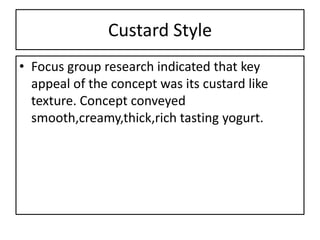

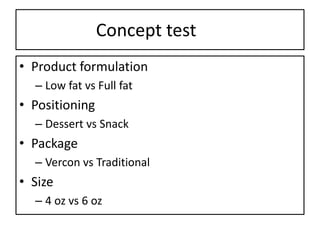

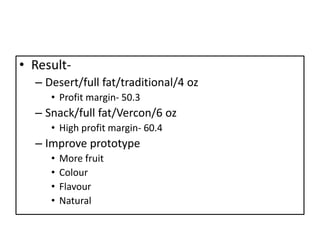

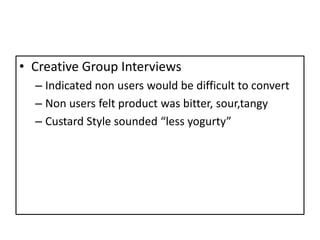

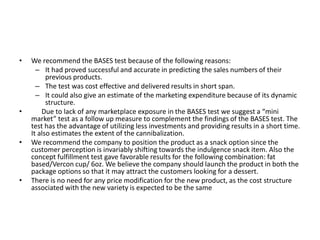

General Mills was considering launching a new custard-style yogurt under their Yoplait brand. Research showed the key appeal was a smooth, creamy, thick texture. Concept tests of low vs full fat, dessert vs snack positioning, and package/size options found the highest profit potential was a full-fat snack-positioned product in a 6oz Vercon cup. Focus groups found non-users may be difficult to convert and saw the product as less "yogurty". The recommendation was to use the proven BASES test for initial market evaluation, followed by a smaller "mini market" test, position it as a snack, and launch both package options without changing price.