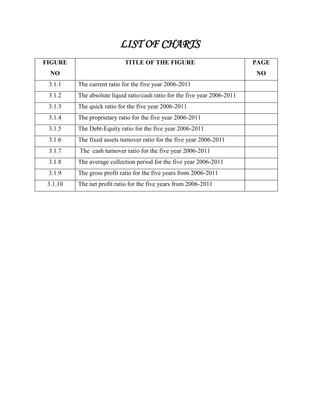

This project analyzes the financial performance of Tiruchirapalli District Central Cooperative Bank Ltd from 2006-2011. The objectives are to analyze the bank's financial position and identify strengths and weaknesses by establishing relationships between balance sheet and profit/loss items. Secondary data from annual reports are used to calculate ratios analyzing profitability, liquidity, leverage, and turnover. Ratios show the bank follows high debt-equity and creditors are owed for nearly a year. The cash turnover is also insufficient. The study recommends reducing debt capital, providing security to creditors, and increasing sales to reduce losses. Tables and charts are used to present the ratio analyses, fund flow statements, and cash flow statements for each year.