03.09.2010, NEWSWIRE, Issue 134

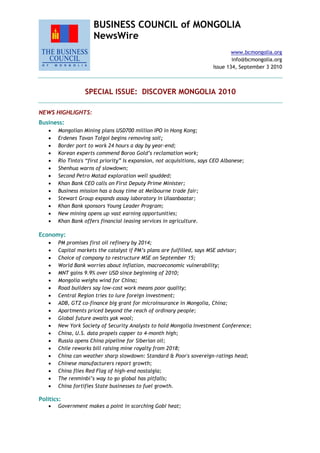

- 1. BUSINESS COUNCIL of MONGOLIA NewsWire www.bcmongolia.org info@bcmongolia.org Issue 134, September 3 2010 SPECIAL ISSUE: DISCOVER MONGOLIA 2010 NEWS HIGHLIGHTS: Business: Mongolian Mining plans USD700 million IPO in Hong Kong; Erdenes Tavan Tolgoi begins removing soil; Border port to work 24 hours a day by year-end; Korean experts commend Boroo Gold’s reclamation work; Rio Tinto's “first priority” Is expansion, not acquisitions, says CEO Albanese; Shenhua warns of slowdown; Second Petro Matad exploration well spudded; Khan Bank CEO calls on First Deputy Prime Minister; Business mission has a busy time at Melbourne trade fair; Stewart Group expands assay laboratory in Ulaanbaatar; Khan Bank sponsors Young Leader Program; New mining opens up vast earning opportunities; Khan Bank offers financial leasing services in agriculture. Economy: PM promises first oil refinery by 2014; Capital markets the catalyst if PM’s plans are fulfilled, says MSE advisor; Choice of company to restructure MSE on September 15; World Bank worries about inflation, macroeconomic vulnerability; MNT gains 9.9% over USD since beginning of 2010; Mongolia weighs wind for China; Road builders say low-cost work means poor quality; Central Region tries to lure foreign investment; ADB, GTZ co-finance big grant for microinsurance in Mongolia, China; Apartments priced beyond the reach of ordinary people; Global future awaits yak wool; New York Society of Security Analysts to hold Mongolia Investment Conference; China, U.S. data propels copper to 4-month high; Russia opens China pipeline for Siberian oil; Chile reworks bill raising mine royalty from 2018; China can weather sharp slowdown: Standard & Poor's sovereign-ratings head; Chinese manufacturers report growth; China flies Red Flag of high-end nostalgia; The renminbi’s way to go global has pitfalls; China fortifies State businesses to fuel growth. Politics: Government makes a point in scorching Gobi heat;

- 2. Time for a change in climate research; Sub-Committee head says they are not bound by any time limit to answer letters; Citizen’s Chamber nominated for German Prize; President teaches a class as new school year begins; New bird disease identified in Ulaanbaatar poultry farm; Foreigners can now enter China at checkpoint in Khovd; Pedestrian obstacles to go. *Click on titles above to link to articles. BUSINESS MONGOLIAN MINING PLANS USD700 MILLION IPO IN HONG KONG Mongolian Mining Corp. is selling about USD700 million of stock in an initial public offering, the first by a Mongolian company in Hong Kong, according to a term sheet sent to investors by the sale‘s arrangers. The company, formerly known as Energy Resources, plans to price its shares on September 24 and start trading on October 5, the term sheet said. Citigroup Inc. and JPMorgan Chase & Co. are managing the IPO. New shares account for 75 percent of the initial sale, which represents 20 percent of the company‘s enlarged share capital. After the listing, the company may exercise an option to sell additional shares equal to 15 percent of the offering. Proceeds of the sale will be used to develop mines, fund transport infrastructure projects and acquire companies with mining rights, according to the term sheet. The underwriters will receive investors‘ orders from September 20 to September 24. Controlling shareholders will be prohibited from selling stock in the 12 months following the IPO, while other major shareholders are subject to a lockup period of 6 months. No company based in Mongolia is currently listed in Hong Kong. The IPO would come after Moscow- based United Co. Rusal in January became the first Russian company to go public in the territory. Source: Bloomberg.com ERDENES TAVAN TOLGOI BEGINS REMOVING SOIL The draft text of the Open International Tender to select the Tavan Tolgoi mine operator is almost final and the advertisement will be published soon. According to the Government‘s Press Office, Erdenes Tavan Tolgoi, formed as a subsidiary of the State-owned Erdenes MGL to be responsible for all work related to the coal deposit, has assembled a field team and hopes to remove soil 12-16 meters deep before November, according to Mr. B.Enebish, its General Director. The Government and the State Property Committee are working on the tender notice inviting bids to operate the deposit under contract with Erdenes Tavan Tolgoi. Among the requirements listed in the tender are: Ability to annually mine 15 million tons of coal; Financial capacity, and/or capacity to access funds from reliable financial organizations; Experience in managing and operating coal mines; Capacity to use modern and progressive technology and techniques; and Application of international standards to protect the environment and to post-mining reclamation. Source: MongolianPortfolio.com, News.mn BORDER PORT TO WORK 24 HOURS A DAY BY YEAR-END Oyu Tolgoi LLC will build 180 new apartments, and enlarge and improve the energy, heating, sewage and drinking water supply system at Gashuun Sukhait in Umnugobi aimag before the end of the year as part of the planned expansion and extension of services at the border point. Once these are in place, the port will start working for 24 hours a day. Announcing this to media, the Chief of the Government Office, Mr. Ch.Khurelbaatar, said the workload at the port has increased dramatically in recent weeks. Apart from the rise in coal export, every day some 50 trucks are bringing mining and construction equipment for the Oyu Tolgoi project from China. Source: Ardiin Erkh

- 3. KOREAN EXPERTS COMMEND BOROO GOLD‟S RECLAMATION WORK At the request of the Government of Mongolia, the South Korean Government has sent an expert team here to assess the damage to the environment from mining and to establish an information database. The team has been very impressed by its visit to the reclamation program of Boroo Gold LLC in Selenge province and has indicated this could well be a model for such work elsewhere in the country. Source: Undesnii Shuudan RIO TINTO‟S “FIRST PRIORITY” IS EXPANSION, NOT ACQUISITIONS, SAYS CEO ALBANESE Rio Tinto Group, the world‘s third-largest mining company, will give priority to boosting output by expanding its own operations rather than through acquisitions, Chief Executive Officer Tom Albanese has said. ―I‘d like to see higher copper production, that‘s why we are investing with‖ Ivanhoe Mines Ltd. in the Oyu Tolgoi project, Mr. Albanese said in an interview in Brisbane. ―We have other projects around the world. If managers can develop an attractive investment proposition to expand in this market, we‘ll certainly look at it. Our first priority is organic growth.‖ Growth plans at Rio, BHP Billiton Ltd. and rivals may help to boost industry spending worldwide next year to a record USD113 billion, Sanford C. Bernstein & Co. said last month. Mr. Albanese has pledged to increase spending by 50 percent next year to USD13 billion as he expands coal, copper and iron ore output to meet rebounding global growth. ―I‘ve just been through post-earnings meetings with a range of shareholders around the world and I think they recognize the strength of those organic growth opportunities,‖ he said. ―They want to know details of what those are, but there is certainly recognition of the importance of focusing on organic growth.‖ Source: Bloomberg.com SHENHUA WARNS OF SLOWDOWN China Shenhua Energy Co., the country's largest listed coal producer by output, has said it faces uncertainties during the second half of this year, as China's economic growth is likely to decelerate. "It is expected that major coal-consuming industries will still post growth in the second half of the year," the company said in a prepared statement. "However, given the impact of factors such as China's macro adjustment and control, energy-saving and emission reduction policies, as well as the relatively higher base in the second half of last year, there will be a slowdown in the growth rate as compared with that in the first half of the year." Shenhua also said growth in coal demand is expected to decline compared with the year's first half. The Beijing-based company, which also operates railways, ports and power plants, said coal output rose 3.2% to 109.2 million metric tons, accounting for 48% of the company's full-year production target of 229 million tons. Coal sales rose 12% to 137.4 million tons, and the average selling price of the company's coal increased 8.4%. Source: The Wall Street Journal Asia SECOND PETRO MATAD EXPLORATION WELL SPUDDED Petro Matad has announced that the Davsan Tolgoi-2 exploration well was spudded on August 28. The well is being drilled vertically to an estimated target depth of approximately 1,300 meters and operations are expected to take approximately 25 days. DT-2 is the second exploration well to be spudded as part of Petro Matad's program to drill three wells in 2010 on its Production Sharing Contract on Block XX in Eastern Mongolia. Source: Petro Matad Limited KHAN BANK CEO CALLS ON FIRST DEPUTY PRIME MINISTER Mr. Simon Morris, who joined Khan Bank as Chief Executive Officer about a month ago, called on First Deputy Prime Minister N.Altankhuyag earlier this week to discuss topical issues. Mr. Altankhuyag said the banking sector has to be restructured in anticipation of the promised mining boom and this requires united action and a sense of responsibility. Mr. Morris said even in the short time he has been here, he has been struck by the Government‘s, as also the people‘s, determination to develop the economy with help from the abundant natural resources, and promised his bank will fulfill all expectations. Source: Montsame BUSINESS MISSION HAS A BUSY TIME AT MELBOURNE TRADE FAIR A 14-member Mongolian Business Mission is back home after attending the Franchising & Business

- 4. Opportunities trade fair and a special workshop in Melbourne on August 19-24. The event was co- hosted by the Business Council of Mongolia and Saki Partners, a BCM member in Australia. Among those the mission met outside the fair were Mrs. Green Yang, Senior Export Advisor of Austrade, and Mr. John Downes, Director of Business Development Center. The high point of the visit was the full-day workshop on franchising. After welcome addresses from Mr. Nigel Finch of Sydney University and Mr. Rod Young of DC Strategy, the participants heard two lectures, ―Introduction to Franchising‖ and ―International and Master Franchising‖. This was followed by five franchiser presentations, before and after lunch. A walking tour of local retail franchises brought the event to an end, with some final concluding words at DC Strategy. The visitors were quite active making business contacts and some of them, such as Khurai, Xacbank and Europharma, have reported they held encouraging initial talks with Australian Hooblestone, the National Australian Bank, and The Natural Source respectively. BCM is working on arranging a follow-up event in Ulaanbaatar in mid-2011. Source: BCM Newswire STEWART GROUP EXPANDS ASSAY LABORATORY IN ULAANBAATAR Stewart Group, the international inspection, analysis and assay group has expanded its operations in Mongolia. A new fire assay laboratory, with state-of-the-art equipment, has been added to the Stewart Mongolia LLC facility in Ulaanbaatar, which can now provide a significantly broader range of services to the key mining regions in the country. The expansion is the second major development at the Mongolia facility in 12 months, after it became the first internationally owned laboratory in the country to achieve ISO/IEC 17025:2009 accreditation. In addition to analysis of gold, silver and platinum group metals, the Mongolian site can conduct multi-elemental analysis, coal and solid fuel analysis, trace element analysis by ICPAES, and sample preparation of solid fuel and geochemical materials. Source: Commodities Now KHAN BANK SPONSORS YOUNG LEADER PROGRAM Khan Bank Foundation is sponsoring, for the fourth consecutive year, the Young Leader Program of Zorig Foundation, aimed at developing future leaders of Mongolia. Applications are now being received from young people for enrolment and 20 persons between 22 and 25 will be selected to participate in an 8-month program designed to improve skills in communication, analysis, project development and implementation, as also to nurture critical thinking and foster team spirit. Some 140 alumni of the program are employed in various social and economic sectors in managerial positions. Source: Khan Bank, Zorig Foundation NEW MINING OPENS UP VAST EARNING OPPORTUNITIES Most people seem unaware of the comparatively high salary that Mongolians working in Oyu Tolgoi and Ukhaa Khudag earn. An employee of Oyu Tolgoi said their average monthly salary is MNT1 million, while Mr. S.Odjargal, President of MCS Group which operates in Ukhaa Khudag, has said, ―Our workers normally get around MNT 890,000 per month, apart from free accommodation and meals.‖ Workers at Koje Govi LLC, owned by the French Areva Group, also make similar amounts. The claim of MP Ya. Batsuuri that once mining takes off and the Sainshand industrial complex is in place, many Mongolians will get a salary of USD 3,000 thus seems very realistic. This is in sharp contrast to the situation only a few months ago when 15,000 young Mongolians were fighting to be chosen for 3,000 employment positions in South Korea, where they can earn much more than what is possible here. But all that is now set to change, it appears. Prime Minister S.Batbold has rightly said that Mongolians will soon find that they can earn as much in the Gobi as abroad. Some 40,000 jobs will be created in the coming five years, to be filled by the 45,000 young people now enrolled in vocational training centers. In addition, Oyu Tolgoi LLC has agreed to train 3,300 people as part of the project development. There can be no let-up in reforming and updating our old and mostly irrelevant vocational training programs, in building the sort of capacity that is likely to be in demand, and in using training techniques and equipment that comply with international standards. The present young generation will find that they can get rich by staying home. Source: Onoodor KHAN BANK OFFERS FINANCIAL LEASING SERVICES IN AGRICULTURE Khan Bank and Agromashtech LLC have signed a financial leasing services agreement that will allow

- 5. individuals and companies working in agriculture, especially in agronomy, to access Agromashtech services, and training on use of equipment such as harvester combines, tractors, agricultural trailers, swing machines, and irrigation and loading equipment. Agromashtech is the official dealer in Mongolia for two large Russian agricultural equipment manufacturing companies and its operations here have made a significant contribution to the successful spread of the Government‘s ambitious agriculture program called Atar-3. Under the agreement, people will be able to lease new technology through the Bank, and also to choose from the products of the vendor company contracted with the bank. Source: Khan Bank ECONOMY PM PROMISES FIRST OIL REFINERY BY 2014 Prime Minister S.Batbold announced after watching the exploration work of the 100% Chinese company Donshen in the Gobi that Mongolia‘s first oil refinery will be ready by 2014. Donshen has a product sharing agreement with the Government and hopes to begin oil extraction before the end of this year. Exploration results so far indicate there is enough oil for the fields to be operated for 30 years. The oil refinery is planned to be built in the Sainshand industrial complex and 10 companies have already expressed their interest in taking up the work. The Prime Minister said Mongolia has enough oil reserves to be self-sufficient and once refineries start processing the crude for domestic use, the country will leave behind its traditional 100% dependence on import. Source: Undesnii Shuudan CAPITAL MARKETS THE CATALYST IF PM‟s PLANS ARE FULFILLED, SAYS MSE ADVISOR The Mongolian Stock Exchange (MSE) celebrated on August 27 the 15th anniversary of the country‘s first bond sales. Executive Director R.Sodkhuu congratulated all individuals and institutions that have participated in and contributed to the growth of the capital market and recalled the early days of the transition from a planned to a market economy. There were only two brokers in the stock exchange then, while today Mongolia has busy and thriving primary and secondary markets. Things are moving fast, he said, as shown by the fact that the capital market, valued at MNT88 billions in 2008, is now worth MNT944 billion. Speaking at the same ceremony, Mr. S.Davaasambuu, an advisor at MSE, said 15 years ago most Mongolians considered a share certificate as just a piece of paper not worth a second look. Things have certainly changed since then, but many more public companies, with shares held by the people, have to come up to provide the platform for the country‘s economic diversity. The capital markets will be the catalyst in this, Mr. Davaasambuu said, if the Prime Minister‘s plans are to be fulfilled. Source: Zuunii Medee, Ardiin Erkh CHOICE OF COMPANY TO RESTRUCTURE MSE ON SEPTEMBER 15 KOSPI from South Korea and the NASDAQ (USA)-Mosdaq consortium are believed to be the front runners for the State Property Committee‘s choice to restructure and privatize the Mongolian Stock Exchange (MSE). The tender announcement two weeks ago was met with bids from 10 international companies. Two other favorites in the running for the selection are the London Stock Exchange and the Deutsche Bourse Group from Germany. The final announcement is expected to be made on September 15. Whoever is chosen will have its plate full to develop the capacity of the small Mongolian capital market to make it ready to meet demands on its resources as mining takes off. At present, share transaction accounts for 2-3% of the GDP and 4-5% of total investment. The international norm for both is 50%. Handing over the job of developing a country‘s stock market to foreign institutions has not always been successful. Mongolia has the added problem that its laws and regulations are often outdated and out of sync with present-day practices. The Ministries of Finance, Justice and Internal Affairs and the Financial Regulatory Authority will have to work harder on this aspect so that the country‘s choice can work without hindrance. Source: Ardiin Erkh WORLD BANK WORRIES ABOUT INFLATION, MACROECONOMIC VULNERABILITY In its Mongolia Quarterly Economic Update, which covers development up to the end of June, the World Bank says the improvement in public finances, coupled with buoyant revenue due to the

- 6. commodity price recovery, has led to growing pressures for increased government spending. Recently approved budget amendments envisage a 4.5 percent of GDP increase in spending on the originally approved 2010 budget, while the Mid-Term Budget Framework (MTBF) for 2011-2013 projects another 12.1 percent of GDP increase in spending in 2011. If these public spending plans materialize, they will set the stage for a renewed bout of high inflation and a possible return to the macroeconomic vulnerability characteristic of the boom-and-bust cycle of the recent past. According to the government‘s own estimates, inflation is likely to reach over 20 percent by the end of the year. With uncertain domestic and foreign financing conditions, continued fiscal consolidation remains crucial for Mongolia. The adoption of, and adherence to, the Fiscal Stability Law—which was recently passed by Parliament—will be key in Mongolia‘s efforts to constrain fiscal spending to prudent and sustainable levels. The new law will also manage the huge revenue inflows expected from the Oyu Tolgoi mine from 2016 onward. Source: The World Bank MNT GAINS 9.9% OVER USD SINCE BEGINNING OF 2010 Mr. S.Bold, a senior official at the Central Bank, has said the MNT has risen 9.9% against the USD and 9.7% against the CNY between January 1 and August 31. Export earning has risen, and so have foreign direct investment and inward remittances, while foreign debts and outflow of foreign currency have been halted. In other words, macro economic trends are good for the MNT. Foreign currency reserves are also high and increasing every month. He has discounted suggestions that this stability has been supported by official intervention, stressing that Mongolia does not believe in maintaining artificial exchange rates. At a certain time of extreme fluctuation, the Central Bank did intervene to avert any risk to the national economy but this is not the Bank‘s policy. Source: Zuunii Medee MONGOLIA WEIGHS WIND FOR CHINA Mongolia, one day, hopes to export more than just coal to neighboring China. At a recent cabinet meeting, Prime Minister S.Batbold outlined plans to ramp up the country‘s investments in alternative energy and to export wind power to China — enough to equal 40 million tons of coal. Landlocked Mongolia‘s largely untapped mineral and energy resources have been generating a lot of interest. But mining, and the burning of coal, exacts an environmental toll that could lead to financial hassles. ―While Mongolia has a lot of coal, it is a matter of time before coal-based power plants will become subject to carbon penalties,‖ said Mr. B.Bold, chief executive of Newcom Group, an investment group in the process of building a wind-power-generation plant in Mongolia. The Mongolian government would like to use proceeds from the country‘s large mining projects to subsidize solar, wind and other renewable energy projects. It would also show preference to mining projects that demonstrate efficient water use, government officials say. Source: Dow Jones Reprints ROAD BUILDERS SAY LOW-COST WORK MEANS POOR QUALITY Representatives of road and bridge construction companies last week told a press conference that with prices of raw materials rising, it now takes MNT475 million to construct 1 km of a 3-level paved road, using asphalt and concrete. Builders can now hope to keep a profit varying between 0.84% and 1.3% per km of road and between 4.3% and 4.4% on the case of a long bridge. They deplored the usual official preference for the lowest bidder, disregarding considerations of quality. Companies that persist in using better material even if prices have risen since they got the contract are in an unenviable situation, with no redress from the Government. A representative of the company now building a 16-km paved road with asphalt and concrete from Mandalgovi toward Undur-dov said they are operating at an 18.3% loss. His claim was immediately supported by another man who said his company was building 27 km of a similar road from Undur- khaan toward Sumber and its loss now stood at 54.8%. Source: Udriin Sonin CENTRAL REGION TRIES TO LURE FOREIGN INVESTMENT Prospective investors, most of them non-Mongolian, in the Central Region – comprising Darkhan- Uul, Selenge, Tov and Gobisumber provinces – spent two days last week attending a forum at Darkhan and listening to the potential of the region‘s mining, infrastructure, agriculture and manufacturing sectors.

- 7. Deputy Premier M.Enkhbold inaugurated the forum which was addressed by representatives of the joint organizers – the Ministry of Foreign Affairs and Trade, FIFTA, The National Committee on Regional Development, and the administrations of the four provinces. Their presentations stressed the promise the region held out to investors and listed a number of large projects seeking investment. Source: Montsame ADB, GTZ CO-FINANCE BIG GRANT FOR MICROINSURANCE IN MONGOLIA, CHINA The Asian Development Bank (ADB) is providing a two-year USD750,000 grant from the ADB- administered Regional Cooperation and Integration Fund to examine market supply and demand for microinsurance in China and Mongolia. The grant will address policy, regulatory and institutional barriers in the region‘s microinsurance sector. ADB will work with the Access to Insurance Initiative (A2II), a global program launched in 2009 with the International Association of Insurance Supervisors (IAIS) – the international standard setting body for insurance regulation and supervision. The Initiative seeks to link development agencies and industry supervisors to promote expanded insurance services to the poor worldwide. A Memorandum of Agreement has been signed under which the German development agency and secretariat of the initiative, GTZ, will provide co-financing of about USD178,000 and will engage in and support work agreed with ADB and A2II. The ADB, A2II, and GTZ teams will work with the Chinese Insurance Regulatory Commission and Mongolia Financial Regulatory Commission. Source: www.microfinancefocus.com APARTMENTS PRICED BEYOND THE REACH OF ORDINARY PEOPLE The construction sector has been limping back to normalcy, with work on 52 buildings completed this year, allowing 3,658 families to move into new apartments. However, 1,080 of them are war veterans who were allotted free accommodation and more than 2,000 Government employees who could take special loans on easy terms. Less than one-sixth of the new owners thus bought apartments with their own money. Many received money from relatives working abroad. When will Mongolians really earn enough to buy apartments for themselves from their own salary? A recent survey shows that 41.79 percent of ger district residents aim to buy apartments within 10 years. Of them, 83.3 percent hope to live with their family, 9.3 percent are newly wed, 2.3 percent want to live alone, and 4.2 percent want to rent out the apartment. Half of those surveyed want two-room apartments, while 34.4 percent want three-room ones. However, most of the apartments actually sold are one-room, which means people end up buying what they can afford, not what they want. Why are apartment prices so much beyond the reach of the average salaried class? An overwhelming majority of the survey respondents said they would find it impossible to pay more than USD700 per sq.m. Five percent, however, were willing to go up to USD1,000 per sq.m. or more. Construction companies usually charge MNT1 million per sq.m. but it is believed they would make 10-15 percent profit even at MNT650,000-MNT750,000. Even at this high price the workmanship and quality of construction in the apartments of Ulaanbaatar are suspect. Source: English.News.mn GLOBAL FUTURE AWAITS YAK WOOL Processed yak wool could be the next big Mongolian fiber export item after cashmere, if a planned pilot project to export some to France this year yields encouraging results. Combed from the shaggy beasts that dot the remote ranges of the Khangai mountains in Arkhangai province, 190 kilograms of washed and de-haired wool await the final freight clearance to Europe. Each processed kilo will fetch 38 Euro, and the entire money will go directly back to the cooperative of herders that collected the wool. Development organizations including Swiss Development Cooperation and Mercy Corps, and NGOs like AVSF have been working over the years to develop new marketing chains for different products from herders and to address the environmental aspects of overgrazing. In 2008 Mercy Corps carried out the first value chain assessment for yak wool where it identified lack of a potential market as the biggest obstacle to its large-scale commercial use. Since then, the organization has been assisting rural producers to gain skills and capacities to win new and diversified markets. Yak wool itself has been recognized as the next best alternative to cashmere. Combed yak wool has properties very similar to those of cashmere. Each fiber has an average diameter of 18 mm and a length of 35 mm compared to cashmere‘s 15 mm diameter and 38 mm length. However, the market demand still remains a niche segment and promoters of yak wool are realistic enough to accept that

- 8. it can never replace cashmere. The complete report by Pearly Jacob can be read at BCM website - News, Mongolia Business News. NEW YORK SOCIETY OF SECURITY ANALYSTS TO HOLD MONGOLIA INVESTMENT CONFERENCE The New York Society of Security Analysts (NYSSA) will hold its first conference on investing in Mongolia on September 23. Regional experts will discuss the country‘s economic outlook and investment potential, and executives from Mongolian public companies will discuss their businesses. They include speakers from: * Khan Bank * SouthGobi Resources * Petro Matad * Erdenes MGL * Prophecy Resource Corp. * Hunnu Coal * Newcom Group * Mongolia Development Resources The conference is sponsored in part by Khan Bank and Bodi Financial Advisory Services. Additional sponsors are Mine Info, Prophecy Resource Corp, SouthGobi Resources Ltd, and Tanan Impex LLC. With over 10,000 members, NYSSA is the largest of the 135 societies worldwide that make up Chartered Financial Analysts (CFA) Institute, which has nearly 100,000 members. Source: NYSSA CHINA, U.S. DATA PROPEL COPPER TO 4-MONTH HIGH Copper hit a four-month high on Wednesday, as firmer manufacturing data in both China, the world's biggest copper consumer, and the United States, the world's largest economy, boosted the demand outlook. Analysts and traders also pointed to a continuous drop in copper inventories and estimates of a small deficit in the copper market by the end of the year, which they believe will keep supporting prices. Copper for three-months delivery on the London Metal Exchange at one time rose to USD7,647 a ton, its highest since April 27, from a close of USD7,440 a ton on Tuesday. Source: The Mining Weekly RUSSIA OPENS CHINA PIPELINE FOR SIBERIAN OIL Prime Minister Vladimir Putin on Sunday opened a new pipeline to export east Siberian oil to China that will help Russia reorientate its oil trade towards the east. The pipeline, running 67 km from Skovorodino in east Siberia to China‘s north-eastern frontier, is an offshoot of a new oil export route Russia is building to the Pacific Ocean, providing a strategic window on the fast-growing energy markets of Asia. ―This is a vital project for us as we begin to diversify our sales of strategic raw materials,‖ Mr. Putin said. ―So far we have delivered most oil to Europe ... The Asia-Pacific region has received insubstantial volumes.‖ Russia began exporting oil this year from a new export terminal on the Pacific Ocean built to serve fields in east Siberia, one of the world‘s last untapped oil provinces. Some Kremlin-friendly oil companies have been granted tax breaks to speed development of east Siberian reserves and offset a decline in production in other regions. Transneft, the Russian oil pipeline monopoly, completed the construction of a pipeline from Taishet in the Irkutsk region to Skovorodino last year, the first stretch of a planned 2,757-km pipeline to the Pacific. On completion in 2012, the pipeline will be capable of carrying up to 1.6 million barrels of oil a day, about one-third of Russia‘s current exports. Russia last year took a USD25-billion loan from China in exchange for future oil deliveries, cementing its energy-trading relations with the world‘s fastest growing oil consumer. The deal entitles China to import 300,000 barrels a day of Russian oil for 20 years starting in 2011. Source: The Financial Times CHILE REWORKS BILL RAISING MINE ROYALTY FROM 2018 Chile's government has said it will soon be sending a revamped bill to Congress aimed at raising royalties paid by mining companies that would be used to pay for reconstruction from February's massive earthquake. President Sebastian Pinera's government reworked the bill after its center-left opponents shot it down in July, in a major challenge to his legislative agenda. Mr. Pinera hopes to raise around USD1 billion over three years from the royalty in the world's No.1 copper producer, and said he would give around USD300 million of that to Chile's regions.

- 9. The royalty revamp is part of a wider plan to finance the state's USD8.4 billion share of reconstruction after the earthquake. The government has also issued USD1.5 billion in international debt, raised taxes on some goods and tapped copper boom savings. Mining companies currently pay a royalty of between 4 and 5 percent. The bill that was rejected called for a sliding scale starting at 4 percent. The new bill initially sets the royalty at 4 percent to 9 percent on mining sales and raises it to 5 percent to 9 percent starting in 2018. "The royalty establishes a minimum rate of 4 percent, which we have today, and so ensures a floor," Mr. Pinera said. "But it allows that when the price of copper is at high levels, the state and all Chileans will in a way be partners of the mining industry and we can share these benefits." However, the royalty would have to be voluntary because the country already has contracts with foreign miners that expire around 2017. Mr. Pinera hopes miners will agree to pay higher royalties amid growing expectations for foreign companies to contribute more to the post-quake rebuilding. Public pressure has been building in Chile to make foreign miners who profit from the country's resources contribute more to rebuilding damage from the earthquake. Source: www.miningweekly.com CHINA CAN WEATHER SHARP SLOWDOWN: STANDARD & POOR‟S SOVEREIGN-RATINGS HEAD China's fiscal position is strong enough to withstand any sharp slowdown in economic growth, in contrast to Japan's weak outlook, the chairman of Standard & Poor's sovereign-ratings committee, Mr. John Chambers, has said. Analysts have warned that China's growth is vulnerable to a collapse in real estate values or a deluge of bad debt after the Government supported the economy during the global financial crisis by increasing bank lending. Mr. Chambers, who heads the committee that sets and changes S&P's ratings for 118 central governments, says such concerns are overdone. "They have plenty of dry powder and the eventual losses that will be borne by the banking system will be manageable," Mr. Chambers said. He added he is not too concerned about a potential real estate bubble in China. China's ability to withstand an economic downturn is crucial for the rest of Asia, because it has been driving growth in the region. Mr. Chambers said China's economy will likely continue to grow in the high single-digit range, but the outlook for Japan is less clear. The ratings company warned in January that Japan's growth outlook remains tepid, and its leaders need to show political will to tackle the fiscal deficit. "The concerns we identified in January still remain," Mr. Chambers said. "The fiscal position and the growth prospects are pretty weak." S&P rates Japan AA, with a negative outlook. China is rated A+, with a stable outlook. South Korea's biggest worry is the stability of North Korea. A collapse of the communist dictatorship could mean huge reunification costs for the south, "which even the government is now recognizing," Mr. Chambers said. Source: The Wall Street Journal Asia CHINESE MANUFACTURERS REPORT GROWTH Fears that the Chinese economy is running out of steam eased after a survey showed that factory activity accelerated in August, but results from other Asian economies were gloomier due to slackening demand from beyond the region. Chinese purchasing managers‘ surveys published on Wednesday registered improvements from July, with the official PMI index published by the Federation of Logistics and Purchasing rising half a point to 51.7 and a HSBC-sponsored poll rising 2.5 points to 51.9. The 50-point mark separates contraction from expansion. The HSBC had hit a 16- month low in July while the official index declined over the previous three months. Most Chinese economists think the country will continue to grow strongly for the rest of the year but that some slowdown is needed after the economy grew at a breakneck rate of 11.9 per cent in the first quarter. However, international investors have been reacting nervously to reports of slowing growth. Elsewhere in the region, PMI survey results fell close to their lowest points in a year and a half. The HSBC PMI index for Taiwan fell below 50 for the first time in 18 months, Japan‘s Nomura/JMMA PMI 2.7 points to 50.1, and South Korea‘s PMI 2.3 points to 50.9 despite data released on Wednesday showing exports rose 29.6 per cent in August from a year before with help from a weakened won. Source: The Financial Times CHINA FLIES RED FLAG OF HIGH-END NOSTALGIA In an effort to exploit nostalgia for China‘s communist and colonialist past, two Chinese State companies have relaunched old brands – including Chairman Mao‘s famous Red Flag limousine – to challenge foreign dominance of the country‘s luxury markets. China‘s evocatively named First Auto

- 10. Works (FAW) has announced it will spend USD263.3 million to re-raise the Red Flag brand, which has largely fallen into disuse along with the ideology that spawned it. The money would fund a production facility with an annual capacity 30,000 units, to give FAW the ultra-luxury model it needs to boost profits and prestige. Shanghai Jahwa, China‘s largest cosmetics brand, has also revived one of its famous nostalgia brands, Shuang Mei, or two sisters. With a logo redolent of 1930s Shanghai, when the city was labeled as the Paris of the Orient, the brand has been renamed Shanghai VIVE, and is sold at the recently reopened Art Deco Peace Hotel on the Shanghai Bund. Its packaging and advertising conjures visions of old Shanghai, in all its decadence. The brand ranges from Pride of Shanghai soap to skin creams – at prices same or above those for foreign luxury cosmetics. The relaunch of the two brands heralds China‘s coming of age as a retail culture, with Chinese brands increasingly eager to compete head to head with foreign brands. Localizing luxury is part of Beijing‘s plan to rebrand China as more than just a cheap goods factory. But retail analysts are uncertain about the value of nostalgia appeal in the country: Shanghai VIVE ―might create a sense of excitement for westerners, but not for most Chinese women‖, says a market research analyst in Shanghai. ―Those were not glamorous time for most Chinese so they don‘t look at it with the same longing and nostalgia as westerners.‖ He also felt ―consumers just don‘t buy into the idea that a Chinese car is as good as a European high-end one‖. Chairman Mao launched the Red Flag in 1958 because he thought China needed its own luxury car. Now, after 52 years, FAW will try again to make that a reality. Source: The Financial Times THE RENMINBI‟S WAY TO GO GLOBAL HAS PITFALLS Great power shifts are usually accompanied by changes in the international reserve currency. So it is telling that China is taking steps to broaden the use of the renminbi among international investors. Dominance of the global economy, Beijing believes, goes hand-in-and with dominance of the global monetary system. Whether China will be able to stomach the rest of the renminbi‘s journey to reserve currency status is far from clear. A reserve renminbi would have to be fully convertible, on the capital account as well as the current account. But this would imply opening up China to the whims of global capital – precisely what it has been protecting itself against (as its huge foreign exchange reserves attest). Freer capital flows may also prove destabilizing for domestic banks, creating liquidity bubbles in good times and choking off the credit supply as conditions deteriorate. No longer would the banking sector be an effective instrument of macroeconomic policy, as it has been during the crisis with its government-induced lending sprees. It would be a source of, and not a remedy to, increasing economic volatility. Even less palatable for the Government is the prospect of losing control over the renminbi. Maintaining a currency peg in the face of massive capital inflows is extremely difficult. And if increasing foreign demand for the renminbi pushes up its value, China‘s export-led growth model – which relies on an undervalued currency – may become unsustainable. China will become the world‘s largest economy in the next few decades. It is natural that the renminbi eventually attains reserve currency status. China should not push this process forward prematurely, lest it destabilizes its economy. But the sooner it starts the domestic reforms that will prepare it for such a shift, the easier it will find its new international role. Read more… Measures to internationalize the renminbi are nothing new. Hong Kong banks have offered offshore renminbi accounts for more than six years, and currency swap agreements with foreign central banks have been in place since 2000. But they have accelerated in recent months. Restrictions on offshore transfers have been eased and a program allowing companies to settle cross-border trades in renminbi expanded. The latest decision to open up domestic bond markets was particularly significant. Until then there were few investment opportunities for international holders of renminbi. These are, however, only small steps. Source: The Financial Times CHINA FORTIFIES STATE BUSINESSES TO FUEL GROWTH During its decades of rapid growth, China thrived by allowing once-suppressed private entrepreneurs to prosper, often at the expense of the old, inefficient State sector of the economy. Now, whether in the coal-rich regions of Shanxi Province, the steel mills of the northern industrial heartland, or the airlines flying overhead, it is often China‘s State-run companies that are on the march.

- 11. As the Chinese government has grown richer — and more worried about sustaining its high-octane growth — it has pumped public money into companies that it expects to upgrade the industrial base and employ more people. The beneficiaries are State-owned interests that many analysts had assumed would gradually wither away in the face of private-sector competition. New data from the World Bank show that the proportion of industrial production by companies controlled by the Chinese state edged up last year, checking a slow but seemingly inevitable eclipse. Moreover, investment by State-controlled companies skyrocketed, driven by hundreds of billions of dollars of government spending and state bank lending to combat the global financial crisis. They join a string of other signals that are fueling discussion among analysts about whether China, which calls itself socialist but is often thought of in the West as brutally capitalist, is in fact seeking to enhance government control over some parts of the economy. The distinction may matter more today than it once did. China surpassed Japan to become the world‘s second-largest economy this year, and its State-directed development model is enormously appealing to poor countries. Even in the West, many admire China‘s ability to build a first-world infrastructure and transform its cities into showpieces. Read more… Once eager to learn from the United States, China‘s leaders during the financial crisis have reaffirmed their faith in their own more statist approach to economic management, in which private capitalism plays only a supporting role. ―The socialist system‘s advantages,‖ Prime Minister Wen Jiabao said in a March address, ―enable us to make decisions efficiently, organize effectively and concentrate resources to accomplish large undertakings.‖ The issue of state versus private control is a slippery one in China. After decades of economic reform, many big State-owned companies face real competition and are expected to operate profitably. The biggest private companies often get their financing from state banks, coordinate their investments with the government and seat their chief executives on government advisory panels. Chinese leaders also no longer publicly emphasize sharp ideological distinctions about ownership. But they never relaxed state control over some sectors considered strategically vital, including finance, defense, energy, telecommunications, railways and ports. Mr. Wen and President Hu Jintao are also seen as less attuned to the interests of foreign investors and China‘s own private sector than the earlier generation of leaders who pioneered economic reforms. They prefer to enhance the clout and economic reach of state-backed companies at the top of the pecking order. Many now believe that the 1980s reforms that unleashed China‘s private sector and the 1990s reforms that dismantled great sections of the state-run sector are being partly undone. There are no comprehensive statistics to catalog the government‘s influence over the economy. So the shift is partly inferred from coarse measures like the share of financing in the economy provided by state banks, which rose sharply during the financial crisis, or the list of the 100 largest publicly listed Chinese companies, all but one of which are majority state owned. The statistic showing an uptick in the share of industrial production attributable to the state sector is regarded by some analysts as a blip rather than the start of a trend. The World Bank‘s senior economist in Beijing, Mr. Louis Kuijs, said the state sector‘s unusually rapid growth will most likely moderate with the ending of the government‘s stimulus spending. In some ways, the differences in this debate are small. Everyone agrees that China runs a bifurcated economy: at one level, a robust and competitive private sector dominates industries like factory-assembled exports, clothing and food. And at higher levels like finance, communications, transportation, mining and metals — the so-called commanding heights — the central government claims majority ownership and a measure of management control. Yet the two camps‘ view of China‘s future are markedly different. Those who see little evidence of an expanding state sector generally believe that China has a decade or more of robust growth awaiting it before its economy matures. Theirs is a Goldilocks view of state intervention — not too much or too little, but just enough to push a developing economy toward prosperity. The skeptics have a darker view: they believe distortions and waste, in no small part due to government meddling, have resulted in gross misallocation of capital and will end up pushing growth rates down well before 2020. What drives their pessimism, the skeptics say, is that China, like Japan a generation ago, has too much confidence in a top-down economic strategy that defies conventional Western theory. The skeptics also point to what they say is the growing political and financial influence of China‘s State-owned giants — 129 huge conglomerates that answer directly to the central government, and

- 12. thousands of smaller ones run by the provinces and cities. In the last year or so, many of these 129 companies have moved forcefully into China‘s real-estate industry, with hundreds of billions of dollars in construction projects and land deals. State-owned steel giants have cut deals to buy out more profitable and often more efficient private competitors. A host of government conglomerates have snapped up coal mining companies in Shanxi Province. The reasons for the state‘s push for greater involvement in business vary. State control of energy supplies is crucial to China‘s growth, and the Shanxi coal takeovers will increase production, guarantee fuel to some state-owned utilities and give Beijing new power to control coal prices. State mining companies also argue that they have a superior safety record to their accident-prone private competitors. But in other areas the state looks more mercenary. Take telecommunications. Upon joining the World Trade Organization, China committed itself to opening its communications market to foreign joint ventures for local and international phone service, e-mail, paging and other businesses. But after eight years, no licenses have been granted — largely, the United States says, because capital requirements, regulatory hurdles and other barriers have made such ventures impractical. Today, basic telecommunications in China are booming, and are virtually 100 percent State-controlled. Take the passenger airline industry. Six years ago, the central government invited private investors to enter the business. By 2006, eight private carriers had sprung up to challenge the three state- controlled majors, Air China, China Southern and China Eastern. The state airlines immediately began a price war. The state-owned monopoly that provided jet fuel refused to service private carriers on the same generous terms given the big three. China‘s only computerized reservation system — currently one-third owned by the three state airlines — refused to book flights for private competitors. And when mismanagement and the 2008 economic crisis drove the three majors into financial straits, the central government bought stock to bail them out: about USD1 billion for China Eastern; USD430 million for China Southern; USD220 million for Air China. Some analysts argue that the state-owned conglomerates, built with state money and favors into global competitors, have now become political power centers in their own right, able to fend off even Beijing‘s efforts to rein them in. Of the 129 major state enterprises, more than half the chairmen and chairwomen and more than one-third of the chief executive officers were appointed by the central organization department of the Communist Party. A score or more serve on the party‘s Central Committee, which elects the ruling Politburo. They control not just the lifeblood of China‘s economy, but a corporate patronage system that dispenses top-paying executive jobs to relatives of the party‘s leading lights. China‘s leaders have sought occasionally in the past year to curb speculative excesses by state- controlled businesses in real estate, lending and other areas. In May the State Council, a top-level policy body sometimes likened to the cabinet in the United States, issued orders to give private companies a better shot at government contracts — for roads and bridges, finance and even military work — that now go almost exclusively to state-owned companies. Virtually the same rules were issued five years ago, to little effect. Yet it is hard to argue with success, other economists say, and China‘s success speaks well of its top-down strategy. Asian powerhouses like South Korea and Japan built their modern economies with strong state help. Many economists agree that shrewd state management can be better than market forces in getting a developing nation on its feet. Experts on both sides of the debate have but two questions. One is how much longer state control of vast areas of the economy will generate that growth. The other is whether, should that strategy stop working, China will be able to change. Source; The New York Times POLITICS GOVERNMENT MAKES A POINT IN SCORCHING GOBI HEAT Chairs and tables had been set up in the sands of the Gobi desert for a Cabinet meeting last Friday aimed at drawing attention to climate change. The Prime Minister sported a blue tie while he and all his 12 ministerial colleagues donned dark green baseball caps reading "Save our planet". The meeting was held in scorching heat in Gashuunii Khooloi, a sandy valley in South Gobi province, about 670 km south of Ulaanbaatar. The ministers, dressed in suits and ties, arrived in the desert in jeeps after a 15-hour journey. Officials planted a Mongolian flag in the ground, set up long tables and chairs in the fine, golden sand and discussed climate change against the backdrop of a vast expanse of desert and a bright blue sky.

- 13. "Mongolia is feeling the impact of global climate change," Prime Minister S.Batbold said at the one- hour meeting. He pointed to the recent winter as an example of problems Mongolia faces. The winter was the harshest in decades and a fifth of the country's livestock died. The Government blames global warming for a decrease in rainfall and says that rising average temperatures have caused many rivers and springs to dry up and snow cover to melt. It also says the frequency of natural disasters and drought has jumped. The site for the meeting was chosen because parts of it used to be arable land, said Badarch, head of social policy for South Gobi province. "Five years ago, many edible plants used to grow in this valley and there were fewer sand dunes. Now the valley is completely covered with sand. The sand dunes are moving and taking up more space each year." Minister of Natural Environment and Tourism L.Gansukh said Mongolian herders' traditional way of life is under threat. "Global climate change accelerates the desertification process in Mongolia. Currently, 70 percent of Mongolian land is affected by desertification." The Government has said it hopes delegates at the global climate talks in Cancun, Mexico, in November would reach a decision that is "favorable for landlocked, developing countries ... very much affected by climate change and desertification". Source: AP TIME FOR A CHANGE IN CLIMATE RESEARCH Over the course of this year, six reviews have examined various aspects of climate research – most recently Monday‘s report on the Intergovernmental Panel on Climate Change by the world‘s scientific academies. While none has challenged the fundamental view that man-made global warming must be tackled by cutting emissions of carbon dioxide and other greenhouse gases, there has been harsh – and often deserved – criticism of the IPCC and the climate research centers that contribute to its assessments. Now it is time to implement fundamental reforms that would reduce the risk of bias and errors appearing in future IPCC assessments, increase transparency and open up the whole field of climate research to the widest possible range of scientific views. Restoring public confidence in the IPCC is essential, because it is the main intermediary between scientists and politicians who have to decide on climate policies that could cost the global economy hundreds of billions of dollars. Given that most scientists believe in the need to tackle global warming, the IPCC cannot hope to satisfy the most extreme ―climate skeptics‖. But it must never again undermine its own credibility by sloppily repeating unsubstantiated statements that exaggerate the risk of climate change, such as the notorious claim that Himalayan glaciers could disappear by 2035. Read more… At its plenary meeting in South Korea next month, the 194 national governments that control the IPCC must push through a thorough overhaul of management and procedures. The IPCC needs stronger leadership to maintain credibility, including a new executive committee (with at least one member who is not a climate scientist) and a chief executive rather than a relatively powerless secretary. Although Rajendra Pachauri, IPCC chairman since 2002, has been unfairly vilified in some quarters, his recent performance under pressure has not helped the cause of climate science; the time has come for him to move on. A rejuvenated IPCC leadership could tackle the deficiencies in its review process. This should become more inclusive, welcoming alternative views where these are scientifically valid, and at the same time more exclusive, rejecting unsubstantiated claims of dramatic change. The many uncertainties need recognition, with IPCC assessments talking more about risks and probabilities than they have in the past. Then the debate can get back to the real issues posed by climate change. Source: The Financial Times SUB-COMMITTEE HEAD SAYS THEY ARE NOT BOUND BY ANY TIME LIMIT TO ANSWER LETTERS Mr. E.Munkh-Ochir, MPRP MP and head of Parliament‘s Sub-Committee on Special Monitoring, told media that its meeting on Monday had not taken up the case of the Anti-Corruption Authority (ACA) officials. This, he said, might have been contrary to people‘s expectation, but did not contravene any legal provision. The sub-committee had indeed received a letter from Parliament‘s Standing Committee on Legislation saying the case is very important and action by the sub-committee was an urgent necessity, but, he said, ―We receive many letters from citizens and standing committees. We shall read them in good time and decide what action needs to be taken on which. ―He rejected the view that the sub-committee was deliberately delaying progress in the case, reiterating his stand that ―there is no legal compulsion for us to reply to any letter within a fixed period‖. He also

- 14. denied that Parliament had failed to act within the stipulated time on the State Prosecutor General‘s request for the dismissal of the ACA director, Mr. Ch.Sangaragchaa, and Vice-Director D.Sunduisuren. According to him, the law did call for discussion on any such request to begin within 14 days but there was no compulsion to reach a decision within a given time. Mr. Munkh-Ochir said he personally felt the Prosecutor General‘s request does not have much support. ―He is not clear on why he is accusing the two ACA officials of abusing power, or of unauthorized spending of budget money, or of spying on employees illegally,‖ he said. Source: Ardiin Erkh CITIZEN‟S CHAMBER NOMINATED FOR GERMAN PRIZE The Citizen‘s Chamber set up at the initiative of President Ts.Elbegdorj has been nominated for the 2011 Reinhard Mohn Prize(formerly known as Carl Bertelsmann Prize), awarded by the Bertelsmann Foundation of Germany. The Prize, instituted in 1988, is awarded annually and is worth €150,000. The 2011 award will go to a governmental institution - possibly in cooperation with a non- governmental actor - which has initiated successful projects (or programs) to vitalize democracy, to integrate underrepresented citizens and to establish new forms of democratic problem-solving capacities through participation. The Citizen‘s Chamber has organized 32 public discussions on national issues, with a total participation of some 2,000 people. It has also 367 opinions through E-mail, letters, phone and fax. Source: Montsame PRESIDENT TEACHES A CLASS AS NEW SCHOOL YEAR BEGINS The most important event of the start of the new academic year on September 1 was President Ts.Elbegdorj teaching a class on Mongolian history in a secondary school in Ulaanbaatar. The lesson termed "Mongolia‘s pride" was broadcast nationwide through the State television channel. The President said every citizen should be proud of being a Mongolian and must learn to value the nation‘s history and heritage. The young generation should also vow to protect the Earth --our home – from environmental degradation. Among others who attended the opening ceremony at various places were Parliament Speaker D. Demberel, Prime Minister S.Batbold and several Ministers. Some 142,000 children will be in kindergarten this year, and 522,000 in secondary school, while professional schools will have 44,000 students and higher educational institutions 164,000. Source: English.News.mn, Montsame NEW BIRD DISEASE IDENTIFIED IN ULAANBAATAR POULTRY FARM Deputy Prime Minister M.Enkhbold, who is also Chief of the National Emergency Commission, will supervise the work of disinfecting areas in a district of Ulaanbaatar where a poultry farm has been identified as the source of a contagious bird disease, "Newcastle," the first time in the country's history. The Government has earmarked MNT125 million for the work and the Mayor has been asked to take all necessary measures without delay. Apart from leading to inflammation of the eyes, Newcastle poses no threat to humans. Chicken death was reported at the farm some days ago and experts confirmed the outbreak, tentatively concluding the disease was transmitted from chicken feed. A total of 1,600 eggs will be destroyed, and 4,847 chickens slaughtered. There are a total of about 270,000 chickens in commercial farms in the Ulaanbatar region. Currently, quarantine has been imposed in all chicken farms and mobile patrols have been set up around the area. Source: Ardiin Erkh FOREIGNERS CAN NOW ENTER CHINA AT CHECKPOINT IN KHOVD Mongolia has begun allowing foreign tourists cross its border to get to China at a checkpoint in Khovd province. Mongolia took the decision after receiving a request from the administration of the Altay region in Siberia to make a popular ―Altay-golden mountains‖ route passing through Russia, Mongolia, China and Kazakhstan more accessible. Source: Voice of Russia PEDESTRIAN OBSTACLES TO GO MNT150 million is planned to be spent under the Mayor‘s orders to make life for pedestrians in Ulaanbaatar easier. Inspection of squares and pavements has identified 77 structures that will be relocated and 215 more that will be demolished. The official notice for this has begun to be served on individuals, businesses, and organizations now benefiting from these.

- 15. Source: News.mn ANNOUNCEMENTS “DISCOVER MONGOLIA” (SEPTEMBER 8-10) ADDS NEW SESSION, PARLIAMENT HOUR This year‘s Discover Mongolia Investors‘ Forum will take place on September 8-10 in Ulaanbaatar. The Organizing Committee plans to have, in addition to the usual Government Hour, a new session, Parliament Hour, where current and prospective investors will be able to interact with the country‘s lawmakers, and to know about the legal framework that Mongolia wants to set up in the mining and exploration sector. Mr. Bernard J. Guarnera, President of Behre Dolbear Group Inc., will be the Keynote Speaker and will talk on a study conducted by the Group on ―Where not to invest‖. Among the other speakers is a Mongolian MP, Mr. D. Odkhuu, whose topic is ―Mongolia‘s Regional Development Concepts‖. The Premier Sponsor for this year‘s event is SouthGobi Resources, and the Gold Sponsors are Erdene Resource Development, Micromine Mongolia, Hunnu Coal, Geosan, and Prophecy Resources. The Regular Sponsors are: Aspire Mining, MoEnCo, Monnis, PricewaterhouseCoopers, Runge Group, Trade and Development Bank of Mongolia, and Energy Resources. __________________________________________ 1ST ANNUAL MONGOLIA INVESTMENT CONFERENCE The 1st Annual Mongolia Investment Conference on September 7 in Ulaanbaatar, co-organized by Eurasia Capital, will provide insight into the most promising sectors of the Mongolian economy through in-depth discussion of the market and the products. It will showcase a range of Mongolia- based opportunities in the natural resource and financial sectors and beyond. The conference also offers investors the chance to meet key decision-makers in Mongolia and to learn of the key market drivers, risks and influences in the frontier market. The session will be preceded by a trip to Oyu Tolgoi and Ovoot Tolgoi in the South Gobi on September 6. All efforts will be made to arrange any one-on-one meeting requested in advance by participants. Seats are limited and access is guaranteed only to those registered. For more information and applications, please contact Ms. Zhyldyz Sadyralieva at zhyldyz.sadyralieva@eurasiac.com or at 976 99061673. __________________________________________ GIANT STEPPES OF JAZZ INTERNATIONAL FESTIVAL (SEPT 28 - OCT 2) Jazz is coming to town again. The 4th Giant Steppes of Jazz International Festival will bring together international and local jazz artists to add more charm to Ulaanbaatar sunny autumn. This year‘s festival line-up includes performers of a variety of jazz styles from Germany, Norway, Switzerland and the U.S. alongside the best of Mongolian jazz. A Gala concert will be held at the Khan Bank Theater on October 1, with nightly performances at River Sounds on September 28, 29, 30 and October 2. There will also be free evening Jam Sessions at The Square in Central Tower. For more information, please call 9911-1061 (Eng/Mgl), 8803-3300 (Mgl). Tickets will be on sale at The Square Restaurant (Central Tower, 3rd fl) and Hi-Fi Video Megastore (Seoul Street). __________________________________________ “BSPOT" on B-TV BTV (Business TV) will be broadcasting a 20-minute Mongolian-language news program on two evenings every week, based mostly on items in the BCM NewsWire that were published outside Mongolia. The program is called ―Through the eyes of others‖ and the first broadcast will be on Saturday, August 28, at 19.30. BTV (Business TV) already telecasts a 10-minute English-language news program called BSPOT every evening from Monday to Friday at 21:30, taking most of the stories from the BCM NewsWire. _____________________________________ “MM TODAY” on MNB-TV BCM is pleased to announce that Mongolian National Broadcasting continues its cooperation with BCM on ―MM Today‖. This English news program is aired every Friday for 10 minutes and is scheduled for 21:15 tonight. Tune in to watch this program that reports stories from today‘s BCM NewsWire. ______________________________________ NEW POSTINGS ON BCM WEBSITE‟S „MONGOLIAN BUSINESS NEWS‟ The draft Tavan Tolgoi Investment Agreement which was submitted by the Government to

- 16. Parliament is posted in both languages to BCM‘s websites, (www.bcmongolia.org) and (www.bcm.mn), ‗Mongolian Business News‘ for your review. As some of you might have noticed, we are now posting some news stories and analyses relevant to Mongolia on the BCM website's ‗Mongolian Business News‘ as they come, instead of waiting until Friday to put them all together in the weekly NewsWire. The NewsWire will, however, continue to be issued on Friday, and will incorporate items that are already on the home page, so that it presents a consolidated account of the week‘s events. SPONSORS ECONOMIC INDICATORS

- 17. INFLATION Year 2006 6.0% [source: National Statistical Office of Mongolia (NSOM)] Year 2007 *15.1% [source: NSOM] Year 2008 *22.1% [source: NSOM] Year 2009 *4.2% [source: NSOM] July 31, 2010 *9.8% [source:NSOM] *Year-over-year (y-o-y) CENTRAL BANK POLICY LOAN RATE December 31, 2008 9.75% [source: IMF] March 11, 2009 14.00% [source: IMF] May 12, 2009 12.75% [source: IMF] June 12, 2009 11.50% [source: IMF] September 30, 2009 10.00% [source: IMF] May 12, 2010 11.00% [source: IMF]

- 18. CURRENCY RATES – September 2, 2010 Currency name Currency Rate US dollars US 1,308.98 Euro EUR 1,665.02 Japanese yen JPY 15.55 British pound GBP 2,015.37 Hong Kong dollar HKD 168.30 Chinese yuan CNY 192.18 Russian ruble RUB 42.49 South Korean won KRW 1.10 Disclaimer: Except for reporting on BCM‘s activities, all information in the BCM NewsWire is selected from various news sources. Opinions are those of the respective news sources.