This document provides information about Yamaha Motors Corporation and their R15 premium bike model in India. Some key points:

- Yamaha is a Japanese company founded in 1887 that is a leading motorcycle manufacturer worldwide.

- The R15 model has won several awards and ranks highly in sales for Yamaha in India.

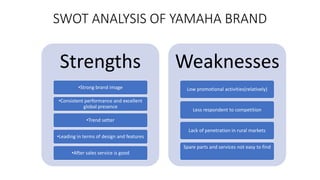

- A SWOT and PESTLE analysis finds Yamaha's strengths are its brand image and performance, while weaknesses include less promotion and rural market penetration.

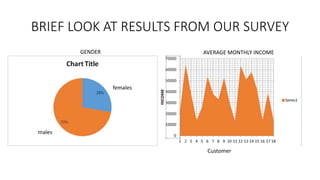

- Market research was conducted including surveys of customers and dealerships, finding the R15 has loyal buyers primarily aged 20-30 years old.

- Yamaha plans to continue improving the R15 and increasing sales, especially during festivals, while