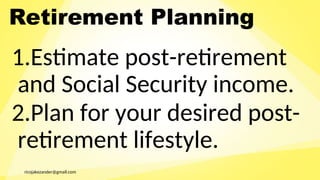

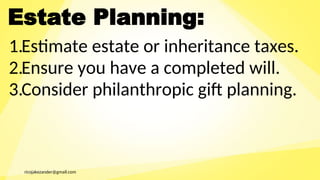

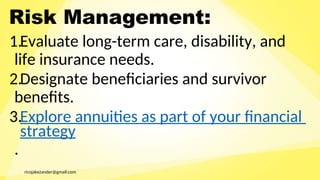

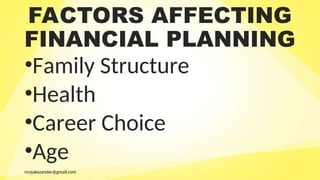

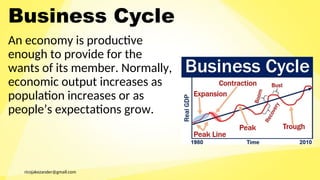

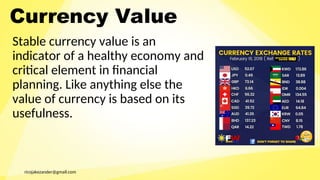

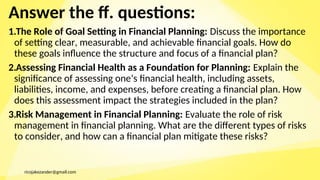

The document outlines the key components of financial planning, including budgeting, investing, retirement planning, estate planning, and risk management. It emphasizes the importance of assessing one's financial health, setting clear goals, and considering factors such as family structure, health, career choice, and age in the planning process. Additionally, it discusses how external economic indicators like the business cycle and employment rates can influence financial planning decisions.