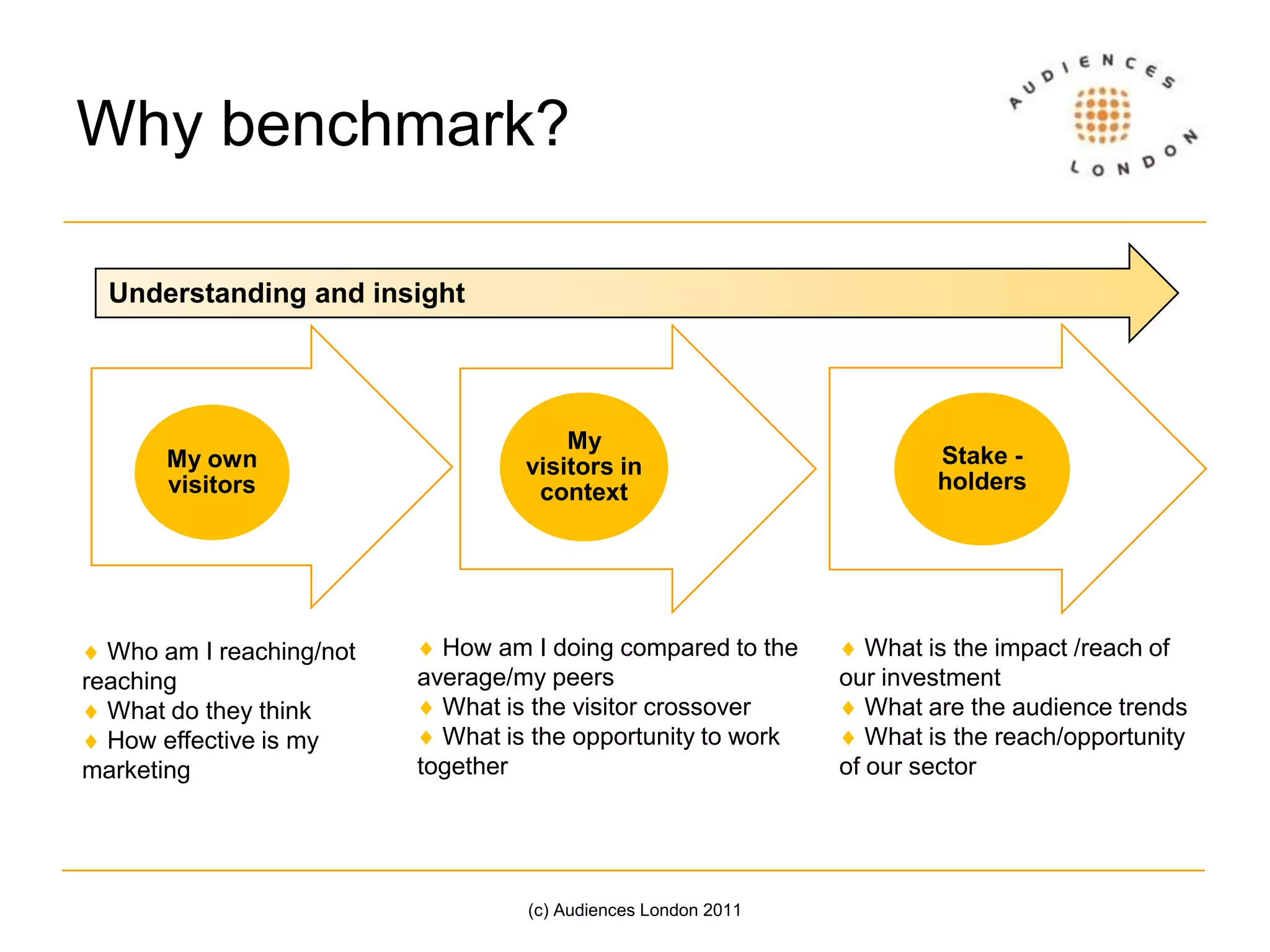

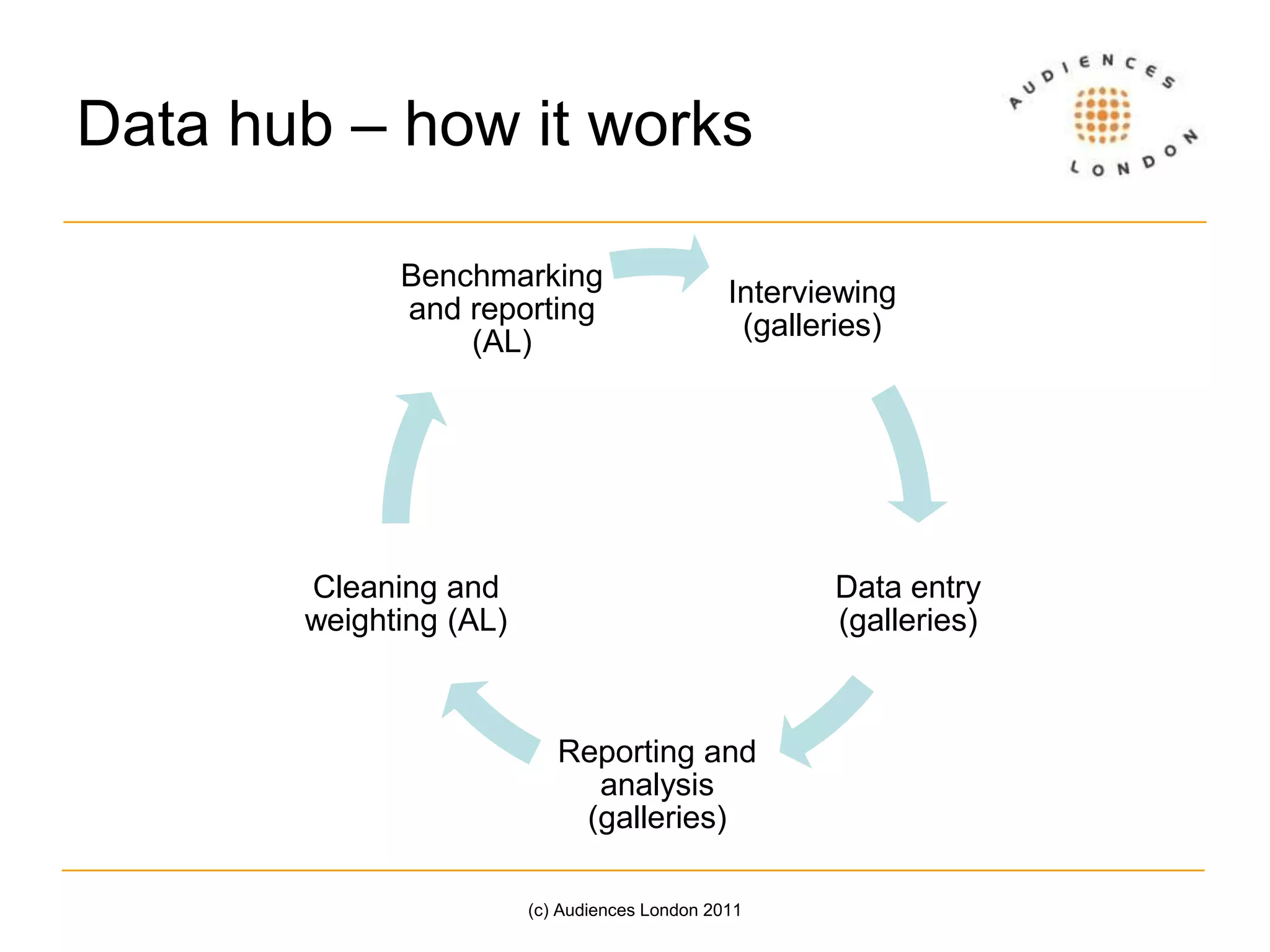

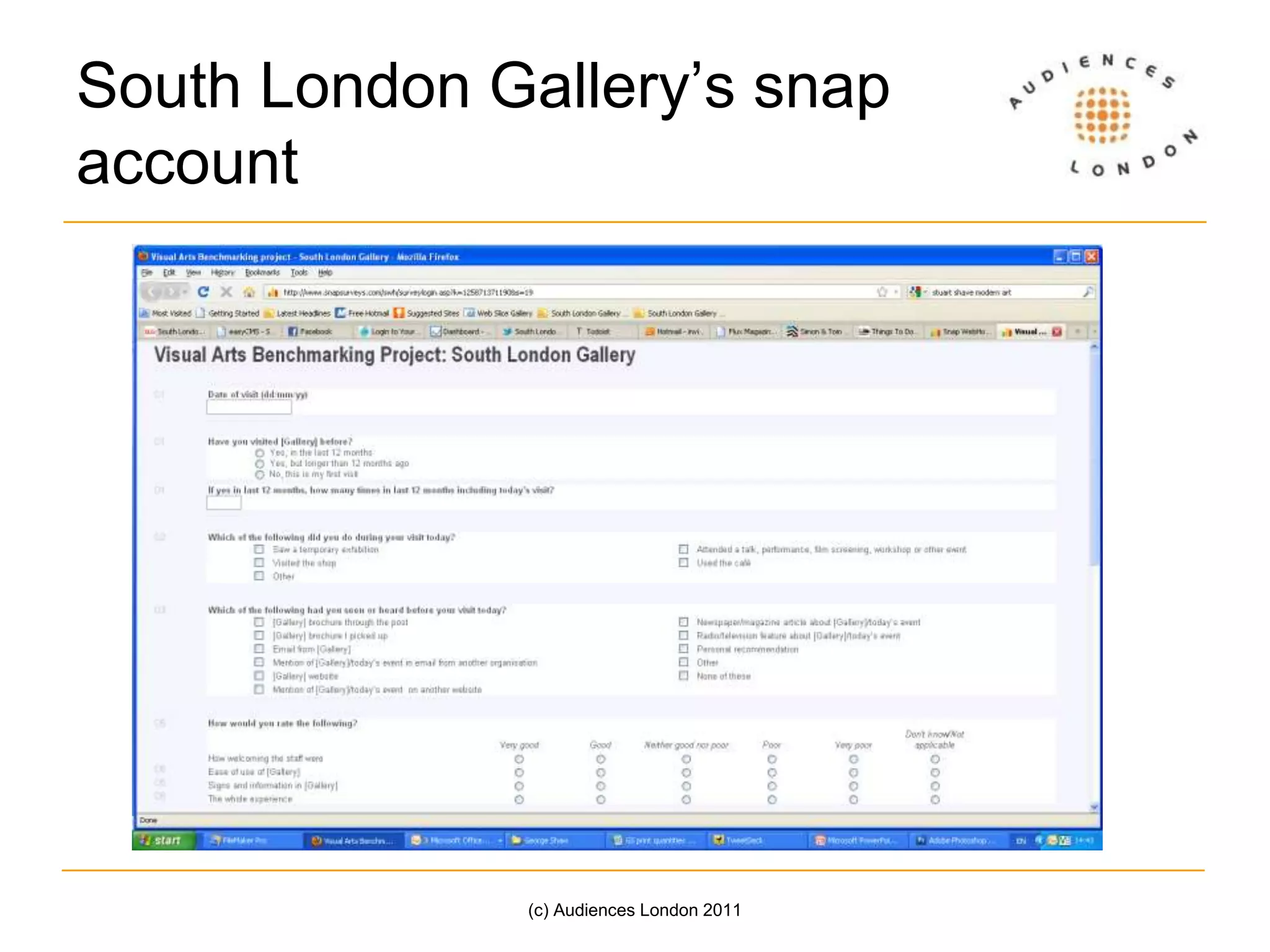

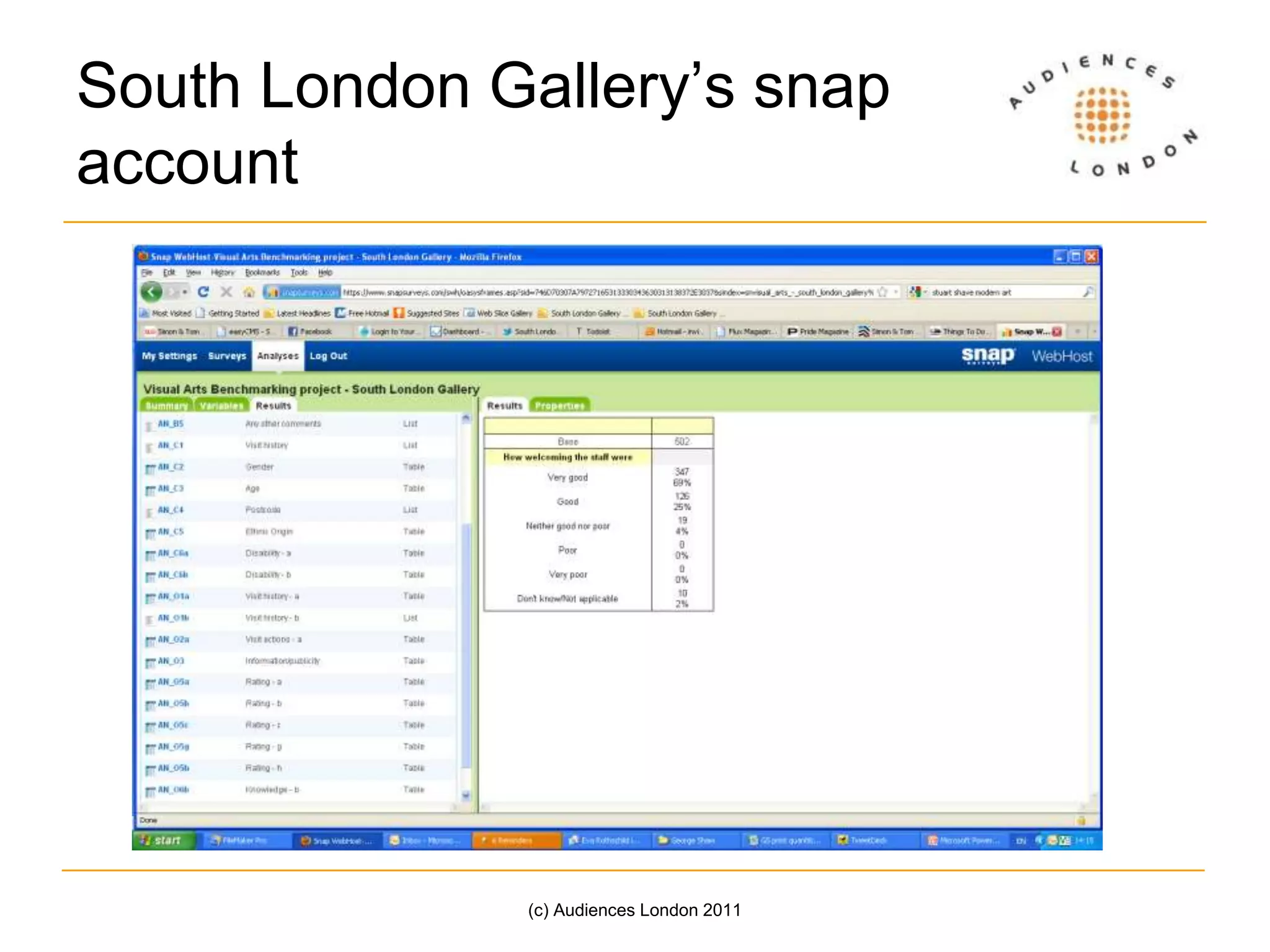

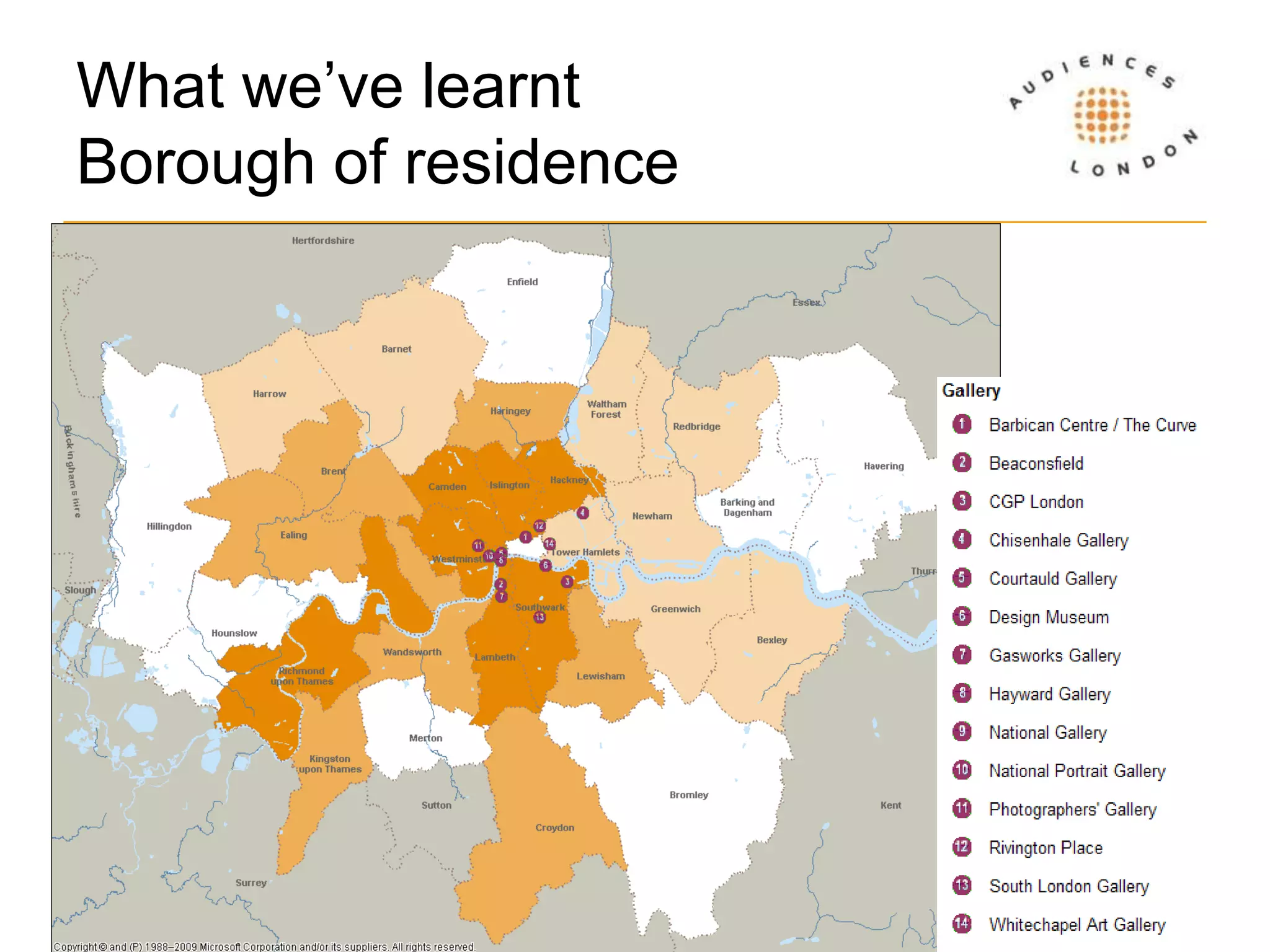

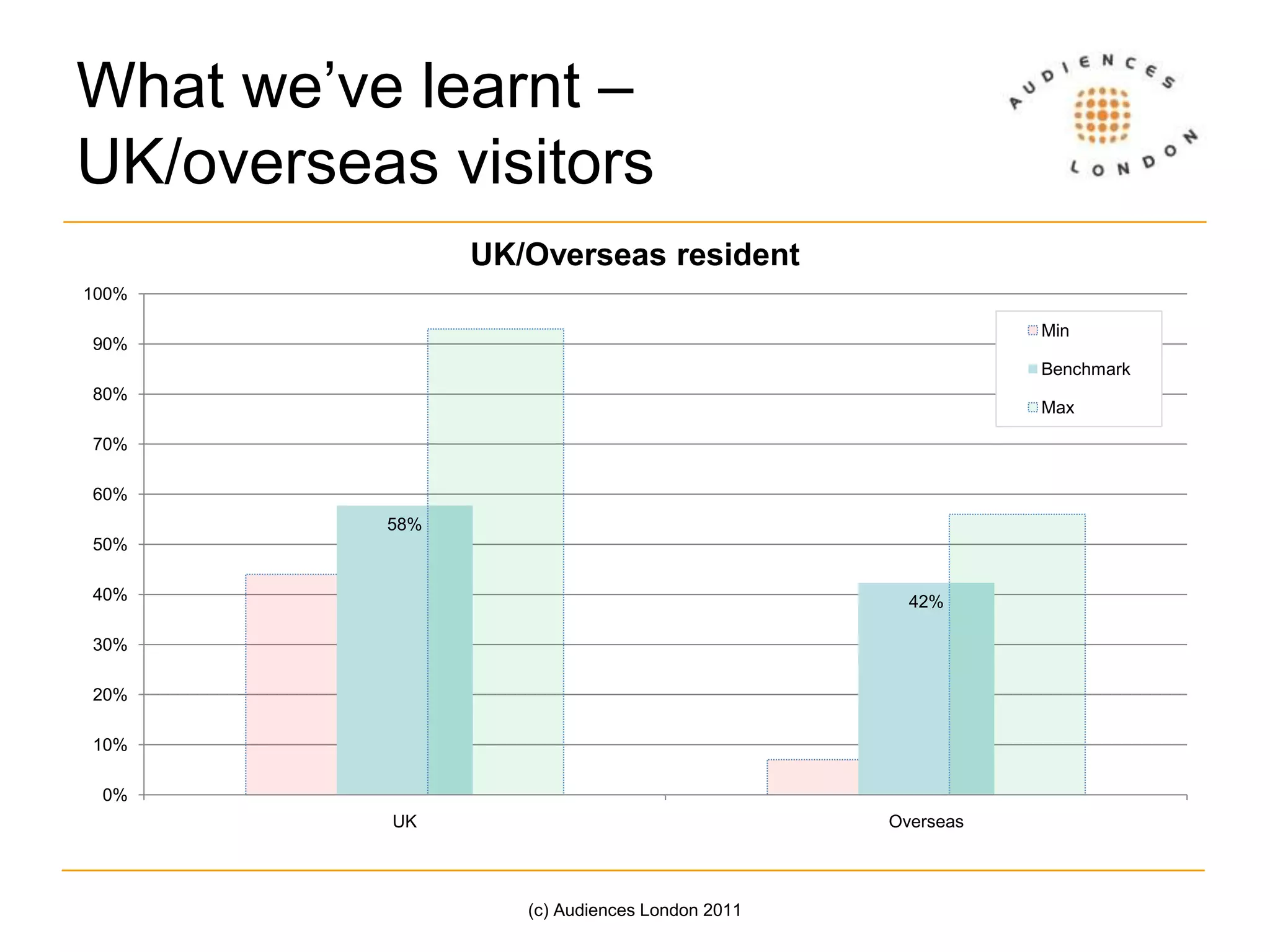

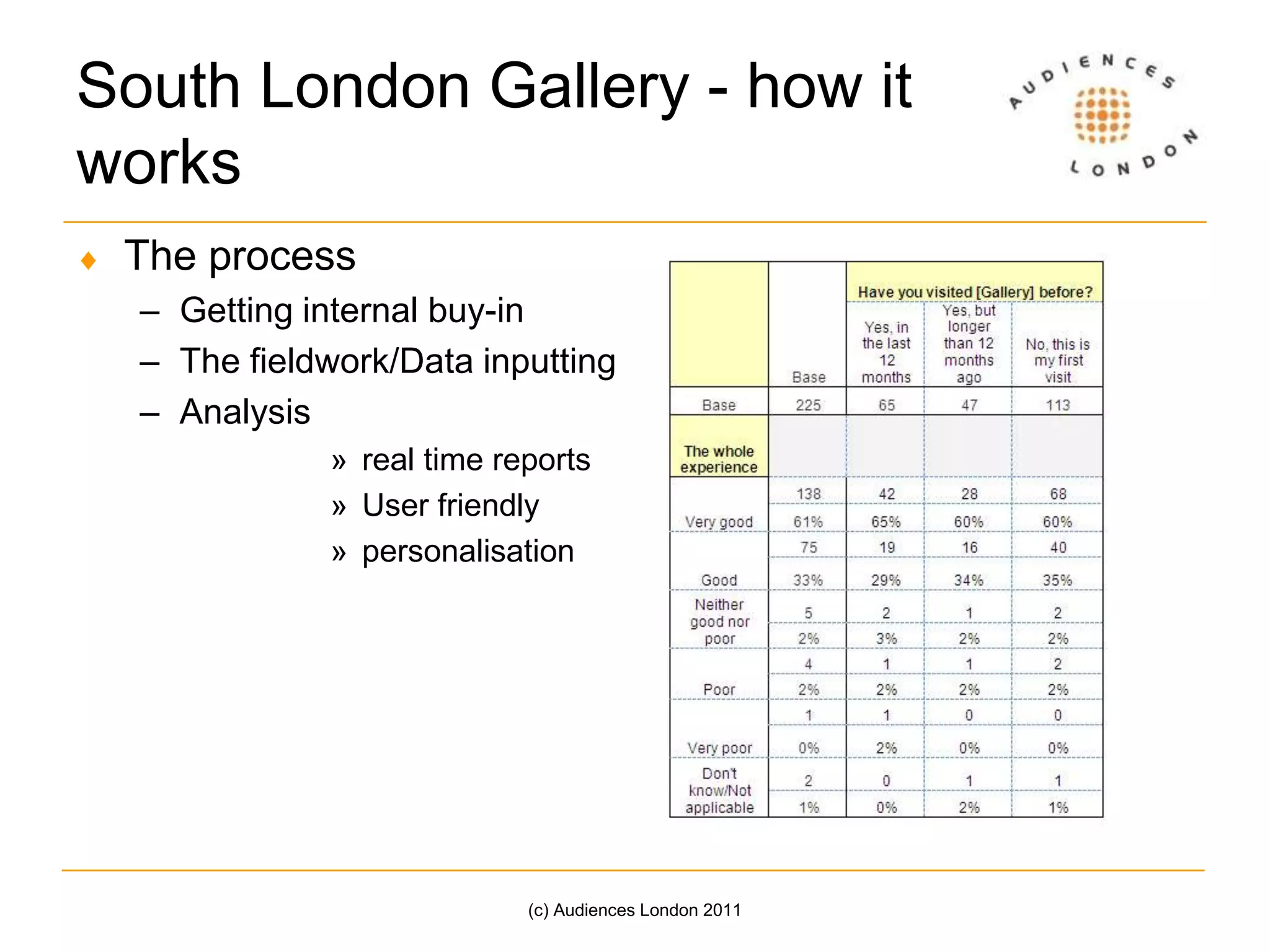

The document discusses a benchmarking initiative by Audiences London aimed at improving audience understanding and engagement across galleries through standardized data collection. It highlights the use of an online data hub for galleries to analyze visitor demographics, motivations, and experiences, and emphasizes the importance of collaboration and sharing insights within the sector. Future plans include a national pilot rollout to expand the initiative across additional regions.