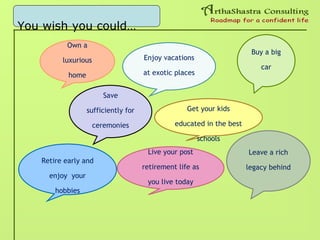

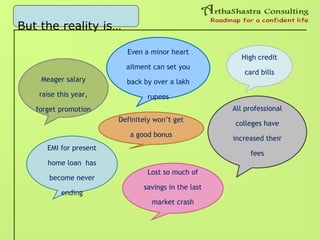

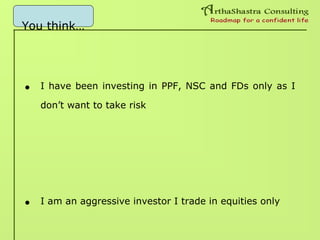

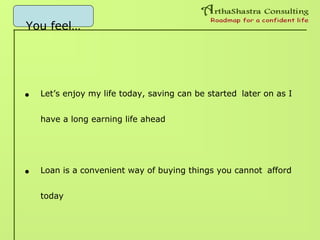

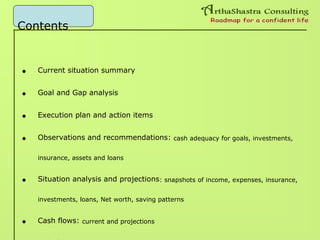

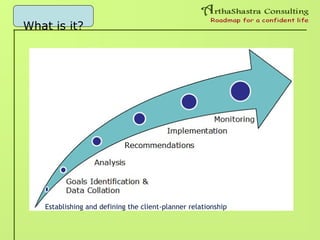

This document provides an overview of a financial planning awareness workshop. It discusses how financial planning can help individuals meet life goals by properly managing finances through a scientific process. The workshop agenda covers life aspirations, common roadblocks to financial success, and a sample financial plan walkthrough. Financial planning benefits include presenting a comprehensive big picture of one's financial situation, evaluating different future scenarios, and providing a financial roadmap and action items. The document emphasizes that a certified financial planner can help by analyzing all aspects of personal finance.