy fees and other charges. 7. Power to grant registration to market intermediaries Ans. In India Indian Banking Structure includes :– The banking sector is very important sector of the country. Through the banking sectors a country can develop their economy. The banking sectors provide loans to industries for the development of the country. Q. Discuss the major problems being faced by Indian Banking Sector. Or Explain the challenges faced by the public sector banks in India. Also specify the steps taken by them in this connection. Banking Structure in India Central Bank or RBI Commercial Bank Cooperative Bank Development Bank Public Sector Bank Private Sector Bank Foreign Bank State Bank of India Nationalised Bank Regional Rural Bank Rural Bank Urban Bank 143 INDIAN BUSINESS ENVIRONMENT footer