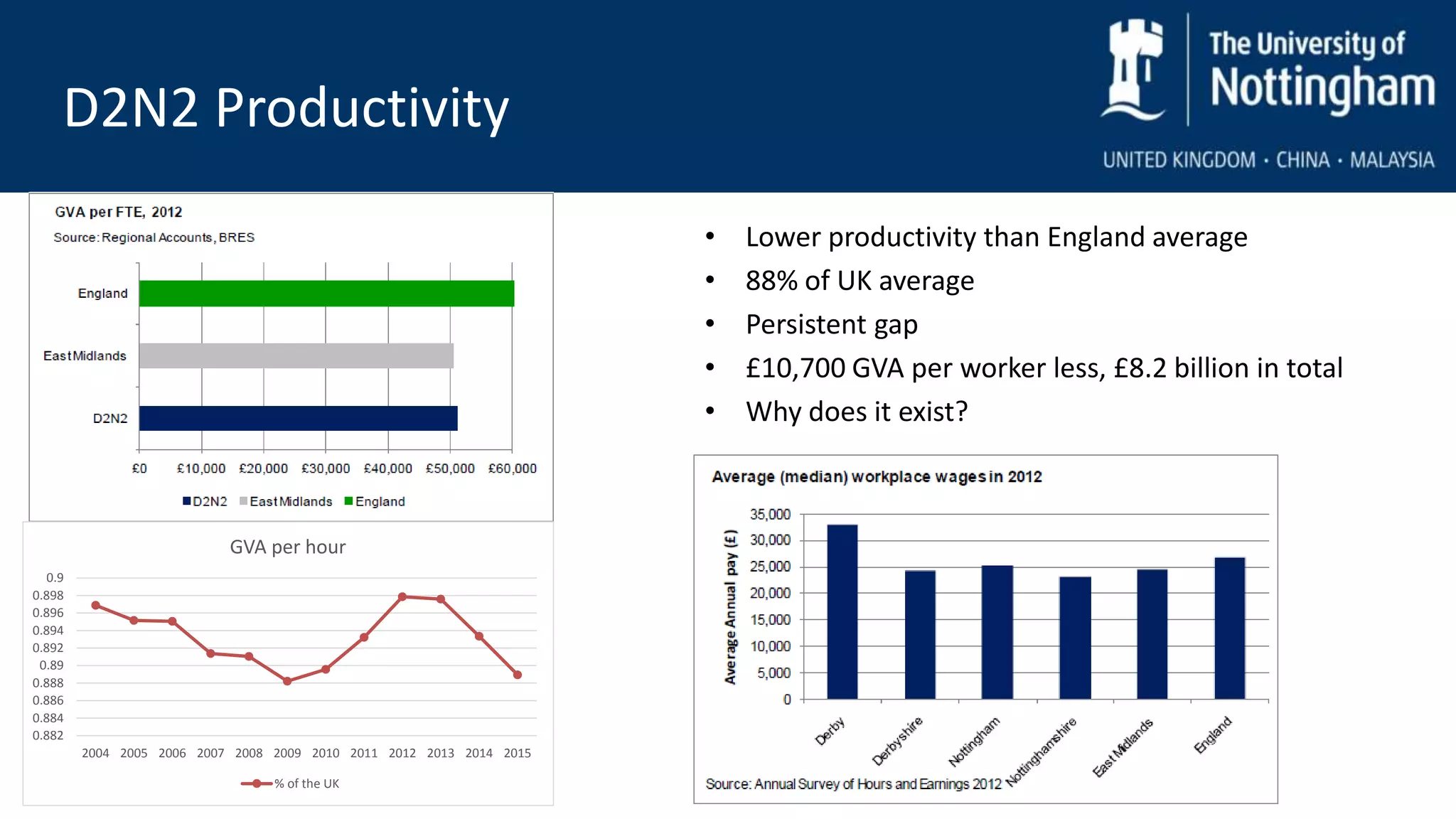

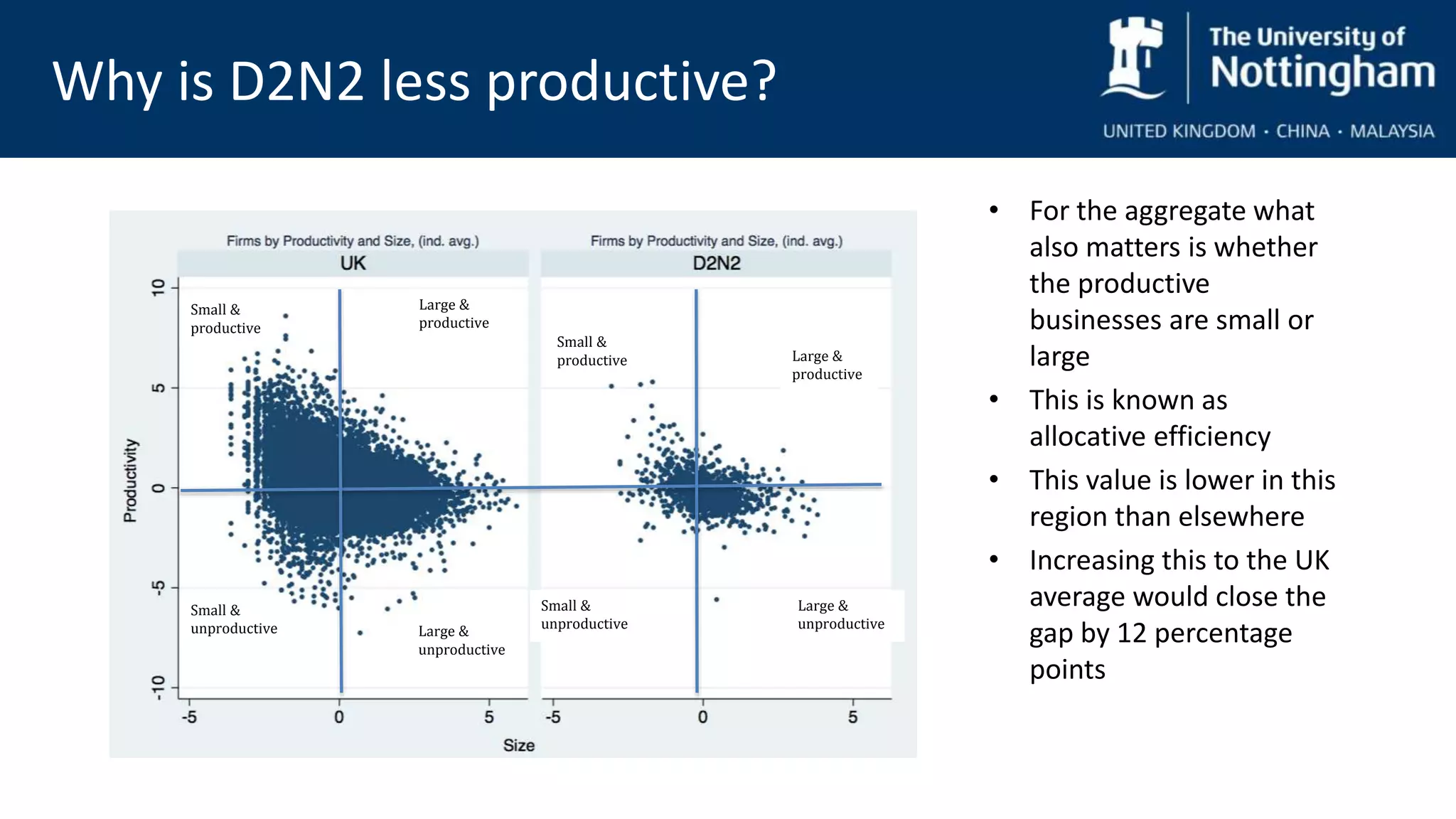

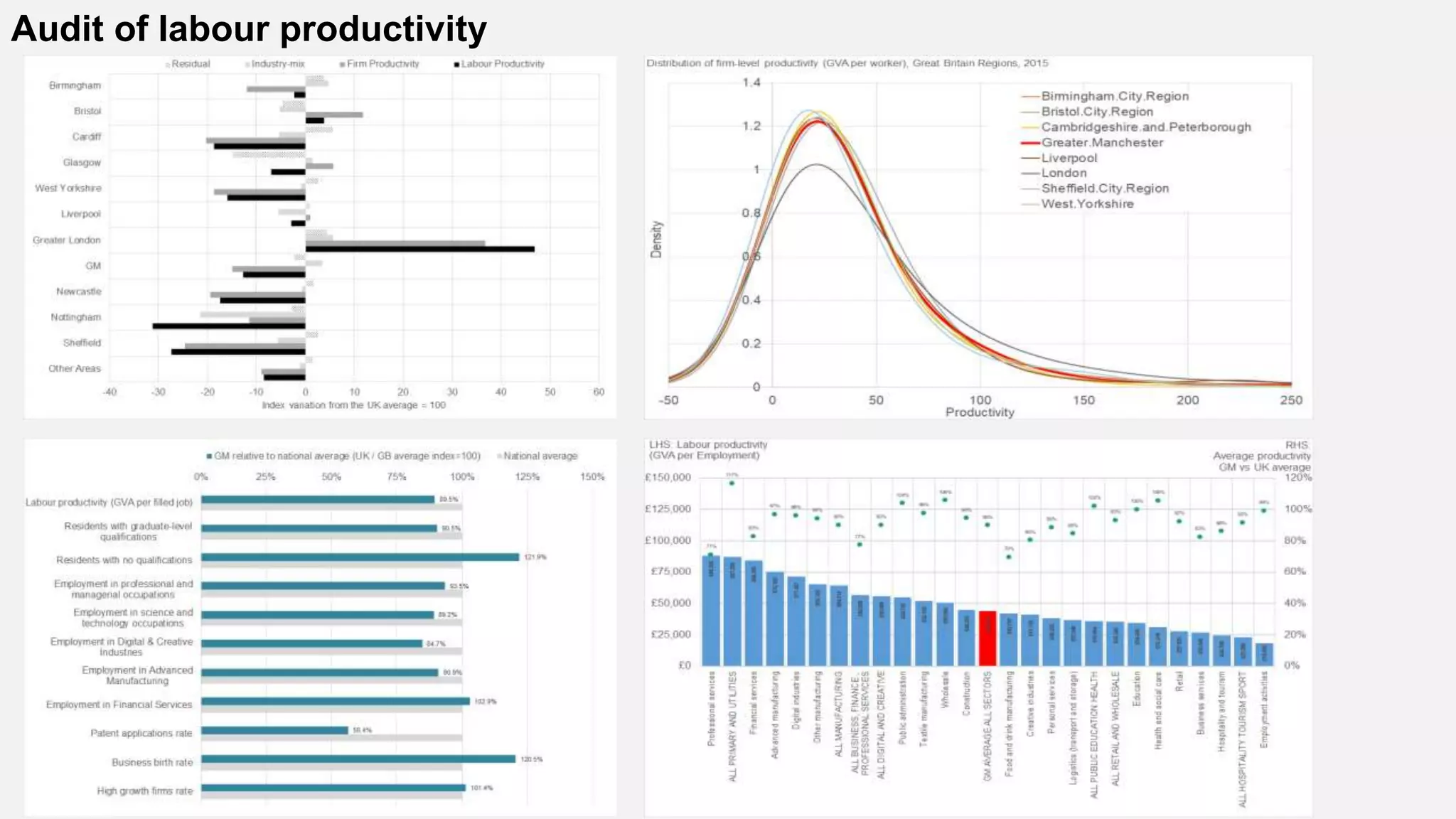

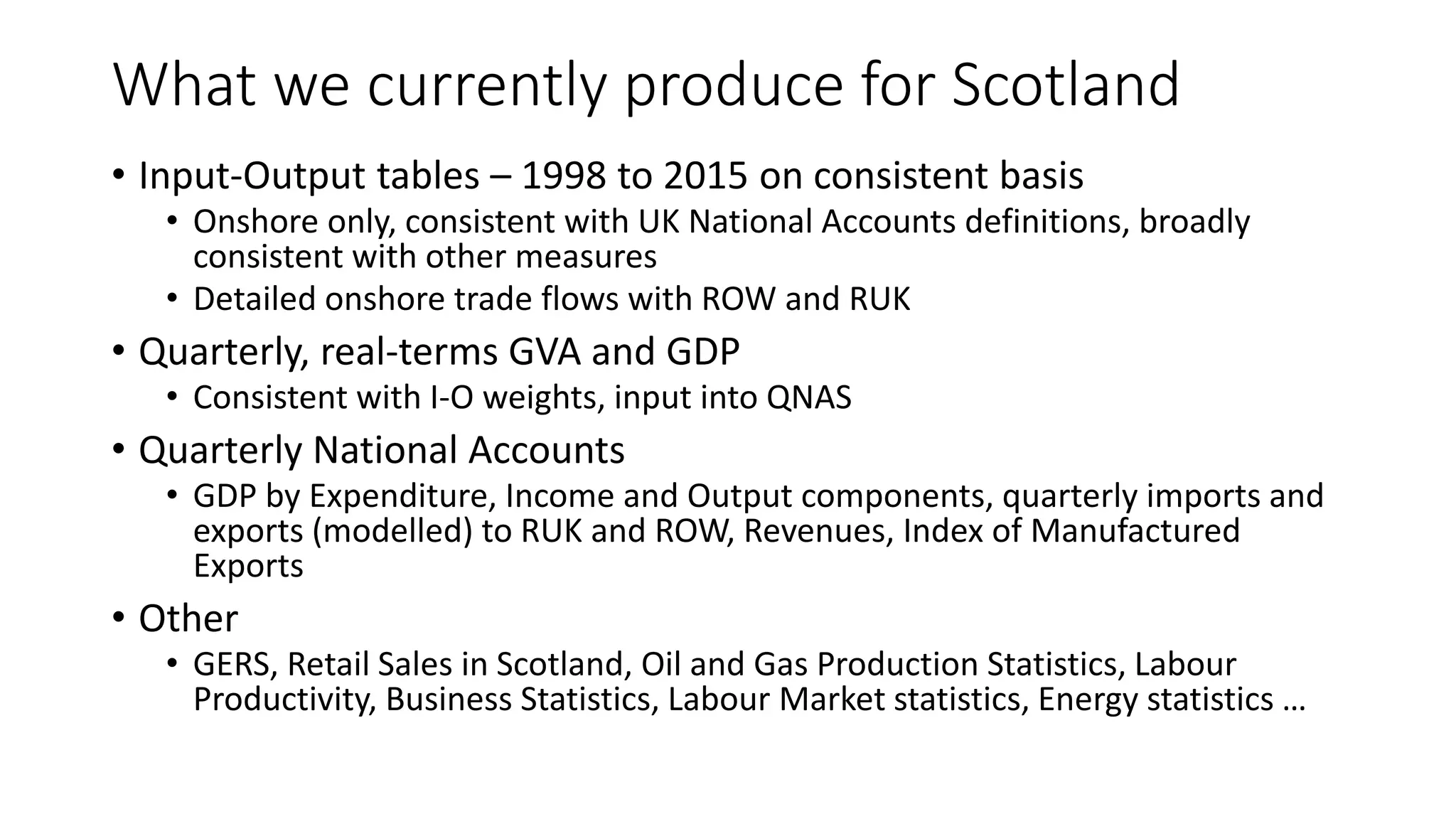

The document discusses the productivity challenges faced by the D2N2 region, highlighting a 10% lower productivity than the UK average and the factors contributing to this gap, such as sectoral composition and a high number of small businesses. Strategies for improving local productivity are proposed, focusing on business support, management practices, and enhancing allocative efficiency. It also outlines the need for continued data collection and analysis to better understand and address these productivity issues in Scotland.