The document provides information about taxes in Fairfax County, Virginia for the 2014-2015 fiscal year, including:

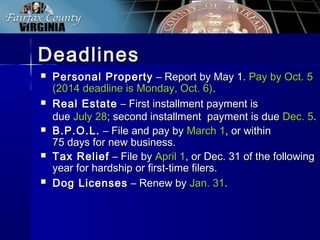

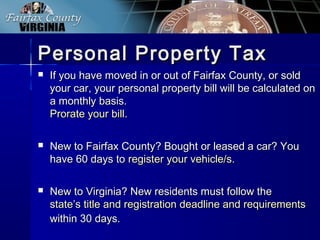

1) Key tax deadlines such as May 1 for reporting personal property taxes and July 28 for the first real estate tax installment.

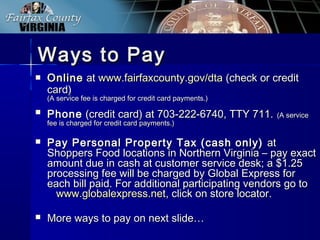

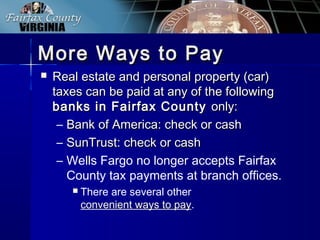

2) Ways to pay taxes including online, by phone, or in-person at various banks and stores.

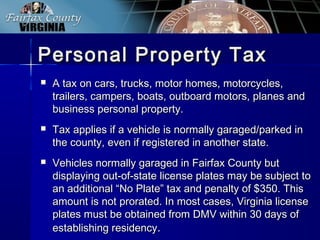

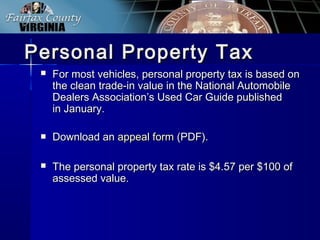

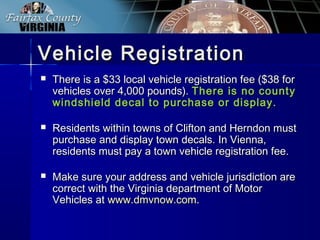

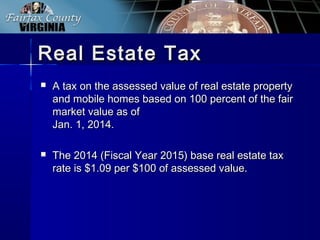

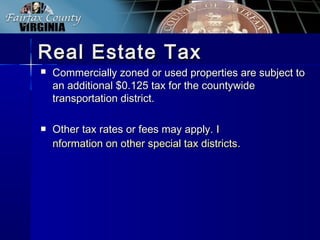

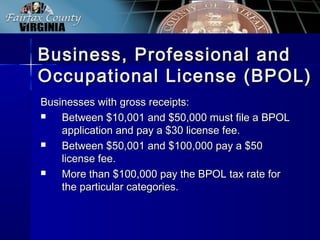

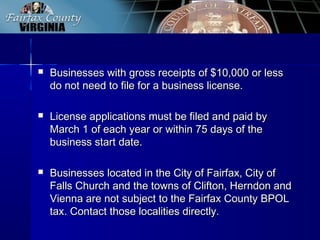

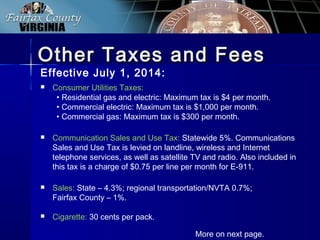

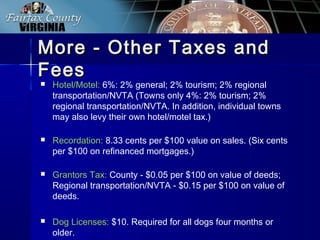

3) An overview of the major taxes including personal property, real estate, business, and other taxes.

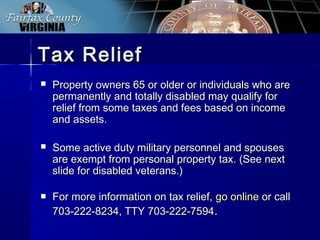

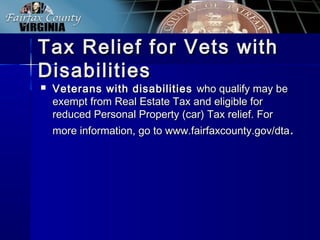

4) Details on tax relief for seniors, disabled veterans, and active duty military members.