Embed presentation

Download to read offline

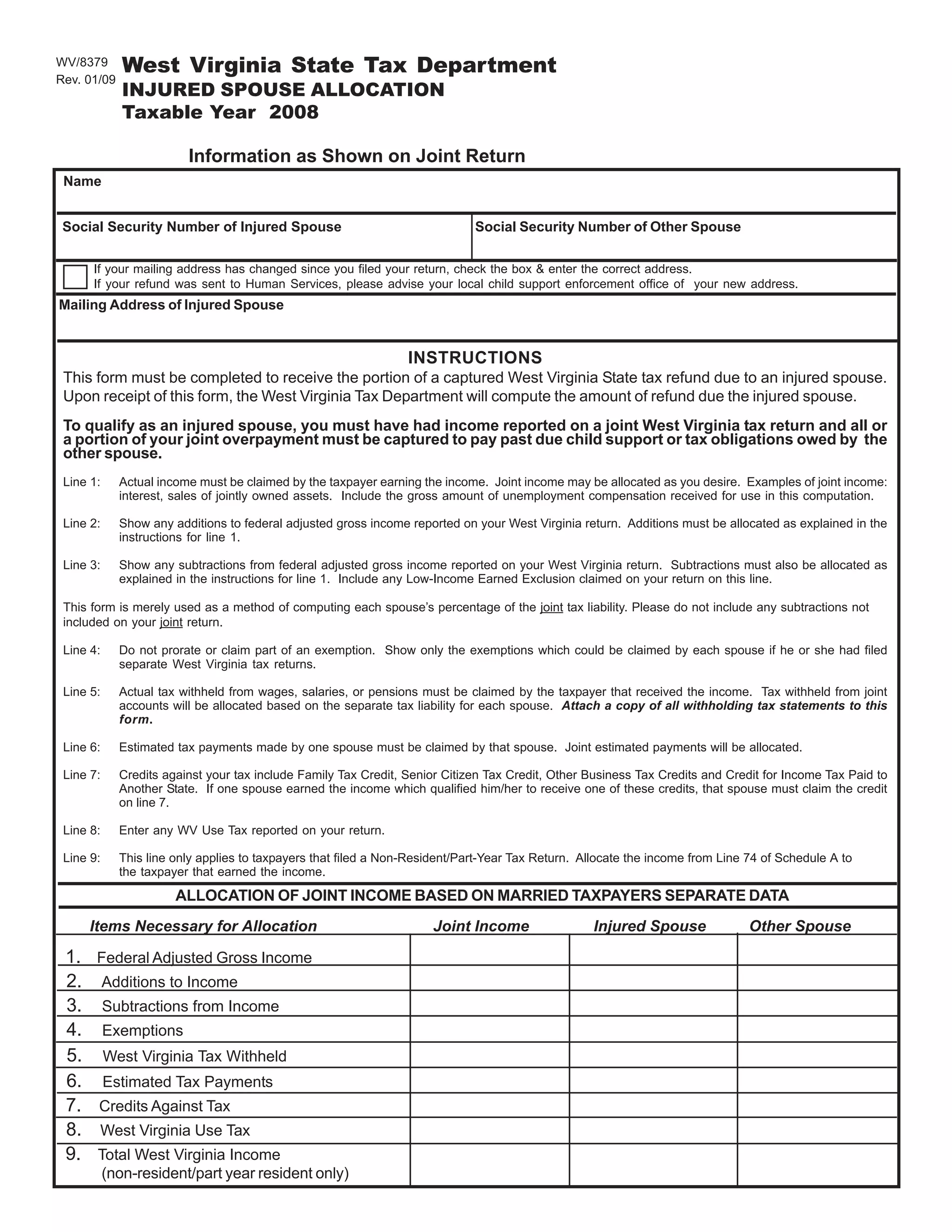

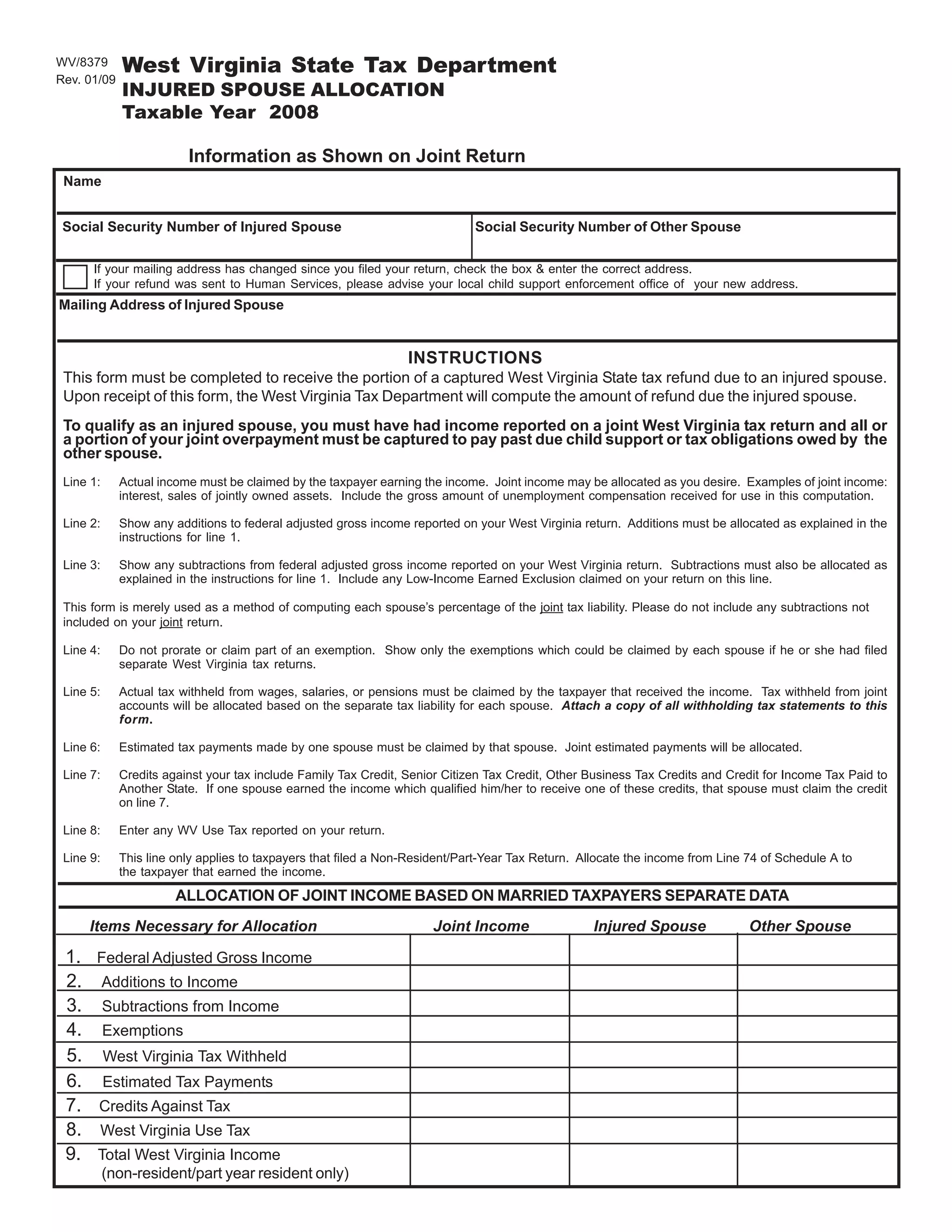

This document provides instructions for an injured spouse to receive their portion of a captured West Virginia state tax refund from a joint return. It explains that an injured spouse's income and tax withholding reported on a joint return was subject to garnishment to pay debts owed by the other spouse. The injured spouse must complete the form to allocate income, deductions, exemptions, payments and credits between the spouses to determine what percentage of the refund each spouse is due. The form lines include actual income, additions/subtractions to income, exemptions, withholding, estimated payments, credits and use tax that must be allocated to each individual spouse.