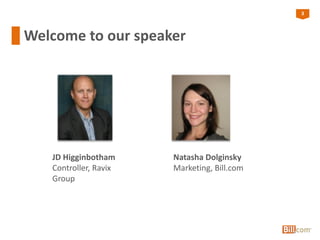

The document provides a comprehensive guide to transitioning from paper-based accounting to a paperless system using cloud technology, emphasizing the benefits of improved efficiency, cost savings, and security. It introduces solutions offered by bill.com, which includes automation of the accounting processes, document management, and electronic payment systems. The summary highlights critical steps for businesses to consider, such as careful selection of cloud-based tools, digitization of documents, and the importance of gaining consensus among decision-makers for successful implementation.