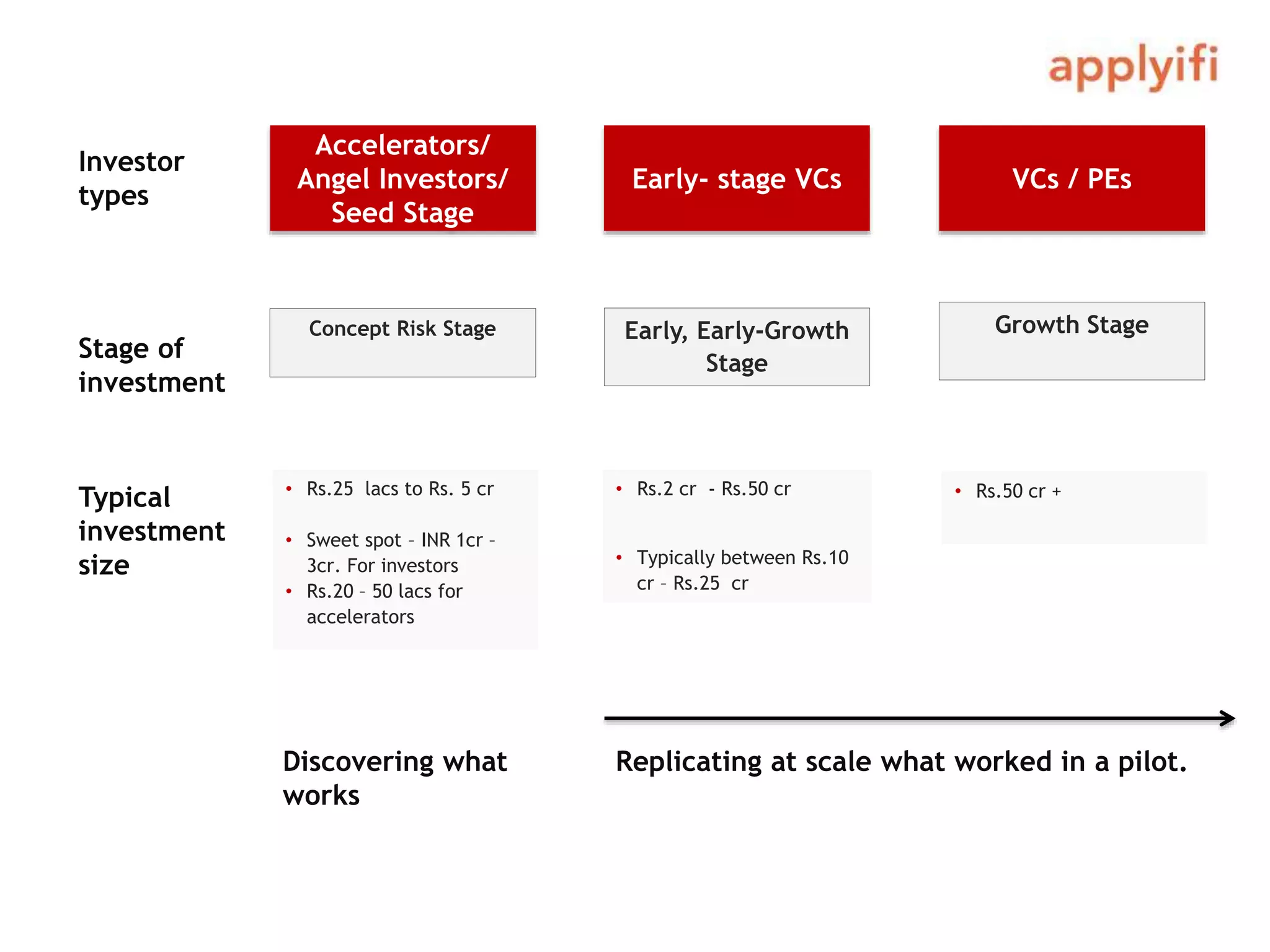

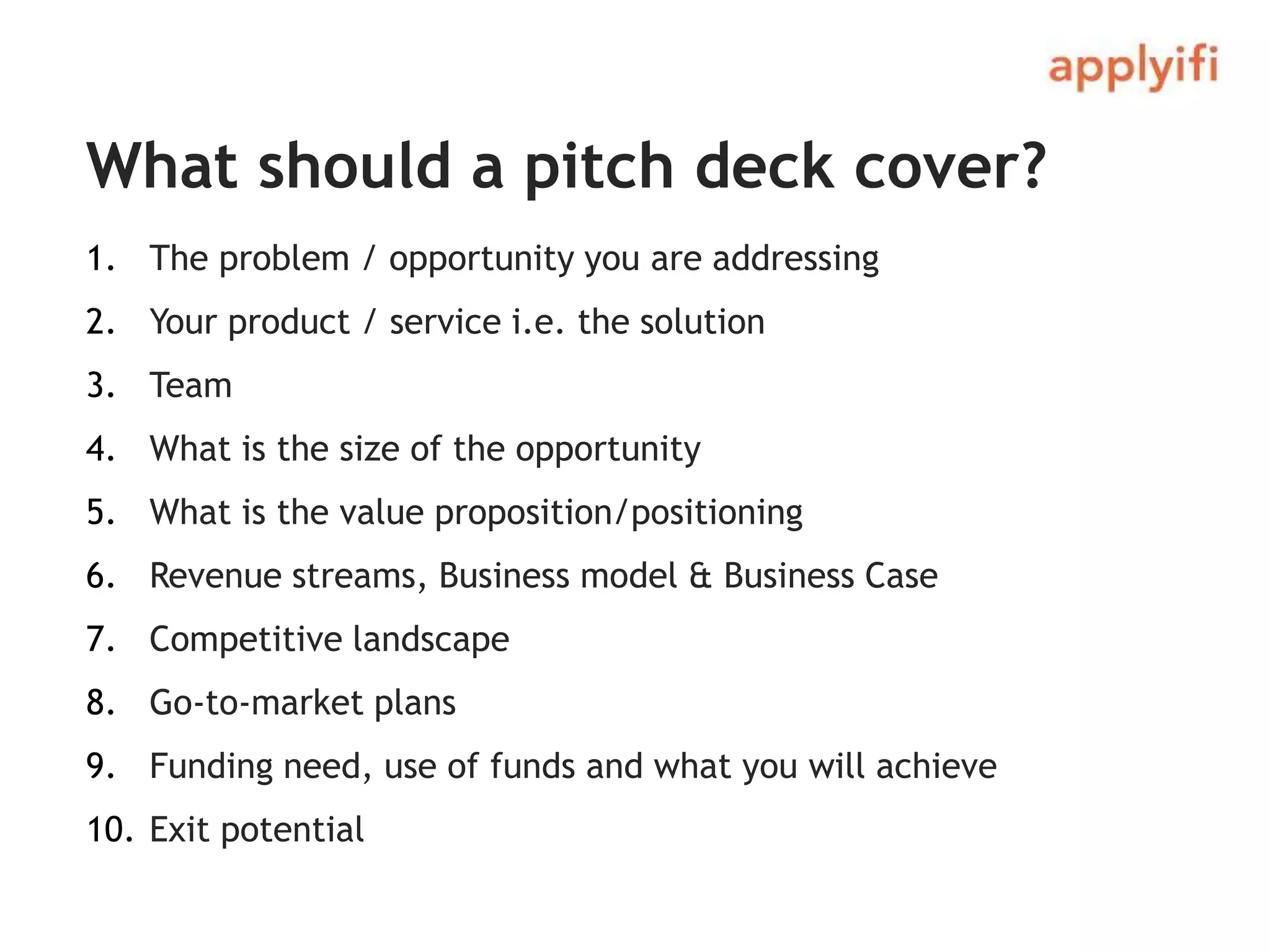

Writing a business plan is an important process for startups seeking investment even if capital is not needed. The business plan should demonstrate a clear value proposition and market opportunity as well as convey practical milestones and goals. Investors seek teams that have a strong understanding of the domain and business, a clear implementation plan, and goals that can be achieved with the funding amount requested. The business plan should leave investors feeling confident in the market potential and team's ability to deliver.